Risk financing techniques in insurance information

Home » Trend » Risk financing techniques in insurance informationYour Risk financing techniques in insurance images are ready in this website. Risk financing techniques in insurance are a topic that is being searched for and liked by netizens today. You can Download the Risk financing techniques in insurance files here. Get all free vectors.

If you’re searching for risk financing techniques in insurance pictures information linked to the risk financing techniques in insurance topic, you have pay a visit to the right site. Our site frequently gives you suggestions for seeking the highest quality video and image content, please kindly hunt and locate more enlightening video content and images that fit your interests.

Risk Financing Techniques In Insurance. What is risk financing techniques? Risk administration is the implementation and monitoring of risk management policies and procedures. Risk retention √ use of organization internal funds or funds from its group of companies to finance the loss. 1) risk retention, and 2) risk transfer.

PPT Chapter 3 Introduction to Risk Management PowerPoint From slideserve.com

PPT Chapter 3 Introduction to Risk Management PowerPoint From slideserve.com

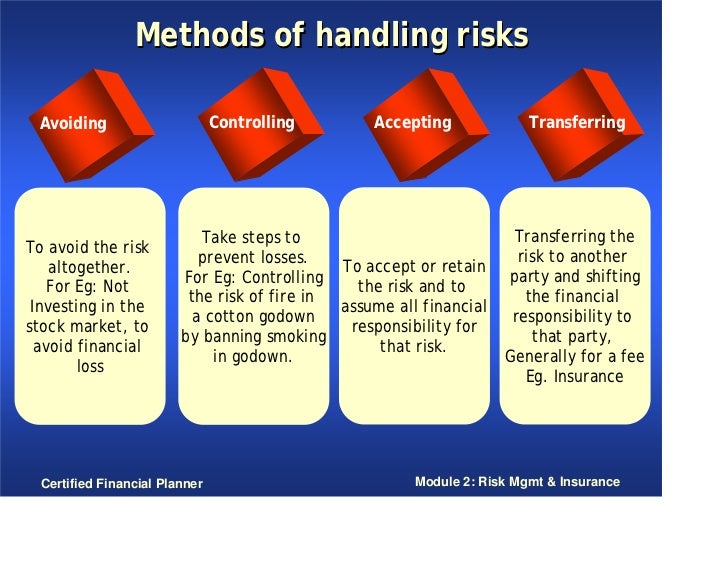

Risk management techniques — methods for treating risks. There are two risk financing techniques: A risk management technique whereby risk of loss is prevented in its entirety by not engaging in activities that presents the risk. Risk financing is the determination of how an organization will pay for loss events in the most effective and least costly way possible. Because it can be the most economic risk financing technique, this type of risk financing is sometimes preferred even when insurance or contractual risk transfer may be obtained. And (2) passive or unplanned retention.

Risk financing involves the identification of risks, determining how to finance the risk, and monitoring the effectiveness of the financing technique that is chosen.

Risk financing requires planning and arranging for the sources of funds before loss events occur and then directing the funds offered by these sources, post loss, to assure. Risk management, of which financing is an integral part, is the set of measurable and sustainable actions for reducing the effect of uncertainty on those objectives. Risk financing requires planning and arranging for the sources of funds before loss events occur and then directing the funds offered by these sources, post loss, to assure. 1) risk retention, and 2) risk transfer. A risk management technique whereby risk of loss is prevented in its entirety by not engaging in activities that presents the risk. The risk financing process consists of five steps:

Source: slideshare.net

Source: slideshare.net

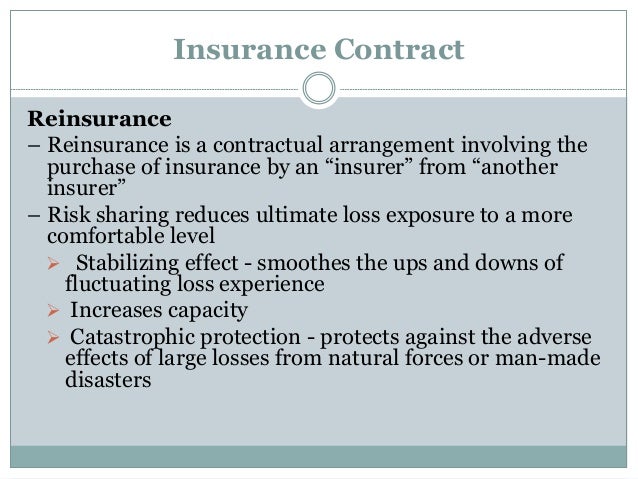

It relegates insurance to just one of a complete range of risk financing techniques and is transforming the insurance industry to deal with hitherto uninsurable business risks such as fluctuation in interest rates, rate in foreign exchange,. 1 financial management basics for beginners.analyzing alternative risk financing techniques, selecting the best risk financing technique(s), implementing the selected. Risk transfer √ enables an organization to transfer its financial responsibility to pay for potential loss to the insurers. Risk financing requires planning and arranging for the sources of funds before loss events occur and then directing the funds offered by these sources, post loss, to assure. For example, a financial firm is exposed to 5 per cent one month value at risk of inr 50,000.

