Reasons not to buy life insurance Idea

Home » Trend » Reasons not to buy life insurance IdeaYour Reasons not to buy life insurance images are available in this site. Reasons not to buy life insurance are a topic that is being searched for and liked by netizens today. You can Get the Reasons not to buy life insurance files here. Find and Download all royalty-free vectors.

If you’re searching for reasons not to buy life insurance pictures information related to the reasons not to buy life insurance topic, you have pay a visit to the right site. Our site always provides you with hints for viewing the maximum quality video and image content, please kindly hunt and find more enlightening video content and images that match your interests.

Reasons Not To Buy Life Insurance. And unfortunately, the numbers keep on rising. Everybody knows that higher education is expensive. Term insurance is very inexpensive: When a whole life insurance policy is sold (and they�re always sold, never bought), the buyer and seller generally focus on the investment portion of the policy, not the insurance policy.

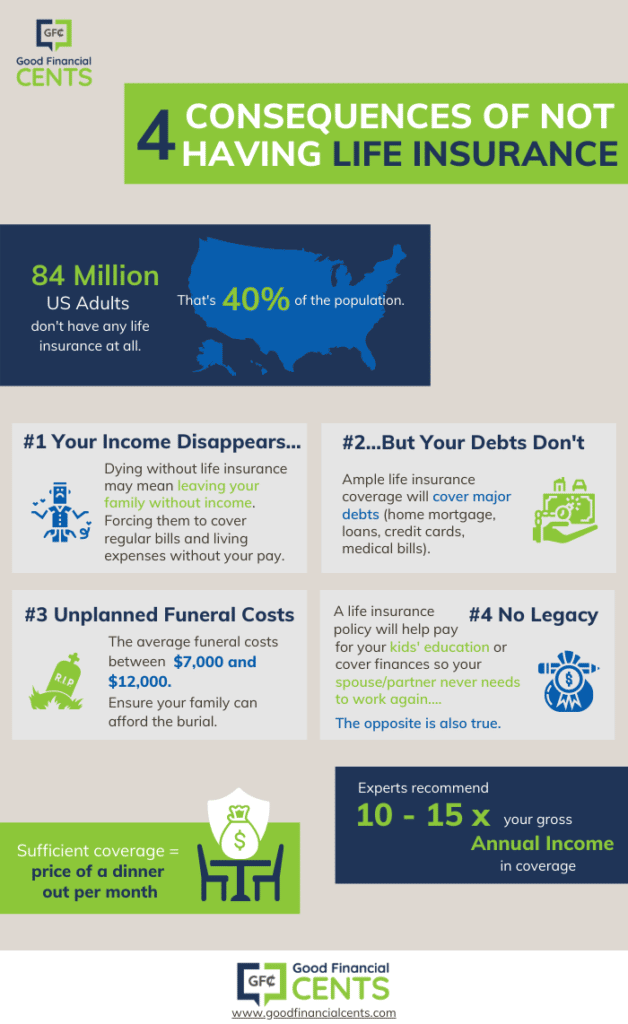

What Are the Consequences of Not Having Life Insurance? From goodfinancialcents.com

What Are the Consequences of Not Having Life Insurance? From goodfinancialcents.com

In many cases, this is not the case, thus life insurance would be a very good idea. Everybody knows that higher education is expensive. While our life expectancy and safety issues have vastly improved, plenty of people still don�t buy life insurance, according to some surveys. A millennial starting his new life as young employee may be buried already under heavy student debt, a new member in the family of young couple has increased the living expense, day care costs, often mechanical breakdowns of an old car, there could be thousands of reasons for not having enough cash to buy life insurance. Top reasons not to buy life insurance. When a whole life insurance policy is sold (and they�re always sold, never bought), the buyer and seller generally focus on the investment portion of the policy, not the insurance policy.

If you are cool with being buried in the local potter’s field in an unmarked grave, instead of having a grave site that your family can put flowers at during regular holidays, then life insurance is unnecessary for you.

