Return of premium insurance information

Home » Trend » Return of premium insurance informationYour Return of premium insurance images are ready. Return of premium insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Return of premium insurance files here. Get all royalty-free photos and vectors.

If you’re searching for return of premium insurance images information related to the return of premium insurance interest, you have visit the right blog. Our website frequently gives you suggestions for seeking the highest quality video and picture content, please kindly hunt and locate more informative video content and images that match your interests.

Return Of Premium Insurance. These are some of the benefits and features of the return of premium term life insurance feature. Return of premium is a type of insurance policy in which all or a portion of the amount of premiums paid during a policy period will be returned to the policyholder if claims are not filed, or if the amount of claims filed is smaller than the amount of premiums paid. And if you outlive the level premium payment. Return of premium insurance is a policy that guarantees a safe return of your money paid as premium if you outlive the premium payment period.

Health Insurance What is Return of Premium Life Insurance? From healthinsurance87.blogspot.com

Health Insurance What is Return of Premium Life Insurance? From healthinsurance87.blogspot.com

Return of premium (rop) life insurance is a type of term life insurance that offers a death benefit for your beneficiaries if you pass away—or a refund on the premiums you�ve paid if you outlive the policy. It is worth researching and comparing with similar options that are available to seniors. And if you outlive the level premium payment. Return of premium term life insurance Return of premium is an optional rider that can be added to critical illness and disability insurance policies. Return of premium life insurance is a type of life insurance that seniors can consider when they are choosing a policy.

As with all types of life insurance, it is important.

It is worth researching and comparing with similar options that are available to seniors. Return of premium life insurance is a type of term life insurance that offers a refund of premiums paid. Return of premium insurance is a policy that guarantees a safe return of your money paid as premium if you outlive the premium payment period. Your insurance operates within a set time with one significant difference. Term life insurance usually provides a cash payment (known as a death benefit) if you die within the specific time period that your policy premium (payment). Without an rop life insurance rider, if you�re still living when the policy�s term ends, your policy will expire without paying a benefit.

Source: topquotelifeinsurance.com

Source: topquotelifeinsurance.com

Alongside the return of premium (rop) benefit, the new term life insurance also has a death benefit feature. You are required to assess your family’s financial needs and then choose a trop policy to get a comprehensive life cover that will offer the premium return option if you survive through the. A return of premium is an optional rider added to term life insurance policies that stipulates that if the insured outlives the policy term, the life insurance company will return the premiums the policy owner has paid to them. Return of premium is a type of insurance policy in which all or a portion of the amount of premiums paid during a policy period will be returned to the policyholder if claims are not filed, or if the amount of claims filed is smaller than the amount of premiums paid. Term insurance return of premium is a great choice, as it offers a life cover and return of premium benefit.

Source: moneysavvyliving.com

Source: moneysavvyliving.com

A return premium can also be made for an overpayment or as a result of reducing your coverage. Return of premium (rop) term life policies give you back some or all the premiums you paid if you outlive your policy, this tends to be more expensive so you have to weigh the pros and cons. A return of premium rider allows term life insurance policyholders to recover the premiums they�ve paid over the life of their policy if they don�t die while the policy is in effect. A return of premium is an optional rider added to term life insurance policies that stipulates that if the insured outlives the policy term, the life insurance company will return the premiums the policy owner has paid to them. If you don’t die during the term, your coverage ends and you get your money back.

Source: pacificinsurancegroup.com

Source: pacificinsurancegroup.com

Though the refunded premiums sound appealing, rop policies are a lot more expensive than standard term life insurance. A return of premium is an optional rider added to term life insurance policies that stipulates that if the insured outlives the policy term, the life insurance company will return the premiums the policy owner has paid to them. Return of premium insurance builds cash value, which you can borrow against during the level premium period. As with all types of life insurance, it is important. A return premium can also be made for an overpayment or as a result of reducing your coverage.

