Retroactive insurance Idea

Home » Trending » Retroactive insurance IdeaYour Retroactive insurance images are ready in this website. Retroactive insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Retroactive insurance files here. Download all free photos.

If you’re searching for retroactive insurance images information connected with to the retroactive insurance interest, you have come to the right blog. Our site frequently gives you hints for seeking the maximum quality video and image content, please kindly hunt and locate more informative video articles and graphics that match your interests.

Retroactive Insurance. And if the accident / insurance event occurs, the insurance company. This is important as for the majority of professional negligence claims it is possible for a. If you’ve had insurance since 2010, and you still have insurance, you could be covered for incidents that fall well outside your current period—as long as they. Any claims that arise from events prior to this date is not covered by your insurance.

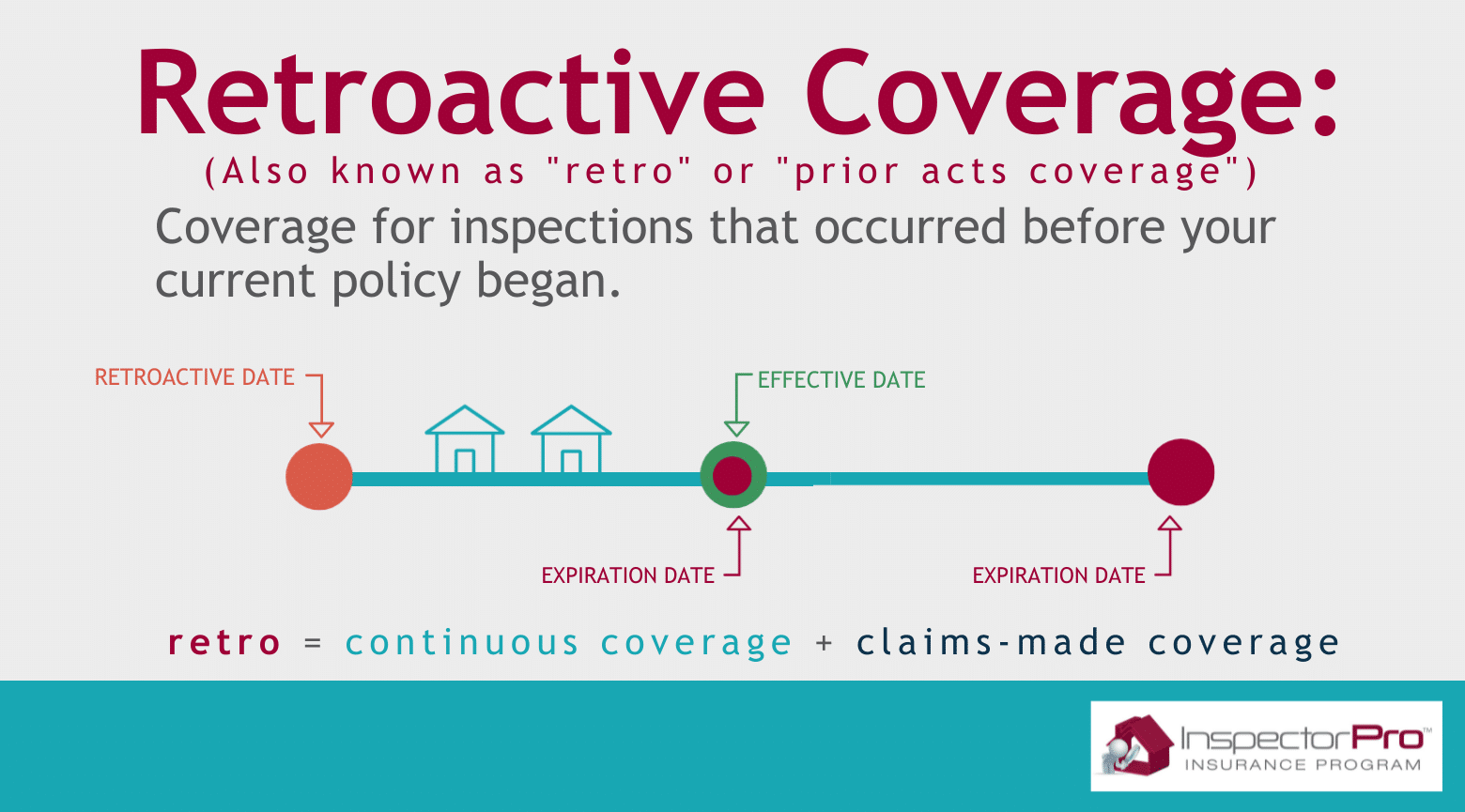

Retro InspectorPro Insurance From inspectorproinsurance.com

Retro InspectorPro Insurance From inspectorproinsurance.com

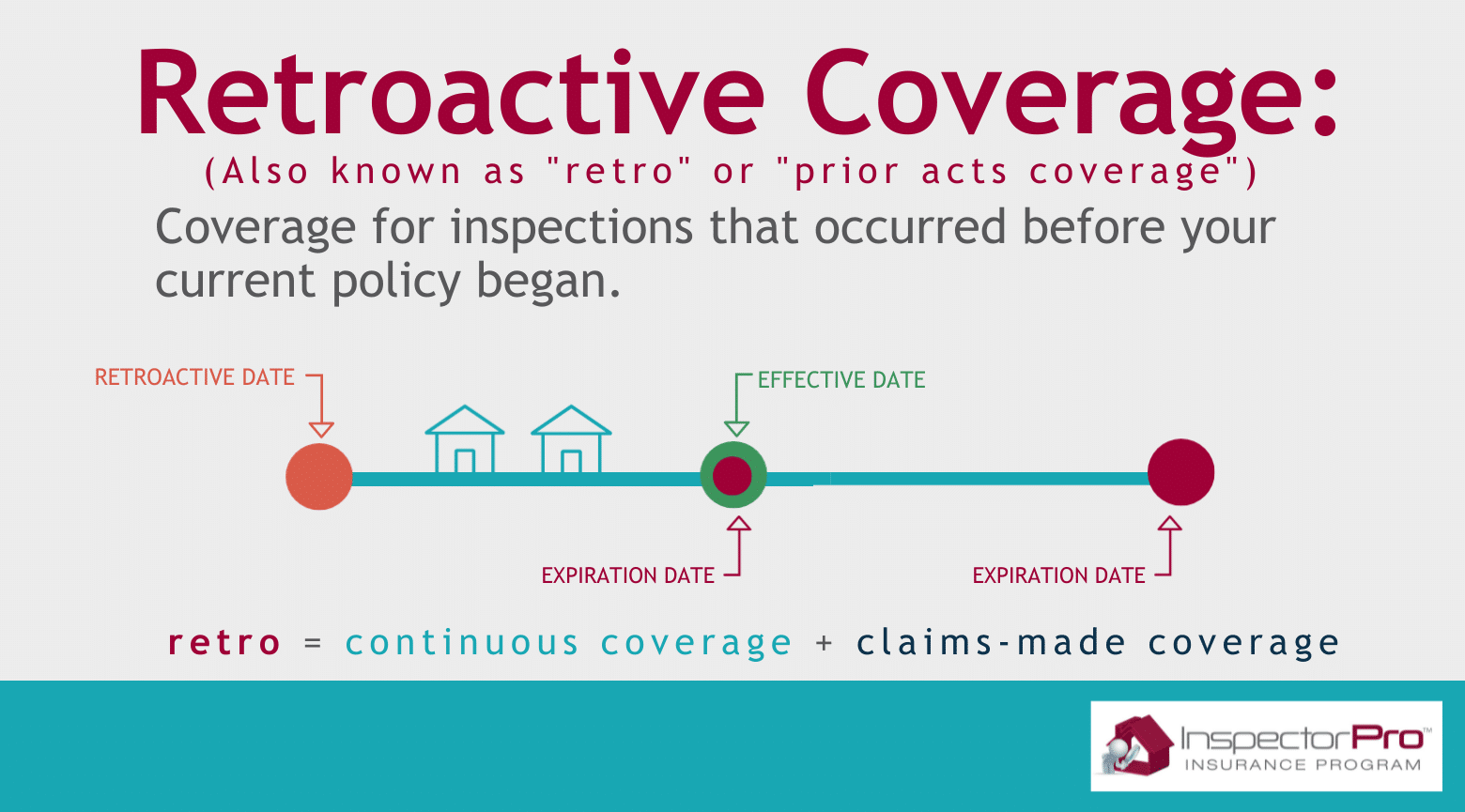

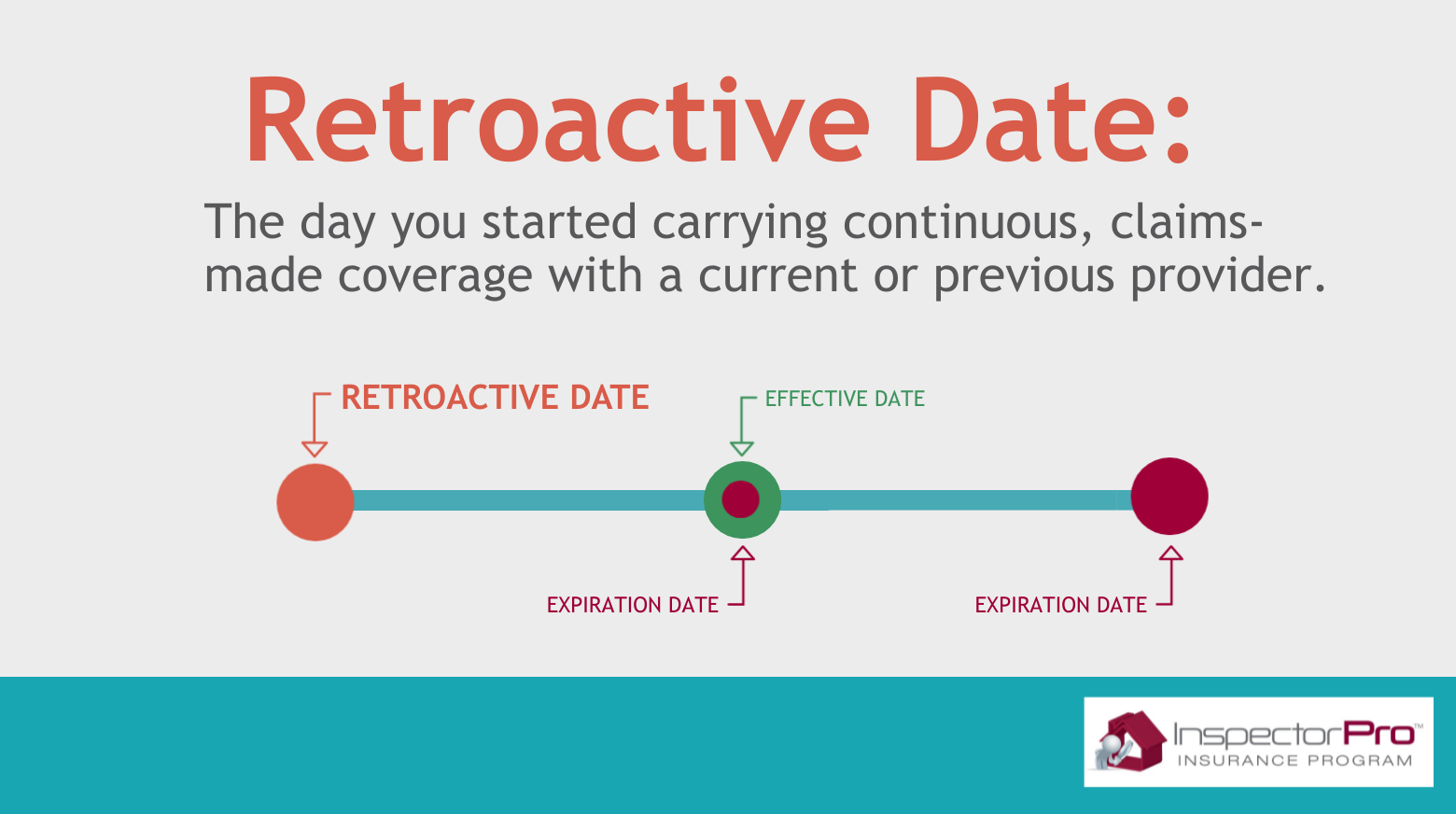

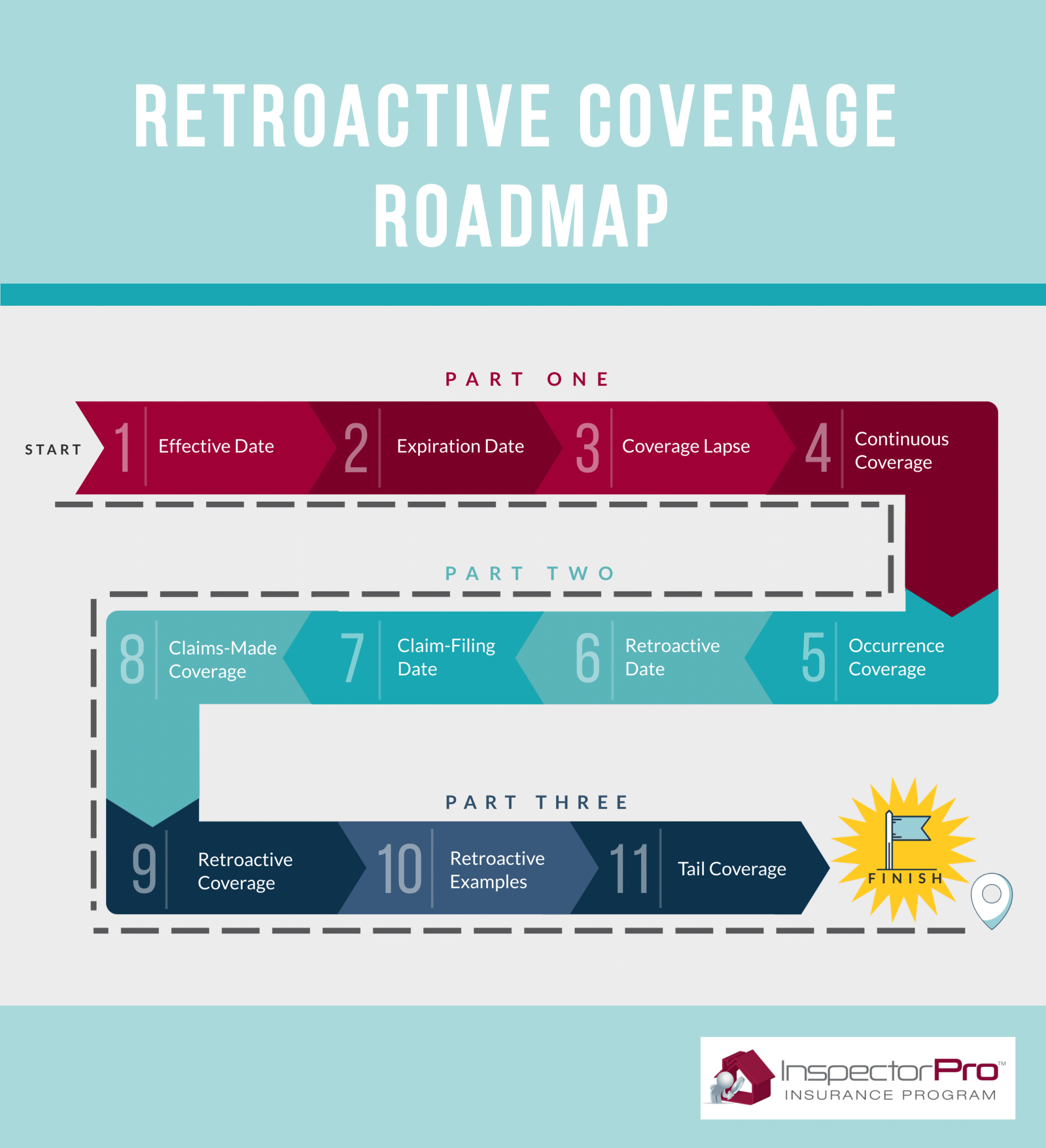

The importance of retroactive insurance. The retroactive date serves as an exclusion, so when such a date appears in the policy declarations, no coverage will apply to claims arising out of acts committed before the specified date, even if the claim is. The retroactive date is the day when insurance coverage begins. How does retroactive cover work? Any claims that arise from events prior to this date is not covered by your insurance. Retroactive insurance helps businesses stay protected against claims that fall outside of their currently active plan, and is an excellent way to mitigate risk and to protect the business.

