Reinstatement clause in general insurance Idea

Home » Trend » Reinstatement clause in general insurance IdeaYour Reinstatement clause in general insurance images are ready. Reinstatement clause in general insurance are a topic that is being searched for and liked by netizens today. You can Get the Reinstatement clause in general insurance files here. Get all free photos and vectors.

If you’re searching for reinstatement clause in general insurance images information connected with to the reinstatement clause in general insurance interest, you have come to the right site. Our website always gives you suggestions for viewing the highest quality video and image content, please kindly search and locate more informative video articles and graphics that fit your interests.

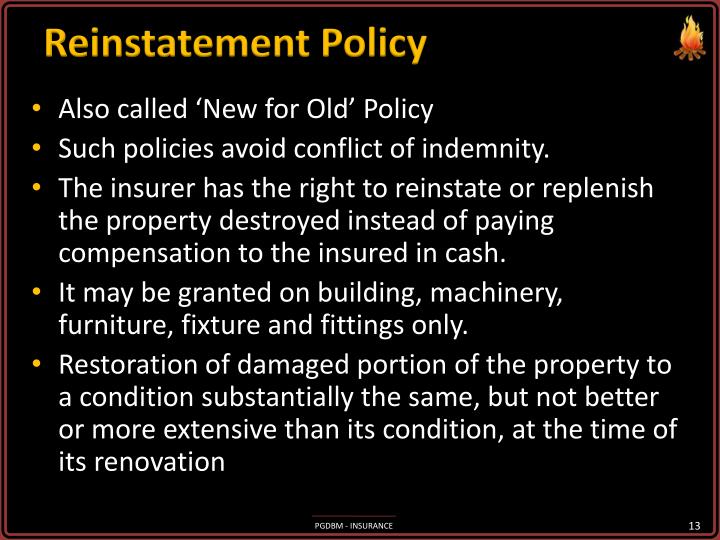

Reinstatement Clause In General Insurance. For the purpose of the insurance under this memorandum ‘reinstatement’ shall mean: Reinstatement in the insurance industry means a person�s previously terminated policy can resume if the already insured meets the specific requirements for reinstatement. It provides information about when the terms of the insurance policy are reset after that claim occurs. If all monies due are not.

HOMEF seeks reinstatement of ‘rights to food’ clause in From von.gov.ng

HOMEF seeks reinstatement of ‘rights to food’ clause in From von.gov.ng

Life insurance reinstatement clauses are you life insurance commissioners. The clause provided the the cover automatically reinstated upon loss unless notice was given otherwise by a party that the cover was to reinstate. It is hereby declared and agreed that in the event of the property insured being destroyed or damaged the basis upon which the amount payable under.…………… of the policy is to be calculated shall be the cost of replacing or reinstating on the same site property of the same kind or type but not superior to or more. In the case of the reinstatement value clause, the insurance company reinstates the damaged property or asset by paying its replacement value as the claim amount to the policyholder. A reinstatement clause is an addition or specific condition listed in a home insurance policy that tells the policyholder when the reinstatement of coverage is possible. A reinstatement clause allows the per occurrence limit to reset and pick up those additional claims under that same occurrence (of course limited to the new reinstated limit), which otherwise would not be reinsured under that reinsurance contract.

A reinstatement clause is an insurance policy clause that states when coverage terms are reset after the insured files a claim.

This clause is also called the ‘new for old’ clause as the insurance company is liable to pay for reinstating the damaged asset with a new asset. This clause is also called the ‘new for old’ clause as the insurance company is liable to pay for reinstating the damaged asset with a new asset. Under the reinstatement value clause, the damaged property is replaced by a new property of the same type. There are two main types of reinstatement, “direct” and “round the clock”. It provides information about when the terms of the insurance policy are reset after that claim occurs. This reinstates each layer of insurance as it is exhausted.

Source: omeheru.blogspot.com

Source: omeheru.blogspot.com

It is hereby declared and agreed that in the event of the property insured being destroyed or damaged the basis upon which the amount payable under.…………… of the policy is to be calculated shall be the cost of replacing or reinstating on the same site property of the same kind or type but not superior to or more. This clause is also called the ‘new for old’ clause as the insurance company is liable to pay for reinstating the damaged asset with a new asset. Second, the judgment confirms that reductions for betterment will not be made in all cases where the policyholder obtains a benefit. Reinstatement, etc the guarantor agrees that this guaranty shall continue to be effective or be reinstated, as the case may be, if at any time any payment (in whole or in part) of any of the guaranteed obligations is rescinded or must otherwise be restored by any lender party, upon the insolvency, bankruptcy or reorganization of the borrowers,. For the purpose of the insurance under this memorandum ‘reinstatement’ shall mean:

Source: youtube.com

Source: youtube.com

Reinstatement clauses typically do not reset a policy�s coverage limit, but they do allow the policy to restart coverage for future claims. We will not lift any responsibility for credit card charges or fees incurred due to expired or cancelled cards or timing delays in processing. Reinstatement in the insurance industry means a person�s previously terminated policy can resume if the already insured meets the specific requirements for reinstatement. Though the reinstatement value clause pays for a new asset or property, the principle of. An insuring clause is a provision in an insurance policy that stipulates the risks assumed.

