Return of premium life insurance pros and cons information

Home » Trend » Return of premium life insurance pros and cons informationYour Return of premium life insurance pros and cons images are available in this site. Return of premium life insurance pros and cons are a topic that is being searched for and liked by netizens now. You can Find and Download the Return of premium life insurance pros and cons files here. Download all free photos.

If you’re looking for return of premium life insurance pros and cons pictures information connected with to the return of premium life insurance pros and cons keyword, you have visit the right blog. Our website always provides you with suggestions for viewing the highest quality video and image content, please kindly hunt and find more enlightening video content and graphics that fit your interests.

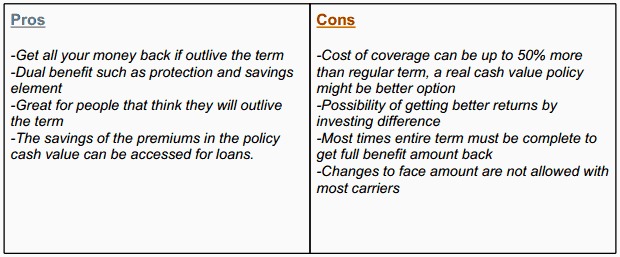

Return Of Premium Life Insurance Pros And Cons. We went over why you should not get a return of premium life insurance, now it is time to turn our attention on the only return of premium policy type we recommend and list 4 reasons why: However, we need to delve a little deeper into the pros and cons of return of premium life insurance before you can make a final decision. If you do die during your term then your family will benefit. Pros of return of premium life.

Source: vittana.org

Source: vittana.org

One advantage is that you will get your premium back if you survive the term. You get the same flexibility as term life insurance including choosing the time period, benefit, and premiums. Weighing the pros and cons of return of premium life insurance first and foremost, the biggest downside is the cost. If you outlive the insurance, you get paid back. Return of premium life insurance is more expensive than other forms of term life insurance and can be over triple the cost of a standard term life insurance policy.

Source: insuranceproaz.com

Source: insuranceproaz.com

However, we need to delve a little deeper into the pros and cons of return of premium life insurance before you can make a final decision. A return of premium life insurance policy is much more expensive than traditional term life insurance coverage. There’s no ‘use it or lose it’ drawback. Because it isn’t income, the money is not taxed when it’s returned to you. The pros and cons of return of premium life insurance.

Source: masonfinance.com

Source: masonfinance.com

Because it isn’t income, the money is not taxed when it’s returned to you. If you die before your policy’s expiration date, the insurer refunds your premium payments. Advantages of return of premium life insurance. As with single premium life insurance, the pros outweigh the cons of single premium universal life insurance. For many people, in the end, the cons of return of premium life insurance outweigh the pros.

Source: dog-diuvel.blogspot.com

Source: dog-diuvel.blogspot.com

If you switch to another life insurance policy in the early part of your term policy (typically the first 5 years), you’ll get no returned premiums. Here are the return of premium life insurance advantages. With a return of premium life insurance policy, the main positive is that you will receive the full amount of your premiums if you outlive the policy term. A return of premium life insurance policy is much more expensive than traditional term life insurance coverage. We went over why you should not get a return of premium life insurance, now it is time to turn our attention on the only return of premium policy type we recommend and list 4 reasons why:

Source: fedfarmer.blogspot.com

Source: fedfarmer.blogspot.com

However, you get your premiums back when your term expires, so that doesn’t mean. As with single premium life insurance, the pros outweigh the cons of single premium universal life insurance. Disadvantages of return of premium term life. As with any insurance policy, there are benefits and catches to consider when looking at return of premium life insurance policy. If you do die during your term then your family will benefit.

Source: locallifeagents.com

Source: locallifeagents.com

You could buy more life insurance coverage for the same money or the identical level term period. There’s no ‘use it or lose it’ drawback. Before you purchase any type of life insurance, it’s important to understand the pros and cons. If you choose a return of premium policy, it will cost you much more than a traditional term policy. If you outlive the insurance, you get paid back.

Source: jrcinsurancegroup.com

Source: jrcinsurancegroup.com

Return of premium policy life insurance pros and cons. If the insured dies before the end of the insurance. If you have the money to pay the sum up front, this can be very beneficial to your cash accumulation. Here are the main pros and cons to consider: There’s no ‘use it or lose it’ drawback.

Source: nextgen-life-insurance.com

Source: nextgen-life-insurance.com

If you outlive the insurance, you get paid back. It can force you to start saving some money if you’re budgeting skills are poor, but this option may also reduce the eventual amount you receive if you were to invest in more traditional ways. If you outlive the insurance, you get paid back. The pros and cons of return of premium life insurance. Here are the pros and cons of a return of premium policy.

Source: insuranceproaz.com

Source: insuranceproaz.com

If you choose a return of premium policy, it will cost you much more than a traditional term policy. If you outlive the insurance, you get paid back. Here are the return of premium life insurance advantages. Because it isn’t income, the money is not taxed when it’s returned to you. Cheaper than universal life insurance and whole life insurance.

Source: moneyunder30.com

Source: moneyunder30.com

Pros and cons of return of premium life insurance. You should also remember that the return of the premium may not be guaranteed if you take out a loan or withdraw money. You could buy more life insurance coverage for the same money or the identical level term period. Return of premium policies cost more. If you love the idea of having life insurance, but don’t love the idea of spending money on a term policy you may never use, rop may be the policy for you.

Source: insurechance.com

Source: insurechance.com

In other words, you essentially pay more for the same amount of policy coverage. As with any insurance policy, there are benefits and catches to consider when looking at return of premium life insurance policy. However, needless to say that this also increases the price of the plan and the payable premiums increase. We went over why you should not get a return of premium life insurance, now it is time to turn our attention on the only return of premium policy type we recommend and list 4 reasons why: Return of premium policies cost more.

Source: locallifeagents.com

Source: locallifeagents.com

One advantage is that you will get your premium back if you survive the term. One advantage is that you will get your premium back if you survive the term. For many people, in the end, the cons of return of premium life insurance outweigh the pros. Here are the main pros and cons to consider: Because it isn’t income, the money is not taxed when it’s returned to you.

Source: cfainsure.com

Source: cfainsure.com

Pros and cons of return of premium life insurance. The only option we recommend and 4 reasons why. Weighing the pros and cons of return of premium life insurance first and foremost, the biggest downside is the cost. Here are the return of premium life insurance advantages. Pros of return of premium life insurance.

Source: lifeinsuranceshoppingreviews.com

Source: lifeinsuranceshoppingreviews.com

If you do die during your term then your family will benefit. If the insured dies before the end of the insurance. If you have the money to pay the sum up front, this can be very beneficial to your cash accumulation. If you die before your policy’s expiration date, the insurer refunds your premium payments. Here are the main pros and cons to consider:

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title return of premium life insurance pros and cons by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information