Redlining insurance definition information

Home » Trending » Redlining insurance definition informationYour Redlining insurance definition images are ready in this website. Redlining insurance definition are a topic that is being searched for and liked by netizens today. You can Get the Redlining insurance definition files here. Get all free photos and vectors.

If you’re looking for redlining insurance definition pictures information related to the redlining insurance definition keyword, you have come to the ideal blog. Our website always gives you hints for refferencing the highest quality video and picture content, please kindly search and find more enlightening video content and images that match your interests.

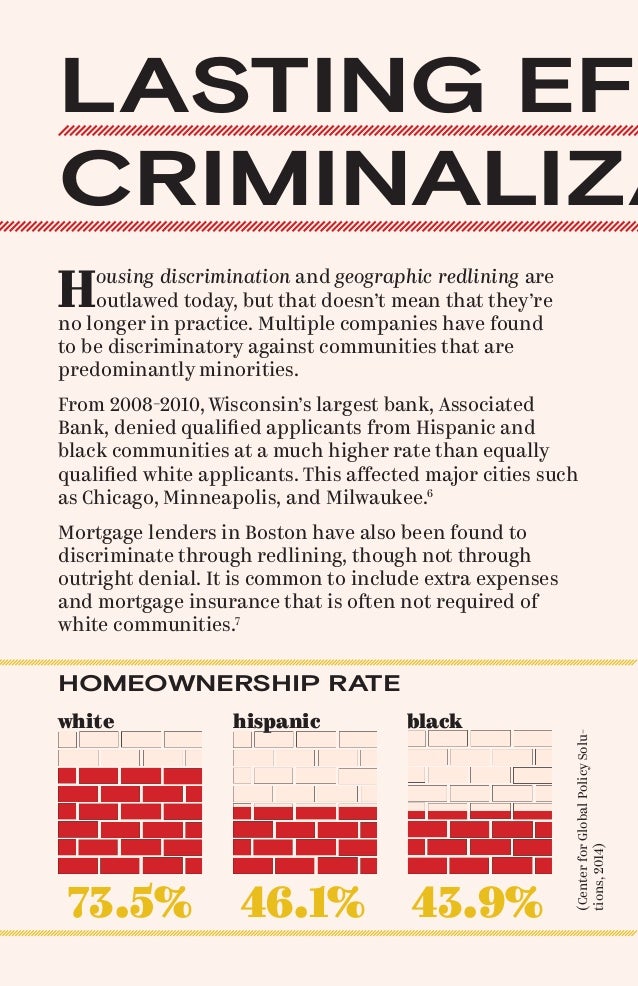

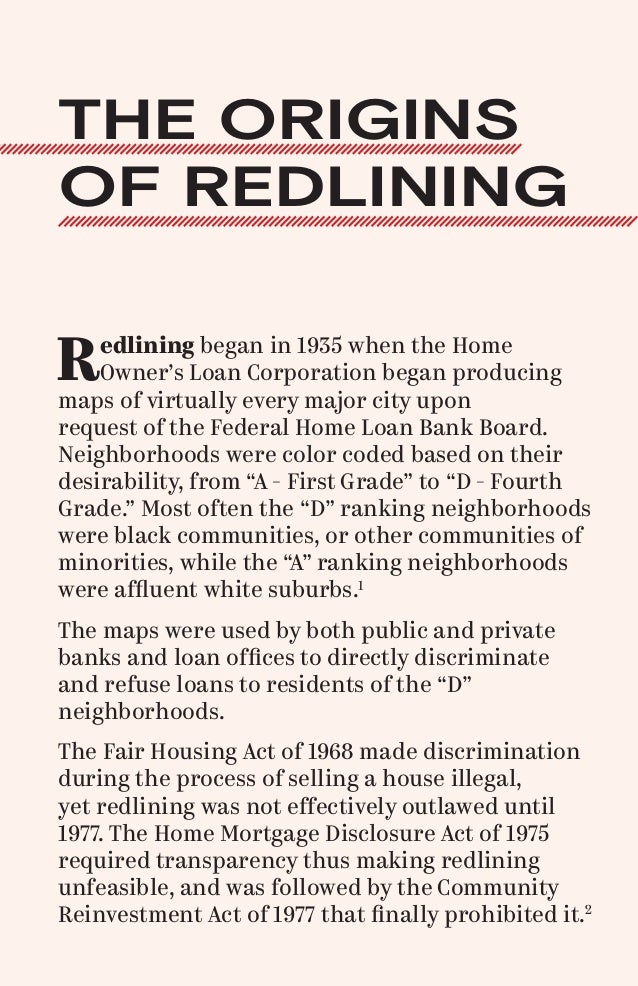

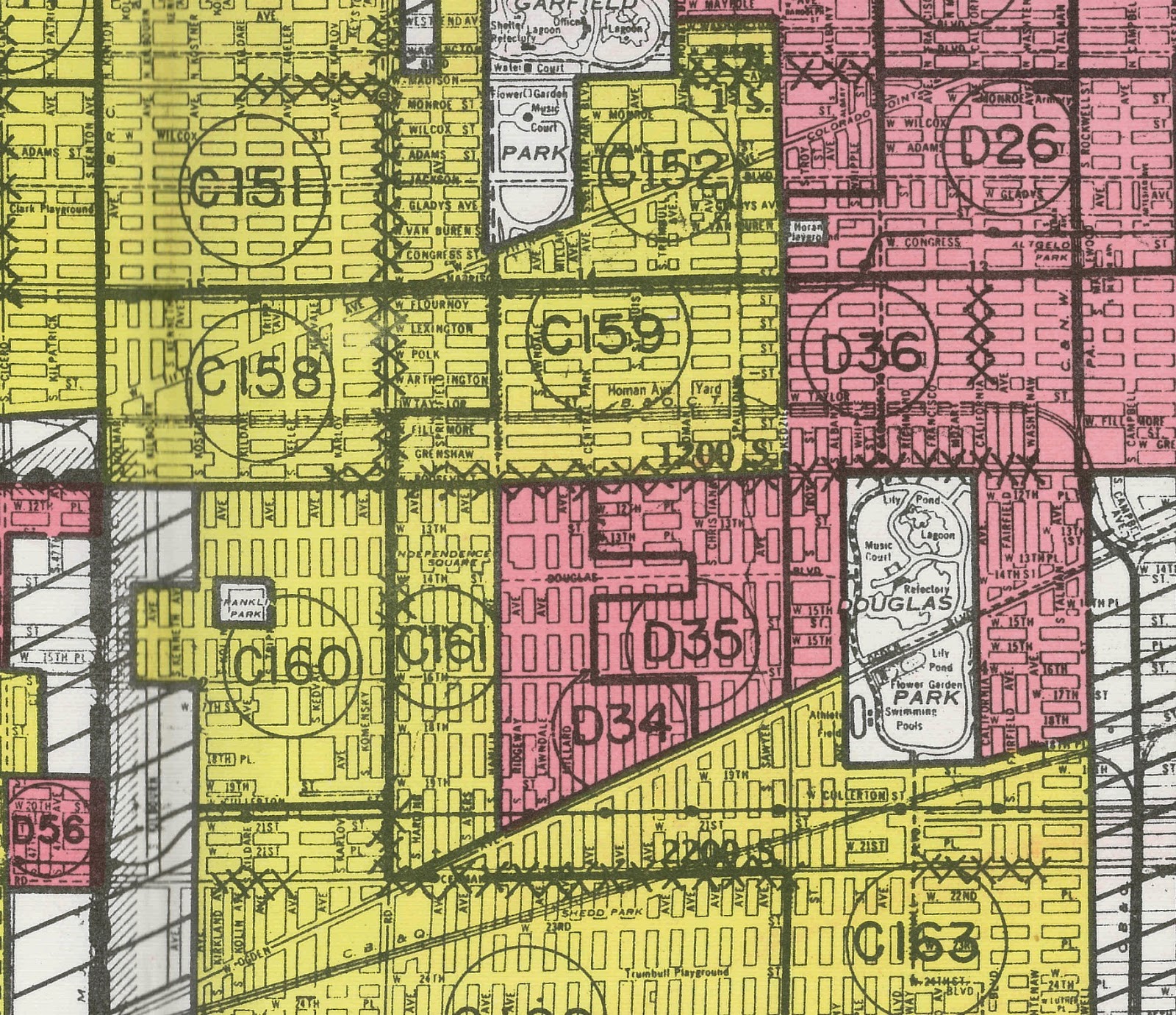

Redlining Insurance Definition. Insurance companies contend that they have to charge higher premiums for certain areas because the chance of a claim being filed for theft or other damage while a vehicle is in that area is higher. Redlining is the practice of turning down loan or insurance applications to applicants who live in an area considered to be a poor financial risk. Lenders used to draw red lines around portions of a map to indicate areas of a city in which they didn’t want to make loans. Redlining is an unethical practice whereby a financial institution refuses to provide services to people living in poor neighborhoods regardless of their specific personal creditworthiness or.

What Is Redlining? WorldAtlas From worldatlas.com

What Is Redlining? WorldAtlas From worldatlas.com

In the united states, redlining is a discriminatory practice in which services (financial and otherwise) are withheld from potential customers who reside in neighborhoods classified as �hazardous� to investment; Redlining is an unethical practice whereby a financial institution refuses to provide services to people living in poor neighborhoods regardless of their specific personal creditworthiness or. “insurance redlining” is discrimination in the marketing, underwriting