Purpose of certificate of insurance information

Home » Trending » Purpose of certificate of insurance informationYour Purpose of certificate of insurance images are ready. Purpose of certificate of insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Purpose of certificate of insurance files here. Download all free vectors.

If you’re looking for purpose of certificate of insurance images information related to the purpose of certificate of insurance interest, you have visit the right site. Our website frequently gives you suggestions for seeing the highest quality video and image content, please kindly surf and find more informative video content and graphics that match your interests.

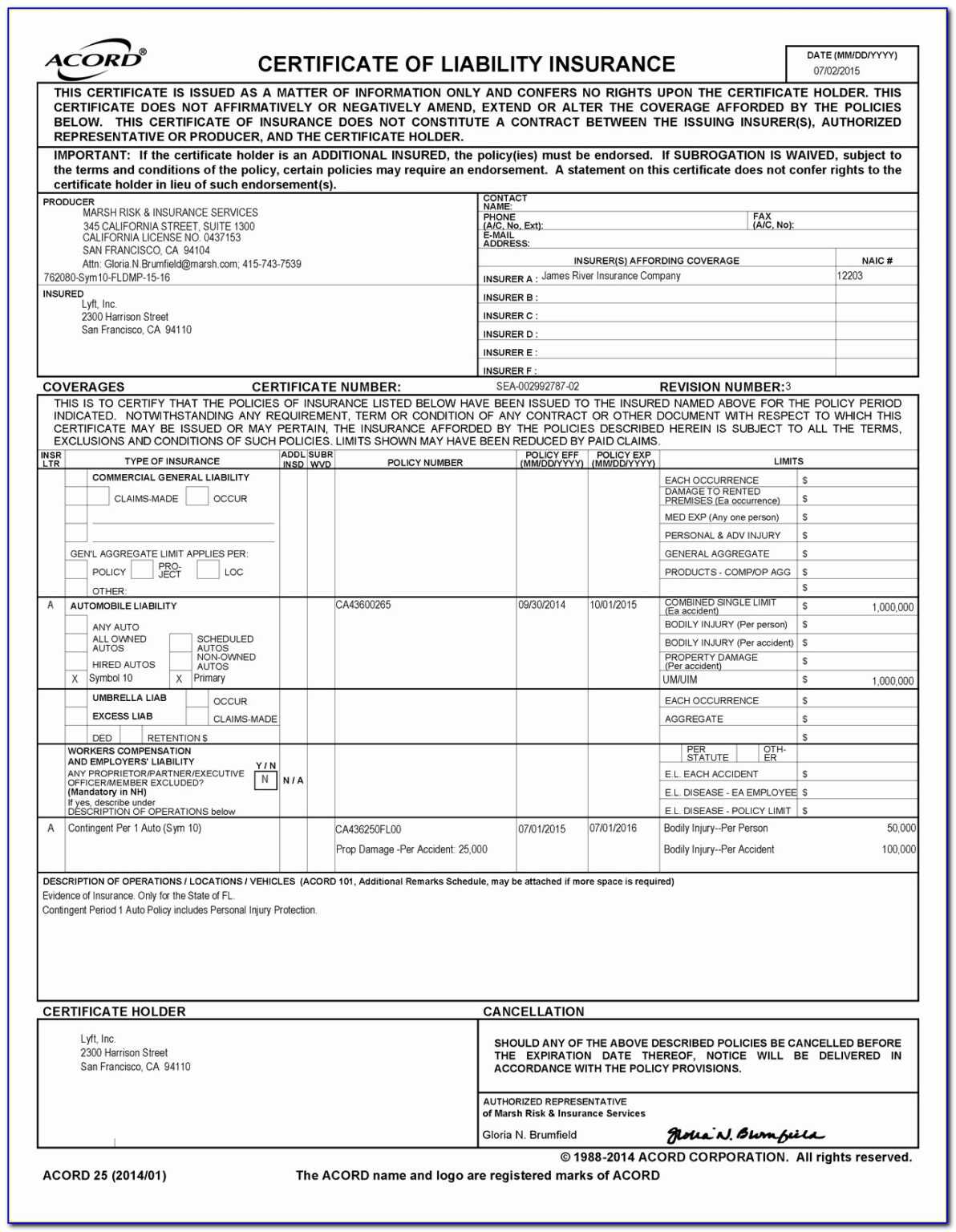

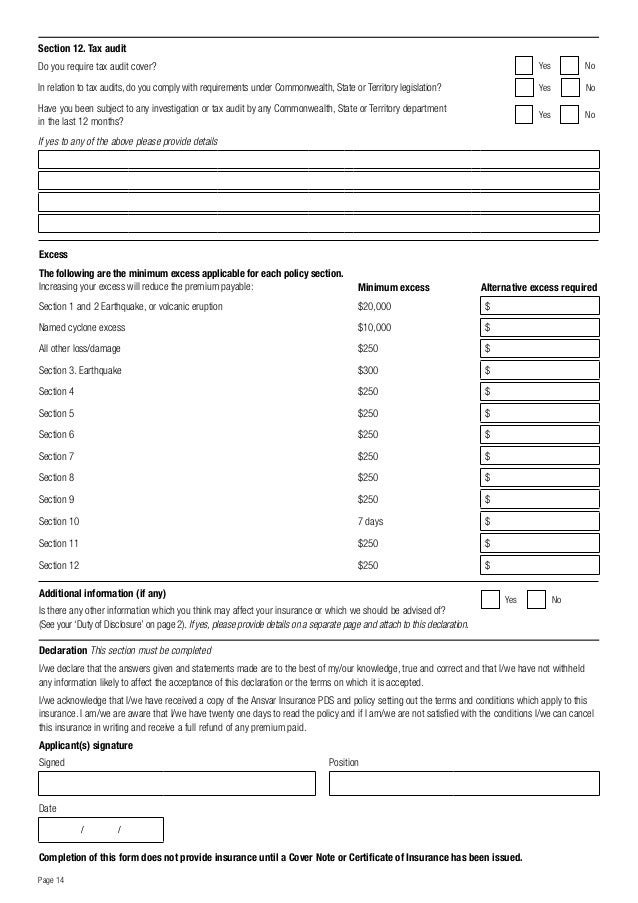