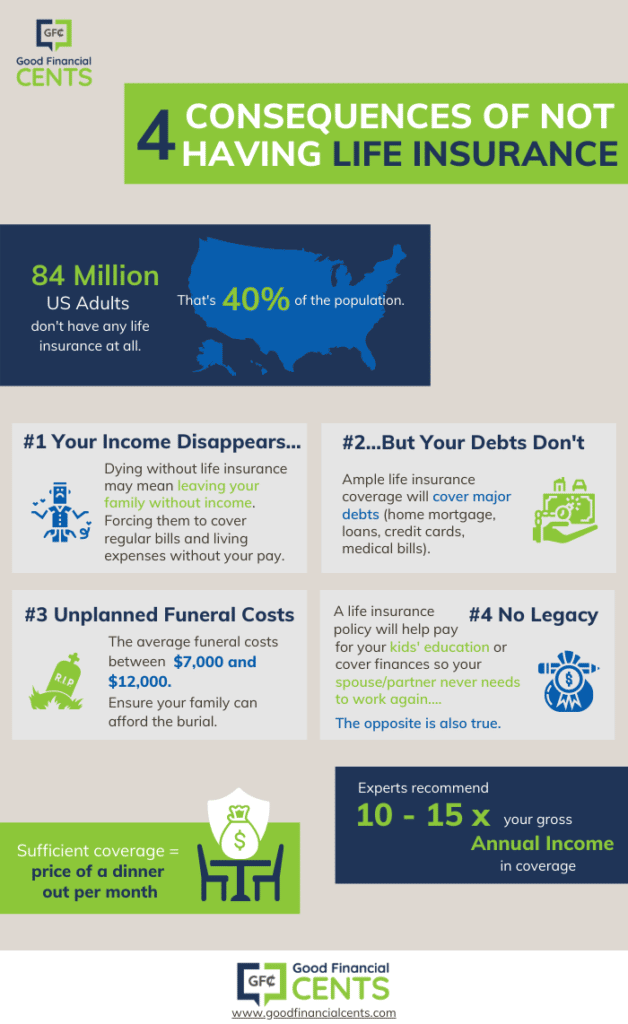

It’s too depressing to think about such things. 4 good reasons to buy life insurance: It looks like there are many different reasons why people avoid buying life insurance. It’s too expensive if you automatically associate life insurance with the word “expensive,” you’re not alone. Here are some of the most popular reasons not to buy life insurance: 5 reasons why buying life insurance as a college savings plan is a bad idea.

Source: rheumatoidarthritislifeinsurance.com

Source: rheumatoidarthritislifeinsurance.com

Here are five reasons you may hear for not obtaining coverage, and why you should reconsider. And unfortunately, the numbers keep on rising. Moneysupermarket suggested all three of these reasons not to. If you purchased a life insurance policy to provide security for a spouse, there may be no reason to keep it once the marriage is dissolved. While our life expectancy and safety issues have vastly improved, plenty of people still don�t buy life insurance, according to some surveys.

Source: trustedchoice.com

Source: trustedchoice.com

Everybody knows that higher education is expensive. 5 reasons for not buying life insurance that are myths. In many cases, this is not the case, thus life insurance would be a very good idea. You have enough money saved to cover the cost of your burial or cremation and settle any outstanding debts. Here, we are going to outline some of them.

Source: visual.ly

Source: visual.ly

For instance, a recent new york life survey of 1,000 americans ages 37 to 48 showed that 20 percent of generation x households don�t have a life insurance policy. With the increasing cost of living, life insurance doesn�t quite fit into their budget. 4 good reasons to buy life insurance: Moneysupermarket suggested all three of these reasons not to. You might think that you are already covered through your employer.

Source: goodfinancialcents.com

Source: goodfinancialcents.com

This is the biggest reason. Iuls are, by definition, permanent life insurance policies. 1) whole life insurance costs too much. Insurers never pay out 3. It’s too depressing to think about such things.

Source: onestoplifeinsurance.com

Source: onestoplifeinsurance.com

You know you should buy life insurance. With the increasing cost of living, life insurance doesn�t quite fit into their budget. You may not need to buy life insurance if any of the following are true. Here are five reasons you may hear for not obtaining coverage, and why you should reconsider. Life cover being too expensive 2.

