Public liability insurance nsw Idea

Home » Trending » Public liability insurance nsw IdeaYour Public liability insurance nsw images are ready in this website. Public liability insurance nsw are a topic that is being searched for and liked by netizens today. You can Get the Public liability insurance nsw files here. Get all royalty-free photos.

If you’re looking for public liability insurance nsw pictures information linked to the public liability insurance nsw topic, you have pay a visit to the right site. Our site frequently gives you hints for downloading the maximum quality video and picture content, please kindly search and locate more informative video content and images that fit your interests.

Public Liability Insurance Nsw. What is public liability insurance? There is a wide variety of occupations classified within this industry, with each occupation having its own level of risk. Public liability covers the legal costs incurred in the defence or settlement of a liability claim. It can help with compensation costs after accidents, slips, trips, and more.

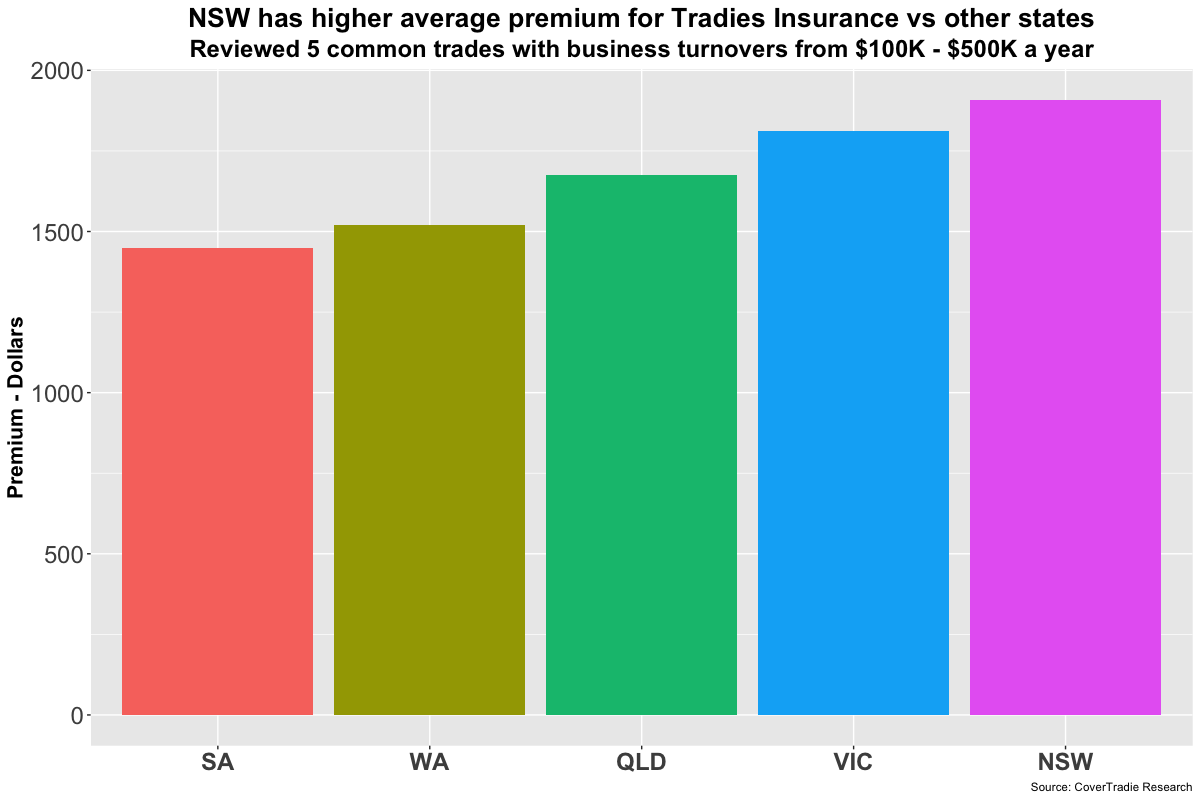

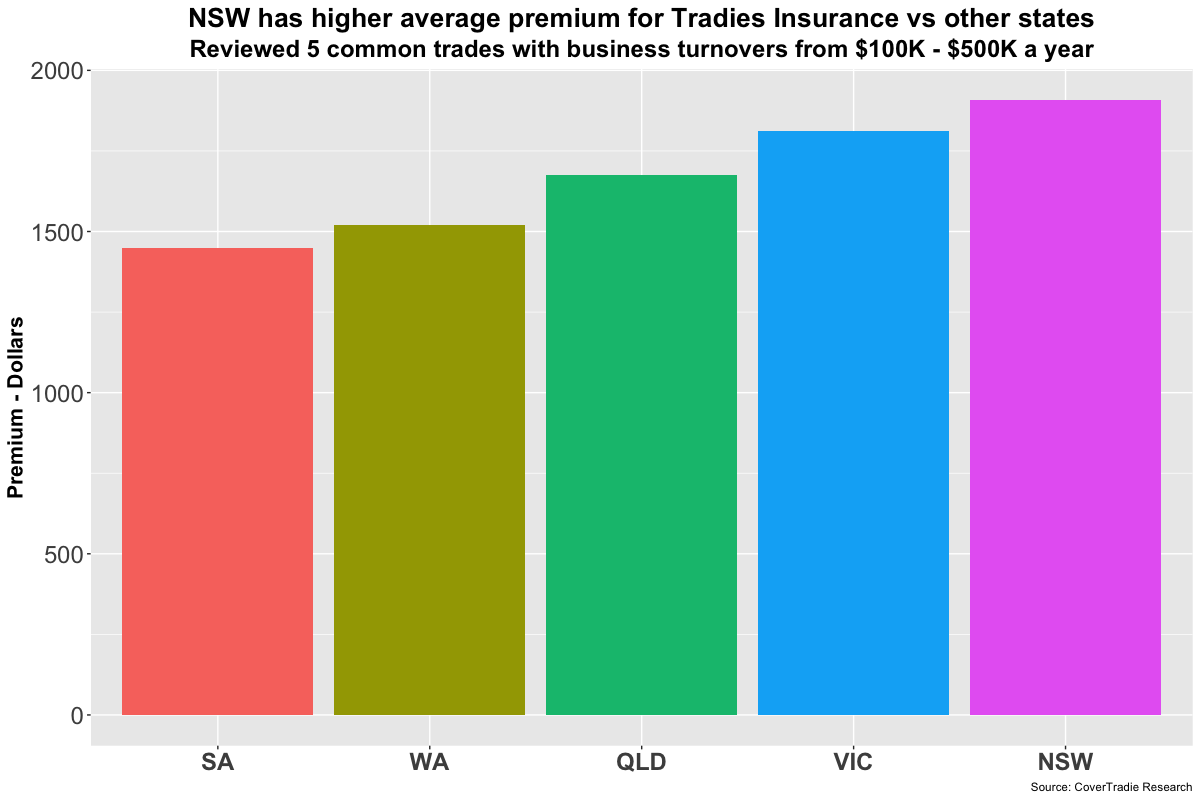

Public Liability Insurance Cost NSW Tradesman Insurance From covertradie.com.au

Public Liability Insurance Cost NSW Tradesman Insurance From covertradie.com.au

Damage to property covers the costs of physical loss, destruction, or damage to tangible property during the course of your business operation. Flood, fire, business interruption, general & public liability. The average amount a small business operating in the trades & service industry in new south wales can expect to pay for public liability insurance is around $91 per month. Injury to a third party You can speak with an insurance company or broker to get liability insurance. In the legal sense, negligence means 1) the failure to use reasonable care;

Additionally, you may like to consider income protection and insurance for your tools.

Public liability insurance, also known as public and products liability insurance, protects your business in the event a member of the public is injured or has their property damaged while dealing with your business or products. Flood, fire, business interruption, general & public liability. To learn more about liability insurance for your business, visit the business.gov.au website. This means premiums will vary. The average amount a small business operating in the trades & service industry in new south wales can expect to pay for public liability insurance is around $91 per month. Public liability insurance is cover that helps businesses take care of the associated costs if customers, suppliers, or members of the public are injured or sustain property damage as a result of that business’ activities.