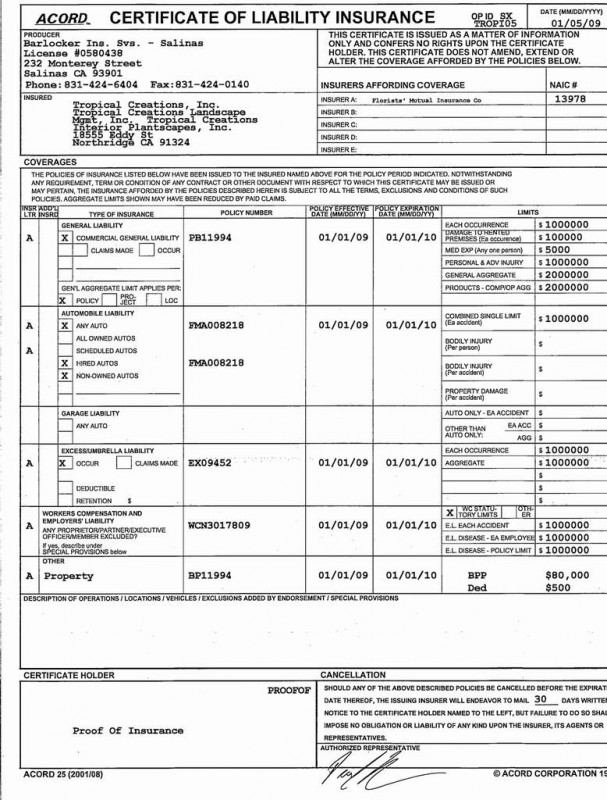

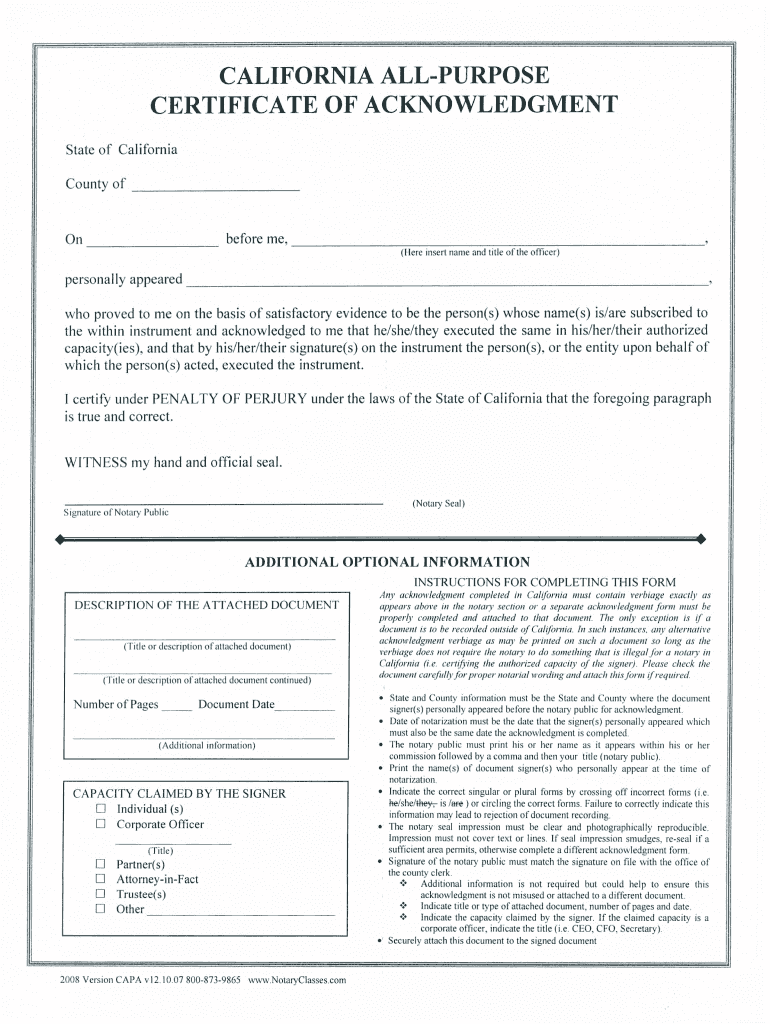

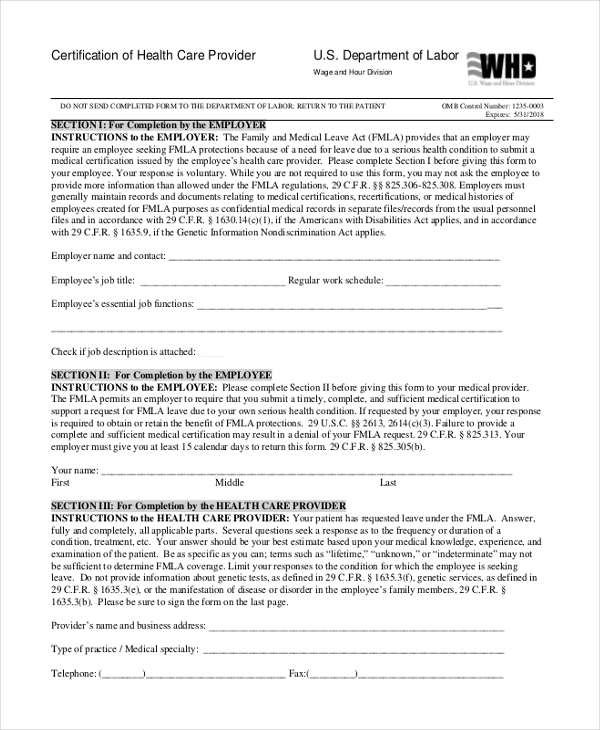

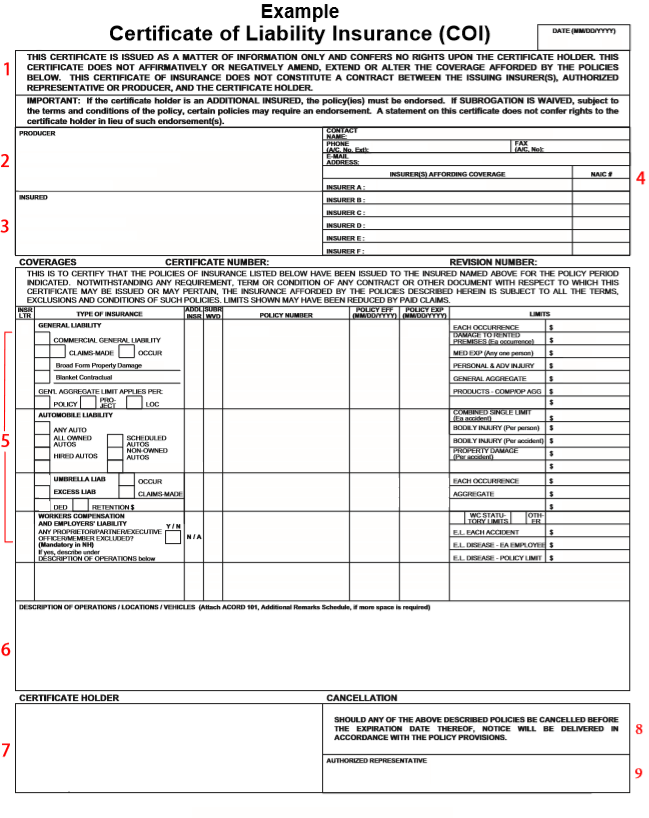

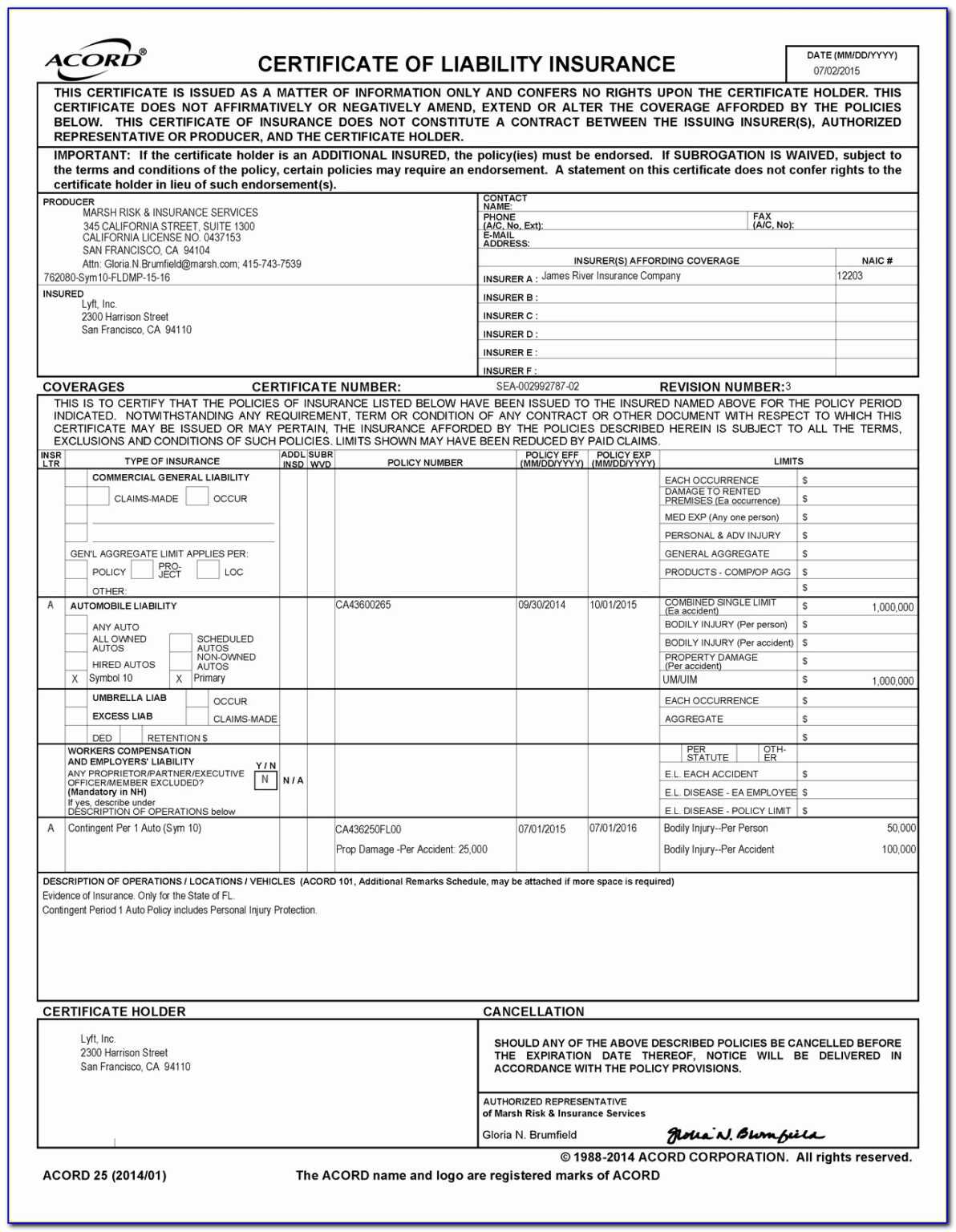

Purpose Of Certificate Of Insurance. A certificate of insurance is not a formal contract between the two parties. The certificate of liability insurance is used for most casualty situations in which the insured has requested certification to a third party of issued casualty coverages. Within each policy there is the policy number, effective date and limits of liability. The truth is that these insurance policies, like any insurance policy, have effective periods during which the coverage is active.

Acord Insurance Certificate Template Great Sample Templates From sample.gelorailmu.com

