Risk management vs insurance information

Home » Trending » Risk management vs insurance informationYour Risk management vs insurance images are ready. Risk management vs insurance are a topic that is being searched for and liked by netizens now. You can Get the Risk management vs insurance files here. Get all free images.

If you’re searching for risk management vs insurance pictures information related to the risk management vs insurance keyword, you have come to the right blog. Our website frequently provides you with hints for seeking the highest quality video and picture content, please kindly hunt and find more informative video content and graphics that match your interests.

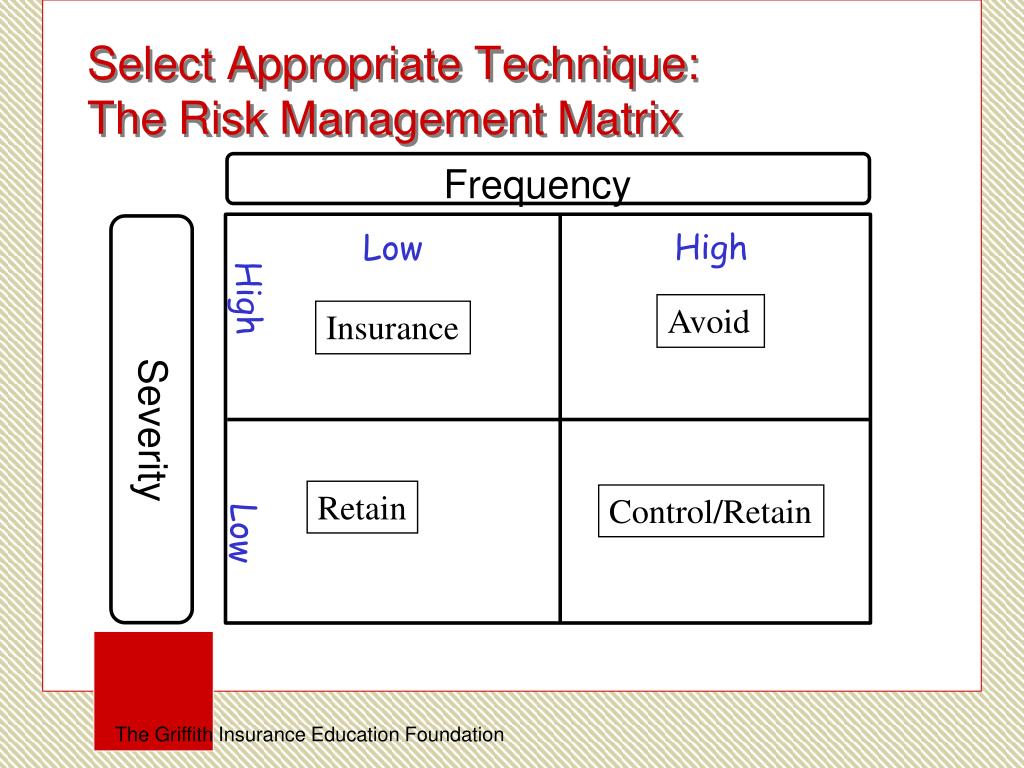

Risk Management Vs Insurance. Risk management and reliability engineering. Assume that the organization has only two alternatives for handling its risk: Traditional risk management tends to get a bad rap these days compared to enterprise risk management. Personal risk management certified financial planner module 2:

