Rep warranty insurance Idea

Home » Trend » Rep warranty insurance IdeaYour Rep warranty insurance images are available. Rep warranty insurance are a topic that is being searched for and liked by netizens now. You can Download the Rep warranty insurance files here. Find and Download all royalty-free photos and vectors.

If you’re searching for rep warranty insurance images information linked to the rep warranty insurance interest, you have visit the ideal site. Our site frequently provides you with hints for downloading the maximum quality video and image content, please kindly search and find more informative video content and graphics that fit your interests.

Rep Warranty Insurance. By shifting the risk of such losses from the seller to an insurer, the buyer and seller can limit […] Today, some targets are demanding that all bidders come to the table with such policies. Rep and warranty insurance is an insurance policy that covers a buyer’s losses from breaches in reps and warranties in a purchase agreement. During sales processes it is common for the seller to provide warranties to the buyer on a broad range of matters about the target such as title to shares, property, employment, tax, intellectual property, and other commercial matters.

Reps and Warranties Insurance in Latin America Jones Day From jonesday.com

Reps and Warranties Insurance in Latin America Jones Day From jonesday.com

Representation & warranty insurance (rwi) is a useful tool to mitigate losses stemming from unknown issues that may arise subsequent to an m&a transaction. In terms of the premium, pricing varies based on the insurer’s risk assessment, coverage limit, length of. Recent years have witnessed a surge in the number of m&a deals that use representations and warranties insurance (“rwi”). Ultimately, reps and warranties insurance helps protect both buyers and sellers involved in transactions from financial loss if inaccuracies in reps and warranties are made. As recently as two years ago, presenting a r/w insurance policy was a way to enhance the attractiveness of a bid in a competitive auction. The seller provides assurance that the business is worth the investment

Rep and warranty insurance is an insurance policy that covers a buyer’s losses from breaches in reps and warranties in a purchase agreement.

Rep and warranty insurance is an insurance policy that covers a buyer’s losses from breaches in reps and warranties in a purchase agreement. In order to obtain an rwi policy, a buyer must conduct diligence on the target. Representations and warranties (r&w) insurance. From 2008 to 2018, the total r&w policies bound per year in north america rose from 40 deals, providing $541 million of coverage to 1500+ r&w. R&w insurance provides coverage for financial losses resulting from breaches of representations and warranties made by the target company or the sellers contained in the purchase agreement. According to a recent study, in 2018 to 2019, 52% of private company transaction agreements referred to rwi, up from only 29% in 2016 to 2017.

Source: diversifiedinsurance.com

Source: diversifiedinsurance.com

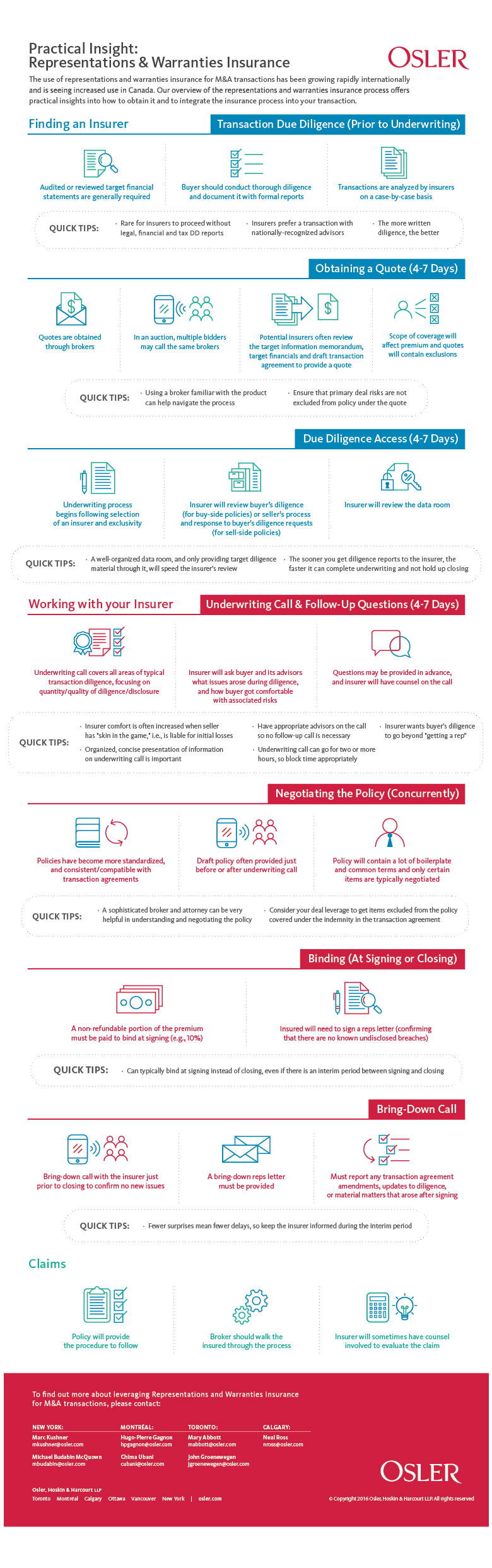

It is designed to provide additional. Representations and warranties insurance (“rwi”) is a risk allocation product that has recently received a significant amount of attention in canada in light of its growing status as a fundamental component of m&a transactions. It requires a dedicated insurance broker who understands this type of coverage and is backed by the resources to handle all the insurance lines and questions that come out of a transaction. Transaction risk specialists with direct personal experience buying, selling, banking, and consulting, we know how to navigate the process and provide support beyond the policy. Rep & warranty insurance focused on practical & trustworthy risk management solutions that support your strategy.

