Reasons for long term care insurance rejection Idea

Home » Trend » Reasons for long term care insurance rejection IdeaYour Reasons for long term care insurance rejection images are available. Reasons for long term care insurance rejection are a topic that is being searched for and liked by netizens now. You can Download the Reasons for long term care insurance rejection files here. Download all free photos.

If you’re looking for reasons for long term care insurance rejection pictures information connected with to the reasons for long term care insurance rejection interest, you have pay a visit to the right site. Our website frequently gives you suggestions for refferencing the highest quality video and image content, please kindly search and locate more informative video content and graphics that match your interests.

Reasons For Long Term Care Insurance Rejection. If you’re suffering from a chronic illness at the time you apply , the insurer may decline your application. One of the reasons why some otherwise qualified people are denied ltc insurance coverage is because they provide wrongful information. These are some of the most common reasons life insurance applications are rejected: Some insurers will accept applicants up to age 89.

Disability Stock Photos, Royalty Free Disability Images From depositphotos.com

Disability Stock Photos, Royalty Free Disability Images From depositphotos.com

Use of a walker, wheelchair, quad cane, motorized scooter, nebulizer. If you’re suffering from a chronic illness at the time you apply , the insurer may decline your application. They say the nursing assessment shows that you are not cognitively impaired. Strategies for dealing with a denial of ltc benefits vary depending on the basis for the denial, but you do not have to accept a denial of ltc benefits. Depending on the reason for denial, moving forward may be as simple as applying with another company, seeking medical care, or just sitting tight for a little while. Benefit payments rose 13 percent.

One of the reasons why some otherwise qualified people are denied ltc insurance coverage is because they provide wrongful information.

Maybe you even had cancer some years ago. If you can’t wait that long for coverage, consider purchasing insurance for the meantime, even if the. Currently receiving home care, adult date care, nursing home, or facility care services. Majority of states have their own time limits on applications for ltc insurance. If you can’t wait that long for coverage, consider purchasing insurance for the meantime, even if the. They say the nursing assessment shows that you are not cognitively impaired.

Source: llis.com

Source: llis.com

These rejections are based on the insurance companies� interpretation of medical. Generally speaking, the younger the applicant is, the better success rate for receiving coverage. Needing assistance with bathing, eating, dressing, transferring to a bed or chair, toileting, or continence. An insurer may have denied you coverage, but that doesn�t mean you can�t get a life insurance policy. When health issues exist the shots become harder and the shooting percentages will decrease.

Source: llis.com

Source: llis.com

If you’re suffering from a chronic illness at the time you apply , the insurer may decline your application. An insurer may have denied you coverage, but that doesn�t mean you can�t get a life insurance policy. Maybe a bit of hypertension for which you take medication. Benefit payments rose 13% from. The same is true for vertigo.

Source: pinterest.com

Source: pinterest.com

Most people have some health issues. When health issues exist the shots become harder and the shooting percentages will decrease. The same is true for vertigo. These are some of the most common reasons life insurance applications are rejected: Your application shouldn’t be kept pending.

Source: pjestatelaw.com

Source: pjestatelaw.com

Most long term care insurance agents run into difficulty for two reasons; If you’re suffering from a chronic illness at the time you apply , the insurer may decline your application. But in most states, you have up to five months before a policy can lapse because premiums weren’t paid. The authors surmised that teetotalers may have had. Depending on the reason for denial, moving forward may be as simple as applying with another company, seeking medical care, or just sitting tight for a little while.

Source: visual.ly

Source: visual.ly

Simplified underwriting is one of the easiest. When health issues exist the shots become harder and the shooting percentages will decrease. They say the nursing assessment and nursing home records show that you do not need assistance in the activities of daily living required by the policy as a condition of benefits. The disability insurance company many require you to undergo a full neurological exam to determine the cause of your vertigo, and your coverage may be contingent on accepting modifications. Maybe you even had cancer some years ago.

Source: godigit.com

Source: godigit.com

Use of a walker, wheelchair, quad cane, motorized scooter, nebulizer. Below, we list the most common reasons that individuals get denied long term care insurance coverage:. Policy cancelled for lack of payment. If you can’t wait that long for coverage, consider purchasing insurance for the meantime, even if the. Simplified underwriting is one of the easiest.

