Pud insurance information

Home » Trending » Pud insurance informationYour Pud insurance images are ready in this website. Pud insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Pud insurance files here. Download all royalty-free images.

If you’re searching for pud insurance pictures information linked to the pud insurance topic, you have pay a visit to the right blog. Our site always gives you suggestions for downloading the maximum quality video and image content, please kindly hunt and find more informative video articles and graphics that fit your interests.

Pud Insurance. No review required 50% presale (as confirmed by appraiser on page 3 of appraisal). The appraiser should note whether there is a case number. The master policy covers losses sustained by the community�s shared spaces. The policy must also cover the replacement cost of the development, including each individual unit, whether through guaranteed replacement cost (insurer will replace the insurable property regardless of.

Slider_Image_web Bill Terry Insurance From billterryinsuranceagency.com

Slider_Image_web Bill Terry Insurance From billterryinsuranceagency.com

Approach to value the approach to value for a pud is the same as the approach to value for other types of. Today, many are taking the opportunity to live in a planned unit development (pud) in order to save money. Each unit within the pud is required to have its own coverage, as well. Sellers must continue to verify and maintain evidence of insurance as required by the guide on any individual unit in a pud and ground lease community, or a pud master/blanket insurance policy as required in section 4703.2. Ronn hall insurance services is a member of the san diego california bbb serving all of california : That planned unit development insurance policy insures amenities, community buildings, supplies, a laundry room, or any common area.

The appraiser should note whether there is a case number.

In a condo situation, the association owns the land. No requirements 1 million master insurance policy for the project (applies to attached Where puds differ from condominiums is that condo owners do not own the land they live on and leave repairs and insurance to their property managers. Today, many are taking the opportunity to live in a planned unit development (pud) in order to save money. They have amenities built into the community, such as parks, pools, and tennis courts, so they need insurance coverage to handle any issues that arise with their equipment. In a condo situation, the association owns the land.

Source: prioritytitle.biz

Source: prioritytitle.biz

A pud is a community in which individual unit owners have ownership of their home, their lot, and the common area. Where puds differ from condominiums is that condo owners do not own the land they live on and leave repairs and insurance to their property managers. In a pud, the homeowner owns the land and is free to use the. That planned unit development insurance policy insures amenities, community buildings, supplies, a laundry room, or any common area. It also includes business liability and medical coverage.

