Risk pooling in insurance information

Home » Trending » Risk pooling in insurance informationYour Risk pooling in insurance images are available in this site. Risk pooling in insurance are a topic that is being searched for and liked by netizens today. You can Download the Risk pooling in insurance files here. Get all royalty-free photos.

If you’re looking for risk pooling in insurance images information linked to the risk pooling in insurance keyword, you have visit the right blog. Our website frequently gives you suggestions for seeing the maximum quality video and picture content, please kindly hunt and find more enlightening video content and images that match your interests.

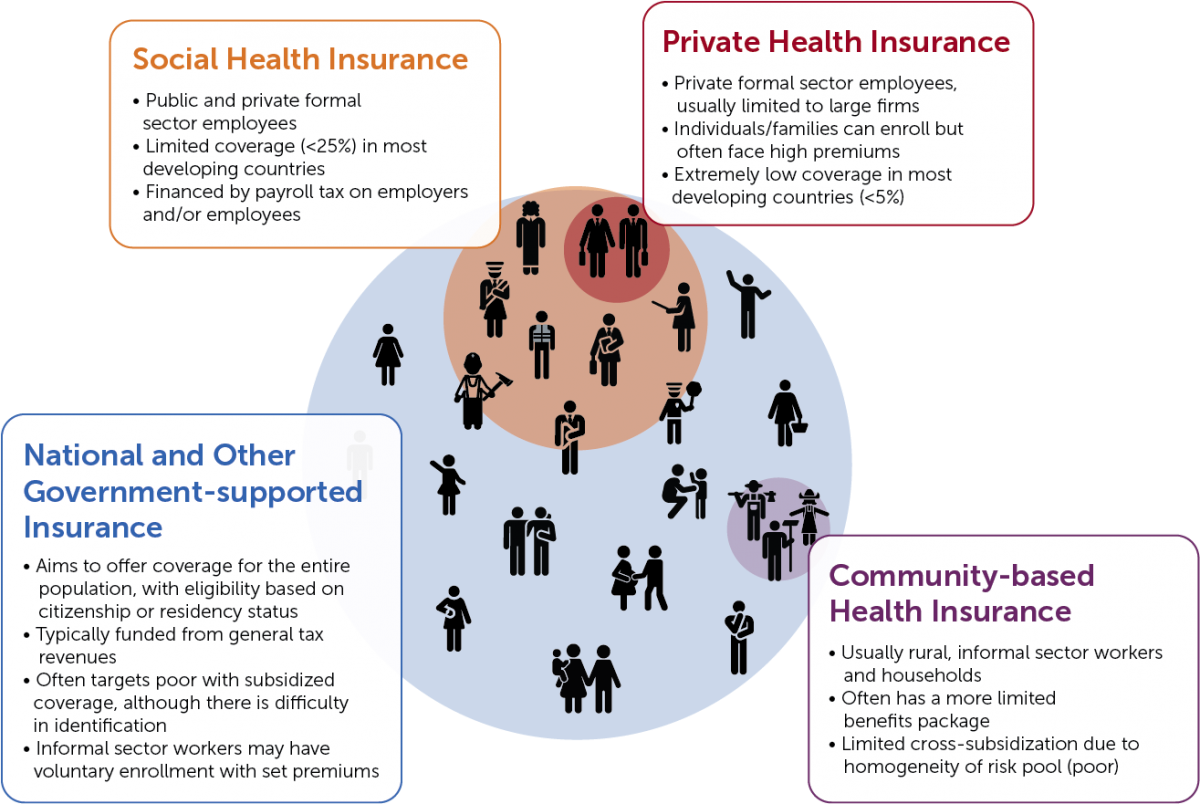

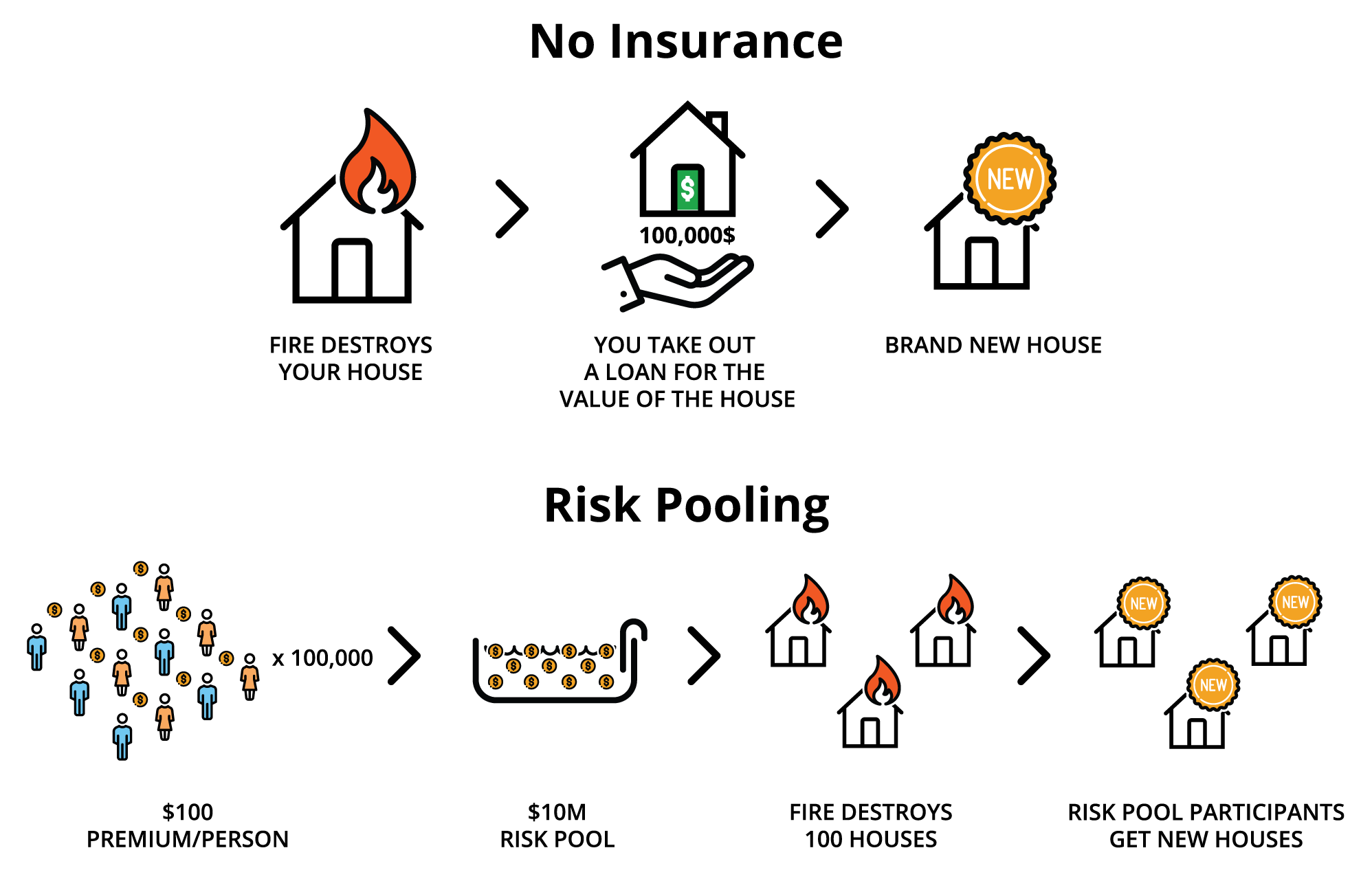

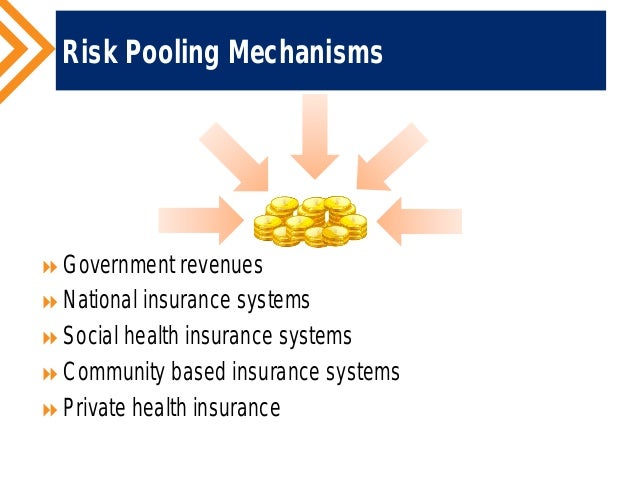

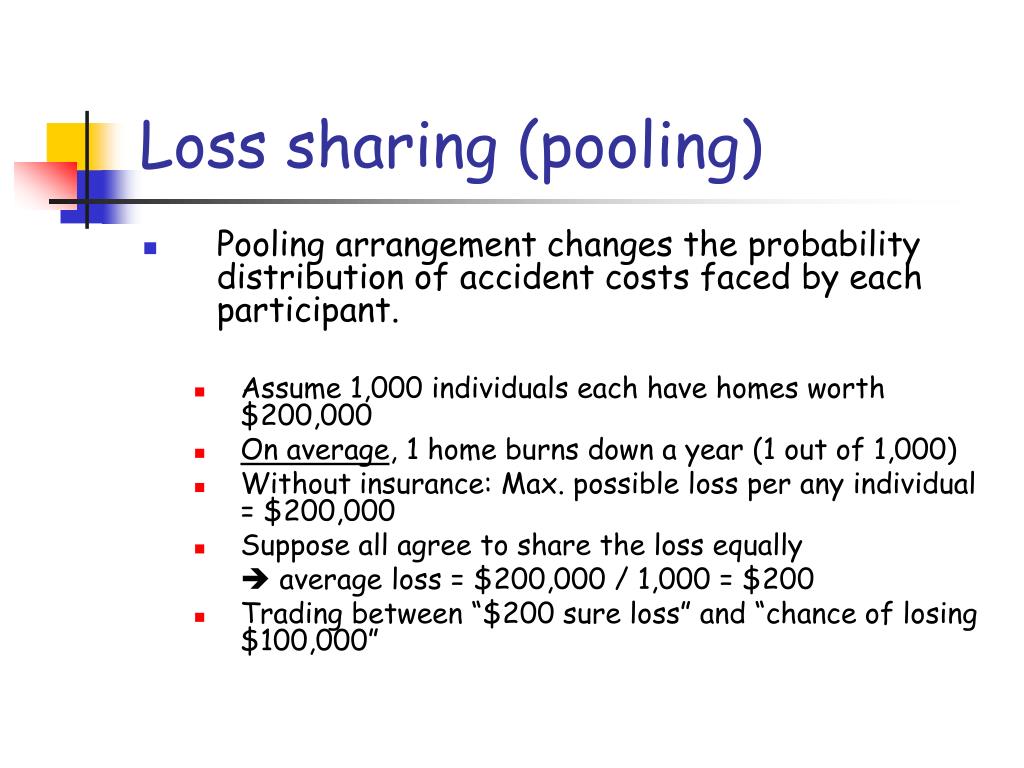

Risk Pooling In Insurance. Risk pooling allows an insurance carrier to provide an income stream via an immediate annuity, even with its costs and expenses, far. Risk pool — multiple subjects of insurance insured or reinsured by a single insurer where, to avoid risk concentration and improve risk distribution, different combinations of exposures, perils, and hazards will be underwritten. The term is also used to describe the pooling of similar risks within the concept of insurance. Pooling is a concept that means sharing or spreading risk among a larger number of plan participants in order to gain rate stability or “comfort in numbers”.

