Revival of insurance policy information

Home » Trend » Revival of insurance policy informationYour Revival of insurance policy images are available in this site. Revival of insurance policy are a topic that is being searched for and liked by netizens now. You can Download the Revival of insurance policy files here. Get all royalty-free photos.

If you’re searching for revival of insurance policy images information linked to the revival of insurance policy keyword, you have visit the right blog. Our website always provides you with suggestions for seeing the highest quality video and picture content, please kindly search and find more enlightening video articles and images that match your interests.

Revival Of Insurance Policy. There is no guarantee that the policy will be revived on the same terms as it was originally accepted. Typically, insurance companies are required to offer a revival period of two years to reinstate insurance policies. Client id * password * email id * mobile * dob * quote id * mobile *. Kotak mahindra life insurance company limited, regd.

Special Revival Campaign for Lapsed policies LIC 2019 From insurancefunda.in

Special Revival Campaign for Lapsed policies LIC 2019 From insurancefunda.in

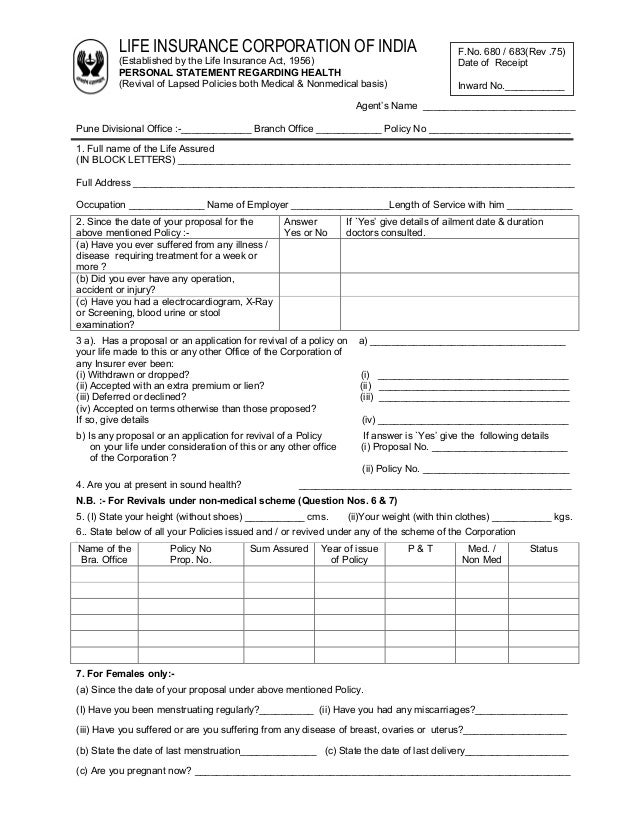

Typically, insurance companies are required to offer a revival period of two years to reinstate insurance policies. To restart the risk cover in the policy, a policyholder has to revive the policy by paying all the due premiums up to the date of revival. If there is any special medical report is called for then policyholder has to visit his servicing branch to revive his/her. The revised dates are mentioned in the new (revised) policy schedule and the eligible benefits will. You can also download the revival form from the official lic website. Public receiving such phone calls are requested to lodge a police complaint.

Client id * password * email id * mobile * dob * quote id * mobile *.

