Renters insurance fire information

Home » Trending » Renters insurance fire informationYour Renters insurance fire images are available in this site. Renters insurance fire are a topic that is being searched for and liked by netizens now. You can Get the Renters insurance fire files here. Get all free vectors.

If you’re looking for renters insurance fire images information linked to the renters insurance fire topic, you have pay a visit to the right site. Our website frequently provides you with hints for downloading the maximum quality video and picture content, please kindly surf and find more enlightening video articles and images that match your interests.

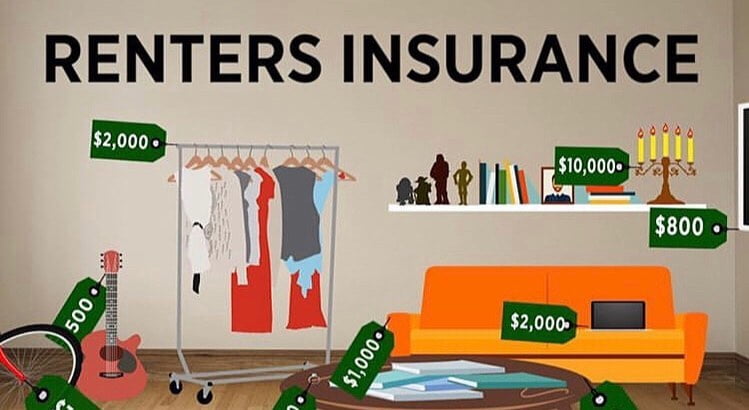

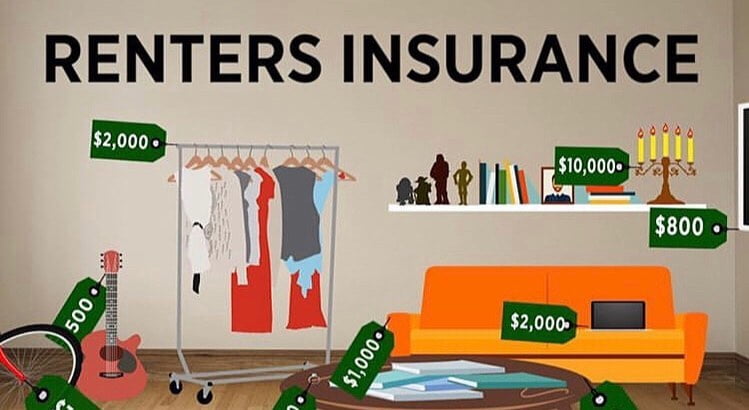

Renters Insurance Fire. For example, while the renters� insurance will pay you for the appliances lost in the fire, it will not pay for the damage to the apartment�s walls and roof. Some people reference this type of insurance as tenant insurance. Your renters insurance protects you from liability when the fire causes property damage or bodily injury to someone else (a third party). Yes, renters insurance covers fire from many different angles.

Should I Get Renters Insurance For Fire & Theft Cover From healthnewsreporting.com

Should I Get Renters Insurance For Fire & Theft Cover From healthnewsreporting.com

The best way to find out more is to ask the insurance provider recommended by your neighbors, effective coverage. Valuables like jewelry and antiques may require additional coverage beyond the standard renter’s insurance. This confusion can leave landlords wondering if landlord insurance will provide enough coverage in the event of a fire and if you need an additional. Renters insurance helps protect you and your belongings if the unexpected happens. Yes, renters insurance covers fire from many different angles. You should be able to obtain the full cost of property lost in a fire rather than the depreciated cash value.

