Renters insurance additional insured information

Home » Trend » Renters insurance additional insured informationYour Renters insurance additional insured images are ready in this website. Renters insurance additional insured are a topic that is being searched for and liked by netizens today. You can Download the Renters insurance additional insured files here. Find and Download all free vectors.

If you’re searching for renters insurance additional insured images information connected with to the renters insurance additional insured keyword, you have come to the right site. Our site always provides you with hints for viewing the highest quality video and picture content, please kindly search and locate more enlightening video articles and images that match your interests.

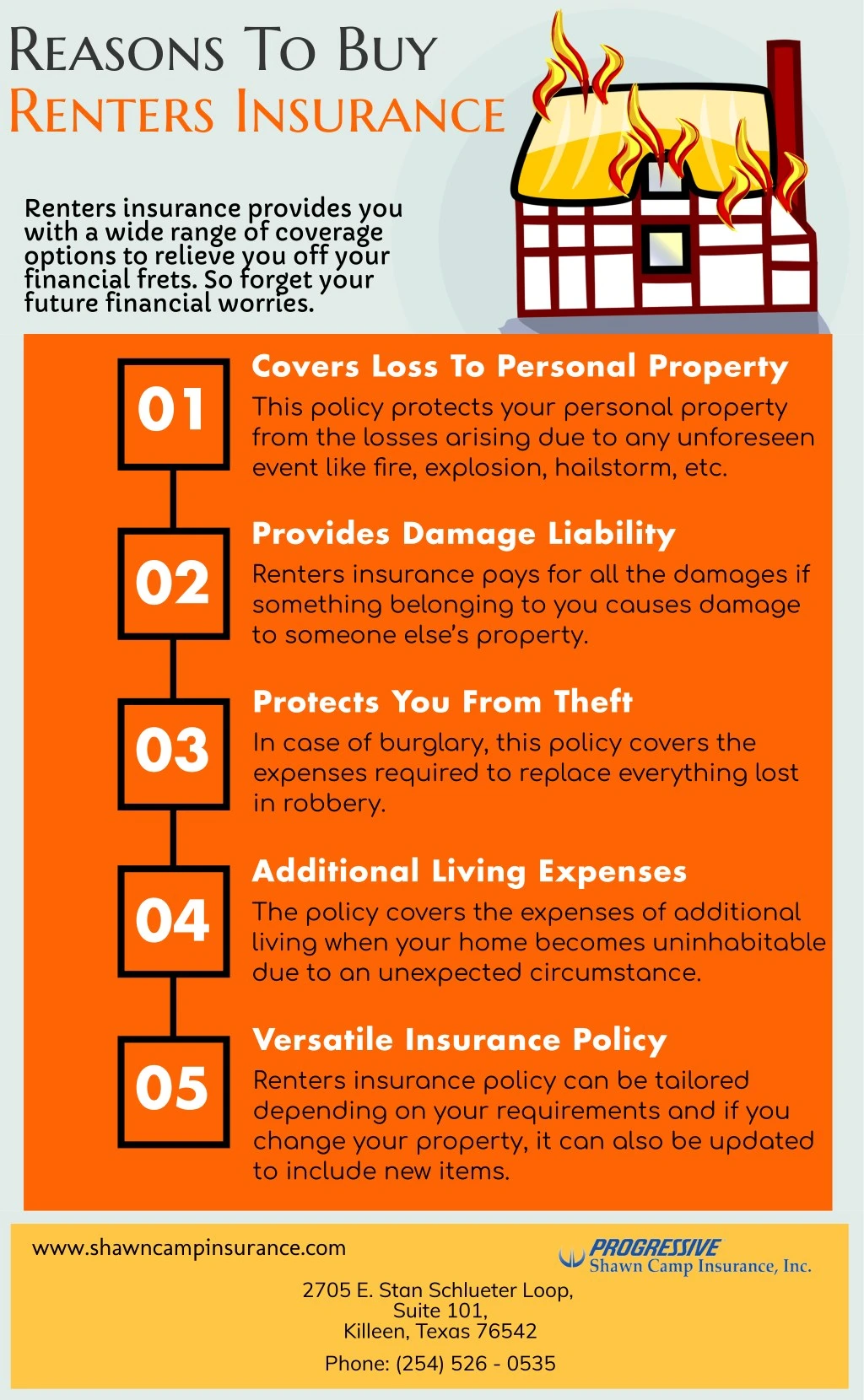

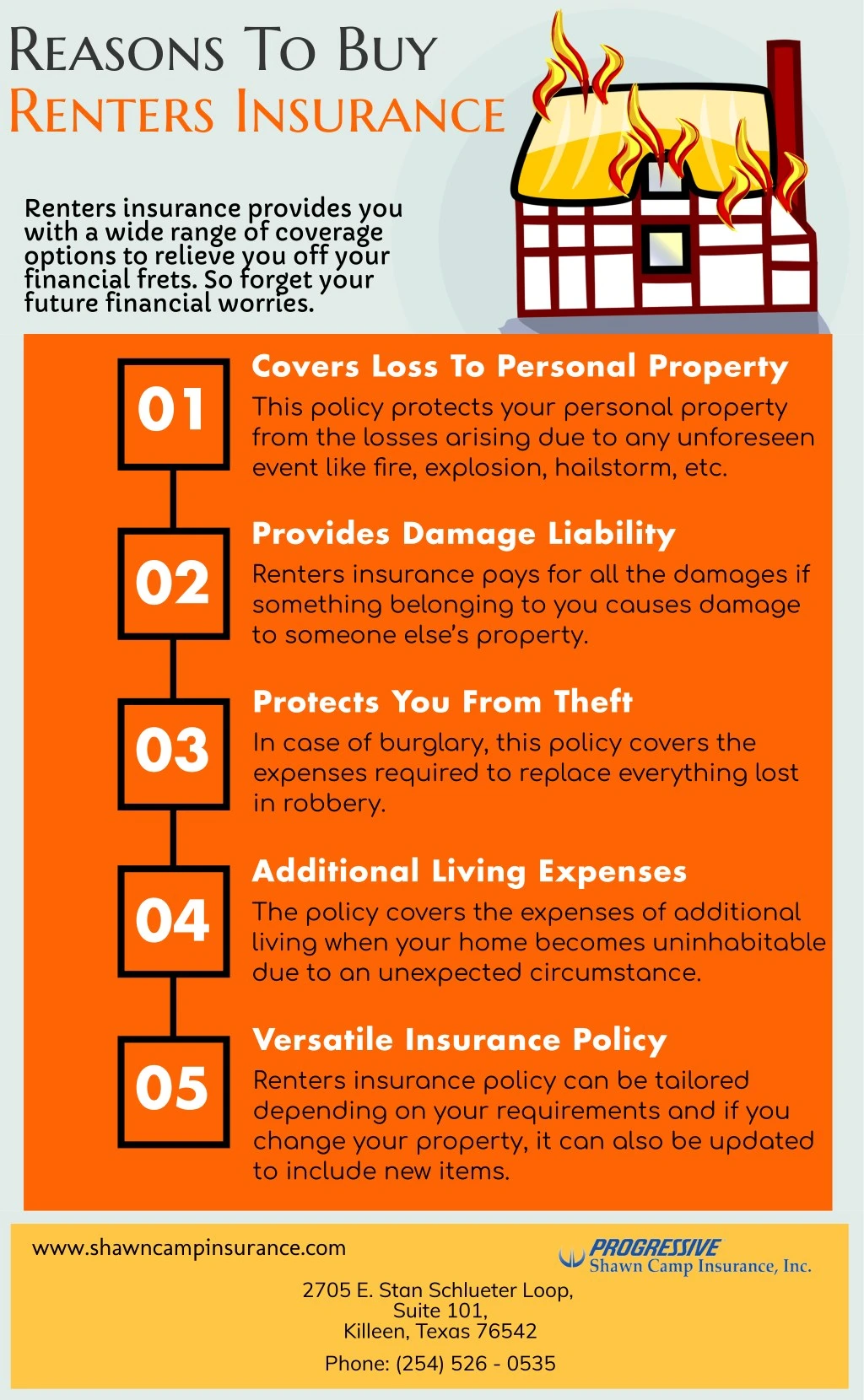

Renters Insurance Additional Insured. Additional insured in renters insurance some landlords may often require you to add them to your renter’s insurance policy as additional interest. If the tenenat is at fault, you would want to try and have the claim be covered by the renters policy. If someone dies on your rented property, whether you pay $25 or $20 a month on your next rental insurance policy is going to be the last of your worries. People often add their roommates or significant others to their policies as additional insured parties so that they can share a single policy.