Health Insurance Markets 101 From sycamoreinstitutetn.org

Health Insurance Markets 101 From sycamoreinstitutetn.org

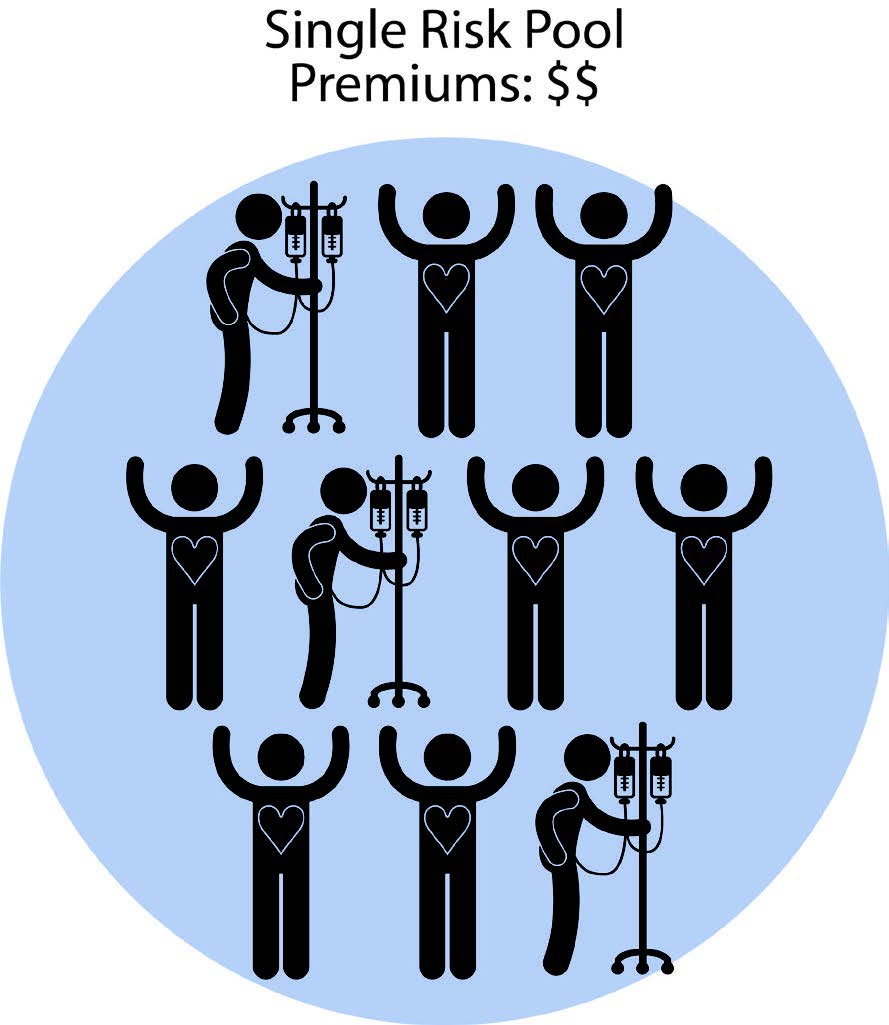

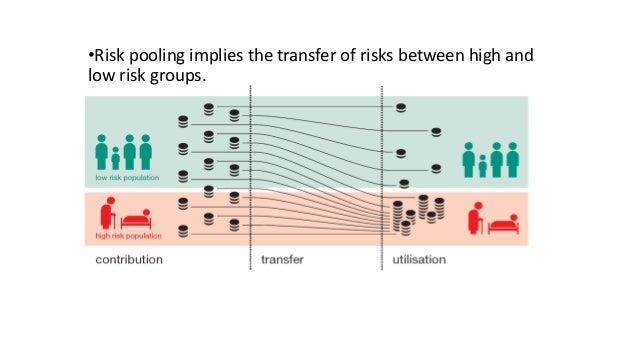

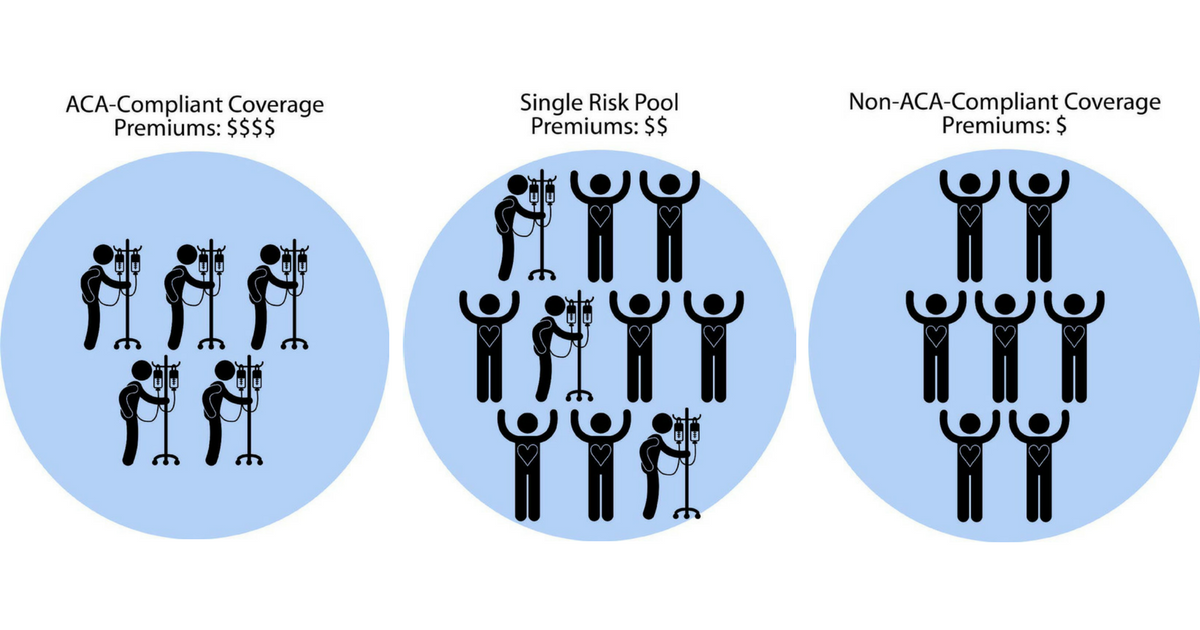

A health insurance risk pool is a group of individuals whose medical costs are combined to calculate premiums. In insurance, the term risk pooling refers to the spreading of financial risks evenly among a large number of contributors to the program. Pooling is a concept that means sharing or spreading risk among a larger number of plan participants in order to gain rate stability or “comfort in numbers”. The term is also used to describe the pooling of similar risks within the concept of insurance. A “risk pool” is a form of risk management that is mostly practiced by insurance companies, which come together to form a pool to provide protection to insurance companies against catastrophic risks such as floods or earthquakes. The standard deviation of the fraction of policies that result in a claim is • probability that fraction of policies that result in loss will lie between p1 and

The effect on risk pooling is small because of the large amount of risk pooling in unregulated individual insurance.

The pooling of risk is fundamental to the concept of insurance. Just as annuities with income guarantees use actuarial science and risk pooling to support a spending level consistent with living to life expectancy, life insurance is. Pooling is a concept that means sharing or spreading risk among a larger number of plan participants in order to gain rate stability or “comfort in numbers”. Risk pooling allows an insurance carrier to provide an income stream via an immediate annuity, even with its costs and expenses, far. But americans differ in risk, and that difference potentially affects both the value they attach to health insurance and the premiums they are charged for it. Together allows the higher costs of the less healthy to be offset by the relatively lower costs of the healthy, either in a plan overall or within a premium.

