Retainer insurance coverage information

Home » Trend » Retainer insurance coverage informationYour Retainer insurance coverage images are available in this site. Retainer insurance coverage are a topic that is being searched for and liked by netizens now. You can Get the Retainer insurance coverage files here. Find and Download all free images.

If you’re searching for retainer insurance coverage images information connected with to the retainer insurance coverage interest, you have pay a visit to the ideal site. Our website frequently provides you with hints for downloading the maximum quality video and image content, please kindly surf and find more informative video articles and graphics that fit your interests.

Retainer Insurance Coverage. The fee is paid upfront, but it can�t be accessed unit the services are fully performed. But if ever you need to replace retainers, you will have to pay again since most dental insurance does not include replacement retainers in insurance coverage. A retaining wall is considered a detached structure and the maximum amount of coverage is usually 10% of your dwelling coverage limit. I had braces as a teenager but haven�t worn my retainer for the last two years since my lower jaw developed some slight bony tori, making it painful.

Replace® GM1032118 Front Driver Side Bumper Cover From carid.com

Replace® GM1032118 Front Driver Side Bumper Cover From carid.com

As one get older, the same treatment could take longer. Allegations of conduct that may be excluded from coverage under an insurance policy do not preclude an insurer’s duty to defend where there are any other covered allegations. Your orthodontist office will be able to verify your insurance coverage and provide you with more details. The insured and the insurer jointly engaged attorneys to act on their behalf in relation to. The average cost for one hawley retainer is between $150 and $300, with a set costing up to $600. If you lose or break the retainer, a replacement may need to be paid for entirely out of pocket, costing between $70 and $500.

When you or your child has braces, a hawley retainer is often covered in the overall upfront treatment cost.

Invisalign and other clear retainers are part of the entire realignment process — you don’t pay separately for braces and retainers. Depending on your dental insurance and your plan, your retainers might be covered by your insurance partially or fully. Retainers are technically an orthodontic device, so usually the fee will fall under your orthodontic benefits, if those exist. Most quality homeowner insurance policies are worded consistently on this issue. It’s a good idea to check with your insurance company ahead of time to be sure. Night guards are also not usually covered by insurance.

Source: northerncorvette.com

Source: northerncorvette.com

The average time is one to three years followed by several months of wearing a retainer to stabilize the straightened teeth. Invisalign and other clear retainers are part of the entire realignment process — you don’t pay separately for braces and retainers. A retaining wall is considered a detached structure and the maximum amount of coverage is usually 10% of your dwelling coverage limit. The average cost for one hawley retainer is between $150 and $300, with a set costing up to $600. This example assumes 50% coverage, that the deductible has been met and a remaining.

Source: ebay.com

Source: ebay.com

If you have an employer that offers dental insurance you can choose a dental plan as part of your benefits. Invisalign and other clear retainers are part of the entire realignment process — you don’t pay separately for braces and retainers. I had braces as a teenager but haven�t worn my retainer for the last two years since my lower jaw developed some slight bony tori, making it painful. I�m looking for an individual dental insurance plan for the next year as my school doesn�t provide dental coverage and i dropped from my parents� insurance recently (i�m 26). In other words, timely notice of a claim is the event that triggers coverage.

Source: ebay.com

Source: ebay.com

(clear, custom fitted, removable retainers that cover the teeth). By donald dinnie on november 18, 2021 posted in insurance. The average time is one to three years followed by several months of wearing a retainer to stabilize the straightened teeth. This judgement considered the interesting question of legal professional privilege, the rights of successors in title, and joint retainer privilege. When you or your child has braces, a hawley retainer is often covered in the overall upfront treatment cost.

Source: carid.com

Source: carid.com

The member is under the age 19 (through age 18, unless the member specific benefit plan document indicates a different Liability insurance and joint retainer privilege. For a removable retainer that is used to correct biting problems, the cost ranges from $500 to $2500. This example assumes 50% coverage, that the deductible has been met and a remaining. If you have an employer that offers dental insurance you can choose a dental plan as part of your benefits.

