Retrocession insurance Idea

Home » Trending » Retrocession insurance IdeaYour Retrocession insurance images are available. Retrocession insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Retrocession insurance files here. Find and Download all royalty-free photos and vectors.

If you’re looking for retrocession insurance images information related to the retrocession insurance interest, you have visit the ideal blog. Our site always provides you with hints for viewing the maximum quality video and picture content, please kindly hunt and locate more informative video content and graphics that match your interests.

Retrocession Insurance. A company that accepts such retrocession business is a retrocessionaire. This helps them avoid catastrophic losses, stabilize financial ratios, and obtain. Irmi offers the most exhaustive resource of definitions and other help to insurance professionals found anywhere. Importance of reinsurance to insurance companies.

Retrocession Insurance Gallagher Re From ajg.com

Retrocession Insurance Gallagher Re From ajg.com

Italian to english translations [pro] insurance / assicurazioni vita. Retrocession the retrocession market is characteristically the most complicated and volatile in terms of capacity and pricing. 3 the oldest known trace of reinsurance existence is found in marine policy issued in genoa in 1370. When a reinsurance company obtains reinsurance. In order to secure a large number of similar risks to permit the prediction of losses with a reasonable degree of certainty, insurance companies have devised the practice of reinsurance. The lloyd�s of london insurance and reinsurance market has taken out a £650 million cover from an investment bank and reinsurers to protect its central fund against significant loss events, according to a report from the ft.

Click to go to the #1 insurance dictionary on the web.

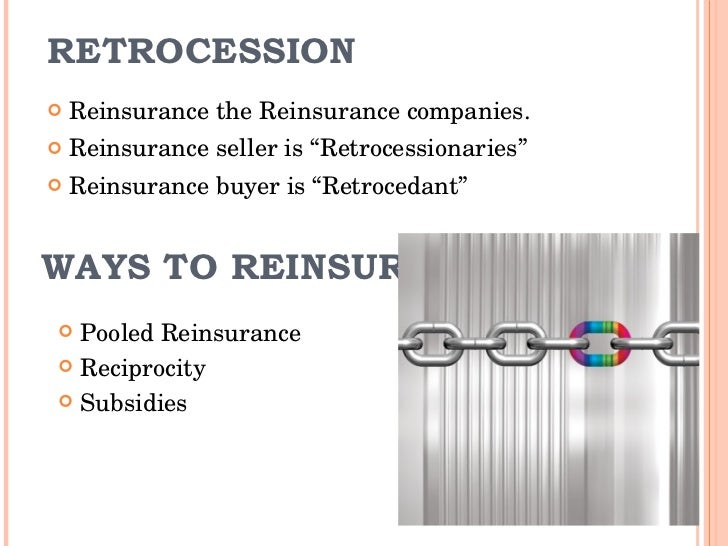

A retrocession is placed to afford additional capacity or reinsurance companies cede risks under retrocession agreements to other reinsurers, for reasons similar to those that cause primary insurers to buy reinsurance. At its simplest, retrocession is where a reinsurer wants to pass on a very large risk to someone else. Reinsurance companies cede risks to retrocessionaires in order to reduce their net liability on individual risks. Also see canopius underwriting bermuda ltd. While retrocession insurance can be confusing, it is a great benefit to insurers because it adds another layer of protection to their businesses. With a highly sophisticated client base, we provide equally sophisticated service capabilities.

