Replacement rule insurance information

Home » Trend » Replacement rule insurance informationYour Replacement rule insurance images are ready in this website. Replacement rule insurance are a topic that is being searched for and liked by netizens today. You can Get the Replacement rule insurance files here. Get all free photos.

If you’re searching for replacement rule insurance images information related to the replacement rule insurance topic, you have come to the ideal site. Our website frequently gives you hints for downloading the highest quality video and image content, please kindly surf and locate more informative video content and graphics that match your interests.

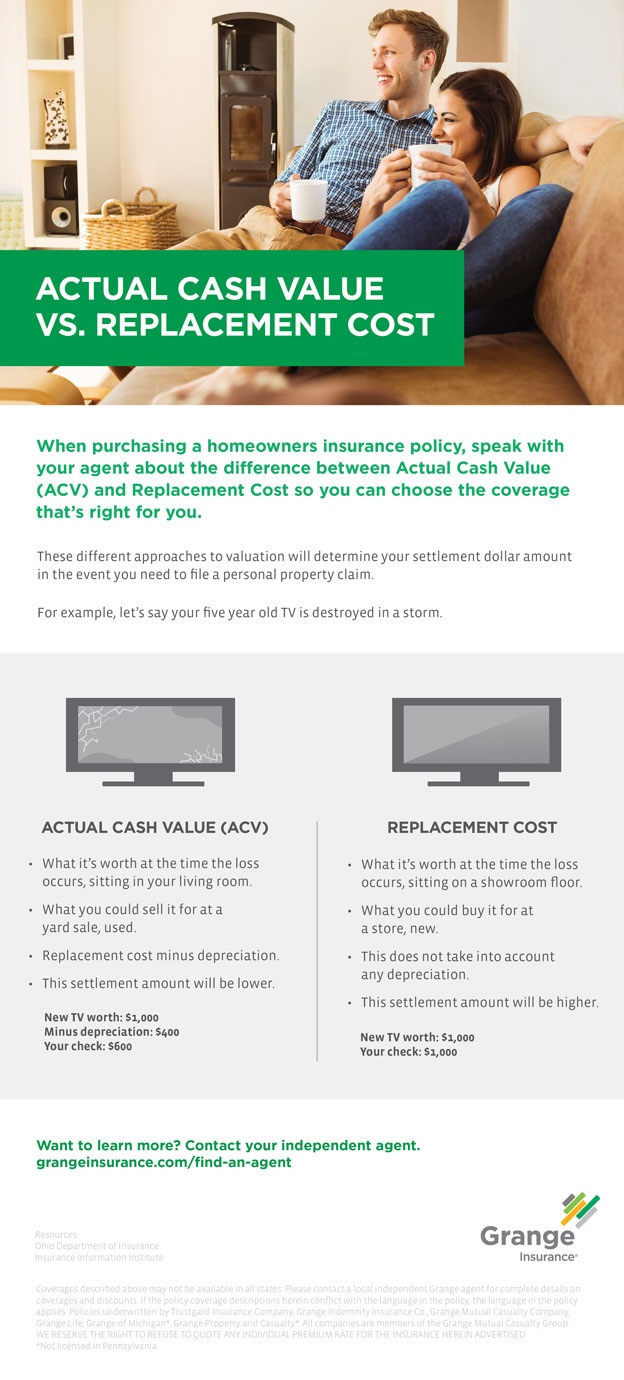

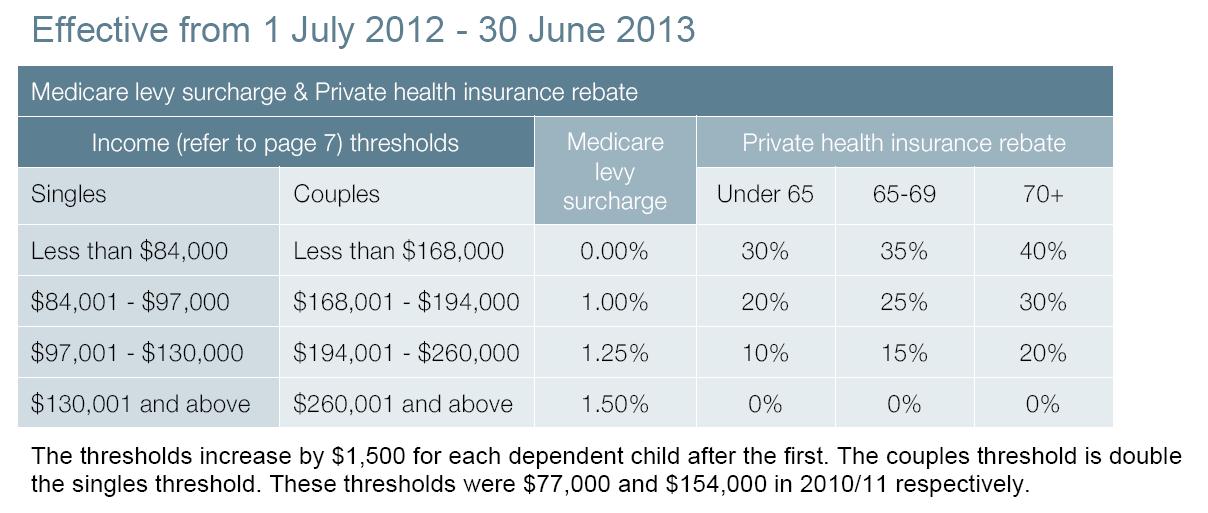

Replacement Rule Insurance. (2) a life insurer shall require, with, or as a part of, each application for life insurance, a statement signed by the applicant as to whether the insurance for which application is made will replace existing life insurance. Replacement rules are used to create new claim lines that replace existing claim lines on one claim. This rule says that the homeowner should have enough insurance to cover a minimum of 80 percent of the rebuild cost. In some cases this purchase may involve discontinuing or changing an existing policy or contract.

Medicare cards getting makeover to protect seniors From wilx.com

Medicare cards getting makeover to protect seniors From wilx.com

In some cases this purchase may involve discontinuing or changing an existing policy or contract. Or click on the rule number to see the detail of the rule. Repair coverage usually takes into consideration depreciation of the roof. A logical system may be constructed so that it uses either axioms, rules of inference, or both as transformation rules for logical expressions in the system. This functionality can be used in (a.o.) the following scenarios: While each state department of insurance is allowed to issue its own specific rules and procedures on replacements, they are required.

The proposed amendment to n.j.a.c.

The department�s current rules apply to the replacement of life insurance policies. Most companies require you to carry insurance equal to at least 80% of the There are hundreds of companies to choose from. Frequently, damage to property does not result in a total loss. Private health insurance (national joint replacement register levy) rule 2015. Financed purchases are also considered replacements.

Source: blog.central-insurance.com

Source: blog.central-insurance.com