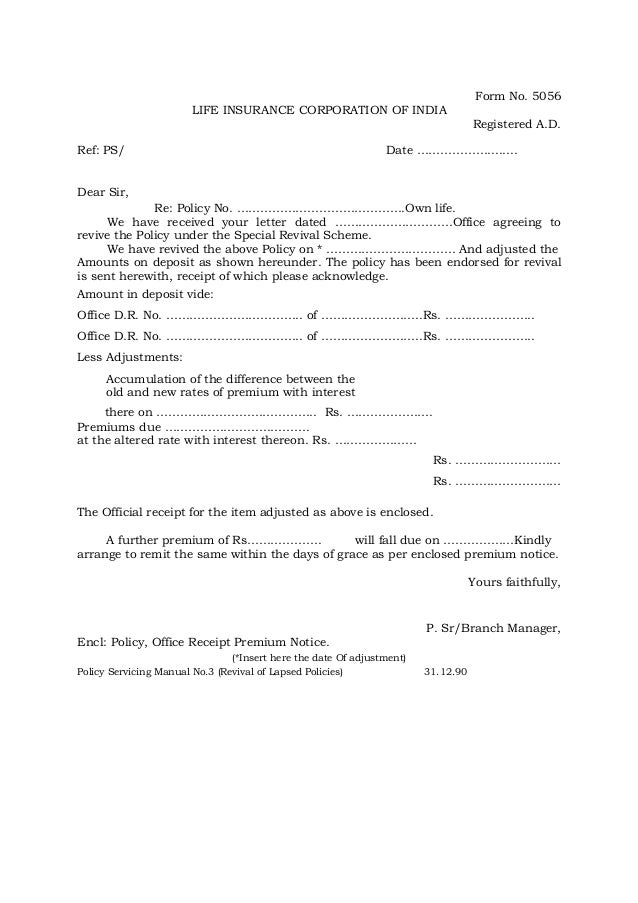

Policy revival “revival” means “to bring back to life”. The special revival scheme will move forward the policy commencement date, risk commencement date and the maturity date. This period offered by the insurer to revive the policy and avail benefits pertaining to it is termed as revival period. In order to provide continuous risk coverage in these uncertain times, the life insurance corporation (lic) has created a chance for revival of lapsed insurance policies. You must fill out the form and submit it to the lic office with the pending premium amount with a late fee. Typically, insurance companies are required to offer a revival period of two years to reinstate insurance policies.

Source: mansakan.blogspot.com

Source: mansakan.blogspot.com

The revised dates are mentioned in the new (revised) policy schedule and the eligible benefits will. In one case, the policy holder needs to. They can reactivate their expired policy by. You must fill out the form and submit it to the lic office with the pending premium amount with a late fee. This section provides basic information on lapsation & revival of your life insurance policy.

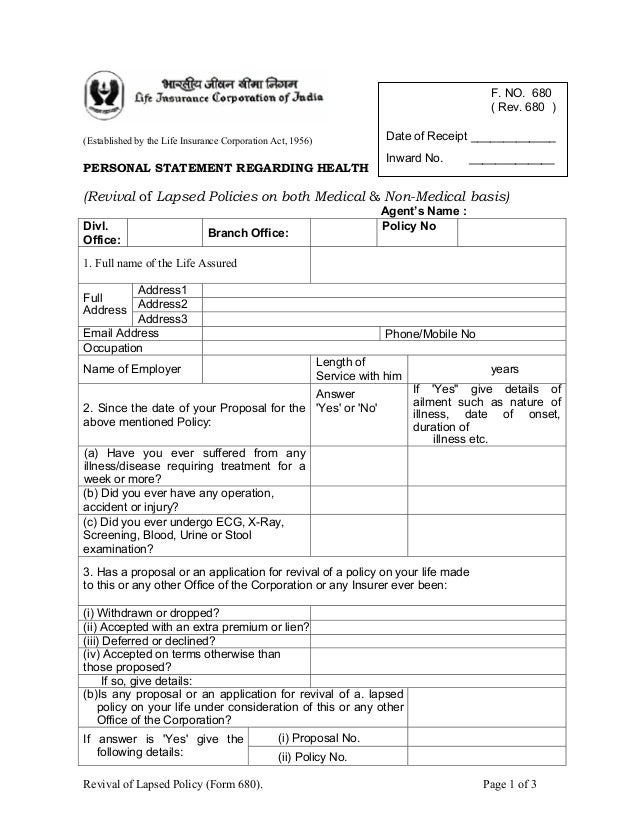

Source: slideshare.net

Source: slideshare.net

Public receiving such phone calls are requested to lodge a police complaint. During the revival period, the policy is reinstated on the basis of certain conditions. The revival of a life insurance policy always works best at the earlier premium. In order to provide continuous risk coverage in these uncertain times, the life insurance corporation (lic) has created a chance for revival of lapsed insurance policies. Insurance companies provide an option of reactivating the lapsed policy, within a specific period of time post the grace period.

Source: slideshare.net

Source: slideshare.net

During the same, the policyholders are not able to avail the benefits of the life insurance policy. Lic will revive your policy based on the number of unpaid premiums, the age of the policyholder and the sum to be revived under the policy. You are subject to fresh health assessment when a revival is underwritten. You must fill out the form and submit it to the lic office with the pending premium amount with a late fee. You can revive policies within five years from the date of the first unpaid premium to offer some respite to life insurance policyholders, lic recently launched a.

Source: sumassured.in

Source: sumassured.in

The revival of a life insurance policy always works best at the earlier premium. The policyholder can contact its representative to revive the expired lic policy under this special offer. Insurance companies provide an option of reactivating the lapsed policy, within a specific period of time post the grace period. During the revival period, the policy is reinstated on the basis of certain conditions. There is no guarantee that the policy will be revived on the same terms as it was originally accepted.

