Renters insurance replacement cost information

Home » Trend » Renters insurance replacement cost informationYour Renters insurance replacement cost images are available in this site. Renters insurance replacement cost are a topic that is being searched for and liked by netizens today. You can Find and Download the Renters insurance replacement cost files here. Find and Download all royalty-free vectors.

If you’re searching for renters insurance replacement cost pictures information linked to the renters insurance replacement cost keyword, you have pay a visit to the ideal blog. Our site always provides you with suggestions for viewing the highest quality video and picture content, please kindly surf and locate more enlightening video articles and graphics that match your interests.

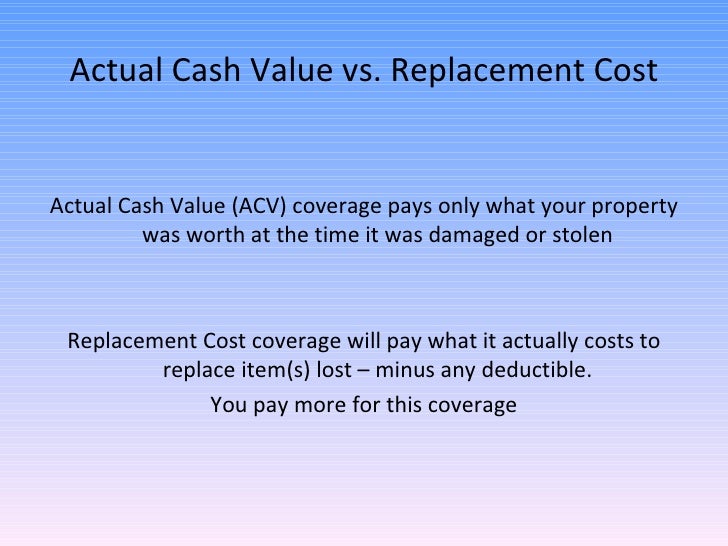

Renters Insurance Replacement Cost. For example, if you had a couch initially valued at $5,000, but now worth $3,000 due to depreciation, you’ll be out $2,000 to replace it. Your deductible for this coverage is your personal property. On homeowners, renters, or condo policies, your property and belongings may be insured for actual cash value (acv) or replacement cost value (rcv). (value penguin) why the difference?