A logical system may be constructed so that it uses either axioms, rules of inference, or both as transformation rules for logical expressions in the system. Private health insurance (national joint replacement register levy) rule 2015. 1) if you replace a policy, you should understand what you are giving up in your old policy and/or gaining in your new policy. Replacement rules are used to create new claim lines that replace existing claim lines on one claim. The department�s current rules apply to the replacement of life insurance policies.

Source: grangeinsurance.com

Source: grangeinsurance.com

In some cases this purchase may involve discontinuing or changing an existing policy or contract. Replacement rules are used to create new claim lines that replace existing claim lines on one claim. Frequently, damage to property does not result in a total loss. Replacement of life insurance or annuities. If your house burns down, homeowners insurance typically covers the entire claim as long as the homeowner has dwelling coverage for more than 80% of the house�s replacement value.

Source: slideshare.net

Source: slideshare.net

This rule and r 500.601, r 500.602, and r 500.604 to r 500.606. This means that if your home is insured for less than 80% of its total replacement value, the insurance company may only pay the. The cost of life insurance can be a major factor in replacing life insurance. It is, however, a practice that can lead to ethical lapses. The department�s current rules apply to the replacement of life insurance policies.

Source: eliscartaodevisita.blogspot.com

Source: eliscartaodevisita.blogspot.com

In some cases this purchase may involve discontinuing or changing an existing policy or contract. But, if a repair can be completed for less than 50% of the baseline, then you should choose to fix. The 80% rule is an unwritten rule that means insurance companies won’t provide complete coverage after a disaster unless the insurance policy in effect equals at least 80% of the home’s total replacement value. The basic idea is that you compare the cost of repair to the cost of replacement. This functionality can be used in (a.o.) the following scenarios:

Source: slideserve.com

Source: slideserve.com

The cost of life insurance can be a major factor in replacing life insurance. In logic, a rule of replacement is a transformation rule that may be applied to only a particular segment of an expression. Also, the amendment changes the references to “agent” in the But, if a repair can be completed for less than 50% of the baseline, then you should choose to fix. The 80% rule is an unwritten rule that means insurance companies won’t provide complete coverage after a disaster unless the insurance policy in effect equals at least 80% of the home’s total replacement value.