Renters Insurance Definition Loss Of Use Coverage In From eskimales.blogspot.com

Renters Insurance Definition Loss Of Use Coverage In From eskimales.blogspot.com

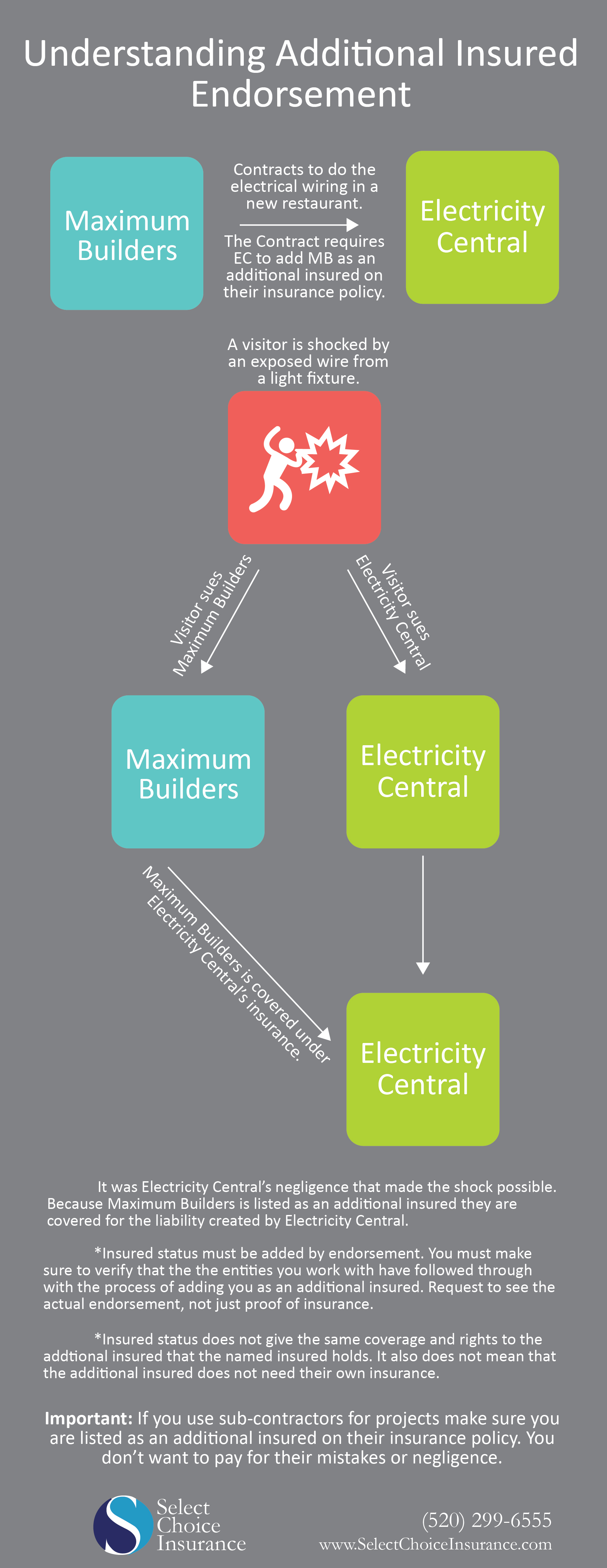

“ typically an endorsement to the policy is added to cover additional insureds. An “additional insured” is a person or entity other than the named insured who is protected under the terms of the insurance policy sometimes referred to as the “loss payee. Additional insured in renters insurance some landlords may often require you to add them to your renter’s insurance policy as additional interest. The policy insures everyone in the household and covers personal belongings in the property. If you operate your business from a space that you rent from a landlord, then there are many important considerations to take into account. Landlords will generally want to be added as an additional insured on your policy so that any claims that arise out of your operations and/or general use of your premises, especially liability claims, will be covered under your policy first.

What is an interested party on a renters insurance policy?

