Redundancy insurance cost Idea

Home » Trending » Redundancy insurance cost IdeaYour Redundancy insurance cost images are ready. Redundancy insurance cost are a topic that is being searched for and liked by netizens today. You can Find and Download the Redundancy insurance cost files here. Get all free photos.

If you’re searching for redundancy insurance cost images information linked to the redundancy insurance cost keyword, you have pay a visit to the ideal blog. Our site frequently gives you suggestions for seeing the highest quality video and image content, please kindly search and find more enlightening video content and images that fit your interests.

Redundancy Insurance Cost. Generally, these fall into two categories: Uk insurers in this comparison do, however. Your employment status will also factor into the calculations of your quote. It’s a huge financial blow if you can’t pay your household bills, mortgage, or rent.

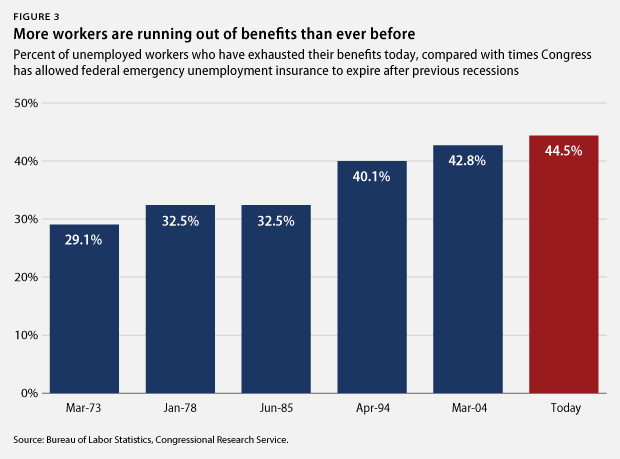

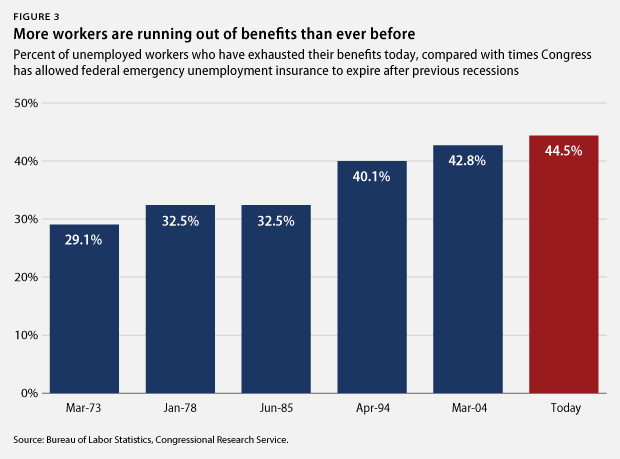

5 Reasons Congress Must Extend Unemployment Insurance From americanprogress.org

5 Reasons Congress Must Extend Unemployment Insurance From americanprogress.org

Income protection, therefore, is designed to help you financially while you wait to get back to work, while redundancy insurance helps you financially while you’re looking for a new job. It provides up to 70% of your gross monthly income for up to 12 months and can be used to meet a range of financial outgoings, such as your mortgage, loan and credit card repayments and household bills. Make sure to compare redundancy protection insurance from across the market. It’s a huge financial blow if you can’t pay your household bills, mortgage, or rent. For a personalised idea, get a quote from us. So what are the true costs of redundancy?

The coverage provided by redundancy insurance generally includes the following:

How much does redundancy insurance cost? Uk insurers in this comparison do, however. Imagine you make a claim after 10 years has passed. The coverage provided by redundancy insurance generally includes the following: So what are the true costs of redundancy? Stuff how nz counts the.

