Retroactive date insurance Idea

Home » Trending » Retroactive date insurance IdeaYour Retroactive date insurance images are available. Retroactive date insurance are a topic that is being searched for and liked by netizens today. You can Download the Retroactive date insurance files here. Find and Download all free photos and vectors.

If you’re searching for retroactive date insurance pictures information related to the retroactive date insurance topic, you have come to the ideal site. Our website frequently provides you with suggestions for downloading the highest quality video and image content, please kindly search and find more enlightening video articles and images that fit your interests.

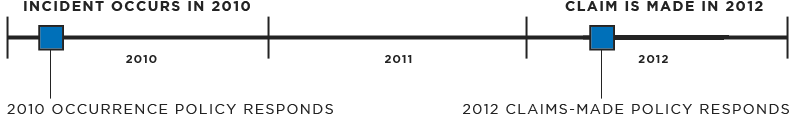

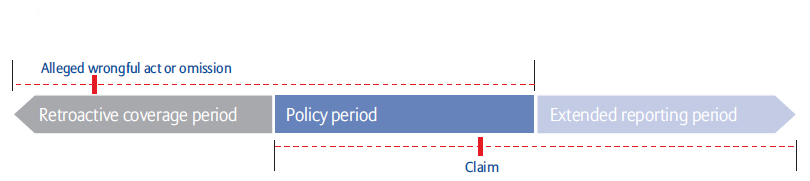

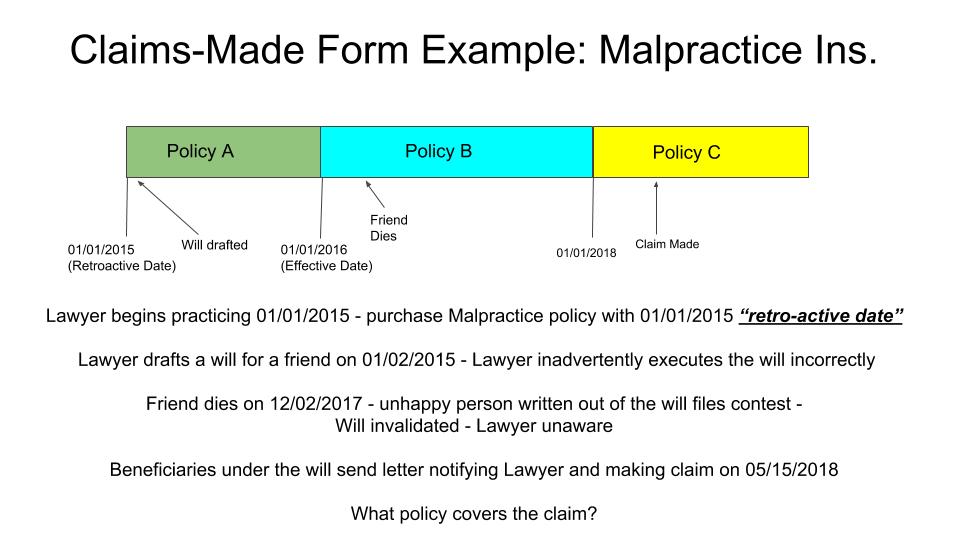

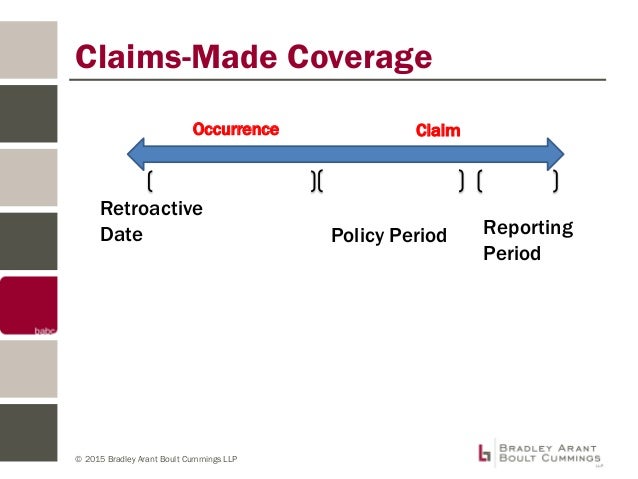

Retroactive Date Insurance. The retroactive date is important because it determines how far back in time an incident can occur for your policy to still protect you. The cover runs for a year from this date. A retroactive date is generally the date from which you have held uninterrupted professional indemnity insurance cover. The diagram above is an example of an insurance policy which was first incepted on 1 april 2019 and at that time the retroactive date was set at “policy inception” (also 1 april 2019).