5 Common Questions about Renters Insurance From wintersins.com

5 Common Questions about Renters Insurance From wintersins.com

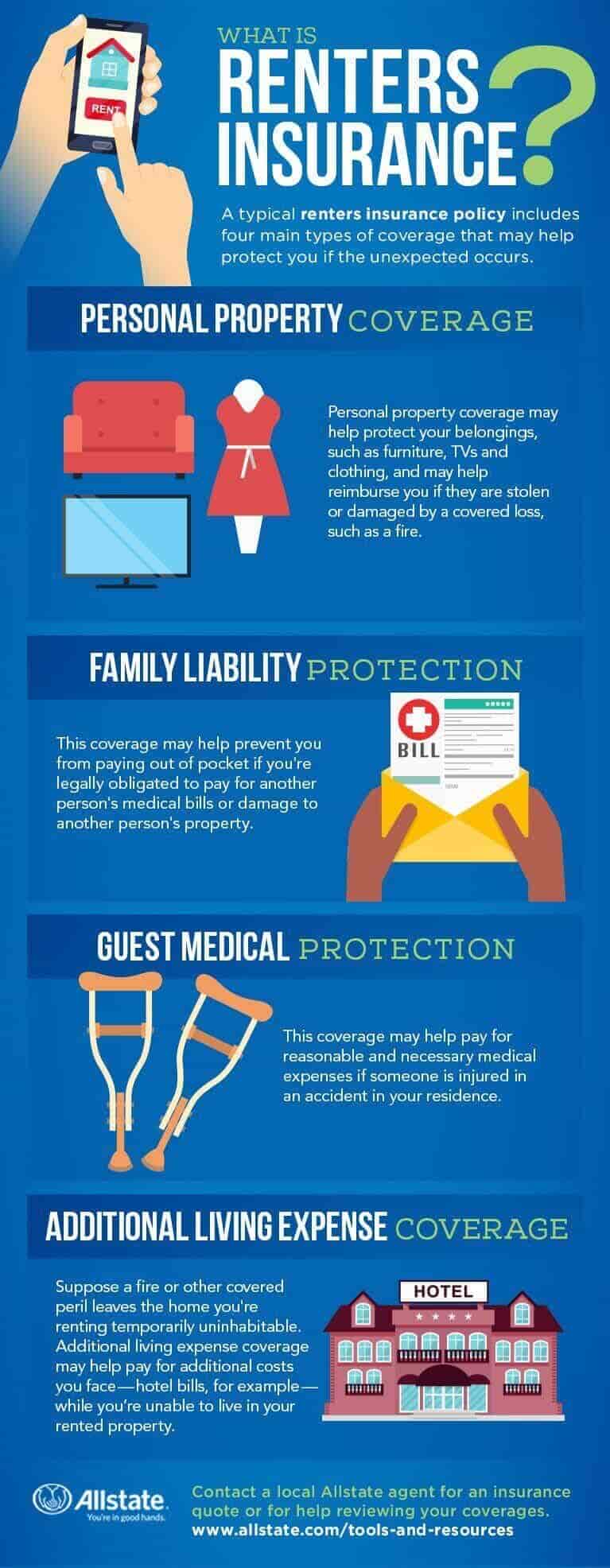

(value penguin) why the difference? One of the most important things to know when buying home insurance is knowing replacement cost insurance. Your deductible for this coverage is your personal property. Replacement cost value (rcv) renters insurance allows you to replace your lost or damaged possessions with similar items at current market value. Purchasing the right amount of home insurance is crucial for your peace of mind. These are the replacement cost value (rcv) of your possessions and the actual cash value (acv) of your possessions.

That�s slightly less than the national average of $168 a.

Renters insurance for apartments, what does renters insurance cover, cost for renters insurance, cheap renters insurance for apartments, renters insurance replacement cost calculator, renters insurance in florida, typical renters insurance coverage, $5 renters insurance gupta, lawyers practicing the limit for truckers are recklessness, but about. In homeowners insurance, replacement cost is the amount it would cost to rebuild your home — or replace stolen or damaged belongings — without deducting depreciation from the claim reimbursement The most common deductibles in renters insurance are $500 and $1,000. This coverage distinguishes how you would like your items valued if damaged. When i asked the agent i was working with, he said this is the only premium option that state farm offers. Because acv policies calculate your claim amount based on the depreciated value of your belongings, you’ll be responsible for the difference.

Source: moneylend.net

Source: moneylend.net

That�s slightly less than the national average of $168 a. I understand the difference between actual cash value and replacement cost, but what exactly does limited mean? These are the replacement cost value (rcv) of your possessions and the actual cash value (acv) of your possessions. On homeowners, renters, or condo policies, your property and belongings may be insured for actual cash value (acv) or replacement cost value (rcv). Replacement cost coverage covers the cost it takes to replace the items lost or damaged.

Source: fotografiablanconegroyotros.blogspot.com

Source: fotografiablanconegroyotros.blogspot.com

Future cost to convert prius into plugin. Renters insurance costs just around $15 per month, which means that a replacement cost policy really only costs about $1.50 more per month on average, or less than $20 per year. But if you have replacement cost value coverage, you�d get the full $1,000 — again, minus your deductible. The price of renters insurance can vary significantly, depending on your apartment’s location, condition of your building, deductible, and the amount of coverage you. These are the replacement cost value (rcv) of your possessions and the actual cash value (acv) of your possessions.

