Purchasing insurance is what type of response to risk information

Home » Trend » Purchasing insurance is what type of response to risk informationYour Purchasing insurance is what type of response to risk images are ready in this website. Purchasing insurance is what type of response to risk are a topic that is being searched for and liked by netizens today. You can Download the Purchasing insurance is what type of response to risk files here. Download all royalty-free vectors.

If you’re searching for purchasing insurance is what type of response to risk pictures information connected with to the purchasing insurance is what type of response to risk topic, you have pay a visit to the right blog. Our site frequently provides you with hints for seeing the maximum quality video and picture content, please kindly search and find more enlightening video content and images that fit your interests.

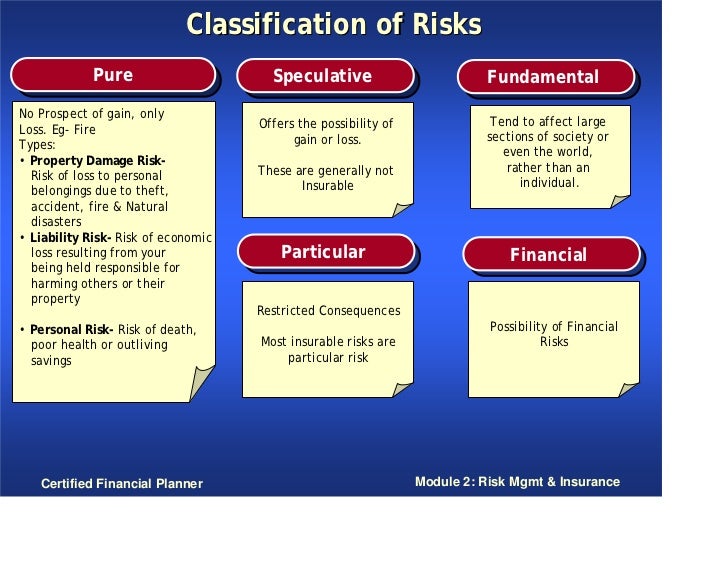

Purchasing Insurance Is What Type Of Response To Risk. After conducting a qualitative risk assessment of her organization, sia recommends purchasing a cybersecurity breach insurance policy. And if the accident / insurance event occurs, the insurance company will bear all or all of the costs in full or in part. A process that is not part of project risk management is identification; This risk response is used when you lack the authority to manage the risk.

The Different Types of Business Insurance Goodison Insurance From goodison.com

The Different Types of Business Insurance Goodison Insurance From goodison.com

The most common example is through outsourcing certain operations such as customer services. Identification of risk sources, assessment of their effects (risk analysis), development of management response to risk, and providing for. Lastly, risk transfer is a risk reduction method that hands off the risk to a third party. For example, though you have asked a third party to manage the risk, you are responsible for the guarantee with the client. Similar to accepting the risk, this response can be used for major risks that carry a high probability and/or severity, but must be accepted by the project. Buying insurance is not such an action.

These risks can be the result of human negligence, natural disaster, communal riots, strikes at the workplace, sudden breakdown in a manufacturing unit, fall of the country, etc.

Buying insurance is not such an action. The purchase of the insurance policy is what type of risk response? Please note that this strategy can cause you a secondary risk. It involves the following two things: These risks can be the result of human negligence, natural disaster, communal riots, strikes at the workplace, sudden breakdown in a manufacturing unit, fall of the country, etc. Insurance is an example of this risk response strategy.

Source: cloudfriday.com

Source: cloudfriday.com

Regularly test restoration procedures transference cable modem ssh A process that is not part of project risk management is identification; 3 types of risk in insurance. The risk event can be mitigated by purchasing an insurance to protect the organization. (risk response strategy or risk response plan is the same thing in essence.

Source: ogs.ny.gov

Source: ogs.ny.gov

The first stage is to determine exactly what the risks facing your business are, in order to assess the likely and potential impact of each incident occurring. Purchasing insurance is what type of response to risk? Risk response strategy is an action plan on what you will do a risk on your project. Purchasing insurance is what type of response to risk is a tool to reduce your risks. Pure risk is an accidental risk that results in the physical loss of the insured.