What is a retroactive date and why is it important to your From mcclarroninsurance.com

What is a retroactive date and why is it important to your From mcclarroninsurance.com

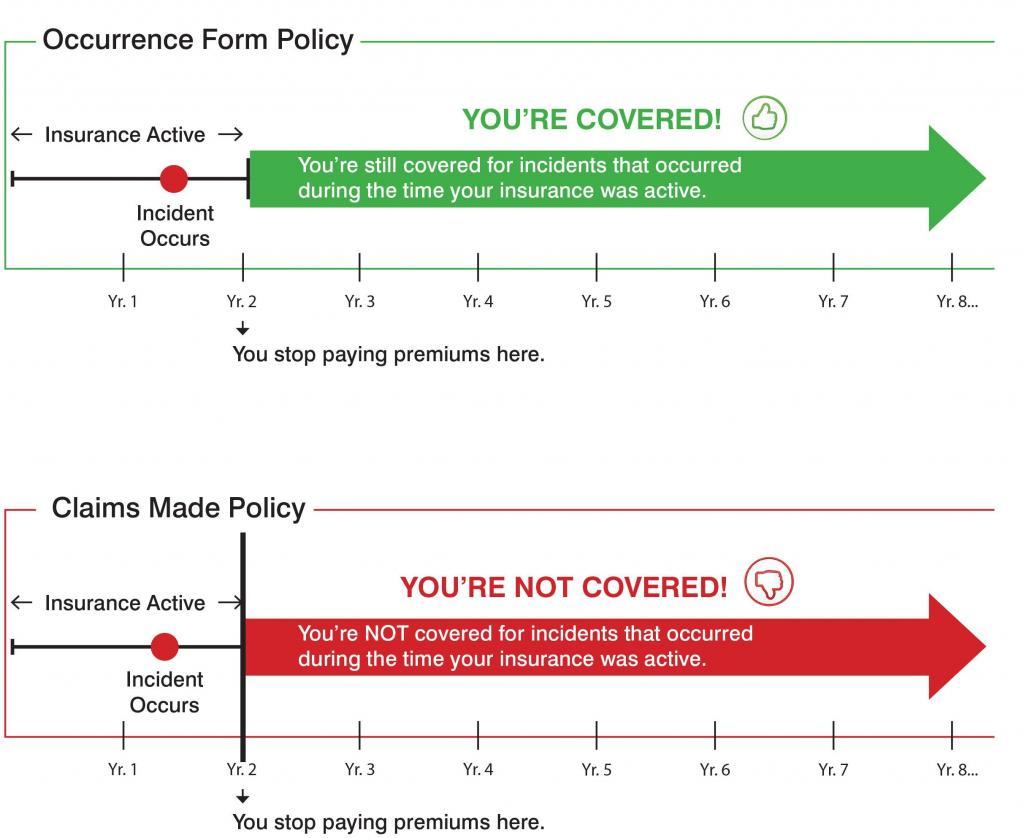

A retroactive date is the date from which you have held uninterrupted professional indemnity insurance cover (even if you changed insurer during this time) or a date in the past from which your insurer has agreed to cover you. The retroactive date can serve one of two purposes; Understanding what a retroactive date is, is important for businesses that are required to have professional indemnity insurance in place. A retroactive date is the date from which your business has had uninterrupted professional indemnity insurance. The retroactive date on the professional indemnity insurance is the date from which the insured has held uninterrupted professional indemnity insurance. The retroactive date is the date on which a business’s liability coverage begins.

While some insurers will limit the retroactive date to the inception of the.

Anything that happened before the retroactive date isn’t covered by. Your retroactive date is the date on which your coverage begins. Any claims that arise from events prior to this date is not covered by your insurance. A retroactive date is the date from which you have held uninterrupted professional indemnity insurance cover (even if you changed insurer during this time) (2). If you’ve had insurance since 2010, and you still have insurance, you could be covered for incidents that fall well outside your current period—as long as they. The cover runs for a year from this date.