Acord Insurance Certificate Template Great Sample Templates From sample.gelorailmu.com

Certificates of insurance don�t just prove you have insurance. Purpose of certificates of insurance is more general in that they merely acknowledge that a policy has been written and set forth the general terms of what the policy covers. That’s the most simple form of a certificate of insurance explained, and once you know exactly which one you need, any list of acord form samples will help you find it. A business can cancel its insurance coverage at any moment. This field is for validation purposes and should be left unchanged. Your contractors submit their initial certificates of insurance (cois) when they begin working with your organization, and you may assume that they are maintaining that coverage for the duration of their contract.

Purpose a certificate of insurance is a document that provides verification to third parties that an individual or entity has insurance coverage.

In short, it provides evidence that a company is insured. It encompasses a complete snapshot of the policy on a single form, including the most pertinent aspects, such as: The typesof coverage the policyholder has purchased A business can cancel its insurance coverage at any moment. The uses of the certificate can include large and small contracting or manufacturing risks, lessor/lessee agreements, or other areas of liability certification. A certificate of insurance is your way of telling a homeowner, business owner, general contractor or other project manager that an insurance company will step in and foot the costs of legally awarded damages.

Source: paramythia.info

Source: paramythia.info

Your contractors submit their initial certificates of insurance (cois) when they begin working with your organization, and you may assume that they are maintaining that coverage for the duration of their contract. The typesof coverage the policyholder has purchased the effective and expiration dates of the policy, and the limits of liability coverage. One of the main requirements is that the tenant, contractor or borrower must show proof that he or she has adequate insurance. Certificates of insurance are designed to prove your insurance status and amount of coverage while. A certificate of coverage is an official contract that outlines what an insured is entitled to, and what they aren�t insured for, under a health insurance policy.

