Reduced paid up insurance Idea

Home » Trending » Reduced paid up insurance IdeaYour Reduced paid up insurance images are ready in this website. Reduced paid up insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Reduced paid up insurance files here. Get all free photos.

If you’re looking for reduced paid up insurance pictures information linked to the reduced paid up insurance keyword, you have visit the right site. Our site frequently gives you suggestions for seeking the maximum quality video and picture content, please kindly surf and locate more informative video articles and graphics that fit your interests.

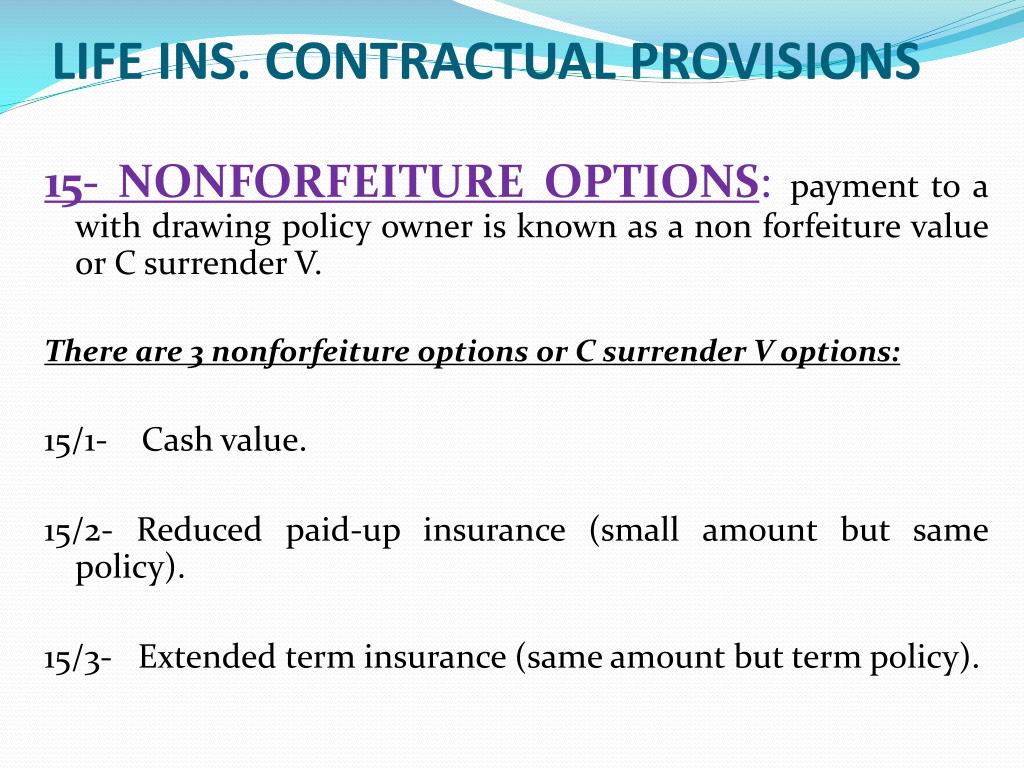

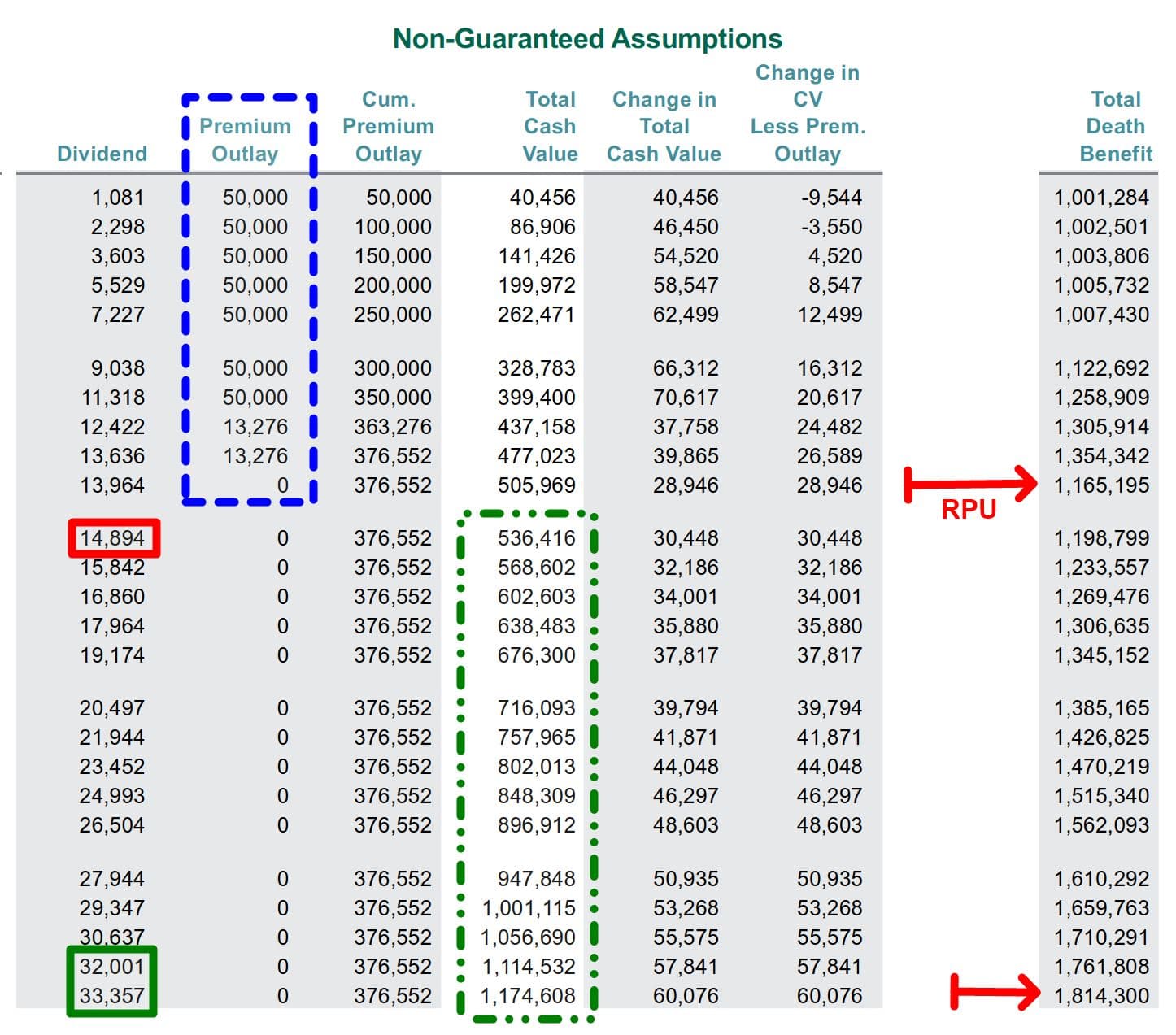

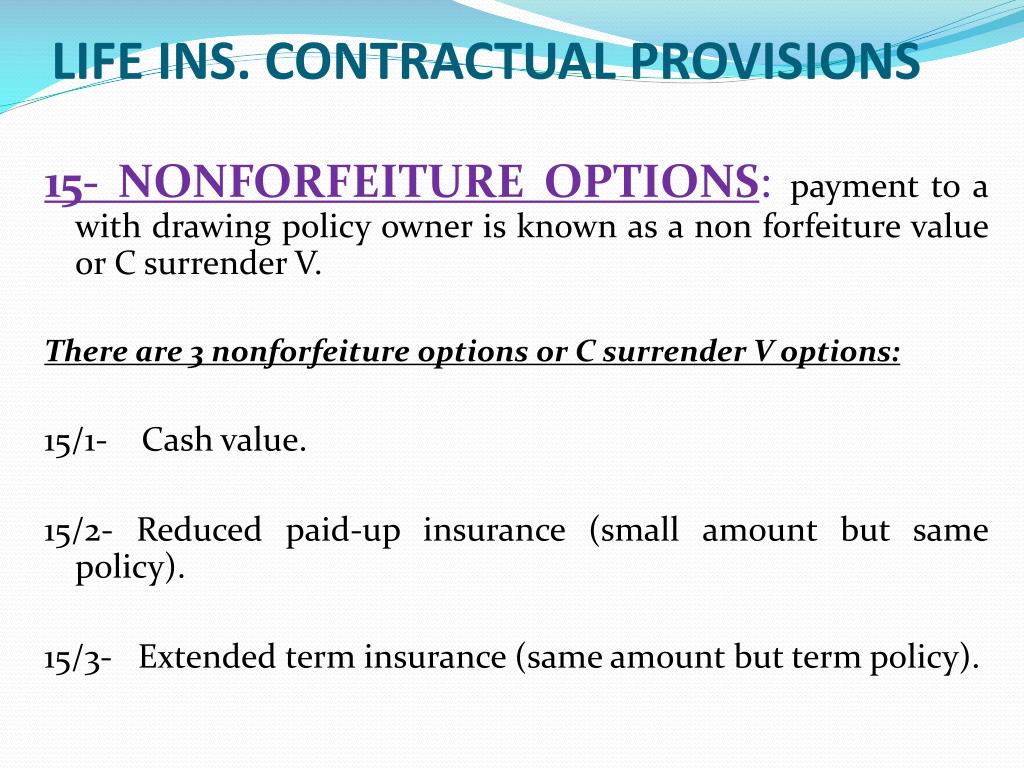

Reduced Paid Up Insurance. Reduced paid up is the reduction in sum assured when a premium is not paid for a traditional participating policy. Reduced paid up insurance will have cash and loan values. Essentially, reduced paid up insurance is a benefit which allows individuals to enjoy access to insurance for a reduced amount relative to the cash value of the policy in question. In exchange for no longer having to pay premiums, the life insurance gives you a reduced amount of life insurance.

Reduced Paid Up Insurance Chapter4. Life Insurance From epahepaee.blogspot.com

Reduced Paid Up Insurance Chapter4. Life Insurance From epahepaee.blogspot.com

