Questions to ask about whole life insurance policies Idea

Home » Trending » Questions to ask about whole life insurance policies IdeaYour Questions to ask about whole life insurance policies images are available in this site. Questions to ask about whole life insurance policies are a topic that is being searched for and liked by netizens today. You can Download the Questions to ask about whole life insurance policies files here. Download all free images.

If you’re searching for questions to ask about whole life insurance policies pictures information related to the questions to ask about whole life insurance policies interest, you have come to the right site. Our site always provides you with suggestions for refferencing the highest quality video and image content, please kindly surf and find more informative video articles and graphics that fit your interests.

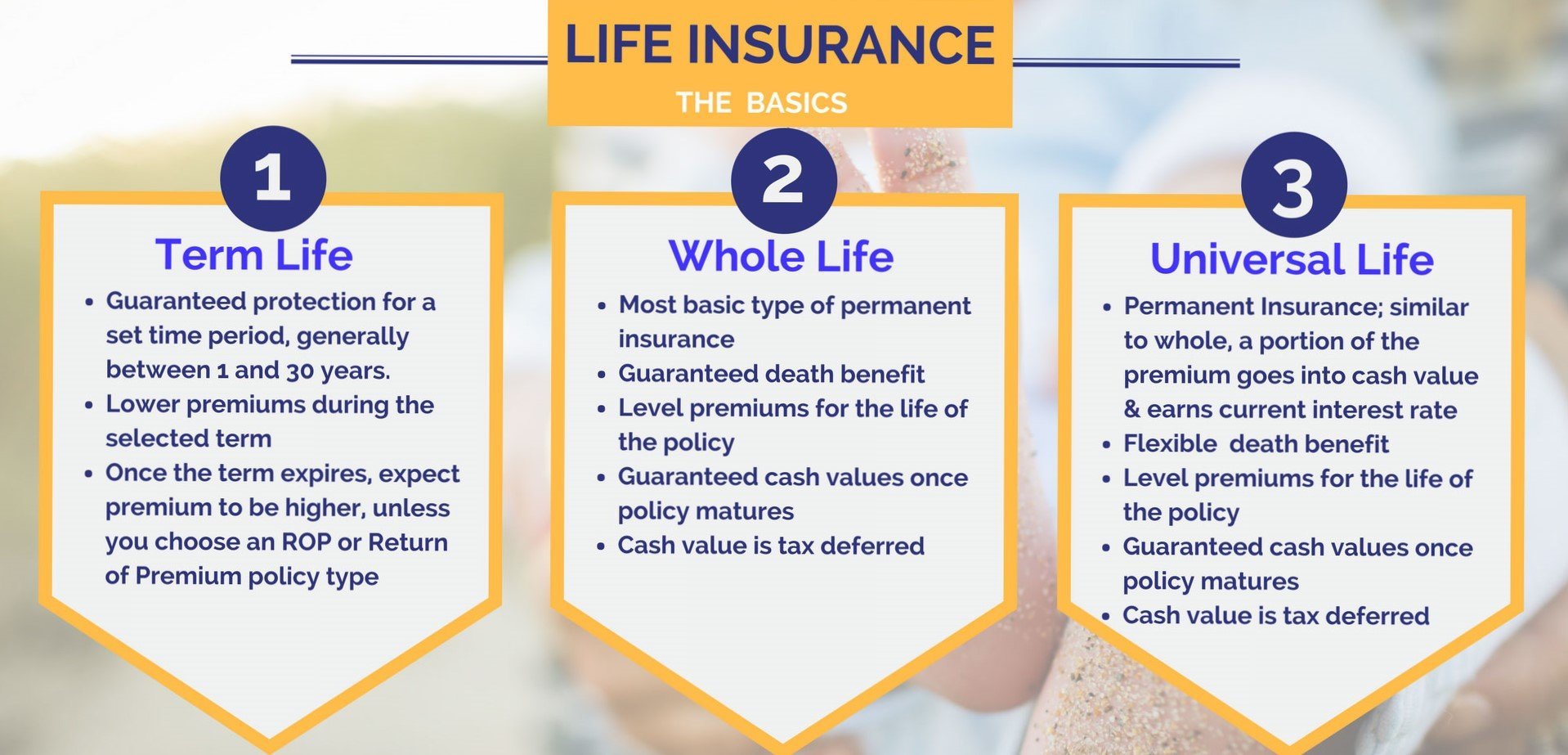

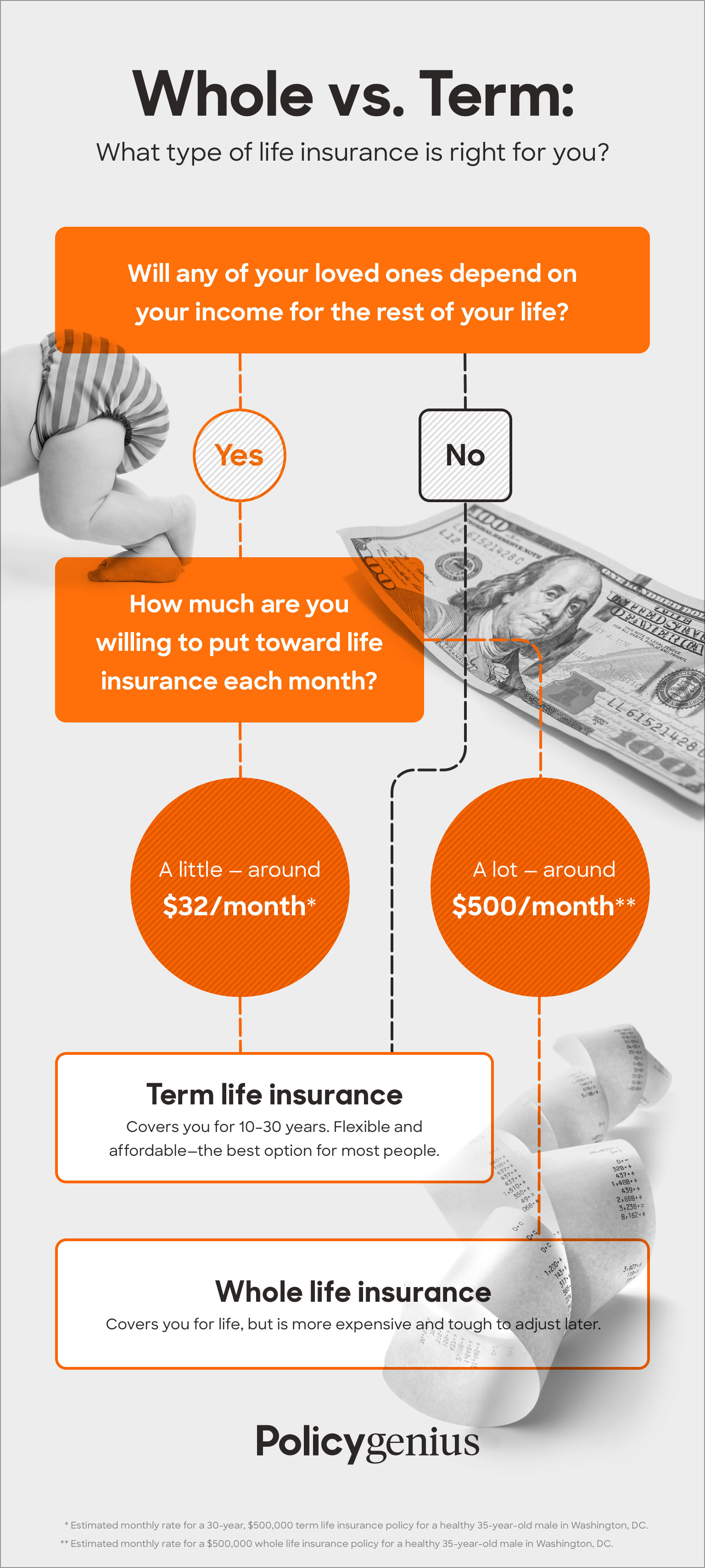

Questions To Ask About Whole Life Insurance Policies. 7 questions to ask before getting life insurance 1. Final expense life insurance refers to specific protection individuals purchase to cover charges and affairs that are associated with your such as burial, funeral service, or final medical bills. Whole life insurance coverage is an excellent option if you seek lifetime coverage and predictable premiums that never increase. When i say “x,” fill in the blank with whatever activity the prospect did to request information on the product.

