Risk transfer insurance Idea

Home » Trending » Risk transfer insurance IdeaYour Risk transfer insurance images are available. Risk transfer insurance are a topic that is being searched for and liked by netizens now. You can Download the Risk transfer insurance files here. Get all free photos.

If you’re looking for risk transfer insurance images information related to the risk transfer insurance interest, you have pay a visit to the right blog. Our website frequently provides you with suggestions for downloading the highest quality video and image content, please kindly hunt and locate more enlightening video content and images that match your interests.

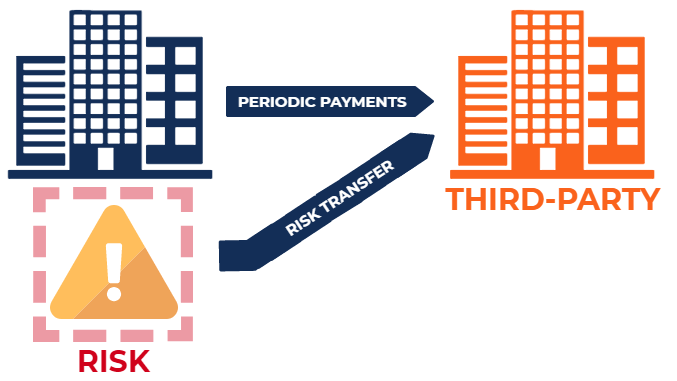

Risk Transfer Insurance. In the following example, we demonstrate the “substantially all” exception to the essential elements of. The insurance business is built on risk transfer: Risk transfer can be defined as a mechanism of risk management that involves the transfer of future risks from one person to another, and one of the most common examples of risk management is purchasing insurance where the risk of an individual or a company is transferred to a third party (insurance company). The main problem with the application of quantitative tests is their technical

Risk Transfer Strategies REI Insurance Academy YouTube From youtube.com

Risk Transfer Strategies REI Insurance Academy YouTube From youtube.com

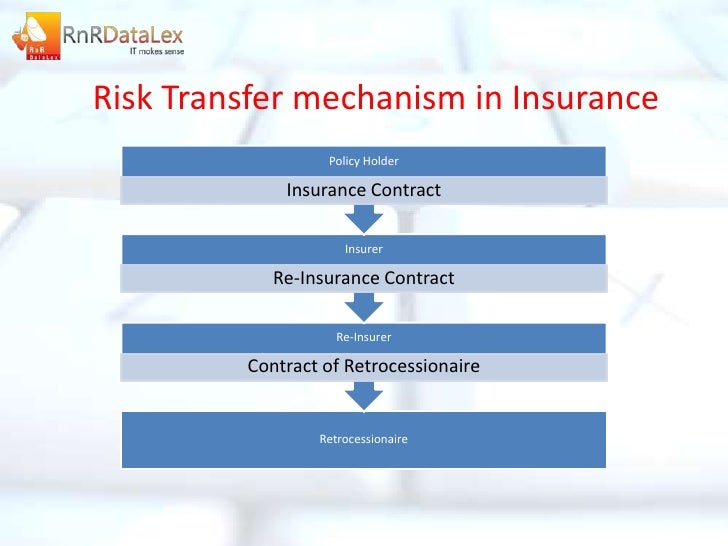

Insurance an insurance policy transfers a specific set of risks such as the fire and flood risk for a particular asset. To determine the extent of risk transfer in a reinsurance treaty, regulators may need to conduct quantitative tests. We utilize our industry expertise and carrier relationships to deliver consultative solutions for our clients, while also advising our clients on how to mitigate their risk exposures. Reinsurance agreements must contain the element of risk transfer where the reinsurer assumes significant insurance risk and may realize a significant loss from the transaction. A company purchases insurance to cover the costs for some unwanted event —. Risk transfer is a risk management technique where risk is transferred from your organization to a third party.

Money because the insurer bears the risk for any losses arising from either the firm failing to transfer the money or from the misappropriation of the client money by the firm.

However, there is an exception to these rules. The main problem with the application of quantitative tests is their technical Risk transfer is a risk management technique where risk is transferred from your organization to a third party. The basic business model of the insurance industry is the acceptance and management of risk. In the case of insurance, there is an insurance policy issued by the company, the risk bearer, to the policyholder, to compensate for the specified risks to the insured asset of the policyholder. Risk transfer obtained by a cedant through a given reinsurance transaction.

