Ransomware insurance information

Home » Trend » Ransomware insurance informationYour Ransomware insurance images are ready in this website. Ransomware insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Ransomware insurance files here. Download all free images.

If you’re looking for ransomware insurance pictures information connected with to the ransomware insurance keyword, you have come to the right site. Our site always gives you hints for downloading the maximum quality video and image content, please kindly hunt and locate more enlightening video content and graphics that match your interests.

Ransomware Insurance. The lake city, florida city council decided to pay a ransom of 42 bitcoin, then worth about $460,000 at the cost of a $10,000 deductible, which they paid to their cyber insurer, beazley, an underwriter at lloyd’s of london. For a number of years insurers flocked to the cybersecurity sector, enticed by the rapid growth and ambiguous risk profile. More on that in the future! Coverage for losses associated with ransomware is available within cyber and privacy insurance policies under an insuring agreement most.

Ransomware Insurance is Fueling Ransomware Business From tritoncomputercorp.com

Ransomware Insurance is Fueling Ransomware Business From tritoncomputercorp.com

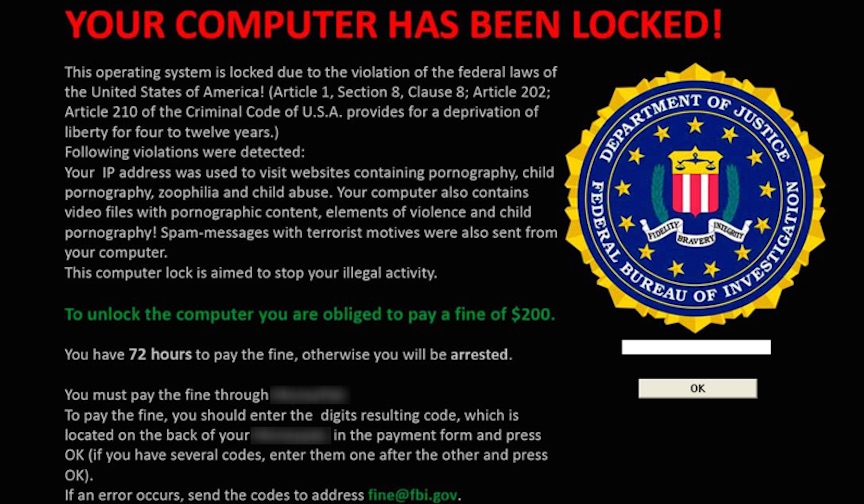

Written by donna hall on january 6, 2022 under blog, blogs. The surge started a couple of years ago and accelerated since early 2020, and it has caused both greater frequency and severity in the claims made under cyber insurance policies. The ransomware cyber insurance cycle fueling the extortion economy. The role of insurance carriers in responding to ransomware attacks and paying ransom demands is often difficult to pin down, but it shows few signs of abating. However, by 2021 the reality is that ransomware has emerged as a new threat, and cyber has become a headline risk for the commercial insurance buyers and risk managers on the frontline. Cyber criminals aren’t just stealing passwords and data.

Cyber criminals aren’t just stealing passwords and data.

Major insurers themselves have suffered losses from ransomware attacks. If insurers are made to exclude liability for ransomware attacks from their cyber risks and pi policies, arben says businesses will be left exposed with no effective remedy because they cannot pay. The sustained surge in ransomware attacks has hit the cyber insurance market hard. Essentially, it’s a subset of an overall cyber policy, with conditions that vary from insurer to insurer, business to business. Ransomware was the top cyber insurance claim in q1 2020, filip truta, bitdefender business insights, september 14 2020. The ransomware cyber insurance cycle fueling the extortion economy.

Source: fullycrypto.com

Source: fullycrypto.com

Ransomware was the top cyber insurance claim in q1 2020, filip truta, bitdefender business insights, september 14 2020. The lake city, florida city council decided to pay a ransom of 42 bitcoin, then worth about $460,000 at the cost of a $10,000 deductible, which they paid to their cyber insurer, beazley, an underwriter at lloyd’s of london. Coverage for losses associated with ransomware is available within cyber and privacy insurance policies under an insuring agreement most. Ransomware insurance is used to pay ransom demands. Ransom payments toward the end of 2020 averaged in the hundreds of thousands of.