Source: k2adviser.com

Source: k2adviser.com

Representations & warranties insurance overview. By purchasing reps and warranties insurance, buyers can distinguish a bid, sellers can reduce indemnity obligations and both parties can close deals with ease, speed and. Today, some targets are demanding that all bidders come to the table with such policies. Representations and warranties (r&w) insurance. Representations and warranties insurance (“rwi”) is a risk allocation product that has recently received a significant amount of attention in canada in light of its growing status as a fundamental component of m&a transactions.

Reps and warranties insurance is essentially breach of contract cover designed to enhance or replace the indemnification given. By purchasing reps and warranties insurance, buyers can distinguish a bid, sellers can reduce indemnity obligations and both parties can close deals with ease, speed and. Representations and warranties (r&w) insurance. By shifting the risk of such losses from the seller to an insurer, the buyer and seller can limit […] As recently as two years ago, presenting a r/w insurance policy was a way to enhance the attractiveness of a bid in a competitive auction.

Representation & warranty insurance (rwi) is a useful tool to mitigate losses stemming from unknown issues that may arise subsequent to an m&a transaction. 1 to 1.5% of the limit of insurance is typically the rep and warranty insurance premium that can be negotiated on average across global jurisdictions. “representation & warranty insurance” (“r&w insurance”) is a type of insurance policy purchased in connection with corporate transactions, and covers the indemnification for certain breaches of the representations and warranties in the transaction agreements. Available for both buyers and sellers in a transaction, representations and warranties insurance provides protection against financial losses ¹, including costs associated with defending claims, for certain unintentional and unknown breaches of the seller’s representations and warranties made. It requires a dedicated insurance broker who understands this type of coverage and is backed by the resources to handle all the insurance lines and questions that come out of a transaction.

Source: thecoylegroup.com

Source: thecoylegroup.com

Yet, despite its dramatic growth in the private company deal […] According to a recent study, in 2018 to 2019, 52% of private company transaction agreements referred to rwi, up from only 29% in 2016 to 2017. During sales processes it is common for the seller to provide warranties to the buyer on a broad range of matters about the target such as title to shares, property, employment, tax, intellectual property, and other commercial matters. Each of the parties in the transaction relies on the other to provide true information about the transaction. And while it may not completely eliminate the need for any escrow, it can help reduce the.

Source: woodruffsawyer.com

Source: woodruffsawyer.com

In terms of the premium, pricing varies based on the insurer’s risk assessment, coverage limit, length of. In order to obtain an rwi policy, a buyer must conduct diligence on the target. It requires a dedicated insurance broker who understands this type of coverage and is backed by the resources to handle all the insurance lines and questions that come out of a transaction. This article, which updates and expands on the author�s previous. Rwi is used primarily to protect the insured party from losses and liabilities incurred as a result of breaches of.

Source: ccrcorp.com

Source: ccrcorp.com

1 to 1.5% of the limit of insurance is typically the rep and warranty insurance premium that can be negotiated on average across global jurisdictions. Representations and warranties (r&w) insurance. While the amount may vary depending on the risk of the deal, it is usually between 1% and 3% of the overall transaction price. Over the last decade the use of r&w insurance in merger and acquisition transactions has grown exponentially. Participants in mergers and acquisitions (m&a) are also increasingly using.

Source: exityourway.us

Source: exityourway.us

There is nothing standard about the sale or merger of a company and so very little is standard about the insurance that supports it. During sales processes it is common for the seller to provide warranties to the buyer on a broad range of matters about the target such as title to shares, property, employment, tax, intellectual property, and other commercial matters. In terms of the premium, pricing varies based on the insurer’s risk assessment, coverage limit, length of. From 2008 to 2018, the total r&w policies bound per year in north america rose from 40 deals, providing $541 million of coverage to 1500+ r&w. The insurer will generally require access to the

Source: expertwebcast.com

Source: expertwebcast.com

While the amount may vary depending on the risk of the deal, it is usually between 1% and 3% of the overall transaction price. Representation and warranties insurance is a complex solution for a complex situation. A rep & warranty insurance policy can cover hanging liabilities from prior transactions and rep related to the current transaction. Available for both buyers and sellers in a transaction, representations and warranties insurance provides protection against financial losses ¹, including costs associated with defending claims, for certain unintentional and unknown breaches of the seller’s representations and warranties made. Rep & warranty insurance focused on practical & trustworthy risk management solutions that support your strategy.