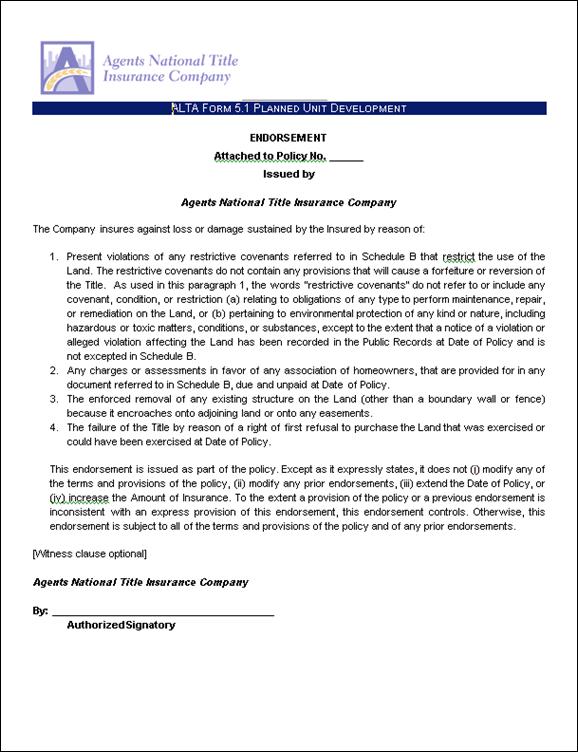

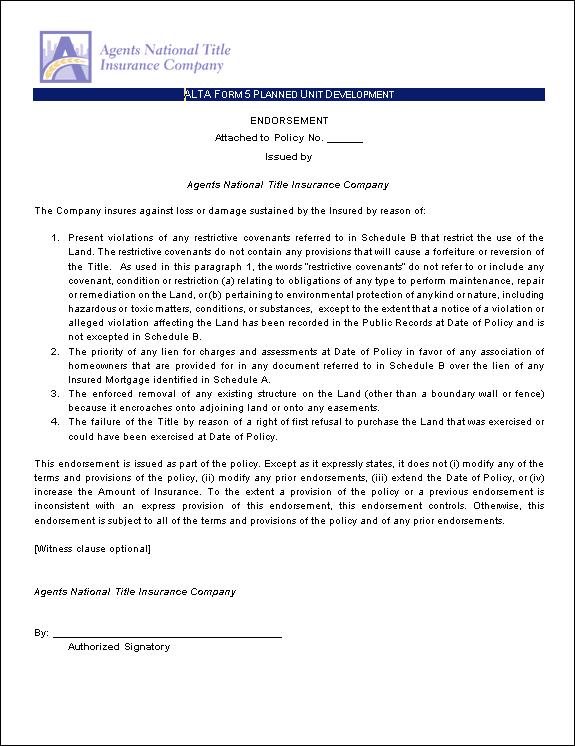

Source: agentstitle.com

Source: agentstitle.com

The policy must also cover the replacement cost of the development, including each individual unit, whether through guaranteed replacement cost (insurer will replace the insurable property regardless of. In a condominium the owners pay dues that cover repairs and insurance on the common walls, roof and amenities. 1 million master insurance policy for the project (applies to attached only) pud: A pud insurance policy must provide coverage against fire and all other perils and hazards that are generally covered for similar projects. In a pud, the homeowner owns the land and is free to use the.

Source: yorkplaceonline.com

Source: yorkplaceonline.com

Today, many are taking the opportunity to live in a planned unit development (pud) in order to save money. Some think the association should do this. In a pud, the hoa is required to have a property insurance policy that covers all of the common elements of the community, including fixture and building service equipment, common property, and supplies. One may also ask, what defines a pud? The pud’s insurance company, ace group/chubb limited, has negotiated for the last three months with the petitioners, according to heavily redacted (blacked out) documents the daily news obtained.

Source: youngalfred.com

Source: youngalfred.com

Each unit within the pud is required to have its own coverage, as well. Some of the owners (me included) feel we should be able to carry the insurance individually; The lender is responsible for obtaining a case number from hud to ensure that the pud is already approved. Insurance carrier, a master or blanket policy insuring the property located in the pud, including all improvements now existing or hereafter erected on the mortgaged premises, and such policy is satisfactory to lender and provides insurance coverage in the amounts, for the The fees of my homeowners association have covered the insurance of all units since it was built, about 2 1/2 yrs.

Source: tdn.com

Source: tdn.com

In a condominium the owners. If the project’s legal documents allow for blanket insurance policies to cover both the individual units and the common elements, fannie mae will accept the blanket policies in satisfaction of its insurance requirements for the. The master policy covers losses sustained by the community�s shared spaces. It also includes business liability and medical coverage. This coverage offers your association building coverage for fire & hazards, directors & officers, employee dishonesty, and building code ordinance coverage.

Source: tdn.com

Source: tdn.com

Today, many are taking the opportunity to live in a planned unit development (pud) in order to save money. Additional differences between pud’s and condo’s. A pud is a community in which individual unit owners have ownership of their home, their lot, and the common area. 1 million master insurance policy for the project (applies to attached only) pud: Insurance coverage for puds if you live in a pud, the hoa or investment group holds a master insurance policy.

Source: bluelimeins.com

Source: bluelimeins.com

A pud insurance policy must provide coverage against fire and all other perils and hazards that are generally covered for similar projects. In a pud development the owners pay for their own repairs and insurance, however. Ronn hall insurance services is a member of the san diego california bbb serving all of california : This coverage offers your association building coverage for fire & hazards, directors & officers, employee dishonesty, and building code ordinance coverage. To be eligible for insurance endorsement, puds must be approved by hud.

Source: phly.com

Source: phly.com

Insurance carrier, a master or blanket policy insuring the property located in the pud, including all improvements now existing or hereafter erected on the mortgaged premises, and such policy is satisfactory to lender and provides insurance coverage in the amounts, for the In a condo situation, the association owns the land. Some additional differences between the two include how repairs and maintenance is handled. A pud consists of a community of homes that are either attached or detached properties. Section 4703.2 pud guide chapter updates

Source: researchgate.net

Source: researchgate.net

The lender is responsible for obtaining a case number from hud to ensure that the pud is already approved. A pud is a community in which individual unit owners have ownership of their home, their lot, and the common area. A pud consists of a community of homes that are either attached or detached properties. We offer the following coverage’s: Insurance coverage for common elements.