Source: compsmag.com

Source: compsmag.com

You can imagine that insurers would say, �force majeure� or �this is a. However, by 2021 the reality is that ransomware has emerged as a new threat, and cyber has become a headline risk for the commercial insurance buyers and risk managers on the frontline. Leading insurers handle thousands of claims a year, and us carriers paid cyber claims totaling an estimated $394 million in 2018. In ransomware attacks, most companies call their ransomware insurer, he said. You can imagine that insurers would say, �force majeure� or �this is a.

Source: zurichna.com

Source: zurichna.com

Hackers and ransomware groups have been known to target cyber insurance companies to obtain insured client documentation and then target those organizations because there is a higher likelihood. The ransomware crisis has put the cyber insurance industry under extreme pressure, increasing both the frequency and value of its customers’ claims. What insurers should know as ransomware takes center stage. Since first emerging back in the mid to late 1990s, cybersecurity insurance has gone from being a product that was hard to sell to what is now very difficult to buy. However, by 2021 the reality is that ransomware has emerged as a new threat, and cyber has become a headline risk for the commercial insurance buyers and risk managers on the frontline.

![]() Source: businessinsurance.com

Source: businessinsurance.com

Leading insurers handle thousands of claims a year, and us carriers paid cyber claims totaling an estimated $394 million in 2018. For a number of years insurers flocked to the cybersecurity sector, enticed by the rapid growth and ambiguous risk profile. Essentially, it’s a subset of an overall cyber policy, with conditions that vary from insurer to insurer, business to business. Ransomware insurance is most effective when coupled with an effective risk management program, as there are many components in the fight against cyber crime. The lake city, florida city council decided to pay a ransom of 42 bitcoin, then worth about $460,000 at the cost of a $10,000 deductible, which they paid to their cyber insurer, beazley, an underwriter at lloyd’s of london.

Source: sahaysdailypost.com

Source: sahaysdailypost.com

In most circumstances, insuring your organization against potential threats is a solid idea. Since first emerging back in the mid to late 1990s, cybersecurity insurance has gone from being a product that was hard to sell to what is now very difficult to buy. You can imagine that insurers would say, �force majeure� or �this is a. Ransomware insurance is most effective when coupled with an effective risk management program, as there are many components in the fight against cyber crime. Written by donna hall on january 6, 2022 under blog, blogs.

Source: iqbrokers.gr

Source: iqbrokers.gr

It said insurance was not an alternative to. The ransomware cyber insurance cycle fueling the extortion economy. Risk managers should work with an insurance broker to review all applicable options before choosing cyber coverage. Coverage for losses associated with ransomware is available within cyber and privacy insurance policies under an insuring agreement most. The surge started a couple of years ago and accelerated since early 2020, and it has caused both greater frequency and severity in the claims made under cyber insurance policies.

Source: securitymagazine.com

Source: securitymagazine.com

Ransomware insurance is a type of cyber insurance coverage that can cover financial losses, including ransom fees and business interruption costs, stemming from a ransomware attack. In most circumstances, insuring your organization against potential threats is a solid idea. Within this frame of logic, particularly for a healthcare organization, a sector where 34% of all organizations were hit by ransomware last year, insurance may seem like a good investment. Ransomware and cyber insurance trends in 2022. For more than a decade, cyber insurance policies have reliably paid claims for ransomware, network interruptions, data breaches, and related liability.

Source: neckerman.com

Source: neckerman.com

Written by donna hall on january 6, 2022 under blog, blogs. Ransomware coverage is often included within cyber liability insurance policies, but as there is no standard cyber or ransomware policy, coverage varies widely. As a result, providers are putting up their premium prices and turning away prospects without sufficient cybersecurity precautions. Hackers and ransomware groups have been known to target cyber insurance companies to obtain insured client documentation and then target those organizations because there is a higher likelihood. Ransomware was the top cyber insurance claim in q1 2020, filip truta, bitdefender business insights, september 14 2020.

Source: ransomwareinsurance.com

Source: ransomwareinsurance.com

Written by donna hall on january 6, 2022 under blog, blogs. For a number of years insurers flocked to the cybersecurity sector, enticed by the rapid growth and ambiguous risk profile. Ransomware insurance is used to pay ransom demands. The sustained surge in ransomware attacks has hit the cyber insurance market hard. More on that in the future!

Source: ransomwaredaily.com

Source: ransomwaredaily.com

Ransomware insurance is used to pay ransom demands. Hackers and ransomware groups have been known to target cyber insurance companies to obtain insured client documentation and then target those organizations because there is a higher likelihood. What insurers should know as ransomware takes center stage. Written by donna hall on january 6, 2022 under blog, blogs. Cyber criminals aren’t just stealing passwords and data.

