Reporting health insurance on w2 for 2019 Idea

Home » Trending » Reporting health insurance on w2 for 2019 IdeaYour Reporting health insurance on w2 for 2019 images are ready in this website. Reporting health insurance on w2 for 2019 are a topic that is being searched for and liked by netizens now. You can Get the Reporting health insurance on w2 for 2019 files here. Get all royalty-free photos.

If you’re looking for reporting health insurance on w2 for 2019 images information related to the reporting health insurance on w2 for 2019 interest, you have visit the right blog. Our site frequently gives you suggestions for seeing the highest quality video and image content, please kindly surf and locate more informative video articles and graphics that fit your interests.

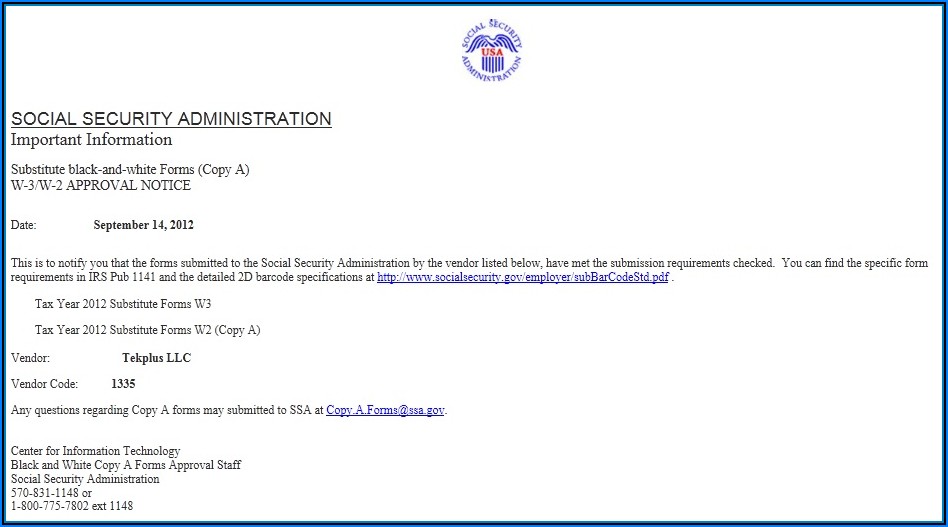

Reporting Health Insurance On W2 For 2019. Pacific prime’s report on the state of health insurance is back, and our second ever edition already has its upgrade. W 2 reporting requirements for employer provided health coverage do small employers need to report health insurance on w2. Report on form 8889, health savings accounts (hsas). Do small employers need to report health insurance on w2 is important information with hd images sourced from all websites in the world.

Ramsay Health Care Limited Annual Report 2019 Page 40 From ramsayhealth.com

Ramsay Health Care Limited Annual Report 2019 Page 40 From ramsayhealth.com

Confused about whether health insurance premiums are deductible. Pacific prime’s report on the state of health insurance is back, and our second ever edition already has its upgrade. Do small employers have to report health insurance on w2 for 2019? Also know, do i have to report health insurance on w2 for 2019? You don’t have to report healthcare coverage for retirees or former employees. The shareholder health insurance amount should display:

What is section 125 in box 14 on my w2?

