Retention insurance definition Idea

Home » Trending » Retention insurance definition IdeaYour Retention insurance definition images are ready. Retention insurance definition are a topic that is being searched for and liked by netizens now. You can Download the Retention insurance definition files here. Find and Download all free vectors.

If you’re looking for retention insurance definition images information connected with to the retention insurance definition keyword, you have visit the ideal site. Our website always provides you with hints for refferencing the highest quality video and image content, please kindly surf and find more enlightening video content and graphics that match your interests.

Retention Insurance Definition. An rrg must be owned by its insureds. In other words the retention of risk means one is liable to bear the losses himself up to the amount retained. First, define a period of time. A driver is stopped at a light and is rammed by the car to the rear.

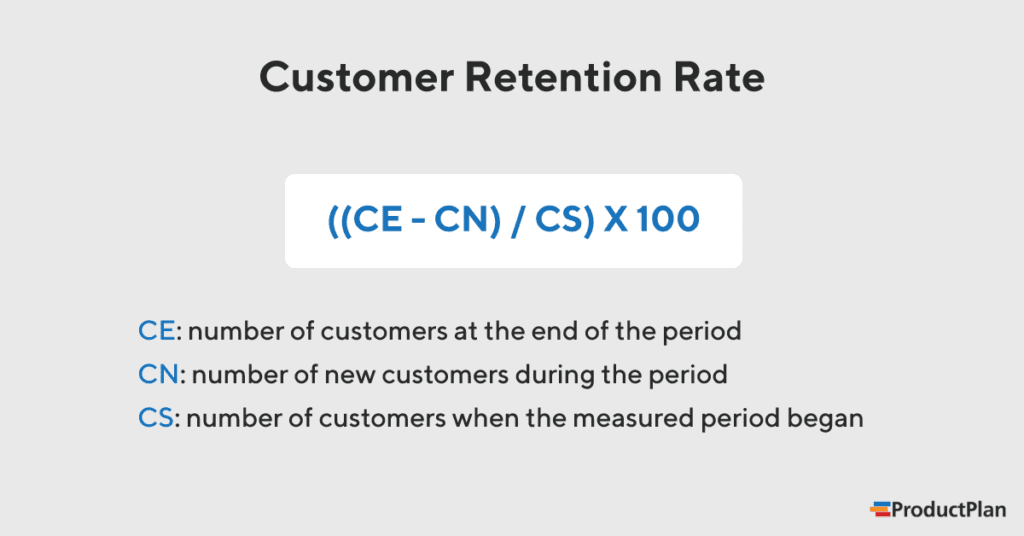

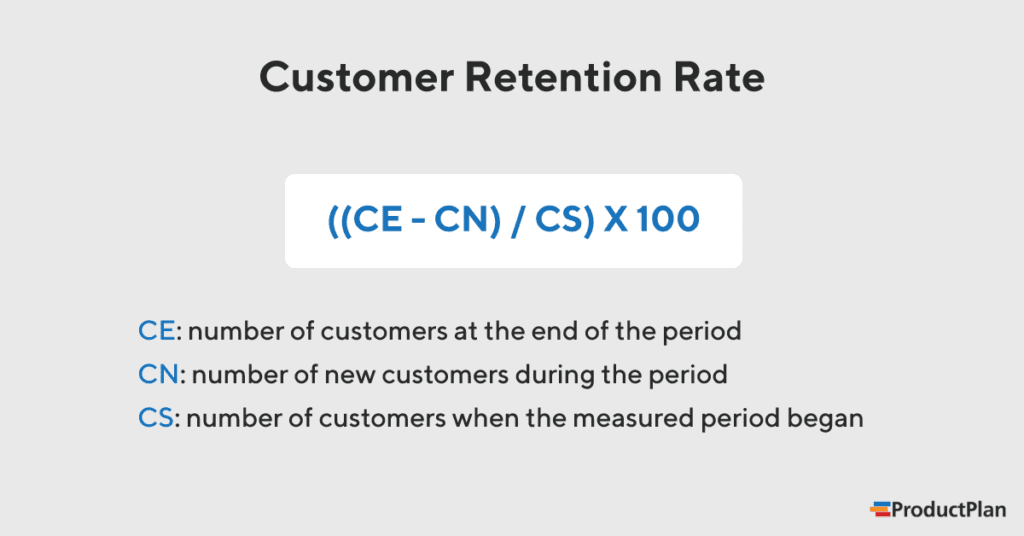

Retention Definition and Overview From productplan.com

Retention Definition and Overview From productplan.com

Technically, you pay a retention upfront and reimburse your insurance company for the deductible after they pay the claim.you can reduce your insurance premium by increasing your retention amount. This is the amount of money that you are required to pay, per claim, before the insurance company will start paying. In the latter case, the insurer takes care of the indemnity and defense costs that are part of. Practice in which no funds are set aside on a mathematical basis to pay for expected losses. Of customers at the end of the period The state of being retained.

