Rescission insurance information

Home » Trending » Rescission insurance informationYour Rescission insurance images are ready in this website. Rescission insurance are a topic that is being searched for and liked by netizens now. You can Download the Rescission insurance files here. Find and Download all royalty-free photos.

If you’re searching for rescission insurance images information linked to the rescission insurance interest, you have pay a visit to the ideal blog. Our site frequently provides you with hints for seeking the highest quality video and picture content, please kindly hunt and locate more informative video content and graphics that match your interests.

Rescission Insurance. Hufana professor rescission • based on the fundamental characteristics of an insurance contract that it be one of perfect good faith (uberrimae fides) for both parties • grounds for rescission of insurance contracts: Under the affordable care act, rescission is illegal except in cases of fraud or intentional. In o’riordan, potential policyholder, amy o’riordan, applied for life insurance through an independent insurance agent, robert hoyme. Rescission can take place when a policyholder is found to have given fraudulent information on their application.

Bad Faith Rescission of a Health Insurance Policy From gmlawyers.com

Bad Faith Rescission of a Health Insurance Policy From gmlawyers.com

Rescission can take place when a policyholder is found to have given fraudulent information on their application. The potential rescission of an insurance policy will involve a careful review of the underwriting of the policy. Insurance companies have the right to rescind a policy issued based on false or missing information. By contrast, when a policy is canceled, the only money refunded is that for the remaining portion of the term. Is the question objective or This tactic is an example of bad faith insurance, meaning you can fight back and recover money damages for the harm caused by the insurer’s bad behavior.

Rescission is the voiding of a contract by a court that does not recognize it as legally binding.

An insurance company is often allowed to rescind a contract when there is a material misrepresentation on the insurance application. Misrepresentation or fraud on the part of the insurer is also a valid reason for an insured to rescind a contract. Claims for health care you got while you were between 31 and 90 days late paying your premiums will be denied and the healthcare provider will expect you to pay them. Insurance companies will sometimes retroactively cancel your entire policy if you made a mistake on your initial application when you buy an individual market insurance policy. It can be the most effective remedy. This tactic is an example of bad faith insurance, meaning you can fight back and recover money damages for the harm caused by the insurer’s bad behavior.

Source: upi.com

Source: upi.com

By contrast, when a policy is canceled, the only money refunded is that for the remaining portion of the term. Insurance companies offer policies based on information provided by the consumer, whether regarding age and physical condition for health insurance, or speeding tickets and accidents for auto insurance. The rescission of an insurance policy is one of the most underutilized tools in handling insurance claims. Rescission of insurance policies, the exceptions being colorado, connecticut, iowa, missouri, new jersey, ohio and pennsylvania. Giving notice of the rescission to the insured;

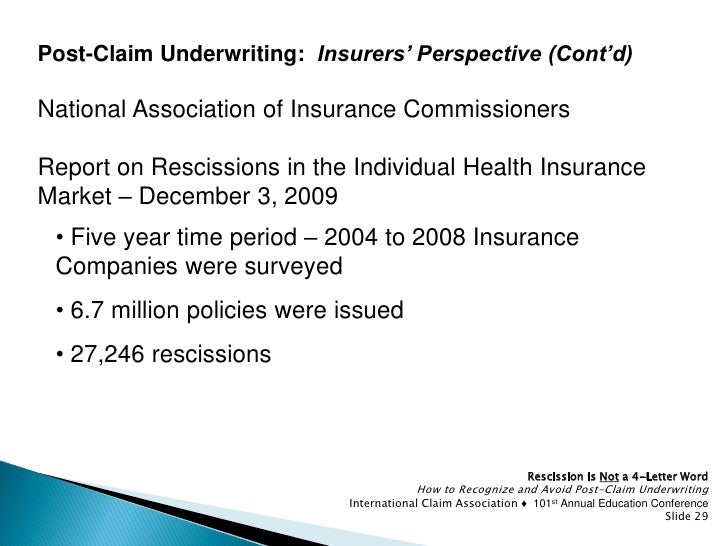

Source: slideshare.net

Source: slideshare.net

In o’riordan, potential policyholder, amy o’riordan, applied for life insurance through an independent insurance agent, robert hoyme. For example, in both new york and connecticut an insurer typically seeks a judgment from a court declaration that rescission is proper. Rescission of insurance policies, the exceptions being colorado, connecticut, iowa, missouri, new jersey, ohio and pennsylvania. Rescission is the voiding of a contract by a court that does not recognize it as legally binding. This tactic is an example of bad faith insurance, meaning you can fight back and recover money damages for the harm caused by the insurer’s bad behavior.

