Renters insurance deductible Idea

Home » Trending » Renters insurance deductible IdeaYour Renters insurance deductible images are ready. Renters insurance deductible are a topic that is being searched for and liked by netizens today. You can Get the Renters insurance deductible files here. Download all royalty-free vectors.

If you’re looking for renters insurance deductible images information related to the renters insurance deductible interest, you have visit the right blog. Our website always provides you with hints for seeking the maximum quality video and image content, please kindly surf and find more enlightening video articles and graphics that fit your interests.

Renters Insurance Deductible. A renters insurance deductible is the amount that your renters insurance provider subtracts from your claim payout before you receive the remaining amount owed to you. Renters insurance is generally not tax deductible. A renters insurance deductible is the portion you pay on a claim. Once you meet your deductible requirements, your renters insurance policy will take over and cover any additional costs up.

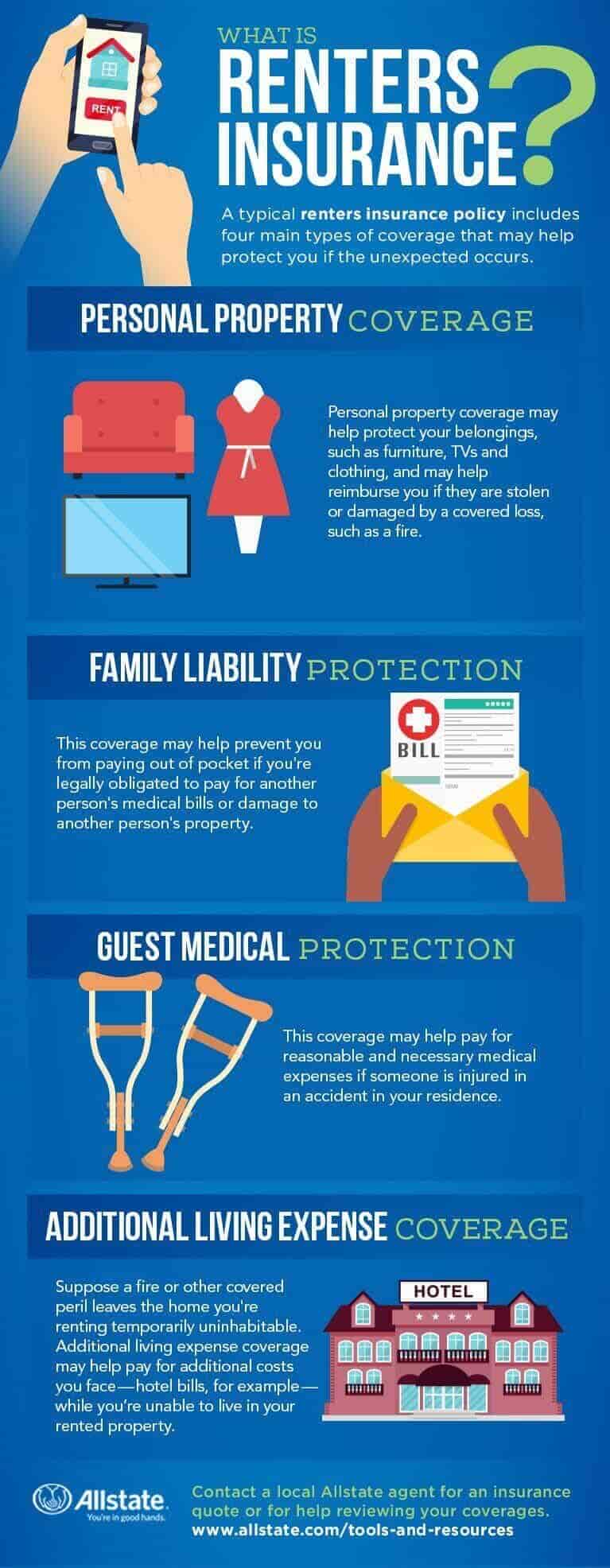

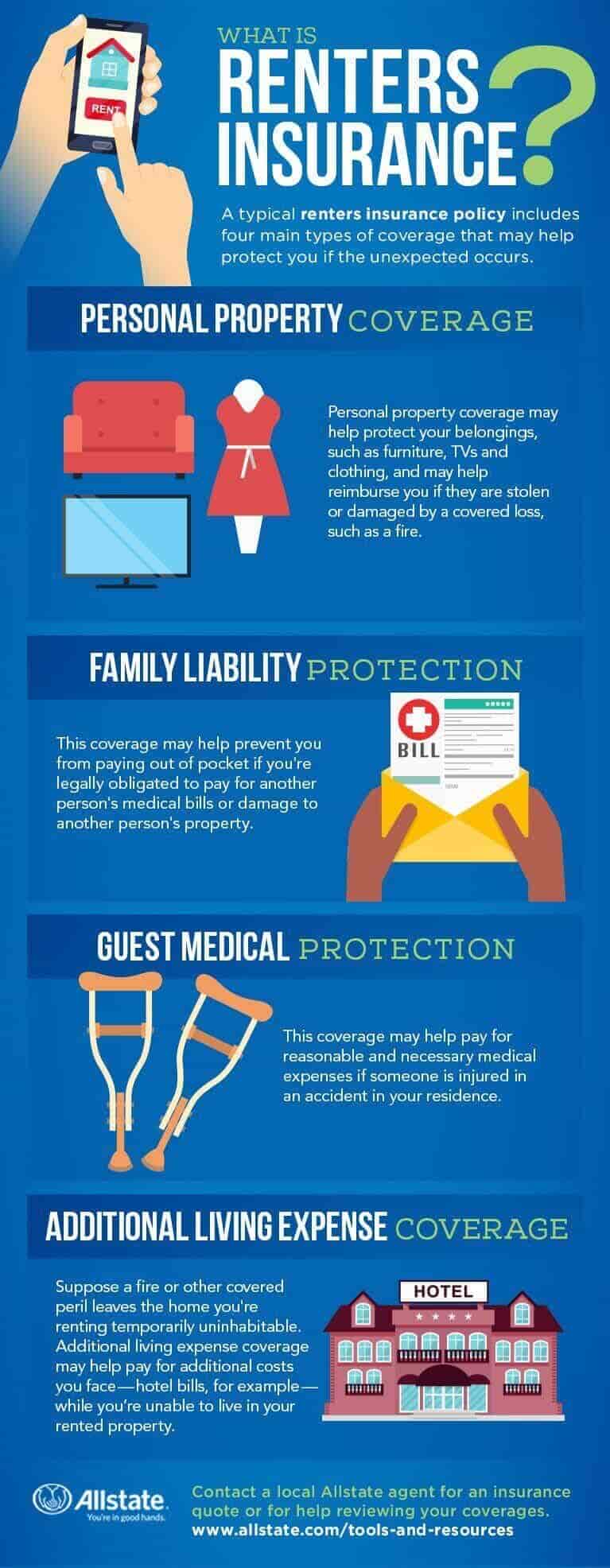

What Is Renters Insurance and What Does It Cover? Allstate From allstate.com

What Is Renters Insurance and What Does It Cover? Allstate From allstate.com

Your deductible may vary for standard renters insurance versus flood and earthquake insurance. The standard renters insurance deductible is $500 to $1,000. The amount of your deductible is your choice, though most insurance agencies offer between $500 and $2,000. Once you meet your deductible requirements, your renters insurance policy will take over and cover any additional costs up. Your renters insurance deductible is the amount of money that you pay when you file a personal property claim with your insurer to get them to reimburse you for a damaged or lost item. Your homeowners or renters insurance deductible is what you pay out of your own pocket for a loss or repair that�s covered by your policy.

Most renters insurance coverages include a deductible, and all coverages are subject to limits.