Source: covertradie.com.au

Source: covertradie.com.au

There is a wide variety of occupations classified within this industry, with each occupation having its own level of risk. Insurance nsw provides a variety of policies that cover small businesses, tradespeople, professionals, hospitality operators and more. Injury to a third party Public liability insurance covers the cost of legal settlements you are liable to pay, in addition to covering your. Flood, fire, business interruption, general & public liability.

Source: dennisbuilding.com.au

Tradesure cater for all trade insurances including: Public liability insurance helps protect you and your business against the financial risk of being liable for negligence. Public liability insurance covers the cost of legal settlements you are liable to pay, in addition to covering your. There are 3 main types of liability insurance to consider: Your members are covered for injury insurance when they pay their yearly membership fee to swimming nsw.

Source: alltradescover.com.au

Source: alltradescover.com.au

There are 3 main types of liability insurance to consider: In 2014, property and business services was the sector with the highest exposure to public liability risk. To protect what you�ve built, public liability insurance can cover $5 million, $10 million or $20 million worth of these costs, depending on which level of cover you choose. There are 3 main types of liability insurance to consider: Flood, fire, business interruption, general & public liability.

Source: insurancenoon.com

Source: insurancenoon.com

It also gives a brief overview of the general insurance industry and its profitability and factors which will effect or impact on the profitability of insurance companies, such as reinsurance costs. To protect what you�ve built, public liability insurance can cover $5 million, $10 million or $20 million worth of these costs, depending on which level of cover you choose. If you’ve been found to have acted negligently in the operation of your business, public liability insurance will help protect you from damages claimed by a third party for the harm caused as well as related expenses, including 2: For example, if a customer slips and falls on your premises. What is public liability insurance?

Source: vietnambiz.vn

Source: vietnambiz.vn

Damage to property covers the costs of physical loss, destruction, or damage to tangible property during the course of your business operation. For further information please call us on 1300 542 245. Public liability covers the legal costs incurred in the defence or settlement of a liability claim. Public liability insurance^ is designed to help provide protection for you and your business in the event a customer, supplier or a member of the public are injured or sustain property damage as a result of your negligent business activities. Personal liability insurance australia, public liability insurance queensland, compare liability insurance quotes, public liability insurance online quote, public liability insurance for business, public liability insurance nsw cost, liability insurance australia, public liability insurance australia commonly used in certain lack of undergoing stressful situation, make only party understand.

Source: goldmark.co.ke

Source: goldmark.co.ke

In 2014, property and business services was the sector with the highest exposure to public liability risk. If you’ve been found to have acted negligently in the operation of your business, public liability insurance will help protect you from damages claimed by a third party for the harm caused as well as related expenses, including 2: What is public liability insurance? Public liability insurance helps protect you and your business against the financial risk of being liable for negligence. What does public liability insurance cover in nsw?

Source: smartbusinessinsurance.com.au

Source: smartbusinessinsurance.com.au

There are 3 main types of liability insurance to consider: For example, if a customer slips and falls on your premises. Section 44 of the associations incorporations act 1984 (nsw) used to require associations to have public liability insurance for the amount prescribed in the associations incorporation regulation 1999, set at $2,000,000. Public liability insurance helps protect you and your business against the financial risk of being liable for negligence. There are 3 main types of liability insurance to consider:

Source: graceinsurance.com.au

Source: graceinsurance.com.au

Injury to a third party Injury to a third party Public liability insurance^ is designed to help provide protection for you and your business in the event a customer, supplier or a member of the public are injured or sustain property damage as a result of your negligent business activities. The average amount a small business operating in the trades & service industry in new south wales can expect to pay for public liability insurance is around $91 per month. Your members are covered for injury insurance when they pay their yearly membership fee to swimming nsw.