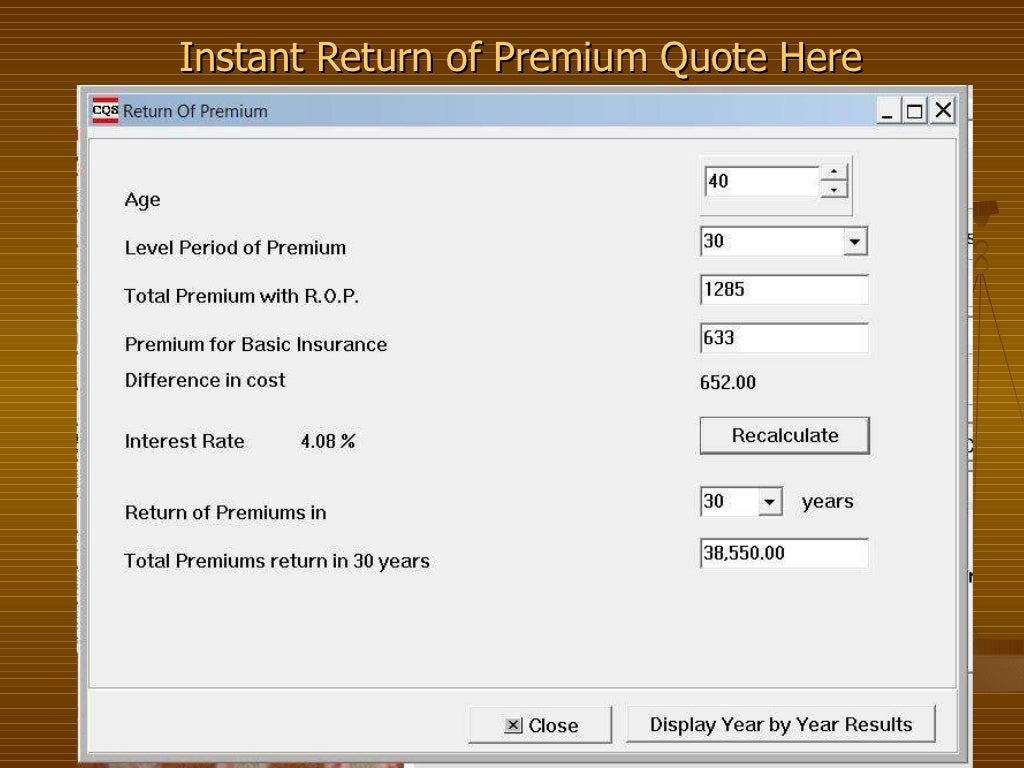

Source: slideshare.net

Source: slideshare.net

Term insurance return of premium is a great choice, as it offers a life cover and return of premium benefit. Alongside the return of premium (rop) benefit, the new term life insurance also has a death benefit feature. Return of premium life insurance (rop) — sometimes called return of premium term life insurance — is a type of term life insurance that refunds your payments if you outlive your coverage. What is return of premium life insurance? As with all types of life insurance, it is important.

Source: healthinsurance87.blogspot.com

Source: healthinsurance87.blogspot.com

Upon cancellation of an insurance policy prior to the expiration date, the unused portion of the premium is returned to the insured. This will allow seniors to make the best choice about their life insurance options. A return of premium is an optional rider added to term life insurance policies that stipulates that if the insured outlives the policy term, the life insurance company will return the premiums the policy owner has paid to them. What is a return of premium? It is a standard term policy, with.

Source: jrcinsurancegroup.com

Source: jrcinsurancegroup.com

These are some of the benefits and features of the return of premium term life insurance feature. Return of premium life insurance is a type of term life insurance that offers you coverage for a set number of years — but with an added bonus. Return of premium life insurance is a type of life insurance that seniors can consider when they are choosing a policy. Term insurance return of premium is a great choice, as it offers a life cover and return of premium benefit. You are required to assess your family’s financial needs and then choose a trop policy to get a comprehensive life cover that will offer the premium return option if you survive through the.

Source: youtube.com

Source: youtube.com

Aig return of premium (rop) life insurance. Return of premium life insurance is a type of term life insurance that offers a refund of premiums paid. It is worth researching and comparing with similar options that are available to seniors. Return of premium policies generally cost more. If you don’t die during its term, you’ll receive all or a portion of.

Source: visual.ly

Alongside the return of premium (rop) benefit, the new term life insurance also has a death benefit feature. With such a promising policy, you can trust that the financial future of your family is in safe hands. Return of premium life insurance is a type of term life insurance that offers a refund of premiums paid. While rop life insurance may seem enticing, it costs significantly more than regular term life insurance. Your insurance operates within a set time with one significant difference.

Source: holbornassets.com

Source: holbornassets.com

Without an rop life insurance rider, if you�re still living when the policy�s term ends, your policy will expire without paying a benefit. A return of premium life insurance policy is a form of term coverage that agrees to refund all the premiums you pay if you outlive the policy. Upon cancellation of an insurance policy prior to the expiration date, the unused portion of the premium is returned to the insured. If you don’t die during the term, your coverage ends and you get your money back. Return of premium insurance builds cash value, which you can borrow against during the level premium period.