Source: zadishqr.blogspot.com

Source: zadishqr.blogspot.com

The court found that “[g]iven the numerous limitations and exclusions that often encumber such [insurance] policies, those who take such certificates at face. It includes coverage types and liability limits, plus the effective date of the policy and insurance company name. They also show what types of. When stores lease real estate spaces or construction firms win jobs, the party on the other end usually has a very specific set of requirements. The typesof coverage the policyholder has purchased the effective and expiration dates of the policy, and the limits of liability coverage.

Source: california-acknowledgement-certificate.pdffiller.com

Source: california-acknowledgement-certificate.pdffiller.com

Purpose a certificate of insurance is a document that provides verification to third parties that an individual or entity has insurance coverage. A certificate of coverage is an official contract that outlines what an insured is entitled to, and what they aren�t insured for, under a health insurance policy. Certificates of insurance don�t just prove you have insurance. It is an informational document showing proof of insurance. One of the main requirements is that the tenant, contractor or borrower must show proof that he or she has adequate insurance.

Source: agencychecklists.com

Source: agencychecklists.com

In reality, the certificate is quite an important document in that it serves as the insured’s. A certificate of insurance is not a formal contract between the two parties. A certificate of insurance (coi) is a document that contains all the essential details of an insurance policy. It is an informational document showing proof of insurance. The certificate holder named on a policy will receive a copy of the policyholder’s certificate of insurance (coi), which verifies insurance and usually contains information on the type and limits of coverage.

Source: rollerworksfamilyskating.com

Source: rollerworksfamilyskating.com

A certificate of insurance is a document issued by an insurance company or broker, that is used to verify the existence of insurance coverage under specific conditions granted to listed individuals. The typesof coverage the policyholder has purchased the effective and expiration dates of the policy, and the limits of liability coverage. A certificate of insurance (coi) is issued by an insurance company or broker and verifies the existence of an insurance policy. That’s the most simple form of a certificate of insurance explained, and once you know exactly which one you need, any list of acord form samples will help you find it. A certificate of insurance is a standardized document that will show:

Source: withcatalonia.org

Source: withcatalonia.org

The typesof coverage the policyholder has purchased the effective and expiration dates of the policy, and the limits of liability coverage. Certificates of insurance are designed to prove your insurance status and amount of coverage while. This field is for validation purposes and should be left unchanged. According to trusted choice, approximately one in 25 errors and omissions (e&o) claims involves a certificate of insurance. A very helpful substitute for document copies is a certificate of insurance.

Source: kargo.tech

Source: kargo.tech

According to trusted choice, approximately one in 25 errors and omissions (e&o) claims involves a certificate of insurance. The form includes policy details, such as coverage limits and effective dates, so business owners can find and share them easily without revealing other, more private information. It encompasses a complete snapshot of the policy on a single form, including the most pertinent aspects, such as: Certificates of insurance don�t just prove you have insurance. A certificate of insurance (also known as a certificate of currency) is a document issued by an insurance company to confirm that insurance has been obtained for a business or individual for a specific time.

Source: pdffiller.com

Source: pdffiller.com

In reality, the certificate is quite an important document in that it serves as the insured’s. Specify your required coverage including general liability, custom policies and other insurance types. When stores lease real estate spaces or construction firms win jobs, the party on the other end usually has a very specific set of requirements. A certificate of insurance is a document issued by an insurance company or broker, that is used to verify the existence of insurance coverage under specific conditions granted to listed individuals. Usually, third parties include any person or company that performs services for the insured or possesses the insured’s property.