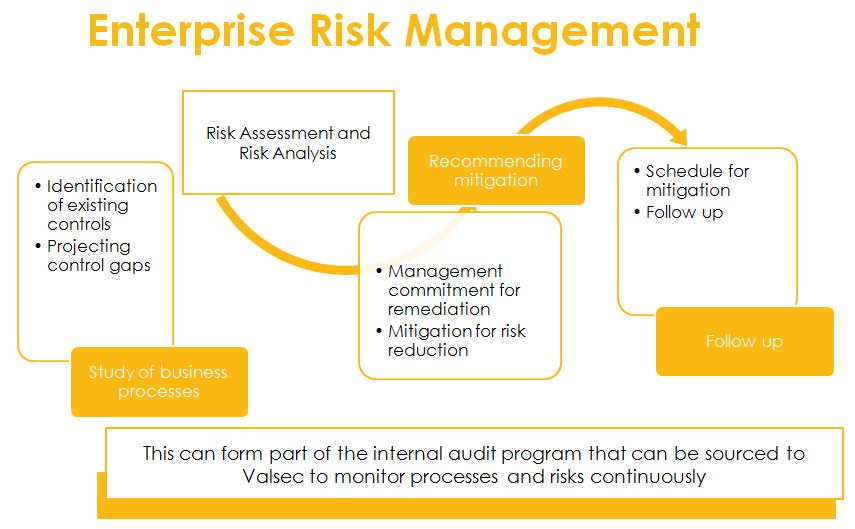

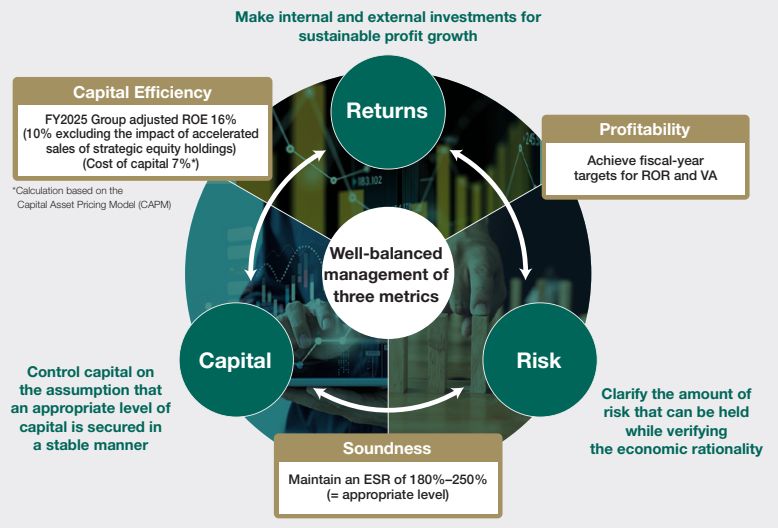

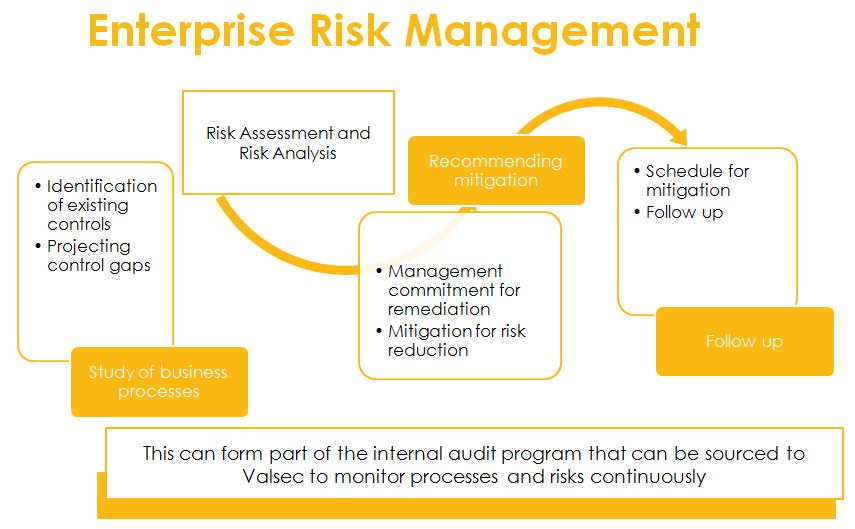

Enterprise Risk Management (ERM) is the process of From en.vcenter.ir

Enterprise Risk Management (ERM) is the process of From en.vcenter.ir

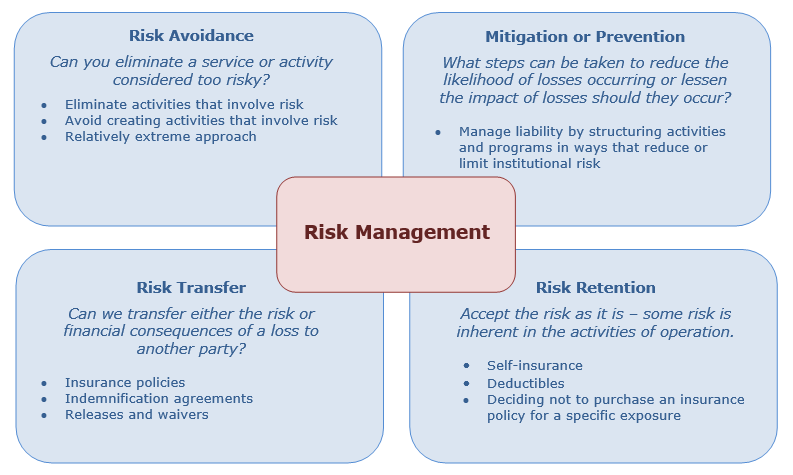

Personal risk management certified financial planner module 2: Risk management can be done quite well without any insurance, but insurance can�t really be done well, correctly, without some level of risk management. Risk management vs risk mitigation. 1.3 the resources available for managing risk are finite and so the aim is to achieve an optimum response to risk, prioritised in accordance with an evaluation of the risks. Risk mgmt & insurance 10. The risk is a condition in which there is a possibility of an adverse deviation from the desired outcome that is expected or hoped for.

What is the definition of chance

Insurance pays for the damages if the risk were to occur. Spontaneity and composure under pressure really come in handy. Personal risk management certified financial planner module 2: What is the definition of chance Both adhere to guidance provided by the major standards bodies. Insurance is a risk management tool where someone transfers a risk to an insurance company.

Source: priorityrisk.com

Source: priorityrisk.com

Buy insurance policies or apply risk management treatments except insurance. Insurance risk management — a term for the traditional risk management concept, which focuses primarily on pure risks rather than operational, market, credit, and other types of risk. Not the other way around. Risk management can be done quite well without any insurance, but insurance can�t really be done well, correctly, without some level of risk management. Risk and insurance management society fellow (rims fellow);