and pricing of homeowners insurance to persons owning homes in. The meaning of redlining is the illegal practice of refusing to offer credit or insurance in a particular community on a discriminatory basis (as because of. A practice in which a company refuses to market its products in a certain area because it is disproportionately poor, has a high rate of default, and/or has a large minority population. Lenders used to draw red lines around portions of a map to indicate areas of a city in which they didn’t want to make loans.

Sep 07, 2011 · insurance redlining is the act of increasing insurance premiums based on the information that the client lives in a particular neighborhood.

This practice is prohibited under the laws of most states as it tends to be discriminatory to minorities. Lenders used to draw red lines around portions of a map to indicate areas of a city in which they didn’t want to make loans. “insurance redlining” is discrimination in the marketing, underwriting and pricing of homeowners insurance to persons owning homes in. Redlining is an unethical practice whereby a financial institution refuses to provide services to people living in poor neighborhoods regardless of their specific personal creditworthiness or. In the united states, redlining is a discriminatory practice in which services (financial and otherwise) are withheld from potential customers who reside in neighborhoods classified as �hazardous� to investment; This practice is prohibited under the laws of most states as it tends to be discriminatory to minorities.

Source: marketbusinessnews.com

Source: marketbusinessnews.com

Insurance companies contend that they have to charge higher premiums for certain areas because the chance of a claim being filed for theft or other damage while a vehicle is in that area is higher. Prior to the passage of the community reinvestment act (cra) in 1977. In the united states, redlining is a discriminatory practice in which services (financial and otherwise) are withheld from potential customers who reside in neighborhoods classified as �hazardous� to investment; Redlining