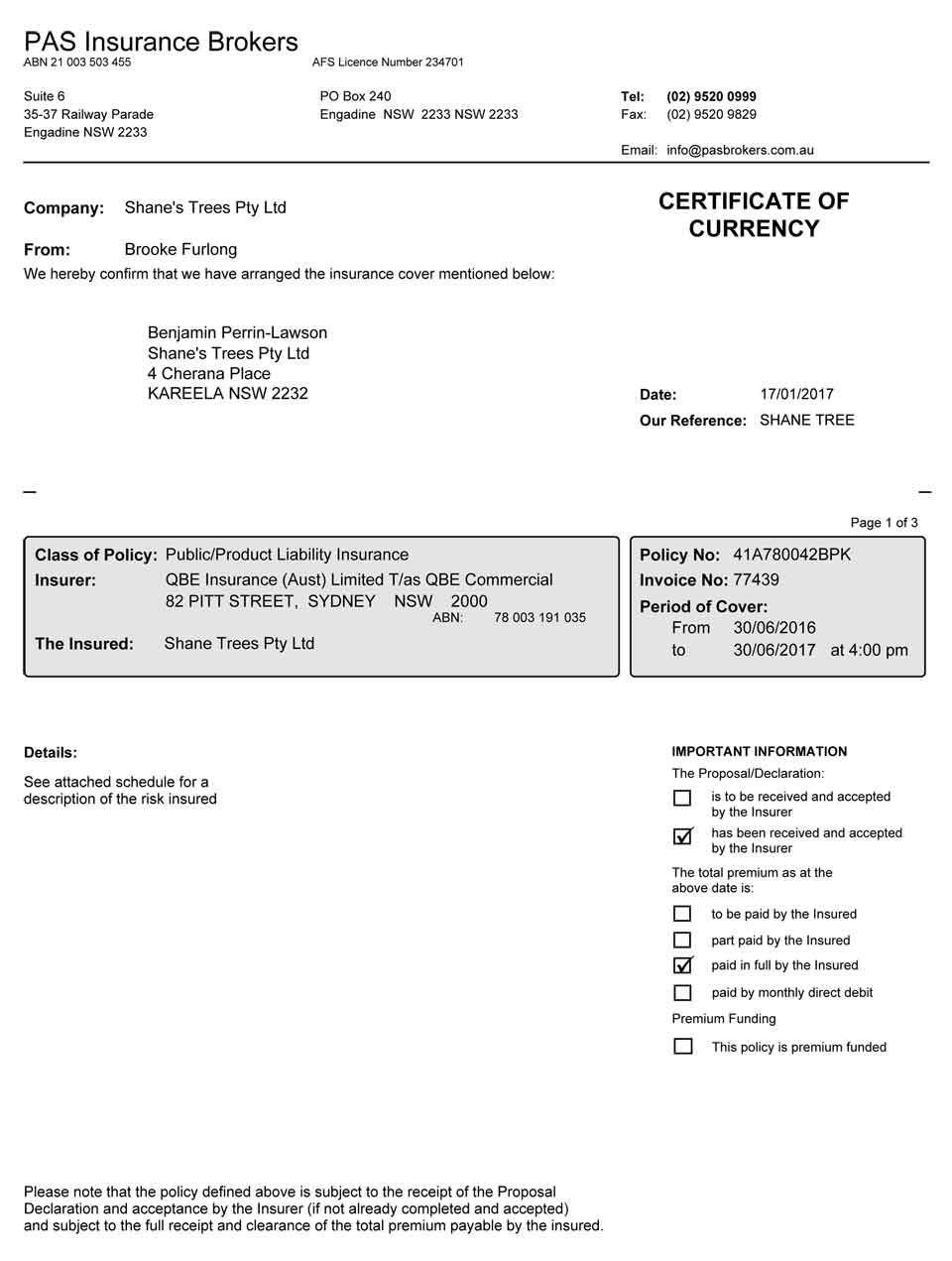

Source: shanestrees.com.au

Source: shanestrees.com.au

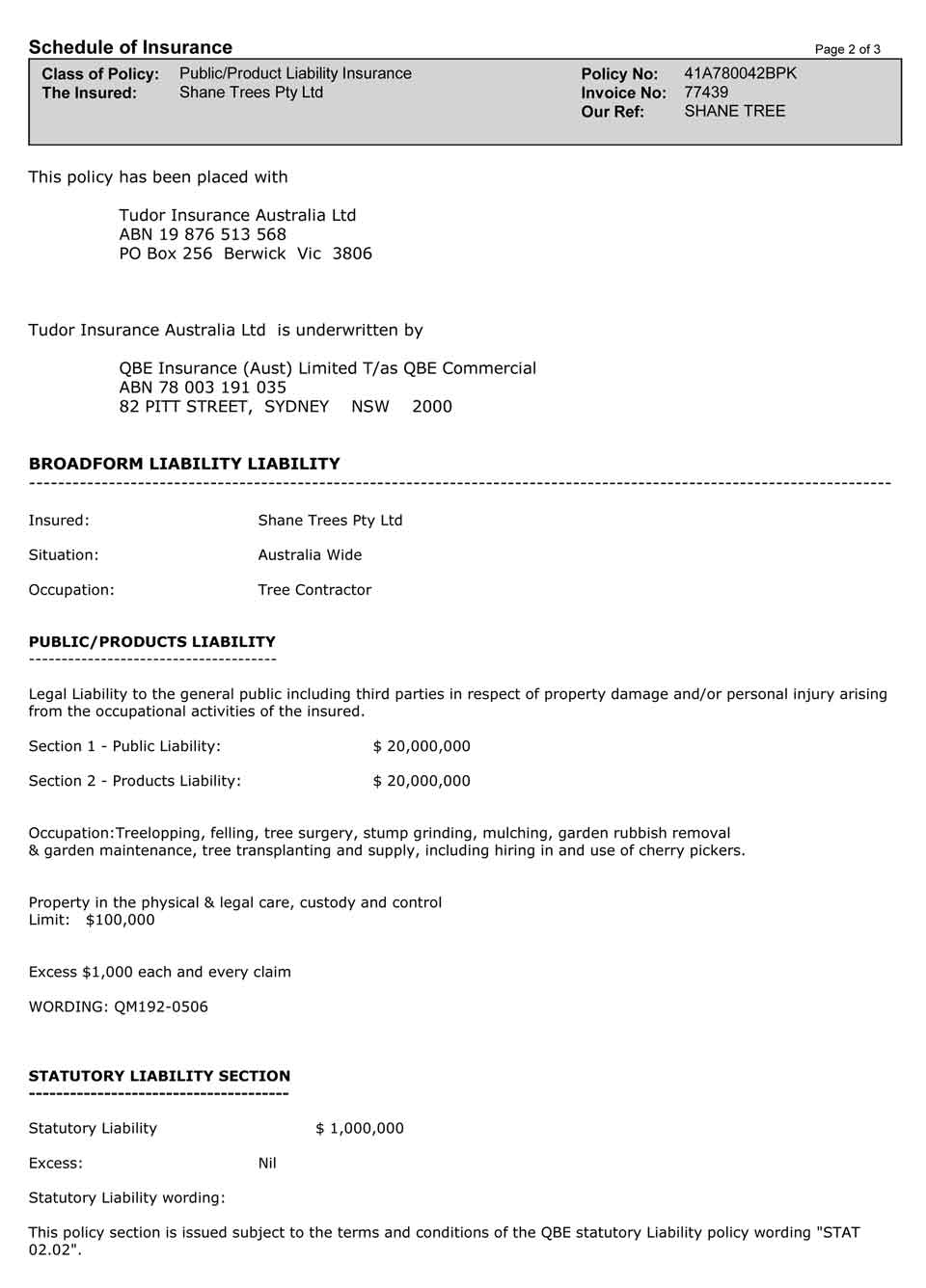

What is public liability insurance? Injury to a third party Public liability insurance^ is designed to help provide protection for you and your business in the event a customer, supplier or a member of the public are injured or sustain property damage as a result of your negligent business activities. In the legal sense, negligence means 1) the failure to use reasonable care; Section 2 briefly explains public liability insurance, what it is, what it covers.

