Renewable term life insurance information

Home » Trending » Renewable term life insurance informationYour Renewable term life insurance images are ready in this website. Renewable term life insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Renewable term life insurance files here. Get all free vectors.

If you’re searching for renewable term life insurance images information related to the renewable term life insurance keyword, you have pay a visit to the ideal site. Our website frequently gives you hints for downloading the maximum quality video and picture content, please kindly search and find more informative video content and graphics that fit your interests.

Renewable Term Life Insurance. Annual renewable term life insurance can keep you protected during periods of time when you might not qualify for more affordable term life insurance. What is renewable term life insurance? If you pass away during this time, your beneficiary receives money from the life insurance company. A renewable term life insurance policy is term life coverage with a clause that allows the policy owner to renew coverage at the end of the term without undergoing new underwriting.

Annual Renewal Term Life Insurance Quotes Low Cost From insurancegeek.com

Annual Renewal Term Life Insurance Quotes Low Cost From insurancegeek.com

Annual renewable term insurance is a unique life insurance product. Renewable term life insurance allows you to extend your coverage once your insurance term finishes. A plan that gives you the option to renew when the policy ends. If your term insurance policy contains a renewable term clause, it entitles you to extend your current coverage. An annual renewable term life (9). The term may be as short as one year.

Renewable term life insurance 👪 sep 2021.

Renewable term life insurance is a primary benefit of having a term life insurance policy. Renewable term life insurance is a type of term life insurance that is designed to be renewed on a regular basis. Renewable term life insurance allows you to extend your coverage once your insurance term finishes. Renewable term life insurance is a policy that gives the policyholder the option to extend their life insurance coverage beyond the period specified in the insurance contract instead of buying a new policy. Annual renewable life insurance works just like a term life policy with a longer coverage period. Life auto home health business renter disability commercial auto long term care annuity.

Source: epsuboy.blogspot.com

Source: epsuboy.blogspot.com

A renewable term life insurance policy can be renewed after the term expires. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. The main benefit that a renewable term life insurance policy can offer to an insured is a lower initial payment for their insurance. A plan that gives you the option to renew when the policy ends. Renewable term life insurance is a type of term life insurance that is designed to be renewed on a regular basis.

Source: effortlessinsurance.com

Source: effortlessinsurance.com

It’s temporary and designed to provide protection for a fixed period.the most common term lengths are 10 year, 20 year and 30 year. The main benefit that a renewable term life insurance policy can offer to an insured is a lower initial payment for their insurance. What is renewable term life insurance? A renewable term life insurance policy is term life coverage with a clause that allows the policy owner to renew coverage at the end of the term without undergoing new underwriting. Life auto home health business renter disability commercial auto long term care annuity.

Source: money.stackexchange.com

Source: money.stackexchange.com

However, the initial policy term is just one year, while (10). Term life insurance is a life insurance policy that expires at the end of a set number of years. Typically, you can renew your policy without a repeat of a medical exam or requalification. An annual renewable term life (9). Life auto home health business renter disability commercial auto long term care annuity.

Source: insurancegeek.com

Source: insurancegeek.com

Term life insurance is the best insurance solution 95% of the time. A plan that gives you the option to renew when the policy ends. What is annual renewable term life insurance? A renewable term is a clause in many term life insurance contracts that lets you extend coverage without buying a new policy. Renew the policy through an optional feature called.