Of customers at the end of the period

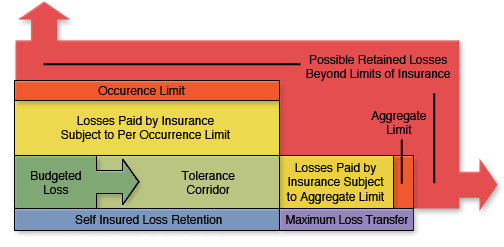

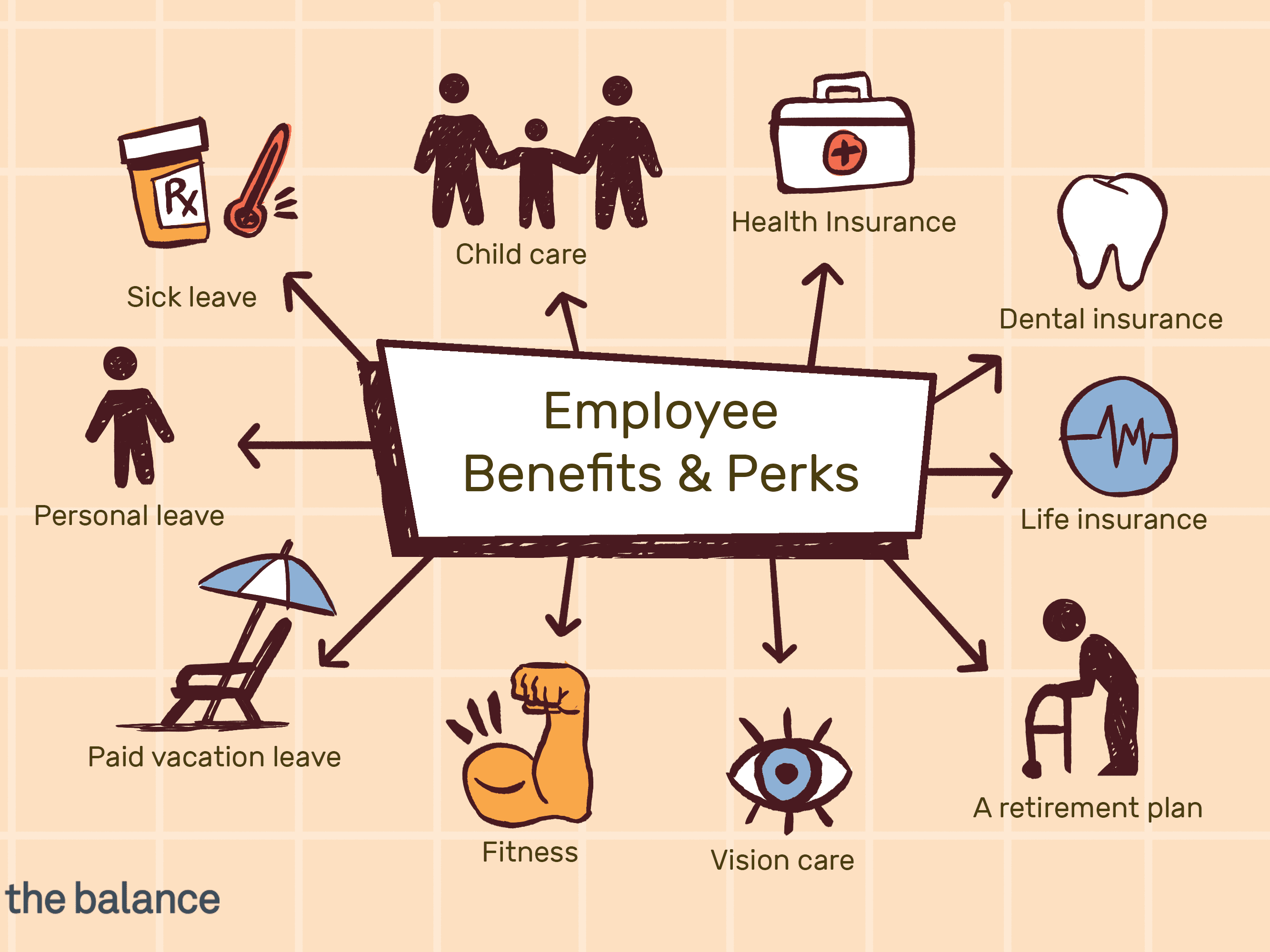

(2) in reinsurance, the net amount of risk the ceding company keeps for its own account. Having explored the employee retention definition and its importance, let’s look at which areas most companies usually focus on when crafting employee retention strategies and programs: Most rrgs are formed as. For example, if you are insured through a liability policy with a $1 million limit and a $100,000 sir, you’ll need to pay for the first $100,000 of any claim before your. For each insurance policy reinsured on a facultative basis, the retention limit will be determined by mutual agreement of. An rrg must be owned by its insureds.