Source: thestatesman.com

Source: thestatesman.com

Policy revival “revival” means “to bring back to life”. Usually, insurance companies need to offer a revival period of two years to restore insurance policies. They can reactivate their expired policy by. Special revival under this scheme the date of. If there is any special medical report is called for then policyholder has to visit his servicing branch to revive his/her.

Source: slideshare.net

Source: slideshare.net

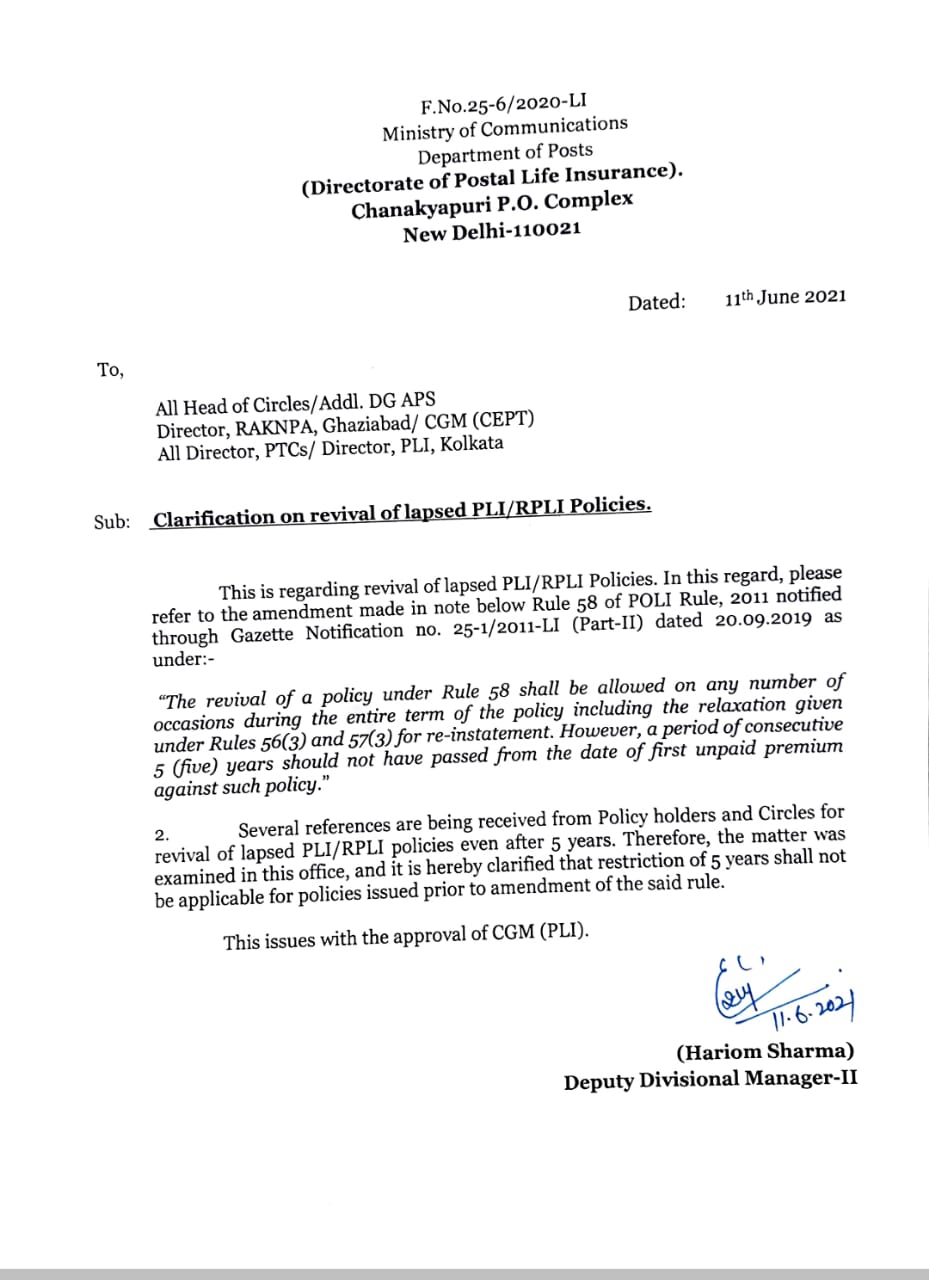

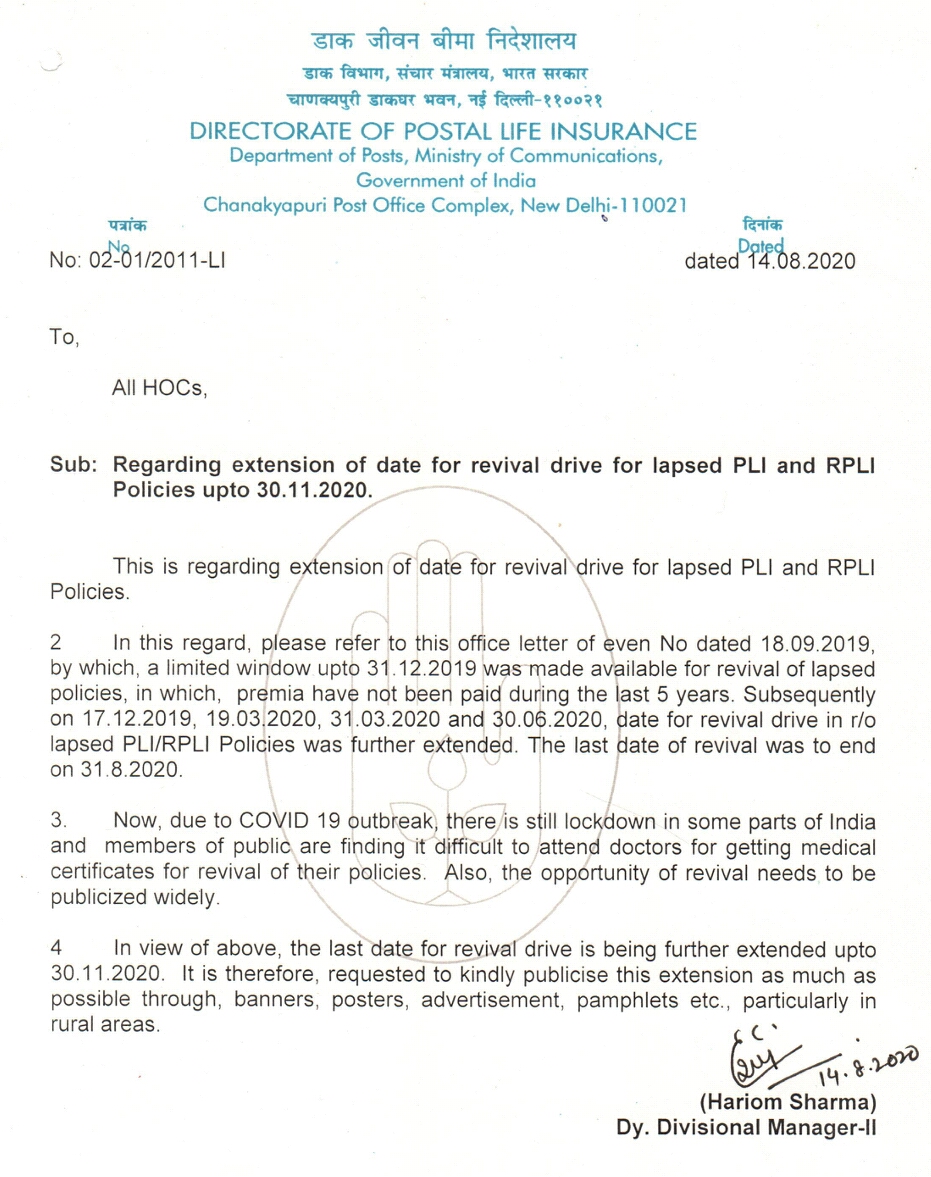

Customers who have been unable to make premium payments for a period of up to five years are eligible for this program. You can revive policies within five years from the date of the first unpaid premium to offer some respite to life insurance policyholders, lic recently launched a. This section provides basic information on lapsation & revival of your life insurance policy. Customers who have been unable to make premium payments for a period of up to five years are eligible for this program. Lic will revive your policy based on the number of unpaid premiums, the age of the policyholder and the sum to be revived under the policy.

Source: gstguntur.com

Source: gstguntur.com

The revival of the lic policy can be done under the following 5 different schemes: Therefore, you as a policyholder must know the ways in which you can renew or revive your policy. Typically, insurance companies are required to offer a revival period of two years to reinstate insurance policies. Special revival under this scheme the date of. You must fill out the form and submit it to the lic office with the pending premium amount with a late fee.