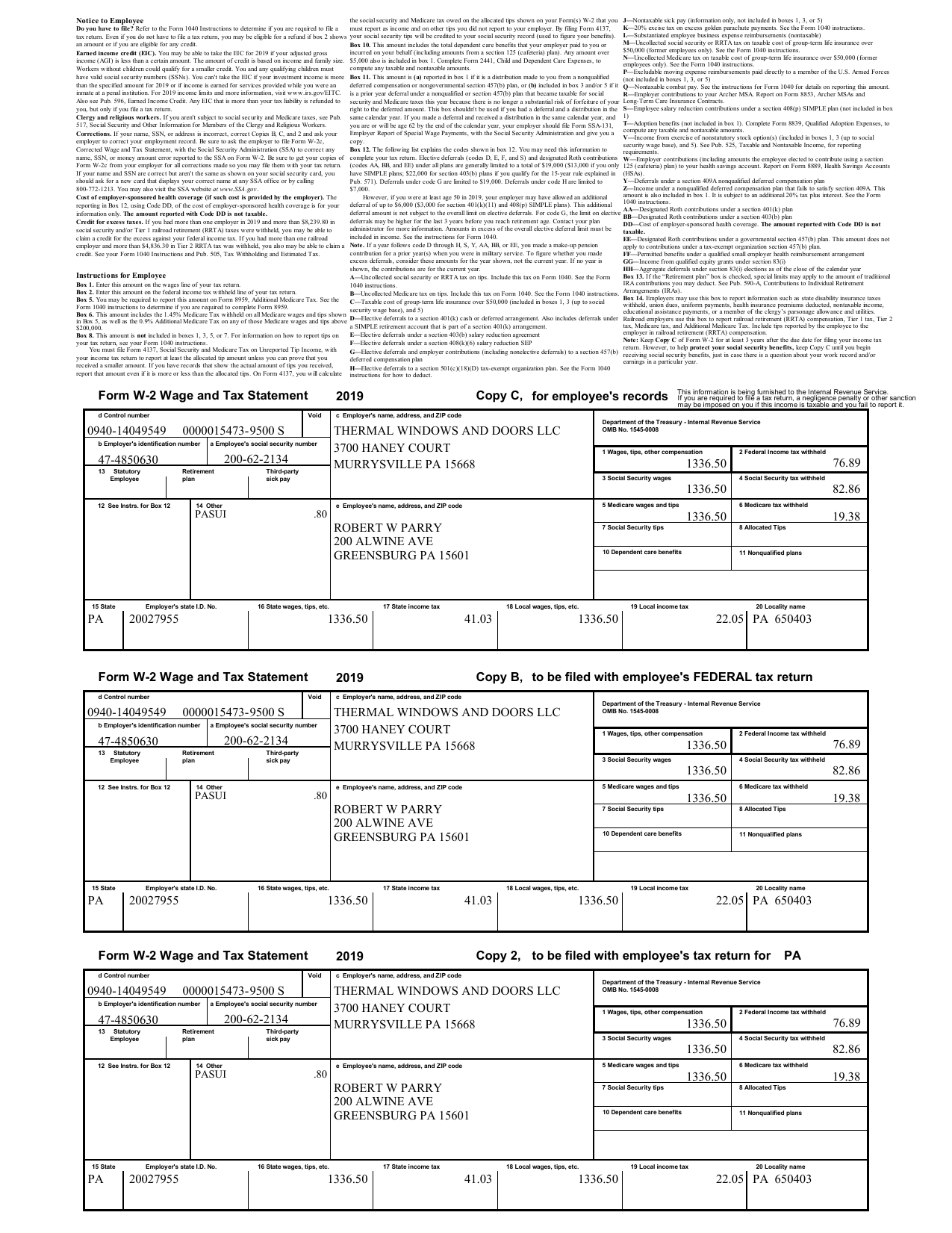

Y—deferrals under a section 409a nonqualified deferred compensation plan. What is section 125 in box 14 on my w2? Y—deferrals under a section 409a nonqualified deferred compensation plan. This reporting is for informational purposes only, to show employees the value of their. 12 {box 12 reporting elements} w2 category: Pacific prime’s report on the state of health insurance is back, and our second ever edition already has its upgrade.

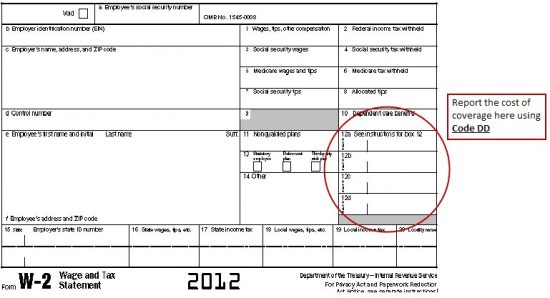

Source: peoplekeep.com

Source: peoplekeep.com

Dues, uniform payments, health insurance premiums deducted,. Also know, do i have to report health insurance on w2 for 2019? And if the accident / insurance event occurs, the insurance company will bear all or all of the costs in full or in part. It is included in box 12 in order to provide comparable consumer information on the cost of health care coverage. This amount is reported for informational purposes only and is not taxable.

Source: basusa.com

Source: basusa.com

2019 w2 instructions notice to employee. Pacific prime’s report on the state of health insurance is back, and our second ever edition already has its upgrade. This amount is reported for informational purposes only and is not taxable. Y—deferrals under a section 409a nonqualified deferred compensation plan. Confused about whether health insurance premiums are deductible.

