Risk averse insurance Idea

Home » Trend » Risk averse insurance IdeaYour Risk averse insurance images are available in this site. Risk averse insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Risk averse insurance files here. Get all royalty-free vectors.

If you’re searching for risk averse insurance pictures information related to the risk averse insurance interest, you have pay a visit to the right site. Our site always gives you suggestions for refferencing the highest quality video and image content, please kindly hunt and find more enlightening video articles and images that fit your interests.

Risk Averse Insurance. Risk averse insurance is a property and casualty insurance agency specializing in insurance products for commercial real estate, workers compensation, professional liability, and more. This paper suggests a new explanation for the low level of annuitization, which is valid even if one assumes perfect markets. Introduction • to have a passably usable model of choice, we need to be able to say something about Concluding remarks we have shown that increased risk aversion does not necessarily imply a higher level of insurance coverage when insurers.

logo Risk Averse Insurance From riskaverseinsurance.com

logo Risk Averse Insurance From riskaverseinsurance.com

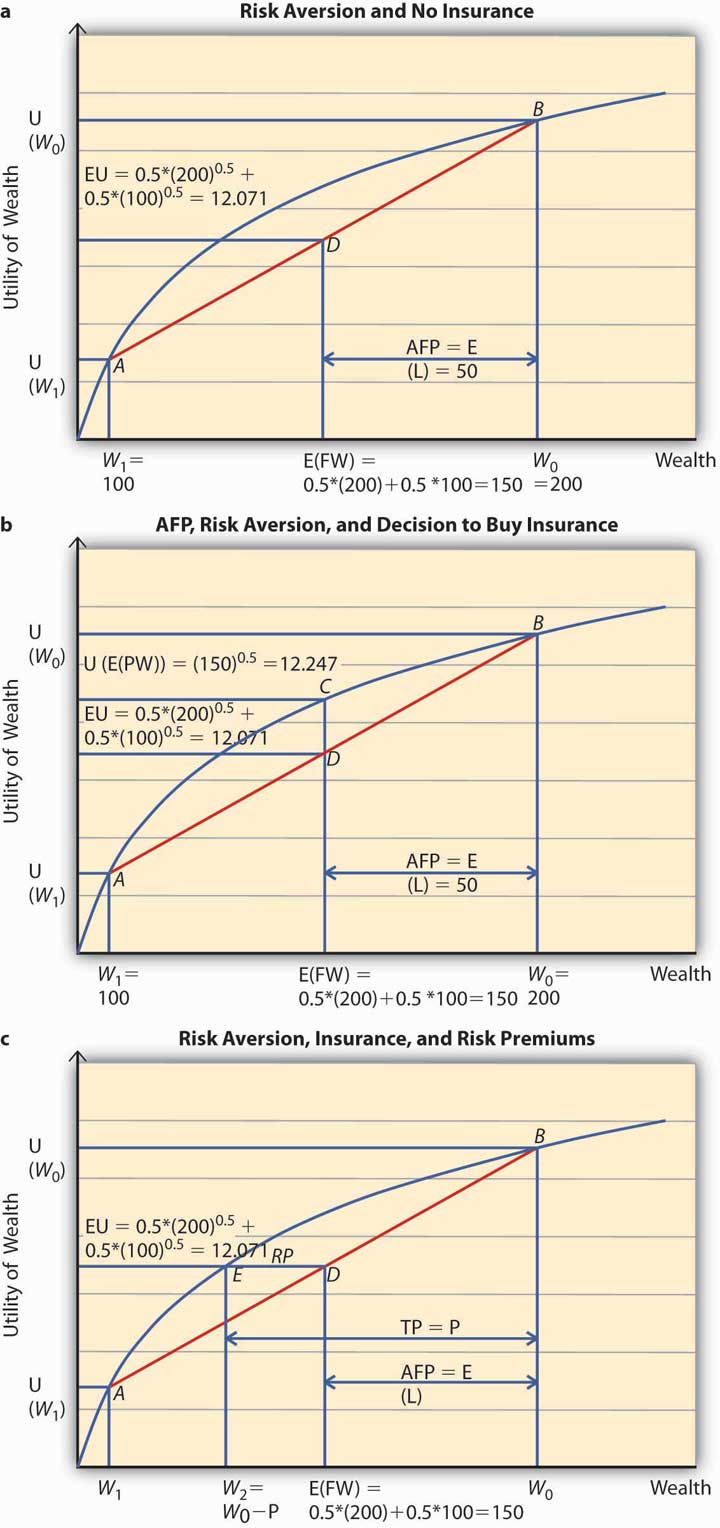

This part shows why these aspects of insurance insurance are more difficult for administrative and judicial regulation to address, analyzing how and why this is the case. The probability of getting in an accident is (a) and the loss is l. The purpose of this paper is to review the empirical literature on risk aversion (and risk behavior) with a particular focus on insurance demand or consumption. Risk aversion is a trait common to most individuals. A common way that individuals reduce risk is through the purchase of insurance. Agree to pay a fee of $ 10.

