Risks of changing insurance companies information

Home » Trend » Risks of changing insurance companies informationYour Risks of changing insurance companies images are ready in this website. Risks of changing insurance companies are a topic that is being searched for and liked by netizens now. You can Download the Risks of changing insurance companies files here. Download all free images.

If you’re looking for risks of changing insurance companies images information linked to the risks of changing insurance companies keyword, you have pay a visit to the ideal blog. Our site frequently gives you hints for refferencing the highest quality video and picture content, please kindly search and locate more informative video content and graphics that match your interests.

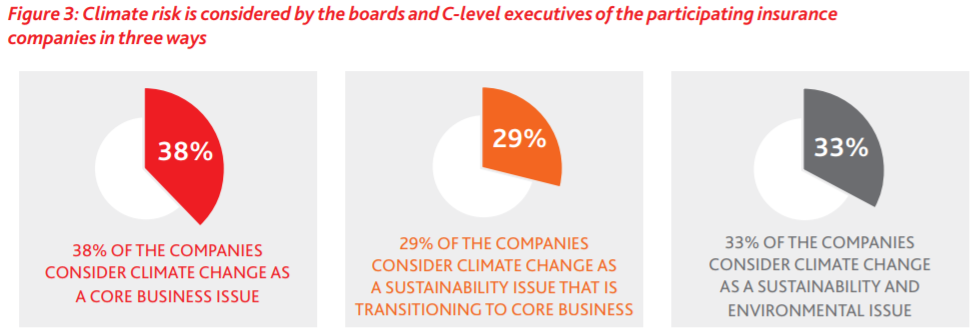

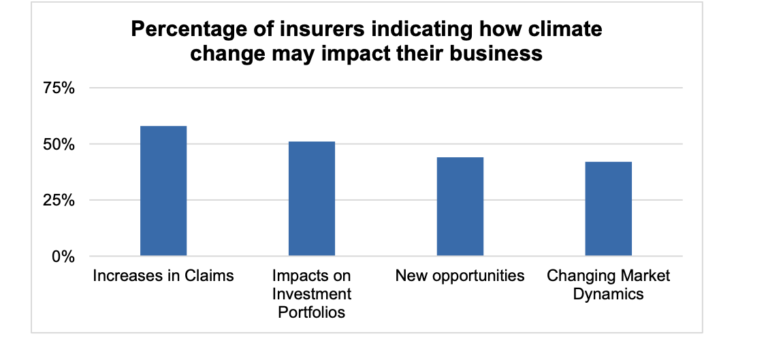

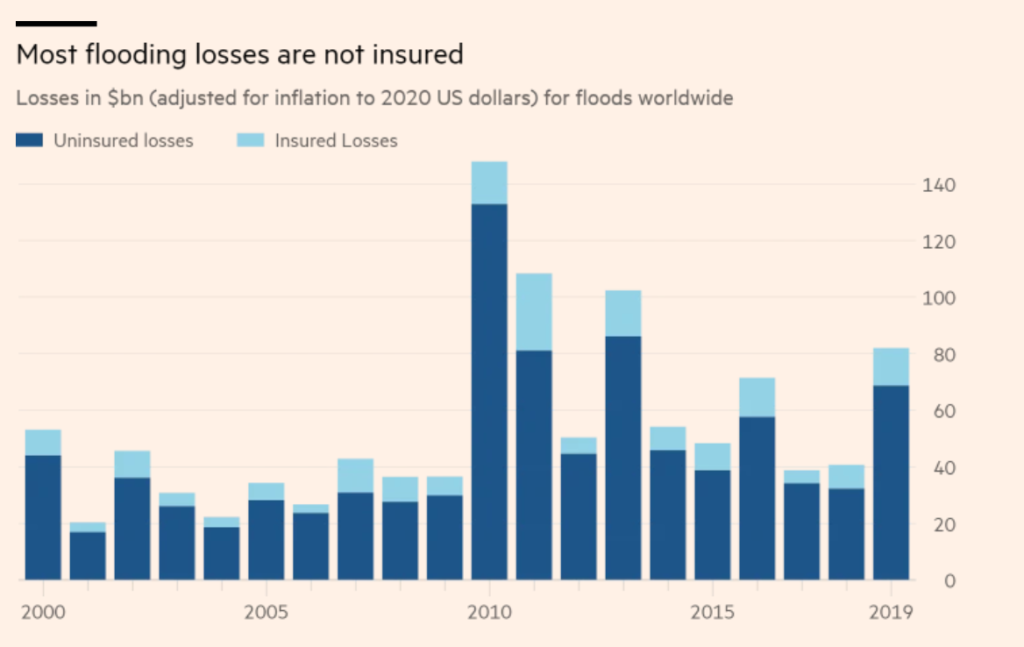

Risks Of Changing Insurance Companies. This was unprecedented in the past 250 years. Through their investment, underwriting and advisory functions, insurers are directly exposed to a changing climate, which creates threats and opportunities for the sector. If you’re considering changing your insurance provider, it’s probably because you want to put yourself in a better place financially. The more that risks are evaluated and understood, the better a business can respond.

The economics, regulation, and systemic risk of insurance From voxeu.org

The economics, regulation, and systemic risk of insurance From voxeu.org

Reinsurers, just like insurance companies, want to know where their exposures will be coming from and at what loss amount. The emerging risk process encompasses the following steps: We can help you evaluate that. 1 introduction welcome to the first in our new series of risk & resilience reports. This report is a compilation of emerging risks relevant to the (re)insurance industry. Through their investment, underwriting and advisory functions, insurers are directly exposed to a changing climate, which creates threats and opportunities for the sector.