Source: potools.blogspot.com

Source: potools.blogspot.com

This section provides basic information on lapsation & revival of your life insurance policy. Therefore, you as a policyholder must know the ways in which you can renew or revive your policy. In order to provide continuous risk coverage in these uncertain times, the life insurance corporation (lic) has created a chance for revival of lapsed insurance policies. Revival of life insurance policy blogs, comments and archive news on economictimes.com Nowadays policies can be revived in other branches if the policy is to be revived on dgh and medical report only.

Source: revisi.net

Source: revisi.net

This section provides basic information on lapsation & revival of your life insurance policy. Usually, insurance companies need to offer a revival period of two years to restore insurance policies. Special revival under this scheme the date of. The policyholders can enjoy the continuation of the life coverage at lower premiums; Revival of life insurance policy blogs, comments and archive news on economictimes.com

Source: postaltechi.com

Source: postaltechi.com

Therefore, you as a policyholder must know the ways in which you can renew or revive your policy. Customers who have been unable to make premium payments for a period of up to five years are eligible for this program. Revive it if you have paid premiums for several years: They can reactivate their expired policy by. According to the insurance laws, if the policy was in force for at least three years, then the policyholder got up to two years to revive the lapsed insurance policy.

Source: revisi.net

Source: revisi.net

The revival of the lic policy can be done under the following 5 different schemes: This section provides basic information on lapsation & revival of your life insurance policy. Therefore, revival option of life insurance policy provides various advantages to the policyholders. Revive it if you have paid premiums for several years: Usually, insurance companies need to offer a revival period of two years to restore insurance policies.

Source: rajdhaniindianews.com

Source: rajdhaniindianews.com

Revive it if you have paid premiums for several years: Revive it if you have paid premiums for several years: Insurance companies provide an option of reactivating the lapsed policy, within a specific period of time post the grace period. The revival of a life insurance policy always works best at the earlier premium. Revival of life insurance policy latest breaking news, pictures, videos, and special reports from the economic times.

Source: licboj.weebly.com

Source: licboj.weebly.com

Revive it if you have paid premiums for several years: This section provides basic information on lapsation & revival of your life insurance policy. In order to provide continuous risk coverage in these uncertain times, the life insurance corporation (lic) has created a chance for revival of lapsed insurance policies. The process of revival depends on its duration and type of policy. This scheme allows you to revive your lapsed insurance policy by paying all your unpaid premiums in one go.

Source: insurancefunda.in

Source: insurancefunda.in

Revival of life insurance policy latest breaking news, pictures, videos, and special reports from the economic times. Now you can revive your lapsed policy online at hdfc life. Public receiving such phone calls are requested to lodge a police complaint. According to the insurance laws, if the policy was in force for at least three years, then the policyholder got up to two years to revive the lapsed insurance policy. You can revive policies within five years from the date of the first unpaid premium to offer some respite to life insurance policyholders, lic recently launched a.

Source: symboinsurance.com

Source: symboinsurance.com

Typically, insurance companies are required to offer a revival period of two years to reinstate insurance policies. Lic lapsed policy revival is a scheme that was launched by lic on august 23, 2021. In order to provide continuous risk coverage in these uncertain times, the life insurance corporation (lic) has created a chance for revival of lapsed insurance policies. The revival of the lic policy can be done under the following 5 different schemes: One can revive the insurance policy at any time, but sometimes it depends on how many days have passed since the policy has lapsed.

Source: sapost.blogspot.com

Source: sapost.blogspot.com

For individual lapsed policies, a special revival campaign. This scheme allows you to revive your lapsed insurance policy by paying all your unpaid premiums in one go. Irdai is not involved in activities like selling insurance policies, announcing bonus or investment of premiums. There is no guarantee that the policy will be revived on the same terms as it was originally accepted. Usually, insurance companies need to offer a revival period of two years to restore insurance policies.

Source: revisi.net

Source: revisi.net

The revised dates are mentioned in the new (revised) policy schedule and the eligible benefits will. Revive it if you have paid premiums for several years: You are subject to fresh health assessment when a revival is underwritten. The revival of lapsed lic insurance policy arises when the insured is not able to make the payment in time or in grace time. Kotak mahindra life insurance company limited, regd.

Source: slideshare.net

Source: slideshare.net

You must fill out the form and submit it to the lic office with the pending premium amount with a late fee. You can also download the revival form from the official lic website. Insurance companies provide an option of reactivating the lapsed policy, within a specific period of time post the grace period. According to the insurance laws, if the policy was in force for at least three years, then the policyholder got up to two years to revive the lapsed insurance policy. Special revival under this scheme the date of.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title revival of insurance policy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information