The policy insures everyone in the household and covers personal belongings in the property. When you buy a home, condo, or renters insurance, you will often need to list any additional insured or additional interest on the policy. An additional insured is a person that enjoys the benefits of being insured under an insurance policy, in addition to whoever originally purchased the insurance policy. To give your landlord additional insured status, you only need the landlord or company name and email. Covering a landlord under a tenant�s liability policy usually requires an endorsement. Tenants may want to add a spouse or roommate to their policy to get everyone in their unit covered under the same policy and reduce the premium cost per person.

Source: youtube.com

Source: youtube.com

Covering your landlord as an additional insured. What is an interested party on a renters insurance policy? Covering your landlord as an additional insured. When a landlord is listed as an additional insured on the tenants renters insurance policy, the landlord then has the right to file claim directly with the insurance carrier. By adding the additional insured, that party now receives the same coverage as the owner of the insurance policy.

Source: emmasdt.blogspot.com

Source: emmasdt.blogspot.com

Covering a landlord under a tenant�s liability policy usually requires an endorsement. In the event of a lawsuit, many parties can be named as defendants, including the landlord. Landlords have to insure their own property and my renter’s insurance is a landlord or a property management firm added as an “additional interest.”. Generally, the renters insurance lease clause will require a tenant to have a renters insurance policy. To give your landlord additional insured status, you only need the landlord or company name and email.

Source: eskimales.blogspot.com

Source: eskimales.blogspot.com

In this case, you have rights to files claims under the policy. Landlords feel this protection is like “a belt and suspenders.”. Generally, the renters insurance lease clause will require a tenant to have a renters insurance policy. Additional insured is anyone who isn’t initially covered by your policy, but who you’ve selected to add, and has a valid interest in your property. Additional insureds are always notified if the policy lapses, cancels or expires;

Source: wnins.com

Source: wnins.com

Know the difference between additional interest vs. When a landlord is listed as an additional insured on the tenants renters insurance policy, the landlord then has the right to file claim directly with the insurance carrier. Like contractual indemnity clauses, additional insured endorsements can serve to protect the recipient from claims made against the recipient. Know the difference between additional interest vs. When you buy a home, condo, or renters insurance, you will often need to list any additional insured or additional interest on the policy.

Source: emmasdt.blogspot.com

Source: emmasdt.blogspot.com

Landlords feel this protection is like “a belt and suspenders.”. For instance, you may find that your lease requires you to cover your landlord as an additional insured on your general liability policy. Renters insurance additional interest vs additional insured. Know the difference between additional interest vs. In the event of a lawsuit, many parties can be named as defendants, including the landlord.

Source: youtube.com

Source: youtube.com

Like contractual indemnity clauses, additional insured endorsements can serve to protect the recipient from claims made against the recipient. Setting up renters insurance additional interest or named insured is easy on your goodcover dashboard. When a landlord is listed as an additional insured on the tenants renters insurance policy, the landlord then has the right to file claim directly with the insurance carrier. In the event of a lawsuit, many parties can be named as defendants, including the landlord. If you operate your business from a space that you rent from a landlord, then there are many important considerations to take into account.

Source: emmasdt.blogspot.com

Source: emmasdt.blogspot.com

Named insured is insurance lingo for people who are covered under your home or renters insurance policy (you, your spouse, your immediate family members living with you, etc.). The policy insures everyone in the household and covers personal belongings in the property. When you buy a home, condo, or renters insurance, you will often need to list any additional insured or additional interest on the policy. Landlords have to insure their own property and my renter’s insurance is a landlord or a property management firm added as an “additional interest.”. Know the difference between additional interest vs.

Source: coverager.com

Source: coverager.com

If you operate your business from a space that you rent from a landlord, then there are many important considerations to take into account. Setting up renters insurance additional interest or named insured is easy on your goodcover dashboard. Named insured is insurance lingo for people who are covered under your home or renters insurance policy (you, your spouse, your immediate family members living with you, etc.). Best example would be a slip and fall. Covering your landlord as an additional insured.

Source: hpminsurance.com

If you purchase a renters insurance policy you may list one named insured and one additional insured. Additional insured is anyone who isn’t initially covered by your policy, but who you’ve selected to add, and has a valid interest in your property. Renters insurance additional interest vs additional insured. What is an interested party on a renters insurance policy? If you add someone to your policy as an additional insured, it means they are protected by your policy�s liability coverage.

