Reservation of rights insurance Idea

Home » Trending » Reservation of rights insurance IdeaYour Reservation of rights insurance images are ready. Reservation of rights insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Reservation of rights insurance files here. Find and Download all free vectors.

If you’re looking for reservation of rights insurance pictures information linked to the reservation of rights insurance topic, you have pay a visit to the ideal blog. Our site always gives you suggestions for seeking the maximum quality video and picture content, please kindly surf and find more informative video articles and graphics that match your interests.

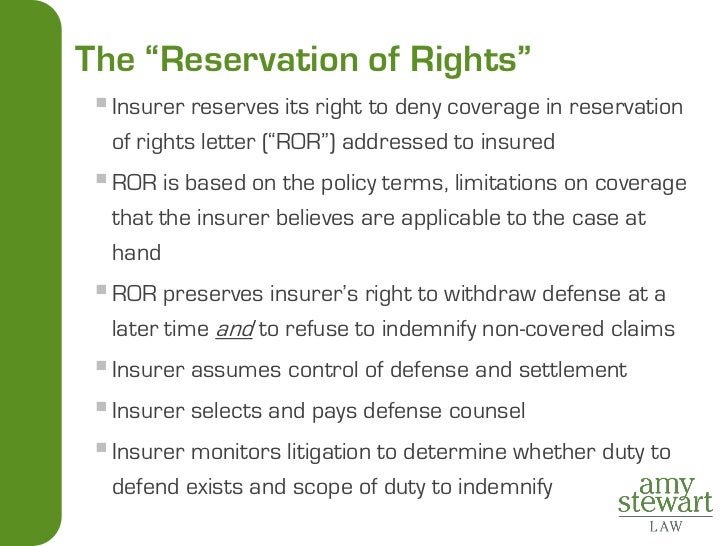

Reservation Of Rights Insurance. Defense under reservation of rights. Home » insurance law » general liability insurance » defense under reservation of rights. A reservation of rights by a liability insurance company is an expression of the insurer’s agreement to defend its policyholder with the limiting condition that it does not waive any right to later deny coverage under the terms of insurance contract. Reservation of rights by an insurance carrier is a form of notice that they are reserving their full legal rights as well as notice that they are not waiving their legal rights to act later.

An Overlooked Reservation Of Rights Issue From coverageopinions.info

An Overlooked Reservation Of Rights Issue From coverageopinions.info

It also announces that the insurer will investigate the soundness of the claim and can advise the insured that he or she may wish to seek out other options for defense regarding a legal action against him or her. The administrative agent and each lender reserves all of its rights to exercise any or all of its rights and remedies at any time and from time to time in connection with any and all defaults or events of default now existing or hereafter arising, whether known or unknown , under the credit agreement or any other document. Defense under reservation of rights. Home » insurance law » general liability insurance » defense under reservation of rights. Reservation of rights by insurers is a subject which evokes strong reactions. Reservation of rights is a useful tool for the insurer to protect itself against the risk of loss of coverage or avoidance rights.

The circumstances surrounding an insurance claim can be extremely difficult for policyholder or other insured party, and an immediate reservation of rights can alienate the insured and damage the relationship of trust which should exist between the insured and its insurer.

Reservation of rights by an insurance company is a statement of intention that they are reserving their full legal rights. In some cases, your liability insurance company may deny coverage to. You would then be on the hook for those damages if you’re found liable. (“the purpose of a reservation of rights letter is to permit the insurer to provide a defense for its insured while it investigates questionable coverage (36). Jun 19, 2017 — a reservation of rights is a term of art in insurance designed to allow an insurer to provide a defense to its insured while still preserving (35). Reservation of rights by an insurance carrier is a form of notice that they are reserving their full legal rights as well as notice that they are not waiving their legal rights to act later.