Source: dreamstime.com

Source: dreamstime.com

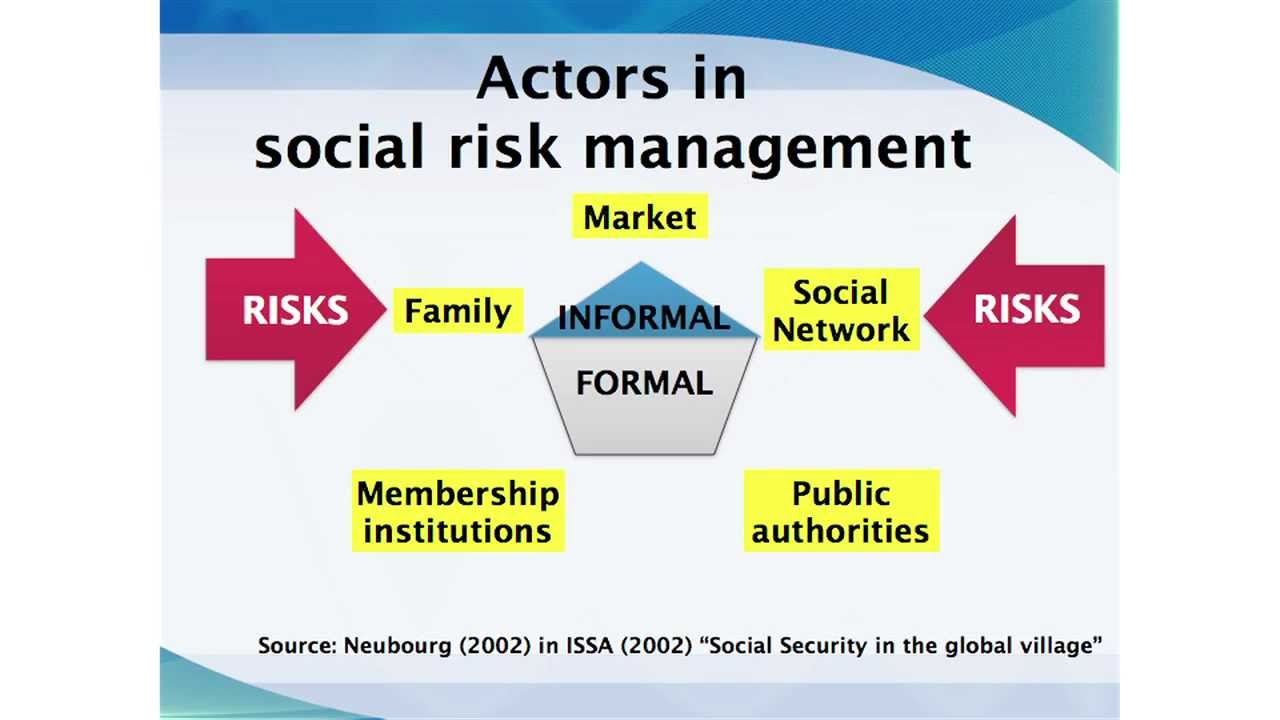

Building action plans that can be immediately mobilized upon occurrance of the risk. Lastly, risk transfer is a risk reduction method that hands off the risk to a third party. After conducting a qualitative risk assessment of her organization, sia recommends purchasing a cybersecurity breach insurance policy. Fundamental risks are the risks mostly emanating from nature. The process of risk management is broken down into:

Source: buzznigeria.com

Source: buzznigeria.com

Please login/register to bookmark chapters. Building action plans that can be immediately mobilized upon occurrance of the risk. The process of risk management is broken down into: Similar to accepting the risk, this response can be used for major risks that carry a high probability and/or severity, but must be accepted by the project. Identification of risk sources, assessment of their effects (risk analysis), development of management response to risk, and providing for.