refers to the unethical, discriminatory practice of denying inhabitants of a particular neighborhood or community access to services, such as banking, insurance, healthcare, retail, etc., because of their race or ethnicity. Redlining is the practice of refusing to approve insurance policies or financial services to people who live in or are from a certain geographical area.

Source: slideshare.net

Source: slideshare.net

Redlining has been challenged as a form of bias, but insurance companies maintain that risk assessment is vital to offering affordable insurance to the largest number of people, and excluding normal insurance sales to some areas is the only way to maintain affordable premiums for the larger group of less risky property owners. In the united states, redlining is a discriminatory practice in which services (financial and otherwise) are withheld from potential customers who reside in neighborhoods classified as �hazardous� to investment; Redlining — an underwriting practice involving the rejection of a risk based solely on geographical location. Taught as good history to know, but definitely not a warning to vigilantly. Redlining refers to the unethical, discriminatory practice of denying inhabitants of a particular neighborhood or community access to services, such as banking, insurance, healthcare, retail, etc., because of their race or ethnicity.

Source: hexylijyhe.prv.pl

Source: hexylijyhe.prv.pl

Insurance companies contend that they have to charge higher premiums for certain areas because the chance of a claim being filed for theft or other damage while a vehicle is in that area is higher. Prior to the passage of the community reinvestment act (cra) in 1977. Redlining is the illegal practice of refusing to provide financial services to consumers based on the area where they live. Redlining is the practice of refusing to approve insurance policies or financial services to people who live in or are from a certain geographical area. Redlining is generally taken to mean the practice of refusing to provide a product or service within a given geographical region.