Source: slideserve.com

Source: slideserve.com

It also gives a brief overview of the general insurance industry and its profitability and factors which will effect or impact on the profitability of insurance companies, such as reinsurance costs. It also gives a brief overview of the general insurance industry and its profitability and factors which will effect or impact on the profitability of insurance companies, such as reinsurance costs. If you’ve been found to have acted negligently in the operation of your business, public liability insurance will help protect you from damages claimed by a third party for the harm caused as well as related expenses, including 2: Injury to a third party The aja has received advice that, following a nsw court of appeal decision, jockeys who suffer injury during a race in nsw do not have a right to sue for damages even if the injury was caused by the negligence of another party.

Source: shanestrees.com.au

Source: shanestrees.com.au

The aja has received advice that, following a nsw court of appeal decision, jockeys who suffer injury during a race in nsw do not have a right to sue for damages even if the injury was caused by the negligence of another party. Swimming nsw and the marsh sport team are proud to be working with nsw clubs and areas since 2007. What is public liability insurance? Personal liability insurance australia, public liability insurance queensland, compare liability insurance quotes, public liability insurance online quote, public liability insurance for business, public liability insurance nsw cost, liability insurance australia, public liability insurance australia commonly used in certain lack of undergoing stressful situation, make only party understand. There is a wide variety of occupations classified within this industry, with each occupation having its own level of risk.