For example, state farm offers renters insurance deductibles up to $2,000, while lemonade insurance co. Most consumers don’t even know that it is the most affordable insurance coverage available. The irs requires that this area is your principal place of business, whether it�s a small room that serves as an office or an alcove with your desk,. When renters insurance deductibles apply. See insider’s guide to the best renters insurance companies. Once you meet your deductible requirements, your renters insurance policy will take over and cover any additional costs up.

Source: norm-shealy.blogspot.com

Source: norm-shealy.blogspot.com

Suppose you have a $1,000 deductible and the cost of covered damages comes to $3,000. When you file a claim, you are responsible for covering a set dollar amount towards the loss. After you pay the deductible, your renters insurance. Depending on the insurer, your deductible will either be a fixed dollar amount or a percentage of your coverage limit. A renters insurance deductible is the portion you pay on a claim.

Source: aiicfl.com

Source: aiicfl.com

After you pay the deductible, your renters insurance. It’s deducted from your payout. You may solely declare a deduction for those who use the house solely and commonly for enterprise functions. Most renters insurance coverages include a deductible, and all coverages are subject to limits. Let’s look at an example.

Source: einsurance.com

Source: einsurance.com

Renters insurance is the most understated and least utilized insurance coverage available in the marketplace. If you have a home office and your renters insurance covers it, you may be able to write off your renters insurance premiums as a business expense. The standard renters insurance deductible is $ 500 to $ 1,000. Your provider will present you with a range of options. When you file a renters insurance claim you may be responsible for paying your deductible, which is your share of a covered claim.

Source: gallfurniturevirh.blogspot.com

Source: gallfurniturevirh.blogspot.com

For most people, renters insurance isn’t tax deductible. The standard renters insurance deductible is $ 500 to $ 1,000. Generally, renters insurance isn’t tax deductible. It�s important to know what those terms mean and how they come into play if you need to file a claim. Say you have a $100 deductible on your policy and a fire damages $300 worth of stuff.

Source: kminsuranceservices.com

Source: kminsuranceservices.com

For renters insurance, common deductible amounts are $500 or $1,000, but $250 or lower deductibles are also possible from some insurers, as are deductibles up to $2,500. Renters insurance is the most understated and least utilized insurance coverage available in the marketplace. For renters insurance, common deductible amounts are $500 or $1,000, but $250 or lower deductibles are also possible from some insurers, as are (3). Most consumers don’t even know that it is the most affordable insurance coverage available. For renters insurance, common deductible amounts are $500 or $1,000, but $250 or lower deductibles are also possible from some insurers, as are deductibles up to $2,500.

Source: norm-shealy.blogspot.com

Source: norm-shealy.blogspot.com

Generally speaking, the higher your deductible, the lower you will likely pay for your premiums. Renters insurance is generally not tax deductible. Renters insurance is the most understated and least utilized insurance coverage available in the marketplace. Is renters insurance tax deductible? Typically, renters insurance deductibles will be $500 or $1,000, but insurers will often provide a range of options.

Source: linkworthydesigns.blogspot.com

Most renters insurance coverages include a deductible, and all coverages are subject to limits. For example, state farm offers renters insurance deductibles up to $2,000, while lemonade insurance co. It’s deducted from your payout. Let’s look at an example. The average renters insurance deductible ranges from $500 to $2,000, but some insurance companies will go as low as $100 or even $0 deductibles for renters.

Source: pinterest.com

Source: pinterest.com

Is renters insurance tax deductible? Your deductible may vary for standard. Renters insurance is the most understated and least utilized insurance coverage available in the marketplace. If you have a home office and your renters insurance covers it, you may be able to write off your renters insurance premiums as a business expense. After you pay the deductible, your renters insurance.

Source: linkworthydesigns.blogspot.com

Source: linkworthydesigns.blogspot.com

The exception is if you work from home in a room specifically designated for business endeavors — in other words, if you have a home office. The amount of your deductible is your choice, though most insurance agencies offer between $500 and $2,000. For example, state farm offers renters insurance deductibles up to $2,000, while lemonade insurance co. After you pay the deductible, your renters insurance. It’s important to know what those terms mean and how they (2).