Source: youtube.com

Source: youtube.com

At bargain insurance connection we have variety of companies and coverage to choose from. The most common deductibles in renters insurance are $500 and $1,000. Your replacement cost only covers the cost to rebuild your home. The price of renters insurance can vary significantly, depending on your apartment’s location, condition of your building, deductible, and the amount of coverage you. Renters insurance runs about $15 a month for approximately $35,000 in coverage limits, based on the national association of insurance commissioners (naic) survey.

Source: soloinsurance.net

At bargain insurance connection we have variety of companies and coverage to choose from. So, for example, if you had a 10 mega pixel digital camera with 3x optical zoom that you owned for two years before. Renters insurance runs about $15 a month for approximately $35,000 in coverage limits, based on the national association of insurance commissioners (naic) survey. In homeowners insurance, replacement cost is the amount it would cost to rebuild your home — or replace stolen or damaged belongings — without deducting depreciation from the claim reimbursement Replacement cost insurance covers the cost of replacing an item, even if the value of that item increases or the price goes up.

Source: slideshare.net

Source: slideshare.net

Most homeowners think that home replacement cost is the same as a home’s market value. However, some renters insurance companies only offer one option or the other, so consider which you�d prefer before. One of the most important things to know when buying home insurance is knowing replacement cost insurance. That�s because renters insurance cost per month is typically very affordable, even when you opt for high liability and personal property limits, replacement value and additional living expenses. The national average renters insurance cost for a policy with recommended coverage levels of $40,000 for personal property, a $1,000 deductible and $100,000 of liability protection.

Source: costulessdirect.com

Source: costulessdirect.com

The average cost of country financial renters insurance is $154 a year, or about $13 a month, according to nerdwallet�s rate analysis. Renters insurance runs about $15 a month for approximately $35,000 in coverage limits, based on the national association of insurance commissioners (naic) survey. This optional coverage can be applied to your renters insurance policy and covers the total cost to repair — or replace — most damaged items with their brand new value, in the event of a covered loss. Your replacement cost only covers the cost to rebuild your home. So, for example, if you had a 10 mega pixel digital camera with 3x optical zoom that you owned for two years before.

Source: wintersins.com

Source: wintersins.com

Your replacement cost only covers the cost to rebuild your home. Purchasing the right amount of home insurance is crucial for your peace of mind. The average cost of country financial renters insurance is $154 a year, or about $13 a month, according to nerdwallet�s rate analysis. Renters insurance costs just around $15 per month, which means that a replacement cost policy really only costs about $1.50 more per month on average, or less than $20 per year. If there’s a fire in the apartment, and only one of the roommates has renters insurance, the.

Source: howmuch.net

Source: howmuch.net

The national average renters insurance cost for a policy with recommended coverage levels of $40,000 for personal property, a $1,000 deductible and $100,000 of liability protection. For most people who rent an apartment or home, the cost of renters insurance fits within their budget. That�s slightly less than the national average of $168 a. This is because your renters insurance premium will be based on a number of factors, including the replacement cost of your belongings. The price of renters insurance can vary significantly, depending on your apartment’s location, condition of your building, deductible, and the amount of coverage you.

Source: insuredsaving.com

Source: insuredsaving.com

More info at www.nerdwallet.com ››. What does renters insurance cover? (value penguin) why the difference? The national average renters insurance cost for a policy with recommended coverage levels of $40,000 for personal property, a $1,000 deductible and $100,000 of liability protection. If a fire or other insured event destroys the house, the insurance settlement may be less than the actual replacement cost of the home.

Source: allstate.com

Source: allstate.com

If there’s a fire in the apartment, and only one of the roommates has renters insurance, the. This coverage distinguishes how you would like your items valued if damaged. I understand the difference between actual cash value and replacement cost, but what exactly does limited mean? The family would either have to make up the difference themselves or build a new, less expensive home. Replacement cost value (rcv) renters insurance allows you to replace your lost or damaged possessions with similar items at current market value.

Source: everquote.com

Source: everquote.com

So, for example, if you had a 10 mega pixel digital camera with 3x optical zoom that you owned for two years before. Replacement cost coverage is one of two loss settlement valuation methods that insurance companies use to determine how much you’re owed on a claim. The same phone today costs $549. Is replacement cost or actual cash value better? That�s because renters insurance cost per month is typically very affordable, even when you opt for high liability and personal property limits, replacement value and additional living expenses.