Source: slideshare.net

Source: slideshare.net

An insurance company is often allowed to rescind a contract when there is a material misrepresentation on the insurance application. An insurance company is often allowed to rescind a contract when there is a material misrepresentation on the insurance application. Rescission is the voiding of a contract by a court that does not recognize it as legally binding. If there is a breach of warranty, a material concealment, or a material misrepresentation, rescission is a remedy available for selection by the insurer or the insured. The law of rescission is a major enforcement tool in maintaining the integrity and commercial dynamics of the insurance marketplace.

Giving notice of the rescission to the insured; Giving notice of the rescission to the insured; • must determine if the application question which is the subject of the potential misrepresentation is clear and unambiguous, i.e. Is it capable of more than one reasonable interpretation. Rescission — with respect to a directors and officers (d&o) liability insurance policy, a declaration by an insurer that the policy was never in effect, the result being that coverage for a claim, when tendered by a corporate organization to an insurer, is not covered.

Source: verywellhealth.com

Source: verywellhealth.com

Misrepresentation or fraud on the part of the insurer is also a valid reason for an insured to rescind a contract. An insurance company is often allowed to rescind a contract when there is a material misrepresentation on the insurance application. Claims for health care you got while you were between 31 and 90 days late paying your premiums will be denied and the healthcare provider will expect you to pay them. This means the policyholder should get back any premiums they paid to the insurance company. Rescission is an insurance industry practice in which an insurer takes action retroactively to cancel a policy holder�s coverage by citing omissions or errors in the customer�s application, even if the policy holder has been diligently keeping their policy current.

Source: mortgage.info

Source: mortgage.info

Rescission is normally done by the insurance company, and involves: When the rescission is tied to an insurance claim, the insurer might be unlawfully rescinding your policy to avoid paying the benefits they otherwise owe. Rescission of an insurance policy is one of the most powerful tools insurers have to combat insurance fraud and avoid unnecessary and unintended risks, and one of the most devastating outcomes to a policyholder seeking coverage for a claim. In o’riordan, potential policyholder, amy o’riordan, applied for life insurance through an independent insurance agent, robert hoyme. The plan requires a to complete a questionnaire regarding a� s prior medical history, which affects setting the group rate by the health insurance issuer.

