Representations and warranties insurance Idea

Home » Trending » Representations and warranties insurance IdeaYour Representations and warranties insurance images are available. Representations and warranties insurance are a topic that is being searched for and liked by netizens now. You can Download the Representations and warranties insurance files here. Find and Download all free images.

If you’re looking for representations and warranties insurance pictures information linked to the representations and warranties insurance topic, you have come to the ideal site. Our site frequently gives you suggestions for downloading the highest quality video and image content, please kindly hunt and locate more informative video articles and graphics that match your interests.

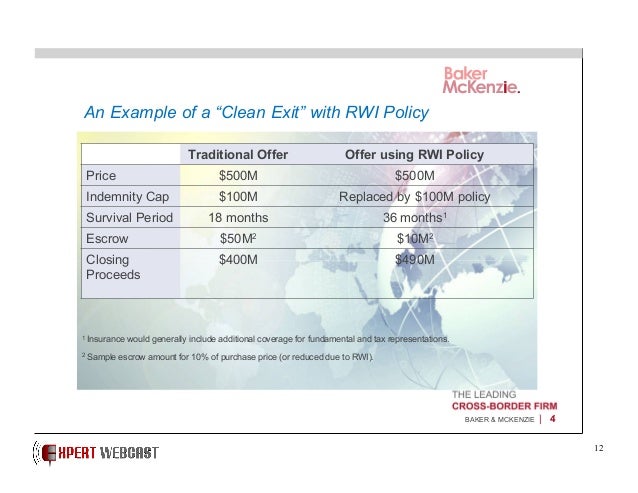

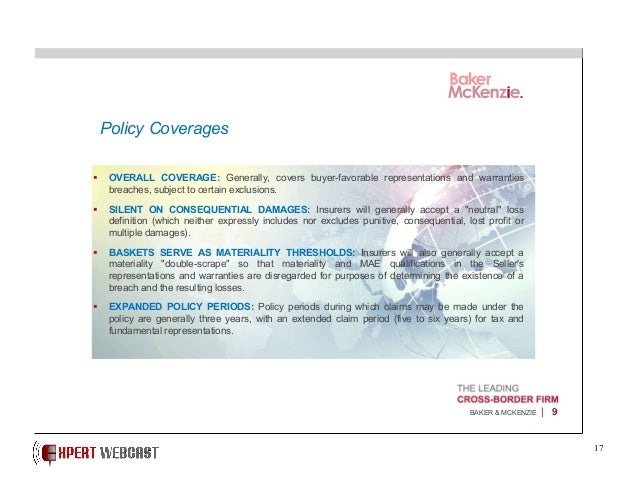

Representations And Warranties Insurance. R&w insurance is often used as an alternative to traditional indemnification in m&a. “representation & warranty insurance” (“r&w insurance”) is a type of insurance policy purchased in connection with corporate transactions, and covers the indemnification for certain breaches of the representations and warranties in the transaction agreements. It offers both buyers and sellers a tailored solution designed to cover breaches in representations and warranties that are provided by sellers in the. Representation and warranties insurance is a complex solution for a complex situation.

M&A Risk Allocation Representations and Warranties Insurance From slideshare.net

M&A Risk Allocation Representations and Warranties Insurance From slideshare.net

It offers both buyers and sellers a tailored solution designed to cover breaches in representations and warranties that are provided by sellers in the. Representations and warranties insurance — a form of coverage designed to guarantee the contractual representations made by sellers associated with corporate mergers and acquisitions. General representations number of years after closing fundamental representations number of years after closing It is designed to provide additional flexibility in. Unlike the typical posture of a litigation, the representations and warranties insurance claim process works optimally when it is collaborative, with the initial goal being to ensure that the insurance carrier understands the breach and the resulting loss. Protection from financial loss resulting from representation and warranty indemnity claims;

Representations and warranties insurance is an insurance policy used in mergers and acquisitions to protect against losses arising due to the seller’s breach of certain of its representations in.