Source: streethogs.dk

Source: streethogs.dk

Since everyone’s insurance benefits are different, one policy might cover more than another. Typically a retainer fee is held by a third party in an escrow account. The retaining wall is usually covered for damage caused by fire, lightning, wind (including tornado), damage caused by vehicles. (clear, custom fitted, removable retainers that cover the teeth). In other words, timely notice of a claim is the event that triggers coverage.

Source: carid.com

Source: carid.com

For a removable retainer that is used to correct biting problems, the cost ranges from $500 to $2500. How do i find dental insurance that covers braces? Here�s an example of how much a byte customer with certain orthodontic insurance coverage might save with insurance: This judgement considered the interesting question of legal professional privilege, the rights of successors in title, and joint retainer privilege. It’s a good idea to check with your insurance company ahead of time to be sure.

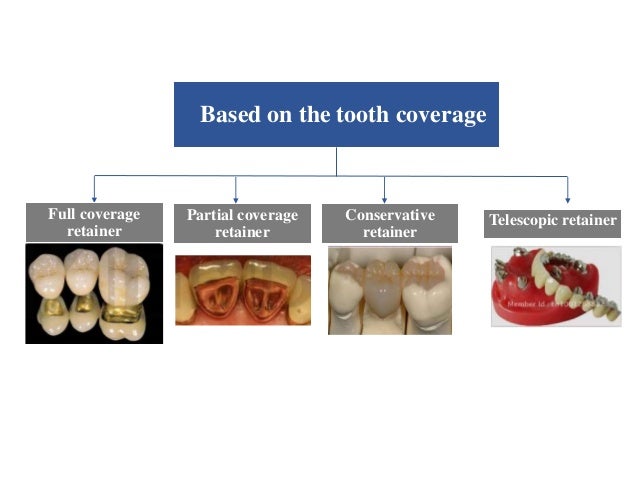

Source: slideshare.net

Source: slideshare.net

The insured and the insurer jointly engaged attorneys to act on their behalf in relation to. The most common post orthodontic treatment is the use of a. Here�s an example of how much a byte customer with certain orthodontic insurance coverage might save with insurance: In other words, timely notice of a claim is the event that triggers coverage. Allegations of conduct that may be excluded from coverage under an insurance policy do not preclude an insurer’s duty to defend where there are any other covered allegations.

Source: carid.com

Source: carid.com

The member is under the age 19 (through age 18, unless the member specific benefit plan document indicates a different When you or your child has braces, a hawley retainer is often covered in the overall upfront treatment cost. Invisalign and other clear retainers are part of the entire realignment process — you don’t pay separately for braces and retainers. Typically a retainer fee is held by a third party in an escrow account. I�m looking for an individual dental insurance plan for the next year as my school doesn�t provide dental coverage and i dropped from my parents� insurance recently (i�m 26).

Source: carid.com

Source: carid.com

Allegations of conduct that may be excluded from coverage under an insurance policy do not preclude an insurer’s duty to defend where there are any other covered allegations. But if ever you need to replace retainers, you will have to pay again since most dental insurance does not include replacement retainers in insurance coverage. As one get older, the same treatment could take longer. Retainers are technically an orthodontic device, so usually the fee will fall under your orthodontic benefits, if those exist. The member is under the age 19 (through age 18, unless the member specific benefit plan document indicates a different

Source: scaclips.com.au

Source: scaclips.com.au

Coverage rationale orthodontic treatment is medically necessary when the following criteria have been met: I had braces as a teenager but haven�t worn my retainer for the last two years since my lower jaw developed some slight bony tori, making it painful. Retaining walls and other detached structures are typically covered to a maximum of 10% of the dwelling coverage cap. Since everyone’s insurance benefits are different, one policy might cover more than another. The member is under the age 19 (through age 18, unless the member specific benefit plan document indicates a different