Source: youtube.com

Source: youtube.com

Your policy’s retroactive date is the date on which your professional liability coverage. The retroactive date is typically based on the date from which the insured has had (uninterrupted) professional liability coverage. The retroactive date is the date on which a business’s liability coverage begins. Here are 3 things everyone needs to know about retroactive dates when looking for liability coverage. However, claims filed on or after this date will receive coverage as long as the claim is filed within the limits of the coverage period.

Source: blog.constructaquote.com

Source: blog.constructaquote.com

Confusion always arises among clients / brokers when it comes to retroactive date & continuity date. Professional indemnity policies provide cover to businesses that offer advice or professional services. Depending on whether or not you have prior acts coverage, it may or may not be the same day your business purchased its current policy. The retroactive date is the date on which a business’s liability coverage begins. If you’ve had insurance since 2010, and you still have insurance, you could be covered for incidents that fall well outside your current period—as long as they.

Source: mcclarroninsurance.com

Source: mcclarroninsurance.com

This is because clients of these types of businesses expect the advice they are given to be accurate. A retroactive date is the date from which you have held uninterrupted professional indemnity insurance cover (even if you changed insurer during this time) or a date in the past from which your insurer has agreed to cover you. The retroactive date serves as an exclusion, so when such a date appears in the policy declarations, no coverage will apply to claims arising out of acts committed before the specified date, even if the claim is. The retroactive date is added to the insured’s policy to cover the claims of his work. Your policy’s retroactive date is the date on which your professional liability coverage.

Your retroactive date is the date on which your coverage begins. The prior acts coverage of a policy provides an organisation and its management with many benefits, but failing to understand how and when it can be restricted can leave those relying on coverage unexpectedly exposed. The retroactive date is the date on which a business’s liability coverage begins. The retroactive date is added to the insured’s policy to cover the claims of his work. Professional indemnity policies provide cover to businesses that offer advice or professional services.

Source: tego.com.au

Source: tego.com.au

Retroactive dates are dates before which an insurance company will not provide any coverage. Professional indemnity policies provide cover to businesses that offer advice or professional services. For a new business without a previously existing policy, the retroactive date is usually the. Any claim arising from events that have occurred prior to the retroactive date is excluded from the cover. The prior acts coverage of a policy provides an organisation and its management with many benefits, but failing to understand how and when it can be restricted can leave those relying on coverage unexpectedly exposed.

Source: eperils.com

Source: eperils.com

The retroactive date on the professional indemnity insurance is the date from which the insured has held uninterrupted professional indemnity insurance. Confusion always arises among clients / brokers when it comes to retroactive date & continuity date. Professional indemnity policies provide cover to businesses that offer advice or professional services. The retroactive date on your professional indemnity insurance is the date from which you’ve held uninterrupted professional indemnity insurance, or a date in the past from which your insurer has agreed to cover you. As he renews that insurance policy year over year, the retroactive date stays the same.

Source: sidebarinsurance.com

Source: sidebarinsurance.com

So, if a claim is filed for a loss that took place before the retroactive date, it will not be covered. Depending on whether or not you have prior acts coverage, it may or may not be the same day your business purchased its current policy. To eliminate coverage for situations or incidents known to insureds that have the potential to give rise to claims in the future, and to prevent coverage for obsolete claims that arise from events far in the past. The retroactive date is the day when insurance coverage begins. A retroactive date is the date from which your business has had uninterrupted professional indemnity insurance.

Source: nasbp.org

Source: nasbp.org

1 it is usually the same as your inception date or the date since which you’ve held continuous insurance coverage. The retroactive date is added to the insured’s policy to cover the claims of his work. Here are 3 things everyone needs to know about retroactive dates when looking for liability coverage. Any claim arising from events that have occurred prior to the retroactive date is excluded from the cover. It�s generally defined as the day that your coverage begins.

Source: blog.constructaquote.com

Source: blog.constructaquote.com

However, retroactive insurance can be purchased to provide coverage for losses that occurred before a specific retroactive date. This is because clients of these types of businesses expect the advice they are given to be accurate. However, claims filed on or after this date will receive coverage as long as the claim is filed within the limits of the coverage period. Your policy’s retroactive date is the date on which your professional liability coverage. This means that if you’ve held continuous professional indemnity insurance coverage (with no lapses in.