Source: butlersnow.com

Source: butlersnow.com

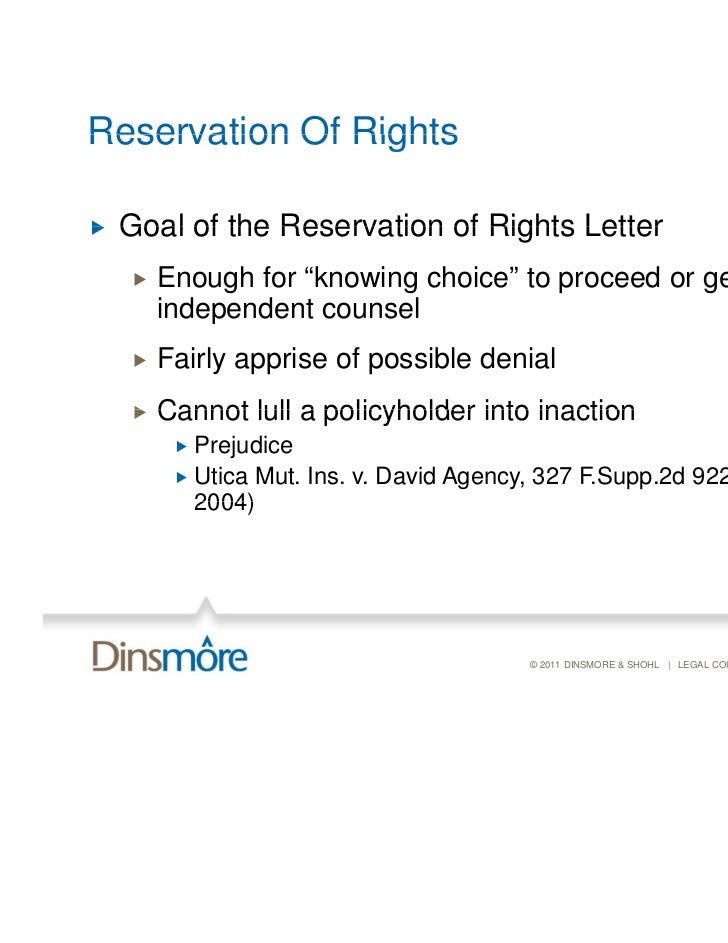

Practical risk management defines a reservation of rights as “an insurer’s notification to an insured that coverage for a claim may not apply. Jun 27, 2017 — a reservation of rights letter can of course affect you as the policyholder if the insurance company does later refuse to cover certain claims (11). It also announces that the insurer will investigate the soundness of the claim and can advise the insured that he or she may wish to seek out other options for defense regarding a legal action against him or her. In an opinion filed january 11, 2017, the south carolina supreme court held that an insurer’s reservation of rights must contain more than verbatim recitation of policy provisions to properly reserve its right to later dispute coverage. Practical risk management defines a reservation of rights as “an insurer’s notification to an insured that coverage for a claim may not apply.

Source: fujoshinoyaoipruebas.blogspot.com

When you receive one of these reservation of rights letters, it means your insurance company is telling you it might not protect you as you thought it would. (“the purpose of a reservation of rights letter is to permit the insurer to provide a defense for its insured while it investigates questionable coverage (36). A reservation of rights by a liability insurance company is an expression of the insurer’s agreement to defend its policyholder with the limiting condition that it does not waive any right to later deny coverage under the terms of insurance contract. Practical risk management defines a reservation of rights as “an insurer’s notification to an insured that coverage for a claim may not apply. Reservation of rights is a useful tool for the insurer to protect itself against the risk of loss of coverage or avoidance rights.

Source: riskmanagementmonitor.com

Source: riskmanagementmonitor.com

A reservation of rights letter can of course affect you as the policyholder if the insurance company does later refuse to cover certain claims made in the lawsuit. When you receive one of these reservation of rights letters, it means your insurance company is telling you it might not protect you as you thought it would. In an opinion filed january 11, 2017, the south carolina supreme court held that an insurer’s reservation of rights must contain more than verbatim recitation of policy provisions to properly reserve its right to later dispute coverage. You would then be on the hook for those damages if you’re found liable. Jun 19, 2017 — a reservation of rights is a term of art in insurance designed to allow an insurer to provide a defense to its insured while still preserving (35).

Source: coverageopinions.info

Source: coverageopinions.info

Reservation of rights is a useful tool for the insurer to protect itself against the risk of loss of coverage or avoidance rights. In some cases, your liability insurance company may deny coverage to. Reservation of rights is a useful tool for the insurer to protect itself against the risk of loss of coverage or avoidance rights. General liability insurance companies will sometimes deny claims if they believe it doesn’t fit your policy, it’s in excess of policy limits or other various reasons. Practical risk management defines a reservation of rights as “an insurer’s notification to an insured that coverage for a claim may not apply.

