Pure risk in insurance Idea

Home » Trend » Pure risk in insurance IdeaYour Pure risk in insurance images are available. Pure risk in insurance are a topic that is being searched for and liked by netizens today. You can Get the Pure risk in insurance files here. Download all free vectors.

If you’re searching for pure risk in insurance pictures information connected with to the pure risk in insurance keyword, you have pay a visit to the ideal site. Our website frequently provides you with suggestions for refferencing the highest quality video and image content, please kindly search and locate more enlightening video articles and graphics that match your interests.

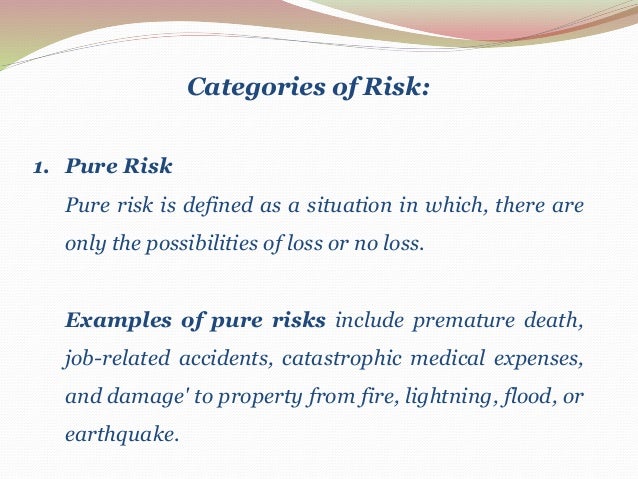

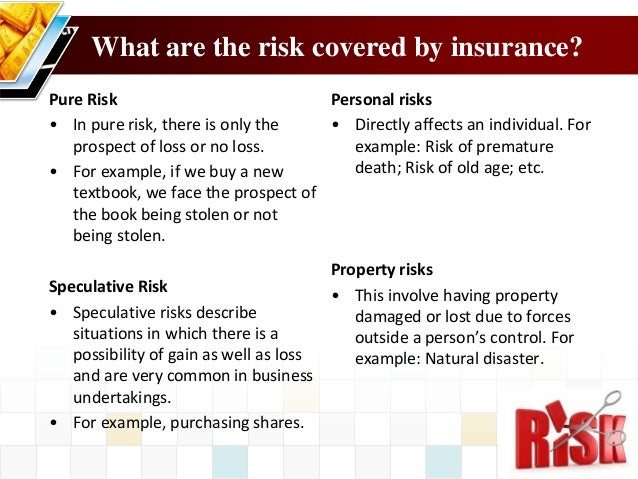

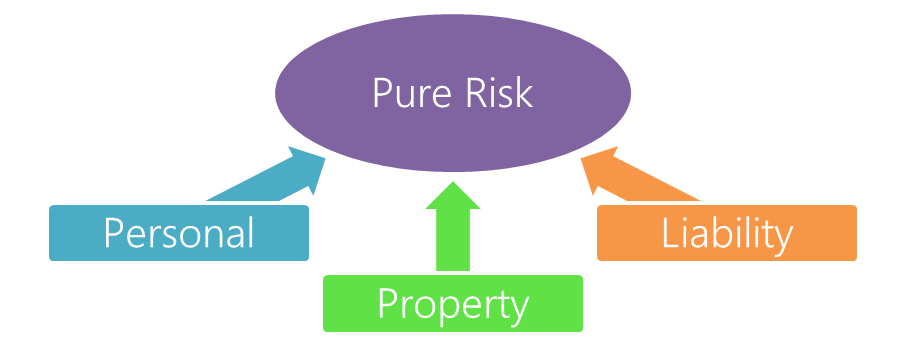

Pure Risk In Insurance. They are pure in the sense that they do not mix both profits and losses. If the life assured dies during the policy duration, then the nominee gets the sum assured amount by the insurance company as death benefit. Pure risks are insurable through commercial, personal or liability insurance policies. Are there other categories of risk besides pure risk?