Hughes, managing director, cpa/cff, cgma, cva. It offers both buyers and sellers a tailored solution designed to cover breaches in representations and warranties that are provided by sellers in the. Protection from financial loss resulting from representation and warranty indemnity claims; Rwi policies typically also provide coverage for losses resulting from breaches of the sellers’ Representations and warranties insurance (“rwi”) is a risk allocation product that has recently received a significant amount of attention in canada in light of its growing status as a fundamental component of m&a transactions. For example, the seller of a company may represent that the company�s underground storage tanks are in good repair.

(4).jpg “What is representations and warranties insurance”) Source: insurancebusinessmag.com

By purchasing reps and warranties insurance, buyers can distinguish a bid, sellers can reduce indemnity obligations and both parties can close deals with ease, speed and confidence. Rwi policies typically also provide coverage for losses resulting from breaches of the sellers’ Protection from financial loss resulting from representation and warranty indemnity claims; 2.3 please advise proposed duration of coverage of representations and warranties: Representations and warranties insurance provides sellers with:

Source: slideshare.net

Source: slideshare.net

For example, the seller of a company may represent that the company�s underground storage tanks are in good repair. Available for both buyers and sellers in a transaction, representations and warranties insurance provides protection against financial losses ¹, including costs associated with defending claims, for certain unintentional and unknown breaches of the seller’s representations and warranties made in the. It offers both buyers and sellers a tailored solution designed to cover breaches in representations and warranties that are provided by sellers in the. What is representation and warranty insurance? The policy later responded for an alleged breach of representations and warranties made by the seller.

Source: slideshare.net

Source: slideshare.net

Reps and warranties insurance is a contract between the buyer (or seller) and an insurance company whereby the insurance company will indemnify for losses resulting from a breach of reps and warrants. R&w insurance policy retention amount will be borne by the insurers in accordance with the terms of the policy. Hughes, managing director, cpa/cff, cgma, cva. Representations and warranties (r&w) insurance. Representations and warranties insurance — a form of coverage designed to guarantee the contractual representations made by sellers associated with corporate mergers and acquisitions.

Source: planattorney.org

Source: planattorney.org

Representations and warranties insurance provides sellers with: It is designed to provide additional flexibility in. While rwi has been around for more than 20 years, rwi policies have become increasingly popular due to the “hot” m&a market and decreased policy costs, including decreases to both the policy What is representations & warranties insurance? Unlike the typical posture of a litigation, the representations and warranties insurance claim process works optimally when it is collaborative, with the initial goal being to ensure that the insurance carrier understands the breach and the resulting loss.

Source: arias-us.org

Source: arias-us.org

Insurance (“r&w,” also known as warranty and indemnity insurance) has now become a valuable and increasingly popular tool that can help mergers and acquisitions progress more smoothly. Ultimately, reps and warranties insurance helps protect both buyers and sellers involved in transactions from financial loss if inaccuracies in reps and warranties are made. Unlike the typical posture of a litigation, the representations and warranties insurance claim process works optimally when it is collaborative, with the initial goal being to ensure that the insurance carrier understands the breach and the resulting loss. Protection from financial loss resulting from representation and warranty indemnity claims; Hughes, managing director, cpa/cff, cgma, cva.

Source: hubinternational.com

Source: hubinternational.com

Rwi policies typically also provide coverage for losses resulting from breaches of the sellers’ Representation is made by the proposer to the insurer relating to a proposed risk. Reps and warranties insurance is a contract between the buyer (or seller) and an insurance company whereby the insurance company will indemnify for losses resulting from a breach of reps and warrants. Ultimately, reps and warranties insurance helps protect both buyers and sellers involved in transactions from financial loss if inaccuracies in reps and warranties are made. Warranty is an undertaking by the insured.

Source: advisorselect.com

Source: advisorselect.com

It is designed to provide additional flexibility in. Ultimately, reps and warranties insurance helps protect both buyers and sellers involved in transactions from financial loss if inaccuracies in reps and warranties are made. A representations and warranties insurance policy featuring an $8,000,000 limit was placed in excess of the $2,000,000 indemnity that the seller agrees to secure can bridge the gap which facilitated the closing of the sale. R&w insurance is often used as an alternative to traditional indemnification in m&a. While the amount may vary depending on the risk of the deal, it is usually between 1% and 3% of the overall transaction price.