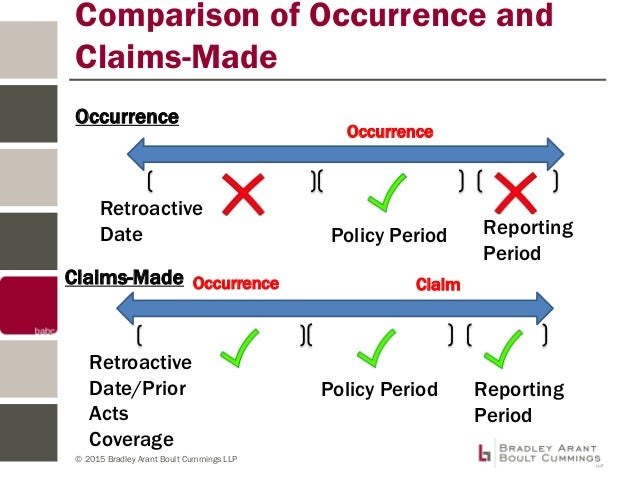

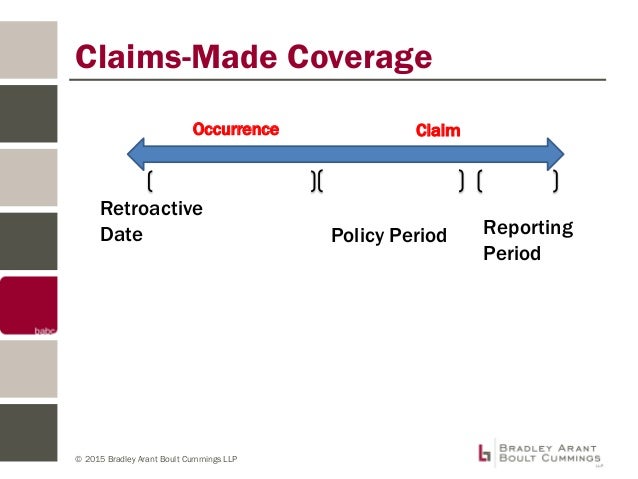

All professional indemnity policies are written on what is a called a ‘claims made’ basis.

Retroactive insurance — insurance purchased to cover a loss after it has occurred. However, claims filed on or after this date will receive coverage as long as the claim is filed within the limits of the coverage period. Individuals who are otherwise uninsured can be considered covered by an insurance product that will pay (4). Retroactive insurance — insurance purchased to cover a loss after it has occurred. Oct 10, 2019 — a retroactive approach is different. And if the accident / insurance event occurs, the insurance company.

Source: inspectorproinsurance.com

Source: inspectorproinsurance.com

All professional indemnity policies are written on what is a called a ‘claims made’ basis. Professional indemnity insurance will include an exclusion whereby any claims relating to services provided prior to the ‘retroactive date’, as noted on your policy schedule, are excluded. 1 it is usually the same as your inception date or the date since which you’ve held continuous insurance coverage. It is not possible to buy retroactive car insurance coverage. 8.2.9 changing an insurance program.

Source: inspectorproinsurance.com

Source: inspectorproinsurance.com

But �most� doesn�t mean �all�, and professional indemnity (pi) insurance is a little different. It is appropriate to consider disclosures in circumstances when the. Any claims that arise from events prior to this date is not covered by your insurance. What is retroactive cobra insurance? 1 it is usually the same as your inception date or the date since which you’ve held continuous insurance coverage.

Source: alignedinsurance.com

Source: alignedinsurance.com

Retroactive insurance helps businesses stay protected against claims that fall outside of their currently active plan, and is an excellent way to mitigate risk and to protect the business. It is not possible to buy retroactive car insurance coverage. A feasible way to bring auto. You can choose not to buy cobra insurance. Retroactive insurance — insurance purchased to cover a loss after it has occurred.

Source: clearskyaccounting.co.uk

Source: clearskyaccounting.co.uk

How does retroactive cover work? The retroactive date is the day when insurance coverage begins. It can cover incidents from the past. 1 it is usually the same as your inception date or the date since which you’ve held continuous insurance coverage. A retroactive date is the date from which you have held uninterrupted professional indemnity insurance cover (even if you changed insurer during this time) or a date in the past from which your insurer has agreed to cover you.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

How does retroactive cover work? It can cover incidents from the past. How does retroactive cover work? And if the accident / insurance event occurs, the insurance company. However, claims filed on or after this date will receive coverage as long as the claim is filed within the limits of the coverage period.

Source: patch.com

Source: patch.com

This ensures that the policy you purchase is covering you for all the past work your business has undertaken. If you’ve had insurance since 2010, and you still have insurance, you could be covered for incidents that fall well outside your current period—as long as they. It is not possible to buy retroactive car insurance coverage. We paid $2,400 total over the two months for insurance we didn’t even need. If you’re not concerned with retroactive coverage for your e&o insurance policy, you should be.

Source: epahepaee.blogspot.com

Retroactive cover refers to coverage for services undertaken previously i.e. Changing an insurance program can result in modifications to coverage for certain risks and events that can lead to noninsured or underinsured risks. Individuals who are otherwise uninsured can be considered covered by an insurance product that will pay (4). Retroactive insurance is a type of insurance that provides coverage for losses that have already occurred but have not yet been reported. Retroactive insurance — insurance purchased to cover a loss after it has occurred.