Source: insurancelinked.com

Source: insurancelinked.com

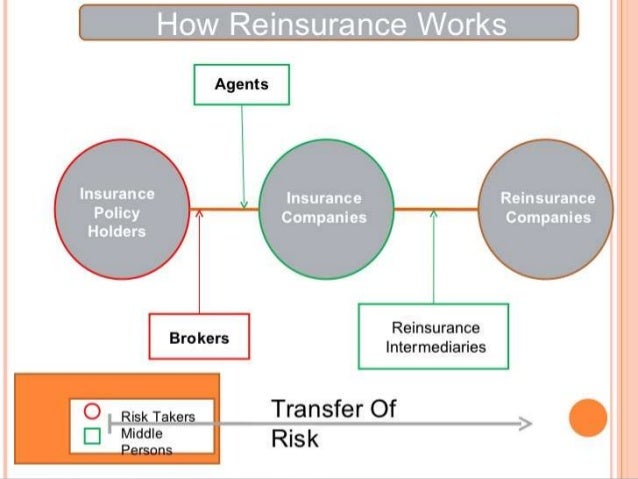

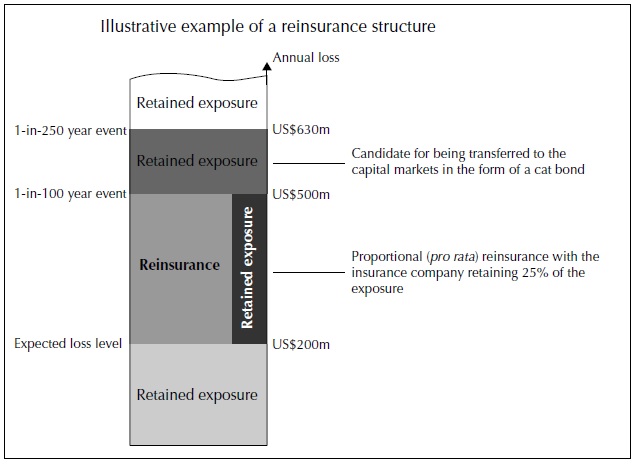

Reinsurance companies cede risks to retrocessionaires in order to reduce their net liability on individual risks. In order to secure a large number of similar risks to permit the prediction of losses with a reasonable degree of certainty, insurance companies have devised the practice of reinsurance. Reinsurance is the insurance protection of an insurance company. In the financial world, it refers to a situation in which one firm which specializes in reinsurance agrees to take on some of the risk for another reinsurance company. When done correctly, retrocession reduces risk and the liability burden of the initial reinsurer by spreading out the risk to other reinsurance companies, giving your insurance company the benefit of:

Source: researchgate.net

Source: researchgate.net

When a reinsurance company obtains reinsurance. This is designed to reduce risk by spreading it out, reducing the liability burden for insurance companies. While retrocession insurance can be confusing, it is a great benefit to insurers because it adds another layer of protection to their businesses. 3 the oldest known trace of reinsurance existence is found in marine policy issued in genoa in 1370. With a highly sophisticated client base, we provide equally sophisticated service capabilities.

Source: ri.co.zw

Source: ri.co.zw

In this regard, no other intermediary can match our structuring ability and market presence. As reinsurance is insurance for insurance, retrocessional, or retro. A retrocession is placed to afford additional capacity or reinsurance companies cede risks under retrocession agreements to other reinsurers, for reasons similar to those that cause primary insurers to buy reinsurance. Regional, national and multinational companies. Retrocession agreements means any agreement, treaty, certificate or other arrangement whereby any insurance subsidiary cedes to another insurer all or part of such insurance subsidiary’s liability under a policy or policies of insurance reinsured by such insurance subsidiary.

Source: getfilings.com

Source: getfilings.com

In this regard, no other intermediary can match our structuring ability and market presence. Our underwriters will consider diverse areas of exposures. In the financial world, it refers to a situation in which one firm which specializes in reinsurance agrees to take on some of the risk for another reinsurance company. Click to go to the #1 insurance dictionary on the web. Looking for information on retrocession?

Source: slideshare.net

Source: slideshare.net

Our underwriters will consider diverse areas of exposures. Retrocession the retrocession market is characteristically the most complicated and volatile in terms of capacity and pricing. This retrocession agreement (this agreement), is made and entered into as of. Per i contratti con prestazioni collegate a gestioni interne separate, tasso annuo. A retrocession is a transaction in which a reinsurer cedes to another reinsurer (the retrocessionaire) part of the reinsurance the former has assumed.

Source: insurancelinked.com

Source: insurancelinked.com

This is designed to reduce risk by spreading it out, reducing the liability burden for insurance companies. In the financial world, it refers to a situation in which one firm which specializes in reinsurance agrees to take on some of the risk for another reinsurance company. To get additional capacity, to optimize capital allocation, to spread risk across space and time, to be financially sound and. Reinsurance companies often also purchase reinsurance, a practice known as retrocession. That policy covered the shipment of goods from genoa to sluys and the most dangerous

Source: insuranceplanet.blogspot.com

Source: insuranceplanet.blogspot.com

Retrocession agreements means any agreement, treaty, certificate or other arrangement whereby any insurance subsidiary cedes to another insurer all or part of such insurance subsidiary’s liability under a policy or policies of insurance reinsured by such insurance subsidiary. Retrocession the retrocession market is characteristically the most complicated and volatile in terms of capacity and pricing. This helps them avoid catastrophic losses, stabilize financial ratios, and obtain. We offer a range of retrocession products on a worldwide basis. Per i contratti con prestazioni collegate a gestioni interne separate, tasso annuo.

Source: slideserve.com

Source: slideserve.com

Retrocession is the reinsuring of a risk by a reinsurer. At its simplest, retrocession is where a reinsurer wants to pass on a very large risk to someone else. This retrocession agreement (this agreement), is made and entered into as of. The lloyd�s of london insurance and reinsurance market has taken out a £650 million cover from an investment bank and reinsurers to protect its central fund against significant loss events, according to a report from the ft. The adviser is keen to close the deal, as is the life insurance company, but the reinsurer may now have a problem, as the value of the risk.

