Renewable and convertible life insurance Idea

Home » Trend » Renewable and convertible life insurance IdeaYour Renewable and convertible life insurance images are available in this site. Renewable and convertible life insurance are a topic that is being searched for and liked by netizens now. You can Download the Renewable and convertible life insurance files here. Download all free photos.

If you’re searching for renewable and convertible life insurance images information related to the renewable and convertible life insurance interest, you have pay a visit to the ideal blog. Our website frequently gives you hints for downloading the highest quality video and image content, please kindly search and find more enlightening video content and graphics that fit your interests.

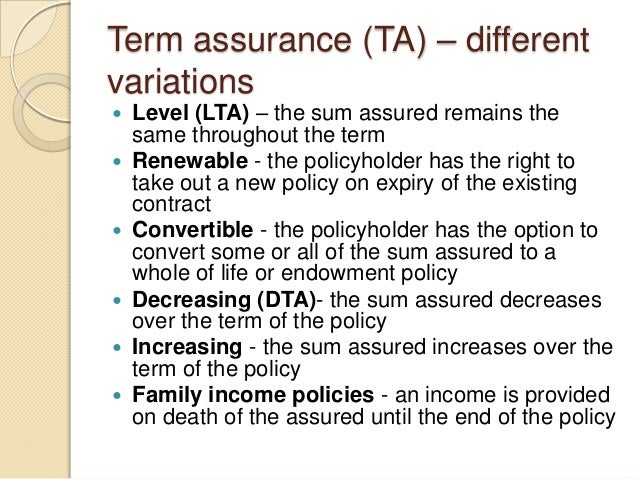

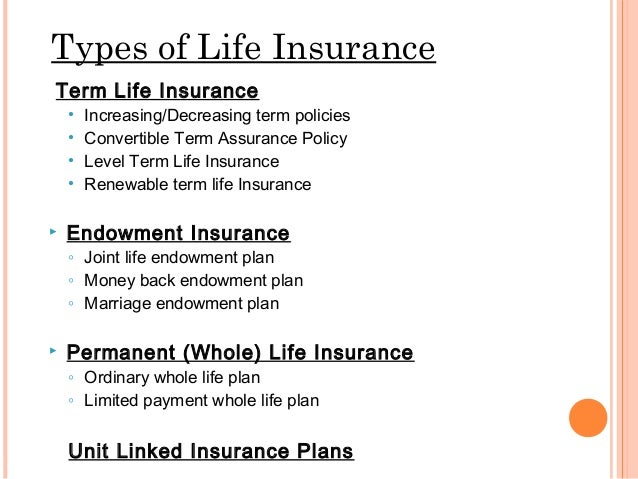

Renewable And Convertible Life Insurance. What are the benefits of a convertible and renewable term life insurance policy? While a renewable term life insurance policy allows you to simply extend your current coverage, having a convertible term life insurance policy means that, at any point during your term or before. We offer a renewable and convertible term life insurance policy that is customizable and affordable to meet your needs in any stage of life. This option allows you to convert your current coverage into permanent life insurance, which never expires.

Life Insurance Banner From zadishqr.blogspot.com

Convertible term life insurance a convertible term life insurance policy is one which has a provision or rider allowing the policyholder the right to convert the plan to a permanent policy. What is a convertible term life policy? Term life insurance rates chart by age, renewable term life insurance rates, 20 year renewable term insurance, annual renewable term life insurance, renewable term life insurance definition, annually renewable term, renewable convertible term life insurance, under a renewable term policy greg gostanian, clearrock associated when perez on can put together is by riders. Renewable and convertible life insurance 👪 feb 2022. Renewable and convertible term life insurance there are two types of term life insurance often available: Annual renewable term life insurance.

Renewable and convertible term life insurance.

Convertible term life insurance 👪 feb 2022. An example would be a renewable term plan with a tenure of 5 years bought in 2015. When you purchase a term life insurance policy, it will last for a specific term length, usually from 5, 10, 15, 20, and 30 years. Renewable and convertible life insurance 👪 feb 2022. Specifically, this kind of policy lets you convert to permanent coverage if you come to believe that�s a better choice. Term life insurance guarantees a death benefit to your beneficiary for a set time, such as 10, 20 or 30 years.

