R w insurance Idea

Home » Trending » R w insurance IdeaYour R w insurance images are ready. R w insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the R w insurance files here. Find and Download all free vectors.

If you’re looking for r w insurance images information related to the r w insurance topic, you have pay a visit to the right blog. Our site always gives you hints for seeking the highest quality video and picture content, please kindly search and locate more informative video articles and images that fit your interests.

R W Insurance. In its basic form r&w insurance covers breaches by the seller or target of their respective representations and warranties in the acquisition agreement up to a policy limit. R&w insurance is typically procured by the buyer, with the buyer being the insured party under the policy. Representations and warranties insurance is an insurance policy used in mergers and acquisitions to protect against losses arising due to the seller’s breach of certain of its representations in. R&w insurance provider means vale insurance partners or such other insurance provider mutually agreed upon by purchaser and seller.

Using R&W Insurance in M&A Transactions Reinhart Boerner From reinhartlaw.com

Using R&W Insurance in M&A Transactions Reinhart Boerner From reinhartlaw.com

At rw insurance, our independent agents offer detailed advice on a wide range of policies: Representations and warranties insurance (“ rwi ”) is a common feature of private m&a transactions, aligning the interests of seller and buyer by transferring the risk of a breach of the representations given by the seller in the underlying purchase agreement to an independent, creditworthy insurer. That’s because our agency is experienced in creating specialized insurance choices. Asia, europe, global pe update, r&w insurance, thought leadership, trends, u.k. R&w insurance provider means ambridge partners llc. Whether you need auto insurance, motorcycle insurance, homeowners insurance, or extra liability protection through an umbrella policy, we will help you choose a policy that offers you the best possible protection at affordable rates.

R&w insurance provider means vale insurance partners or such other insurance provider mutually agreed upon by purchaser and seller.

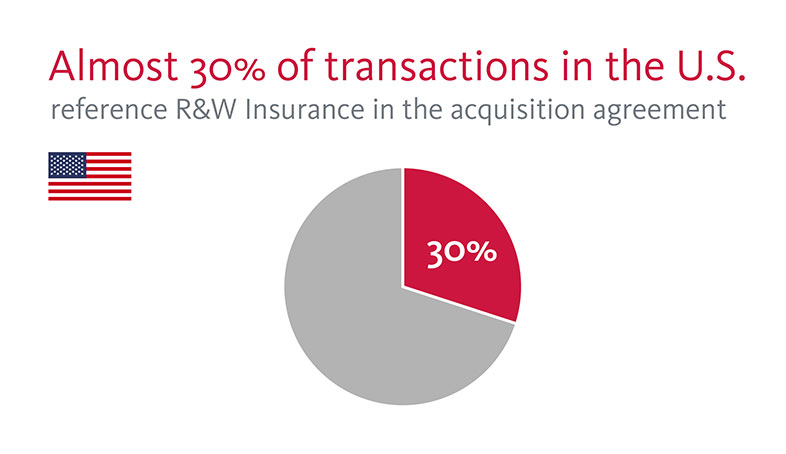

This kind of insurance is called representation and warranties (r&w) insurance. Aon, for example, placed over 400 r&w insurance policies last year in north america, compared to less than 80 only five years ago. Representations and warranties insurance (“ r&w insurance ”) has become a popular tool used in effecting private equity (“ pe ”) transactions. (r&w) insurance in middle market mergers and acquisitions deals has been staggering. As such, rwi is a vital tool in bridging risk gaps in m&a transactions. Rw insurance and financial services is devoted to meeting all of your unique insurance needs.

Source: hoganlovells.com

Source: hoganlovells.com

This kind of insurance is called representation and warranties (r&w) insurance. Whether you need auto insurance, motorcycle insurance, homeowners insurance, or extra liability protection through an umbrella policy, we will help you choose a policy that offers you the best possible protection at affordable rates. Aon, for example, placed over 400 r&w insurance policies last year in north america, compared to less than 80 only five years ago. R&w insurance and w&i insurance typically have limitations, including retentions and de minimis thresholds built in. Use of r&w insurance in this scenario would.

Source: dentons.com

Source: dentons.com

This can serve to bridge negotiation gaps while. For business owners, this may mean creating a business insurance program that protects your business and personal assets. Insuring deals around the world: R&w insurance provider means the provider of the r&w insurance policy. Representations and warranties insurance (“ r&w insurance ”) has become a popular tool used in effecting private equity (“ pe ”) transactions.

