Requiring renters insurance in lease Idea

Home » Trending » Requiring renters insurance in lease IdeaYour Requiring renters insurance in lease images are ready in this website. Requiring renters insurance in lease are a topic that is being searched for and liked by netizens now. You can Find and Download the Requiring renters insurance in lease files here. Download all free photos.

If you’re searching for requiring renters insurance in lease pictures information related to the requiring renters insurance in lease keyword, you have visit the right site. Our website frequently gives you suggestions for seeing the highest quality video and image content, please kindly search and find more informative video content and graphics that match your interests.

Requiring Renters Insurance In Lease. However, the lease condition must require that all tenants purchase renters insurance. If a tenant’s belongings are stolen or damaged, their renters insurance will generally cover the loss, whereas a tenant without renters insurance may look to you to help replace the items. Generally, you can and may require renters insurance as part of a lease agreement. One of the requirements of your new lease is that you must maintain at least $100,000 (or $300,000) of personal liability insurance.

Should Landlords Require Renters Insurance? Zillow From zillow.com

Should Landlords Require Renters Insurance? Zillow From zillow.com

Generally, you can and may require renters insurance as part of a lease agreement. Such a provision extends your renter�s insurance to your landlord, which may keep a lawsuit from requiring the use of rental property insurance. Again, many tenants don’t know that the landlord won’t pay for them to stay in a hotel after a fire, but renters insurance covers that. The results of the case were an indication that even if your lease requires renter’s insurance, a tenant’s failure to maintain that policy is not a material breech and therefore likely to leave no option for enforcement. Generally, the renters insurance lease clause will require a tenant to have a renters insurance policy. And they can ask tenants to have a minimum amount of insurance coverage.

Once you receive proof of their insurance policies, keep them on file.

If done correctly, requiring your tenant to have their own renters insurance policy is legal. Once you receive proof of their insurance policies, keep them on file. Mitigates the risk of conflict. Then, make a document tracking each. Since this will be an added cost to your tenants, you want to be as upfront about this policy as possible. “lessee is required to provide proof of renters insurance within 14 days of the lease start date.”.

Source: fool.com

Source: fool.com

Generally, you can and may require renters insurance as part of a lease agreement. It’s a contractual issue, and what a landlord says usually goes. Generally, the renters insurance lease clause will require a tenant to have a renters insurance policy. If you’re weighing this decision, be aware that adding a renters. As a landlord or property manager, you can and should require a tenant to buy and maintain renters insurance in the lease.

