Report someone without car insurance Idea

Home » Trending » Report someone without car insurance IdeaYour Report someone without car insurance images are ready in this website. Report someone without car insurance are a topic that is being searched for and liked by netizens today. You can Get the Report someone without car insurance files here. Download all free images.

If you’re looking for report someone without car insurance pictures information related to the report someone without car insurance keyword, you have visit the right blog. Our website always gives you suggestions for viewing the maximum quality video and image content, please kindly hunt and locate more enlightening video content and images that fit your interests.

Report Someone Without Car Insurance. After filing a police report, your next step should be to file an uninsured motorist claim with your insurance provider. The insurer could drop you, forcing you to start over again. Additionally, insurance claims can go forth without police reports under most circumstances. If you lend your uninsured car to someone who has insurance, their policy will usually cover any damage or injury they cause to someone else.

How Do I Report Someone Without Car Insurance emuartdesigns From emuartdesigns.blogspot.com

How Do I Report Someone Without Car Insurance emuartdesigns From emuartdesigns.blogspot.com

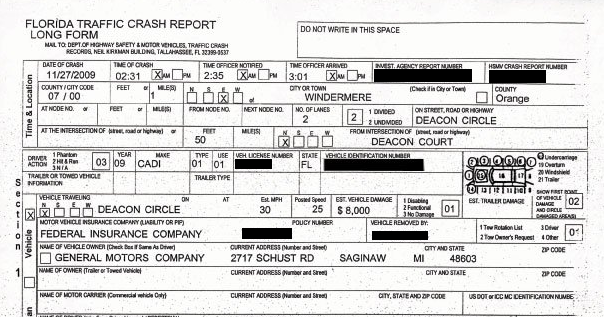

When an accident occurs, it’s important to make sure that you get the other driver’s name, license number, insurance information, plate number, and vehicle registration. An mvr details your driving history. If you get into a car accident, whether the other person has insurance or not, it’s always a good idea to call the police. An insurer will run a motor vehicle report (mvr) when calculating your premium. If the number of uninsured drivers is lowered, you could see a reduction in premiums in the long run. If you use a fake or invalid driver�s license number, it will register on your mvr.

However, there are times when filing a claim makes the most financial sense, like if the repairs will cost more than your deductible, or if there is a high risk for medical bills or lawsuit.

If the case goes to court you could get: Filing a claim against someone else’s car insurance company can be a smooth or difficult process depending on the situation. In the long run, it pays to be upfront about your driving situation. How to settle without insurance if you’re intent on settling without insurance, here are 5 steps you must take in order to protect yourself in the process: You need to report abandoned vehicles to your local council. The number can also be used to report people driving without insurance or people who regularly indulge in drink or drug driving.

Source: revisi.net

Source: revisi.net

If you’re involved in a car accident you’d usually swap car insurance details with the other party involved. You need to know who to file your claim against. Don’t exchange cash or personal checks at the scene of the accident. In the long run, it pays to be upfront about your driving situation. You can call crimestoppers anonymously on 0800 555 111 to report the person driving without a valid licence.

Source: flickr.com

Source: flickr.com

However, damage to your vehicle likely won�t be covered. An insurer will run a motor vehicle report (mvr) when calculating your premium. When an accident occurs, it’s important to make sure that you get the other driver’s name, license number, insurance information, plate number, and vehicle registration. File the claim sooner rather than later. Your insurer will have to take your word, and they might not be willing to pay out the full amount you’re owed.

Source: ardalanlaw.com

Source: ardalanlaw.com

A police report helps prove back up your claims, especially if you are stating that you weren’t at fault for the accident. When you go to traffic court, you’ll be asked to provide proof of insurance at that time. If the offending driver hasn’t fled the scene, a report sometimes isn’t. If you lend your uninsured car to someone who has insurance, their policy will usually cover any damage or injury they cause to someone else. To make an insurance claim without a police report in denver, you need to know the other driver’s information.