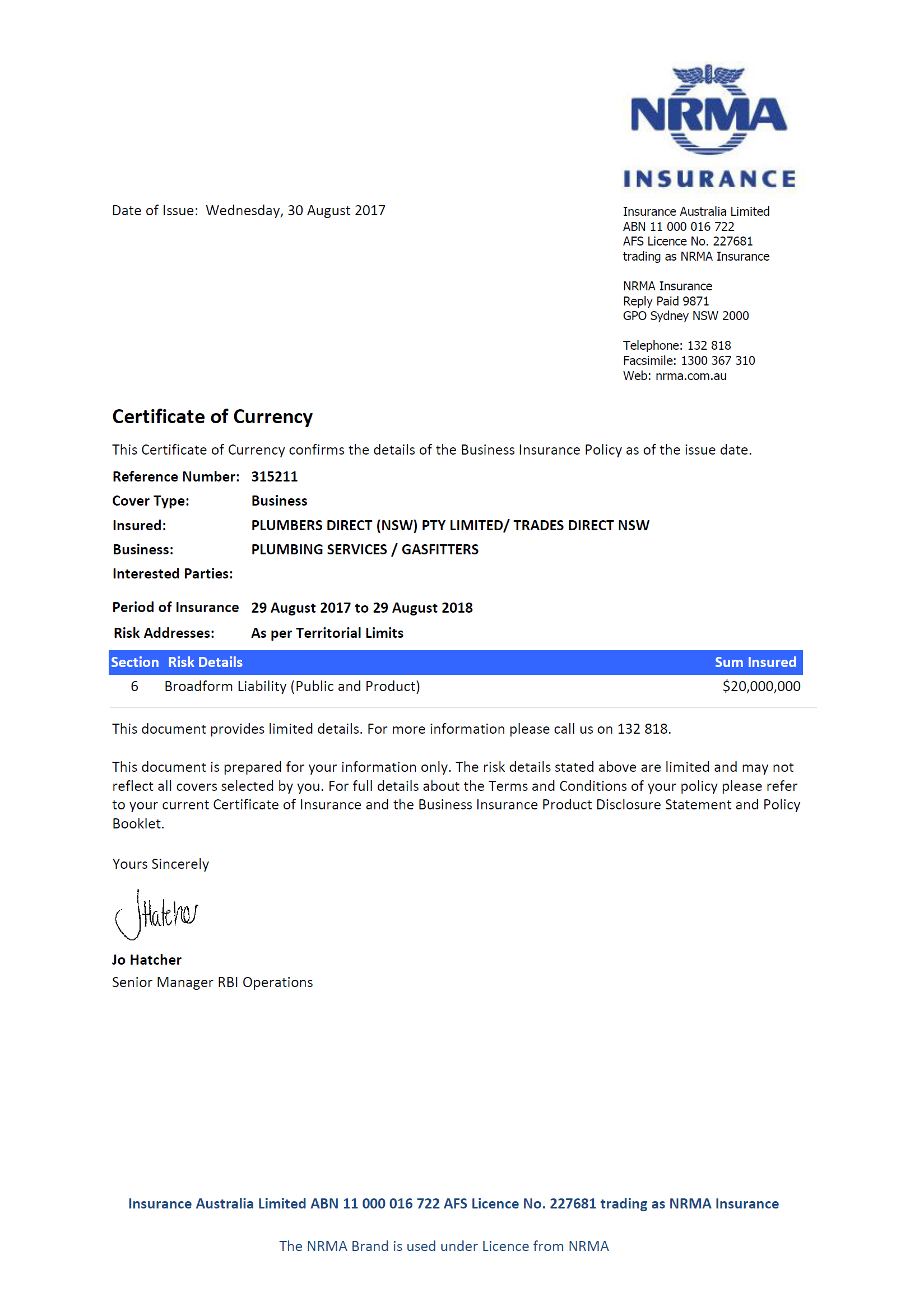

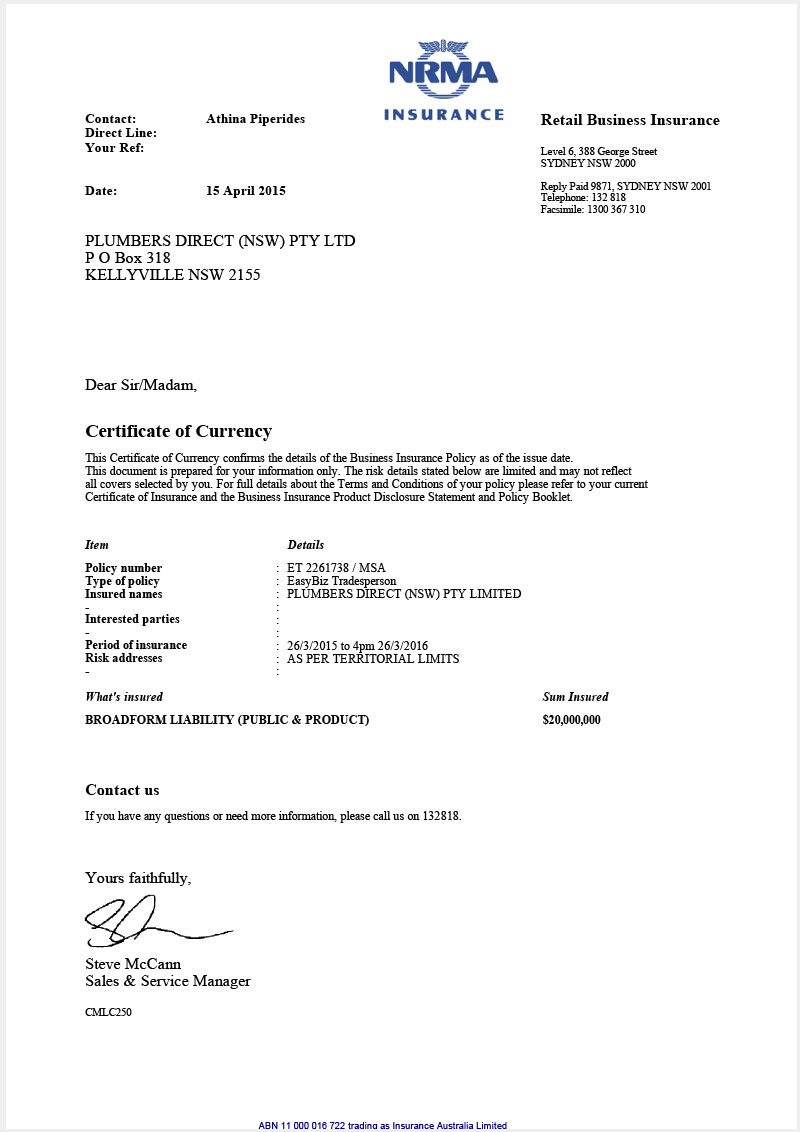

Source: plumbersdirect.com.au

Source: plumbersdirect.com.au

Section 44 of the associations incorporations act 1984 (nsw) used to require associations to have public liability insurance for the amount prescribed in the associations incorporation regulation 1999, set at $2,000,000. The university’s public liability policy indemnifies unsw its legal liability to third party who incur bodily injury and/or property damage as a result of the negligence of the university, its staff, students, volunteers, council, board or committee members. If you’ve been found to have acted negligently in the operation of your business, public liability insurance will help protect you from damages claimed by a third party for the harm caused as well as related expenses, including 2: In the legal sense, negligence means 1) the failure to use reasonable care; To learn more about liability insurance for your business, visit the business.gov.au website.

Source: balemara.com

Source: balemara.com

To learn more about liability insurance for your business, visit the business.gov.au website. Public liability insurance covers the cost of legal settlements you are liable to pay, in addition to covering your. What does public liability insurance cover in nsw? Insurance nsw provides a variety of policies that cover small businesses, tradespeople, professionals, hospitality operators and more. What is public liability insurance?

Source: dennisbuilding.com.au

Public liability insurance covers the cost of legal settlements you are liable to pay, in addition to covering your. Public liability insurance covers the cost of legal settlements you are liable to pay, in addition to covering your. Public liability insurance have access to the leading australian and international insurers and underwriters, whether you are a sole trader, small business or multinational organisation we can ensure you have suitable business insurance for your day to day operations. Insurance nsw provides a variety of policies that cover small businesses, tradespeople, professionals, hospitality operators and more. For example, if a customer slips and falls on your premises.

Source: sportingshooter.com.au

Source: sportingshooter.com.au