Source: slideserve.com

Source: slideserve.com

And (2) passive or unplanned retention. Risk financing requires planning and arranging for the sources of funds before loss events occur and then directing the funds offered by these sources, post loss, to assure. The risk financing process consists of five steps: In many cases, it gives capital market investors a more direct role in providing protection. Risk management, of which financing is an integral part, is the set of measurable and sustainable actions for reducing the effect of uncertainty on those objectives.

Source: slideshare.net

Source: slideshare.net

Risk financing techniques in insurance. 1 financial management basics for beginners.analyzing alternative risk financing techniques, selecting the best risk financing technique(s), implementing the selected. The risk financing process consists of five steps: Because it can be the most economic risk financing technique, this type of risk financing is sometimes preferred even when insurance or contractual Risk financing is designed to help a business align its desire to take.

Source: youtube.com

Source: youtube.com

Because it can be the most economic risk financing technique, this type of risk financing is sometimes preferred even when insurance or contractual risk transfer may be obtained. Risk financing involves the identification of risks, determining how to finance the risk, and monitoring the effectiveness of the financing technique that is chosen. 1) risk retention, and 2) risk transfer. Risk financing is financing strategy used by businesses that involves figuring out how to cover risks in the most cost effective way. Risk financing is the determination of how an organization will pay for loss events in the most effective and least costly way possible.

Source: slideserve.com

Source: slideserve.com

Because it can be the most economic risk financing technique, this type of risk financing is sometimes preferred even when insurance or contractual An effective risk management program must use at least one risk control technique and one risk financing technique for each identified exposure. Risk retention √ use of organization internal funds or funds from its group of companies to finance the loss. Risk administration is the implementation and monitoring of risk management policies and procedures. The purpose of structuring financing in this way is to attempt to prevent the company from assuming too much risk, yet still allowing the company to take on enough risk to grow.

Source: slideserve.com

Source: slideserve.com

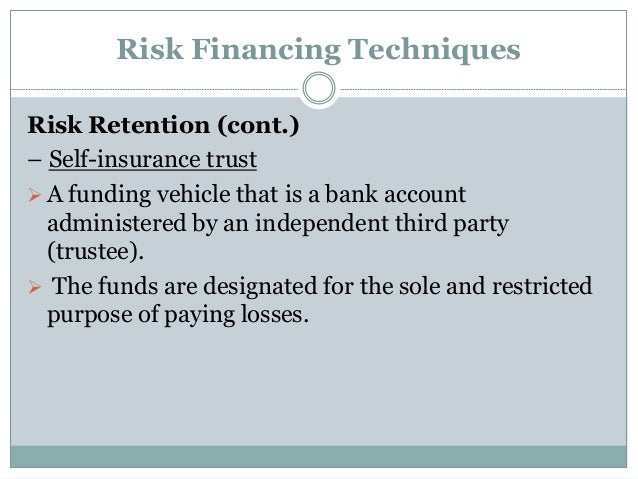

Risk control and risk financing activities interact with each other. Retention can be (1) active or planned retention; Because it can be the most economic risk financing technique, this type of risk financing is sometimes preferred even when insurance or contractual risk transfer may be obtained. Risk financing techniques can be broadly divided into three categories: Risk management techniques — methods for treating risks.