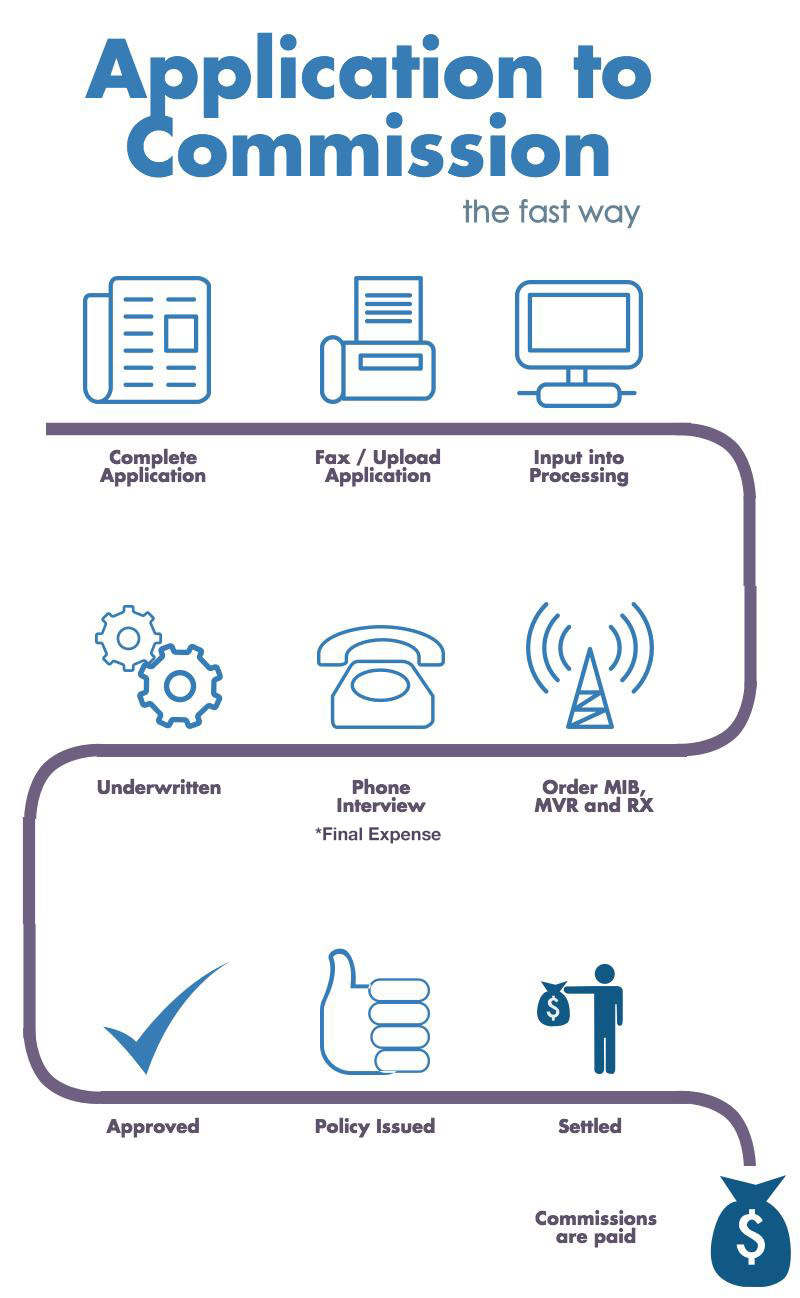

Source: termlb.gpmlife.com

Source: termlb.gpmlife.com

Hurricane on record, and a sizable chunk. The purpose of this rule is: Also, the amendment changes the references to “agent” in the • replace your vehicle, or • receive compensation. If anything happens to your home, your.

Source: canalpartners.com

Source: canalpartners.com

If your house burns down, homeowners insurance typically covers the entire claim as long as the homeowner has dwelling coverage for more than 80% of the house�s replacement value. Repair coverage usually takes into consideration depreciation of the roof. Hurricane on record, and a sizable chunk. What is the 80 percent rule in homeowners insurance? This rule says that the homeowner should have enough insurance to cover a minimum of 80 percent of the rebuild cost.