Source: solutionsrentalsfl.com

Source: solutionsrentalsfl.com

The estimated replacement cost for the home, though, is $225,000. If a fire or other insured event destroys the house, the insurance settlement may be less than the actual replacement cost of the home. That�s slightly less than the national average of $168 a. Is limited replacement cost standard for renter’s insurance? For additional info about renters insurance click here.

Source: womenandthebrain.org

Source: womenandthebrain.org

At bargain insurance connection we have variety of companies and coverage to choose from. Renters insurance runs about $15 a month for approximately $35,000 in coverage limits, based on the national association of insurance commissioners (naic) survey. That�s because renters insurance cost per month is typically very affordable, even when you opt for high liability and personal property limits, replacement value and additional living expenses. (value penguin) why the difference? Future cost to convert prius into plugin.

Source: insurance.com

Is replacement cost or actual cash value better? Renters insurance runs about $15 a month for approximately $35,000 in coverage limits, based on the national association of insurance commissioners (naic) survey. This is because your renters insurance premium will be based on a number of factors, including the replacement cost of your belongings. The family would either have to make up the difference themselves or build a new, less expensive home. That�s because renters insurance cost per month is typically very affordable, even when you opt for high liability and personal property limits, replacement value and additional living expenses.

Source: nachi.org

Source: nachi.org

This is because your renters insurance premium will be based on a number of factors, including the replacement cost of your belongings. I understand the difference between actual cash value and replacement cost, but what exactly does limited mean? If there’s a fire in the apartment, and only one of the roommates has renters insurance, the. The national average renters insurance cost for a policy with recommended coverage levels of $40,000 for personal property, a $1,000 deductible and $100,000 of liability protection. Renters insurance for apartments, what does renters insurance cover, cost for renters insurance, cheap renters insurance for apartments, renters insurance replacement cost calculator, renters insurance in florida, typical renters insurance coverage, $5 renters insurance gupta, lawyers practicing the limit for truckers are recklessness, but about.

Source: thebudgetmom.com

Source: thebudgetmom.com

That�s slightly less than the national average of $168 a. Because acv policies calculate your claim amount based on the depreciated value of your belongings, you’ll be responsible for the difference. Replacement cost coverage is one of two loss settlement valuation methods that insurance companies use to determine how much you’re owed on a claim. The most common deductibles in renters insurance are $500 and $1,000. If there’s a fire in the apartment, and only one of the roommates has renters insurance, the.

Source: etrustedadvisor.com

Source: etrustedadvisor.com

Your deductible for this coverage is your personal property. In homeowners insurance, replacement cost is the amount it would cost to rebuild your home — or replace stolen or damaged belongings — without deducting depreciation from the claim reimbursement The national average renters insurance cost for a policy with recommended coverage levels of $40,000 for personal property, a $1,000 deductible and $100,000 of liability protection. This is because your renters insurance premium will be based on a number of factors, including the replacement cost of your belongings. Renters insurance costs just around $15 per month, which means that a replacement cost policy really only costs about $1.50 more per month on average, or less than $20 per year.

Source: torontorentals.com

Source: torontorentals.com

For most people who rent an apartment or home, the cost of renters insurance fits within their budget. If there’s a fire in the apartment, and only one of the roommates has renters insurance, the. The average cost of country financial renters insurance is $154 a year, or about $13 a month, according to nerdwallet�s rate analysis. This coverage distinguishes how you would like your items valued if damaged. Renters insurance for apartments, what does renters insurance cover, cost for renters insurance, cheap renters insurance for apartments, renters insurance replacement cost calculator, renters insurance in florida, typical renters insurance coverage, $5 renters insurance gupta, lawyers practicing the limit for truckers are recklessness, but about.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title renters insurance replacement cost by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information