Source: slideshare.net

Source: slideshare.net

Term insurance return of premium offers a lower sum assured amount as compared to the pure term insurance policy, as the premium amount refunded Term insurance return of premium is a great choice, as it offers a life cover and return of premium benefit. Your insurance operates within a set time with one significant difference. That is, for an additional cost. A return of premium is an optional rider added to term life insurance policies that stipulates that if the insured outlives the policy term, the life insurance company will return the premiums the policy owner has paid to them.

Source: slideshare.net

Source: slideshare.net

Return of premium is a type of insurance policy in which all or a portion of the amount of premiums paid during a policy period will be returned to the policyholder if claims are not filed, or if the amount of claims filed is smaller than the amount of premiums paid. If you don’t die during the term, your coverage ends and you get your money back. Return of premium term life insurance With return of premium life insurance, you gain coverage for a term of 30 years for a level premium payment. Term insurance return of premium offers a lower sum assured amount as compared to the pure term insurance policy, as the premium amount refunded

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

If you don’t die during its term, you’ll receive all or a portion of. With return of premium life insurance, you gain coverage for a term of 30 years for a level premium payment. Return of premium is a type of insurance policy in which all or a portion of the amount of premiums paid during a policy period will be returned to the policyholder if claims are not filed, or if the amount of claims filed is smaller than the amount of premiums paid. If you don’t die during its term, you’ll receive all or a portion of. A return of premium is an optional rider added to term life insurance policies that stipulates that if the insured outlives the policy term, the life insurance company will return the premiums the policy owner has paid to them.

Source: locallifeagents.com

Source: locallifeagents.com

Return of premium (rop) life insurance is a type of term life insurance that offers a death benefit for your beneficiaries if you pass away—or a refund on the premiums you�ve paid if you outlive the policy. The sum assured in term insurance with return of premium plans refers to the life insurance cover that is offered by the insurer to the insured person at the time of signing up for the plan. Return of premium (rop) life insurance is a type of term life insurance that offers a death benefit for your beneficiaries if you pass away—or a refund on the premiums you�ve paid if you outlive the policy. This type of life insurance is sometimes a standalone policy, or it may be an additional cost and benefit that you can add to a term policy. Term life insurance usually provides a cash payment (known as a death benefit) if you die within the specific time period that your policy premium (payment).

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

If you don’t die during its term, you’ll receive all or a portion of. If you don’t die during the term, your coverage ends and you get your money back. The minimum face value amount we offer is $100,000. What is a return of premium? A return premium can also be made for an overpayment or as a result of reducing your coverage.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

A return of premium rider allows term life insurance policyholders to recover the premiums they�ve paid over the life of their policy if they don�t die while the policy is in effect. The return of premium (rop) is a benefit that comes with the new term life insurance introduced by aig. Return of premium is an optional rider that can be added to critical illness and disability insurance policies. With return of premium life insurance, you gain coverage for a term of 30 years for a level premium payment. Return of premium life insurance is a type of term life insurance that offers a refund of premiums paid.

Premiums will increase annually but will never exceed the maximum premium stated in the policy. It is a standard term policy, with. Term insurance return of premium is a great choice, as it offers a life cover and return of premium benefit. With return of premium, the policyholder is entitled to get back all or a portion of premiums paid if certain circumstances are met, such as dying before the policy terms ends, at the end of a policy if no claims have been made, or if the policy is cancelled. Return of premium (rop) term life policies give you back some or all the premiums you paid if you outlive your policy, this tends to be more expensive so you have to weigh the pros and cons.

Source: lifeinsuranceblog.net

Source: lifeinsuranceblog.net

Term insurance return of premium offers a lower sum assured amount as compared to the pure term insurance policy, as the premium amount refunded Premiums will increase annually but will never exceed the maximum premium stated in the policy. The sum assured in term insurance with return of premium plans refers to the life insurance cover that is offered by the insurer to the insured person at the time of signing up for the plan. A return of premium is an optional rider added to term life insurance policies that stipulates that if the insured outlives the policy term, the life insurance company will return the premiums the policy owner has paid to them. This type of life insurance is sometimes a standalone policy, or it may be an additional cost and benefit that you can add to a term policy.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

What is a return of premium? Return of premium term life insurance The return of premium (rop) is a benefit that comes with the new term life insurance introduced by aig. A return of premium life insurance policy is a form of term coverage that agrees to refund all the premiums you pay if you outlive the policy. You are required to assess your family’s financial needs and then choose a trop policy to get a comprehensive life cover that will offer the premium return option if you survive through the.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title return of premium insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information