Reporting minor accidents to insurance Idea

Home » Trending » Reporting minor accidents to insurance IdeaYour Reporting minor accidents to insurance images are available in this site. Reporting minor accidents to insurance are a topic that is being searched for and liked by netizens now. You can Download the Reporting minor accidents to insurance files here. Get all free images.

If you’re searching for reporting minor accidents to insurance images information connected with to the reporting minor accidents to insurance topic, you have pay a visit to the ideal blog. Our site always provides you with suggestions for viewing the highest quality video and picture content, please kindly search and find more enlightening video content and graphics that match your interests.

Reporting Minor Accidents To Insurance. Always report accidents to your insurance company, no matter how minor they appear. What are the risks of not reporting an accident to your insurance company? By reporting your accident to your insurance company, you may be able to avoid premium increases. After all, it’s just a few scratches.

ACCIDENT REPORTING AND INSURANCE CLAIMS Precision From precision-motorworks.com.sg

ACCIDENT REPORTING AND INSURANCE CLAIMS Precision From precision-motorworks.com.sg

Based on what you included, you most likely should not report it to your insurance company. The other driver could decide to report the accident to insurance : Failing to report may put your entire claim at risk. By letting them know the accident was minor and explaining what happened, you eliminate the chance the other driver will have to manipulate the accident into a version that never happened. Reporting minor accidents to insurance. Even if you don’t intend to make a claim, you should report all accidents to your insurance company.

Usually car insurance policies state that you must tell your insurer about any accident, even if it was minor and you don’t want to claim on your insurance.

Usually car insurance policies state that you must tell your insurer about any accident, even if it was minor and you don’t want to claim on your insurance. The police will make a report if necessary, but if it’s a minor accident with minimal damage or injuries, then it may not be necessary. These are accidents where there are no injuries or property damage. If you fail to report it, your insurer could refuse to renew your policy or you. The driver assumes that his insurance rates will increase, and the driver assumes that things can just be worked out with the other driver without. The other driver could decide to report the accident to insurance :