Source: uhcprovider.com

Source: uhcprovider.com

Repair coverage usually takes into consideration depreciation of the roof. Replacement is defined as changes in existing coverage, usually with coverage from one insurer being replaced with coverage from another. Frequently, damage to property does not result in a total loss. The insurance company for your new policy does not. This functionality can be used in (a.o.) the following scenarios:

Source: slideshare.net

Source: slideshare.net

• replace your vehicle, or • receive compensation. The proposed amendment to n.j.a.c. The insurance company for your new policy does not. The 80% rule is an unwritten rule that means insurance companies won’t provide complete coverage after a disaster unless the insurance policy in effect equals at least 80% of the home’s total replacement value. Private health insurance (national joint replacement register levy) act 2009.

Source: servicemarket.com

Source: servicemarket.com

Although this web site is updated on a regular basis, the insurance commission cannot guarantee the accuracy or completeness of the site’s contents and disclaims liability for errors and omissions in the contents. (2) a life insurer shall require, with, or as a part of, each application for life insurance, a statement signed by the applicant as to whether the insurance for which application is made will replace existing life insurance. If you�re not careful, underinsuring your home can leave you paying a large bill. In logic, a rule of replacement is a transformation rule that may be applied to only a particular segment of an expression. With homeowners insurance, companies tend to follow the 80/20 rule.

![Life Insurance Replacement [Top 5 Dos and Don�ts] Life Insurance Replacement [Top 5 Dos and Don�ts]](https://www.lifeinsuranceblog.net/wp-content/uploads/2018/11/Life-Insurance-Replacement.jpg) Source: lifeinsuranceblog.net

Source: lifeinsuranceblog.net

Or click on the rule number to see the detail of the rule. It is, however, a practice that can lead to ethical lapses. Replacement of life insurance or annuities. But, if a repair can be completed for less than 50% of the baseline, then you should choose to fix. The insurance company for your new policy does not.

Source: pocketsense.com

Source: pocketsense.com

If your house burns down, homeowners insurance typically covers the entire claim as long as the homeowner has dwelling coverage for more than 80% of the house�s replacement value. If so, a replacement is occurring. The florida building code and its 25% replacement rule hurricane irma caused an estimated $50 billion in damage, according to the national oceanic and atmospheric administration. The department�s current rules apply to the replacement of life insurance policies. Or click on the rule number to see the detail of the rule.

Source: fmwic.com

Source: fmwic.com

This rule and r 500.601, r 500.602, and r 500.604 to r 500.606. The 80% rule is an unwritten rule that means insurance companies won’t provide complete coverage after a disaster unless the insurance policy in effect equals at least 80% of the home’s total replacement value. If you�re not careful, underinsuring your home can leave you paying a large bill. With homeowners insurance, companies tend to follow the 80/20 rule. This rule says that the homeowner should have enough insurance to cover a minimum of 80 percent of the rebuild cost.

Source: allwestinsurance.com

Source: allwestinsurance.com

In some cases this purchase may involve discontinuing or changing an existing policy or contract. Or click on the rule number to see the detail of the rule. With homeowners insurance, companies tend to follow the 80/20 rule. You are contemplating the purchase of a life insurance policy or annuity contract. The cost of life insurance can be a major factor in replacing life insurance.

Source: slideserve.com

Source: slideserve.com

In some cases this purchase may involve discontinuing or changing an existing policy or contract. The basic idea is that you compare the cost of repair to the cost of replacement. Private health insurance (national joint replacement register levy) act 2009. Most companies require you to carry insurance equal to at least 80% of the It is, however, a practice that can lead to ethical lapses.

Source: unovest.co

Source: unovest.co

This means that if your home is insured for less than 80% of its total replacement value, the insurance company may only pay the. With homeowners insurance, companies tend to follow the 80/20 rule. This means that if your home is insured for less than 80% of its total replacement value, the insurance company may only pay the. 2) whether or not you make the replacement is up to you to do. Click on the word icon to view the latest rule version.

Source: rubachwealth.com

Source: rubachwealth.com

Or click on the rule number to see the detail of the rule. It is, however, a practice that can lead to ethical lapses. The insurance company for your new policy does not. While each state department of insurance is allowed to issue its own specific rules and procedures on replacements, they are required. Replacement of life insurance or annuities.

Source: businessresources2k13.weebly.com

Source: businessresources2k13.weebly.com

If repair exceeds 50% of a particular threshold, the rule says you should opt to replace. 1) if you replace a policy, you should understand what you are giving up in your old policy and/or gaining in your new policy. The rules found on the insurance commission web site are provided as a public service only. Most companies require you to carry insurance equal to at least 80% of the You are contemplating the purchase of a life insurance policy or annuity contract.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title replacement rule insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information