Source: topqualitycommercialandcarinsurance.wordpress.com

Source: topqualitycommercialandcarinsurance.wordpress.com

And if the accident / insurance event occurs, the insurance company will bear all or all of the costs in full or in part. Please login/register to bookmark chapters. Lastly, risk transfer is a risk reduction method that hands off the risk to a third party. Fundamental risks are the risks mostly emanating from nature. What type of risk response behavior is she recommending to her organization in the given scenario?

Source: cobalt.net

Source: cobalt.net

However, mitigating risk is taking action before a risk event occurs. Creating plans for monitoring the triggers that activate the risk. The first stage is to determine exactly what the risks facing your business are, in order to assess the likely and potential impact of each incident occurring. You can purchase term insurance with guaranteed renewal for a. 3 types of risk in insurance.

Source: firstireland.ie

Source: firstireland.ie

The process of risk management is broken down into: The four techniques of risk management. Lastly, risk transfer is a risk reduction method that hands off the risk to a third party. Similar to accepting the risk, this response can be used for major risks that carry a high probability and/or severity, but must be accepted by the project. Many people think of using insurance as a way of decreasing impact.

Source: sageoakfinancial.com

Source: sageoakfinancial.com

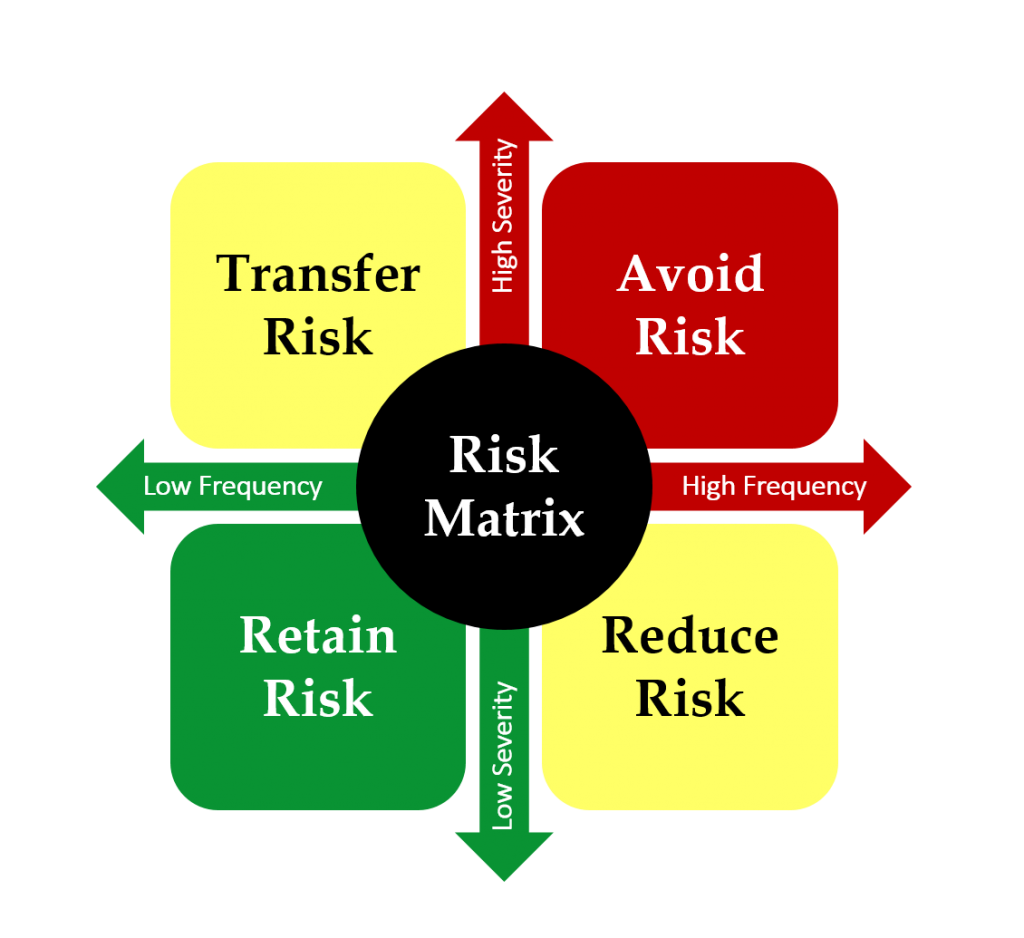

The main risk response strategies for threats are mitigate, avoid, transfer, actively accept, passively accept, and escalate a risk. Deployment of a countermeasure b. See the answer see the answer done loading. Purchasing insurance is what type of response to risk is a tool to reduce your risks. Insurance is an example of this risk response strategy.

Source: goodison.com

Source: goodison.com

Many people think of using insurance as a way of decreasing impact. Another method is through the purchase of insurance, allowing the risk to be transferred from the project to the insurance company. Purchasing insurance is what type of response to risk? When an individual or entity is purchasing insurance, they are shifting financial risks to the insurance company. Eliminating the cause of a risk;

Source: finansialku.com

Source: finansialku.com

Similar to accepting the risk, this response can be used for major risks that carry a high probability and/or severity, but must be accepted by the project. Identification of risk sources, assessment of their effects (risk analysis), development of management response to risk, and providing for. Deployment of a countermeasure b. Purchasing insurance is what type of response to risk? To mitigate risk (choice a), we either reduce the probability of the event happening or reduce its impact.

Source: evcvaluation.com

Source: evcvaluation.com

