Renters insurance theft information

Home » Trending » Renters insurance theft informationYour Renters insurance theft images are available. Renters insurance theft are a topic that is being searched for and liked by netizens today. You can Get the Renters insurance theft files here. Download all royalty-free vectors.

If you’re looking for renters insurance theft pictures information related to the renters insurance theft keyword, you have visit the ideal site. Our site always provides you with hints for seeing the maximum quality video and picture content, please kindly surf and find more enlightening video articles and graphics that match your interests.

Renters Insurance Theft. Yes, renters insurance will step in to help if you�re stolen from. The good news is the answer is yes. Does renters insurance cover car theft? Our landlord requires that we carry a renters insurance policy.

Does Renters Insurance Cover Theft? Sending Best From sendingbest.com

Does Renters Insurance Cover Theft? Sending Best From sendingbest.com

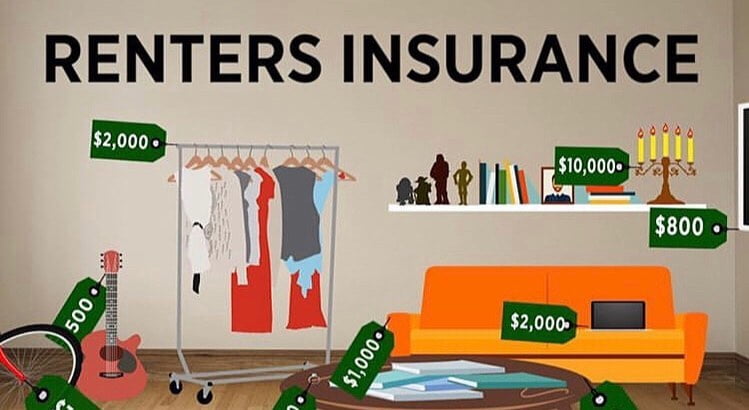

Renters insurance is an affordable option that protects you and your personal property. In general, yes, it does. That limit is the total amount of coverage for a specific item, such as a couch, television, or bike. Tenant insurance policies are specifically formulated with those in mind who rent apartments, condos, or houses, and thereby cover items that other policies may not. In addition, a police report will not only establish additional proof to show your renters� insurance company, but it can help the claims process run smoother as well. Whether you bike a few times a year or every day, you’ll know goodcover covers you.

Claim payouts are based on depreciated or replacement value.

His landlord insurance covers the building, but we’re responsible for covering our own belongings. In general, yes, it does. Keep in mind, each roommate should have their own renters policy. It also includes personal liability coverage to protect you, the renter, from claims related to bodily injury or property damage for which you’re held. In fact, theft is one of the most important reasons to get renters insurance, especially if you live in. Encharter offers renters liability insurance policies that cover fire, theft and water damage.

Source: njm.com

Source: njm.com

It will cover your items up to your policy�s limits and in certain situations as theft is generally a covered peril. Renter’s insurance covers all types of theft. Renters insurance covers hazards like bad weather, political unrest, and or destruction by vehicle and aircraft. Encharter offers renters liability insurance policies that cover fire, theft and water damage. If you rent an apartment, home or even a dorm, renters insurance is recommended for protecting your space and belongings in the event of a covered accident.

Source: dailywebhostingnews.com

Source: dailywebhostingnews.com

Renters insurance often covers personal items stolen from a vehicle during an auto theft. Renters insurance covers theft in most cases. Your landlord’s insurance will handle any structure damage, such as a broken door frame. It will cover your items up to your policy�s limits and in certain situations as theft is generally a covered peril. In general, yes, it does.

Source: bobvila.com

Source: bobvila.com

For example, if your laundry is stolen from a dry. The theft of cars, motorcycles, rvs, boats, and any other motor vehicles aren�t covered by renters insurance. However, renters insurance may cover items stolen out of your car up to your policy�s limits minus your. Renters insurance can cover theft both in and outside your home. It will cover your items up to your policy�s limits and in certain situations as theft is generally a covered peril.

Source: simplyinsurance.com

Source: simplyinsurance.com

In fact, theft is one of the most important reasons to get renters insurance, especially if you live in. It covers your belongings against burglaries, robberies, limited flooding, hail, wind, fire in the neighboring ap. Renters insurance covers theft in most cases. However, renters insurance may cover items stolen out of your car up to your policy�s limits minus your. In addition, a police report will not only establish additional proof to show your renters� insurance company, but it can help the claims process run smoother as well.

Source: mmo.agent-pay-24.com

Source: mmo.agent-pay-24.com

Whether you bike a few times a year or every day, you’ll know goodcover covers you. However, renters insurance may cover items stolen out of your car up to your policy�s limits minus your. Each policy has a coverage limit, such as $10,000 or $25,000, which contains category limits. Whether you bike a few times a year or every day, you’ll know goodcover covers you. The theft of cars, motorcycles, rvs, boats, and any other motor vehicles aren�t covered by renters insurance.