Source: erminsightsbycarol.com

Source: erminsightsbycarol.com

Risk management takes an approach that investigates where the money to pay for a loss will come from if a loss were to occur. Risk management is concerned with all loss exposures, not only the ones that can be insured. Risk management vs risk mitigation. • process that uses physical & human resources to accomplish certain objectives concerning most pure loss exposures. Insurance companies have given risk management responsibilities to one of the actuaries, which is not a very strong move toward independence.

Source: slideshare.net

Source: slideshare.net

We tend to find failures, qualify and quantify the risk, then attempt to mitigate with design or process changes. Risk management is concerned with all loss exposures, not only the ones that can be insured. 1.3 the resources available for managing risk are finite and so the aim is to achieve an optimum response to risk, prioritised in accordance with an evaluation of the risks. Risk management includes identifying and assessing risks (the “inherent risks”) and then responding to them. Payments under insurance policies for losses are contractually guaranteed, but at a cost of premium payments, application of deductibles or.

Source: voleyball-games.blogspot.com

Source: voleyball-games.blogspot.com

Not the other way around. It is a form of risk management primarily used to hedge against the risk of a contingent, uncertain loss. Personal risk management certified financial planner module 2: Insurance is given by way of an insurance policy, which is a contract whereby a type of risk is. Risk management provides a clear and structured approach to identifying risks.