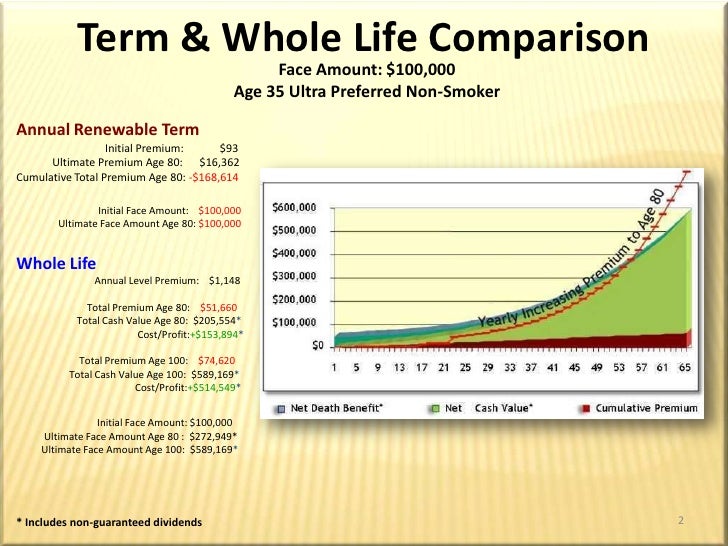

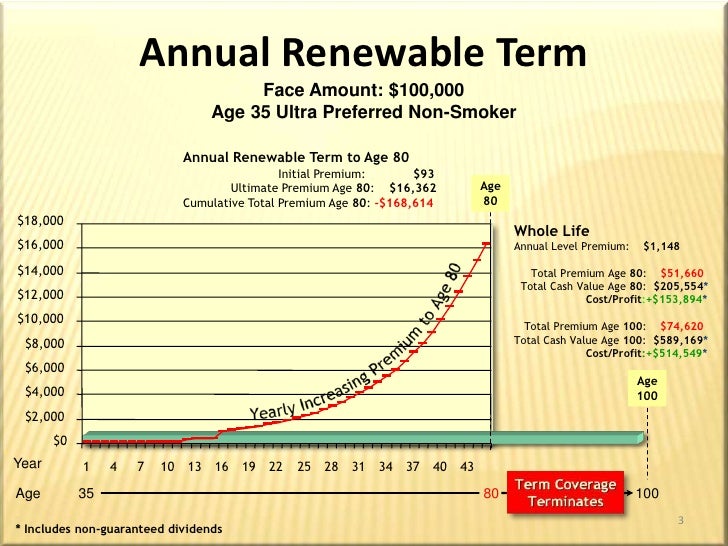

Source: slideshare.net

Source: slideshare.net

Term life insurance is a life insurance policy that expires at the end of a set number of years. The main benefit that a renewable term life insurance policy can offer to an insured is a lower initial payment for their insurance. If a longer term policy is out of reach for you, a renewable. A plan that gives you the option to renew when the policy ends. Renew the policy through an optional feature called.

Source: integon-life-insurance.blogspot.com

Source: integon-life-insurance.blogspot.com

While most people may benefit from opting for a standard term life policy, an art policy could make sense in. The insurance company guarantees to renew the policy yearly for a set number of years. What is annual renewable term life insurance? If a longer term policy is out of reach for you, a renewable. It’s temporary and designed to provide protection for a fixed period.the most common term lengths are 10 year, 20 year and 30 year.

Source: slideshare.net

Source: slideshare.net

If you pass away during this time, your beneficiary receives money from the life insurance company. Convertible term life insurance 👪 feb 2022. Term life insurance is the best insurance solution 95% of the time. If you pass away during this time, your beneficiary receives money from the life insurance company. Annual renewable term life insurance can keep you protected during periods of time when you might not qualify for more affordable term life insurance.

Source: pacificinsurancegroup.com

Source: pacificinsurancegroup.com

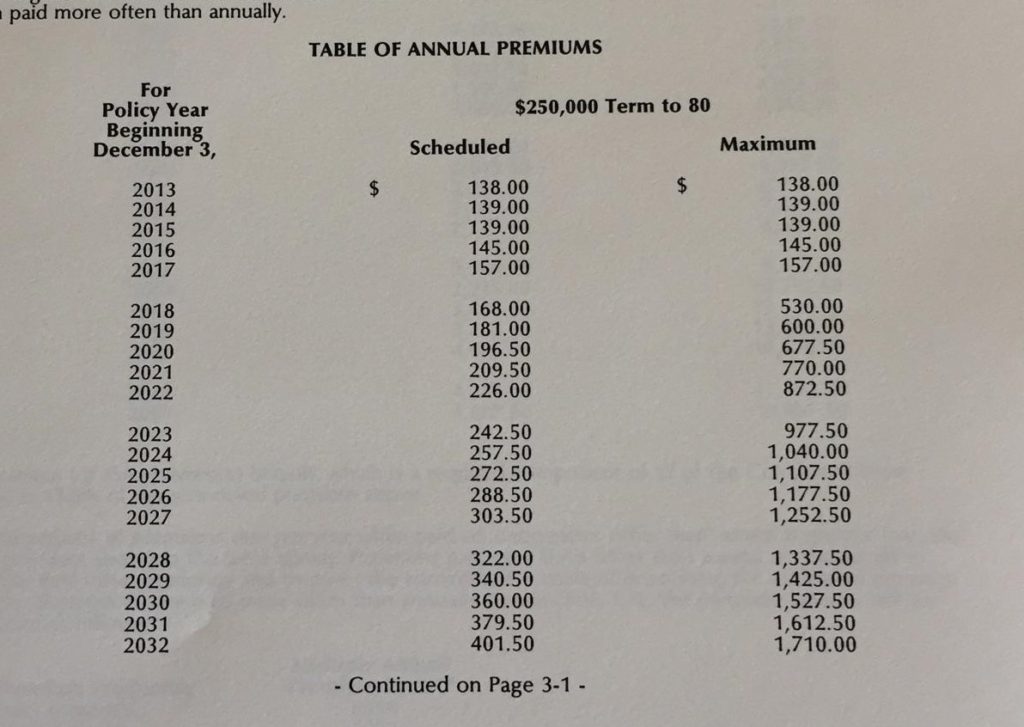

At the completion of the term, insured patrons typically have three options: Renewable term life insurance allows you to extend your coverage once your insurance term finishes. Annual renewable term life insurance is insurance that increases in cost each year. Renewable term life insurance is a primary benefit of having a term life insurance policy. Term life insurance is a life insurance policy that expires at the end of a set number of years.