Source: sampleforms.com

Source: sampleforms.com

A certificate of insurance (coi) is issued by an insurance company or broker and verifies the existence of an insurance policy. A very helpful substitute for document copies is a certificate of insurance. These documents are valid for a single day. A certificate of insurance is not a formal contract between the two parties. A certificate of insurance is a standardized document that will show:

Source: atriplefullfatvent.blogspot.com

Source: atriplefullfatvent.blogspot.com

A certificate of insurance (coi) is issued by an insurance company or broker and verifies the existence of an insurance policy. The certificate holder named on a policy will receive a copy of the policyholder’s certificate of insurance (coi), which verifies insurance and usually contains information on the type and limits of coverage. Your contractors submit their initial certificates of insurance (cois) when they begin working with your organization, and you may assume that they are maintaining that coverage for the duration of their contract. It is an informational document showing proof of insurance. It includes coverage types and liability limits, plus the effective date of the policy and insurance company name.

Source: fitsmallbusiness.com

Source: fitsmallbusiness.com

This field is for validation purposes and should be left unchanged. It is also possible for a business to modify its insurance policy at any point in time. In short, it provides evidence that a company is insured. A certificate of insurance is issued by an agent and certifies that the named insured carries the protections and coverage listed at the time the certificate was issued. A certificate of coverage is an official contract that outlines what an insured is entitled to, and what they aren�t insured for, under a health insurance policy.

Source: atlantasbestguttercleaners.com

Source: atlantasbestguttercleaners.com

A certificate of insurance (coi) is a document that contains all the essential details of an insurance policy. Specify your required coverage including general liability, custom policies and other insurance types. This field is for validation purposes and should be left unchanged. But, not all companies want copies of documents sitting around. A certificate of insurance is a snapshot in time it is important to stress that each certificate is a snapshot of current business insurance coverage.

Source: sample.gelorailmu.com

Source: sample.gelorailmu.com

It is an informational document showing proof of insurance. The typesof coverage the policyholder has purchased A very helpful substitute for document copies is a certificate of insurance. A certificate of insurance (coi) is a document that contains all the essential details of an insurance policy. The perfect solution for your company contractors ensure continuity of insurance by flagging issues and managing reminders.