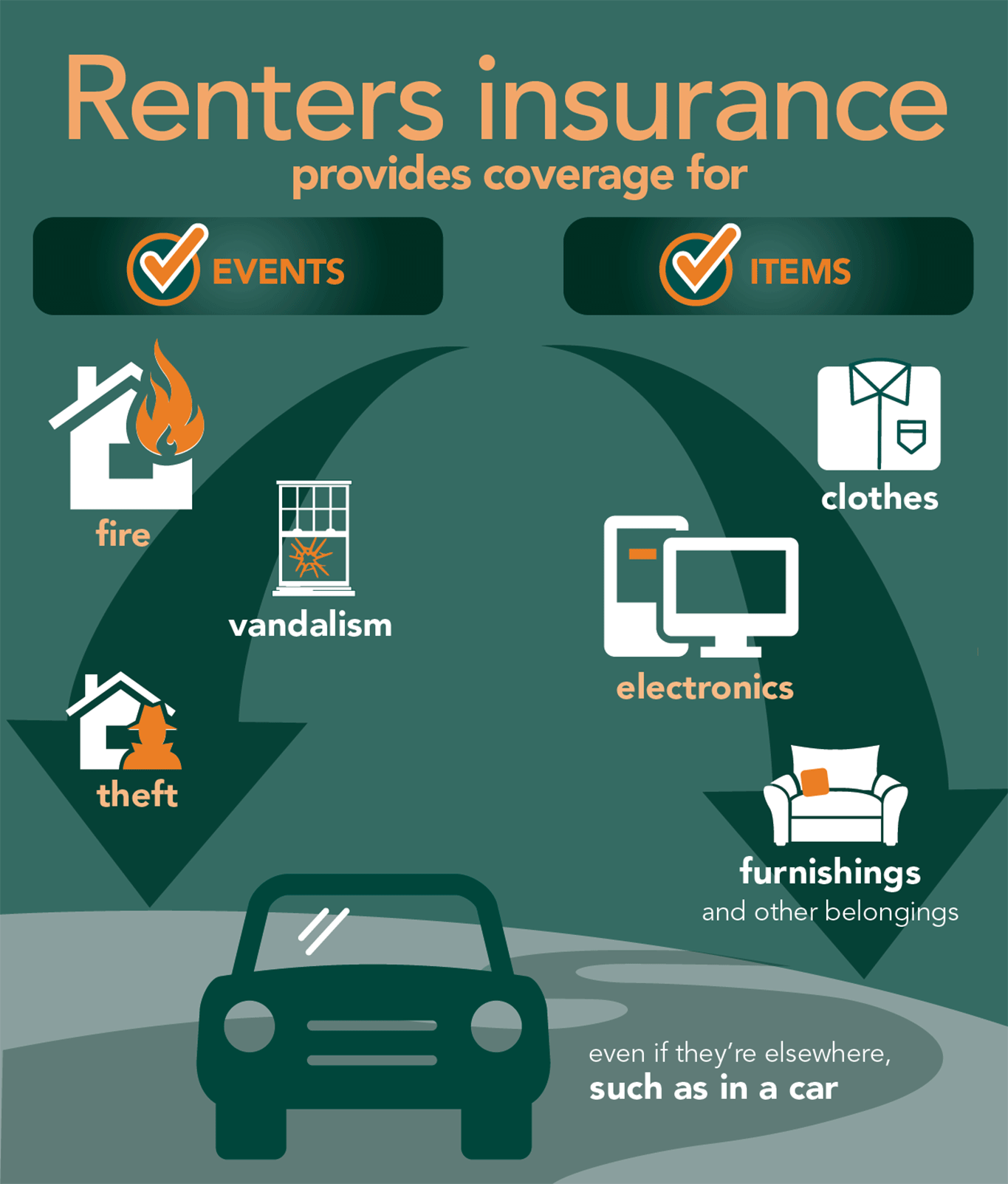

Renters insurance is designed to cover your personal belongings from loss or damage due to fire, lightning, smoke, theft, vandalism and more.

However, there are some exceptions. The best way to find out more is to ask the insurance provider recommended by your neighbors, effective coverage. Renters insurance covers your personal property, but not the actual rental dwelling. If a fire breaks out in your apartment, your personal belongings should be covered. We want to help you make sure you�re fully covered no matter what. The amount of the average renters insurance policy typically includes $20,000 or $30,000 worth of coverage.

Source: kijijiblog.ca

Source: kijijiblog.ca

The best way to find out more is to ask the insurance provider recommended by your neighbors, effective coverage. Renters insurance helps protect you and your belongings if the unexpected happens. Get a renters insurance quote today and we�ll show you how to easily and affordably protect what you care about. If so, you may need to add an additional clause to your policy. The amount of the average renters insurance policy typically includes $20,000 or $30,000 worth of coverage.