The most common example is through outsourcing certain operations such as customer services. These risks can be the result of human negligence, natural disaster, communal riots, strikes at the workplace, sudden breakdown in a manufacturing unit, fall of the country, etc. (risk response strategy or risk response plan is the same thing in essence. Some comments on life insurance. The risk event can be mitigated by purchasing an insurance to protect the organization.

Source: pinterest.com

Source: pinterest.com

Please login/register to bookmark chapters. Eliminating the cause of a risk; Purchasing insurance is what type of response to risk is a tool to reduce your risks. See the answer see the answer done loading. The purchase of the insurance policy is what type of risk response?

Source: youtube.com

Source: youtube.com

There are several types of life insurance to choose from: Purchasing insurance is what type of response to risk is a tool to reduce your risks. Please login/register to bookmark chapters. The purchase of the insurance policy is what type of risk response? Lastly, risk transfer is a risk reduction method that hands off the risk to a third party.

Source: corporatecomplianceinsights.com

Source: corporatecomplianceinsights.com

Eliminating the cause of a risk; See the answer see the answer done loading. Fundamental risks are the risks mostly emanating from nature. Joe is responsible for the security of. The main risk response strategies for threats are mitigate, avoid, transfer, actively accept, passively accept, and escalate a risk.

Source: slideshare.net

Source: slideshare.net

You can purchase term insurance with guaranteed renewal for a. It involves the following two things: The risk event can be mitigated by purchasing an insurance to protect the organization. You can use terms interchangeably.) The four techniques of risk management.

Source: mormonproposition.com

Source: mormonproposition.com

Building action plans that can be immediately mobilized upon occurrance of the risk. Eliminating the cause of a risk; Buying insurance is not such an action. Fundamental risks are the risks mostly emanating from nature. Similar to accepting the risk, this response can be used for major risks that carry a high probability and/or severity, but must be accepted by the project.

Source: buyyourproduct.com

Source: buyyourproduct.com

Pure risk is an accidental risk that results in the physical loss of the insured. Financial risks can be measured in monetary terms. This risk response is used when you lack the authority to manage the risk. A process that is not part of project risk management is identification; You can use terms interchangeably.)

Source: allbusiness.com

Source: allbusiness.com

The process of risk management is broken down into: Many people think of using insurance as a way of decreasing impact. The most common example is through outsourcing certain operations such as customer services. You can purchase term insurance with guaranteed renewal for a. Building action plans that can be immediately mobilized upon occurrance of the risk.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title purchasing insurance is what type of response to risk by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information