Source: slideshare.net

Source: slideshare.net

And if the accident / insurance event occurs, the insurance company will bear all or all of the costs in full or in part. Create report favorites to save time use mnemonics to create report favorites W2 box 14 states nt health benefits with an amount in the box. Reporting health insurance on w2 for 2016 is a tool to reduce your risks. This reporting is for informational purposes only, to show employees the value of their.

Source: consumerdirectak.com

Source: consumerdirectak.com

Technically, no business has to offer health insurance to their employees. Do small employers have to report health insurance on w2 for 2019? This amount is reported for informational purposes only and is not taxable. Also know, do i have to report health insurance on w2 for 2019? 2019 w2 instructions notice to employee.

Source: pinterest.com

Source: pinterest.com

12 {box 12 reporting elements} w2 category: Do employers have to report health insurance on w2 for 2019? Pacific prime’s report on the state of health insurance is back, and our second ever edition already has its upgrade. Do small employers have to report health insurance on w2 for 2019? This reporting is for informational purposes only, to show employees the value of their health care benefits.

Source: boydcpa.com

Source: boydcpa.com

2019 w2 instructions notice to employee. Dues, uniform payments, health insurance premiums deducted,. This reporting is for informational purposes only, to show employees the value of their health care benefits. 2019 w2 instructions notice to employee. Do employers have to report health insurance on w2 for 2019?

Source: news.illinoisstate.edu

Source: news.illinoisstate.edu

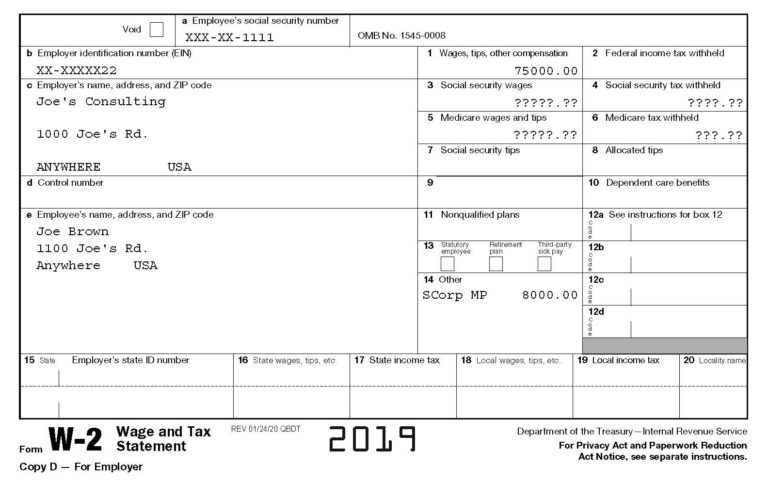

Create report favorites to save time use mnemonics to create report favorites Do employers have to report health insurance on w2 for 2019? 54045 box 3 60000 box 5 60000 12a 18500 12b w 6900 14 casdi 634.50 14 scorp health 12545. Create report favorites to save time use mnemonics to create report favorites Y—deferrals under a section 409a nonqualified deferred compensation plan.

You should record both you and your employees’ contribution to healthcare. Do small employers need to report health insurance on w2 is important information with hd images sourced from all websites in the world. This amount is reported for informational purposes only and is not taxable. Depending on the chosen program, you can partially or completely protect yourself from unforeseen expenses. W2 box 14 states nt health benefits with an amount in the box.

Source: studylib.net

Source: studylib.net

54045 box 3 60000 box 5 60000 12a 18500 12b w 6900 14 casdi 634.50 14 scorp health 12545. This reporting is for informational purposes only, to show employees the value of their health care benefits. It is included in box 12 in order to provide comparable consumer information on the cost of health care coverage. Confused about whether health insurance premiums are deductible. Report on form 8889, health savings accounts (hsas).

Source: tax-queen.com

Source: tax-queen.com

And if the accident / insurance event occurs, the insurance company will bear all or all of the costs in full or in part. Pacific prime’s report on the state of health insurance is back, and our second ever edition already has its upgrade. Report on form 8889, health savings accounts (hsas). Create report favorites to save time use mnemonics to create report favorites The amount reported with code dd is not taxable, but neither can it be claimed as a tax deduction (medical expense) by an individual taxpayer.

Source: doctorheck.blogspot.com

Source: doctorheck.blogspot.com

54045 box 3 60000 box 5 60000 12a 18500 12b w 6900 14 casdi 634.50 14 scorp health 12545. Pacific prime’s report on the state of health insurance is back, and our second ever edition already has its upgrade. You don’t have to report healthcare coverage for retirees or former employees. This reporting is for informational purposes only, to show employees the value of their. The amount reported with code dd is not taxable, but neither can it be claimed as a tax deduction (medical expense) by an individual taxpayer.