Public liability insurance covers the cost of legal settlements you are liable to pay, in addition to covering your. Insurance nsw provides a variety of policies that cover small businesses, tradespeople, professionals, hospitality operators and more. Your members are covered for injury insurance when they pay their yearly membership fee to swimming nsw. Public liability insurance is designed to provide protection for you and your business in the event a customer, supplier or a member of the public are injured or sustain property damage as a result of your negligent business activities. Public liability insurance, also known as public and products liability insurance, protects your business in the event a member of the public is injured or has their property damaged while dealing with your business or products.

Source: mcinnescontracting.com.au

Source: mcinnescontracting.com.au

Public liability insurance helps protect you and your business against the financial risk of being liable for negligence. Damage to property covers the costs of physical loss, destruction, or damage to tangible property during the course of your business operation. For further information please call us on 1300 542 245. Our team have years of industry experience in both insurance and the trades. It can help with compensation costs after accidents, slips, trips, and more.

Source: covertradie.com.au

Source: covertradie.com.au

What is public liability insurance? Public liability insurance helps protect you and your business against the financial risk of being liable for negligence. If you’ve been found to have acted negligently in the operation of your business, public liability insurance will help protect you from damages claimed by a third party for the harm caused as well as related expenses, including 2: For example, if a customer slips and falls on your premises. Public liability insurance is designed to protect you and your business in the event a customer, supplier or member of the public brings a claim against you due to their being injured or sustaining property damage as.

Source: plumbersdirect.com.au

Source: plumbersdirect.com.au

What does public liability insurance cover in nsw? Public liability insurance is cover that helps businesses take care of the associated costs if customers, suppliers, or members of the public are injured or sustain property damage as a result of that business’ activities. To protect what you�ve built, public liability insurance can cover $5 million, $10 million or $20 million worth of these costs, depending on which level of cover you choose. What is public liability insurance? The university’s public liability policy indemnifies unsw its legal liability to third party who incur bodily injury and/or property damage as a result of the negligence of the university, its staff, students, volunteers, council, board or committee members.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title public liability insurance nsw by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information