Pleasant Hill Life Insurance From aggettainsurance.com

Pleasant Hill Life Insurance From aggettainsurance.com

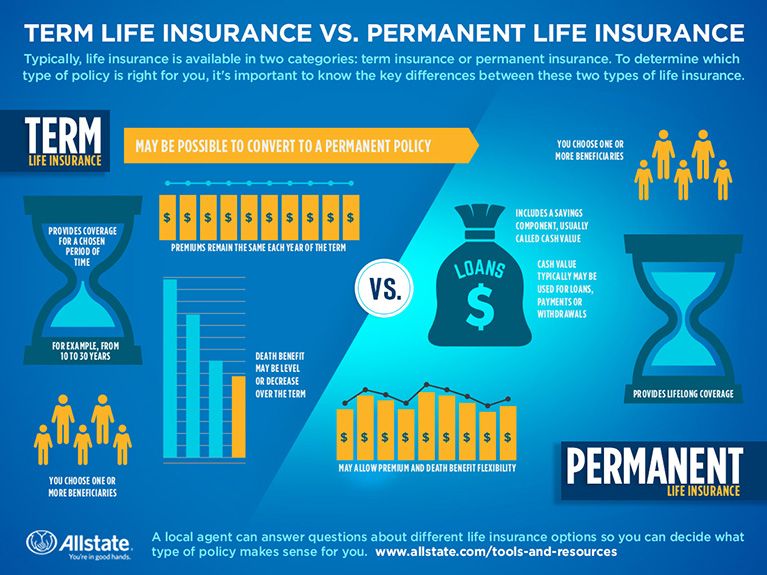

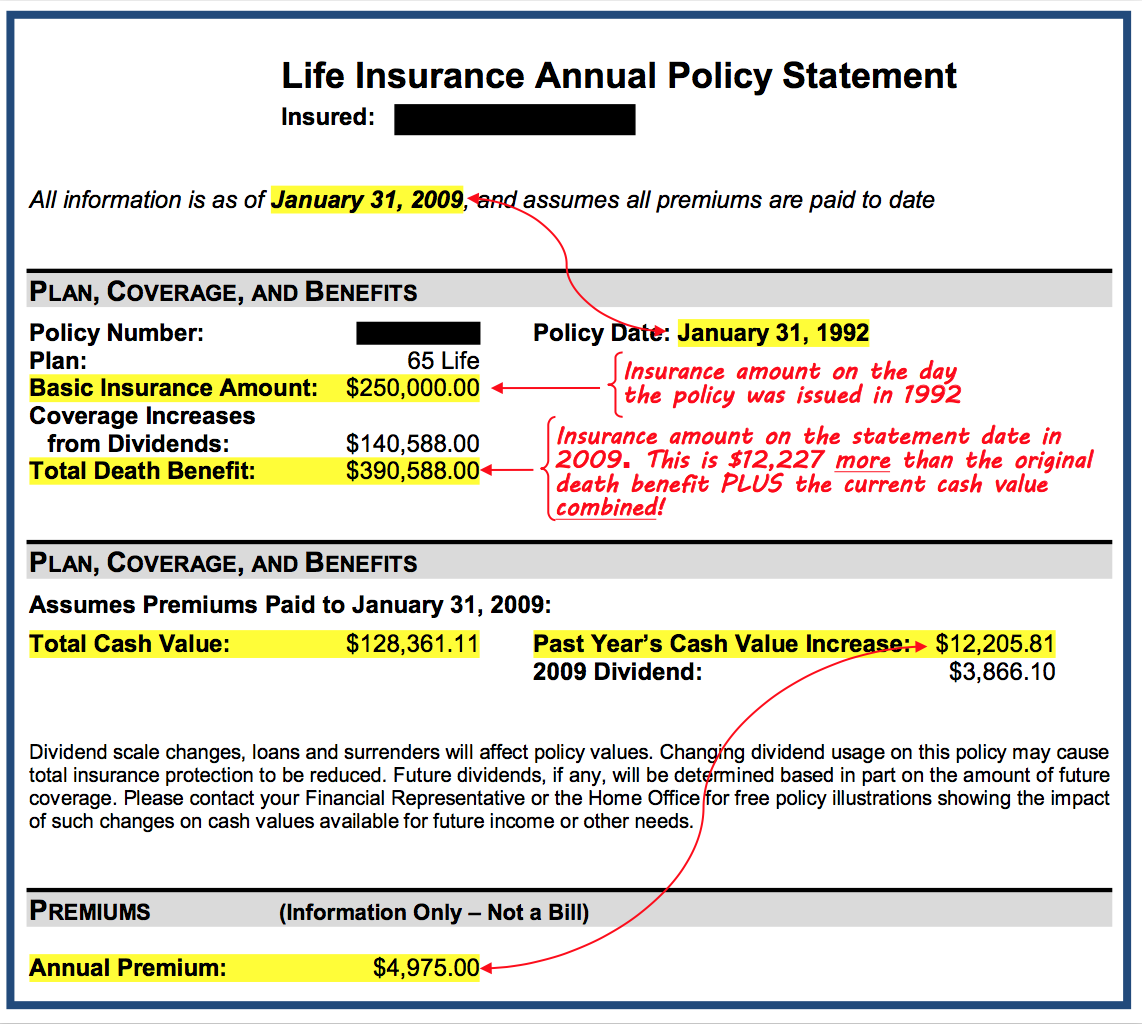

1 all whole life insurance policy guarantees are subject to the timely payment of all required premiums and the claims paying ability of the issuing insurance company. Why do i need life insurance? 2 some whole life polices do not have cash values in the first two years of the policy