Source: sycamoreinstitutetn.org

Source: sycamoreinstitutetn.org

The effect on risk pooling is small because of the large amount of risk pooling in unregulated individual insurance. Pooling is a system in which a large number of people purchase insurance as a group in order to lessen the cost of coverage. With risk pooling arrangements, instead of participants transferring risk to someone else, each company reduces their own risk. Together allows the higher costs of the less healthy to be offset by the relatively lower costs of the healthy, either in a plan overall or within a premium. The standard deviation of the fraction of policies that result in a claim is • probability that fraction of policies that result in loss will lie between p1 and

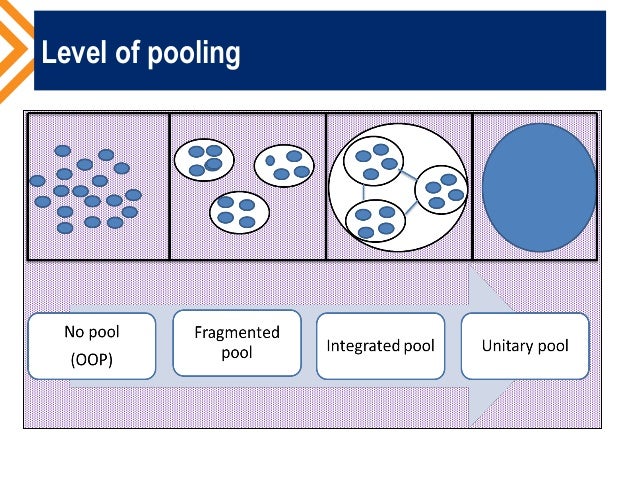

Source: slideshare.net

Source: slideshare.net

Now also an important supply chain management concept, risk pooling reduces variability by aggregating demand across customer locations thereby reducing safety stock and inventory across the enterprise. Together allows the higher costs of the less healthy to be offset by the relatively lower costs of the healthy, either in a plan overall or within a premium. The term is also used to describe the pooling of similar risks within the concept of insurance. Now also an important supply chain management concept, risk pooling reduces variability by aggregating demand across customer locations thereby reducing safety stock and inventory across the enterprise. The pool itself must meet the same distribution requirement by having a sufficient number of members and an even spread of risk among those members.