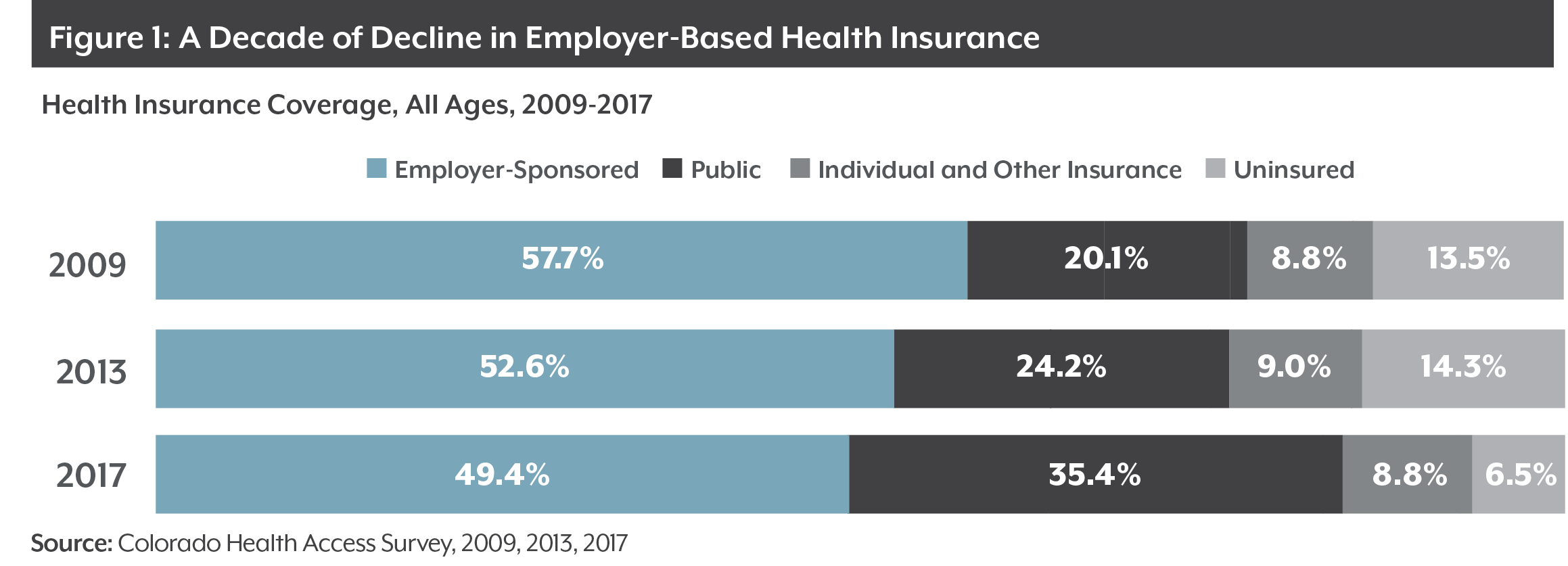

Source: coloradohealthinstitute.org

Source: coloradohealthinstitute.org

Make sure to compare redundancy protection insurance from across the market. Generally, redundancy protection can pay monthly benefits of up to 85% of your usual income after you lose your job for a set period of time. Redundancy insurance, on the other hand, provides financial assistance if you lose your job unexpectedly because of redundancy or retrenchment. This really depends on your own personal circumstances and your own requirements. When you purchase redundancy insurance, uk providers will often include clauses such as an exclusion period.

Source: thirdway.org

Many find themselves having to cut costs and often this can mean having to make some employees redundant. As you can see, redundancy cover costs £34 a month which provides a monthly benefit of £1,000. The maximum benefit, which is the highest income an insurer will cover. Make sure to compare redundancy protection insurance from across the market. If your employee earned less than usual because you used the coronavirus job retention scheme to put them ‘on furlough’, you must work out their redundancy payments based on.

Source: houstonlatest.blogspot.com

How much is redundancy insurance? Uk insurers in this comparison do, however. A combination of the above benefits. It’s a huge financial blow if you can’t pay your household bills, mortgage, or rent. There are some very obvious costs of making someone redundant.

Source: iecfst.com

Source: iecfst.com

There are some very obvious costs of making someone redundant. Your employment status will also factor into the calculations of your quote. The current pandemic has left many business owners in a difficult position. What types of redundancy insurance are available? Redundancy insurance or involuntary unemployment cover can add another layer to your financial coverage.

Source: houstonlatest.blogspot.com

Source: houstonlatest.blogspot.com

This can range from 3 to 6 months from the start of the policy. Redundancy cover is a specialist type of income protection insurance to safeguard your monthly expenses if you are made redundant involuntarily. How much does redundancy insurance cost? So what are the true costs of redundancy? For example, if they have over two years of service you have to pay statutory redundancy pay of up to 30 weeks of pay, depending on their age and length of service.