Source: nerdwallet.com

Source: nerdwallet.com

If your car was stolen or the other driver involved in an accident with your car is not insured, you will also need to contact the police to report the incident before you speak to. You may also be liable for some of the damages if the driver�s insurance doesn�t cover the full amount. The driver and vehicle licensing agency (dvla) and the driver and vehicle standards agency (dvsa) cannot take action against a. When an insured driver borrows an insured car: You can call crimestoppers anonymously on 0800 555 111 to report the person driving without a valid licence.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

If the case goes to court you could get: Unless there is an imminent threat to public safety, the police have more pressing issues to deal with than this. To make an insurance claim without a police report in denver, you need to know the other driver’s information. Always exchange contact information with the other drivers. We all have a right to feel secure on the road.

Source: reddit.com

Source: reddit.com

Unless there is an imminent threat to public safety, the police have more pressing issues to deal with than this. Don’t exchange cash or personal checks at the scene of the accident. Additionally, insurance claims can go forth without police reports under most circumstances. After filing a police report, your next step should be to file an uninsured motorist claim with your insurance provider. If you get into a car accident, whether the other person has insurance or not, it’s always a good idea to call the police.

Source: dixoninjuryfirm.com

Source: dixoninjuryfirm.com

When an insured driver borrows an insured car: You need to know who to file your claim against. Also, the damages that occurred as a result of the accident exceed the limits of your auto insurance policy, you may be held liable and might have to pay for the damages and/or medical costs that exceed. The insurer could drop you, forcing you to start over again. If you’re involved in a car accident you’d usually swap car insurance details with the other party involved.

Source: kbb.com

Source: kbb.com

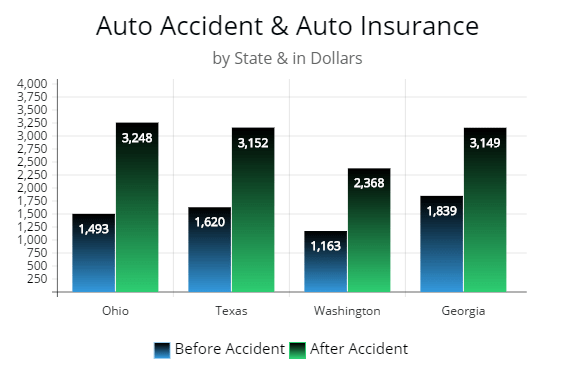

The police could give you a fixed penalty of £300 and 6 penalty points if you’re caught driving a vehicle you’re not insured to drive. If the number of uninsured drivers is lowered, you could see a reduction in premiums in the long run. The police could give you a fixed penalty of £300 and 6 penalty points if you’re caught driving a vehicle you’re not insured to drive. The insurer could drop you, forcing you to start over again. Also, the damages that occurred as a result of the accident exceed the limits of your auto insurance policy, you may be held liable and might have to pay for the damages and/or medical costs that exceed.

Source: emuartdesigns.blogspot.com

Source: emuartdesigns.blogspot.com

An insurer will run a motor vehicle report (mvr) when calculating your premium. If the offending driver hasn’t fled the scene, a report sometimes isn’t. To make an insurance claim without a police report in denver, you need to know the other driver’s information. Unless there is an imminent threat to public safety, the police have more pressing issues to deal with than this. There is nothing wrong with paying for your own car repairs without filing an insurance claim and it is a great way to avoid a car insurance premium increase.