Source: philipbarron.net

Source: philipbarron.net

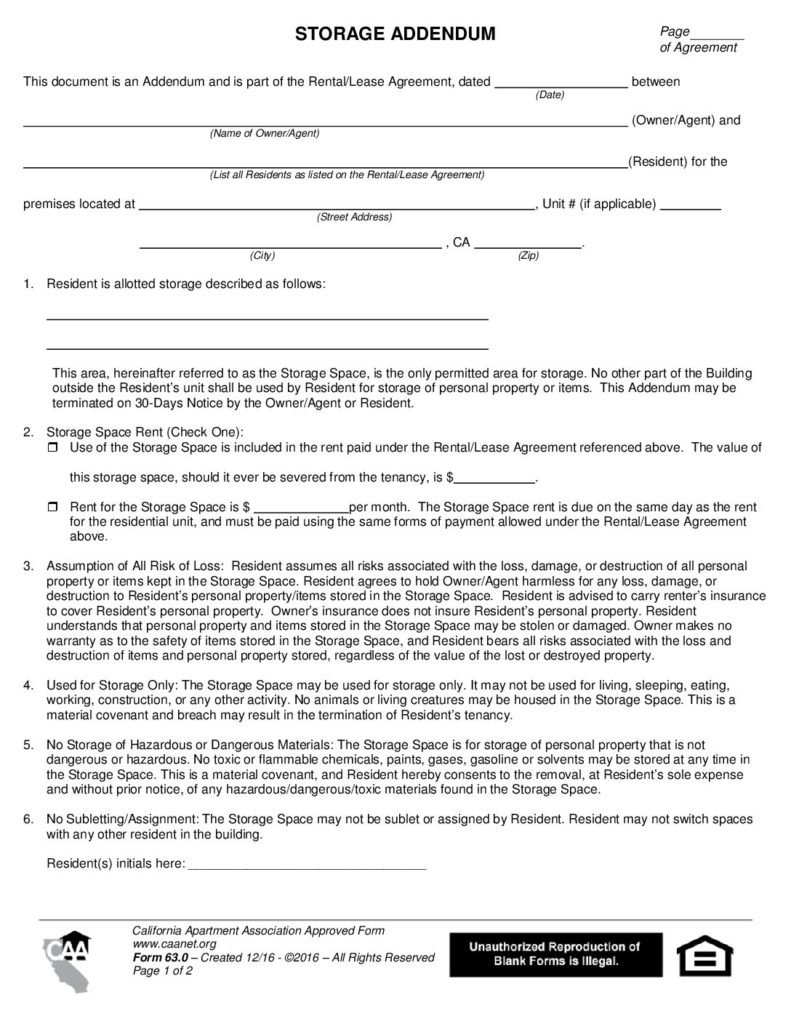

The first step is requiring renter’s insurance, but it goes deeper than that. In most states, a landlord may require renters insurance in their lease agreement. (i) commercial general liability insurance, written on an occurrence basis, with a combined single limit for bodily injury and property damages of not less than two million dollars. The policy insures everyone in the household and covers personal belongings in the property. And they can ask tenants to have a minimum amount of insurance coverage.

Source: zillow.com

Source: zillow.com

Professional companies that require insurance do not give the keys to a property until the tenant provides them a copy of a policy that the landlord’s name has been added to. It’s a contractual issue, and what a landlord says usually goes. The landlord may require renters insurance by including a clause in the lease that says: The results of the case were an indication that even if your lease requires renter’s insurance, a tenant’s failure to maintain that policy is not a material breech and therefore likely to leave no option for enforcement. Most tenants do not consider renters insurance a priority, especially when they first move into a new place, even if their lease requires it.

Source: apartments.com

Source: apartments.com

The landlord disclaims any and all responsibility for damages to your personal property arising from fires and other events. Generally, the renters insurance lease clause will require a tenant to have a renters insurance policy. The first step is requiring renter’s insurance, but it goes deeper than that. Many renters do not understand the value of good insurance coverage until it is too late. If done correctly, requiring your tenant to have their own renters insurance policy is legal.

Source: prontoinsurance.com

Source: prontoinsurance.com

Reduces the risk of damage caused by. In your lease, specify the amount of coverage you require as well as when you need proof of insurance from their policy provider. Your landlord�s inclusion on the policy also means he or she can request notice of changes to the policy, including cancelation, which would make you in violation of the rental lease agreement. Requiring rental insurance on an existing lease. And they can ask tenants to have a minimum amount of insurance coverage.