and don’t. It’s a good idea when considering life insurance to weigh out your options, so here are some of the top questions to ask about whole life insurance policies. In addition to those two advantages,. You need whole life insurance for estate planning.

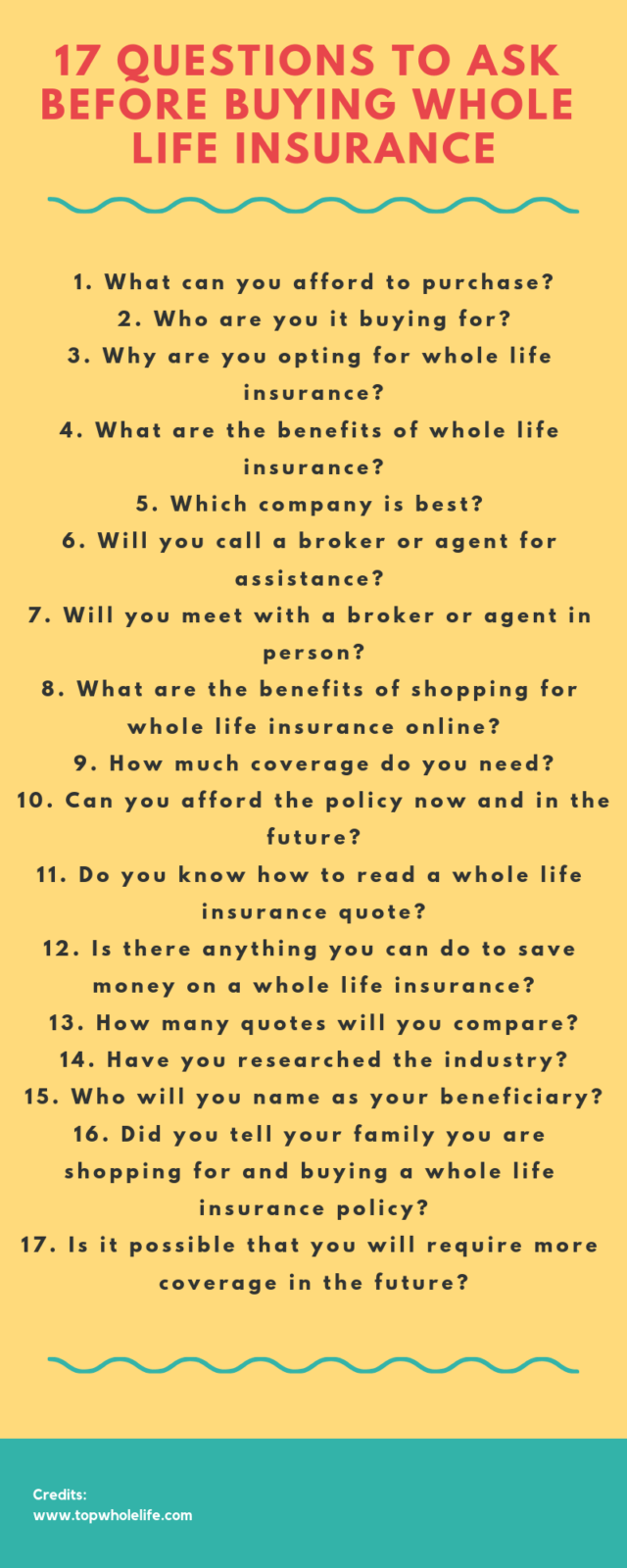

When considering life insurance, it’s a good idea to weigh out your options, so we put together some of the top questions to consider when it comes to whole life insurance policies.