Source: info.ecbm.com

The city chose to pay the ransom because the cost of a prolonged. Ransomware insurance is a type of cyber insurance coverage that can cover financial losses, including ransom fees and business interruption costs, stemming from a ransomware attack. Cyber criminals aren’t just stealing passwords and data. The sustained surge in ransomware attacks has hit the cyber insurance market hard. However, by 2021 the reality is that ransomware has emerged as a new threat, and cyber has become a headline risk for the commercial insurance buyers and risk managers on the frontline.

Source: assuredstandard.com

Source: assuredstandard.com

Ransomware insurance is a type of cyber insurance coverage that can cover financial losses, including ransom fees and business interruption costs, stemming from a ransomware attack. More on that in the future! The surge started a couple of years ago and accelerated since early 2020, and it has caused both greater frequency and severity in the claims made under cyber insurance policies. You can imagine that insurers would say, �force majeure� or �this is a. If insurers are made to exclude liability for ransomware attacks from their cyber risks and pi policies, arben says businesses will be left exposed with no effective remedy because they cannot pay.

Source: simplesure.com

Source: simplesure.com

If insurers are made to exclude liability for ransomware attacks from their cyber risks and pi policies, arben says businesses will be left exposed with no effective remedy because they cannot pay. The average ransomware payment is also increasing, rising from $312,000 in 2019 to $570,000 in 2020. Hackers and ransomware groups have been known to target cyber insurance companies to obtain insured client documentation and then target those organizations because there is a higher likelihood. In most circumstances, insuring your organization against potential threats is a solid idea. Ransomware insurance is used to pay ransom demands.

Source: gulfshoreinsurance.com

Source: gulfshoreinsurance.com

More on that in the future! However, by 2021 the reality is that ransomware has emerged as a new threat, and cyber has become a headline risk for the commercial insurance buyers and risk managers on the frontline. It said insurance was not an alternative to. Ransomware coverage is often included within cyber liability insurance policies, but as there is no standard cyber or ransomware policy, coverage varies widely. Essentially, it’s a subset of an overall cyber policy, with conditions that vary from insurer to insurer, business to business.

Source: canon-powershotelph100hs.blogspot.com

Ransomware insurance is used to pay ransom demands. The sustained surge in ransomware attacks has hit the cyber insurance market hard. Hackers and ransomware groups have been known to target cyber insurance companies to obtain insured client documentation and then target those organizations because there is a higher likelihood. You can imagine that insurers would say, �force majeure� or �this is a. The city chose to pay the ransom because the cost of a prolonged.

Source: tritoncomputercorp.com

Source: tritoncomputercorp.com

The lake city, florida city council decided to pay a ransom of 42 bitcoin, then worth about $460,000 at the cost of a $10,000 deductible, which they paid to their cyber insurer, beazley, an underwriter at lloyd’s of london. The lake city, florida city council decided to pay a ransom of 42 bitcoin, then worth about $460,000 at the cost of a $10,000 deductible, which they paid to their cyber insurer, beazley, an underwriter at lloyd’s of london. Ransom payments toward the end of 2020 averaged in the hundreds of thousands of. If insurers are made to exclude liability for ransomware attacks from their cyber risks and pi policies, arben says businesses will be left exposed with no effective remedy because they cannot pay. Ransomware was the top cyber insurance claim in q1 2020, filip truta, bitdefender business insights, september 14 2020.

Source: breachsecurenow.com

Source: breachsecurenow.com

Meanwhile, cyber insurance is becoming a condition for doing. If insurers are made to exclude liability for ransomware attacks from their cyber risks and pi policies, arben says businesses will be left exposed with no effective remedy because they cannot pay. In most circumstances, insuring your organization against potential threats is a solid idea. What insurers should know as ransomware takes center stage. Ransomware insurance is a type of cyber insurance coverage that can cover financial losses, including ransom fees and business interruption costs, stemming from a ransomware attack.

Source: technadu.com

Source: technadu.com

Written by donna hall on january 6, 2022 under blog, blogs. Since first emerging back in the mid to late 1990s, cybersecurity insurance has gone from being a product that was hard to sell to what is now very difficult to buy. Within this frame of logic, particularly for a healthcare organization, a sector where 34% of all organizations were hit by ransomware last year, insurance may seem like a good investment. Hackers and ransomware groups have been known to target cyber insurance companies to obtain insured client documentation and then target those organizations because there is a higher likelihood. What insurers should know as ransomware takes center stage.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title ransomware insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information