Source: comarch.com

Source: comarch.com

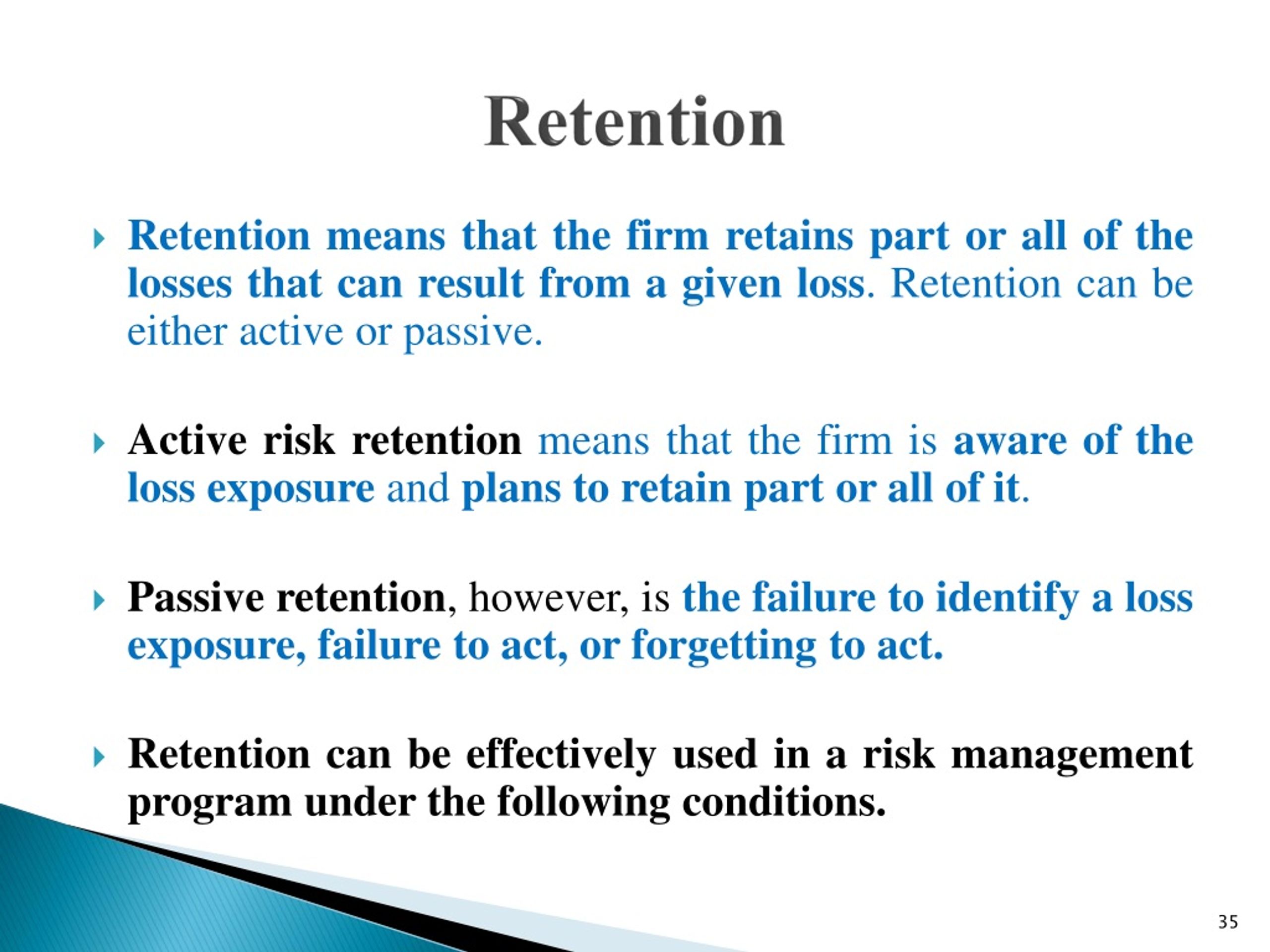

Of customers at the end of the period However, for any insurance obtained through the blanket insurance programs, insurance retention shall mean the retirement community�s per occurrence limit for any loss or reserve as established for the retirement community, which limit shall be the same as is applied to other similar retirement. May be it is done to keep the cost of insurance premium at the minimum level. Practice in which no funds are set aside on a mathematical basis to pay for expected losses. Risk retention is an individual or organization’s decision to take responsibility for a particular risk it faces, as opposed to transferring the risk over to an insurance company by purchasing insurance.

Source: budgeting.thenest.com

Source: budgeting.thenest.com

When insurance is available only at a high price, organizations shift from a commercial insurer to retention. May be it is done to keep the cost of insurance premium at the minimum level. Means the insurance policy deductible; That means the individual or organization has chosen to pay for any losses out of pocket rather than purchasing insurance as a means of. Technically, you pay a retention upfront and reimburse your insurance company for the deductible after they pay the claim.you can reduce your insurance premium by increasing your retention amount.