When considering life insurance, it’s a good idea to weigh out your options, so we put together some of the top questions to consider when it comes to whole life insurance policies. Will changing your gender and legal name make a whole life insurance policy invalid? Do i really need whole life insurance? One of the most common life insurance questions is “ how much life insurance will i need ?” the answer involves two major factors: The bottom line is the ‘whole of life’ plan is one of the most effective life insurance policies you could invest in, especially if you do not have medical support from your home country. What is the insurance plan monthly and annual premium?

Source: pinterest.com

Source: pinterest.com

Your response to this question will influence how large of a life insurance policy you’ll need, as well as how you answer many of the remaining questions. The first and most obvious question, your need for life insurance will usually depend on whether or not you have financial dependents like a family. One of the most common life insurance questions is “ how much life insurance will i need ?” the answer involves two major factors: In some cases, this means that people are outliving their universal life policies that they believed to. Not only will they ask questions but they will also go into your medical records to verify all this information.

Source: topwholelife.com

Source: topwholelife.com

The following are 25 questions you should ask, as you consider what company to do business with and what plan to buy. What is the insurance plan monthly and annual premium? Here are five questions to ask yourself before buying a whole life policy. In addition to those two advantages,. True in some states, but not others.

Source: allstate.com

Source: allstate.com

Whole life insurance protects your money from creditors. Here are five questions to ask yourself before buying a whole life policy. The first and most obvious question, your need for life insurance will usually depend on whether or not you have financial dependents like a family. There are plans where you can select payment term between 7 years to 50 years or even for the full term of the plan. Not only will they ask questions but they will also go into your medical records to verify all this information.

Source: easyquotes4you.com

Source: easyquotes4you.com

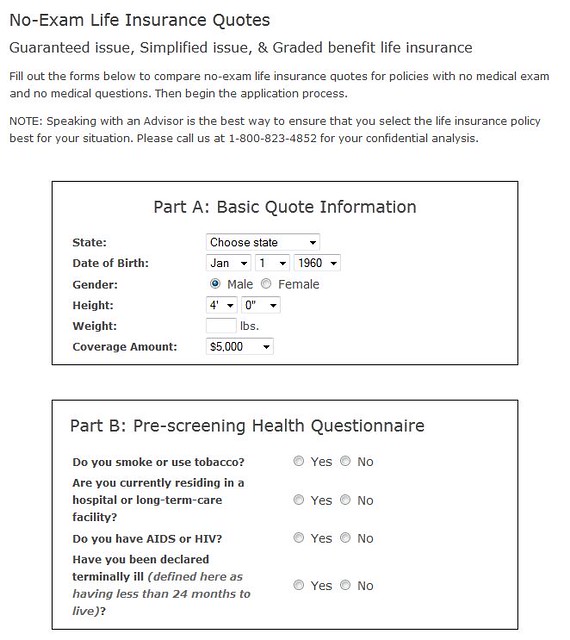

7 questions to ask before getting life insurance 1. Is there a waiting period before coverage goes into effect? Premiums can vary greatly depending on the plan and benefits. The bottom line is the ‘whole of life’ plan is one of the most effective life insurance policies you could invest in, especially if you do not have medical support from your home country. What is the term of payment?

Source: youtube.com

Source: youtube.com

When i say “x,” fill in the blank with whatever activity the prospect did to request information on the product. When considering life insurance, it’s a good idea to weigh out your options, so we put together some of the top questions to consider when it comes to whole life insurance policies. The following are 25 questions you should ask, as you consider what company to do business with and what plan to buy. What is the insurance plan monthly and annual premium? Final expense life insurance refers to specific protection individuals purchase to cover charges and affairs that are associated with your such as burial, funeral service, or final medical bills.