Source: slideshare.net

Source: slideshare.net

First, parents with young children. You might think that you are already covered through your employer. Consequently you have double pain; It’s too depressing to think about such things. 4 good reasons to buy life insurance:

Source: slideshare.net

Source: slideshare.net

6 reasons not to cancel your life insurance policy. Here, we are going to outline some of them. Iuls are, by definition, permanent life insurance policies. If you decide to keep your life policy after a. If you are cool with being buried in the local potter’s field in an unmarked grave, instead of having a grave site that your family can put flowers at during regular holidays, then life insurance is unnecessary for you.

Source: naturalstateins.com

Source: naturalstateins.com

Life insurance would provide them a means to pay off the loans without me. Unfortunately, as with most things in life, there are no free lunches. Insurers never pay out 3. While our life expectancy and safety issues have vastly improved, plenty of people still don�t buy life insurance, according to some surveys. When the side fund is reduced by a drop in the market or current interest rates, it now has less value so more term insurance must be bought to make up the difference which further reduces the side fund.

Source: pinterest.ph

Source: pinterest.ph

You are okay with your family not being able to afford a decent burial for you. It’s too expensive if you automatically associate life insurance with the word “expensive,” you’re not alone. It looks like there are many different reasons why people avoid buying life insurance. When the side fund is reduced by a drop in the market or current interest rates, it now has less value so more term insurance must be bought to make up the difference which further reduces the side fund. And unfortunately, the numbers keep on rising.

Source: slideshare.net

Source: slideshare.net

What it seemed to begin revealing were some of the tragically comic, ridiculous reasons that many people choose not to buy life insurance. 4 good reasons to buy life insurance: Over half of americans over estimate the cost by 3x or more according to the latest “2019 insurance barometer study, life happens and limra”. It looks like there are many different reasons why people avoid buying life insurance. Unfortunately, as with most things in life, there are no free lunches.

Source: usamutualins.com

Source: usamutualins.com

Consider the common reasons why you might not invest in life insurance, as well as why you really should. There is no question about it. With the increasing cost of living, life insurance doesn�t quite fit into their budget. The reason it is so inexpensive is that people are unlikely to die before 60. You know you should buy life insurance.

Source: buylifeinsuranceforburial.com

Source: buylifeinsuranceforburial.com

For instance, a recent new york life survey of 1,000 americans ages 37 to 48 showed that 20 percent of generation x households don�t have a life insurance policy. If you purchased a life insurance policy to provide security for a spouse, there may be no reason to keep it once the marriage is dissolved. And unfortunately, the numbers keep on rising. It’s too expensive if you automatically associate life insurance with the word “expensive,” you’re not alone. When a whole life insurance policy is sold (and they�re always sold, never bought), the buyer and seller generally focus on the investment portion of the policy, not the insurance policy.

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

Moneysupermarket suggested all three of these reasons not to. For instance, a recent new york life survey of 1,000 americans ages 37 to 48 showed that 20 percent of generation x households don�t have a life insurance policy. Term insurance is very inexpensive: 10 jun 2021 | takaful | 0 |. We just got married and we both owe thousands of dollars in college loans, i don’t want my partner left high and dry if something happens to me before we can pay them off.

Source: simplelifeinsure.com

Source: simplelifeinsure.com

Iuls are, by definition, permanent life insurance policies. With the increasing cost of living, life insurance doesn�t quite fit into their budget. It’s too depressing to think about such things. Unfortunately, as with most things in life, there are no free lunches. The survey, which was conducted in january, found this was due to three main reasons, including:

Source: dempseyweiss.com

Source: dempseyweiss.com

It’s too depressing to think about such things. Consequently you have double pain; The survey, which was conducted in january, found this was due to three main reasons, including: It’s too expensive if you automatically associate life insurance with the word “expensive,” you’re not alone. This is the biggest reason.

Source: strategicpartners-insurancegroup.com

Source: strategicpartners-insurancegroup.com

Here are some common reasons people don�t buy life. Insurers never pay out 3. Iuls are, by definition, permanent life insurance policies. If you purchased a life insurance policy to provide security for a spouse, there may be no reason to keep it once the marriage is dissolved. You have enough money saved to cover the cost of your burial or cremation and settle any outstanding debts.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title reasons not to buy life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information