Source: productplan.com

Source: productplan.com

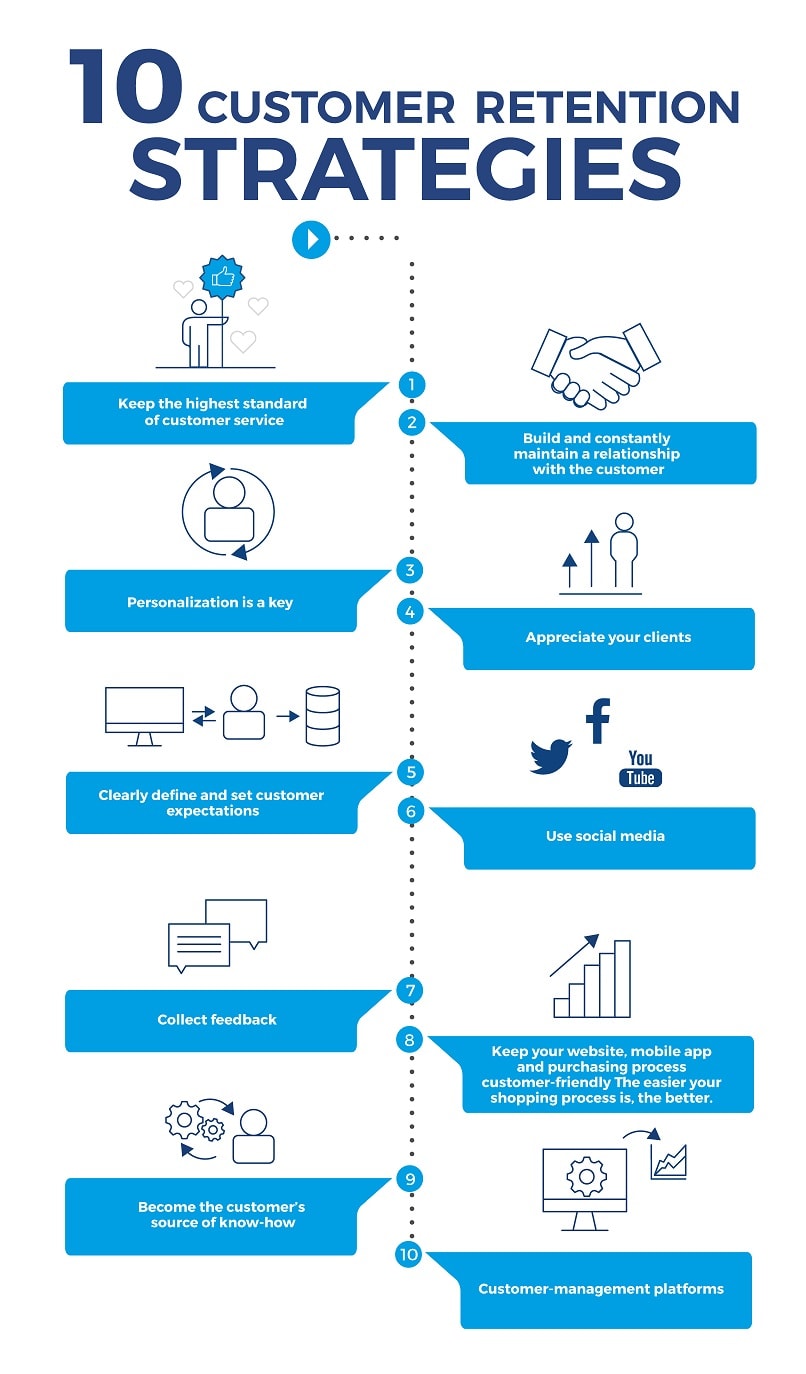

Risk retention group (rrg) — an insurance company formed pursuant to the federal risk retention act of 1981, which was amended in 1986 to allow insurers underwriting all types of liability risks except workers compensation to avoid cumbersome multistate licensing laws. You can attract a good candidate by offering them a competitive salary and basic benefits (e.g. Risk retention is an individual or organization’s decision to take responsibility for a particular risk it faces, as opposed to transferring the risk over to an insurance company by purchasing insurance. A loss retention definition shows up most commonly in the form of deductibles. For example, if you are insured through a liability policy with a $1 million limit and a $100,000 sir, you’ll need to pay for the first $100,000 of any claim before your insurer.

Source: outboundengine.com

Source: outboundengine.com

In case of companies the risk retention is either by not having insurance that covers a particular eventuality or in the form of deductibles. In case of companies the risk retention is either by not having insurance that covers a particular eventuality or in the form of deductibles. Practice in which no funds are set aside on a mathematical basis to pay for expected losses. Technically, you pay a retention upfront and reimburse your insurance company for the deductible after they pay the claim.you can reduce your insurance premium by increasing your retention amount. When insurance is available only at a high price, organizations shift from a commercial insurer to retention.