Pure Risk In Insurance PPT Math 479 / 568 Casualty From teenagersusanamaria.blogspot.com

Pure Risk In Insurance PPT Math 479 / 568 Casualty From teenagersusanamaria.blogspot.com

Typically, events that are considered to carry this level of risk are out of the control of the individual who is assuming the risk, making it impossible to actually make a conscious decision to take on the risk. Pure risks are one of the fastest growing independent specialist professional indemnity insurance brokers in the uk. The benefit of pure risk policies to the policyholder is a potentially large payoff in the event of a catastrophe; In placing professional indemnity insurance for professionals. There is no maturity benefit or an investment component. In these policies, individuals or organizations transfer part of the pure risk to the insurer.

Speculative risks on the other hand are a family of risks in which some possible outcomes are beneficial.

In these policies, individuals or organizations transfer part of the pure risk to the insurer. Examples include natural disasters, theft, property damage or death. For example, home insurance policies protect against natural disasters by providing money for rebuilding. Pure risk refers to an unavoidable and uncontrollable event where the outcome eventually leads to either total loss or no loss at all. Particular risk can be insured. Why term insurance is pure risk protection?

Source: slideshare.net

Source: slideshare.net

Are there other categories of risk besides pure risk? In these policies, individuals or organizations transfer part of the pure risk to the insurer. Term insurance plans are the most basic and purest form of life insurance. There are no opportunities for gain or. 2 two dimensions of pure risk killed in accident lose property in.

Source: slideshare.net

Source: slideshare.net

Pure risks are an independent insurance intermediary specialising. What is pure risk in insurance? Make sure to watch our videos;cargo misappropriation : The benefit to the insurance company is the likelihood that the policy will remain active, and premiums will continue to be paid. Pure risk refers to an unavoidable and uncontrollable event where the outcome eventually leads to either total loss or no loss at all.

Source: slideshare.net

Source: slideshare.net

Pure risk is a term that is applied to any situation where there is no potential for any benefit to be realized if a specific outcome should result. Term insurance provides coverage against any unfortunate event that can affect. Pure risk is a term that is applied to any situation where there is no potential for any benefit to be realized if a specific outcome should result. For example, the risks of an accident, a car theft or earthquake are pure risks. Pure risk refers to an unavoidable and uncontrollable event where the outcome eventually leads to either total loss or no loss at all.

Source: slideserve.com

Source: slideserve.com

Loss, gain or no change. Pure risk is defined as a risk situation that presents a chance of loss only, and no chance for gain. Pure risk in life insurance is classified as, an �only death benefit plan� in which, only the loss of the life is covered. Examples include natural disasters, theft, property damage or death. If the life assured dies during the policy duration, then the nominee gets the sum assured amount by the insurance company as death benefit.

Source: definitionus.blogspot.com

Pure risks are an independent insurance intermediary specialising. Pure risks are an independent insurance intermediary specialising. Make sure to watch our videos;cargo misappropriation : Pure risk in life insurance is classified as, an �only death benefit plan� in which, only the loss of the life is covered. Term insurance plans are often called pure risk protection because these plans mitigate the risk of financial instability in case of premature demise of the breadwinner of the family.

Source: slideshare.net

Source: slideshare.net

Are there other categories of risk besides pure risk? Term insurance covers the finances of the family against the untimely demise of the life assured. The term insurance policy efficiently covers the risk that may arise due to an eventuality. Term insurance provides coverage against any unfortunate event that can affect. Pure risk refers to an unavoidable and uncontrollable event where the outcome eventually leads to either total loss or no loss at all.

Source: luxpiration.com

Source: luxpiration.com

What is pure risk in insurance? Speculative risks are not insurable. What is pure risk and how does it apply in regards to insurance? There are no opportunities for gain or. The benefit to the insurance company is the likelihood that the policy will remain active, and premiums will continue to be paid.