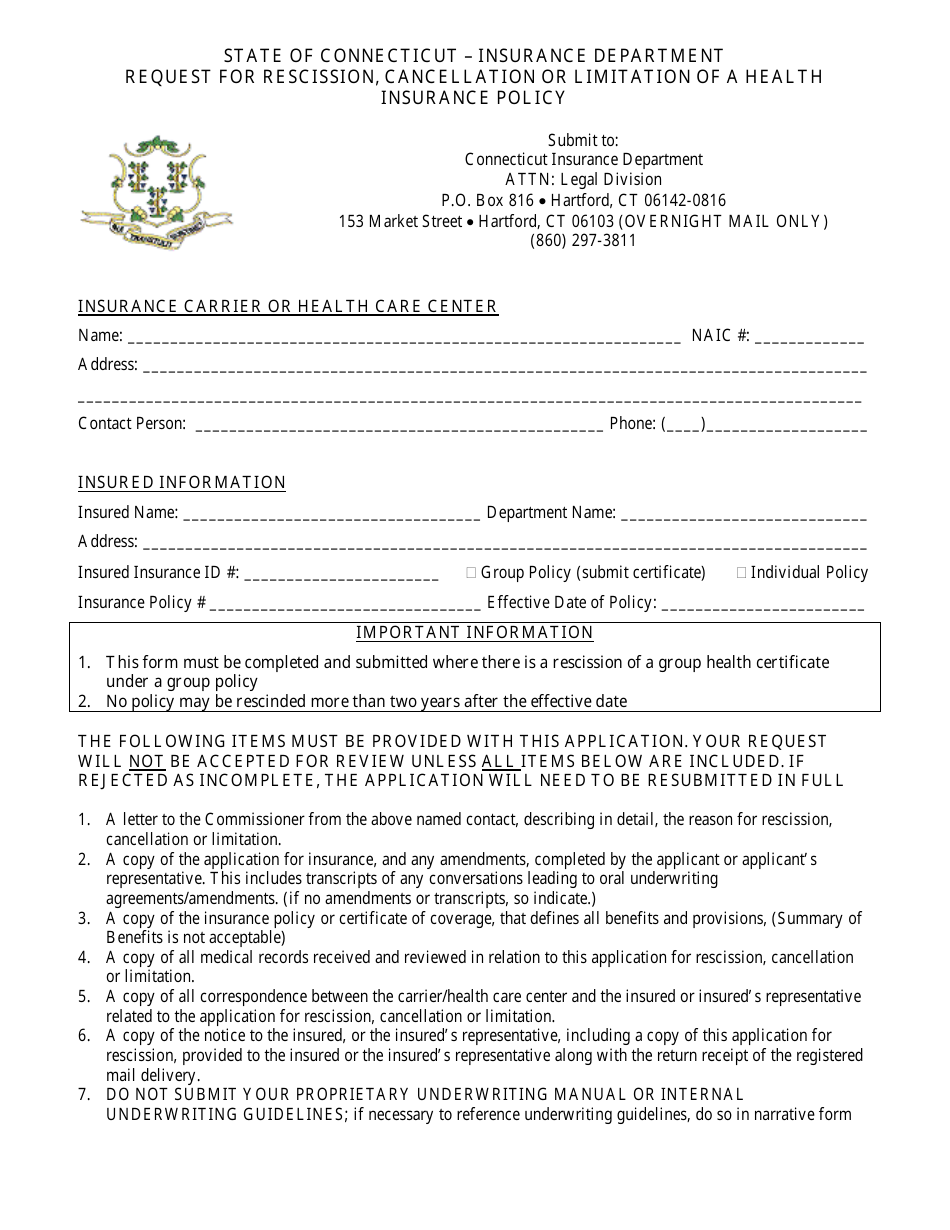

Source: templateroller.com

Source: templateroller.com

Insurance companies offer policies based on information provided by the consumer, whether regarding age and physical condition for health insurance, or speeding tickets and accidents for auto insurance. Rescission of insurance policies, the exceptions being colorado, connecticut, iowa, missouri, new jersey, ohio and pennsylvania. Rescission — with respect to a directors and officers (d&o) liability insurance policy, a declaration by an insurer that the policy was never in effect, the result being that coverage for a claim, when tendered by a corporate organization to an insurer, is not covered. Rescission is an insurance industry practice in which an insurer takes action retroactively to cancel a policy holder�s coverage by citing omissions or errors in the customer�s application, even if the policy holder has been diligently keeping their policy current. Giving notice of the rescission to the insured;

Source: gardenstateloans.com

Source: gardenstateloans.com

By contrast, when a policy is canceled, the only money refunded is that for the remaining portion of the term. Since passage of the affordable care act, rescission is no longer allowed except where fraud is proven. Insurance companies will sometimes retroactively cancel your entire policy if you made a mistake on your initial application when you buy an individual market insurance policy. For example, in both new york and connecticut an insurer typically seeks a judgment from a court declaration that rescission is proper. Insurance companies offer policies based on information provided by the consumer, whether regarding age and physical condition for health insurance, or speeding tickets and accidents for auto insurance.

Source: propertyinsurancecoveragelaw.com

Source: propertyinsurancecoveragelaw.com

Alycen moss and michael handler of the global insurance department present this one hour cozen o’connor webinar on rescission. The affordable care act cites fraud as the only reason for an insurance company to rescind an insurance contract. This means the policyholder should get back any premiums they paid to the insurance company. Is the question objective or Rescission creates procedural considerations, as well.

Source: executivesummaryblog.com

Source: executivesummaryblog.com

Rescission of an insurance policy is one of the most powerful tools insurers have to combat insurance fraud and avoid unnecessary and unintended risks, and one of the most devastating outcomes to a policyholder seeking coverage for a claim. Rescission is an insurance industry practice in which an insurer takes action retroactively to cancel a policy holder�s coverage by citing omissions or errors in the customer�s application, even if the policy holder has been diligently keeping their policy current. Insurance companies have the right to rescind a policy issued based on false or missing information. The potential rescission of an insurance policy will involve a careful review of the underwriting of the policy. This means the policyholder should get back any premiums they paid to the insurance company.

Source: gmlawyers.com

Source: gmlawyers.com

If there is a breach of warranty, a material concealment, or a material misrepresentation, rescission is a remedy available for selection by the insurer or the insured. • must determine if the application question which is the subject of the potential misrepresentation is clear and unambiguous, i.e. As we explained in a previous blog article, rescission legally renders the contract as if it never existed and releases both parties from their obligations under the contract. Rescission can take place when a policyholder is found to have given fraudulent information on their application. The plan terms permit rescission of coverage with respect to an individual if the individual engages in fraud or makes an intentional misrepresentation of a material fact.

The affordable care act cites fraud as the only reason for an insurance company to rescind an insurance contract. For example, in both new york and connecticut an insurer typically seeks a judgment from a court declaration that rescission is proper. If there is a breach of warranty, a material concealment, or a material misrepresentation, rescission is a remedy available for selection by the insurer or the insured. Federal kemper life assur., 36 cal.4th 281 (2005), the california supreme court discussed the importance of the distinction between an insurance agent and a broker when it comes to rescission. Rescission of an insurance policy is one of the most powerful tools insurers have to combat insurance fraud and avoid unnecessary and unintended risks, and one of the most devastating outcomes to a policyholder seeking coverage for a claim.