Source: slideserve.com

Source: slideserve.com

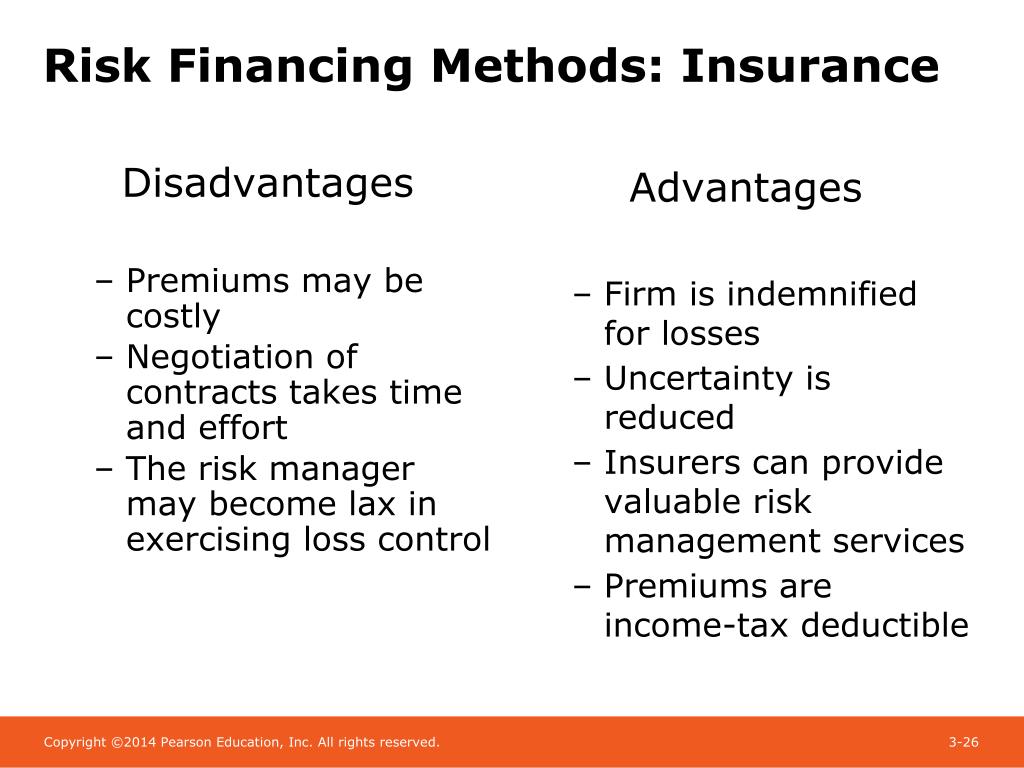

Traditional risk management techniques for handling event risks include risk retention, contractual or noninsurance risk transfer, risk control, risk avoidance, and insurance transfer. Risk financing techniques in insurance. Var is measured with respect to the amount of potential loss, the probability of that amount of loss, and the time frame. Retention of the amount below the deductible and this kind of risk financing technique of the insured portion of loss above the deductible. Risk financing is the determination of how an organization will pay for loss events in the most effective and least costly way possible.

Source: slideshare.net

Source: slideshare.net

The purpose of structuring financing in this way is to attempt to prevent the company from assuming too much risk, yet still allowing the company to take on enough risk to grow. Risk towards foreign exchange, credit risk, market risk, inflation risk, liquidity risk, business risk, volatility risk, etc. Risk financing and insurance what is harvard�s risk financing scheme? Risk management techniques — methods for treating risks. Retention of the amount below the deductible and this kind of risk financing technique of the insured portion of loss above the deductible.

Source: slideshare.net

Source: slideshare.net

Risk towards foreign exchange, credit risk, market risk, inflation risk, liquidity risk, business risk, volatility risk, etc. Risk financing is designed to help a business align its desire to take. Traditional risk management techniques for handling event risks include risk retention, contractual or noninsurance risk transfer, risk control, risk avoidance, and insurance transfer. Risk transfer √ enables an organization to transfer its financial responsibility to pay for potential loss to the insurers. An effective risk management program must use at least one risk control technique and one risk financing technique for each identified exposure.