Source: teagueins.com

Source: teagueins.com

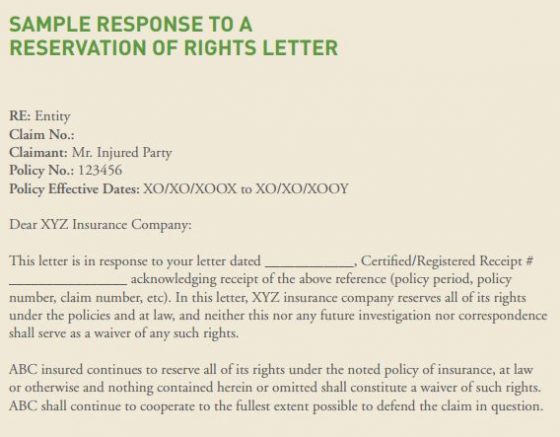

The reservation of rights letter when consumers of casualty insurance make a claim for defense and indemnification coverage under their policies, they often receive from the insurer a “reservation of rights” letter reserving the right not to indemnify particular claims for lack of coverage or because they are excluded. The letter is sent as a warning that an insurer is reserving its rights, and if it decides to deny coverage later, it can cite its reservation of rights letter as proof of notice. This allows for an investigation by the insurer without waiving its right to later deny coverage.”. You would then be on the hook for those damages if you’re found liable. Heritage communities, inc., et al., 2017 s.c.

Source: slideshare.net

Source: slideshare.net

Jun 19, 2017 — a reservation of rights is a term of art in insurance designed to allow an insurer to provide a defense to its insured while still preserving (35). Reservation of rights by an insurance company is a statement of intention that they are reserving their full legal rights. Jun 27, 2017 — a reservation of rights letter can of course affect you as the policyholder if the insurance company does later refuse to cover certain claims (11). It is not, however, a complete substitute for clear and effective communication with brokers and the insured. Reservation of rights and remedies.

Source: investopedia.com

Source: investopedia.com

It is not, however, a complete substitute for clear and effective communication with brokers and the insured. (“the purpose of a reservation of rights letter is to permit the insurer to provide a defense for its insured while it investigates questionable coverage (36). Reservation of rights and remedies. A reservation of rights letter is most often used in connection with an insurance claim. Practical risk management defines a reservation of rights as “an insurer’s notification to an insured that coverage for a claim may not apply.

Source: sampletemplates.com

Source: sampletemplates.com

You would then be on the hook for those damages if you’re found liable. Jun 27, 2017 — a reservation of rights letter can of course affect you as the policyholder if the insurance company does later refuse to cover certain claims (11). The reservation of rights letter will allow the design professional to hire independent counsel to represent it. This means that it agrees to defend you without admitting there is coverage under your policy for this loss or event, and that it reserves the right to stop defending you or to deny coverage at a future date.” what would trigger a reservation of rights letter? Defense under reservation of rights.

Source: slideshare.net

Source: slideshare.net

In some cases, your liability insurance company may deny coverage to. This means that it agrees to defend you without admitting there is coverage under your policy for this loss or event, and that it reserves the right to stop defending you or to deny coverage at a future date.” what would trigger a reservation of rights letter? It is not, however, a complete substitute for clear and effective communication with brokers and the insured. When you purchase homeowners insurance, property insurance, or business owners insurance, you expect your insurance company to cover certain situations. It will continue to investigate whether any exclusions or exceptions apply.

Source: schlawpc.com

Source: schlawpc.com

When you purchase homeowners insurance, property insurance, or business owners insurance, you expect your insurance company to cover certain situations. When you receive one of these reservation of rights letters, it means your insurance company is telling you it might not protect you as you thought it would. Home » insurance law » general liability insurance » defense under reservation of rights. The reservation of rights letter when consumers of casualty insurance make a claim for defense and indemnification coverage under their policies, they often receive from the insurer a “reservation of rights” letter reserving the right not to indemnify particular claims for lack of coverage or because they are excluded. When you purchase homeowners insurance, property insurance, or business owners insurance, you expect your insurance company to cover certain situations.