Source: slideserve.com

Source: slideserve.com

Retention limit means the amount of an insurance policy �s benefits that ceding company will not cede to reinsurer. (2) in reinsurance, the net amount of risk the ceding company keeps for its own account. Invest in direct mutual funds & new fund offer (nfo) discover 5000+ schemes. The truth is that there are at least three different types of retention in insurance— customer retention , revenue retention, and policy retention —and although there is some overlap. In the latter case, the insurer takes care of the indemnity and defense costs that are part of.

Source: staeti.blogspot.com

Source: staeti.blogspot.com

For example, if you are insured through a liability policy with a $1 million limit and a $100,000 sir, you’ll need to pay for the first $100,000 of any claim before your. Abnormal retaining of a fluid or secretion in a body cavity. Most rrgs are formed as. The state of being retained. (2) in reinsurance, the net amount of risk the ceding company keeps for its own account.

Source: robustdesigns.com

Source: robustdesigns.com

The state of being retained. Practice in which no funds are set aside on a mathematical basis to pay for expected losses. However, for any insurance obtained through the blanket insurance programs, insurance retention shall mean the retirement community�s per occurrence limit for any loss or reserve as established for the retirement community, which limit shall be the same as is applied to other similar retirement. Of customers at the end of the period For each insurance policy reinsured on a facultative basis, the retention limit will be determined by mutual agreement of.

Source: irmi.com

Source: irmi.com

The truth is that there are at least three different types of retention in insurance— customer retention , revenue retention, and policy retention —and although there is some overlap. For example, if you are insured through a liability policy with a $1 million limit and a $100,000 sir, you’ll need to pay for the first $100,000 of any claim before your insurer. An rrg must be owned by its insureds. Retention limit means the amount of an insurance policy �s benefits that ceding company will not cede to reinsurer. Abnormal retaining of a fluid or secretion in a body cavity.

Source: hughesrisk.com

Source: hughesrisk.com

This occurs when a risk manager is not aware of an exposure, when the cost of treating an exposure positively is prohibitive, or if the severity of a loss (should it occur) would be inconsequential. A loss retention definition shows up most commonly in the form of deductibles. Practice in which no funds are set aside on a mathematical basis to pay for expected losses. The state of being retained. May be it is done to keep the cost of insurance premium at the minimum level.

Source: attendancebot.com

Source: attendancebot.com

The damage amounts to $3,000, so the driver puts in a claim for the repairs. In case of companies the risk retention is either by not having insurance that covers a particular eventuality or in the form of deductibles. This occurs when a risk manager is not aware of an exposure, when the cost of treating an exposure positively is prohibitive, or if the severity of a loss (should it occur) would be inconsequential. In the latter case, the insurer takes care of the indemnity and defense costs that are part of. A loss retention definition shows up most commonly in the form of deductibles.

Source: agedleadstore.com

Source: agedleadstore.com

Invest in direct mutual funds & new fund offer (nfo) discover 5000+ schemes. An rrg must be owned by its insureds. Retention limit means the amount of an insurance policy �s benefits that ceding company will not cede to reinsurer. This occurs when a risk manager is not aware of an exposure, when the cost of treating an exposure positively is prohibitive, or if the severity of a loss (should it occur) would be inconsequential. In the latter case, the insurer takes care of the indemnity and defense costs that are part of.

Source: slideserve.com

Source: slideserve.com

When insurance is available only at a high price, organizations shift from a commercial insurer to retention. For each insurance policy reinsured on an automatic basis, the retention limit is specified in exhibit a. Having explored the employee retention definition and its importance, let’s look at which areas most companies usually focus on when crafting employee retention strategies and programs: Means the insurance policy deductible; A driver is stopped at a light and is rammed by the car to the rear.

Source: youtube.com

Source: youtube.com

However, for any insurance obtained through the blanket insurance programs, insurance retention shall mean the retirement community�s per occurrence limit for any loss or reserve as established for the retirement community, which limit shall be the same as is applied to other similar retirement. When insurance is available only at a high price, organizations shift from a commercial insurer to retention. The term “retention” alone is vague and simplistic, suggesting that there is a single way of looking at retention in general. For each insurance policy reinsured on a facultative basis, the retention limit will be determined by mutual agreement of. Invest in direct mutual funds & new fund offer (nfo) discover 5000+ schemes.