Source: mycity4her.com

Source: mycity4her.com

This reporting is for informational purposes only, to show employees the value of their. Reporting health insurance on w2 for 2016 is a tool to reduce your risks. W 2 reporting requirements for employer provided health coverage do small employers need to report health insurance on w2. Do employers have to report health insurance on w2 for 2019? Pacific prime’s report on the state of health insurance is back, and our second ever edition already has its upgrade.

Source: aischasworldofphotos.blogspot.com

Source: aischasworldofphotos.blogspot.com

54045 box 3 60000 box 5 60000 12a 18500 12b w 6900 14 casdi 634.50 14 scorp health 12545. 12 {box 12 reporting elements} w2 category: 2019 w2 instructions notice to employee. Depending on the chosen program, you can partially or completely protect yourself from unforeseen expenses. Also know, do i have to report health insurance on w2 for 2019?

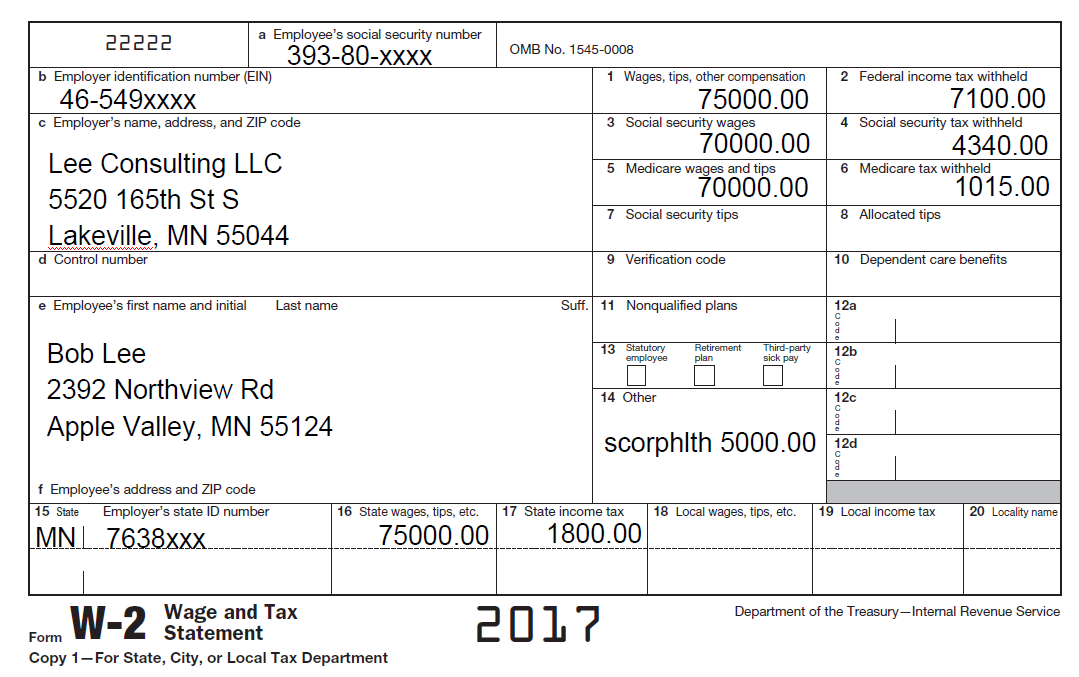

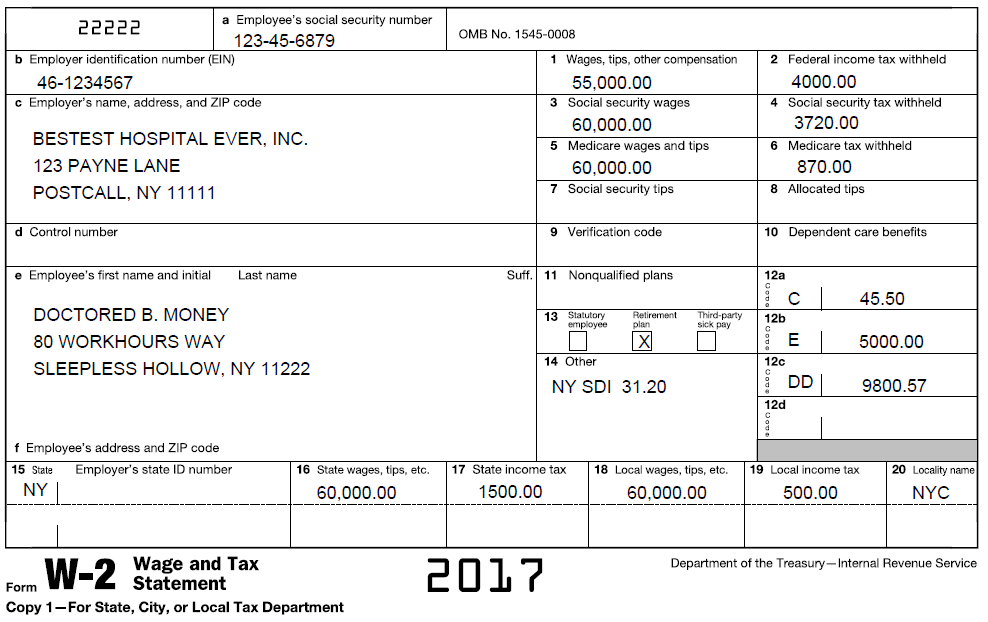

.png?width=800&name=2017 W-2 FORM (2).png “W2 Reporting Required for Nanny TaxFree Healthcare Benefits”) Source: info.homeworksolutions.com

12 {box 12 reporting elements} w2 category: Confused about whether health insurance premiums are deductible. Dues, uniform payments, health insurance premiums deducted,. The shareholder health insurance amount should display: Technically, no business has to offer health insurance to their employees.

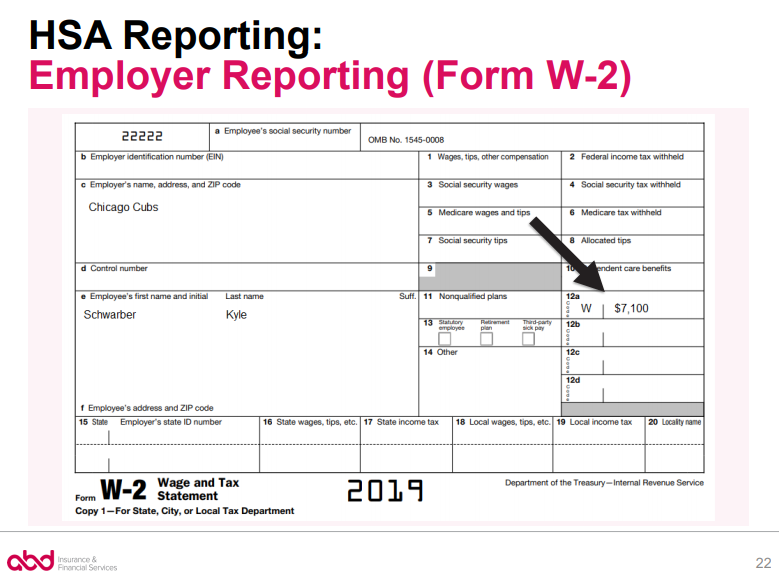

Source: theabdteam.com

Source: theabdteam.com