![]() Source: rubiconins.com

Source: rubiconins.com

Reps and warranties insurance is essentially breach of contract cover designed to enhance or replace the indemnification given. Transaction risk specialists with direct personal experience buying, selling, banking, and consulting, we know how to navigate the process and provide support beyond the policy. Available for both buyers and sellers in a transaction, representations and warranties insurance provides protection against financial losses ¹, including costs associated with defending claims, for certain unintentional and unknown breaches of the seller’s representations and warranties made. Representations & warranties insurance overview. In terms of the premium, pricing varies based on the insurer’s risk assessment, coverage limit, length of.

Source: dechert.com

Source: dechert.com

R&w insurance provides coverage for financial losses resulting from breaches of representations and warranties made by the target company or the sellers contained in the purchase agreement. In order to obtain an rwi policy, a buyer must conduct diligence on the target. The seller provides assurance that the business is worth the investment Rwi is used primarily to protect the insured party from losses and liabilities incurred as a result of breaches of. The sale purchase agreement (spa) provides credit against the purchase price for the insurance cost (1% of transaction value) seller achieves more bids and a better sale price.

Source: repsandwarrantiesconference.com

Source: repsandwarrantiesconference.com

Over the last decade the use of r&w insurance in merger and acquisition transactions has grown exponentially. A rep & warranty insurance policy can cover hanging liabilities from prior transactions and rep related to the current transaction. Rep and warranty insurance is an insurance policy that covers a buyer’s losses from breaches in reps and warranties in a purchase agreement. Ultimately, reps and warranties insurance helps protect both buyers and sellers involved in transactions from financial loss if inaccuracies in reps and warranties are made. Each of the parties in the transaction relies on the other to provide true information about the transaction.

Source: dentons.com

Source: dentons.com

Representation and warranties insurance is a complex solution for a complex situation. Yet, despite its dramatic growth in the private company deal […] Over the last decade the use of r&w insurance in merger and acquisition transactions has grown exponentially. Representation and warranty insurance the robust and competitive m&a market has led to an increase in representation and warranty insurance (rwi) policies, which has transformed the m&a process. Available for both buyers and sellers in a transaction, representations and warranties insurance provides protection against financial losses ¹, including costs associated with defending claims, for certain unintentional and unknown breaches of the seller’s representations and warranties made.

Source: jonesday.com

Source: jonesday.com

Vale’s rwi product is a custom insurance policy that provides protection to buyers or sellers against losses arising from the breach of a representation or warranty made in the purchase. Representation & warranty insurance (rwi) is a useful tool to mitigate losses stemming from unknown issues that may arise subsequent to an m&a transaction. The use of representations and warranties insurance in merger and acquisition transactions has grown tremendously in recent years. As recently as two years ago, presenting a r/w insurance policy was a way to enhance the attractiveness of a bid in a competitive auction. The seller provides assurance that the business is worth the investment

Source: sunacquisitions.com

Source: sunacquisitions.com

The seller provides assurance that the business is worth the investment A rep & warranty insurance policy can cover hanging liabilities from prior transactions and rep related to the current transaction. Representations and warranties insurance (“rwi”) is a risk allocation product that has recently received a significant amount of attention in canada in light of its growing status as a fundamental component of m&a transactions. Each of the parties in the transaction relies on the other to provide true information about the transaction. The use of representations and warranties insurance in merger and acquisition transactions has grown tremendously in recent years.

Source: robfreeman.com

Source: robfreeman.com

Representation and warranty insurance the robust and competitive m&a market has led to an increase in representation and warranty insurance (rwi) policies, which has transformed the m&a process. Representations and warranties insurance (“rwi”) is a risk allocation product that has recently received a significant amount of attention in canada in light of its growing status as a fundamental component of m&a transactions. The sale purchase agreement (spa) provides credit against the purchase price for the insurance cost (1% of transaction value) seller achieves more bids and a better sale price. Representation and warranty insurance the robust and competitive m&a market has led to an increase in representation and warranty insurance (rwi) policies, which has transformed the m&a process. Today, some targets are demanding that all bidders come to the table with such policies.

Source: heritageia.com

Source: heritageia.com

Representation and warranty insurance (r/w insurance) continues to gain momentum. By shifting the risk of such losses from the seller to an insurer, the buyer and seller can limit […] And while it may not completely eliminate the need for any escrow, it can help reduce the. There is nothing standard about the sale or merger of a company and so very little is standard about the insurance that supports it. The seller provides assurance that the business is worth the investment

Source: osler.com

Source: osler.com

Participants in mergers and acquisitions (m&a) are also increasingly using. Representations and warranties insurance (“rwi”) is a risk allocation product that has recently received a significant amount of attention in canada in light of its growing status as a fundamental component of m&a transactions. The sale purchase agreement (spa) provides credit against the purchase price for the insurance cost (1% of transaction value) seller achieves more bids and a better sale price. Analysis, explains what rwi is, what it�s used for, and how it works. Participants in mergers and acquisitions (m&a) are also increasingly using.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title rep warranty insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information