Source: newqbo.com

Source: newqbo.com

Redundancy insurance, on the other hand, provides financial assistance if you lose your job unexpectedly because of redundancy or retrenchment. Redundancy costs means all payments that the station purchaser or third party service provider is obliged to pay to any transferring employee on the termination of their employment on the grounds of redundancy, whether under (i) section 135 of the employment rights act 1996, (ii) the transferring employee’s contractual entitlement in place at the. This seems pretty expensive to me considering it won�t pay out for any longer than 12 months. Find the cover you need for the cheapest price by completing our quotes form. The cost of redundancy insurance depends on many factors, ranging from your age to lifestyle to total earnings and even if you have a family.

Source: imprecisaoemelodia.blogspot.com

Source: imprecisaoemelodia.blogspot.com

The government estimates that of the $3.54b estimated costs, $1.81b would pay for redundancy cover, and $1.73b to cover loss of work due to health and disability claims. Income protection, therefore, is designed to help you financially while you wait to get back to work, while redundancy insurance helps you financially while you’re looking for a new job. This really depends on your own personal circumstances and your own requirements. You’ll usually get one week’s pay for every year you’ve worked for a company. This seems pretty expensive to me considering it won�t pay out for any longer than 12 months.

Source: opportunitywa.org

Source: opportunitywa.org

There are some very obvious costs of making someone redundant. The maximum benefit, which is the highest income an insurer will cover. If your employee earned less than usual because you used the coronavirus job retention scheme to put them ‘on furlough’, you must work out their redundancy payments based on. Your employment status will also factor into the calculations of your quote. This seems pretty expensive to me considering it won�t pay out for any longer than 12 months.