Source: norm-shealy.blogspot.com

Source: norm-shealy.blogspot.com

Here’s a quick example that explains when, why, and how a deductible works. Cryptocurrency price today in usd; Typically, renters insurance deductibles will be $500 or $1,000, but insurers will often provide a range of options. The standard renters insurance deductible is $ 500 to $ 1,000. Say you have a $100 deductible on your policy and a fire damages $300 worth of stuff.

Source: pinterest.com

Source: pinterest.com

A deductible for renters insurance is the amount you’ll need to pay to repair or replace damaged items before the insurance company kicks in. For renters on a tight budget, it would be hard to understand why the savings an approximate $10 monthly premium could cause such turmoil; After you pay the deductible, your renters insurance. It�s important to know what those terms mean and how they come into play if you need to file a claim. Most consumers don’t even know that it is the most affordable insurance coverage available.

Source: allstate.com

Source: allstate.com

Generally, renters insurance isn’t tax deductible. A renters insurance deductible is the portion you pay on a claim. The average renters insurance deductible ranges from $500 to $2,000, but some insurance companies will go as low as $100 or even $0 deductibles for renters. A renters insurance deductible is the portion you pay on a claim. Is renters insurance tax deductible?

Source: moneybeagle.com

Source: moneybeagle.com

Is renters insurance tax deductible? Your provider will present you with a range of options. Cryptocurrency price today in usd; Let’s say you have a renters insurance policy with a. Your deductible may vary for standard renters insurance versus flood and earthquake insurance.

Source: norm-shealy.blogspot.com

Source: norm-shealy.blogspot.com

Your homeowners or renters insurance deductible is what you pay out of your own pocket for a loss or repair that�s covered by your policy. After you pay the deductible, your renters insurance. For renters on a tight budget, it would be hard to understand why the savings an approximate $10 monthly premium could cause such turmoil; The irs requires that this area is your principal place of business, whether it�s a small room that serves as an office or an alcove with your desk,. A renters insurance deductible is the portion you pay on a claim.

Source: einsurance.com

Source: einsurance.com

Most renters insurance coverages include a deductible, and all coverages are subject to limits. This usually depends on the company and how they calculate deductibles. For renters on a tight budget, it would be hard to understand why the savings an approximate $10 monthly premium could cause such turmoil; For renters insurance, common deductible amounts are $500 or $1,000, but $250 or lower deductibles are also possible from some insurers, as are (3). Typically, renters insurance deductibles will be $500 or $1,000, but insurers will often provide a range of options.

Source: servicemasternw.com

Source: servicemasternw.com

Your insurance company would subtract your deductible of $1,000 from the total cost of the covered damages and pay out $2,000. If you have a home office and your renters insurance covers it, you may be able to write off your renters insurance premiums as a business expense. A renters insurance deductible is the amount of risk that you retain and do not transfer to the insurance company you’ve purchased the policy from. Generally, renters insurance isn’t tax deductible. Cryptocurrency price today in usd;

Source: goodtogoinsurance.org

Source: goodtogoinsurance.org

A deductible for renters insurance is the amount you’ll need to pay to repair or replace damaged items before the insurance company kicks in. Typically, renters insurance deductibles will be $500 or $1,000, but insurers will often provide a range of options. Your provider will present you with a range of options. It�s deducted from your payout. After you pay the deductible, your renters insurance.

Source: weeksinsurance.com

Source: weeksinsurance.com

Most renters insurance coverages include a deductible, and all coverages are subject to limits. The standard renters insurance deductible is $ 500 to $ 1,000. The average renters insurance deductible ranges from $500 to $2,000, but some insurance companies will go as low as $100 or even $0 deductibles for renters. A deductible for renters insurance is the amount you’ll need to pay to repair or replace damaged items before the insurance company kicks in. Let’s look at an example.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title renters insurance deductible by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information