Source: actuary.org

Source: actuary.org

Risk pooling allows the higher costs of the riskier physicians to be offset by the relatively lower costs of the physicians with less exposure, either in a plan overall or within a premium rating category. The effect on risk pooling is small because of the large amount of risk pooling in unregulated individual insurance. But americans differ in risk, and that difference potentially affects both the value they attach to health insurance and the premiums they are charged for it. The pooling of risk is fundamental to the concept of insurance. Together allows the higher costs of the less healthy to be offset by the relatively lower costs of the healthy, either in a plan overall or within a premium.

Source: sycamoreinstitutetn.org

Source: sycamoreinstitutetn.org

Risk pooling allows an insurance carrier to provide an income stream via an immediate annuity, even with its costs and expenses, far. Risk pool — multiple subjects of insurance insured or reinsured by a single insurer where, to avoid risk concentration and improve risk distribution, different combinations of exposures, perils, and hazards will be underwritten. Risk pooling allows an insurance carrier to provide an income stream via an immediate annuity, even with its costs and expenses, far. Together allows the higher costs of the less healthy to be offset by the relatively lower costs of the healthy, either in a plan overall or within a premium. The term is also used to describe the pooling of similar risks within the concept of insurance.

Source: researchgate.net

Source: researchgate.net

Americans should all have health insurance. A “risk pool” is a form of risk management that is mostly practiced by insurance companies, which come together to form a pool to provide protection to insurance companies against catastrophic risks such as floods or earthquakes. Together allows the higher costs of the less healthy to be offset by the relatively lower costs of the healthy, either in a plan overall or within a premium. The pooling of risk is fundamental to the concept of insurance. Although risk pooling is a fundamental concept of insurance, particularly health insurance, it’s slightly less enticing for professional liability insurance.

Source: areyouready.gov.sg

The editorial staff of risk & insurance had no role in its preparation. Pooling is a concept that means sharing or spreading risk among a larger number of plan participants in order to gain rate stability or “comfort in numbers”. The term has traditionally been used to describe the pooling of similar risks that underlies the concept of insurance. The editorial staff of risk & insurance had no role in its preparation. Risk pool — multiple subjects of insurance insured or reinsured by a single insurer where, to avoid risk concentration and improve risk distribution, different combinations of exposures, perils, and hazards will be underwritten.

Source: fr.slideshare.net

Source: fr.slideshare.net

Risk pooling in insurance • if n policies, each has independent probability p of a claim, then the number of claims follows the binomial distribution. In insurance, the term risk pooling refers to the spreading of financial risks evenly among a large number of contributors to the program. Americans should all have health insurance. Although risk pooling is a fundamental concept of insurance, particularly health insurance, it’s slightly less enticing for professional liability insurance. Risk pooling is the practice of sharing all risks among a group of insurance companies.

Source: fincash.com

Source: fincash.com

Risk pools also must demonstrate risk distribution. Risk pooling allows the higher costs of the riskier physicians to be offset by the relatively lower costs of the physicians with less exposure, either in a plan overall or within a premium rating category. The effect on risk pooling is small because of the large amount of risk pooling in unregulated individual insurance. Insurance pooling is a practice wherein a group of small firms join together to secure better insurance rates and coverage plans by. Risk pools also must demonstrate risk distribution.

Source: friendsforeverplus.blogspot.com

Source: friendsforeverplus.blogspot.com

Risk pooling allows the higher costs of the riskier physicians to be offset by the relatively lower costs of the physicians with less exposure, either in a plan overall or within a premium rating category. In insurance, the term risk pooling refers to the spreading of financial risks evenly among a large number of contributors to the program. Risk pooling in insurance • if n policies, each has independent probability p of a claim, then the number of claims follows the binomial distribution. Just as annuities with income guarantees use actuarial science and risk pooling to support a spending level consistent with living to life expectancy, life insurance is. Risk pooling allows an insurance carrier to provide an income stream via an immediate annuity, even with its costs and expenses, far.

Source: presidioinsurance.com

Source: presidioinsurance.com

Risk pooling in insurance • if n policies, each has independent probability p of a claim, then the number of claims follows the binomial distribution. Insurance pooling is a practice wherein a group of small firms join together to secure better insurance rates and coverage plans by. In insurance, the term risk pooling refers to the spreading of financial risks evenly among a large number of contributors to the program. The pool itself must meet the same distribution requirement by having a sufficient number of members and an even spread of risk among those members. Pooling is a concept that means sharing or spreading risk among a larger number of plan participants in order to gain rate stability or “comfort in numbers”.