Source: ecoflatsseattle.com

Source: ecoflatsseattle.com

Will renters insurance cover fire damage. Fire damage to the contents in a rental property is a covered peril under most renters insurance policies. We just had a kitchen fire, which caused the house to smell like smoke, so i have to stay in a hotel for a few days. Should a fire start in your rental home, any damage to your belongings caused by the fire or the subsequent smoke will be claimable under renters insurance. If you rent an apartment, condo, house, etc., you need renters insurance.

Source: nrmafla.com

Source: nrmafla.com

For example, if a fire destroys your furniture and clothes, you would be covered. Almost all renters insurance policies include fire as a named peril so you should receive coverage to replace your clothing. The amount of the average renters insurance policy typically includes $20,000 or $30,000 worth of coverage. Renters insurance helps protect you and your belongings if the unexpected happens. If a fire breaks out in your apartment, your personal belongings should be covered.

Source: teambeck.com

Source: teambeck.com

The current cash value will likely not be. Some instances of fire damage that should be covered include. Your renters insurance protects you from liability when the fire causes property damage or bodily injury to someone else (a third party). As long as you didn’t deliberately start it, renters insurance covers fire and smoke damage to your personal property. The best way to find out more is to ask the insurance provider recommended by your neighbors, effective coverage.

Source: iastl.com

Source: iastl.com

For example, while the renters� insurance will pay you for the appliances lost in the fire, it will not pay for the damage to the apartment�s walls and roof. The current cash value will likely not be. If so, you may need to add an additional clause to your policy. Will renters insurance cover fire damage. If you rent an apartment, condo, house, etc., you need renters insurance.

Source: elisorte.blogspot.com

Source: elisorte.blogspot.com

This confusion can leave landlords wondering if landlord insurance will provide enough coverage in the event of a fire and if you need an additional. Renters� insurance, often called tenants� insurance, is an insurance policy that provides some of the benefits of homeowners� insurance, but does not include coverage for the dwelling, or structure, with the exception of small alterations that a tenant makes to the structure.it provides liability insurance and the tenant�s personal property is covered against named perils such as. You should be able to obtain the full cost of property lost in a fire rather than the depreciated cash value. Yes, renters insurance covers fire. The current cash value will likely not be.

Source: everquote.com

Source: everquote.com

The amount of the average renters insurance policy typically includes $20,000 or $30,000 worth of coverage. Does renters insurance cover fire or smoke damage? Almost all renters insurance policies include fire as a named peril so you should receive coverage to replace your clothing. Some people reference this type of insurance as tenant insurance. Some instances of fire damage that should be covered include.

Source: servicemasternw.com

Source: servicemasternw.com

A clause in an insurance policy that says that the insurance company will not require the policyholder to provide a written list of the property that was not damaged. Liability coverage will cater for the individual’s medical expenses if the fire accidentally causes bodily injury or damages their property, as long as the fire is a proven accident. For example, if a fire destroys your furniture and clothes, you would be covered. Be sure to check any policy you are considering to make sure this is the case. If so, you may need to add an additional clause to your policy.

Source: healthnewsreporting.com

Source: healthnewsreporting.com

If so, you may need to add an additional clause to your policy. This includes damage or loss of personal property caused by a fire or smoke. The fire could be the result of a cooking incident, electrical appliance, etc., so long as you did not purposely start it, you�re protected. If a fire breaks out in your apartment, your personal belongings should be covered. A clause in an insurance policy that says that the insurance company will not require the policyholder to provide a written list of the property that was not damaged.

Source: pinterest.com

Source: pinterest.com

For example, while the renters� insurance will pay you for the appliances lost in the fire, it will not pay for the damage to the apartment�s walls and roof. Renters insurance helps protect you and your belongings if the unexpected happens. Yes, renters insurance usually covers personal property that is lost or damaged by a covered peril like fire, smoke, and theft. You should be able to obtain the full cost of property lost in a fire rather than the depreciated cash value. A landlord�s insurance policy covers the building, but not your personal things.