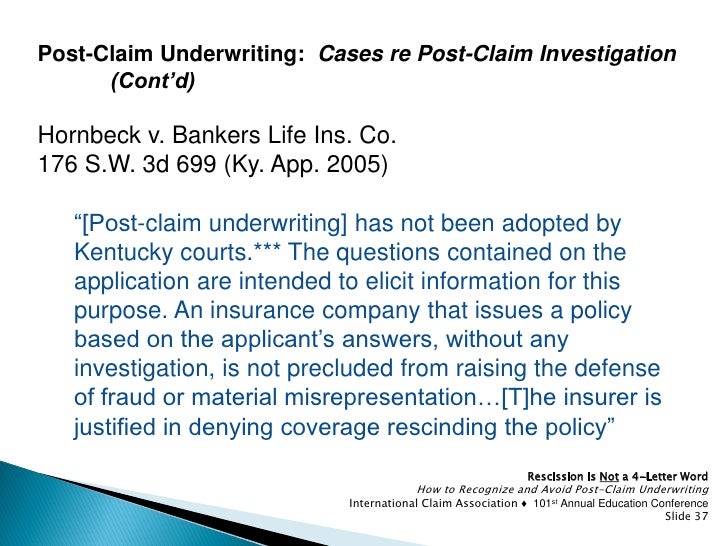

Source: slideshare.net

Source: slideshare.net

An action for rescission permits an An action for rescission permits an Insurance companies will sometimes retroactively cancel your entire policy if you made a mistake on your initial application when you buy an individual market insurance policy. Insurance companies offer policies based on information provided by the consumer, whether regarding age and physical condition for health insurance, or speeding tickets and accidents for auto insurance. The potential rescission of an insurance policy will involve a careful review of the underwriting of the policy.

Source: printablelegaldoc.com

Source: printablelegaldoc.com

Rescission can take place when a policyholder is found to have given fraudulent information on their application. It can be the most effective remedy. The plan requires a to complete a questionnaire regarding a� s prior medical history, which affects setting the group rate by the health insurance issuer. Application questions whether the insurance applicant made any misrepresentations in the application that would merit As we explained in a previous blog article, rescission legally renders the contract as if it never existed and releases both parties from their obligations under the contract.

Source: slideshare.net

Source: slideshare.net

Insurance companies have the right to rescind a policy issued based on false or missing information. The rescission of an insurance policy is one of the most underutilized tools in handling insurance claims. Further, rescission in the context of certain lines of coverage such as life or health insurance can raise additional issues. Rescission is the voiding of a contract by a court that does not recognize it as legally binding. The potential rescission of an insurance policy will involve a careful review of the underwriting of the policy.

Source: gustancho.com

Source: gustancho.com

The retroactive cancellation of a health insurance policy. For example, in both new york and connecticut an insurer typically seeks a judgment from a court declaration that rescission is proper. Application questions whether the insurance applicant made any misrepresentations in the application that would merit The plan requires a to complete a questionnaire regarding a� s prior medical history, which affects setting the group rate by the health insurance issuer. When the rescission is tied to an insurance claim, the insurer might be unlawfully rescinding your policy to avoid paying the benefits they otherwise owe.

Rescission is an insurance industry practice in which an insurer takes action retroactively to cancel a policy holder�s coverage by citing omissions or errors in the customer�s application, even if the policy holder has been diligently keeping their policy current. Rescission — with respect to a directors and officers (d&o) liability insurance policy, a declaration by an insurer that the policy was never in effect, the result being that coverage for a claim, when tendered by a corporate organization to an insurer, is not covered. The law of rescission is a major enforcement tool in maintaining the integrity and commercial dynamics of the insurance marketplace. Rescission of insurance policies, the exceptions being colorado, connecticut, iowa, missouri, new jersey, ohio and pennsylvania. Key points to be reviewed include the following.

Source: researchgate.net

Source: researchgate.net

When the rescission is tied to an insurance claim, the insurer might be unlawfully rescinding your policy to avoid paying the benefits they otherwise owe. Insurance companies have the right to rescind a policy issued based on false or missing information. By contrast, when a policy is canceled, the only money refunded is that for the remaining portion of the term. Rescission of an insurance policy is one of the most powerful tools insurers have to combat insurance fraud and avoid unnecessary and unintended risks, and one of the most devastating outcomes to a policyholder seeking coverage for a claim. Is the question objective or

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title rescission insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information