Source: slideshare.net

Source: slideshare.net

Insurance companies contend that they have to charge higher premiums for certain areas because the chance of a claim being filed for theft or other damage while a vehicle is in that area is higher. Lenders used to draw red lines around portions of a map to indicate areas of a city in which they didn’t want to make loans. Redlining is the practice of turning down loan or insurance applications to applicants who live in an area considered to be a poor financial risk. Redlining is an unethical practice whereby a financial institution refuses to provide services to people living in poor neighborhoods regardless of their specific personal creditworthiness or. It is most often used in the context of extending credit or providing insurance coverage.

Source: marketbusinessnews.com

Source: marketbusinessnews.com

Sep 07, 2011 · insurance redlining is the act of increasing insurance premiums based on the information that the client lives in a particular neighborhood. It is most often used in the context of extending credit or providing insurance coverage. Government insurance subsidies tend to benefit the wealthy rather than those who need it most. In the united states, redlining is a discriminatory practice in which services (financial and otherwise) are withheld from potential customers who reside in neighborhoods classified as �hazardous� to investment; Taught as good history to know, but definitely not a warning to vigilantly.

Source: ednaalves14.blogspot.com

Source: ednaalves14.blogspot.com

Redlining — an underwriting practice involving the rejection of a risk based solely on geographical location. Government insurance subsidies tend to benefit the wealthy rather than those who need it most. “insurance redlining” is discrimination in the marketing, underwriting and pricing of homeowners insurance to persons owning homes in. Redlining is the illegal practice of refusing to provide financial services to consumers based on the area where they live. A practice in which a company refuses to market its products in a certain area because it is disproportionately poor, has a high rate of default, and/or has a large minority population.

Source: insuredclaims.blogspot.com

Insurance companies contend that they have to charge higher premiums for certain areas because the chance of a claim being filed for theft or other damage while a vehicle is in that area is higher. Redlining is an unethical practice whereby a financial institution refuses to provide services to people living in poor neighborhoods regardless of their specific personal creditworthiness or. “insurance redlining” is discrimination in the marketing, underwriting and pricing of homeowners insurance to persons owning homes in. The practice of redlining is a familiar, but distant, term in the industry. These residents largely belong to racial and ethnic minorities.

Source: marketbusinessnews.com

Source: marketbusinessnews.com

Redlining is generally taken to mean the practice of refusing to provide a product or service within a given geographical region. It is most often used in the context of extending credit or providing insurance coverage. A practice in which a company refuses to market its products in a certain area because it is disproportionately poor, has a high rate of default, and/or has a large minority population. Redlining — an underwriting practice involving the rejection of a risk based solely on geographical location. Redlining is the illegal practice of refusing to provide financial services to consumers based on the area where they live.

Source: slideshare.net

Source: slideshare.net

Sharon & joshua edelman, real estate agent keller williams realty. Sep 07, 2011 · insurance redlining is the act of increasing insurance premiums based on the information that the client lives in a particular neighborhood. A practice in which a company refuses to market its products in a certain area because it is disproportionately poor, has a high rate of default, and/or has a large minority population. Redlining has been challenged as a form of bias, but insurance companies maintain that risk assessment is vital to offering affordable insurance to the largest number of people, and excluding normal insurance sales to some areas is the only way to maintain affordable premiums for the larger group of less risky property owners. Lenders used to draw red lines around portions of a map to indicate areas of a city in which they didn’t want to make loans.

Source: insuredclaims.blogspot.com

Source: insuredclaims.blogspot.com

This practice is prohibited under the laws of most states as it tends to be discriminatory to minorities. Redlining is the illegal practice of refusing to provide financial services to consumers based on the area where they live. The practice of redlining is a familiar, but distant, term in the industry. Redlining is the practice of refusing to approve insurance policies or financial services to people who live in or are from a certain geographical area. Redlining has been challenged as a form of bias, but insurance companies maintain that risk assessment is vital to offering affordable insurance to the largest number of people, and excluding normal insurance sales to some areas is the only way to maintain affordable premiums for the larger group of less risky property owners.