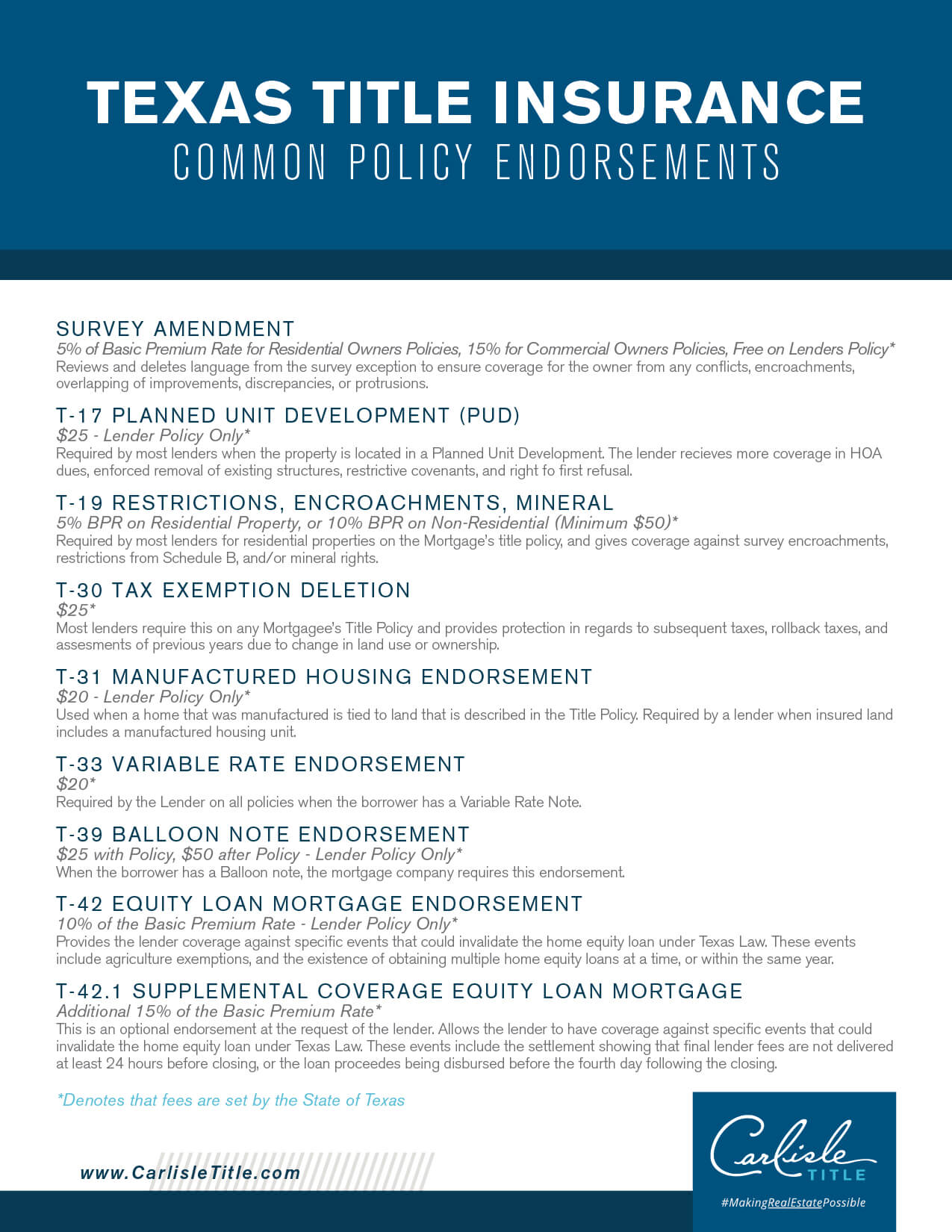

Source: carlisletitle.com

Source: carlisletitle.com

The term “pud” is the. Individual insurance policies are also required for each unit mortgage that fannie mae purchases in a pud project. The master policy covers losses sustained by the community�s shared spaces. We offer the following coverage’s: This coverage offers your association building coverage for fire & hazards, directors & officers, employee dishonesty, and building code ordinance coverage.

Source: billterryinsuranceagency.com

Source: billterryinsuranceagency.com

The term “pud” is the. Today, many are taking the opportunity to live in a planned unit development (pud) in order to save money. If the project’s legal documents allow for blanket insurance policies to cover both the individual units and the common elements, fannie mae will accept the blanket policies in satisfaction of its insurance requirements for the. Some think the association should do this. In a pud, the homeowner owns the land and is free to use the.

Source: mortgage.info

Source: mortgage.info

Insurance coverage for common elements. Ronn hall insurance services is a member of the san diego california bbb serving all of california : New f new or proposed attached: While each pud is different, there are certain puds that will have stricter rules than others. If the project’s legal documents allow for blanket insurance policies to cover both the individual units and the common elements, fannie mae will accept the blanket policies in satisfaction of its insurance requirements for the.

Source: birminghamappraisalblog.com

Source: birminghamappraisalblog.com

Unit is 100% complete detached: A pud consists of a community of homes that are either attached or detached properties. In a pud, the homeowner owns the land and is free to use the. Pud insurance is a category of insurance coverage that is designed to protect those in charge of hoas that run puds. While each pud is different, there are certain puds that will have stricter rules than others.