Source: altcp.org

Source: altcp.org

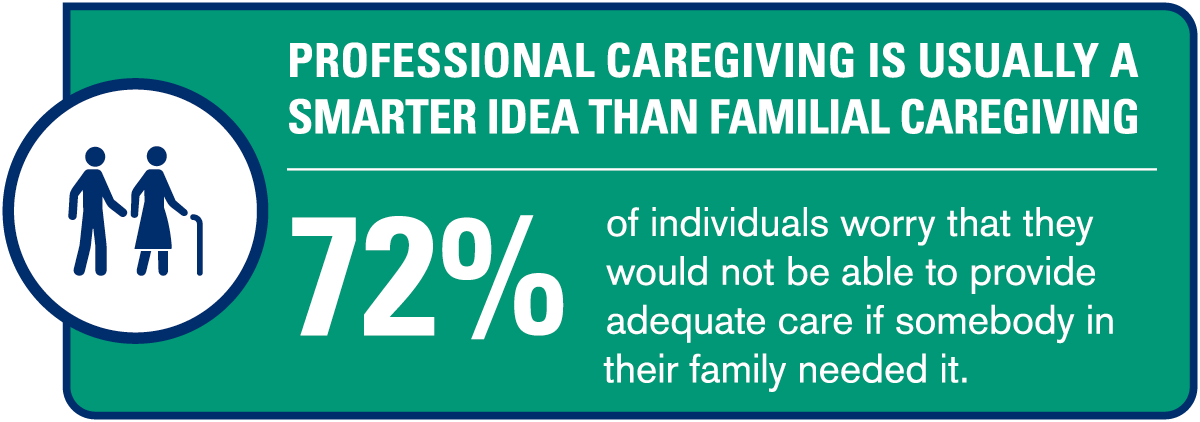

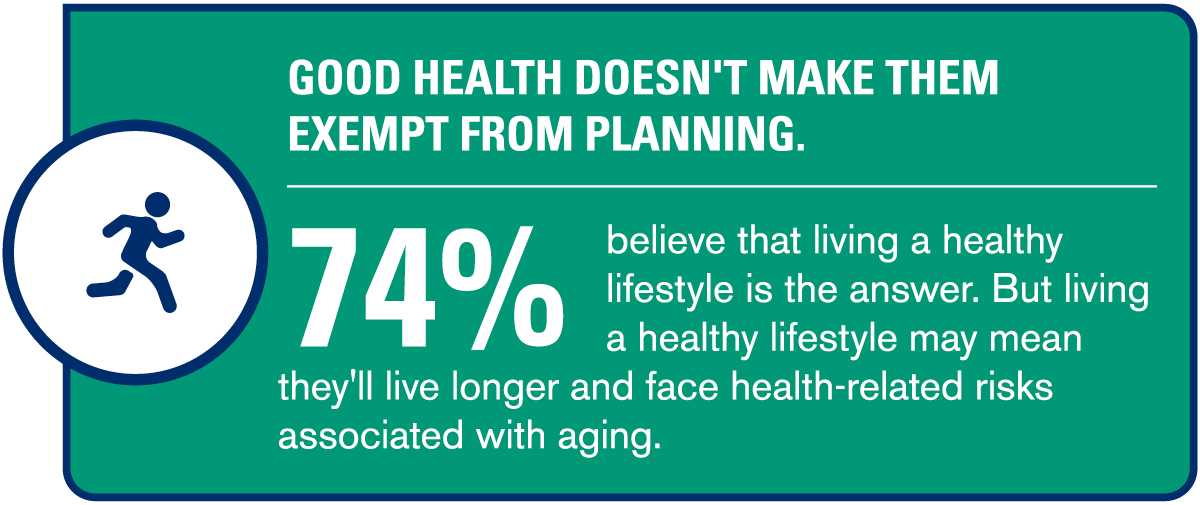

3 reasons for longterm care reasons. It’s the duty of insurance companies to reply to an applicant within that time limit. Simplified underwriting is one of the easiest. The same is true for vertigo. Use of a walker, wheelchair, quad cane, motorized scooter, nebulizer.

Source: visual.ly

Source: visual.ly

One of the reasons why some otherwise qualified people are denied ltc insurance coverage is because they provide wrongful information. The same is true for vertigo. Generally speaking, the younger the applicant is, the better success rate for receiving coverage. Benefit payments rose 13% from. Explain why the payment wasn’t made, such as a payroll error, or a new bank account was established and you forgot to notify the insurer of the account change.

Source: pinterest.com

Source: pinterest.com

Maybe you even had cancer some years ago. One of the reasons why some otherwise qualified people are denied ltc insurance coverage is because they provide wrongful information. These are some of the most common reasons life insurance applications are rejected: The easiest rejection for insurance companies to give out is if you currently need help with any of the 6 activities of daily living, which are eating, bathing, dressing, toileting, transferring, and continence. Depending on the reason for denial, moving forward may be as simple as applying with another company, seeking medical care, or just sitting tight for a little while.

Source: depositphotos.com

Source: depositphotos.com

Strategies for dealing with a denial of ltc benefits vary depending on the basis for the denial, but you do not have to accept a denial of ltc benefits. If you’re suffering from a chronic illness at the time you apply , the insurer may decline your application. Errors and omissions are some of the causes of insurance denials, and your insurance company will not hesitate to deny your claim if you have made mistakes in your application. These are some of the most common reasons life insurance applications are rejected: Maybe you even had cancer some years ago.