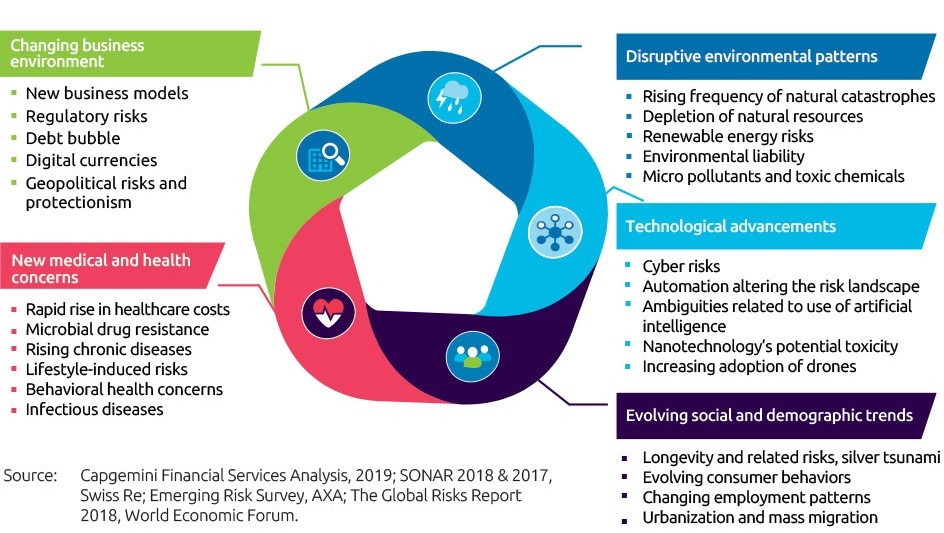

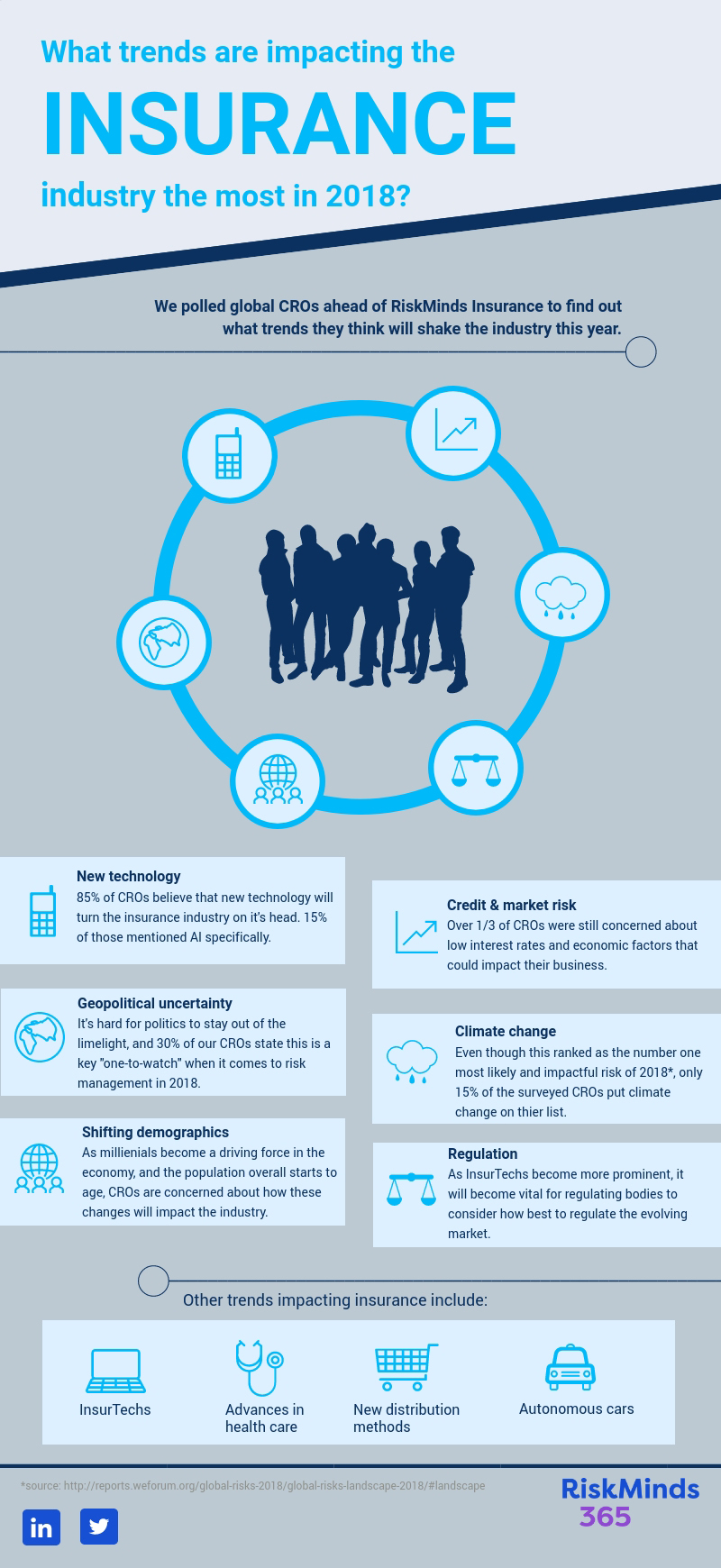

The insurance industry has been adapting to a changing business environment due to the rise of digital technology and more demanding customers.

The insurance industry has been adapting to a changing business environment due to the rise of digital technology and more demanding customers. If the savings outweigh the risks, maybe it’s time to change insurance companies. See why climate change insurance risk is intensifying, examine the insurance industry’s response to climate change, and explore action items insurers should consider to address risks and achieve greater resilience. Compare the costs, savings and risks. The business of insurance is based on dealing with uncertainty. By arthur zuckerman may 14, 2020.

Source: insuramatch.com

Source: insuramatch.com

6 risks of changing insurance companies. To deal with the changing risk environment, insurers need to continuously assess the evolving risk landscape by monitoring and evaluating issues that are contributing. Compare the costs, savings and risks. 13 top insurance industry trends: If the savings outweigh the risks, maybe it’s time to change insurance companies.