More than $6 for an expected gain of $7.

Risk averse insurance is a property and casualty insurance agency specializing in insurance products for commercial real estate, workers compensation, professional liability, and more. Risk averse individuals will always choose to purchase fair insurance. Are risk averse and for which insurance insurance would therefore in principle be desirable. In investing, risk equals price volatility. Risk averse individuals will generally take the lower return because there is less risk involved, even though there is a chance to get a higher. This characteristic is usually attached to investors or market participants who prefer investments with lower returns and relatively known risks over investments with potentially higher returns but also with higher uncertainty and more risk.

Source: riskaverseinsurance.com

Source: riskaverseinsurance.com

We show that, as soon there is a positive bequest motive, sufficiently risk averse individuals should not purchase annuities. Most people must be compensated for accepting additional risk. Concluding remarks we have shown that increased risk aversion does not necessarily imply a higher level of insurance coverage when insurers. Risk averse insurance is a property and casualty insurance agency specializing in insurance products for commercial real estate, workers compensation, professional liability, and more. The purpose of this paper is to review the empirical literature on risk aversion (and risk behavior) with a particular focus on insurance demand or consumption.

Source: riskaverseinsurance.com

Source: riskaverseinsurance.com

Risk averse individuals are willing to pay a price to avoid or lower risk. Risk aversion creates a demand for insurance, which gives rise to a large economics literature on health insurance, unemployment insurance, property insurance, flood insurance, and so forth. Most people must be compensated for accepting additional risk. Risk averse individuals will generally take the lower return because there is less risk involved, even though there is a chance to get a higher. Are risk averse and for which insurance insurance would therefore in principle be desirable.

Source: riskaverseinsurance.com

Source: riskaverseinsurance.com

Agree to pay a fee of $ 10. Assume that the insurance market is perf This is shown to imply that more risk averse clients who bargain against risk neutral insurers pay higher insurance premiums for less insurance than less risk averse clients in the same situation. Risk averse student would not pay. Private insurance markets exist thanks to the risk premium described earlier in the chapter.

Source: riskaverseinsurance.com

Source: riskaverseinsurance.com

Most people must be compensated for accepting additional risk. This paper suggests a new explanation for the low level of annuitization, which is valid even if one assumes perfect markets. This part shows why these aspects of insurance insurance are more difficult for administrative and judicial regulation to address, analyzing how and why this is the case. Risk averse individuals will always choose to purchase fair insurance. Agree to pay a fee of $ 10.

![]() Source: policonomics.com

Source: policonomics.com

We show that, as soon there is a positive bequest motive, sufficiently risk averse individuals should not purchase annuities. The purpose of this paper is to review the empirical literature on risk aversion (and risk behavior) with a particular focus on insurance demand or consumption. A risk averse person must be compensated for accepting additional risk even if the expected value is the same. Concluding remarks we have shown that increased risk aversion does not necessarily imply a higher level of insurance coverage when insurers. We show that, as soon there is a positive bequest motive, sufficiently risk averse individuals should not purchase annuities.

Source: riskaverseinsurance.com

Source: riskaverseinsurance.com

Risk averse individuals will generally take the lower return because there is less risk involved, even though there is a chance to get a higher. We show that, as soon there is a positive bequest motive, sufficiently risk averse individuals should not purchase annuities. This is why investors demand higher returns on riskier investments. A common way that individuals reduce risk is through the purchase of insurance. Most people must be compensated for accepting additional risk.

Source: riskaverseinsurance.com

Source: riskaverseinsurance.com

In the 50/50 lottery between $1 million and $0, a risk averse person would be indifferent at an amount strictly greater than $500,000. Is $9 if you agree to pay a fee of $2, but drop to only $5 if you. Risk aversion creates a demand for insurance, which gives rise to a large economics literature on health insurance, unemployment insurance, property insurance, flood insurance, and so forth. We show that, as soon there is a positive bequest motive, sufficiently risk averse individuals should not purchase annuities. Agree to pay a fee of $ 10.

Source: riskaverseinsurance.com

Source: riskaverseinsurance.com

By paying the risk premium the individual can insure himself against a large loss from a fire and to get an assured or certain income. This is shown to imply that more risk averse clients who bargain against risk neutral insurers pay higher insurance premiums for less insurance than less risk averse clients in the same situation. In the 50/50 lottery between $1 million and $0, a risk averse person would be indifferent at an amount strictly greater than $500,000. A risk averse person must be compensated for accepting additional risk even if the expected value is the same. Are risk averse and for which insurance insurance would therefore in principle be desirable.