Source: slideshare.net

Source: slideshare.net

Warranty is an undertaking by the insured. Insurance (“r&w,” also known as warranty and indemnity insurance) has now become a valuable and increasingly popular tool that can help mergers and acquisitions progress more smoothly. In short, once the ink has dried on the merger or acquisition deal, r&w covers some of the unforeseen costs caused by any breaches of the seller’s representations, whether. Reps and warranties insurance is essentially breach of contract cover designed to enhance or replace the indemnification given by. What is representation and warranty insurance?

Source: slideshare.net

Source: slideshare.net

Rwi is a type of insurance policy that can be purchased in connection with an acquisition. Representation and warranties insurance is a complex solution for a complex situation. In short, once the ink has dried on the merger or acquisition deal, r&w covers some of the unforeseen costs caused by any breaches of the seller’s representations, whether. Often, during m&a negotiations, a gap exists between the level of indemnification that will be offered by a seller and 2.3 please advise proposed duration of coverage of representations and warranties:

Source: slideshare.net

Source: slideshare.net

Rwi is a type of insurance policy that can be purchased in connection with an acquisition. Unlike the typical posture of a litigation, the representations and warranties insurance claim process works optimally when it is collaborative, with the initial goal being to ensure that the insurance carrier understands the breach and the resulting loss. “representation & warranty insurance” (“r&w insurance”) is a type of insurance policy purchased in connection with corporate transactions, and covers the indemnification for certain breaches of the representations and warranties in the transaction agreements. Ultimately, reps and warranties insurance helps protect both buyers and sellers involved in transactions from financial loss if inaccuracies in reps and warranties are made. Cleaner exits by reducing escrows or purchase price holdbacks and enhancing returns on sellers’ capital;

Source: slideshare.net

Source: slideshare.net

Rwi is used primarily to protect the insured party from losses and liabilities incurred as a result of breaches of. Ultimately, reps and warranties insurance helps protect both buyers and sellers involved in transactions from financial loss if inaccuracies in reps and warranties are made. Representation is made by the proposer to the insurer relating to a proposed risk. Representations and warranties insurance provides sellers with: Representation and warranties insurance is a complex solution for a complex situation.

Source: hubinternational.com

Source: hubinternational.com

There is nothing standard about the sale or merger of a company and so very little is standard about the insurance that supports it. R&w insurance is often used as an alternative to traditional indemnification in m&a. In short, once the ink has dried on the merger or acquisition deal, r&w covers some of the unforeseen costs caused by any breaches of the seller’s representations, whether. Warranty is an undertaking by the insured. “representation & warranty insurance” (“r&w insurance”) is a type of insurance policy purchased in connection with corporate transactions, and covers the indemnification for certain breaches of the representations and warranties in the transaction agreements.

Source: slideshare.net

Source: slideshare.net

What is representations & warranties insurance? “representation & warranty insurance” (“r&w insurance”) is a type of insurance policy purchased in connection with corporate transactions, and covers the indemnification for certain breaches of the representations and warranties in the transaction agreements. Representation and warranties insurance is a complex solution for a complex situation. It offers both buyers and sellers a tailored solution designed to cover breaches in representations and warranties that are provided by sellers in the. Representations and warranties insurance is an insurance policy used in mergers and acquisitions to protect against losses arising due to the seller’s breach of certain of its representations in.

Source: slideshare.net

Source: slideshare.net

Representations and warranties insurance is an insurance policy used in mergers and acquisitions to protect against losses arising due to the seller’s breach of certain of its representations in. Often, during m&a negotiations, a gap exists between the level of indemnification that will be offered by a seller and R&w insurance is essentially a breach of contract coverage designed to enhance or replace the indemnification given by the seller to the buyer. Rwi is insurance that provides protection against losses that result from breaches of the representations and warranties in an acquisition agreement. Available for both buyers and sellers in a transaction, representations and warranties insurance provides protection against financial losses ¹, including costs associated with defending claims, for certain unintentional and unknown breaches of the seller’s representations and warranties made in the.