Source: insurancejournal.com

Source: insurancejournal.com

Risk identification, risk assessment, risk implementation (split into risk dialogue, risk mitigation measures and business opportunities), as well as risk monitoring and control. Some examples affecting the insurance industry are obvious (for example, climate change) and How are businesses’ attitudes to risk & resilience changing? To deal with the changing risk environment, insurers need to continuously assess the evolving risk landscape by monitoring and evaluating issues that are contributing. Quite a few insurance companies with reinsurance subsidiaries and some smaller reinsurers themselves.

Source: hdi-specialty.com

Source: hdi-specialty.com

By arthur zuckerman may 14, 2020. Based on a survey of over 1,000 business leaders and insurance buyers from across 10 industry sectors in the uk and the us, and with insights We can help you evaluate that. To deal with the changing risk environment, insurers need to continuously assess the evolving risk landscape by monitoring and evaluating issues that are contributing. Changing insurance companies is not to be done lightly.

Source: slideshare.net

Source: slideshare.net

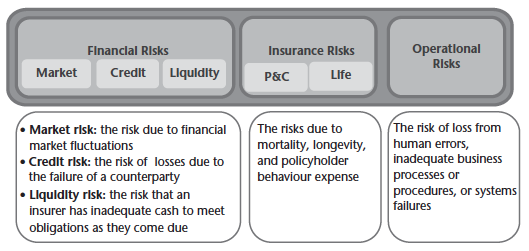

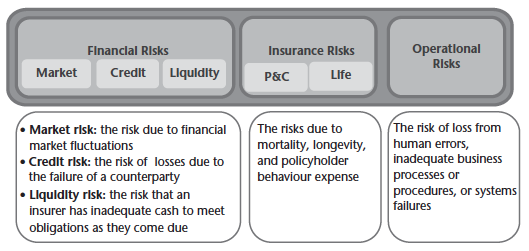

In addition to these traditional risks, the risk profile of insurance companies changed significantly during the last 20 years, due to product innovation (variable annuities) and new tools that insurance companies use to manage their capital (securities lending. Introduction to the risks faced by insurance companies: Written by arthur zuckerman may 14, 2020. If you�re looking to lower monthly costs or add new plan benefits, consider these risks of changing insurance companies. This was unprecedented in the past 250 years.

Source: bimabazaar.com

Source: bimabazaar.com

How are businesses’ attitudes to risk & resilience changing? The insurance industry has been adapting to a changing business environment due to the rise of digital technology and more demanding customers. Compare the costs, savings and risks. Some examples affecting the insurance industry are obvious (for example, climate change) and Insurance market risk metrics assessment 1.identification of risks from exposures in case of stress scenarios predefined scenarios to assess market wide risk exposure company specific scenarios to assess specific risks of single insurers 2.defining scenarios for the analysis would be the next steps

Source: www2.deloitte.com

Source: www2.deloitte.com

If you’re considering changing your insurance provider, it’s probably because you want to put yourself in a better place financially. 2021/2022 data, statistics & predictions. 1 introduction welcome to the first in our new series of risk & resilience reports. Often referred to as society’s risk manager, insurance companies have an important role in the web of climate change complexities. The risk profile of insurance companies has changed during the last two decades.