Source: usefulinsurance.us

Source: usefulinsurance.us

Reinstatement in the insurance industry means a person�s previously terminated policy can resume if the already insured meets the specific requirements for reinstatement. This clause is also called the ‘new for old’ clause as the insurance company is liable to pay for reinstating the damaged asset with a new asset. Correspondingly, when should a policy be reinstated? The treaty will of course state the number of reinstatement�s that the reinsurer is wiling to offer. In the case of the reinstatement value clause, the insurance company reinstates the damaged property or asset by paying its replacement value as the claim amount to the policyholder.

Source: mymuseandmore.blogspot.com

Source: mymuseandmore.blogspot.com

Reinstatement premium — a prorated insurance or reinsurance premium charged for the reinstatement of the amount of a primary policy or reinsurance coverage limit that has been reduced or exhausted by loss payments under such coverages. It does not appear that either party ever gave notice that the cover was not to reinstate. The insurer may establish a reasonable minimum cash value below which any nonforfeiture insurance options will ot be available. Reinstatement premium — a prorated insurance or reinsurance premium charged for the reinstatement of the amount of a primary policy or reinsurance coverage limit that has been reduced or exhausted by loss payments under such coverages. Click to see full answer.

Source: slideshare.net

Source: slideshare.net

Reinstatement clauses typically do not reset a policy�s coverage limit, but they do allow the policy to restart coverage for future claims. A reinstatement clause is an insurance policy clause that states when coverage terms are reset after the insured files a claim. Though the reinstatement value clause pays for a new asset or property, the principle of. Reinstatement clauses typically do not reset a policy�s coverage limit, but they do allow the policy to restart coverage for future claims. Click to see full answer.

Source: template.net

Source: template.net

The clause provided the the cover automatically reinstated upon loss unless notice was given otherwise by a party that the cover was to reinstate. Though the reinstatement value clause pays for a new asset or property, the principle of. Reinstatement in the insurance industry means a person�s previously terminated policy can resume if the already insured meets the specific requirements for reinstatement. In either case in a condition equal to, but not better or more extensive than, its condition when new. It defines the reinstatement value that will be payable after the loss, and the conditions under which this value may be altered even after the claim has been accepted by the insurer.

Source: whohaa.my

Source: whohaa.my

Reinstatement in the insurance industry means a person�s previously terminated policy can resume if the already insured meets the specific requirements for reinstatement. A reinstatement clause is an insurance policy clause that states when coverage terms are reset after the insured files a claim. A reinstatement clause is an insurance policy clause that states when coverage terms are reset after the insured files a claim. Correspondingly, when should a policy be reinstated? To have the cover reinstated, a reinstatement premium is paid.

Source: propertywalls.blogspot.com

Source: propertywalls.blogspot.com

The clause provided the the cover automatically reinstated upon loss unless notice was given otherwise by a party that the cover was to reinstate. A reinstatement clause is an addition or specific condition listed in a home insurance policy that tells the policyholder when the reinstatement of coverage is possible. Correspondingly, when should a policy be reinstated? In a professional indemnity policy the term “reinstatement” refers to the reinstatement of an aggregate limit of indemnity following a loss or claim. It defines the reinstatement value that will be payable after the loss, and the conditions under which this value may be altered even after the claim has been accepted by the insurer.

Source: youtube.com

Source: youtube.com

Reinstatement clauses typically do not reset a policy�s coverage limit, but they do allow the policy to restart coverage for future claims. Reinstatement clauses typically do not reset a policy�s coverage limit, but they do allow the policy to restart coverage for future claims. Reinstatement premium — a prorated insurance or reinsurance premium charged for the reinstatement of the amount of a primary policy or reinsurance coverage limit that has been reduced or exhausted by loss payments under such coverages. It is hereby declared and agreed that in the event of the property insured being destroyed or damaged the basis upon which the amount payable under.…………… of the policy is to be calculated shall be the cost of replacing or reinstating on the same site property of the same kind or type but not superior to or more. We will not lift any responsibility for credit card charges or fees incurred due to expired or cancelled cards or timing delays in processing.