Source: youngalfred.com

Source: youngalfred.com

The pud’s insurance company, ace group/chubb limited, has negotiated for the last three months with the petitioners, according to heavily redacted (blacked out) documents the daily news obtained. We offer the following coverage’s: Before delivering a loan secured by an individual unit in In a pud, the homeowner owns the land and is free to use the. Ronn hall insurance services is a member of the san diego california bbb serving all of california :

Source: agentstitle.com

Source: agentstitle.com

New f new or proposed attached: Insurance coverage for puds if you live in a pud, the hoa or investment group holds a master insurance policy. Additionally, a homeowner’s association association (hoa) typically owns the common areas of the community. Puds are ideal for residents that want everything in one place so that they are able to come home and hardly ever leave. Approach to value the approach to value for a pud is the same as the approach to value for other types of.

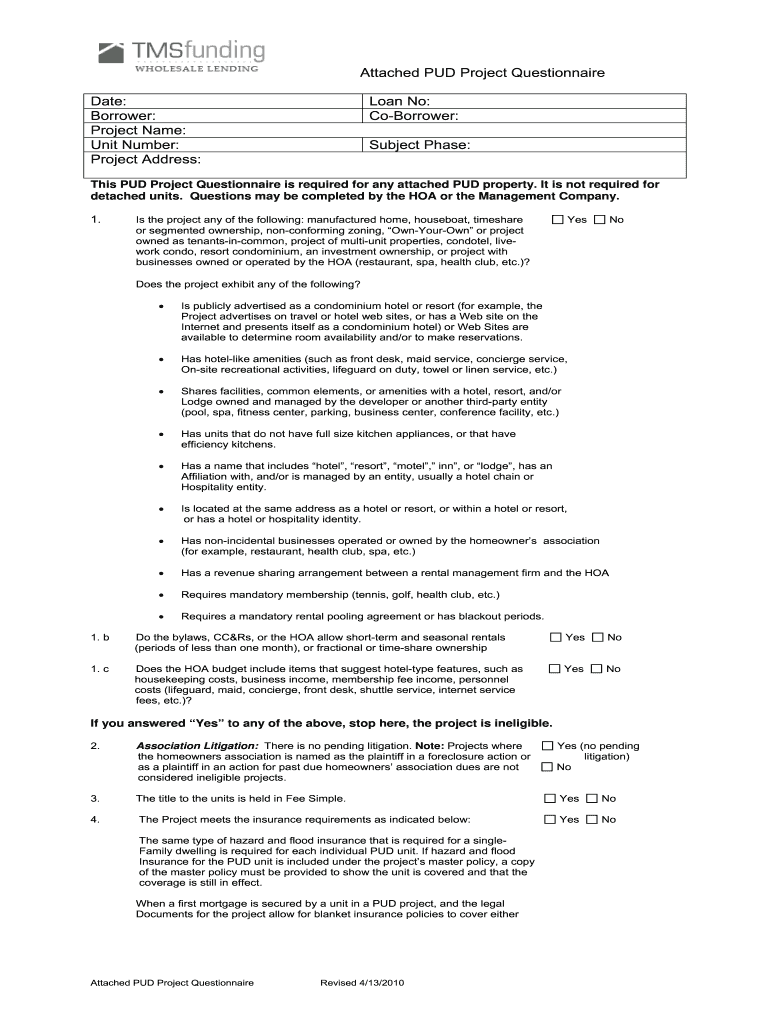

Source: pdffiller.com

Source: pdffiller.com

One may also ask, what defines a pud? Insurance coverage for common elements. It also includes business liability and medical coverage. If the project’s legal documents allow for blanket insurance policies to cover both the individual units and the common elements, fannie mae will accept the blanket policies in satisfaction of its insurance requirements for the. To be eligible for insurance endorsement, puds must be approved by hud.

Source: billterryinsuranceagency.com

Source: billterryinsuranceagency.com

A pud warranty form is not required for attached or detached puds. The pud’s insurance company, ace group/chubb limited, has negotiated for the last three months with the petitioners, according to heavily redacted (blacked out) documents the daily news obtained. Insurance coverage for puds if you live in a pud, the hoa or investment group holds a master insurance policy. The lender is responsible for obtaining a case number from hud to ensure that the pud is already approved. A pud insurance policy must provide coverage against fire and all other perils and hazards that are generally covered for similar projects.

Source: ronnhall.com

Source: ronnhall.com

In a pud, the hoa is required to have a property insurance policy that covers all of the common elements of the community, including fixture and building service equipment, common property, and supplies. In a pud, the homeowner owns the land and is free to use the. No review required 50% presale (as confirmed by appraiser on page 3 of appraisal). 1 million master insurance policy for the project (applies to attached only) pud: A pud is a community in which individual unit owners have ownership of their home, their lot, and the common area.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title pud insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information