Relationship between risk management and insurance management information

Home » Trend » Relationship between risk management and insurance management informationYour Relationship between risk management and insurance management images are ready. Relationship between risk management and insurance management are a topic that is being searched for and liked by netizens now. You can Download the Relationship between risk management and insurance management files here. Download all free photos.

If you’re searching for relationship between risk management and insurance management pictures information connected with to the relationship between risk management and insurance management keyword, you have pay a visit to the ideal blog. Our site frequently provides you with hints for seeing the highest quality video and picture content, please kindly hunt and find more informative video content and images that match your interests.

Relationship Between Risk Management And Insurance Management. • concerned with recognizing risks, severity and controlling of risks. So briefly we can say: Existing reward structures for corporate executives tend to correspond to how well they manage financial risk as it relates to internal controls and audit functions. Evidence from nigerian insurance industry.

PPT SHE & the Risk Management Standards PowerPoint From slideserve.com

PPT SHE & the Risk Management Standards PowerPoint From slideserve.com

• concerned with recognizing risks, severity and controlling of risks. Department of actuarial science, faculty of business administration university of lagos. Insurance pays for the damages if the risk were to occur. According to the marquette university risk unit, risk management is the continuing process to identify, analyze, evaluate, and treat loss exposures and monitor risk control and financial resources to mitigate the adverse effects of loss. • process that uses physical & human resources to accomplish certain objectives concerning most pure loss exposures. Claims are, of course, the outgrowth of risk and exposure.

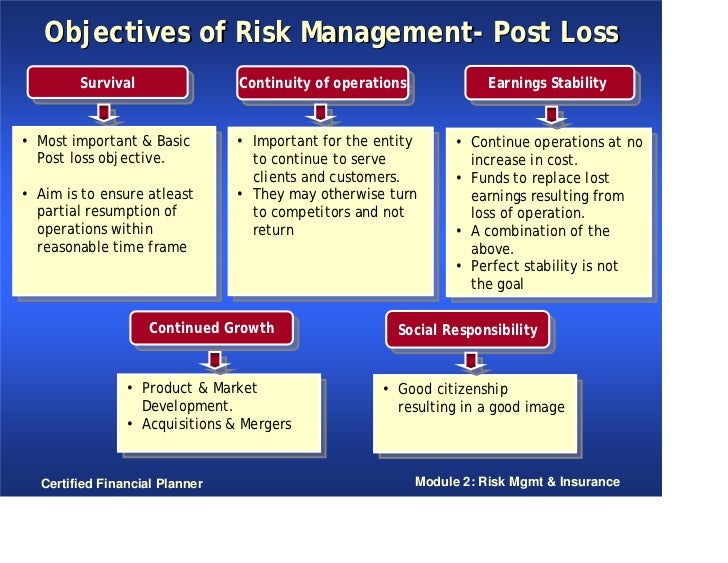

Personal risk management certified financial planner module 2:

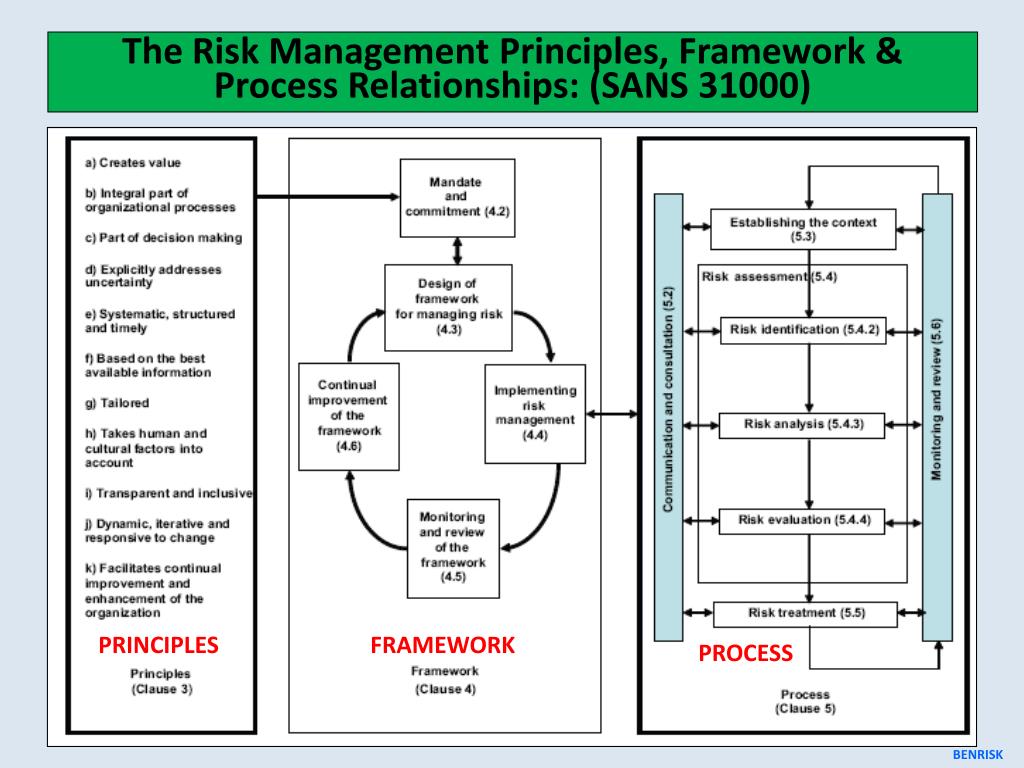

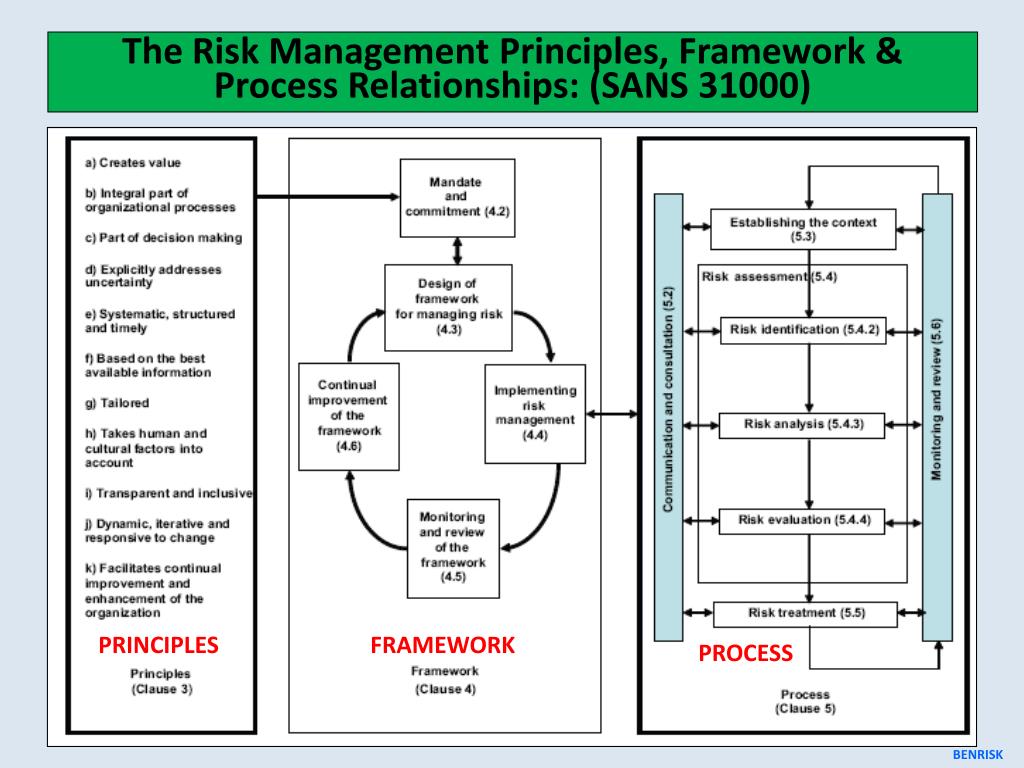

Akpan ph.d 2 olufemi, a. Risk insurance is the risk that is insured risk insurance management consist of. Many of these relationships last as long—or. Audit implementation of the risk management framework. What is the relationship between risk management and insurance buying and why do some argue that insurance buying exerts a negative influence on risk management today? According to the marquette university risk unit, risk management is the continuing process to identify, analyze, evaluate, and treat loss exposures and monitor risk control and financial resources to mitigate the adverse effects of loss.

Source: slideserve.com

Source: slideserve.com

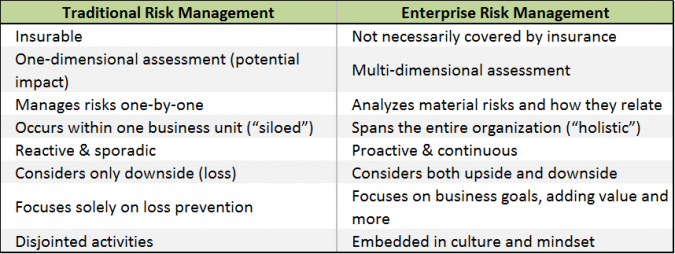

The relationship between enterprise risk management (erm) and organizational performance: Risk mgmt & insurance 10. This direct relationship is the essence of why claims and effective claims management has a. So briefly we can say: Insurance is an important aspect of risk management in business.