Essentially, reduced paid up insurance is a benefit which allows individuals to enjoy access to insurance for a reduced amount relative to the cash value of the policy in question. Essentially, reduced paid up insurance is a benefit which allows individuals to enjoy access to insurance for a reduced amount relative to the cash value of the policy in question. Essentially, reduced paid up insurance is a benefit which allows individuals to enjoy access to insurance for a reduced amount relative to the cash value of the policy in question. In exchange for no longer having to pay premiums, the life insurance gives you a reduced amount of life insurance. Reduced paid up is the reduction in sum assured when a premium is not paid for a traditional participating policy. If your policy status shows reduced paid up that means its acquired certain value that is less than your basic sum assured because of discontinue of premium paid during its term.

(stock exchange) denoting all the money that a company has received from its shareholders:

Didn�t read) many business owners take out life insurance policies to ensure their families can cover business expenses if something happened. In exchange for no longer having to pay premiums, the life insurance gives you a reduced amount of life insurance. If your policy status shows reduced paid up that means its acquired certain value that is less than your basic sum assured because of discontinue of premium paid during its term. This option is sometimes used when people no longer want to pay the premiums noted in the life insurance contract, but do not want to surrender the policy and lose all their coverage. Reduced paid up means that the policy has acquired a paid up value but is presently in lapsed condition. You no longer owe premiums and you keep your whole life insurance policy, just with a reduced death benefit.

Source: epahepaee.blogspot.com

Source: epahepaee.blogspot.com

It�s when you take your whole life insurance policy�s accumulated cash value and use it to buy a new life insurance policy with a smaller face value. You could take out a loan against the life insurance policy’s cash value. Get the best quote and save 30% today! You no longer owe premiums and you keep your whole life insurance policy, just with a reduced death benefit. What does reduced paid up means in lic policy status?

Source: npa1.org

Source: npa1.org

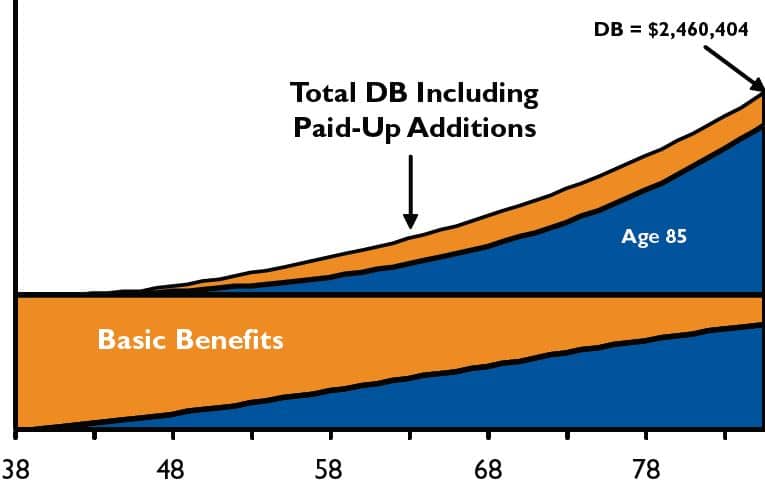

With some whole life insurance polices, the death benefit is reduced by more than the. If your policy status shows reduced paid up that means its acquired certain value that is less than your basic sum assured because of discontinue of premium paid during its term. Moving forward, the policy will continue to grow thanks in part to guaranteed interest and potential dividend payments, but you’ll never have to make another premium payment. In exchange for no longer having to pay premiums, the life insurance gives you a reduced amount of life insurance. Once a policy acquires a guaranteed surrender value post payment of 3 annual premiums, it can be made paid up if in any of the futur.