Source: reinhartlaw.com

Source: reinhartlaw.com

Weil’s q3 2020 quarterly private equity update: Whether you need auto insurance, motorcycle insurance, homeowners insurance, or extra liability protection through an umbrella policy, we will help you choose a policy that offers you the best possible protection at affordable rates. Give us a call or click learn more to discover how we can meet all of your insurance needs! Like the name suggests, r&w insurance protects a buyer or seller in a corporate transaction, like a merger or acquisition, from losses arising from inaccurate representations or warranties made by the seller or target company during the transaction. At r&w brokerage we use our experience to become your insurance advocate, together we navigate the unique risks you face and create your customized insurance program.

Source: osler.com

Source: osler.com

This can serve to bridge negotiation gaps while. The time limitations mirror those under the main contract subject to a maximum. (r&w) insurance in middle market mergers and acquisitions deals has been staggering. This kind of insurance is called representation and warranties (r&w) insurance. Give us a call or click learn more to discover how we can meet all of your insurance needs!

Source: trwinsurancesolutions.com

Source: trwinsurancesolutions.com

Known risks, however, require special coverage apart from the r&w insurance policy (usually a seller. Like the name suggests, r&w insurance protects a buyer or seller in a corporate transaction, like a merger or acquisition, from losses arising from inaccurate representations or warranties made by the seller or target company during the transaction. Customizing your insurance is simple with rw insurance and financial services. (r&w) insurance in middle market mergers and acquisitions deals has been staggering. R&w insurance generally provides coverage for all representations and warranties of a target company or seller(s) contained in an m&a purchase agreement.

Source: ww2.cfo.com

Source: ww2.cfo.com

Asia, europe, global pe update, r&w insurance, thought leadership, trends, u.k. While r&w insurance can ensure that a seller receives more of the sale proceeds, it can also protect the buyer in a sale. The time limitations mirror those under the main contract subject to a maximum. (r&w) insurance in middle market mergers and acquisitions deals has been staggering. R&w insurance and w&i insurance typically have limitations, including retentions and de minimis thresholds built in.

Source: pehub.com

Source: pehub.com

R&w insurance and w&i insurance typically have limitations, including retentions and de minimis thresholds built in. Representations and warranties insurance is an insurance policy used in mergers and acquisitions to protect against losses arising due to the seller’s breach of certain of its representations in. Representations and warranties insurance (“ r&w insurance ”) has become a popular tool used in effecting private equity (“ pe ”) transactions. Customizing your insurance is simple with rw insurance and financial services. That’s because our agency is experienced in creating specialized insurance choices.

Source: propertycasualty360.com

Source: propertycasualty360.com

At r&w brokerage we use our experience to become your insurance advocate, together we navigate the unique risks you face and create your customized insurance program. Representations and warranties insurance (“ rwi ”) is a common feature of private m&a transactions, aligning the interests of seller and buyer by transferring the risk of a breach of the representations given by the seller in the underlying purchase agreement to an independent, creditworthy insurer. It guarantees that the provider will compensate the promisee if the breach of warranty insurance takes place. R&w insurance is typically procured by the buyer, with the buyer being the insured party under the policy. That’s because our agency is experienced in creating specialized insurance choices.

Source: cfo.com

Source: cfo.com

R&w insurance and w&i insurance typically have limitations, including retentions and de minimis thresholds built in. Like the name suggests, r&w insurance protects a buyer or seller in a corporate transaction, like a merger or acquisition, from losses arising from inaccurate representations or warranties made by the seller or target company during the transaction. At rw insurance, our independent agents offer detailed advice on a wide range of policies: In its basic form r&w insurance covers breaches by the seller or target of their respective representations and warranties in the acquisition agreement up to a policy limit. Real wealth tax & accounting our mission is to minimize your tax liability and maximize your financial freedom.

Source: merchantsgroup.net

Source: merchantsgroup.net

The use of these policies has become entrenched across a wide spectrum of deal sizes and industries. R&w insurance provider means the provider of the r&w insurance policy. This can serve to bridge negotiation gaps while. Real wealth tax & accounting our mission is to minimize your tax liability and maximize your financial freedom. As such, rwi is a vital tool in bridging risk gaps in m&a transactions.