Source: researchgate.net

Source: researchgate.net

Prior to the passage of the community reinvestment act (cra) in 1977. These residents largely belong to racial and ethnic minorities. It is most often used in the context of extending credit or providing insurance coverage. Redlining refers to the the practice of discrimination based on the racial makeup or character of a person�s neighborhood. Redlining is the practice of refusing to approve insurance policies or financial services to people who live in or are from a certain geographical area.

Source: worldatlas.com

Source: worldatlas.com

Taught as good history to know, but definitely not a warning to vigilantly. Refusal by an insurance company to underwrite or to continue to underwrite questionable risks in a given geographical area. This practice is considered illegal in most states, and companies engaged in. These residents largely belong to racial and ethnic minorities. The practice of redlining is a familiar, but distant, term in the industry.

Source: haikudeck.com

Source: haikudeck.com

Redlining refers to the the practice of discrimination based on the racial makeup or character of a person�s neighborhood. Redlining is generally taken to mean the practice of refusing to provide a product or service within a given geographical region. The term comes from the image of an owner of a service firm drawing a red line around a portion of a map and deciding not to provide any service within that area. Redlining — an underwriting practice involving the rejection of a risk based solely on geographical location. Government insurance subsidies tend to benefit the wealthy rather than those who need it most.

Source: contractbuyersleague.blogspot.com

Source: contractbuyersleague.blogspot.com

Insurance companies contend that they have to charge higher premiums for certain areas because the chance of a claim being filed for theft or other damage while a vehicle is in that area is higher. “insurance redlining” is discrimination in the marketing, underwriting and pricing of homeowners insurance to persons owning homes in. Sharon & joshua edelman, real estate agent keller williams realty. Sep 07, 2011 · insurance redlining is the act of increasing insurance premiums based on the information that the client lives in a particular neighborhood. Redlining refers to the the practice of discrimination based on the racial makeup or character of a person�s neighborhood.

Source: thejemicyfrisbee.net

Source: thejemicyfrisbee.net

Redlining — an underwriting practice involving the rejection of a risk based solely on geographical location. Taught as good history to know, but definitely not a warning to vigilantly. Sharon & joshua edelman, real estate agent keller williams realty. A practice in which a company refuses to market its products in a certain area because it is disproportionately poor, has a high rate of default, and/or has a large minority population. Sep 07, 2011 · insurance redlining is the act of increasing insurance premiums based on the information that the client lives in a particular neighborhood.

Source: contractbuyersleague.blogspot.com

Source: contractbuyersleague.blogspot.com

Government insurance subsidies tend to benefit the wealthy rather than those who need it most. Lenders used to draw red lines around portions of a map to indicate areas of a city in which they didn’t want to make loans. This practice is prohibited under the laws of most states as it tends to be discriminatory to minorities. “insurance redlining” is discrimination in the marketing, underwriting and pricing of homeowners insurance to persons owning homes in. Sharon & joshua edelman, real estate agent keller williams realty.

Source: blog.fincrew.my

Source: blog.fincrew.my

Redlining is the practice of turning down loan or insurance applications to applicants who live in an area considered to be a poor financial risk. It is most often used in the context of extending credit or providing insurance coverage. Government insurance subsidies tend to benefit the wealthy rather than those who need it most. Redlining refers to the unethical, discriminatory practice of denying inhabitants of a particular neighborhood or community access to services, such as banking, insurance, healthcare, retail, etc., because of their race or ethnicity. These residents largely belong to racial and ethnic minorities.

Source: bungalower.com

Source: bungalower.com

The meaning of redlining is the illegal practice of refusing to offer credit or insurance in a particular community on a discriminatory basis (as because of. These residents largely belong to racial and ethnic minorities. Insurance companies contend that they have to charge higher premiums for certain areas because the chance of a claim being filed for theft or other damage while a vehicle is in that area is higher. Government insurance subsidies tend to benefit the wealthy rather than those who need it most. Redlining refers to the the practice of discrimination based on the racial makeup or character of a person�s neighborhood.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title redlining insurance definition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information