Source: thebalance.com

Source: thebalance.com

If you’re involved in a car accident you’d usually swap car insurance details with the other party involved. After filing a police report, your next step should be to file an uninsured motorist claim with your insurance provider. When you go to traffic court, you’ll be asked to provide proof of insurance at that time. Please provide me with a new car as soon as possible in accordance with the insurance policy. Also, the damages that occurred as a result of the accident exceed the limits of your auto insurance policy, you may be held liable and might have to pay for the damages and/or medical costs that exceed.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

You can call crimestoppers anonymously on 0800 555 111 to report the person driving without a valid licence. Items such as a police report, photos from the scene, and the contact information for any witnesses will help prove you weren’t to blame. Surrenders an insurance card for inspection to a police officer, when requested to do so, purporting to show that the motor vehicle is insured under a contract of automobile coverage when the motor vehicle is not so insured, is guilty of an offense and is liable on a first conviction to a fine of not less than $5,000 and not more than $25,000 and on a subsequent conviction to. The number can also be used to report people driving without insurance or people who regularly indulge in drink or drug driving. If you let someone drive your car and they get into a collision, the rates on your auto insurance policy may increase because of the accident.

Source: autoinsuresavings.org

Source: autoinsuresavings.org

When you go to traffic court, you’ll be asked to provide proof of insurance at that time. The insurer could drop you, forcing you to start over again. If your car was stolen or the other driver involved in an accident with your car is not insured, you will also need to contact the police to report the incident before you speak to. If you get into a car accident, whether the other person has insurance or not, it’s always a good idea to call the police. In the long run, it pays to be upfront about your driving situation.

Source: visual.ly

Source: visual.ly

If you lend your uninsured car to someone who has insurance, their policy will usually cover any damage or injury they cause to someone else. For example, if one of the drivers realizes that fault has been assigned to the wrong driver, he or she can appeal to have the report changed. Items such as a police report, photos from the scene, and the contact information for any witnesses will help prove you weren’t to blame. Filing a claim against someone else’s car insurance company can be a smooth or difficult process depending on the situation. Please provide me with a new car as soon as possible in accordance with the insurance policy.

Source: reddit.com

Source: reddit.com

If you don’t have proof of insurance with you, you’ll be given a ticket. Additionally, insurance claims can go forth without police reports under most circumstances. When an insured driver borrows an insured car: If your car was stolen or the other driver involved in an accident with your car is not insured, you will also need to contact the police to report the incident before you speak to. For example, if one of the drivers realizes that fault has been assigned to the wrong driver, he or she can appeal to have the report changed.

Source: cadoretdesign.blogspot.com

Source: cadoretdesign.blogspot.com

You can check whether another vehicle is insured by going to the askmid website. Provide all requested information and keep communication with the claims representative until the case is closed. I am attaching a police report. The driver and vehicle licensing agency (dvla) and the driver and vehicle standards agency (dvsa) cannot take action against a. Unless there is an imminent threat to public safety, the police have more pressing issues to deal with than this.

Source: kbb.com

Source: kbb.com

When you go to traffic court, you’ll be asked to provide proof of insurance at that time. To make an insurance claim without a police report in denver, you need to know the other driver’s information. You need to report abandoned vehicles to your local council. If you lend your uninsured car to someone who has insurance, their policy will usually cover any damage or injury they cause to someone else. In the long run, it pays to be upfront about your driving situation.

Source: cheapcarinsurancequotes.com

Source: cheapcarinsurancequotes.com

However, there are times when filing a claim makes the most financial sense, like if the repairs will cost more than your deductible, or if there is a high risk for medical bills or lawsuit. You need to know who to file your claim against. If your car was stolen or the other driver involved in an accident with your car is not insured, you will also need to contact the police to report the incident before you speak to. There is nothing wrong with paying for your own car repairs without filing an insurance claim and it is a great way to avoid a car insurance premium increase. Please provide me with a new car as soon as possible in accordance with the insurance policy.

Source: yaulaw.com

Source: yaulaw.com

You can call crimestoppers anonymously on 0800 555 111 to report the person driving without a valid licence. Dear sir, my car (car registration number) is insured with your company under policy number (00000) and it was stolen three days ago at (mention the place). If you lend your uninsured car to someone who has insurance, their policy will usually cover any damage or injury they cause to someone else. You can call crimestoppers anonymously on 0800 555 111 to report the person driving without a valid licence. Insurance claim letter for car theft or stolen.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title report someone without car insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information