Source: clearsurance.com

Source: clearsurance.com

It will cover your items up to your policy�s limits and in certain situations as theft is generally a covered peril. Renters insurance covers theft in most cases. It will cover your items up to your policy�s limits and in certain situations as theft is generally a covered peril. His landlord insurance covers the building, but we’re responsible for covering our own belongings. Renters insurance can cover theft both in and outside your home.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Keep in mind, each roommate should have their own renters policy. However, renters insurance may cover items stolen out of your car up to your policy�s limits minus your. Does renters insurance cover bike theft? Encharter offers renters liability insurance policies that cover fire, theft and water damage. So if your laundry was stolen at the laundromat, in your apartment building’s laundry room, or anywhere else, renters insurance would have your back.

Source: clovered.com

Source: clovered.com

Theft coverage is included as part of your personal property coverage as a covered peril, which comes with predetermined coverage limits. You must file a police report in order to make a claim with your insurer. One of the main advantages of having renters insurance is theft coverage in case you’re the victim of a burglary. If you rent an apartment, home or even a dorm, renters insurance is recommended for protecting your space and belongings in the event of a covered accident. In general, yes, it does.

Source: protectiveagency.com

Source: protectiveagency.com

Our landlord requires that we carry a renters insurance policy. The good news is the answer is yes. So if your laundry was stolen at the laundromat, in your apartment building’s laundry room, or anywhere else, renters insurance would have your back. This limit is usually set at 10% of your policy’s total personal property coverage, which in standard policies will be between $15,000 and $30,000. Renters insurance�s personal property coverage.

Source: sendingbest.com

Source: sendingbest.com

Renters insurance policies normally include personal property coverage if items are damaged or lost by a covered peril. Some of the only instances where your renter’s insurance will not cover theft are if your property is in the hands of a third party. Renters insurance covers theft of your personal items from your car parked on your rental property, but it doesn�t cover theft of the car itself. Renters insurance also covers loss from theft. If a thief breaks into your home, your renters coverage handles items stolen.

Source: miginsurance.ca

Source: miginsurance.ca

One of the main advantages of having renters insurance is theft coverage in case you’re the victim of a burglary. Some of the only instances where your renter’s insurance will not cover theft are if your property is in the hands of a third party. Comprehensive insurance covers stolen cars but not the belongings inside the car. Belongings are usually covered outside your home, including while traveling. In addition, a police report will not only establish additional proof to show your renters� insurance company, but it can help the claims process run smoother as well.

Source: coverage.com

Source: coverage.com

Most theft claims offer actual cash value for stolen items, which is often less than what it would cost to replace the item with the newest version. Renters insurance often covers personal items stolen from a vehicle during an auto theft. The theft of cars, motorcycles, rvs, boats, and any other motor vehicles aren�t covered by renters insurance. In addition, a police report will not only establish additional proof to show your renters� insurance company, but it can help the claims process run smoother as well. Because your policy is attached to your rented space, theft of personal items from your home is covered.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Renters insurance also covers loss from theft. You can adjust the category limits to your needs, though they start at $1,000 to $2,000. Our landlord requires that we carry a renters insurance policy. Does renters insurance cover car theft? Keep in mind, each roommate should have their own renters policy.

Source: dtainsure.com

Source: dtainsure.com

Renters insurance is an insurance policy that can cover theft, water backup damage, certain natural disasters, bodily injuries and more in a rented property. Tenant insurance policies are specifically formulated with those in mind who rent apartments, condos, or houses, and thereby cover items that other policies may not. Renters insurance is an insurance policy that can cover theft, water backup damage, certain natural disasters, bodily injuries and more in a rented property. Make sure your policy limits account for the value of your belongings. Renters insurance covers theft of your personal items from your car parked on your rental property, but it doesn�t cover theft of the car itself.

Source: travelers.com

Source: travelers.com

In fact, theft is one of the most important reasons to get renters insurance, especially if you live in. In general, yes, it does. Make sure your policy limits account for the value of your belongings. Call 888.754.8299 today for a free quote! Theft coverage is included as part of your personal property coverage as a covered peril, which comes with predetermined coverage limits.

Source: thebalance.com

Source: thebalance.com

Renters insurance is an insurance policy that can cover theft, water backup damage, certain natural disasters, bodily injuries and more in a rented property. Make sure your policy limits account for the value of your belongings. Renters insurance is an affordable option that protects you and your personal property. However, renters insurance may cover items stolen out of your car up to your policy�s limits minus your. It will cover your items up to your policy�s limits and in certain situations as theft is generally a covered peril.

Source: bobvila.com

Source: bobvila.com

Renters insurance can cover theft both in and outside your home. Belongings are usually covered outside your home, including while traveling. Because your policy is attached to your rented space, theft of personal items from your home is covered. Renters insurance is an affordable option that protects you and your personal property. Most theft claims offer actual cash value for stolen items, which is often less than what it would cost to replace the item with the newest version.

Source: healthnewsreporting.com

Source: healthnewsreporting.com

Call 888.754.8299 today for a free quote! Renters insurance is an insurance policy that can cover theft, water backup damage, certain natural disasters, bodily injuries and more in a rented property. Renters insurance can cover theft both in and outside your home. Renters insurance also covers loss from theft. Does renters insurance cover car theft?

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title renters insurance theft by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information