Source: researchgate.net

Gallagher re�s team of experts help our clients navigate the global retrocession market in order to structure solutions that. To get additional capacity, to optimize capital allocation, to spread risk across space and time, to be financially sound and. Importance of reinsurance to insurance companies. A retrocession is a transaction in which a reinsurer cedes to another reinsurer (the retrocessionaire) part of the reinsurance the former has assumed. In the financial world, it refers to a situation in which one firm which specializes in reinsurance agrees to take on some of the risk for another reinsurance company.

Source: investopedia.com

Source: investopedia.com

Our underwriters will consider diverse areas of exposures. Reinsurance companies often also purchase reinsurance, a practice known as retrocession. The lloyd�s of london insurance and reinsurance market has taken out a £650 million cover from an investment bank and reinsurers to protect its central fund against significant loss events, according to a report from the ft. Importance of reinsurance to insurance companies. In order to secure a large number of similar risks to permit the prediction of losses with a reasonable degree of certainty, insurance companies have devised the practice of reinsurance.

Source: ajg.com

Source: ajg.com

With a highly sophisticated client base, we provide equally sophisticated service capabilities. Our underwriters will consider diverse areas of exposures. Retrocession is the reinsuring of a risk by a reinsurer. Importance of reinsurance to insurance companies. They typically purchase this reinsurance from other reinsurance companies, but may also retrocede to other insurance companies to spread the risk more widely.

Source: berkleyre.com

Source: berkleyre.com

The term retrocession is used in two very different ways. | meaning, pronunciation, translations and examples Per i contratti con prestazioni collegate a gestioni interne separate, tasso annuo. Gallagher re�s team of experts help our clients navigate the global retrocession market in order to structure solutions that. When a reinsurance company obtains reinsurance.

Reinsurance companies often also purchase reinsurance, a practice known as retrocession. Charles is our treaty product leader based in bermuda, although our products can be accessed through the canopius offices worldwide. That policy covered the shipment of goods from genoa to sluys and the most dangerous The adviser is keen to close the deal, as is the life insurance company, but the reinsurer may now have a problem, as the value of the risk. In this regard, no other intermediary can match our structuring ability and market presence.

Source: slideshare.net

Source: slideshare.net

A retrocession is placed to afford additional capacity or reinsurance companies cede risks under retrocession agreements to other reinsurers, for reasons similar to those that cause primary insurers to buy reinsurance. Reinsurance companies often also purchase reinsurance, a practice known as retrocession. A company that accepts such retrocession business is a retrocessionaire. This refers to the reinsuring of a reinsurance contract. Retrocession agreements means any agreement, treaty, certificate or other arrangement whereby any insurance subsidiary cedes to another insurer all or part of such insurance subsidiary’s liability under a policy or policies of insurance reinsured by such insurance subsidiary.

Source: sec.gov

Source: sec.gov

Also see canopius underwriting bermuda ltd. The mechanism of risk transfer through insurance, reinsurance and retrocession is shown by figure 2. The adviser is keen to close the deal, as is the life insurance company, but the reinsurer may now have a problem, as the value of the risk. A retrocession is placed to afford additional capacity or reinsurance companies cede risks under retrocession agreements to other reinsurers, for reasons similar to those that cause primary insurers to buy reinsurance. | meaning, pronunciation, translations and examples

Source: qsstudy.com

Source: qsstudy.com

This is designed to reduce risk by spreading it out, reducing the liability burden for insurance companies. Irmi offers the most exhaustive resource of definitions and other help to insurance professionals found anywhere. Looking for information on retrocession? A retrocession is placed to afford additional capacity or reinsurance companies cede risks under retrocession agreements to other reinsurers, for reasons similar to those that cause primary insurers to buy reinsurance. This retrocession agreement (this agreement), is made and entered into as of.

Source: researchgate.net

Source: researchgate.net

Reinsurance portfolios can comprise several thousand contracts that may be contingent on the same events, which makes retrocession a complex decision. This thesis develops an optimization model for retrocession. That policy covered the shipment of goods from genoa to sluys and the most dangerous As reinsurance is insurance for insurance, retrocessional, or retro. Retrocession agreements means any agreement, treaty, certificate or other arrangement whereby any insurance subsidiary cedes to another insurer all or part of such insurance subsidiary’s liability under a policy or policies of insurance reinsured by such insurance subsidiary.

Source: researchgate.net

Source: researchgate.net

Imagine a case where a customer wants a £30m life insurance contract and has a valid reason for this. The lloyd�s of london insurance and reinsurance market has taken out a £650 million cover from an investment bank and reinsurers to protect its central fund against significant loss events, according to a report from the ft. In the financial world, it refers to a situation in which one firm which specializes in reinsurance agrees to take on some of the risk for another reinsurance company. At its simplest, retrocession is where a reinsurer wants to pass on a very large risk to someone else. This helps them avoid catastrophic losses, stabilize financial ratios, and obtain.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title retrocession insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information