Source: lifeinsurancewithoutamedicalexams.com

Source: lifeinsurancewithoutamedicalexams.com

What is renewable term life insurance? Life auto home health business renter disability commercial auto long term care annuity. Renewable term life insurance is exactly what it sounds like: However, the initial policy term is just one year, while (10). A plan that gives you the option to renew when the policy ends.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

So, if someone believes that they will only need to own their insurance policy for a short period or time, this “type” of term life insurance policy might be a good option for them. Annual renewable term (art) life insurance is a short term life insurance policy which locks in your premiums for one year and can be optionally renewed at the end of each year. Renewable term life insurance allows you to extend your coverage once your insurance term finishes. While most people may benefit from opting for a standard term life policy, an art policy could make sense in. Typically, you can renew your policy without a repeat of a medical exam or requalification.

Source: archstoneinsurance.com

Source: archstoneinsurance.com

Term life insurance is the best insurance solution 95% of the time. A plan that gives you the option to renew when the policy ends. The main benefit that a renewable term life insurance policy can offer to an insured is a lower initial payment for their insurance. Annual renewable term (art) life insurance is a short term life insurance policy which locks in your premiums for one year and can be optionally renewed at the end of each year. Renewable and convertible life insurance 👪 feb 2022.

Source: effortlessinsurance.com

Source: effortlessinsurance.com

Annual renewable life insurance works just like a term life policy with a longer coverage period. Annual renewable term (art) life insurance is a short term life insurance policy which locks in your premiums for one year and can be optionally renewed at the end of each year. Renewable term life insurance is a primary benefit of having a term life insurance policy. Term life insurance guarantees a death benefit to your beneficiary for a set time, such as 10, 20 or 30 years. The term may be as short as one year.

Source: jrcinsurancegroup.com

Source: jrcinsurancegroup.com

So, if someone believes that they will only need to own their insurance policy for a short period or time, this “type” of term life insurance policy might be a good option for them. Unlike traditional term life insurance, premiums start low and increase every time you renew your policy. Annual renewable life insurance works just like a term life policy with a longer coverage period. Renewable term life insurance is a type of term life insurance that is designed to be renewed on a regular basis. If a longer term policy is out of reach for you, a renewable.

Source: yourfriend4life.com

Source: yourfriend4life.com

Annual renewable term insurance is a unique life insurance product. What is annual renewable term life insurance? When you purchase a term life insurance policy, it will last for a specific term length, usually from 5, 10, 15, 20, and 30 years. While most people may benefit from opting for a standard term life policy, an art policy could make sense in. What is renewable term life insurance?

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

At the completion of the term, insured patrons typically have three options: Renewable term assurance is level term assurance but with the flexibility to renew the plan regardless of your state of health at the point of renewal. Annual renewable term life insurance is insurance that increases in cost each year. Life auto home health business renter disability commercial auto long term care annuity. A renewable term is a clause in many term life insurance contracts that lets you extend coverage without buying a new policy.

Source: simplyinsurance.com

Source: simplyinsurance.com

Renewable term life insurance allows you to extend your coverage once your insurance term finishes. Annual renewable term life insurance is insurance that increases in cost each year. Term life insurance guarantees a death benefit to your beneficiary for a set time, such as 10, 20 or 30 years. A renewable term life insurance policy can be renewed after the term expires. Renew the policy through an optional feature called.

Source: aaronpeacock.com

Source: aaronpeacock.com

A renewable term life insurance policy is term life coverage with a clause that allows the policy owner to renew coverage at the end of the term without undergoing new underwriting. Convertible term life insurance 👪 feb 2022. With annual renewable term life insurance rates as low as $22.08/mo, you can have peace of mind until you can secure a proper longer term insurance policy. A plan that gives you the option to renew when the policy ends. The term may be as short as one year.

Source: thelazysite.com

Source: thelazysite.com

The insurance company guarantees to renew the policy yearly for a set number of years. The insurance company guarantees to renew the policy yearly for a set number of years. Renewable term life insurance is a policy that gives the policyholder the option to extend their life insurance coverage beyond the period specified in the insurance contract instead of buying a new policy. Term life insurance is a life insurance policy that expires at the end of a set number of years. In short, you take out your term assurance for a set term, for example 10 years, but include the renewable option.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title renewable term life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information