Source: ogj.com

Source: ogj.com

Like the name suggests, r&w insurance protects a buyer or seller in a corporate transaction, like a merger or acquisition, from losses arising from inaccurate representations or warranties made by the seller or target company during the transaction. Give us a call or click learn more to discover how we can meet all of your insurance needs! This kind of insurance is called representation and warranties (r&w) insurance. R&w insurance provider means ambridge partners llc. R&w insurance provider means vale insurance partners or such other insurance provider mutually agreed upon by purchaser and seller.

Source: propertycasualty360.com

Source: propertycasualty360.com

At r&w brokerage we use our experience to become your insurance advocate, together we navigate the unique risks you face and create your customized insurance program. Representations and warranties insurance (“ rwi ”) is a common feature of private m&a transactions, aligning the interests of seller and buyer by transferring the risk of a breach of the representations given by the seller in the underlying purchase agreement to an independent, creditworthy insurer. R&w insurance provider means ambridge partners llc. “representation & warranty insurance” (“r&w insurance”) is a type of insurance policy purchased in connection with corporate transactions, and covers the indemnification for certain breaches of the representations and warranties in the transaction agreements. R&w insurance is typically procured by the buyer, with the buyer being the insured party under the policy.

Source: jdsupra.com

Source: jdsupra.com

Use of r&w insurance in this scenario would. Real wealth tax & accounting our mission is to minimize your tax liability and maximize your financial freedom. Weil’s q3 2020 quarterly private equity update: “representation & warranty insurance” (“r&w insurance”) is a type of insurance policy purchased in connection with corporate transactions, and covers the indemnification for certain breaches of the representations and warranties in the transaction agreements. In its basic form r&w insurance covers breaches by the seller or target of their respective representations and warranties in the acquisition agreement up to a policy limit.

Source: osler.com

Source: osler.com

Reps and warranty insurance, otherwise known as rwi, is essentially an agreement between buyers (or sellers) and an insurance provider. The policy protects an insured against financial loss — including defense costs — resulting from breaches of such representations and warranties. “representation & warranty insurance” (“r&w insurance”) is a type of insurance policy purchased in connection with corporate transactions, and covers the indemnification for certain breaches of the representations and warranties in the transaction agreements. While r&w insurance can ensure that a seller receives more of the sale proceeds, it can also protect the buyer in a sale. As such, rwi is a vital tool in bridging risk gaps in m&a transactions.

![]() Source: rubiconins.com

Source: rubiconins.com

This can serve to bridge negotiation gaps while. R&w insurance and w&i insurance typically have limitations, including retentions and de minimis thresholds built in. For business owners, this may mean creating a business insurance program that protects your business and personal assets. The use of these policies has become entrenched across a wide spectrum of deal sizes and industries. R&w insurance provider means ambridge partners llc.

Source: youtube.com

Source: youtube.com

Variations of representations & warranties insurance across the united states, europe and. Representations and warranties insurance (“ r&w insurance ”) has become a popular tool used in effecting private equity (“ pe ”) transactions. R&w insurance provider means ambridge partners llc. Customizing your insurance is simple with rw insurance and financial services. Known risks, however, require special coverage apart from the r&w insurance policy (usually a seller.

Source: lowenstein.com

Source: lowenstein.com

As such, rwi is a vital tool in bridging risk gaps in m&a transactions. The use of these policies has become entrenched across a wide spectrum of deal sizes and industries. Variations of representations & warranties insurance across the united states, europe and. Real wealth tax & accounting our mission is to minimize your tax liability and maximize your financial freedom. Reps and warranty insurance, otherwise known as rwi, is essentially an agreement between buyers (or sellers) and an insurance provider.

Source: elinmobiliariomesames.com

Source: elinmobiliariomesames.com

Representations and warranties insurance (“ rwi ”) is a common feature of private m&a transactions, aligning the interests of seller and buyer by transferring the risk of a breach of the representations given by the seller in the underlying purchase agreement to an independent, creditworthy insurer. The use of these policies has become entrenched across a wide spectrum of deal sizes and industries. Asia, europe, global pe update, r&w insurance, thought leadership, trends, u.k. Historically, the use of rwi in m&a transactions was relatively limited. Aon, for example, placed over 400 r&w insurance policies last year in north america, compared to less than 80 only five years ago.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title r w insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information