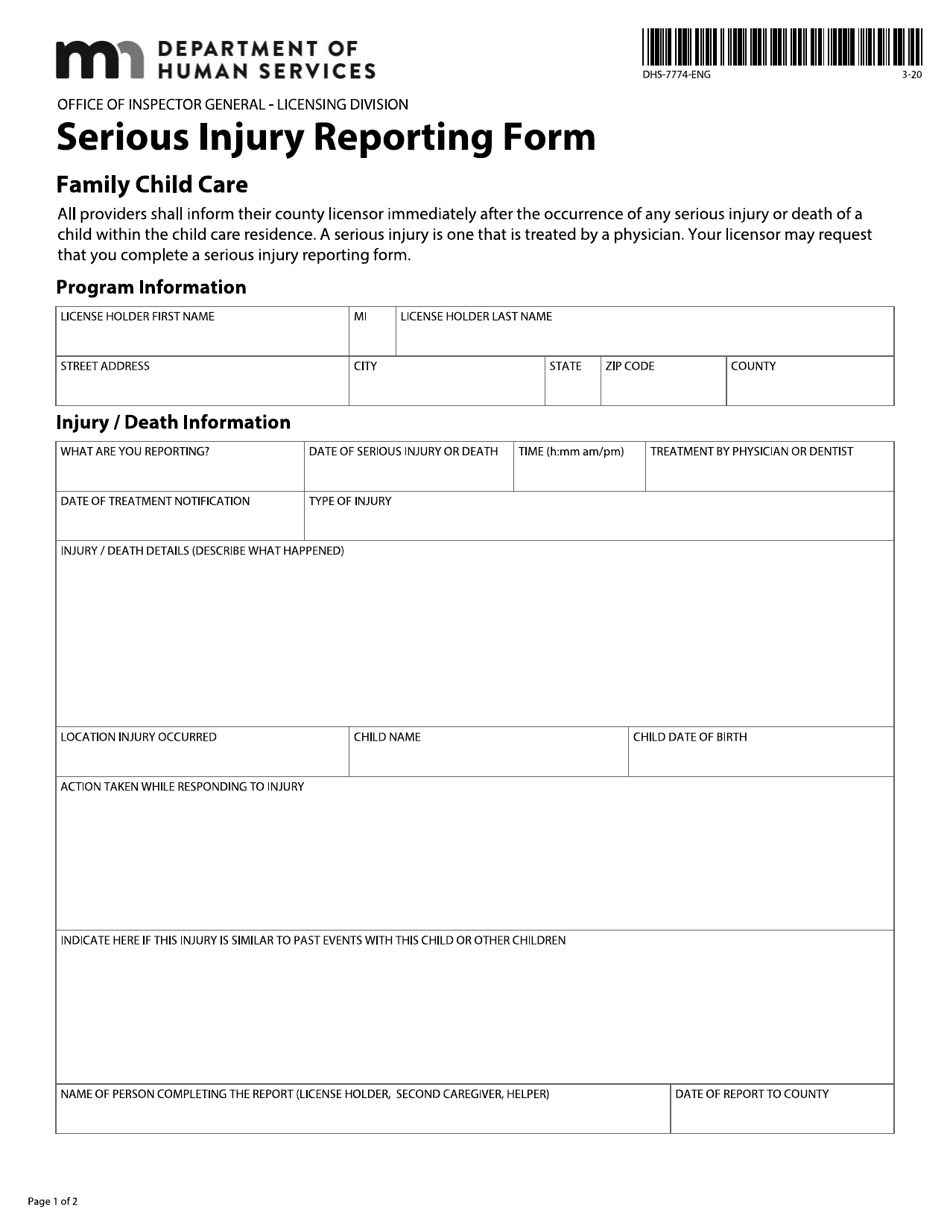

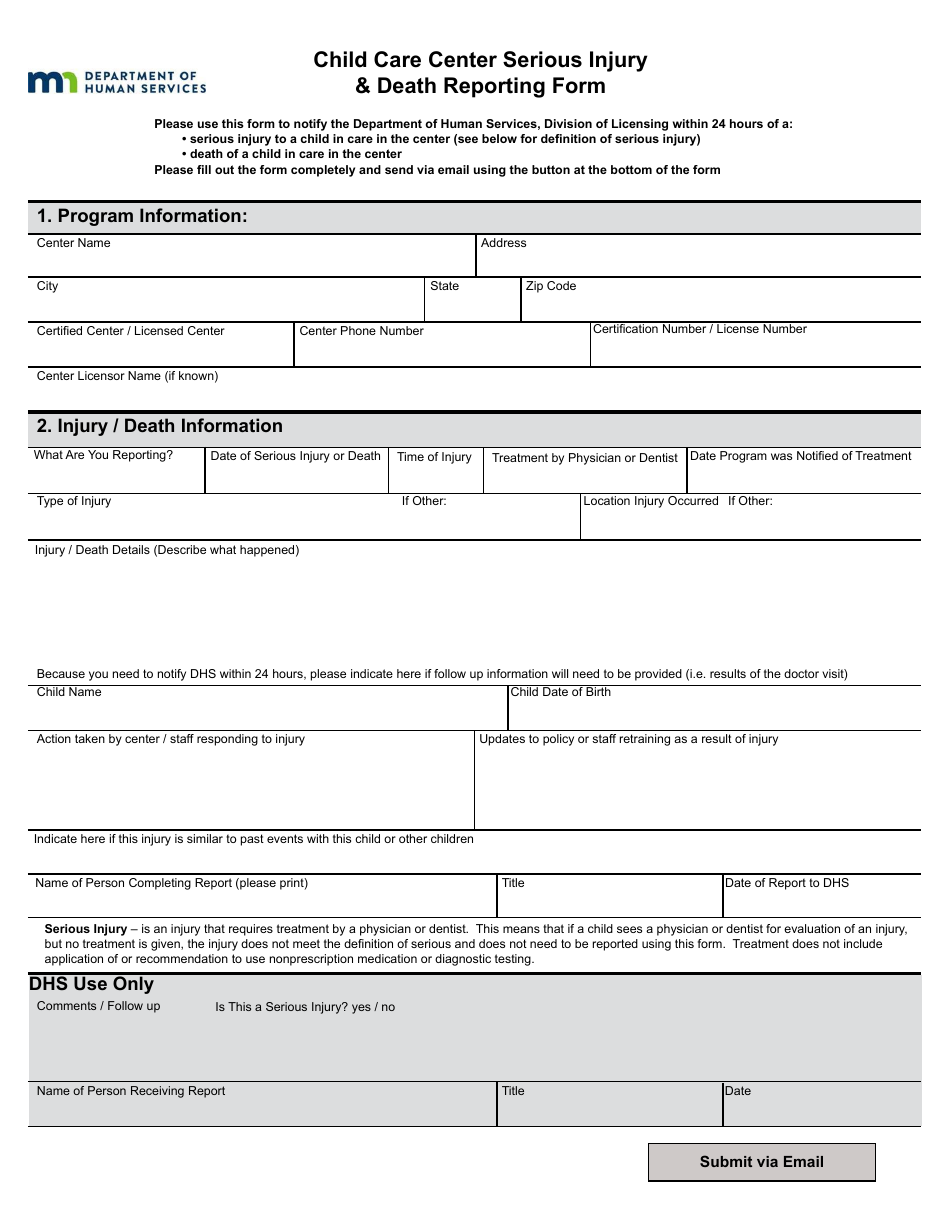

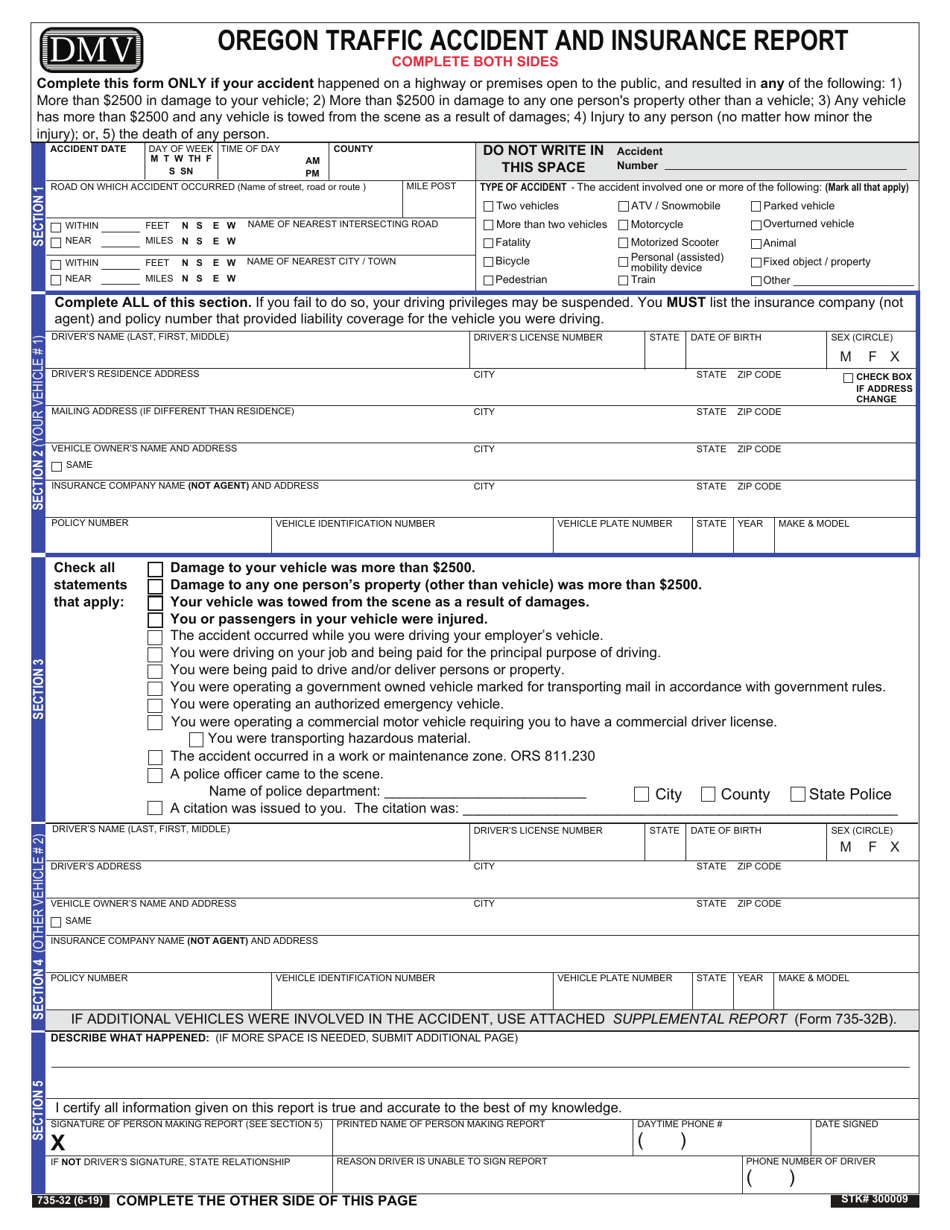

Source: templateroller.com

Source: templateroller.com

First, though, you don�t have a deductible for the damage you caused to the other car. There are many other risks associated with failure to report an accident to police and your insurance company. A minor fender bender may not seem like a major problem. In some states, you do not need to report minor accidents in which you will not be filing an insurance claim. You must also report the accident to your insurance company, even if.