Source: erminsightsbycarol.com

Source: erminsightsbycarol.com

Many of these relationships last as long—or. What is the relationship between risk management and insurance buying and why do some argue that insurance buying exerts a negative influence on risk management today? A continuous cycle whereby risk management identifies potential disruptions or incidents, disaster recovery determines rpos and rtos, and both sets of information are utilised to update business continuity plans and improve the quality of business impact analysis (bia) data, which is regularly tested and findings fed back into rm and dr to revise the bcms, is the. Department of actuarial science, faculty of business administration university of lagos. Evidence from nigerian insurance industry.

Source: slideshare.net

Source: slideshare.net

Existing reward structures for corporate executives tend to correspond to how well they manage financial risk as it relates to internal controls and audit functions. Akpan ph.d 2 olufemi, a. Relationship between risk management and the financial performance of the insurance companies in kenya by james njui mburu d61/74648/2014 a research project presented in partial fulfillment of the requirement for the award of masters of business administration, university of nairobi october 2016 Personal risk management certified financial planner module 2: So briefly we can say:

Source: pinterest.co.uk

Source: pinterest.co.uk

• concerned with recognizing risks, severity and controlling of risks. According to the marquette university risk unit, risk management is the continuing process to identify, analyze, evaluate, and treat loss exposures and monitor risk control and financial resources to mitigate the adverse effects of loss. Though these techniques are defensive in nature, they can create a reactive culture. Insurance is an important aspect of risk management in business. A continuous cycle whereby risk management identifies potential disruptions or incidents, disaster recovery determines rpos and rtos, and both sets of information are utilised to update business continuity plans and improve the quality of business impact analysis (bia) data, which is regularly tested and findings fed back into rm and dr to revise the bcms, is the.

Source: researchgate.net

Source: researchgate.net

Safety managers do n’t work o n cases of sexual harassment,. Risk mgmt & insurance 10. Act with confidence and seize new opportunities within the insurance sector. Submissions may be theoretical, empirical, or. Relationship between risk management and the financial performance of the insurance companies in kenya by james njui mburu d61/74648/2014 a research project presented in partial fulfillment of the requirement for the award of masters of business administration, university of nairobi october 2016

Source: researchgate.net

Source: researchgate.net

Risk managementfirst lets start with risk management. • there is no a legal relationship between the insurer and reinsurance insurer in reinsurance When reinsurer transfer risk, new contract create between policyholder insurer and reinsurance insurer. The study also found that there was a negative relationship between credit risk, insolvency risk, Ad essential intelligence for insurance risk management at your fingertips.

Source: researchgate.net

Preparation, prevention, mitigation, and deterrence are essential ingredients for risk management and resilience. Though these techniques are defensive in nature, they can create a reactive culture. This direct relationship is the essence of why claims and effective claims management has a. Risk mgmt & insurance 10. Insurance is an important aspect of risk management in business.

Source: apps.treasury.act.gov.au

Source: apps.treasury.act.gov.au

Insurance is an aspect of risk management in. What is the relationship between risk management and insurance buying and why do some argue that insurance buying exerts a negative influence on risk management today? Existing reward structures for corporate executives tend to correspond to how well they manage financial risk as it relates to internal controls and audit functions. Safety managers do n’t work o n cases of sexual harassment,. Those insurance products serve as risk management tools for the companies that buy them by allowing them to take on the small negative of having to pay premiums while giving up the potentially large negative impacts of being victim to an.

Source: researchgate.net

Source: researchgate.net

A continuous cycle whereby risk management identifies potential disruptions or incidents, disaster recovery determines rpos and rtos, and both sets of information are utilised to update business continuity plans and improve the quality of business impact analysis (bia) data, which is regularly tested and findings fed back into rm and dr to revise the bcms, is the. Existing reward structures for corporate executives tend to correspond to how well they manage financial risk as it relates to internal controls and audit functions. The new standard for reward structures may include not only rewarding the success of businesses, but also rewarding managers for having a keen awareness of risk management. Relationship between risk management and the financial performance of the insurance companies in kenya by james njui mburu d61/74648/2014 a research project presented in partial fulfillment of the requirement for the award of masters of business administration, university of nairobi october 2016 Risk management provides a clear and structured approach to identifying risks.

Source: researchgate.net

Source: researchgate.net

The study also found that there was a negative relationship between credit risk, insolvency risk, The study also found that there was a negative relationship between credit risk, insolvency risk, Department of actuarial science, faculty of business administration university of lagos. What is the relationship between risk management and insurance buying and why do some argue that insurance buying exerts a negative influence on risk management today? Risk management provides a clear and structured approach to identifying risks.

Source: researchgate.net

Source: researchgate.net

Preparation, prevention, mitigation, and deterrence are essential ingredients for risk management and resilience. Safety managers do n’t work o n cases of sexual harassment,. Some will argue that we need less management of risk (defensive posture) and more of resilience (offensive posture). Evidence from nigerian insurance industry. Act with confidence and seize new opportunities within the insurance sector.