Source: theonebrief.com

Source: theonebrief.com

Contractors like snow and ice removal companies , for example, should carry general liability insurance, workers’ compensation coverage and automobile insurance with proper limits of coverage. Insurance is a funded risk transfer mechanism that ensures the transfer of financial consequences of a loss from a party (the insured) to another party (the insurer) in exchange for a premium payment. Insurance an insurance policy transfers a specific set of risks such as the fire and flood risk for a particular asset. In order for a contract to qualify for reinsurance accounting treatment in accordance with fas 113, it must transfer insurance risk from an insurer to a reinsurer. Money because the insurer bears the risk for any losses arising from either the firm failing to transfer the money or from the misappropriation of the client money by the firm.

Source: presidioinsurance.com

Source: presidioinsurance.com

Risk transfer is a risk management and control strategy that involves the contractual shifting of a pure risk from one party to another. In the following example, we demonstrate the “substantially all” exception to the essential elements of. The main problem with the application of quantitative tests is their technical A transfer of risk shifts responsibility for losses from one party to another in return for payment. Risk transfer is a risk management and control strategy that involves the contractual shifting of a pure risk from one party to another.

Source: youtube.com

Source: youtube.com

Reinsurance agreements must contain the element of risk transfer where the reinsurer assumes significant insurance risk and may realize a significant loss from the transaction. The basic business model of the insurance industry is the acceptance and management of risk. Insurance an insurance policy transfers a specific set of risks such as the fire and flood risk for a particular asset. A company purchases insurance to cover the costs for some unwanted event —. And (b) it is reasonably possible that the reinsurer may realize a significant loss from the transaction.

Source: slideserve.com

Source: slideserve.com

Risk transfer can be of mainly three types, namely, insurance, derivatives, and outsourcing. Transferring risks to another entity through insurance, outsourcing or a partnership should be approached with caution!! 1 insurance, a risk transfer mechanism insurance is a mechanism through which firms can reduce negative financial consequences of an uncertain event or possible financial loss. A transfer of risk shifts responsibility for losses from one party to another in return for payment. Transferring risk examples include commercial property tenants assuming the risk for keeping sidewalks clear, an apartment complex transferring the risk of theft to a.

Source: docutrax.com

Source: docutrax.com

And (b) it is reasonably possible that the reinsurer may realize a significant loss from the transaction. Alternative risk transfer products and catastrophe bonds, are specially designed to address insurance risks. Money because the insurer bears the risk for any losses arising from either the firm failing to transfer the money or from the misappropriation of the client money by the firm. Risk transfer is a risk management and control strategy that involves the contractual shifting of a pure risk from one party to another. To determine the extent of risk transfer in a reinsurance treaty, regulators may need to conduct quantitative tests.

Alternative risk transfer products and catastrophe bonds, are specially designed to address insurance risks. 1 insurance, a risk transfer mechanism insurance is a mechanism through which firms can reduce negative financial consequences of an uncertain event or possible financial loss. Coverage limits, exclusions, contract language, and oversight of the other party’s risk management practices are crucial to ensuring the risk is truly transferred out of your hands. A risk transfer occurs when one party pays a certain amount of money to another party in exchange for the second party taking on a risk from them. Since the insurer is accepting the risk of a firm holding money as agent on its behalf, the firm

Source: wellsfinancialpartners.com

Source: wellsfinancialpartners.com

Insurance reduces the impact of financial loss on firms, including banks. Evidence and lessons learned 1 1 introduction this paper was commissioned by the organising team of a special session on risk transfer and insurance to be held at the 5 th global platform for disaster risk reduction hosted by the government of mexico in may 2017. Alternative risk transfer products and catastrophe bonds, are specially designed to address insurance risks. In the following example, we demonstrate the “substantially all” exception to the essential elements of. Transferring risk examples include commercial property tenants assuming the risk for keeping sidewalks clear, an apartment complex transferring the risk of theft to a.

Source: clearyinsurance.com

Source: clearyinsurance.com

Money because the insurer bears the risk for any losses arising from either the firm failing to transfer the money or from the misappropriation of the client money by the firm. Risk transfer can be of mainly three types, namely, insurance, derivatives, and outsourcing. 1 insurance, a risk transfer mechanism insurance is a mechanism through which firms can reduce negative financial consequences of an uncertain event or possible financial loss. We utilize our industry expertise and carrier relationships to deliver consultative solutions for our clients, while also advising our clients on how to mitigate their risk exposures. Reinsurance agreements must contain the element of risk transfer where the reinsurer assumes significant insurance risk and may realize a significant loss from the transaction.