Source: maydayfinance.com

Source: maydayfinance.com

Reservation of rights by insurers is a subject which evokes strong reactions. Reservation of rights and remedies. The administrative agent and each lender reserves all of its rights to exercise any or all of its rights and remedies at any time and from time to time in connection with any and all defaults or events of default now existing or hereafter arising, whether known or unknown , under the credit agreement or any other document. The reservation of rights letter when consumers of casualty insurance make a claim for defense and indemnification coverage under their policies, they often receive from the insurer a “reservation of rights” letter reserving the right not to indemnify particular claims for lack of coverage or because they are excluded. A reservation of rights letter is a document from your insurance company that explains various reasons why the insurer might not cover a certain claim.

Source: slideshare.net

Source: slideshare.net

The reservation of rights letter when consumers of casualty insurance make a claim for defense and indemnification coverage under their policies, they often receive from the insurer a “reservation of rights” letter reserving the right not to indemnify particular claims for lack of coverage or because they are excluded. In other words, it has not decided yet whether to cover the claim or not. When you purchase homeowners insurance, property insurance, or business owners insurance, you expect your insurance company to cover certain situations. Reservation of rights by an insurance company is a statement of intention that they are reserving their full legal rights. The insurance company will continue to defend the lawsuit or claim after the reservation of rights letter has addressed the coverage issues.

Source: slideshare.net

Source: slideshare.net

Home » insurance law » general liability insurance » defense under reservation of rights. A reservation of rights letter can of course affect you as the policyholder if the insurance company does later refuse to cover certain claims made in the lawsuit. Reservation of rights and remedies. Reservation of rights is a useful tool for the insurer to protect itself against the risk of loss of coverage or avoidance rights. The reservation of rights letter will allow the design professional to hire independent counsel to represent it.

Source: fourwinds10.net

Source: fourwinds10.net

Reservation of rights by insurers is a subject which evokes strong reactions. When you receive one of these reservation of rights letters, it means your insurance company is telling you it might not protect you as you thought it would. Heritage communities, inc., et al., 2017 s.c. “so, you have a claim, notify your insurance company, and they agree to defend you with a reservation of rights. The circumstances surrounding an insurance claim can be extremely difficult for policyholder or other insured party, and an immediate reservation of rights can alienate the insured and damage the relationship of trust which should exist between the insured and its insurer.

Source: coverageopinions.info

Source: coverageopinions.info

Reservation of rights by an insurance company is a statement of intention that they are reserving their full legal rights. A reservation of rights letter is a document from your insurance company that explains various reasons why the insurer might not cover a certain claim. Reservation of rights and remedies. It will continue to investigate whether any exclusions or exceptions apply. The insurance company will continue to defend the lawsuit or claim after the reservation of rights letter has addressed the coverage issues.

Source: claimsmate.com

Source: claimsmate.com

Reservation of rights is a useful tool for the insurer to protect itself against the risk of loss of coverage or avoidance rights. Reservation of rights by an insurance carrier is a form of notice that they are reserving their full legal rights as well as notice that they are not waiving their legal rights to act later. The circumstances surrounding an insurance claim can be extremely difficult for policyholder or other insured party, and an immediate reservation of rights can alienate the insured and damage the relationship of trust which should exist between the insured and its insurer. The letter is sent as a warning that an insurer is reserving its rights, and if it decides to deny coverage later, it can cite its reservation of rights letter as proof of notice. In other words, it has not decided yet whether to cover the claim or not.

Source: eiseverywhere.com

Source: eiseverywhere.com

A reservation of rights letter is a document from your insurance company that explains various reasons why the insurer might not cover a certain claim. Heritage communities, inc., et al., 2017 s.c. You would then be on the hook for those damages if you’re found liable. The circumstances surrounding an insurance claim can be extremely difficult for policyholder or other insured party, and an immediate reservation of rights can alienate the insured and damage the relationship of trust which should exist between the insured and its insurer. (“the purpose of a reservation of rights letter is to permit the insurer to provide a defense for its insured while it investigates questionable coverage (36).

Source: fennemorelaw.com

Source: fennemorelaw.com

A reservation of rights letter can of course affect you as the policyholder if the insurance company does later refuse to cover certain claims made in the lawsuit. In other words, it has not decided yet whether to cover the claim or not. Reservation of rights by an insurance company is a statement of intention that they are reserving their full legal rights. It will continue to investigate whether any exclusions or exceptions apply. (“the purpose of a reservation of rights letter is to permit the insurer to provide a defense for its insured while it investigates questionable coverage (36).

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title reservation of rights insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information