Source: insurancehotline.com

Source: insurancehotline.com

Many insurance companies require that you report car damage and accidents within seven days, even if you’re not sure about filing a claim. In pennsylvania, the police do not have to report to the scene of an accident when there are no or only very minor injuries and no or very limited damage to property. Reporting minor accidents to insurance. Many insurance companies require that you report car damage and accidents within seven days, even if you’re not sure about filing a claim. Even if you don’t intend to make a claim, you should report all accidents to your insurance company.

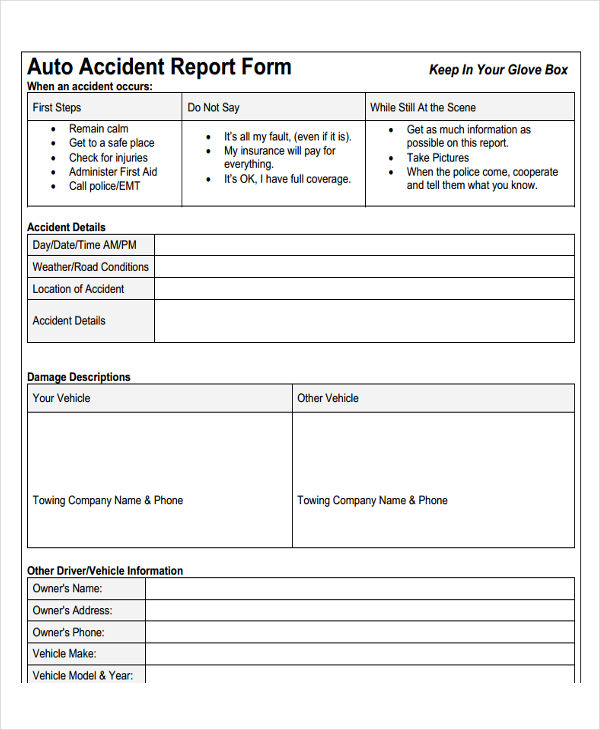

Source: pinterest.com

Source: pinterest.com

It is recommended that you call your insurance company or broker in the event of a car accident, even if it’s minor. You’ve been in a car wreck involving another vehicle. Here are reasons why it is important to do this: This can also make you look guilty because you didn’t file a claim. In pennsylvania, the police do not have to report to the scene of an accident when there are no or only very minor injuries and no or very limited damage to property.