Source: homeworklib.com

Source: homeworklib.com

The truth is, life is uncertain and you may face an emergency that can compel you to forfeit paying your premiums. Reduced paid up means that the policy has acquired a paid up value but is presently in lapsed condition. Moving forward, the policy will continue to grow thanks in part to guaranteed interest and potential dividend payments, but you’ll never have to make another premium payment. That reduced amount is based on the cash value at the time you stop the policy. Generally, a reduced paid up policy reduces the face value to preserve the full insurance coverage period.

Source: epahepaee.blogspot.com

Source: epahepaee.blogspot.com

Generally, a reduced paid up policy reduces the face value to preserve the full insurance coverage period. Didn�t read) many business owners take out life insurance policies to ensure their families can cover business expenses if something happened. You could take out a loan against the life insurance policy’s cash value. Once a policy acquires a guaranteed surrender value post payment of 3 annual premiums, it can be made paid up if in any of the futur. What does reduced paid up means in lic policy status?

Source: kamuslengkap.com

Source: kamuslengkap.com

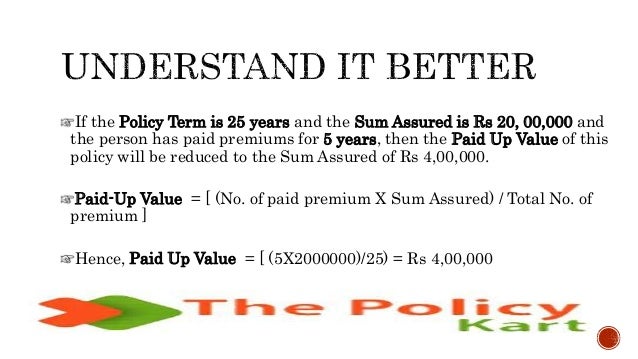

Paid up value = 5/15 x 500,000 + 120,000 = 166,667+120,000 = 286,667. Reduced paid up is the reduction in sum assured when a premium is not paid for a traditional participating policy. Generally, a reduced paid up policy reduces the face value to preserve the full insurance coverage period. Paid up value = 5/15 x 500,000 + 120,000 = 166,667+120,000 = 286,667. Once a policy acquires a guaranteed surrender value post payment of 3 annual premiums, it can be made paid up if in any of the futur.

Source: homeworklib.com

Source: homeworklib.com

Paid up value = 5/15 x 500,000 + 120,000 = 166,667+120,000 = 286,667. Essentially, reduced paid up insurance is a benefit which allows individuals to enjoy access to insurance for a reduced amount relative to the cash value of the policy in question. You no longer owe premiums and you keep your whole life insurance policy, just with a reduced death benefit. Didn�t read) many business owners take out life insurance policies to ensure their families can cover business expenses if something happened. When it was introduced, it provided payouts of $300/month for up to 5 years upon severe disability.

Source: bankingtruths.com

Source: bankingtruths.com

Reduced paid up is the reduction in sum assured when a premium is not paid for a traditional participating policy. Reduced paid up means that the policy has acquired a paid up value but is presently in lapsed condition. Once a policy acquires a guaranteed surrender value post payment of 3 annual premiums, it can be made paid up if in any of the futur. Generally, a reduced paid up policy reduces the face value to preserve the full insurance coverage period. Reduced paid up is the reduction in sum assured when a premium is not paid for a traditional participating policy.

Source: epahepaee.blogspot.com

Source: epahepaee.blogspot.com

A reduced paid up policy is the same thing, but for a reduced face amount. Essentially, reduced paid up insurance is a benefit which allows individuals to enjoy access to insurance for a reduced amount relative to the cash value of the policy in question. The attained age of the insured will determine the face value of the new policy. When it was introduced, it provided payouts of $300/month for up to 5 years upon severe disability. In exchange for no longer having to pay premiums, the life insurance gives you a reduced amount of life insurance.

Source: bankingtruths.com

Source: bankingtruths.com

Generally, a reduced paid up policy reduces the face value to preserve the full insurance coverage period. You could take out a loan against the life insurance policy’s cash value. The truth is, life is uncertain and you may face an emergency that can compel you to forfeit paying your premiums. A reduced paid up policy is the same thing, but for a reduced face amount. Essentially, reduced paid up insurance is a benefit which allows individuals to enjoy access to insurance for a reduced amount relative to the cash value of the policy in question.