Source: actuary.org

Source: actuary.org

The pooling of risk is fundamental to the concept of insurance. But americans differ in risk, and that difference potentially affects both the value they attach to health insurance and the premiums they are charged for it. The pooling of risk is fundamental to the concept of insurance. Together allows the higher costs of the less healthy to be offset by the relatively lower costs of the healthy, either in a plan overall or within a premium. Risk pooling is the practice of sharing all risks among a group of insurance companies.

Source: nashinsurance.com

Source: nashinsurance.com

In insurance, the term risk pooling refers to the spreading of financial risks evenly among a large number of contributors to the program. Risk pooling allows the higher costs of the riskier physicians to be offset by the relatively lower costs of the physicians with less exposure, either in a plan overall or within a premium rating category. The term is also used to describe the pooling of similar risks within the concept of insurance. Together allows the higher costs of the less healthy to be offset by the relatively lower costs of the healthy, either in a plan overall or within a premium. Risk pool — multiple subjects of insurance insured or reinsured by a single insurer where, to avoid risk concentration and improve risk distribution, different combinations of exposures, perils, and hazards will be underwritten.

Source: blog.etherisc.com

Source: blog.etherisc.com

Together allows the higher costs of the less healthy to be offset by the relatively lower costs of the healthy, either in a plan overall or within a premium. The term is also used to describe the pooling of similar risks within the concept of insurance. The pooling of risk is fundamental to the concept of insurance. Pooling is a system in which a large number of people purchase insurance as a group in order to lessen the cost of coverage. A health insurance risk pool is a group of individuals whose medical costs are combined to calculate premiums.

Source: slideshare.net

Source: slideshare.net

Americans should all have health insurance. The editorial staff of risk & insurance had no role in its preparation. This requirement does not just fall on the individual member captive; Risk pooling allows an insurance carrier to provide an income stream via an immediate annuity, even with its costs and expenses, far. Together allows the higher costs of the less healthy to be offset by the relatively lower costs of the healthy, either in a plan overall or within a premium.

Source: slideshare.net

Source: slideshare.net

Just as annuities with income guarantees use actuarial science and risk pooling to support a spending level consistent with living to life expectancy, life insurance is. A health insurance risk pool is a group of individuals whose medical costs are combined to calculate premiums. In insurance, the term risk pooling refers to the spreading of financial risks evenly among a large number of contributors to the program. The pooling of risk is fundamental to the concept of insurance. Risk pools also must demonstrate risk distribution.

Source: actuary.org

Source: actuary.org

The effect on risk pooling is small because of the large amount of risk pooling in unregulated individual insurance. Just as annuities with income guarantees use actuarial science and risk pooling to support a spending level consistent with living to life expectancy, life insurance is. Now also an important supply chain management concept, risk pooling reduces variability by aggregating demand across customer locations thereby reducing safety stock and inventory across the enterprise. Together allows the higher costs of the less healthy to be offset by the relatively lower costs of the healthy, either in a plan overall or within a premium. The pool itself must meet the same distribution requirement by having a sufficient number of members and an even spread of risk among those members.

Source: slideserve.com

Source: slideserve.com

Pooling is a concept that means sharing or spreading risk among a larger number of plan participants in order to gain rate stability or “comfort in numbers”. Together allows the higher costs of the less healthy to be offset by the relatively lower costs of the healthy, either in a plan overall or within a premium. Just as annuities with income guarantees use actuarial science and risk pooling to support a spending level consistent with living to life expectancy, life insurance is. Together allows the higher costs of the less healthy to be offset by the relatively lower costs of the healthy, either in a plan overall or within a premium. In insurance, the term risk pooling refers to the spreading of financial risks evenly among a large number of contributors to the program.

Source: woodworking.kevclak.com

Source: woodworking.kevclak.com

A health insurance risk pool is a group of individuals whose medical costs are combined to calculate premiums. With risk pooling arrangements, instead of participants transferring risk to someone else, each company reduces their own risk. A health insurance risk pool is a group of individuals whose medical costs are combined to calculate premiums. Pooling is a system in which a large number of people purchase insurance as a group in order to lessen the cost of coverage. Although risk pooling is a fundamental concept of insurance, particularly health insurance, it’s slightly less enticing for professional liability insurance.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title risk pooling in insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information