Source: formtemplate.org

Source: formtemplate.org

Here are reasons why it is important to do this: Usually car insurance policies state that you must tell your insurer about any accident, even if it was minor and you don’t want to claim on your insurance. Based on what you included, you most likely should not report it to your insurance company. In some states, you do not need to report minor accidents in which you will not be filing an insurance claim. Why you must report a minor accident to your insurance company.

Source: templateroller.com

Source: templateroller.com

There are a few situations when notification is always recommended. You must also report the accident to your insurance company, even if. Your responsibility for reporting an accident to your insurance company. The other driver could decide to report the accident to insurance : Your broker and insurance company will help you follow the process that takes place after an accident occurs.

Source: lowrylaw.com

Source: lowrylaw.com

First, though, you don�t have a deductible for the damage you caused to the other car. Even if you don’t intend to make a claim, you should report all accidents to your insurance company. This can also make you look guilty because you didn’t file a claim. Many insurance companies require that you report car damage and accidents within seven days, even if you’re not sure about filing a claim. You should call them as soon after the accident as possible.

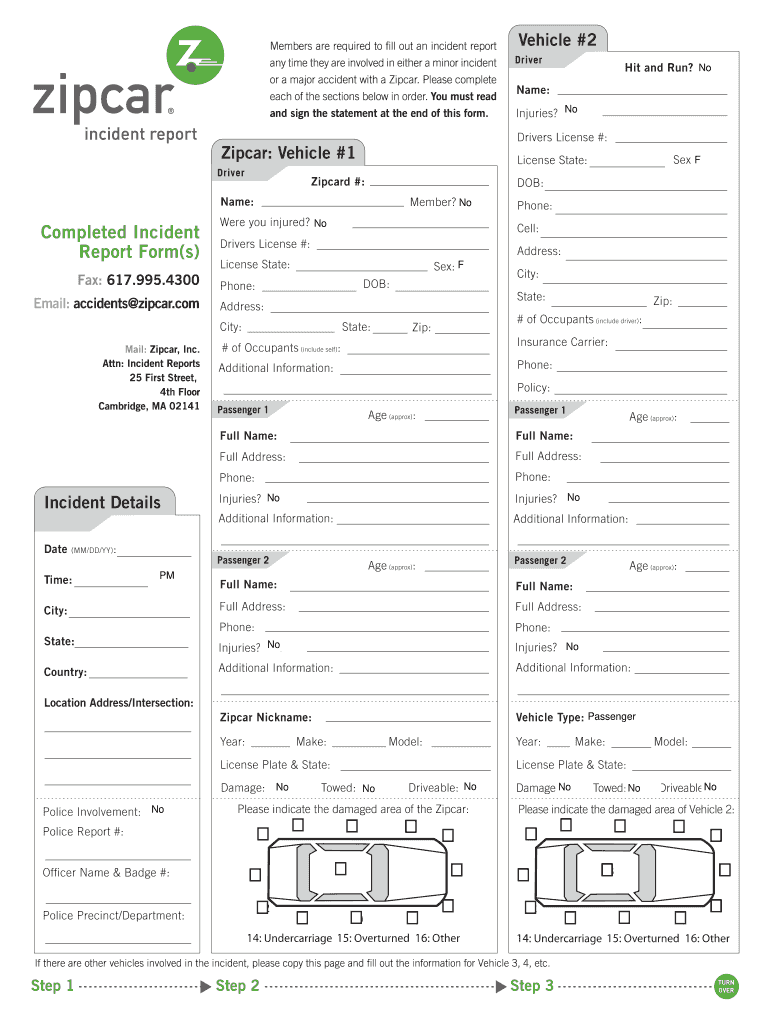

Source: signnow.com

Source: signnow.com

After all, it’s just a few scratches. A minor fender bender may not seem like a major problem. Your broker and insurance company will help you follow the process that takes place after an accident occurs. However, more serious accidents, those involving injuries, damage, or both, will need to be reported to the dmv and/or police. Here are reasons why it is important to do this:

Source: lundylaw.com

Source: lundylaw.com

If, for any reason you do not exchange details at the scene of the accident, you should report the incident to the police within 24hrs. If this happens, your insurance company will be notified of the accident and you could risk having your insurance cancelled. The police will make a report if necessary, but if it’s a minor accident with minimal damage or injuries, then it may not be necessary. It is recommended that you call your insurance company or broker in the event of a car accident, even if it’s minor. People who are involved in minor collisions often try to avoid reporting these types of accidents to their insurance companies for two reasons:

Source: financialsignal.com

Source: financialsignal.com

Reporting your accident is simply notifying your insurance company that an accident occurred, not filing a claim to receive coverage for your property damages or injuries. Your responsibility for reporting an accident to your insurance company. You will save yourself a lot of trouble in the future. These are accidents where there are no injuries or property damage. Failing to report may put your entire claim at risk.

Source: templateroller.com

Source: templateroller.com

By letting them know the accident was minor and explaining what happened, you eliminate the chance the other driver will have to manipulate the accident into a version that never happened. This is because the other driver might decide to make a claim without you knowing. You should report the accident to your car insurance provider even if you’re not planning to make a claim. The other driver could decide to report the accident to insurance : The insurance claim is definitely one of them, but the sooner you report your accident, the sooner you can be finished with the entire process.

Source: templateroller.com

Source: templateroller.com

First, though, you don�t have a deductible for the damage you caused to the other car. Based on what you included, you most likely should not report it to your insurance company. Why you must report a minor accident to your insurance company. People who are involved in minor collisions often try to avoid reporting these types of accidents to their insurance companies for two reasons: In other instances, accidents may never get reported to anyone;

Source: butlerwootenpeak.com

Source: butlerwootenpeak.com

You should call them as soon after the accident as possible. Reporting minor accidents to insurance. Your responsibility for reporting an accident to your insurance company. There are many other risks associated with failure to report an accident to police and your insurance company. Or repairs could be made by the owner or at a repair facility that doesn’t report to carfax.