Source: slideshare.net

Source: slideshare.net

By purchasing reps and warranties insurance, buyers can distinguish a bid, sellers can reduce indemnity obligations and both parties can close deals with ease, speed and confidence. Rwi is used primarily to protect the insured party from losses and liabilities incurred as a result of breaches of. Protection from financial loss resulting from representation and warranty indemnity claims; It offers both buyers and sellers a tailored solution designed to cover breaches in representations and warranties that are provided by sellers in the. Reps and warranties insurance is essentially breach of contract cover designed to enhance or replace the indemnification given by.

Source: slideshare.net

Source: slideshare.net

It offers both buyers and sellers a tailored solution designed to cover breaches in representations and warranties that are provided by sellers in the. Hughes, managing director, cpa/cff, cgma, cva. While the amount may vary depending on the risk of the deal, it is usually between 1% and 3% of the overall transaction price. Representations and warranties insurance provides sellers with: Reps and warranties insurance is a contract between the buyer (or seller) and an insurance company whereby the insurance company will indemnify for losses resulting from a breach of reps and warrants.

Source: machadomeyer.com.br

Source: machadomeyer.com.br

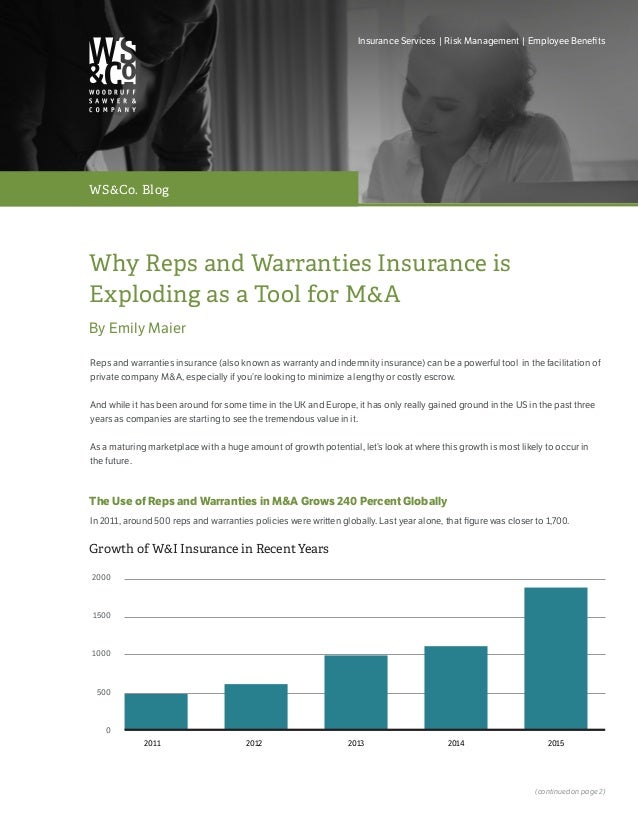

Representations and warranties insurance (rwi) is becoming an increasingly common and required tool to expedite m&a transactions, bridge gaps in deal negotiations and reduce buyers’ and sellers’ risks of financial losses after deals close. It is designed to provide additional flexibility in. Representations and warranties insurance — a form of coverage designed to guarantee the contractual representations made by sellers associated with corporate mergers and acquisitions. R&w insurance policy retention amount will be borne by the insurers in accordance with the terms of the policy. Unlike the typical posture of a litigation, the representations and warranties insurance claim process works optimally when it is collaborative, with the initial goal being to ensure that the insurance carrier understands the breach and the resulting loss.

Source: luanncapital.com

Source: luanncapital.com

Representation is made by the proposer to the insurer relating to a proposed risk. While the amount may vary depending on the risk of the deal, it is usually between 1% and 3% of the overall transaction price. By purchasing reps and warranties insurance, buyers can distinguish a bid, sellers can reduce indemnity obligations and both parties can close deals with ease, speed and confidence. Protection from financial loss resulting from representation and warranty indemnity claims; Reps and warranties insurance is a contract between the buyer (or seller) and an insurance company whereby the insurance company will indemnify for losses resulting from a breach of reps and warrants.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title representations and warranties insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information