Source: risktransfer.com

Source: risktransfer.com

A risk transfer occurs when one party pays a certain amount of money to another party in exchange for the second party taking on a risk from them. Transferring risk means that one party assumes the general liabilities of another party. An insurance policy is the most common way risk transfer is achieved. Risk transfer and insurance for disaster risk management: A risk transfer occurs when one party pays a certain amount of money to another party in exchange for the second party taking on a risk from them.

Source: defitioni.blogspot.com

Source: defitioni.blogspot.com

However, there is an exception to these rules. In order for a contract to qualify for reinsurance accounting treatment in accordance with fas 113, it must transfer insurance risk from an insurer to a reinsurer. Risk transfer is a risk management and control strategy that involves the contractual shifting of a pure risk from one party to another. Transferring risk examples include commercial property tenants assuming the risk for keeping sidewalks clear, an apartment complex transferring the risk of theft to a. Insurance reduces the impact of financial loss on firms, including banks.

Source: slideshare.net

Source: slideshare.net

Risk transfer is a risk management technique where risk is transferred from your organization to a third party. Since the insurer is accepting the risk of a firm holding money as agent on its behalf, the firm Transferring risks to another entity through insurance, outsourcing or a partnership should be approached with caution!! Transferring risk means that one party assumes the general liabilities of another party. And (b) it is reasonably possible that the reinsurer may realize a significant loss from the transaction.

Source: sterlingrisk.com

Source: sterlingrisk.com

These agreements are often referred to as risk transfer agreements. Risk transfer and insurance for disaster risk management: In order for a contract to qualify for reinsurance accounting treatment in accordance with fas 113, it must transfer insurance risk from an insurer to a reinsurer. Insurance reduces the impact of financial loss on firms, including banks. An insurance policy is the most common way risk transfer is achieved.

Source: thealsgroup.com

Source: thealsgroup.com

The main problem with the application of quantitative tests is their technical However, there is an exception to these rules. And (b) it is reasonably possible that the reinsurer may realize a significant loss from the transaction. The basic business model of the insurance industry is the acceptance and management of risk. The insurance business is built on risk transfer:

Source: slideserve.com

Source: slideserve.com

Insurance can be taken for insuring against an. Risk transfer obtained by a cedant through a given reinsurance transaction. Transferring risk means that one party assumes the general liabilities of another party. One example is the purchase of an insurance policy, by which a specified risk of loss is passed from the policyholder to the insurer. Insurance reduces the impact of financial loss on firms, including banks.

Source: osservatori.net

Source: osservatori.net

Risk transfer is a risk management technique where risk is transferred from your organization to a third party. Transferring risk means that one party assumes the general liabilities of another party. However, there is an exception to these rules. Coverage limits, exclusions, contract language, and oversight of the other party’s risk management practices are crucial to ensuring the risk is truly transferred out of your hands. By purchasing an insurance policy, the policyholder transfers risk to an insurer.

Source: defitioni.blogspot.com

Source: defitioni.blogspot.com

1 insurance, a risk transfer mechanism insurance is a mechanism through which firms can reduce negative financial consequences of an uncertain event or possible financial loss. Reinsurance agreements must contain the element of risk transfer where the reinsurer assumes significant insurance risk and may realize a significant loss from the transaction. Insurance can be taken for insuring against an. A risk transfer occurs when one party pays a certain amount of money to another party in exchange for the second party taking on a risk from them. By purchasing an insurance policy, the policyholder transfers risk to an insurer.

Source: risktransfer.com

Source: risktransfer.com

In order for a contract to qualify for reinsurance accounting treatment in accordance with fas 113, it must transfer insurance risk from an insurer to a reinsurer. Transferring risks to another entity through insurance, outsourcing or a partnership should be approached with caution!! Evidence and lessons learned 1 1 introduction this paper was commissioned by the organising team of a special session on risk transfer and insurance to be held at the 5 th global platform for disaster risk reduction hosted by the government of mexico in may 2017. These agreements are often referred to as risk transfer agreements. To determine the extent of risk transfer in a reinsurance treaty, regulators may need to conduct quantitative tests.

Source: researchgate.net

Source: researchgate.net

Risk transfer obtained by a cedant through a given reinsurance transaction. Insurance is a funded risk transfer mechanism that ensures the transfer of financial consequences of a loss from a party (the insured) to another party (the insurer) in exchange for a premium payment. Risk transfer is a risk management technique where risk is transferred from your organization to a third party. To meet the risk transfer requirement, a reinsurance contract must satisfy one of two conditions: Since the insurer is accepting the risk of a firm holding money as agent on its behalf, the firm

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title risk transfer insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information