Source: voleyball-games.blogspot.com

Source: voleyball-games.blogspot.com

Risk management and reliability engineering. Assume that the organization has only two alternatives for handling its risk: For understanding the risk, we should know these terms which are related to the concept of risk; Insurance pays for the damages if the risk were to occur. The biggest and most notable difference between safety and risk management is the money involved.

Source: assured.enterprises

Source: assured.enterprises

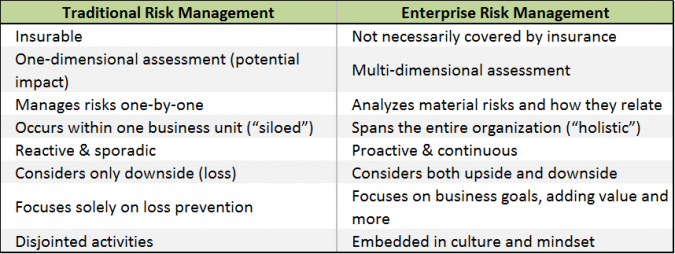

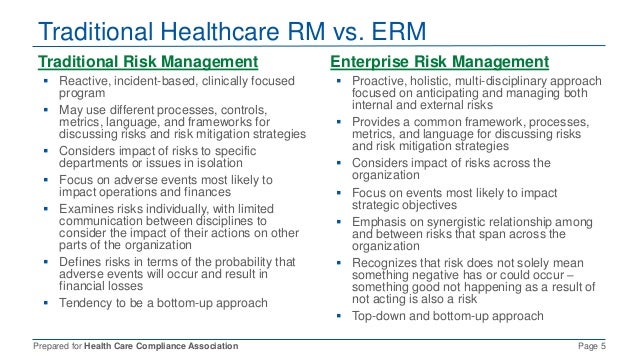

This term is frequently used to distinguish between the traditional risk management concept and the newer practice of enterprise risk management (erm). Not the other way around. The objective of risk management is to protect and create value by improving the university’s understanding, management and communication of threats and opportunities. Insurance is usually sold without any risk management efforts due to many factors, including lack of knowledge among consumers, the difficulty of explaining insurance coverages, laziness on the part of insurance. Insurance is a risk management tool where someone transfers a risk to an insurance company.

Source: slideserve.com

Source: slideserve.com

Insurance is given by way of an insurance policy, which is a contract whereby a type of risk is. Risk management and insurance course name: It aims to breaks down threats into identifiable categories and define all the potential impact of each risk. Risk management is the active identification, evaluation and management of all potential hazards and exposures to loss that a risk may experience. Spontaneity and composure under pressure really come in handy.

Source: integrityinsure.com

Source: integrityinsure.com

Risk management vs risk mitigation. It aims to breaks down threats into identifiable categories and define all the potential impact of each risk. • concerned with recognizing risks, severity and controlling of risks. The risk is a condition in which there is a possibility of an adverse deviation from the desired outcome that is expected or hoped for. Risk and insurance management society fellow (rims fellow);

Source: voleyball-games.blogspot.com

Source: voleyball-games.blogspot.com

We tend to find failures, qualify and quantify the risk, then attempt to mitigate with design or process changes. Risk managers should possess a desire to help companies handle uncertainties. 1.3 the resources available for managing risk are finite and so the aim is to achieve an optimum response to risk, prioritised in accordance with an evaluation of the risks. Risk management includes identifying and assessing risks (the “inherent risks”) and then responding to them. • concerned with recognizing risks, severity and controlling of risks.

Source: youtube.com

Source: youtube.com

Certification offered by the risk and insurance management society (rims). And the ability to spread the risk of these events occurring across other insurance underwriter�s in the market. Having a clear understanding of all risks allows an organization to measure and prioritize them and take the appropriate actions to reduce losses.an effective risk management practice does not eliminate risks. The risk is a condition in which there is a possibility of an adverse deviation from the desired outcome that is expected or hoped for. • process that uses physical & human resources to accomplish certain objectives concerning most pure loss exposures.