Source: allcountydenvermetro.com

Source: allcountydenvermetro.com

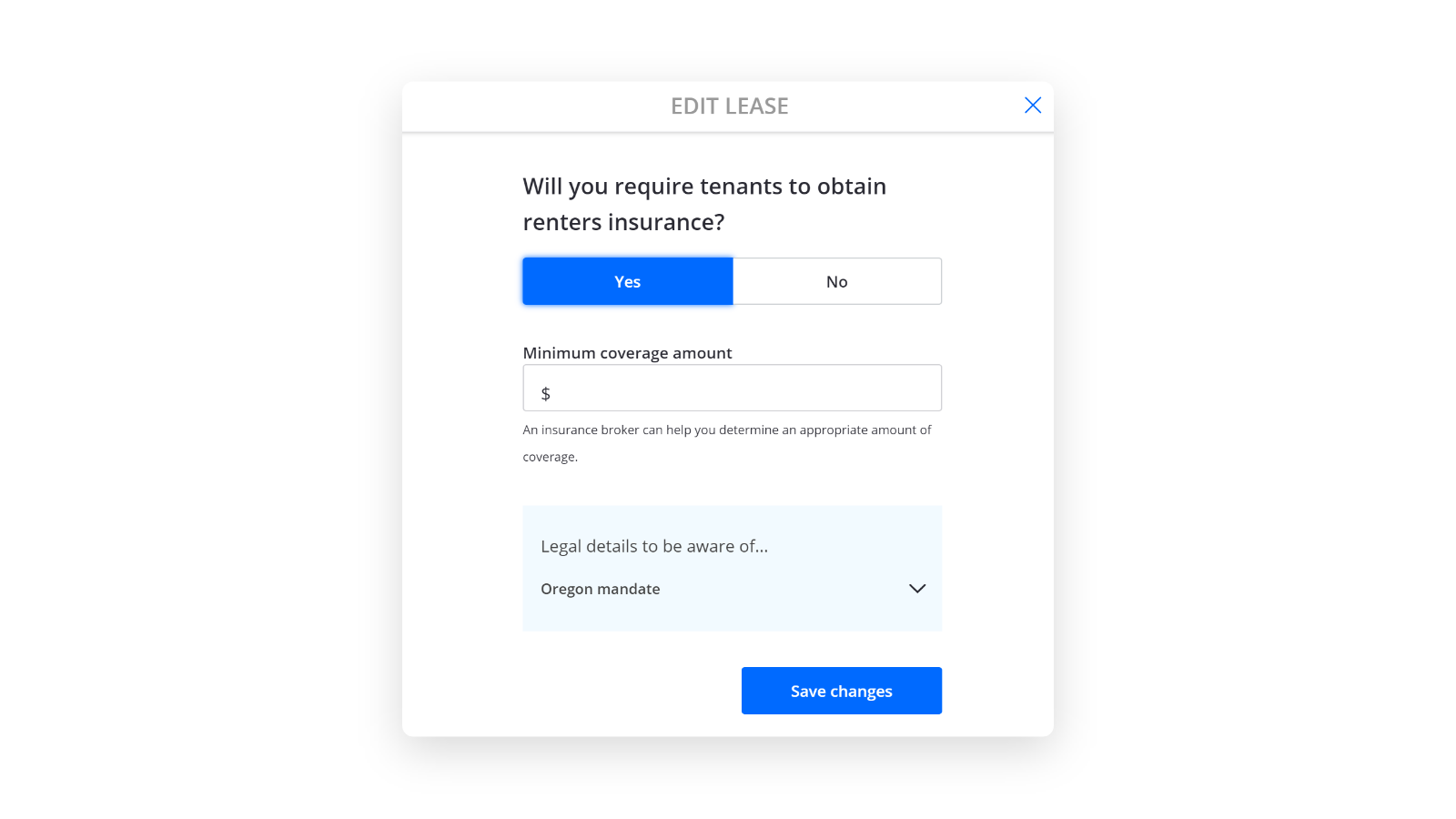

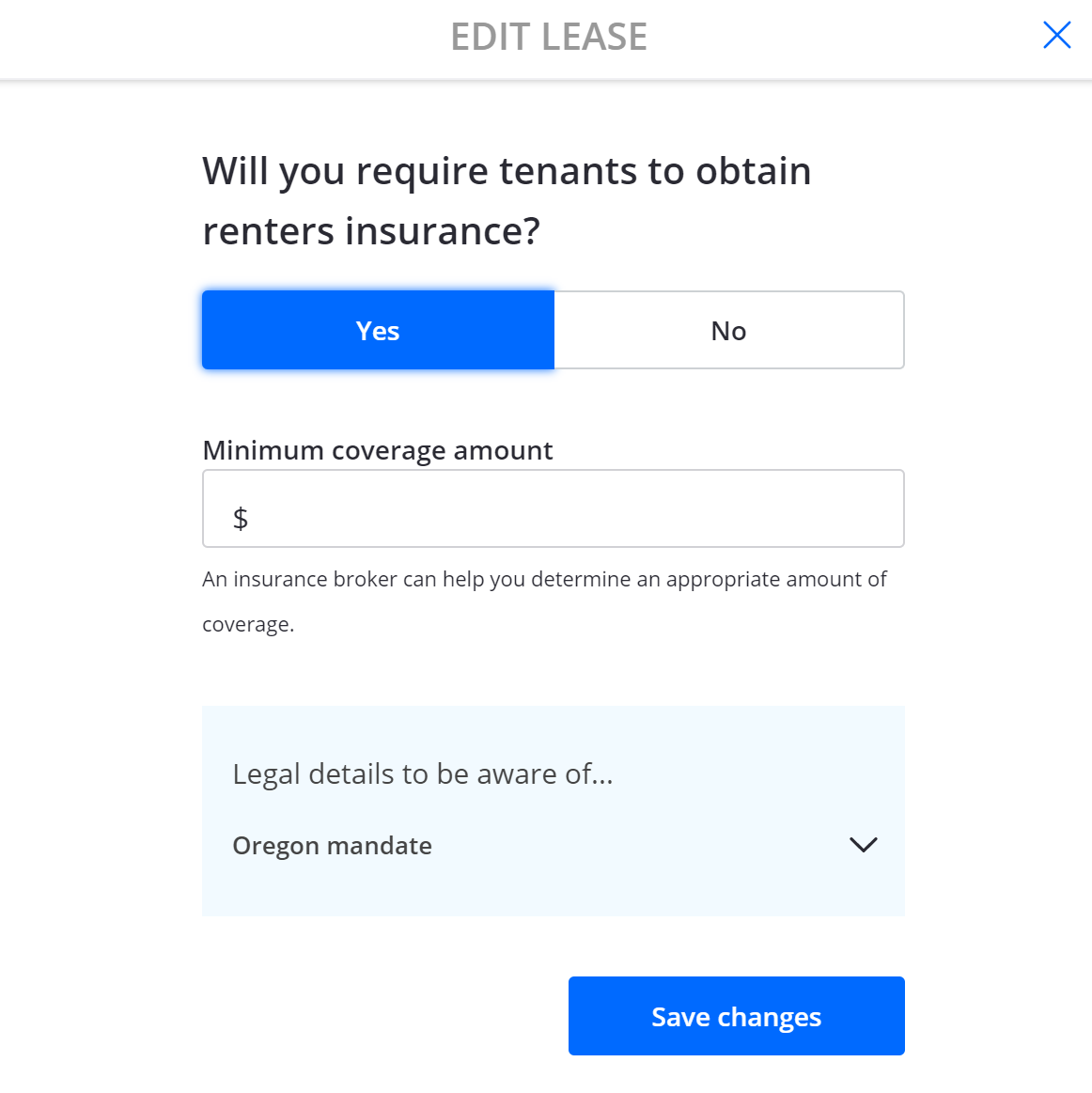

From the main menu, select leasing > active leases. You are able to require a minimum amount of coverage as well; (i) commercial general liability insurance, written on an occurrence basis, with a combined single limit for bodily injury and property damages of not less than two million dollars. From the available tabs, click on settings and then renters. One of the requirements of your new lease is that you must maintain at least $100,000 (or $300,000) of personal liability insurance.

Source: sampletemplates.com

Source: sampletemplates.com

The most common way to do this is with a renters insurance policy. ( check one) ☐ tenant is required to obtain, and maintain at all times during the term, a renter ’s insurance policy with a minimum of $100,000.00 personal liability coverage. In your lease, specify the amount of coverage you require as well as when you need proof of insurance from their policy provider. It’s a contractual issue, and what a landlord says usually goes. From the main menu, select leasing > active leases.

Source: clovered.com

Source: clovered.com

The first step is requiring renter’s insurance, but it goes deeper than that. And they can ask tenants to have a minimum amount of insurance coverage. If a landlord did not initially require renters insurance in the lease, it may be added through a lease amendment or at renewal time, provided the tenant agrees or the lease terms allow for changes. The landlord disclaims any and all responsibility for damages to your personal property arising from fires and other events. There was a case that was recently decided by the california court of appeals.

Source: insuranceupdates.org

Source: insuranceupdates.org

The first step is requiring renter’s insurance, but it goes deeper than that. And they can ask tenants to have a minimum amount of insurance coverage. Using the search bar at the top of the page, type in the name of the lease you wish to require renters insurance for. It’s a contractual issue, and what a landlord says usually goes. Yes, landlords can require renters insurance as a condition of leases in most states ( oklahoma is an exception).