Source: selectchoiceinsurance.com

Source: selectchoiceinsurance.com

Covering a landlord under a tenant�s liability policy usually requires an endorsement. This allows the landlord to verify that you are carrying renters insurance coverage as required in your lease. Misuse of additional insured whether it’s homeowners or renters insurance, additional insured should be used very carefully. Landlords feel this protection is like “a belt and suspenders.”. In the scheme of requested landlord concessions, this is nothing.

Source: howmuch.net

Source: howmuch.net

By adding the additional insured, that party now receives the same coverage as the owner of the insurance policy. To give your landlord additional insured status, you only need the landlord or company name and email. Renter�s insurance costs peanuts unless you have a history of arson; Additional insureds on renters insurance. If someone dies on your rented property, whether you pay $25 or $20 a month on your next rental insurance policy is going to be the last of your worries.

Source: allstate.com

Source: allstate.com

Best example would be a slip and fall. If you are not listed as an additional insured, you need to have the tenant file the claim or bring a lawsuit to trigger the insurance policy. Additional insured is anyone who isn’t initially covered by your policy, but who you’ve selected to add, and has a valid interest in your property. An additional insured endorsement is an amendment to one party�s insurance policy which adds another party (also called the “additional insured”) as an insured under the policy. Generally, the renters insurance lease clause will require a tenant to have a renters insurance policy.

Source: growfinancial.org

Source: growfinancial.org

In this case, you have rights to files claims under the policy. What is an interested party on a renters insurance policy? Setting up renters insurance additional interest or named insured is easy on your goodcover dashboard. An additional insured is a third party added to the insurance policy of another entity known as the named insured. If you are not listed as an additional insured, you need to have the tenant file the claim or bring a lawsuit to trigger the insurance policy.

Source: revisi.net

Source: revisi.net

Renters insurance additional interest vs additional insured. An additional insured (also known as an additional insured party or secondary insured) is someone who’s added to a renters insurance policy by the policyholder. Covering your landlord as an additional insured. Tenants may want to add a spouse or roommate to their policy to get everyone in their unit covered under the same policy and reduce the premium cost per person. Additional interest has nothing to do with who is an insured, it just means that the additional interest (your leasing office) would be.

Source: mid-southins.com

Source: mid-southins.com

Named insured is insurance lingo for people who are covered under your home or renters insurance policy (you, your spouse, your immediate family members living with you, etc.). Covering a landlord under a tenant�s liability policy usually requires an endorsement. An additional insured is a third party added to the insurance policy of another entity known as the named insured. Renter�s insurance costs peanuts unless you have a history of arson; The policy insures everyone in the household and covers personal belongings in the property.

Source: emmasdt.blogspot.com

Source: emmasdt.blogspot.com

The additional insured language adds you to the renters policy. So while the tenant may purchase the renters policy, the owner or the corresponding organization has just as many rights to that coverage as the tenant does. An additional insured is a third party added to the insurance policy of another entity known as the named insured. When a landlord is listed as an additional insured on the tenants renters insurance policy, the landlord then has the right to file claim directly with the insurance carrier. It also provides coverage for a given amount of liability, and lists the landlord or their agent as additional interest or insured so that they’ll be notified if the policy lapses, cancels, or.

Source: chooseinsuranceonlinecom.com

Source: chooseinsuranceonlinecom.com

Named insured is insurance lingo for people who are covered under your home or renters insurance policy (you, your spouse, your immediate family members living with you, etc.). This allows the landlord to verify that you are carrying renters insurance coverage as required in your lease. When a landlord is listed as an additional insured on the tenants renters insurance policy, the landlord then has the right to file claim directly with the insurance carrier. You might commonly add your spouse or your roommate as an additional insured so that you�re all protected under the same policy. Additional insureds are always notified if the policy lapses, cancels or expires;

The additional insured language adds you to the renters policy. Residents can choose to add additional insured people to their renters insurance policy during the checkout flow in the resident center. So while the tenant may purchase the renters policy, the owner or the corresponding organization has just as many rights to that coverage as the tenant does. If someone dies on your rented property, whether you pay $25 or $20 a month on your next rental insurance policy is going to be the last of your worries. What is an interested party on a renters insurance policy?

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title renters insurance additional insured by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information