Simon”) Source: sites.google.com

The reinstatement value is a method of claim settlement under a fire insurance policy. 3.9.6 the reinstatement clause it stands to reason that if you don�t pay for something as promised, the promise is broken. First, it makes clear that there is no general requirement that a policyholder must show a fixed and settled intention to reinstate, to be entitled to the cost of reinstatement. It provides information about when the terms of the insurance policy are reset after that claim occurs. Reinstatement value clause (rvc), defines the terms and conditions of payment of reinstatement claims under property insurance policies.

Source: cuusmagic.co.uk

Source: cuusmagic.co.uk

A reinstatement clause is an insurance policy clause that states when coverage terms are reset after the insured files a claim. It enables the policyholder to replace the damaged property with a new property. A reinstatement clause is an insurance policy clause that states when coverage terms are reset after the insured individual or business files a claim due to previous loss or damage. This clause is also called the ‘new for old’ clause as the insurance company is liable to pay for reinstating the damaged asset with a new asset. 3.9.6 the reinstatement clause it stands to reason that if you don�t pay for something as promised, the promise is broken.

Source: mymuseandmore.blogspot.com

Source: mymuseandmore.blogspot.com

We will not lift any responsibility for credit card charges or fees incurred due to expired or cancelled cards or timing delays in processing. Click to see full answer. For the purpose of the insurance under this memorandum ‘reinstatement’ shall mean: Second, the judgment confirms that reductions for betterment will not be made in all cases where the policyholder obtains a benefit. Under the reinstatement value clause, the damaged property is replaced by a new property of the same type.

Source: purge-it.com

Source: purge-it.com

Click to see full answer. Reinstatement clauses typically do not reset a policy�s coverage limit, but they do allow the policy to restart coverage for future claims. Click to see full answer. In either case in a condition equal to, but not better or more extensive than, its condition when new. An insuring clause is a provision in an insurance policy that stipulates the risks assumed.

Source: von.gov.ng

Source: von.gov.ng

A reinstatement clause is an insurance policy clause that states when coverage terms are reset after the insured files a claim. We will not lift any responsibility for credit card charges or fees incurred due to expired or cancelled cards or timing delays in processing. A reinstatement clause is an insurance policy clause that states when coverage terms are reset after the insured files a claim. It enables the policyholder to replace the damaged property with a new property. A reinstatement clause is an insurance policy clause that states when coverage terms are reset after the insured individual or business files a claim due to previous loss or damage.

Source: blakessurveyors.com

Source: blakessurveyors.com

It does not appear that either party ever gave notice that the cover was not to reinstate. First, it makes clear that there is no general requirement that a policyholder must show a fixed and settled intention to reinstate, to be entitled to the cost of reinstatement. Reinstatement premium — a prorated insurance or reinsurance premium charged for the reinstatement of the amount of a primary policy or reinsurance coverage limit that has been reduced or exhausted by loss payments under such coverages. An automatic reinstatement clause is a provision in property insurance contracts that states that the insurance company will set back the insurance coverage�s limit to its original agreement without a legal prompting after it pays the insured for a claim. Under the reinstatement value clause, the damaged property is replaced by a new property of the same type.

Source: sirvec.blogspot.com

Source: sirvec.blogspot.com

This reinstates each layer of insurance as it is exhausted. A reinstatement clause is an insurance policy clause that states when coverage terms are reset after the insured files a claim. It defines the reinstatement value that will be payable after the loss, and the conditions under which this value may be altered even after the claim has been accepted by the insurer. A contract in life insurance that allows a policy that has lapsed to be reinstated. It applies to situations in which the policyholder has filed a claim.

Source: ovolobc.com

Source: ovolobc.com

The reinstatement value is a method of claim settlement under a fire insurance policy. Reinstatement in the insurance industry means a person�s previously terminated policy can resume if the already insured meets the specific requirements for reinstatement. It applies to situations in which the policyholder has filed a claim. If premiums are not paid, the insurer can cancel the policy because of a broken promise. Reinstatement value clause (rvc), defines the terms and conditions of payment of reinstatement claims under property insurance policies.

Source: slideserve.com

Source: slideserve.com

This reinstates each layer of insurance as it is exhausted. An automatic reinstatement clause is a provision in property insurance contracts that states that the insurance company will set back the insurance coverage�s limit to its original agreement without a legal prompting after it pays the insured for a claim. An automatic reinstatement clause is a provision in property insurance contracts that states that the insurance company will set back the insurance coverage�s limit to its original agreement without a legal prompting after it pays the insured for a claim. It is hereby declared and agreed that in the event of the property insured being destroyed or damaged the basis upon which the amount payable under.…………… of the policy is to be calculated shall be the cost of replacing or reinstating on the same site property of the same kind or type but not superior to or more. First, it makes clear that there is no general requirement that a policyholder must show a fixed and settled intention to reinstate, to be entitled to the cost of reinstatement.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title reinstatement clause in general insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information