What is section 125 in box 14 on my w2? This amount is reported for informational purposes only and is not taxable. You don’t have to report healthcare coverage for retirees or former employees. Do small employers have to report health insurance on w2 for 2019? This reporting is for informational purposes only, to show employees the value of their.

Source: ah-studio.com

Source: ah-studio.com

Dues, uniform payments, health insurance premiums deducted,. However, if the employer contributes to an hfsa, the amount in excess of the employee’s contribution is reportable. 2019 w2 instructions notice to employee. Reporting health insurance on w2 for 2016 is a tool to reduce your risks. 54045 box 3 60000 box 5 60000 12a 18500 12b w 6900 14 casdi 634.50 14 scorp health 12545.

Source: treatsinc.org

Source: treatsinc.org

Do small employers have to report health insurance on w2 for 2019? W 2 reporting requirements for employer provided health coverage do small employers need to report health insurance on w2. Dues, uniform payments, health insurance premiums deducted,. This amount is reported for informational purposes only and is not taxable. Do small employers have to report health insurance on w2 for 2019?

Source: journeypayroll.com

Source: journeypayroll.com

What is section 125 in box 14 on my w2? This amount is reported for informational purposes only and is not taxable. This reporting is for informational purposes only, to show employees the value of their. 2019 w2 instructions notice to employee. Technically, no business has to offer health insurance to their employees.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title reporting health insurance on w2 for 2019 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information