Source: youtube.com

Source: youtube.com

2 two dimensions of pure risk killed in accident lose property in. For example, the risks of an accident, a car theft or earthquake are pure risks. In other words a speculative risk is a situation that might also end in a gain. Pure risk is defined as a risk situation that presents a chance of loss only, and no chance for gain. Why term insurance is pure risk protection?

Source: slideshare.net

Source: slideshare.net

There is no maturity benefit or an investment component. Pure risk is a category of risk that cannot be controlled and has two outcomes: Speculative risks on the other hand are a family of risks in which some possible outcomes are beneficial. Term insurance covers the finances of the family against the untimely demise of the life assured. Pure risk is defined as a risk situation that presents a chance of loss only, and no chance for gain.

Source: slideserve.com

Source: slideserve.com

Examples include natural disasters, theft, property damage or death. In these policies, individuals or organizations transfer part of the pure risk to the insurer. Prm is a subsidiary of privilege underwriters, inc., a member of the tokio marine group of companies. Are there other categories of risk besides pure risk? Pure risks are insurable through commercial, personal or liability insurance policies.

Source: freshnewattitude.blogspot.com

Source: freshnewattitude.blogspot.com

Loss, gain or no change. Why term insurance is pure risk protection? Particular risk can be insured. Damage or loss brought about by pure risk events can be covered by an insurance policy. Pure risks are an independent insurance intermediary specialising.

Source: brainly.in

Source: brainly.in

Make sure to watch our videos;cargo. In placing professional indemnity insurance for professionals. For example, the risks of Loss, gain or no change. Are there other categories of risk besides pure risk?

Source: financegab.com

Source: financegab.com

Examples include natural disasters, theft, property damage or death. There are no opportunities for gain or. Pure risks are an independent insurance intermediary specialising. Term insurance provides coverage against any unfortunate event that can affect. Pure risks are those risks where only a loss can occur if the event happens.

Source: youtube.com

Source: youtube.com

Pure risk refers to an unavoidable and uncontrollable event where the outcome eventually leads to either total loss or no loss at all. We place over a billion pounds of cover in the professional indemnity insurance market which includes. What is pure risk in insurance? Pure risk is a term that is applied to any situation where there is no potential for any benefit to be realized if a specific outcome should result. For example, home insurance policies protect against natural disasters by providing money for rebuilding.

Source: teenagersusanamaria.blogspot.com

Source: teenagersusanamaria.blogspot.com

Pure risk in life insurance is classified as, an �only death benefit plan� in which, only the loss of the life is covered. Pure risks are an independent insurance intermediary specialising. Only pure risks are insurable because they involve only the chance of loss. The term insurance policy efficiently covers the risk that may arise due to an eventuality. In other words a speculative risk is a situation that might also end in a gain.

Source: slideserve.com

Source: slideserve.com

However, before we get there we need to discuss the definition of risk. Pure risk in life insurance is classified as, an �only death benefit plan� in which, only the loss of the life is covered. Pure risk in life insurance is classified as, an �only death benefit plan� in which, only the loss of the life is covered. For example, the risks of an accident, a car theft or earthquake are pure risks. For example, home insurance policies protect against natural disasters by providing money for rebuilding.

Source: iedunote.com

Source: iedunote.com

Pure risk in life insurance is classified as, an �only death benefit plan� in which, only the loss of the life is covered. Make sure to watch our videos;cargo. For example, the risks of Insurance and risk make sure to watch our videos;cargo misappropriation : There are no opportunities for gain or.

Source: slideshare.net

Source: slideshare.net

Insurance is concerned with the economic problems created by pure risks. Term insurance plans are the most basic and purest form of life insurance. What is pure risk and how does it apply in regards to insurance? Complete loss or no loss at all. The benefit of pure risk policies to the policyholder is a potentially large payoff in the event of a catastrophe;

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title pure risk in insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information