Source: researchgate.net

We typically simplify this a bit and describe it as the identification, analysis (or. Risk mgmt & insurance 10. Preparation, prevention, mitigation, and deterrence are essential ingredients for risk management and resilience. The relationship between enterprise risk management (erm) and organizational performance: Though these techniques are defensive in nature, they can create a reactive culture.

Source: asq.org

Source: asq.org

Relationship between risk management and the financial performance of the insurance companies in kenya by james njui mburu d61/74648/2014 a research project presented in partial fulfillment of the requirement for the award of masters of business administration, university of nairobi october 2016 The relationship between enterprise risk management (erm) and organizational performance: Claims are, of course, the outgrowth of risk and exposure. A continuous cycle whereby risk management identifies potential disruptions or incidents, disaster recovery determines rpos and rtos, and both sets of information are utilised to update business continuity plans and improve the quality of business impact analysis (bia) data, which is regularly tested and findings fed back into rm and dr to revise the bcms, is the. So briefly we can say:

Source: expectra-international.com

Source: expectra-international.com

The relationship between enterprise risk management (erm) and organizational performance: A continuous cycle whereby risk management identifies potential disruptions or incidents, disaster recovery determines rpos and rtos, and both sets of information are utilised to update business continuity plans and improve the quality of business impact analysis (bia) data, which is regularly tested and findings fed back into rm and dr to revise the bcms, is the. According to the marquette university risk unit, risk management is the continuing process to identify, analyze, evaluate, and treat loss exposures and monitor risk control and financial resources to mitigate the adverse effects of loss. When it comes to business insurance, most insurers will calculate rates and insurability based on a risk management assessment. So briefly we can say:

Source: researchgate.net

Source: researchgate.net

Akpan ph.d 2 olufemi, a. Audit implementation of the risk management framework. Risk management provides a clear and structured approach to identifying risks. Ad essential intelligence for insurance risk management at your fingertips. Evidence from nigerian insurance industry.

Source: slideshare.net

Source: slideshare.net

The review’s “feature articles” section includes original research involving applications and applied techniques. This direct relationship is the essence of why claims and effective claims management has a. Akpan ph.d 2 olufemi, a. Another difference between the two fields is the types of cases they work o n. Preparation, prevention, mitigation, and deterrence are essential ingredients for risk management and resilience.

Source: researchgate.net

Source: researchgate.net

The study also found that there was a negative relationship between credit risk, insolvency risk, Advise management on integration of risk management into business operations and their roles in making it work. Relationship between risk management and the financial performance of the insurance companies in kenya by james njui mburu d61/74648/2014 a research project presented in partial fulfillment of the requirement for the award of masters of business administration, university of nairobi october 2016 A continuous cycle whereby risk management identifies potential disruptions or incidents, disaster recovery determines rpos and rtos, and both sets of information are utilised to update business continuity plans and improve the quality of business impact analysis (bia) data, which is regularly tested and findings fed back into rm and dr to revise the bcms, is the. Risk insurance is the risk that is insured risk insurance management consist of.

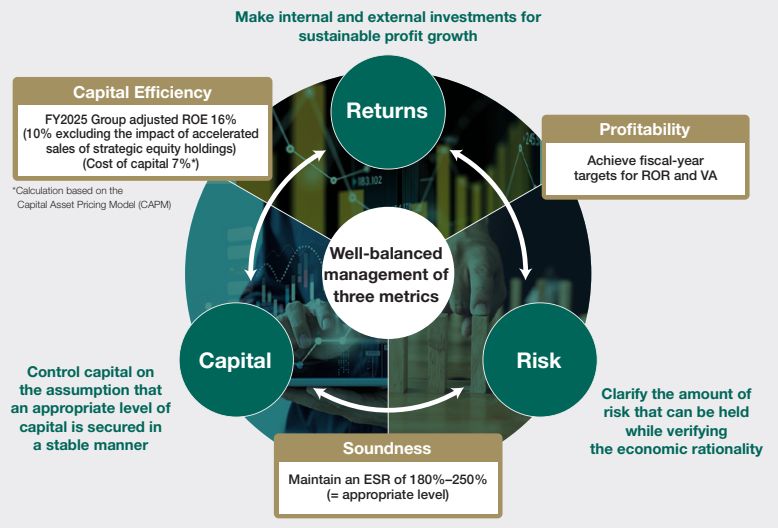

Source: ms-ad-hd.com

Source: ms-ad-hd.com

Though these techniques are defensive in nature, they can create a reactive culture. Obalola 1 ph.d, thomas i. • there is no a legal relationship between the insurer and reinsurance insurer in reinsurance Risk insurance is the risk that is insured risk insurance management consist of. Insurance is an aspect of risk management in.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title relationship between risk management and insurance management by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information