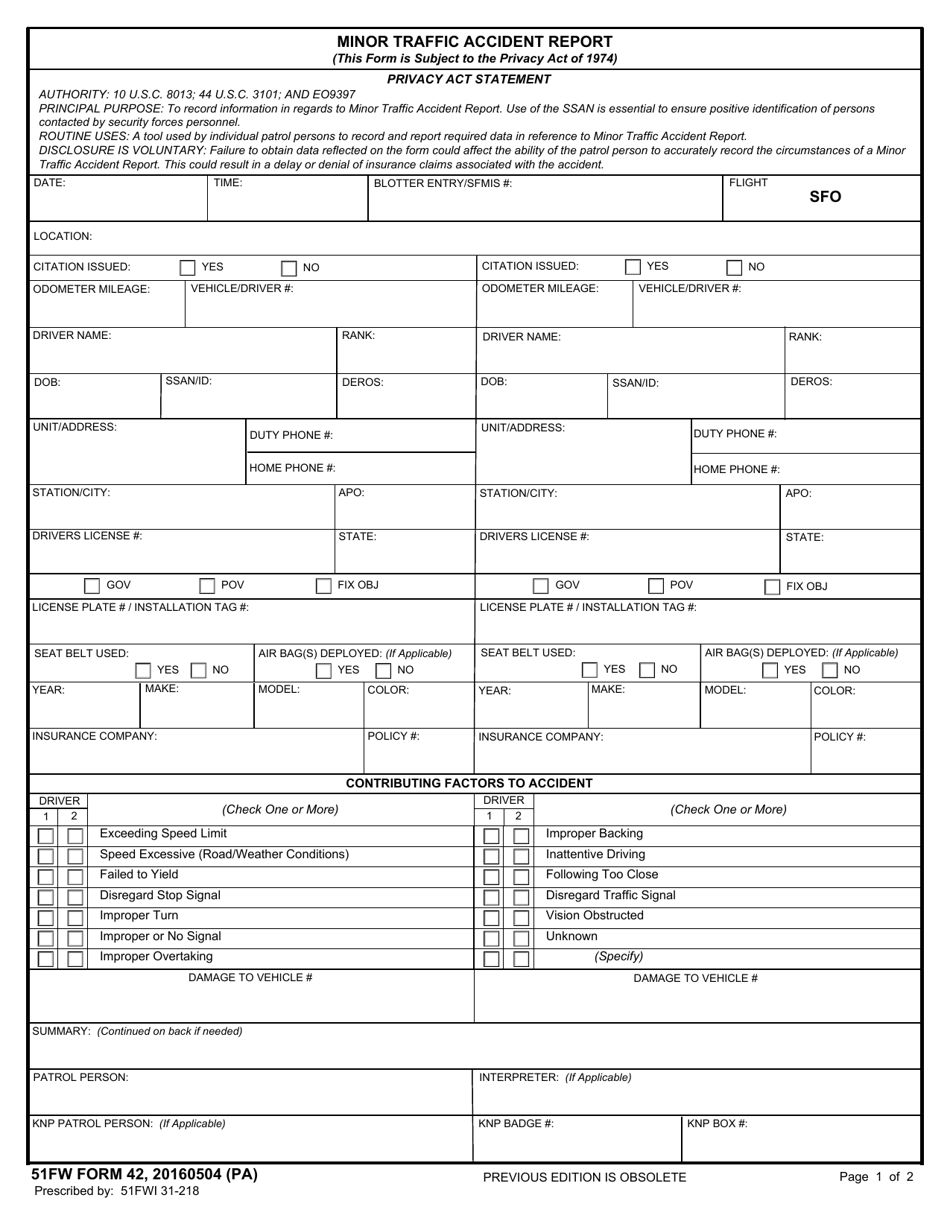

Source: affordablecarinsswa.blogspot.com

There are many other risks associated with failure to report an accident to police and your insurance company. However, more serious accidents, those involving injuries, damage, or both, will need to be reported to the dmv and/or police. One of the conditions policyholders agree to is to report all accidents to the insurer. Usually car insurance policies state that you must tell your insurer about any accident, even if it was minor and you don’t want to claim on your insurance. A minor fender bender may not seem like a major problem.

Source: bryantpsc.com

Source: bryantpsc.com

A minor fender bender may not seem like a major problem. You can do this by going to your local police station. Even if you don’t intend to make a claim, you should report all accidents to your insurance company. The other driver could decide to report the accident to insurance : Reporting your accident is simply notifying your insurance company that an accident occurred, not filing a claim to receive coverage for your property damages or injuries.

Source: thebalance.com

Source: thebalance.com

Even if you don’t intend to make a claim, you should report all accidents to your insurance company. If, for any reason you do not exchange details at the scene of the accident, you should report the incident to the police within 24hrs. How much does minor accident affect car value? The driver assumes that his insurance rates will increase, and the driver assumes that things can just be worked out with the other driver without. What are the risks of not reporting an accident to your insurance company?

Source: fotorise.com

Source: fotorise.com

If you fail to report it, your insurer could refuse to renew your policy or you. There are a few situations when notification is always recommended. Failing to report may put your entire claim at risk. Your insurance rates will in all likelihood go up over the course of the next three years more than $600 to $700 so financially it�s not a good idea. However, this is generally not a good idea.

Source: precision-motorworks.com.sg

Source: precision-motorworks.com.sg

For example, if your car was. First, though, you don�t have a deductible for the damage you caused to the other car. You will save yourself a lot of trouble in the future. What are the risks of not reporting an accident to your insurance company? If you are involved in a crash, there as some key steps you can take to protect yourself.

Source: pinterest.com

Source: pinterest.com

People who are involved in minor collisions often try to avoid reporting these types of accidents to their insurance companies for two reasons: Reporting your accident is simply notifying your insurance company that an accident occurred, not filing a claim to receive coverage for your property damages or injuries. This is because the other driver might decide to make a claim without you knowing. The registration numbers of the cars involved. After all, it’s just a few scratches.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title reporting minor accidents to insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information