Source: caanet.org

Source: caanet.org

Here are some reasons why requiring renters insurance can be beneficial to a landlord: Since this will be an added cost to your tenants, you want to be as upfront about this policy as possible. From the available tabs, click on settings and then renters. You are able to require a minimum amount of coverage as well; Once you receive proof of their insurance policies, keep them on file.

Source: ranchomesarentals.com

Source: ranchomesarentals.com

As a landlord or property manager, you can and should require a tenant to buy and maintain renters insurance in the lease. Americanheritageproperties • may 23, 2017. If done correctly, requiring your tenant to have their own renters insurance policy is legal. Can renters insurance be required by a lease? “lessee is required to provide proof of renters insurance within 14 days of the lease start date.”.

Source: uslegalforms.com

Source: uslegalforms.com

From the available tabs, click on settings and then renters. In your lease, specify the amount of coverage you require as well as when you need proof of insurance from their policy provider. Once you receive proof of their insurance policies, keep them on file. If you really want to protect yourself, require the tenant’s policy to list you as an additionally insured. If you’re weighing this decision, be aware that adding a renters.

Source: effectivecoverage.com

Source: effectivecoverage.com

“lessee is required to provide proof of renters insurance within 14 days of the lease start date.”. Requiring renters insurance for your tenants is not required by law, but some landlords make renters insurance mandatory as a part of their lease. The landlord may require renters insurance by including a clause in the lease that says: If done correctly, requiring your tenant to have their own renters insurance policy is legal. Landlords are legally allowed to require renters insurance on a rental lease agreement.

Source: luxurypropertycare.com

Source: luxurypropertycare.com

One of the requirements of your new lease is that you must maintain at least $100,000 (or $300,000) of personal liability insurance. He had tenant insurance, but his insurance company tried to tell him that the replacement of the window was the owner�s responsibility, which it is not, based on the language in the lease. If a tenant’s belongings are stolen or damaged, their renters insurance will generally cover the loss, whereas a tenant without renters insurance may look to you to help replace the items. Professional companies that require insurance do not give the keys to a property until the tenant provides them a copy of a policy that the landlord’s name has been added to. From the main menu, select leasing > active leases.

Source: ecoflatsseattle.com

Source: ecoflatsseattle.com

Such a provision extends your renter�s insurance to your landlord, which may keep a lawsuit from requiring the use of rental property insurance. Professional companies that require insurance do not give the keys to a property until the tenant provides them a copy of a policy that the landlord’s name has been added to. As a landlord or property manager, you can and should require a tenant to buy and maintain renters insurance in the lease. And they can ask tenants to have a minimum amount of insurance coverage. Can renters insurance be required by a lease?

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Your landlord�s inclusion on the policy also means he or she can request notice of changes to the policy, including cancelation, which would make you in violation of the rental lease agreement. Many renters do not understand the value of good insurance coverage until it is too late. Yes, landlords can require renters insurance as a condition of leases in most states ( oklahoma is an exception). Such a provision extends your renter�s insurance to your landlord, which may keep a lawsuit from requiring the use of rental property insurance. The policy insures everyone in the household and covers personal belongings in the property.

Source: rentalleaseagreement.net

Source: rentalleaseagreement.net

The results of the case were an indication that even if your lease requires renter’s insurance, a tenant’s failure to maintain that policy is not a material breech and therefore likely to leave no option for enforcement. The most common way to do this is with a renters insurance policy. Professional companies that require insurance do not give the keys to a property until the tenant provides them a copy of a policy that the landlord’s name has been added to. Many renters do not understand the value of good insurance coverage until it is too late. Yes, landlords can require renters insurance as a condition of leases in most states ( oklahoma is an exception).

Source: ranchomesarentals.com

Source: ranchomesarentals.com

The tenant’s insurance policy needs to include liability insurance. If you really want to protect yourself, require the tenant’s policy to list you as an additionally insured. The first step is requiring renter’s insurance, but it goes deeper than that. Tenant will name landlord as an interested party or additional insured. Using the search bar at the top of the page, type in the name of the lease you wish to require renters insurance for.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title requiring renters insurance in lease by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information