Source: slideserve.com

Source: slideserve.com

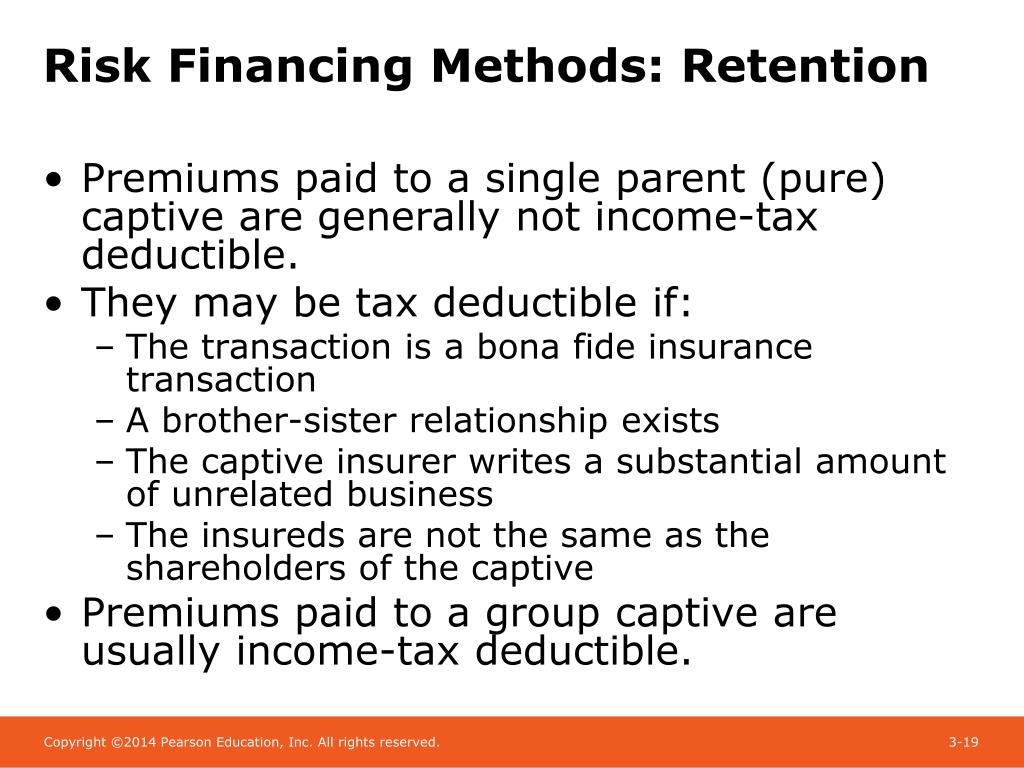

Chapter objectives determine, in which situations, risk retention is a preferable solution to risk transfer. Because it can be the most economic risk financing technique, this type of risk financing is sometimes preferred even when insurance or contractual risk transfer may be obtained. Risk administration is the implementation and monitoring of risk management policies and procedures. Identifying and analyzing exposures, analyzing alternative risk financing techniques, selecting the best risk financing technique(s), implementing the selected technique(s), and monitoring the selected technique(s). For example, a financial firm is exposed to 5 per cent one month value at risk of inr 50,000.

Source: slideshare.net

Source: slideshare.net

Risk administration is the implementation and monitoring of risk management policies and procedures. Beside this, why is risk financing important? What is risk financing techniques? The risk financing process consists of five steps: And (2) passive or unplanned retention.

Source: asigestadvisor.com

Source: asigestadvisor.com

An effective risk management program must use at least one risk control technique and one risk financing technique for each identified exposure. Risk control and risk financing activities interact with each other. Risk financing and insurance what is harvard�s risk financing scheme? The risk financing process consists of five steps: In many cases, it gives capital market investors a more direct role in providing protection.

Source: insuranceblockchain.center

Source: insuranceblockchain.center

And (2) passive or unplanned retention. Identifying and analyzing exposures, analyzing alternative risk financing techniques, selecting the best risk financing technique(s), implementing the selected technique(s), and monitoring the selected technique(s). What is risk financing techniques? Risk transfer √ enables an organization to transfer its financial responsibility to pay for potential loss to the insurers. Risk administration is the implementation and monitoring of risk management policies and procedures.

Source: slideserve.com

Source: slideserve.com

Risk towards foreign exchange, credit risk, market risk, inflation risk, liquidity risk, business risk, volatility risk, etc. Chapter objectives determine, in which situations, risk retention is a preferable solution to risk transfer. Two risk financing techniques for losses: 1 financial management basics for beginners.analyzing alternative risk financing techniques, selecting the best risk financing technique(s), implementing the selected. Retention can be (1) active or planned retention;

Source: slideshare.net

Source: slideshare.net

There are two risk financing techniques: The risk financing process consists of five steps: Because it can be the most economic risk financing technique, this type of risk financing is sometimes preferred even when insurance or contractual risk transfer may be obtained. Because it can be the most economic risk financing technique, this type of risk financing is sometimes preferred even when insurance or contractual There are two risk financing techniques:

Source: springgroup.com

Source: springgroup.com

Risk financing and insurance what is harvard�s risk financing scheme? Risk management, of which financing is an integral part, is the set of measurable and sustainable actions for reducing the effect of uncertainty on those objectives. Risk control and risk financing activities interact with each other. 1 financial management basics for beginners.analyzing alternative risk financing techniques, selecting the best risk financing technique(s), implementing the selected. Risk transfer √ enables an organization to transfer its financial responsibility to pay for potential loss to the insurers.

Source: slideshare.net

Source: slideshare.net

Identifying and analyzing exposures, analyzing alternative risk financing techniques, selecting the best risk financing technique(s), implementing the selected technique(s), and monitoring the selected technique(s). The purpose of structuring financing in this way is to attempt to prevent the company from assuming too much risk, yet still allowing the company to take on enough risk to grow. Risk financing is financing strategy used by businesses that involves figuring out how to cover risks in the most cost effective way. A risk management technique whereby risk of loss is prevented in its entirety by not engaging in activities that presents the risk. Risk management, of which financing is an integral part, is the set of measurable and sustainable actions for reducing the effect of uncertainty on those objectives.

Source: slideshare.net

Source: slideshare.net

The risk financing process consists of five steps: Risk financing is the determination of how an organization will pay for loss events in the most effective and least costly way possible. Traditional risk management techniques for handling event risks include risk retention, contractual or noninsurance risk transfer, risk control, risk avoidance, and insurance transfer. Risk management, of which financing is an integral part, is the set of measurable and sustainable actions for reducing the effect of uncertainty on those objectives. Risk financing is the determination of how an organization will pay for loss events in the most effective and least costly way possible.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title risk financing techniques in insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information