Source: investopedia.com

Source: investopedia.com

In other words the retention of risk means one is liable to bear the losses himself up to the amount retained. The damage amounts to $3,000, so the driver puts in a claim for the repairs. In other words the retention of risk means one is liable to bear the losses himself up to the amount retained. This occurs when a risk manager is not aware of an exposure, when the cost of treating an exposure positively is prohibitive, or if the severity of a loss (should it occur) would be inconsequential. A driver is stopped at a light and is rammed by the car to the rear.

Source: familie-techniek.blogspot.com

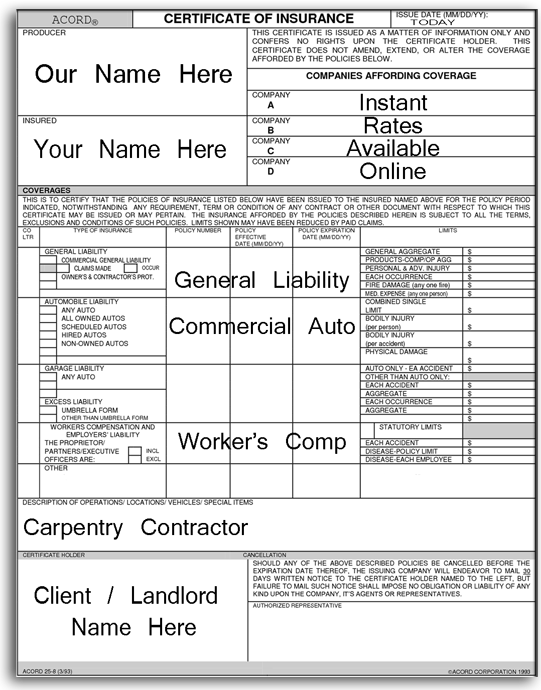

Invest in direct mutual funds & new fund offer (nfo) discover 5000+ schemes. For each insurance policy reinsured on an automatic basis, the retention limit is specified in exhibit a. Risk retention group (rrg) — an insurance company formed pursuant to the federal risk retention act of 1981, which was amended in 1986 to allow insurers underwriting all types of liability risks except workers compensation to avoid cumbersome multistate licensing laws. In other words the retention of risk means one is liable to bear the losses himself up to the amount retained. A driver is stopped at a light and is rammed by the car to the rear.

Source: carpentry.idealchoiceinsurance.com

Source: carpentry.idealchoiceinsurance.com

(2) in reinsurance, the net amount of risk the ceding company keeps for its own account. For example, if you are insured through a liability policy with a $1 million limit and a $100,000 sir, you’ll need to pay for the first $100,000 of any claim before your. Retention of risk is the net amount of any risk which an insurance company does not | meaning, pronunciation, translations (9). Risk retention is an individual or organization’s decision to take responsibility for a particular risk it faces, as opposed to transferring the risk over to an insurance company by purchasing insurance. Abnormal retaining of a fluid or secretion in a body cavity.

Source: budgeting.thenest.com

Source: budgeting.thenest.com

Practice in which no funds are set aside on a mathematical basis to pay for expected losses. An insurance retention is similar to a deductible, and the two words are often used interchangeably. The damage amounts to $3,000, so the driver puts in a claim for the repairs. This occurs when a risk manager is not aware of an exposure, when the cost of treating an exposure positively is prohibitive, or if the severity of a loss (should it occur) would be inconsequential. In case of companies the risk retention is either by not having insurance that covers a particular eventuality or in the form of deductibles.

Source: zoomshift.com

Source: zoomshift.com

The state of being retained. Abnormal retaining of a fluid or secretion in a body cavity. Practice in which no funds are set aside on a mathematical basis to pay for expected losses. Means the insurance policy deductible; In case of companies the risk retention is either by not having insurance that covers a particular eventuality or in the form of deductibles.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title retention insurance definition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information