Source: infographicpost.com

Source: infographicpost.com

Benefit payments rose 13 percent. They say the nursing assessment and nursing home records show that you do not need assistance in the activities of daily living required by the policy as a condition of benefits. If you can’t wait that long for coverage, consider purchasing insurance for the meantime, even if the. Benefit payments rose 13% from. Maybe you even had cancer some years ago.

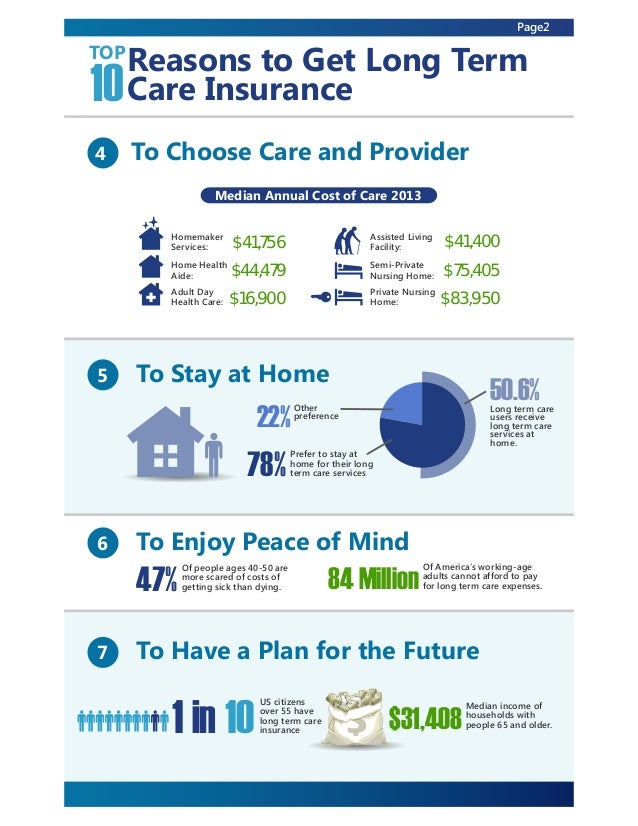

Source: slideshare.net

Source: slideshare.net

The authors surmised that teetotalers may have had. Currently receiving home care, adult date care, nursing home, or facility care services. Some insurers will accept applicants up to age 89. But in most states, you have up to five months before a policy can lapse because premiums weren’t paid. Needing assistance with bathing, eating, dressing, transferring to a bed or chair, toileting, or continence.

Source: youtube.com

Source: youtube.com

Generally speaking, the younger the applicant is, the better success rate for receiving coverage. They say the nursing assessment and nursing home records show that you do not need assistance in the activities of daily living required by the policy as a condition of benefits. Benefit payments rose 13% from. Generally speaking, the younger the applicant is, the better success rate for receiving coverage. An insurer may have denied you coverage, but that doesn�t mean you can�t get a life insurance policy.

Source: slideshare.net

Source: slideshare.net

Some insurers will accept applicants up to age 89. If you’re suffering from a chronic illness at the time you apply , the insurer may decline your application. Errors and omissions are some of the causes of insurance denials, and your insurance company will not hesitate to deny your claim if you have made mistakes in your application. Simplified underwriting is one of the easiest. Most people have some health issues.

Source: slideshare.net

Source: slideshare.net

Some insurers will accept applicants up to age 89. If you can’t wait that long for coverage, consider purchasing insurance for the meantime, even if the. One of the reasons why some otherwise qualified people are denied ltc insurance coverage is because they provide wrongful information. Benefit payments rose 13% from. Below, we list the most common reasons that individuals get denied long term care insurance coverage:.

Source: longtermcareinsuranceamerica.com

Source: longtermcareinsuranceamerica.com

One of the reasons why some otherwise qualified people are denied ltc insurance coverage is because they provide wrongful information. Maybe you even had cancer some years ago. Long term care insurance will generally require a health examination and will examine your prior health records as part of an underwriting process. Policy cancelled for lack of payment. In that case, a knowledgeable insurance attorney can help to correct the errors and submit proof or testing that will force the insurance company pay the claim.

Source: altcp.org

Source: altcp.org

When health issues exist the shots become harder and the shooting percentages will decrease. Majority of states have their own time limits on applications for ltc insurance. 3 reasons for longterm care reasons. Maybe you even had cancer some years ago. Policy cancelled for lack of payment.

Source: llis.com

Source: llis.com

The easiest rejection for insurance companies to give out is if you currently need help with any of the 6 activities of daily living, which are eating, bathing, dressing, toileting, transferring, and continence. Errors and omissions are some of the causes of insurance denials, and your insurance company will not hesitate to deny your claim if you have made mistakes in your application. One of the reasons why some otherwise qualified people are denied ltc insurance coverage is because they provide wrongful information. Majority of states have their own time limits on applications for ltc insurance. They say the nursing assessment and nursing home records show that you do not need assistance in the activities of daily living required by the policy as a condition of benefits.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title reasons for long term care insurance rejection by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information