Source: longhallconsulting.com

Source: longhallconsulting.com

Insurance is a technique to finance some loss exposures and, therefore, a part of the broader concept of managing risk; It incorporates insurance in the process but also provides organized alternatives if insurance is not available, inappropriate or too expensive. Traditional risk management tends to get a bad rap these days compared to enterprise risk management. Risk management takes an approach that investigates where the money to pay for a loss will come from if a loss were to occur. The risk is a condition in which there is a possibility of an adverse deviation from the desired outcome that is expected or hoped for.

Source: erminsightsbycarol.com

Source: erminsightsbycarol.com

The biggest and most notable difference between safety and risk management is the money involved. (a) moral hazard (b) fundamental risk (c) subrogation (d) adverse selection (e) ipsa res loquitur 22. Inherently, all businesses have some degree of risk, which can become very costly if not taken seriously. Both approaches aim to mitigate risks that could harm organizations. The objective of risk management is to protect and create value by improving the university’s understanding, management and communication of threats and opportunities.

Source: floodflash.co

Source: floodflash.co

What is the definition of chance Risk management process and risk mitigation plan is the way towards recognizing, evaluating, and moderating risks to scope, timetable, cost and quality of a venture. (a) moral hazard (b) fundamental risk (c) subrogation (d) adverse selection (e) ipsa res loquitur 22. Insurance is usually sold without any risk management efforts due to many factors, including lack of knowledge among consumers, the difficulty of explaining insurance coverages, laziness on the part of insurance. Insurance is given by way of an insurance policy, which is a contract whereby a type of risk is.

Source: cjfig.com

Source: cjfig.com

For understanding the risk, we should know these terms which are related to the concept of risk; It is a form of risk management primarily used to hedge against the risk of a contingent, uncertain loss. Risk mgmt & insurance 10. The tendency of unhealthy persons to seek life or health insurance at standard rates is an example of: Insurance companies have given risk management responsibilities to one of the actuaries, which is not a very strong move toward independence.

Source: sandrunrisk.com

Source: sandrunrisk.com

Both approaches aim to mitigate risks that could harm organizations. And the ability to spread the risk of these events occurring across other insurance underwriter�s in the market. Risks come as unforeseen circumstances and they are scored on likelihood of event and effect on the venture. (a) moral hazard (b) fundamental risk (c) subrogation (d) adverse selection (e) ipsa res loquitur 22. Not the other way around.

Source: voleyball-games.blogspot.com

Source: voleyball-games.blogspot.com

• process that uses physical & human resources to accomplish certain objectives concerning most pure loss exposures. Risk management provides a clear and structured approach to identifying risks. For understanding the risk, we should know these terms which are related to the concept of risk; Risk management as commonly practiced by reliability practitioners is characterized as: Risk management work typically involves the application of mathematical and.

Source: en.vcenter.ir

Source: en.vcenter.ir

Insurance is usually sold without any risk management efforts due to many factors, including lack of knowledge among consumers, the difficulty of explaining insurance coverages, laziness on the part of insurance. It incorporates insurance in the process but also provides organized alternatives if insurance is not available, inappropriate or too expensive. Insurance is given by way of an insurance policy, which is a contract whereby a type of risk is. The risk is a condition in which there is a possibility of an adverse deviation from the desired outcome that is expected or hoped for. Insurance pays for the damages if the risk were to occur.

Source: voleyball-games.blogspot.com

Source: voleyball-games.blogspot.com

Assume that the organization has only two alternatives for handling its risk: Risk management provides a clear and structured approach to identifying risks. The tendency of unhealthy persons to seek life or health insurance at standard rates is an example of: • concerned with recognizing risks, severity and controlling of risks. Risk management is the active identification, evaluation and management of all potential hazards and exposures to loss that a risk may experience.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title risk management vs insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information