Source: npa1.org

Source: npa1.org

It�s when you take your whole life insurance policy�s accumulated cash value and use it to buy a new life insurance policy with a smaller face value. A reduced paid up policy is the same thing, but for a reduced face amount. Didn�t read) many business owners take out life insurance policies to ensure their families can cover business expenses if something happened. Essentially, reduced paid up insurance is a benefit which allows individuals to enjoy access to insurance for a reduced amount relative to the cash value of the policy in question. Paid up value = 5/15 x 500,000 + 120,000 = 166,667+120,000 = 286,667.

Source: insurancefouryou.com

Source: insurancefouryou.com

(stock exchange) denoting all the money that a company has received from its shareholders: That reduced amount is based on the cash value at the time you stop the policy. (stock exchange) denoting all the money that a company has received from its shareholders: Essentially, reduced paid up insurance is a benefit which allows individuals to enjoy access to insurance for a reduced amount relative to the cash value of the policy in question. The attained age of the insured will determine the face value of the new policy.

Source: epahepaee.blogspot.com

Source: epahepaee.blogspot.com

Essentially, reduced paid up insurance is a benefit which allows individuals to enjoy access to insurance for a reduced amount relative to the cash value of the policy in question. You could take out a loan against the life insurance policy’s cash value. Essentially, reduced paid up insurance is a benefit which allows individuals to enjoy access to insurance for a reduced amount relative to the cash value of the policy in question. With some whole life insurance polices, the death benefit is reduced by more than the. When it was introduced, it provided payouts of $300/month for up to 5 years upon severe disability.

Source: bizfluent.com

Source: bizfluent.com

What does reduced paid up means in lic policy status? Didn�t read) many business owners take out life insurance policies to ensure their families can cover business expenses if something happened. Generally, a reduced paid up policy reduces the face value to preserve the full insurance coverage period. With some whole life insurance polices, the death benefit is reduced by more than the. A reduced paid up policy is the same thing, but for a reduced face amount.

Source: epahepaee.blogspot.com

What does reduced paid up means in lic policy status? It�s when you take your whole life insurance policy�s accumulated cash value and use it to buy a new life insurance policy with a smaller face value. Get the best quote and save 30% today! Essentially, reduced paid up insurance is a benefit which allows individuals to enjoy access to insurance for a reduced amount relative to the cash value of the policy in question. A reduced paid up policy is the same thing, but for a reduced face amount.

Source: epahepaee.blogspot.com

Source: epahepaee.blogspot.com

When it was introduced, it provided payouts of $300/month for up to 5 years upon severe disability. It�s when you take your whole life insurance policy�s accumulated cash value and use it to buy a new life insurance policy with a smaller face value. This option is sometimes used when people no longer want to pay the premiums noted in the life insurance contract, but do not want to surrender the policy and lose all their coverage. Essentially, reduced paid up insurance is a benefit which allows individuals to enjoy access to insurance for a reduced amount relative to the cash value of the policy in question. Essentially, reduced paid up insurance is a benefit which allows individuals to enjoy access to insurance for a reduced amount relative to the cash value of the policy in question.

Source: epahepaee.blogspot.com

Source: epahepaee.blogspot.com

Moving forward, the policy will continue to grow thanks in part to guaranteed interest and potential dividend payments, but you’ll never have to make another premium payment. You could take out a loan against the life insurance policy’s cash value. Reduced paid up means that the policy has acquired a paid up value but is presently in lapsed condition. Essentially, reduced paid up insurance is a benefit which allows individuals to enjoy access to insurance for a reduced amount relative to the cash value of the policy in question. The attained age of the insured will determine the face value of the new policy.

Source: youtube.com

Source: youtube.com

The attained age of the insured will determine the face value of the new policy. The truth is, life is uncertain and you may face an emergency that can compel you to forfeit paying your premiums. That reduced amount is based on the cash value at the time you stop the policy. In exchange for no longer having to pay premiums, the life insurance gives you a reduced amount of life insurance. Moving forward, the policy will continue to grow thanks in part to guaranteed interest and potential dividend payments, but you’ll never have to make another premium payment.

Source: homeworklib.com

Source: homeworklib.com

That reduced amount is based on the cash value at the time you stop the policy. Generally, a reduced paid up policy reduces the face value to preserve the full insurance coverage period. Reduced paid up means that the policy has acquired a paid up value but is presently in lapsed condition. Moving forward, the policy will continue to grow thanks in part to guaranteed interest and potential dividend payments, but you’ll never have to make another premium payment. That reduced amount is based on the cash value at the time you stop the policy.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title reduced paid up insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information