Source: youtube.com

Source: youtube.com

In the event of theft, vandalism, a flood, fire or other type of damage where your personal belongings inside the dwelling you are renting are severely damaged or destroyed, a renter’s insurance policy will reimburse you for the replacement value. The good news is that renters insurance covers fire damage in your apartment. Harper, who has denver, co renters insurance, writes in with a question that stems from her limited knowledge of how renters insurance in denver, co works.she asks, can i get renters insurance after a fire to cover the loss? Fire damage to the contents in a rental property is a covered peril under most renters insurance policies. Liability coverage will cater for the individual’s medical expenses if the fire accidentally causes bodily injury or damages their property, as long as the fire is a proven accident.

Source: barrettpm.com

Source: barrettpm.com

You should be able to obtain the full cost of property lost in a fire rather than the depreciated cash value. Liability coverage will cater for the individual’s medical expenses if the fire accidentally causes bodily injury or damages their property, as long as the fire is a proven accident. Should a fire start in your rental home, any damage to your belongings caused by the fire or the subsequent smoke will be claimable under renters insurance. Your renters insurance should cover damage to your personal property if it was caused by a fire. With a focus on the insurance needs of renters, effective coverage can help you get the coverage you need at the price you deserve.

Source: iselect.com.au

Source: iselect.com.au

Fire damage is generally part of a standard renters insurance policy. Renters� insurance, often called tenants� insurance, is an insurance policy that provides some of the benefits of homeowners� insurance, but does not include coverage for the dwelling, or structure, with the exception of small alterations that a tenant makes to the structure.it provides liability insurance and the tenant�s personal property is covered against named perils such as. Most cases of smoke damage are also covered. Fire damage to the contents in a rental property is a covered peril under most renters insurance policies. If you rent an apartment, condo, house, etc., you need renters insurance.

Source: effectivecoverage.com

Source: effectivecoverage.com

However, there are some exceptions. Many instances of fire damage are covered, and you should be protected whether the fire originated from your place or from somewhere else. Does renters insurance cover fire or smoke damage? Does renters insurance cover fire? February 22, 2021 get a renters insurance quote.

Source: everquote.com

Source: everquote.com

Renters� insurance, often called tenants� insurance, is an insurance policy that provides some of the benefits of homeowners� insurance, but does not include coverage for the dwelling, or structure, with the exception of small alterations that a tenant makes to the structure.it provides liability insurance and the tenant�s personal property is covered against named perils such as. The amount of the average renters insurance policy typically includes $20,000 or $30,000 worth of coverage. However, there are some exceptions. You should be able to obtain the full cost of property lost in a fire rather than the depreciated cash value. While most insurance policies designed to protect any dwelling cover accidental fire damage, there is a fine line between the landlord’s coverage and the tenant’s coverag e in a rental home.

Source: elisorte.blogspot.com

Source: elisorte.blogspot.com

With a focus on the insurance needs of renters, effective coverage can help you get the coverage you need at the price you deserve. If a fire breaks out in your apartment, your personal belongings should be covered. Contents coverage of $10,000 to $30,000. If your home becomes uninhabitable as a result of the fire, renters insurance can even pay for the cost of a hotel or other living arrangement until repairs are finished. Yes, renters insurance covers fire.

Source: youtube.com

Source: youtube.com

Renters insurance covers your personal property, but not the actual rental dwelling. Renters insurance fire coverage limits. Yes, renters insurance covers fire. Renters insurance helps protect you and your belongings if the unexpected happens. Does renters insurance cover fire?

Source: nachi.org

Source: nachi.org

Read on for more info on how renters insurance can help you in the case of a fire. Get a renters insurance quote today and we�ll show you how to easily and affordably protect what you care about. Specifics on renter’s insurance protection. This is because fire is a named peril in every home and renters insurance policy. If your home becomes uninhabitable as a result of the fire, renters insurance can even pay for the cost of a hotel or other living arrangement until repairs are finished.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title renters insurance fire by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information