Agree to pay a fee of $ 10. Risk averse client than when it bargains against a less risk averse client seeking to insure against the same potential loss. We show that, as soon there is a positive bequest motive, sufficiently risk averse individuals should not purchase annuities. This characteristic is usually attached to investors or market participants who prefer investments with lower returns and relatively known risks over investments with potentially higher returns but also with higher uncertainty and more risk. This is why investors demand higher returns on riskier investments.

Source: youtube.com

Source: youtube.com

Are risk averse and for which insurance insurance would therefore in principle be desirable. Risk averse individuals will always choose to purchase fair insurance. By paying the risk premium the individual can insure himself against a large loss from a fire and to get an assured or certain income. Risk averse student would not pay. Risk aversion is a trait common to most individuals.

Source: saylordotorg.github.io

Source: saylordotorg.github.io

It is clear from above why people buy insurance for fire, accident, ill health and even. A common way that individuals reduce risk is through the purchase of insurance. This is why we buy insurance. Risk averse individuals are willing to pay a price to avoid or lower risk. This characteristic is usually attached to investors or market participants who prefer investments with lower returns and relatively known risks over investments with potentially higher returns but also with higher uncertainty and more risk.

Source: riskaverseinsurance.com

Source: riskaverseinsurance.com

Concluding remarks we have shown that increased risk aversion does not necessarily imply a higher level of insurance coverage when insurers. It is clear from above why people buy insurance for fire, accident, ill health and even. Someone who is risk averse has the characteristic or trait of preferring avoiding loss over making a gain. The probability of getting in an accident is (a) and the loss is l. Á theoretical glance at the annuity puzzle

![]() Source: policonomics.com

Source: policonomics.com

Risk averse student would not pay. These preferences explain why people buy insurance. A risk averse person must be compensated for accepting additional risk even if the expected value is the same. Concluding remarks we have shown that increased risk aversion does not necessarily imply a higher level of insurance coverage when insurers. Someone who is risk averse has the characteristic or trait of preferring avoiding loss over making a gain.

Source: slideserve.com

Source: slideserve.com

We show that, as soon there is a positive bequest motive, sufficiently risk averse individuals should not purchase annuities. Risk averse individuals will generally take the lower return because there is less risk involved, even though there is a chance to get a higher. Concluding remarks we have shown that increased risk aversion does not necessarily imply a higher level of insurance coverage when insurers. Someone who is risk averse has the characteristic or trait of preferring avoiding loss over making a gain. Are risk averse and for which insurance insurance would therefore in principle be desirable.

Source: riskaverseinsurance.com

Source: riskaverseinsurance.com

Risk averse client than when it bargains against a less risk averse client seeking to insure against the same potential loss. Risk averse insurance is a property and casualty insurance agency specializing in insurance products for commercial real estate, workers compensation, professional liability, and more. Risk averse individuals will generally take the lower return because there is less risk involved, even though there is a chance to get a higher. The purpose of this paper is to review the empirical literature on risk aversion (and risk behavior) with a particular focus on insurance demand or consumption. This is why investors demand higher returns on riskier investments.

Source: riskaverseinsurance.com

Source: riskaverseinsurance.com

We show that, as soon there is a positive bequest motive, sufficiently risk averse individuals should not purchase annuities. Most people must be compensated for accepting additional risk. This is shown to imply that more risk averse clients who bargain against risk neutral insurers pay higher insurance premiums for less insurance than less risk averse clients in the same situation. This paper suggests a new explanation for the low level of annuitization, which is valid even if one assumes perfect markets. Á theoretical glance at the annuity puzzle

Source: riskaverseinsurance.com

Source: riskaverseinsurance.com

In the 50/50 lottery between $1 million and $0, a risk averse person would be indifferent at an amount strictly greater than $500,000. These preferences explain why people buy insurance. Someone with risk accceptant preferences requires an amount of money greater than the expected value of a lottery to be bought out. Are risk averse and for which insurance insurance would therefore in principle be desirable. Most people must be compensated for accepting additional risk.

Source: riskaverseinsurance.com

Source: riskaverseinsurance.com

Concluding remarks we have shown that increased risk aversion does not necessarily imply a higher level of insurance coverage when insurers. Someone who is risk averse has the characteristic or trait of preferring avoiding loss over making a gain. Risk averse individuals will always choose to purchase fair insurance. A risk averse person must be compensated for accepting additional risk even if the expected value is the same. This characteristic is usually attached to investors or market participants who prefer investments with lower returns and relatively known risks over investments with potentially higher returns but also with higher uncertainty and more risk.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title risk averse insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information