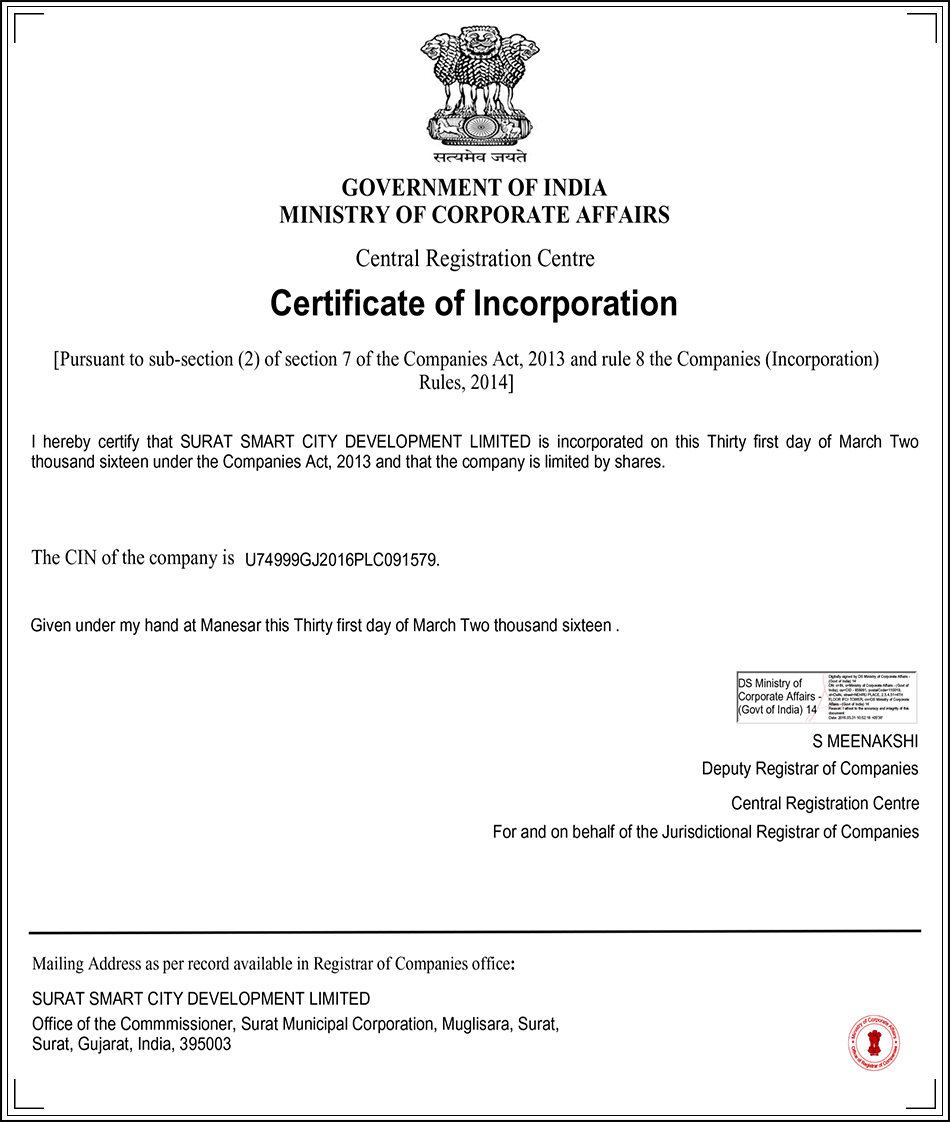

Source: suratsmartcity.com

Source: suratsmartcity.com

Initiate updates when coverage lapses with configurable notifications and alerts. A certificate of insurance is your way of telling a homeowner, business owner, general contractor or other project manager that an insurance company will step in and foot the costs of legally awarded damages. It encompasses a complete snapshot of the policy on a single form, including the most pertinent aspects, such as: The typesof coverage the policyholder has purchased the effective and expiration dates of the policy, and the limits of liability coverage. According to trusted choice, approximately one in 25 errors and omissions (e&o) claims involves a certificate of insurance.

Source: spiinsurance.com.pk

Source: spiinsurance.com.pk

It is an informational document showing proof of insurance. This field is for validation purposes and should be left unchanged. The truth is that these insurance policies, like any insurance policy, have effective periods during which the coverage is active. Purpose of certificates of insurance is more general in that they merely acknowledge that a policy has been written and set forth the general terms of what the policy covers. A certificate of insurance is a document issued by an insurance company or broker, that is used to verify the existence of insurance coverage under specific conditions granted to listed individuals.

Source: simbayanancoop.org

Source: simbayanancoop.org

The court found that “[g]iven the numerous limitations and exclusions that often encumber such [insurance] policies, those who take such certificates at face. A certificate of insurance is a standardized document that will show: A certificate of insurance is a snapshot in time it is important to stress that each certificate is a snapshot of current business insurance coverage. A certificate of insurance is a standardized document that will show: Purpose of certificates of insurance is more general in that they merely acknowledge that a policy has been written and set forth the general terms of what the policy covers.

Source: pinterest.com.au

Source: pinterest.com.au

These documents are valid for a single day. That’s the most simple form of a certificate of insurance explained, and once you know exactly which one you need, any list of acord form samples will help you find it. It refers to which insurance company provides each type of coverage. Understanding the purpose of certificates of insurance. In short, it provides evidence that a company is insured.

Source: symboinsurance.com

Source: symboinsurance.com

Usually, third parties include any person or company that performs services for the insured or possesses the insured’s property. Copies of insurance documents may be sufficient. Certificates of insurance don�t just prove you have insurance. The truth is that these insurance policies, like any insurance policy, have effective periods during which the coverage is active. This certified piece of paper proves that an individual or company has insurance.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title purpose of certificate of insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information