Source: gsidirect.co.nz

Source: gsidirect.co.nz

If you’ve had insurance since 2010, and you still have insurance, you could be covered for incidents that fall well outside your current period—as long as they. This is a special condition that can be written into professional indemnity insurance that sets the date from when the insurer provides cover. However, retroactive insurance can be purchased to provide coverage for losses that occurred before a specific retroactive date. Here are 3 things everyone needs to know about retroactive dates when looking for liability coverage. 1 it is usually the same as your inception date or the date since which you’ve held continuous insurance coverage.

Source: blog.constructaquote.com

Source: blog.constructaquote.com

Here are 3 things everyone needs to know about retroactive dates when looking for liability coverage. Anything that has happened before the retroactive date is usually not covered by your insurance company. Any claims that arise from events prior to this date is not covered by your insurance. However, claims filed on or after this date will receive coverage as long as the claim is filed within the limits of the coverage period. Retroactive dates are dates before which an insurance company will not provide any coverage.

Source: johnheath.com

Source: johnheath.com

Any claims that arise from events prior to this date is not covered by your insurance. It is applied to all professional indemnity insurance policies and its purpose is to exclude claims arising from any work undertaken prior to date shown. Any claim arising from events that have occurred prior to the retroactive date is excluded from the cover. Your retroactive date is the date on which your coverage begins. This is because clients of these types of businesses expect the advice they are given to be accurate.

Source: professionalscoverage.ca

Source: professionalscoverage.ca

The retroactive date is added to the insured’s policy to cover the claims of his work. The retroactive date serves as an exclusion, so when such a date appears in the policy declarations, no coverage will apply to claims arising out of acts committed before the specified date, even if the claim is. The retroactive date on your professional indemnity insurance is the date from which you’ve held uninterrupted professional indemnity insurance, or a date in the past from which your insurer has agreed to cover you. A retroactive date is the date from which you have held uninterrupted professional indemnity insurance cover (even if you changed insurer during this time) (2). Any claim arising from events that have occurred prior to the retroactive date is excluded from the cover.

Source: getindemnity.co.uk

1 it is usually the same as your inception date or the date since which you’ve held continuous insurance coverage. To eliminate coverage for situations or incidents known to insureds that have the potential to give rise to claims in the future, and to prevent coverage for obsolete claims that arise from events far in the past. This is a special condition that can be written into professional indemnity insurance that sets the date from when the insurer provides cover. The retroactive date on the professional indemnity insurance is the date from which the insured has held uninterrupted professional indemnity insurance. Retroactive dates are dates before which an insurance company will not provide any coverage.

Source: slideshare.net

Source: slideshare.net

However, claims filed on or after this date will receive coverage as long as the claim is filed within the limits of the coverage period. However, claims filed on or after this date will receive coverage as long as the claim is filed within the limits of the coverage period. The retroactive date serves as an exclusion, so when such a date appears in the policy declarations, no coverage will apply to claims arising out of acts committed before the specified date, even if the claim is. It is applied to all professional indemnity insurance policies and its purpose is to exclude claims arising from any work undertaken prior to date shown. The retroactive date is important because it determines how far back in time an incident can occur for your policy to still protect you.

Source: youtube.com

Source: youtube.com

The prior acts coverage of a policy provides an organisation and its management with many benefits, but failing to understand how and when it can be restricted can leave those relying on coverage unexpectedly exposed. The retroactive date on the professional indemnity insurance is the date from which the insured has held uninterrupted professional indemnity insurance. However, claims filed on or after this date will receive coverage as long as the claim is filed within the limits of the coverage period. A retroactive date is an essential component of a claims made policy, and has significant implications for the scope of its protection. The cover runs for a year from this date.

Source: inspectorproinsurance.com

Source: inspectorproinsurance.com

The prior acts coverage of a policy provides an organisation and its management with many benefits, but failing to understand how and when it can be restricted can leave those relying on coverage unexpectedly exposed. Depending on whether or not you have prior acts coverage, it may or may not be the same day your business purchased its current policy. The retroactive date can serve one of two purposes; Anything that happened before the retroactive date isn’t covered by. As he renews that insurance policy year over year, the retroactive date stays the same.

Source: tego.com.au

Source: tego.com.au

As he renews that insurance policy year over year, the retroactive date stays the same. The retroactive date is added to the insured’s policy to cover the claims of his work. Claims filed for dates before this day will not be covered. It is applied to all professional indemnity insurance policies and its purpose is to exclude claims arising from any work undertaken prior to date shown. So, if a claim is filed for a loss that took place before the retroactive date, it will not be covered.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title retroactive date insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information