Source: nextgen-life-insurance.com

Source: nextgen-life-insurance.com

There are plans where you can select payment term between 7 years to 50 years or even for the full term of the plan. Some plans may have a waiting period between the time you. If there are people who depend on you for financial support, your death could cause a financial hardship for them. What is the insurance plan monthly and annual premium? How are death benefits paid?

Source: imsguenstony.blogspot.com

Source: imsguenstony.blogspot.com

The bottom line is the ‘whole of life’ plan is one of the most effective life insurance policies you could invest in, especially if you do not have medical support from your home country. There are several important questions you should ask yourself: Whole life insurance (also known as ‘life assurance’) is a type of life insurance that covers you for the rest of your life. What is the term of payment? When considering life insurance, it’s a good idea to weigh out your options, so we put together some of the top questions to consider when it comes to whole life insurance policies.

Source: wealthnation.io

Source: wealthnation.io

Typical life insurance health questions. Here are five questions to ask yourself before buying a whole life policy. Whole life serves a purpose, but not everybody needs it. When i say “x,” fill in the blank with whatever activity the prospect did to request information on the product. It’s a good idea when considering life insurance to weigh out your options, so here are some of the top questions to ask about whole life insurance policies.

Source: pinterest.com

Source: pinterest.com

Your agent can help guide you through the consideration process, asking questions such as how much is left on the mortgage, what are your monthly bills and how much you may want for your surviving spouse to live on. The following are 25 questions you should ask, as you consider what company to do business with and what plan to buy. If there are people who depend on you for financial support, your death could cause a financial hardship for them. How are death benefits paid? The first and most obvious question, your need for life insurance will usually depend on whether or not you have financial dependents like a family.

Source: successiblelife.com

Source: successiblelife.com

Has anyone dealt with something like that? Typical life insurance health questions. There are plans where you can select payment term between 7 years to 50 years or even for the full term of the plan. Why do i need life insurance? If there are people who depend on you for financial support, your death could cause a financial hardship for them.

Source: lifeinsurancebyjeff.com

Source: lifeinsurancebyjeff.com

What is the insurance plan monthly and annual premium? What is the insurance plan monthly and annual premium? Not only will they ask questions but they will also go into your medical records to verify all this information. What is the insurance plan monthly and annual premium? Is there a waiting period before coverage goes into effect?

Source: pinterest.com

Source: pinterest.com

Posted by 21 hours ago. Not only will they ask questions but they will also go into your medical records to verify all this information. In addition to those two advantages,. Is there a waiting period before coverage goes into effect? You need whole life insurance for estate planning.

Source: bestinsurancequotes.ie

Source: bestinsurancequotes.ie

Posted by 21 hours ago. What is the term of payment? Life insurance companies don’t like taking risks. All of our content is verified for accuracy by mark herman, cfp and our team of certified financial experts. True in some states, but not others.

Source: visual.ly

Source: visual.ly

Whole life serves a purpose, but not everybody needs it. Whole life insurance is a great way to pay for college. When considering life insurance, it’s a good idea to weigh out your options, so we put together some of the top questions to consider when it comes to whole life insurance policies. The following are 25 questions you should ask, as you consider what company to do business with and what plan to buy. What is the term of payment?

Source: aggettainsurance.com

Source: aggettainsurance.com

Whole life insurance coverage is an excellent option if you seek lifetime coverage and predictable premiums that never increase. If you need only temporary coverage that lasts until you�ve paid off debts or seen your kids through college, then term life insurance is your best bet. Once you take out a policy you make monthly payments to your insurance provider for premiums. Not only will they ask questions but they will also go into your medical records to verify all this information. The following are 25 questions you should ask, as you consider what company to do business with and what plan to buy.

Source: nophysicaltermlife.com

Source: nophysicaltermlife.com

7 questions to ask before getting life insurance 1. Not only will they ask questions but they will also go into your medical records to verify all this information. Life insurance companies don’t like taking risks. Has anyone dealt with something like that? Why do i need life insurance?

Source: policygenius.com

Source: policygenius.com

In some cases, this means that people are outliving their universal life policies that they believed to. Not only will they ask questions but they will also go into your medical records to verify all this information. Whole life insurance (also known as ‘life assurance’) is a type of life insurance that covers you for the rest of your life. Shopping for a life insurance policy is a big decision, and deserves plenty of consideration. Most doctors won�t owe estate taxes or have estate liquidity needs.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title questions to ask about whole life insurance policies by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information