Source: fixht.com

Source: fixht.com

Losses may go unreported because they were forgotten, not recognized, or the paperwork simply wasn�t filed when it. Prior to the policy start date. If you’ve had insurance since 2010, and you still have insurance, you could be covered for incidents that fall well outside your current period—as long as they. We paid $2,400 total over the two months for insurance we didn’t even need. It extends cover backwards to a specified date (the.

Source: nasbp.org

Source: nasbp.org

Oct 10, 2019 — a retroactive approach is different. The retroactive date serves as an exclusion, so when such a date appears in the policy declarations, no coverage will apply to claims arising out of acts committed before the specified date, even if the claim is. However, claims filed on or after this date will receive coverage as long as the claim is filed within the limits of the coverage period. Once it is determined that the contract passes significant insurance risk, the next step is to evaluate whether the contract is prospective or retroactive. Retroactive insurance helps businesses stay protected against claims that fall outside of their currently active plan, and is an excellent way to mitigate risk and to protect the business.

Source: slideshare.net

Source: slideshare.net

Prior to the policy start date. Your retroactive date is the date on which your coverage begins. Losses may go unreported because they were forgotten, not recognized, or the paperwork simply wasn�t filed when it. Changing an insurance program can result in modifications to coverage for certain risks and events that can lead to noninsured or underinsured risks. A feasible way to bring auto.

Source: inspectorproinsurance.com

Source: inspectorproinsurance.com

The determination of whether the contract reinsures future versus past. Retroactive cover refers to coverage for services undertaken previously i.e. Retroactive insurance — insurance purchased to cover a loss after it has occurred. Retroactive date insurance pays for claims that ocurred while you were covered by an insurance policy, even if you are no longer covered by that particulary (5). All professional indemnity policies are written on what is a called a ‘claims made’ basis.

Source: autoinsuranceape.com

Source: autoinsuranceape.com

How retroactive coverage can help after a loss. If you’ve had insurance since 2010, and you still have insurance, you could be covered for incidents that fall well outside your current period—as long as they. Retroactive insurance helps businesses stay protected against claims that fall outside of their currently active plan, and is an excellent way to mitigate risk and to protect the business. How retroactive coverage can help after a loss. Instead, retroactive insurance accounting would be followed for the new insurance contract.

Source: slideshare.net

Source: slideshare.net

Prior to the policy start date. Losses may go unreported because they were forgotten, not recognized, or the paperwork simply wasn�t filed when it. But �most� doesn�t mean �all�, and professional indemnity (pi) insurance is a little different. This is because the insurance company will be forced to pay out money in the event that an. This means that when you have a potential claim, or are made aware of a possible claim, the claim will.

Source: constech.net

Source: constech.net

Instead, retroactive insurance accounting would be followed for the new insurance contract. It is appropriate to consider disclosures in circumstances when the. What is retroactive insurance cover? Instead, retroactive insurance accounting would be followed for the new insurance contract. The importance of retroactive insurance.

Source: youtube.com

Source: youtube.com

Any claims that arise from events prior to this date is not covered by your insurance. A feasible way to bring auto. It is applied to all professional indemnity insurance policies and its purpose is to exclude claims arising from any work undertaken prior to date shown. This ensures that the policy you purchase is covering you for all the past work your business has undertaken. Instead, retroactive insurance accounting would be followed for the new insurance contract.

Source: tego.com.au

Source: tego.com.au

This ensures that the policy you purchase is covering you for all the past work your business has undertaken. Your retroactive date is the date on which your coverage begins. Individuals who are otherwise uninsured can be considered covered by an insurance product that will pay (4). Instead, retroactive insurance accounting would be followed for the new insurance contract. Prior to the policy start date.

Source: acore.org

Source: acore.org

It is applied to all professional indemnity insurance policies and its purpose is to exclude claims arising from any work undertaken prior to date shown. The international risk management institute (irmi) defines retroactive coverage as insurance that is purchased to cover a loss after it occurs. This means that when you have a potential claim, or are made aware of a possible claim, the claim will. Your policy’s retroactive date is the date on which your professional liability coverage. Changing an insurance program can result in modifications to coverage for certain risks and events that can lead to noninsured or underinsured risks.

Source: inspectorproinsurance.com

Source: inspectorproinsurance.com

If you’re not concerned with retroactive coverage for your e&o insurance policy, you should be. The importance of retroactive insurance. It can cover incidents from the past. How does retroactive cover work? For example, such insurance may cover incurred but not reported.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title retroactive insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information