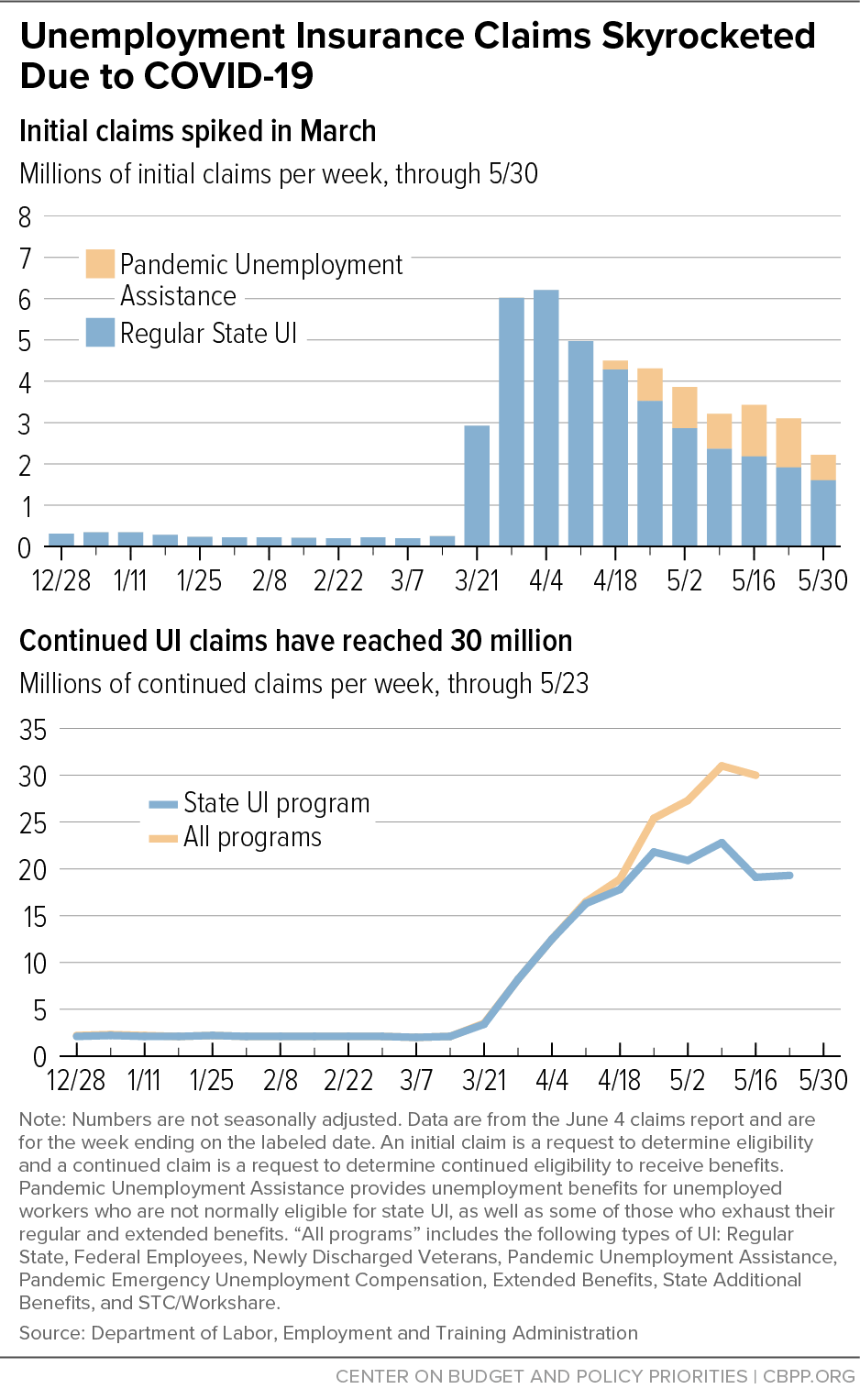

Source: americanprogress.org

Source: americanprogress.org

A combination of the above benefits. Redundancy insurance or involuntary unemployment cover can add another layer to your financial coverage. How much is redundancy insurance? Many find themselves having to cut costs and often this can mean having to make some employees redundant. It also looks pricey given that accident and sickness cover can be added for just £5 extra a month.

Source: researchgate.net

Source: researchgate.net

So what does it cover? Make sure to compare redundancy protection insurance from across the market. How much does redundancy insurance cost? However, most employees will get statutory redundancy pay, set at £538 a week, as the very minimum amount if they’ve been working for the same company for at least two years. This seems pretty expensive to me considering it won�t pay out for any longer than 12 months.