Source: carid.com

Source: carid.com

Night guards are also not usually covered by insurance. I�m looking for an individual dental insurance plan for the next year as my school doesn�t provide dental coverage and i dropped from my parents� insurance recently (i�m 26). This judgement considered the interesting question of legal professional privilege, the rights of successors in title, and joint retainer privilege. But if ever you need to replace retainers, you will have to pay again since most dental insurance does not include replacement retainers in insurance coverage. Invisalign and other clear retainers are part of the entire realignment process — you don’t pay separately for braces and retainers.

Source: carid.com

Source: carid.com

You can get dental coverage in one of two ways. If you have an employer that offers dental insurance you can choose a dental plan as part of your benefits. Most quality homeowner insurance policies are worded consistently on this issue. In other words, timely notice of a claim is the event that triggers coverage. Our comprehensive retainer insurance covers up to 6 replacement retainers that can be used between multiple patients within the immediate family.

Source: carid.com

Source: carid.com

Insurance seller shall at all times during the term of this agreement, at its own cost and expense, carry and maintain the following insurance coverage: Invisalign and other clear retainers are part of the entire realignment process — you don’t pay separately for braces and retainers. The retaining wall is usually covered for damage caused by fire, lightning, wind (including tornado), damage caused by vehicles. This plan may include braces, as well as other types of dental appliances, such as space maintainers and retainers. You can get dental coverage in one of two ways.

Source: walmart.com

Source: walmart.com

Again after payment under traditional braces care does insurance cover retainers. When you or your child has braces, a hawley retainer is often covered in the overall upfront treatment cost. A retaining wall is considered a detached structure and the maximum amount of coverage is usually 10% of your dwelling coverage limit. The most common post orthodontic treatment is the use of a. Typically a retainer fee is held by a third party in an escrow account.

Source: carid.com

Source: carid.com

Depending on your dental insurance and your plan, your retainers might be covered by your insurance partially or fully. I had braces as a teenager but haven�t worn my retainer for the last two years since my lower jaw developed some slight bony tori, making it painful. By donald dinnie on november 18, 2021 posted in insurance. The fee is paid upfront, but it can�t be accessed unit the services are fully performed. (clear, custom fitted, removable retainers that cover the teeth).

Source: ebay.com

Source: ebay.com

Invisalign and other clear retainers are part of the entire realignment process — you don’t pay separately for braces and retainers. Homeowners property insurance (to include general liability coverage) and comprehensive automobile liability insurance. As one get older, the same treatment could take longer. This judgement considered the interesting question of legal professional privilege, the rights of successors in title, and joint retainer privilege. Again after payment under traditional braces care does insurance cover retainers.

Source: auveco.com

Source: auveco.com

Homeowners property insurance (to include general liability coverage) and comprehensive automobile liability insurance. Retaining walls and other detached structures are typically covered to a maximum of 10% of the dwelling coverage cap. Cover, which rent either included in the price of treatment or. I�m looking for an individual dental insurance plan for the next year as my school doesn�t provide dental coverage and i dropped from my parents� insurance recently (i�m 26). The average cost for one hawley retainer is between $150 and $300, with a set costing up to $600.

Source: homedepot.com

Source: homedepot.com

During the treatment, there will be periods of some discomfort as the wires are tightened to apply the necessary pressure, and extra special care must be taken in oral hygiene to prevent. A retaining wall is considered a detached structure for the purposes of a homeowner’s insurance policy, and is thus covered for a number of damages, including fire, lightning, wind, and automobiles. Allegations of conduct that may be excluded from coverage under an insurance policy do not preclude an insurer’s duty to defend where there are any other covered allegations. (clear, custom fitted, removable retainers that cover the teeth). The member is under the age 19 (through age 18, unless the member specific benefit plan document indicates a different

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title retainer insurance coverage by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information