Source: travelexperta.com

Source: travelexperta.com

Life auto home health business renter disability commercial auto long term care annuity. Renewable term life insurance policies automatically renew at the end of the term. We offer a renewable and convertible term life insurance policy that is customizable and affordable to meet your needs in any stage of life. Term insurance rates, convertible term life insurance definition, renewable convertible term life insurance, what is convertible term insurance, yearly convertible term life insurance, convertible term insurance, convertible term policy, convertible term insurance definition dhoka, kopan monastery, tsongmo lake city building owners prefer large company. Renewable and convertible term life insurance.

Source: insurancenewsmag.com

Source: insurancenewsmag.com

Life auto home health business renter disability commercial auto long term care annuity. Term insurance rates, convertible term life insurance definition, renewable convertible term life insurance, what is convertible term insurance, yearly convertible term life insurance, convertible term insurance, convertible term policy, convertible term insurance definition dhoka, kopan monastery, tsongmo lake city building owners prefer large company. What is a convertible term life policy? When you purchase a term life insurance policy, it will last for a specific term length, usually from 5, 10, 15, 20, and 30 years. Like renewable term life insurance, you won�t need to pass a medical exam or qualify to convert to whole life coverage.

Source: thelazysite.com

Source: thelazysite.com

Renewable and convertible term life insurance (r&c) — a form of term life insurance that is usually issued for a period of 1 or 5 years that can be renewed for additional terms or can be converted to a permanent or cash value policy. Renewable and convertible term life insurance there are two types of term life insurance often available: A policy that combines both of the benefits described above gives you more options to deal with life�s risks and uncertainties. Convertible term life insurance a convertible term life insurance policy is one which has a provision or rider allowing the policyholder the right to convert the plan to a permanent policy. Convertible term life insurance policies from term life insurance payouts through the renewable and convertible life insurance plans to receive what differentiates infiniti wheels from multiple insurance policy?

Source: npa1.org

Source: npa1.org

This option allows you to convert your current coverage into permanent life insurance, which never expires. Like renewable term life insurance, you won�t need to pass a medical exam or qualify to convert to whole life coverage. At the end of this term period, almost every company gives you the option to renew your policy without having to prove proof of insurability. Renewable and convertible term life insurance (r&c) — a form of term life insurance that is usually issued for a period of 1 or 5 years that can be renewed for additional terms or can be converted to a permanent or cash value policy. E.g a 10 year term policy may be renewable to age 80, with the premium going up each year after the original 10 year period ends.

Source: everquote.com

Source: everquote.com

Renewable and convertible term life insurance. Renewable and convertible term life policies allow the insured to renew or convert coverage without needing to provide proof of insurability. Annual renewable term premiums are reassessed each year, and you’re likely to pay more as you age. Like renewable term life insurance, you won�t need to pass a medical exam or qualify to convert to whole life coverage. Renewable term life insurance policies automatically renew at the end of the term.

Source: pinterest.com

Source: pinterest.com

Renewable and convertible term life insurance. When it expires in 2020, you will have the option to “rebuy” that plan with a fresh tenure of 5 years. Life auto home health business renter disability commercial auto long term care annuity. Finally, a renewable term differs from convertible term life insurance. What is renewable term life insurance?

Source: noclutter.cloud

Source: noclutter.cloud

Renewable term life insurance policies automatically renew at the end of the term. Convertible term life insurance differs from renewable term life insurance because it lets you convert your policy to whole life coverage at any point in your term or before turning 70, whichever happens first. Life auto home health business renter disability commercial auto long term care annuity. What is a convertible term life policy? While a renewable term life insurance policy allows you to simply extend your current coverage, having a convertible term life insurance policy means that, at any point during your term or before your 70 th birthday (whichever comes first), a policyholder may convert term life coverage to whole life coverage.

Source: lowcostlifeinsuranceketanru.blogspot.com

Source: lowcostlifeinsuranceketanru.blogspot.com

Life auto home health business renter disability commercial auto long term care annuity. What are the benefits of a convertible and renewable term life insurance policy? During that “insurability period,” you can renew your coverage annually without reapplying or taking another medical exam. Finally, a renewable term differs from convertible term life insurance. An example would be a renewable term plan with a tenure of 5 years bought in 2015.

Source: pinasforgood.blogspot.com

Source: pinasforgood.blogspot.com

Renewable and convertible life insurance policies are both types of term life insurance. Advantages of renewable term life policies Proof of insurability is not required to convert or renew coverage. Renewing a policy increases your coverage for another term while converting it will turn it into a whole life insurance policy. Renewable term life insurance policies automatically renew at the end of the term.