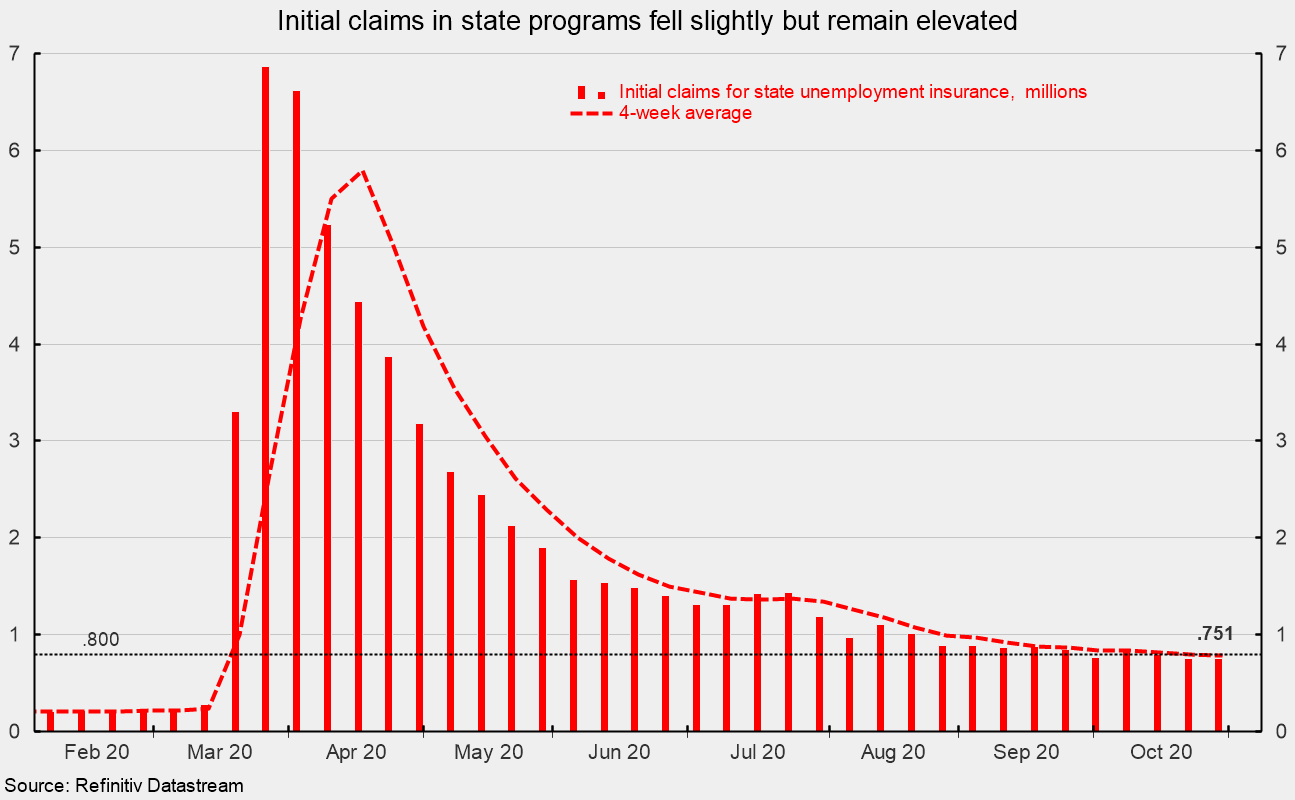

Source: mercatus.org

Source: mercatus.org

In the uk, you’ll generally be able to insure up to 70% of your salary. Where the redundancy is the result of an estimate, the estimated amount of redundancy (or even the. Uk insurers in this comparison do, however. It provides up to 70% of your gross monthly income for up to 12 months and can be used to meet a range of financial outgoings, such as your mortgage, loan and credit card repayments and household bills. There are a lot of different redundancy protection policies available, with very different terms and conditions,.

Source: houstonlatest.blogspot.com

Source: houstonlatest.blogspot.com

Uk insurers in this comparison do, however. There are some very obvious costs of making someone redundant. However, the costs for a redundancy process isn’t free and there are several costs you must consider. If you were made redundant on or after 6th april 2019, this stands at £525 and the maximum statutory redundancy pay you can get is £15,750. This can range from 3 to 6 months from the start of the policy.

Source: leading.gsb.columbia.edu

Source: leading.gsb.columbia.edu

There are a lot of different redundancy protection policies available, with very different terms and conditions,. So what are the true costs of redundancy? Permanent disability insurance of at least $75,000 comprised of: How much is redundancy insurance? It’s a huge financial blow if you can’t pay your household bills, mortgage, or rent.

Source: healthpopuli.com

Source: healthpopuli.com

The coverage provided by redundancy insurance generally includes the following: Uk insurers in this comparison do, however. Redundancy insurance, on the other hand, provides financial assistance if you lose your job unexpectedly because of redundancy or retrenchment. Make sure to compare redundancy protection insurance from across the market. Many find themselves having to cut costs and often this can mean having to make some employees redundant.

Source: blog.questco.net

Source: blog.questco.net

Generally, these fall into two categories: When you purchase redundancy insurance, uk providers will often include clauses such as an exclusion period. How much does redundancy insurance cost? So what are the true costs of redundancy? It also looks pricey given that accident and sickness cover can be added for just £5 extra a month.

Source: friends-was-else.blogspot.com

Source: friends-was-else.blogspot.com

When you purchase redundancy insurance, uk providers will often include clauses such as an exclusion period. This depends on various things like your age, smoker status, income needs and length of cover. Find the cover you need for the cheapest price by completing our quotes form. Redundancy insurance (more commonly known as income protection policy) pays you each month to compensate for the lost income if you’re physically incapable of working. A combination of the above benefits.

Source: urban.org

Source: urban.org

When you purchase redundancy insurance, uk providers will often include clauses such as an exclusion period. Your employment status will also factor into the calculations of your quote. One example is that someone in their twenties with no mortgage or family will have a lower cost compared to someone in their thirties with a mortgage, family, and higher earnings. Come to think of it: Uk insurers in this comparison do, however.

Source: equitablegrowth.org

Source: equitablegrowth.org

It also looks pricey given that accident and sickness cover can be added for just £5 extra a month. You’ll usually get one week’s pay for every year you’ve worked for a company. The limit if you were made redundant on or after 6 april 2021 is £544 a week (£566 in northern ireland) and the maximum statutory redundancy pay. Redundancy insurance (more commonly known as income protection policy) pays you each month to compensate for the lost income if you’re physically incapable of working. So what are the true costs of redundancy?

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title redundancy insurance cost by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information