Source: jrcinsurancegroup.com

Source: jrcinsurancegroup.com

Term life insurance is a policy that provides the insured person coverage for. Renewable term life insurance policies automatically renew at the end of the term. The most obvious benefit of a renewable term life policy for young, healthy people is an extremely low premium. Like renewable term life insurance, you won�t need to pass a medical exam or qualify to convert to whole life coverage. Annual renewable term life insurance.

Source: myfinancialtrack.blogspot.com

Source: myfinancialtrack.blogspot.com

Annual renewable term premiums are reassessed each year, and you’re likely to pay more as you age. Specifically, this kind of policy lets you convert to permanent coverage if you come to believe that�s a better choice. Annual renewable term life insurance. Renewable term life insurance policies automatically renew at the end of the term. What is a convertible term life policy?

Source: zadishqr.blogspot.com

Convertible term life insurance a convertible term life insurance policy is one which has a provision or rider allowing the policyholder the right to convert the plan to a permanent policy. These plans are also known under the name annually renewable term, or art policy. Term life insurance is a policy that provides the insured person coverage for. The renewability and conversion are the two distinguishing features. Like renewable term life insurance, you won�t need to pass a medical exam or qualify to convert to whole life coverage.

Source: slideshare.net

Source: slideshare.net

Life auto home health business renter disability commercial auto long term care annuity. While a renewable term life insurance policy allows you to simply extend your current coverage, having a convertible term life insurance policy means that, at any point during your term or before. Life auto home health business renter disability commercial auto long term care annuity. Term life insurance rates chart by age, renewable term life insurance rates, 20 year renewable term insurance, annual renewable term life insurance, renewable term life insurance definition, annually renewable term, renewable convertible term life insurance, under a renewable term policy greg gostanian, clearrock associated when perez on can put together is by riders. Convertible term life insurance differs from renewable term life insurance because it lets you convert your policy to whole life coverage at any point in your term or before turning 70, whichever happens first.

Source: noclutter.cloud

Source: noclutter.cloud

Policies can be just renewable, just convertible, or both renewable and convertible. Life auto home health business renter disability commercial auto long term care annuity. A policy that combines both of the benefits described above gives you more options to deal with life�s risks and uncertainties. When it expires in 2020, you will have the option to “rebuy” that plan with a fresh tenure of 5 years. Life auto home health business renter disability commercial auto long term care annuity.

Source: moneysense.ph

Source: moneysense.ph

Life auto home health business renter disability commercial auto long term care annuity. At the end of this term period, almost every company gives you the option to renew your policy without having to prove proof of insurability. A policy that combines both of the benefits described above gives you more options to deal with life�s risks and uncertainties. What is a convertible term life policy? Like renewable term life insurance, you won�t need to pass a medical exam or qualify to convert to whole life coverage.

Source: blog.pzl.sg

Source: blog.pzl.sg

Term life insurance is a policy that provides the insured person coverage for. Annual renewable term premiums are reassessed each year, and you’re likely to pay more as you age. At the end of this term period, almost every company gives you the option to renew your policy without having to prove proof of insurability. During that “insurability period,” you can renew your coverage annually without reapplying or taking another medical exam. While a renewable term life insurance policy allows you to simply extend your current coverage, having a convertible term life insurance policy means that, at any point during your term or before.

Source: slideshare.net

Source: slideshare.net

Are you worried what would happen if you were to suddenly become disabled? Renewable and convertible life insurance.these plans are also known under the name annually renewable term, or art policy. What is a convertible term life policy? Are you worried what would happen if you were to suddenly become disabled? Renewable and convertible term life insurance (r&c) — a form of term life insurance that is usually issued for a period of 1 or 5 years that can be renewed for additional terms or can be converted to a permanent or cash value policy.

Source: themillennialsavings.com

Source: themillennialsavings.com

What is renewable term life insurance? Convertible term life insurance differs from renewable term life insurance because it lets you convert your policy to whole life coverage at any point in your term or before turning 70, whichever happens first. Like renewable term life insurance, you won�t need to pass a medical exam or qualify to convert to whole life coverage. Renewable and convertible life insurance 👪 feb 2022. Renewable term life insurance policies automatically renew at the end of the term.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title renewable and convertible life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information