Source: insurance-canada.ca

Source: insurance-canada.ca

By arthur zuckerman may 14, 2020. Naturally, reinsurers are just as interested in emerging risks as the insurance companies that purchase reinsurance are. To deal with the changing risk environment, insurers need to continuously assess the evolving risk landscape by monitoring and evaluating issues that are contributing. The insurance industry has been adapting to a changing business environment due to the rise of digital technology and more demanding customers. Based on a survey of over 1,000 business leaders and insurance buyers from across 10 industry sectors in the uk and the us, and with insights

Source: isure.ca

Source: isure.ca

The more that risks are evaluated and understood, the better a business can respond. 6 risks of changing insurance companies. If the savings outweigh the risks, maybe it’s time to change insurance companies. Introduction to the risks faced by insurance companies: Insurance market risk metrics assessment 1.identification of risks from exposures in case of stress scenarios predefined scenarios to assess market wide risk exposure company specific scenarios to assess specific risks of single insurers 2.defining scenarios for the analysis would be the next steps

Source: voxeu.org

Source: voxeu.org

Written by arthur zuckerman may 14, 2020. Losing means sinking into obscurity. Winning the race means thriving in the business; Here is an essay on the risks faced by insurance companies. If you’re considering changing your insurance provider, it’s probably because you want to put yourself in a better place financially.

Source: gjia.georgetown.edu

Source: gjia.georgetown.edu

You can save money, but there are costs and risks to consider, too. Based on a survey of over 1,000 business leaders and insurance buyers from across 10 industry sectors in the uk and the us, and with insights Five global shifts changing the way we live and do business rapid urbanisation by 2030, the un projects that 4.9 billion people will be urban dwellers and, by 2050, the world’s urban population will have increased by some 72%4. Introduction to the risks faced by insurance companies: See why climate change insurance risk is intensifying, examine the insurance industry’s response to climate change, and explore action items insurers should consider to address risks and achieve greater resilience.

Source: insurancebusinessmag.com

Source: insurancebusinessmag.com

Through their investment, underwriting and advisory functions, insurers are directly exposed to a changing climate, which creates threats and opportunities for the sector. Losing means sinking into obscurity. Introduction to the risks faced by insurance companies: See why climate change insurance risk is intensifying, examine the insurance industry’s response to climate change, and explore action items insurers should consider to address risks and achieve greater resilience. If you’re considering changing your insurance provider, it’s probably because you want to put yourself in a better place financially.

Source: capgemini.com

Source: capgemini.com

1 introduction welcome to the first in our new series of risk & resilience reports. How coronavirus is changing claims, risks, work, habits, supply chains and more. The insurance industry has been adapting to a changing business environment due to the rise of digital technology and more demanding customers. Introduction to the risks faced by insurance companies: See why climate change insurance risk is intensifying, examine the insurance industry’s response to climate change, and explore action items insurers should consider to address risks and achieve greater resilience.

Source: readerspice.com

Source: readerspice.com

Insurance companies face the dual challenge of addressing escalating climate change risks and shifting industry regulations. The more that risks are evaluated and understood, the better a business can respond. This was unprecedented in the past 250 years. By arthur zuckerman may 14, 2020. To deal with the changing risk environment, insurers need to continuously assess the evolving risk landscape by monitoring and evaluating issues that are contributing.

Source: informaconnect.com

Source: informaconnect.com

Based on a survey of over 1,000 business leaders and insurance buyers from across 10 industry sectors in the uk and the us, and with insights See why climate change insurance risk is intensifying, examine the insurance industry’s response to climate change, and explore action items insurers should consider to address risks and achieve greater resilience. Here is an essay on the risks faced by insurance companies. This report is a compilation of emerging risks relevant to the (re)insurance industry. Losing means sinking into obscurity.

Source: gjia.georgetown.edu

Source: gjia.georgetown.edu

The insurance industry has been adapting to a changing business environment due to the rise of digital technology and more demanding customers. Changing insurance companies is not to be done lightly. Compare the costs, savings and risks. We can help you evaluate that. To deal with the changing risk environment, insurers need to continuously assess the evolving risk landscape by monitoring and evaluating issues that are contributing.

Source: dqindia.com

Source: dqindia.com

Reinsurers, just like insurance companies, want to know where their exposures will be coming from and at what loss amount. Therefore, an insurer needs to consider a wide range of possible risks and the outcome that may affect the current and future financial position. Often referred to as society’s risk manager, insurance companies have an important role in the web of climate change complexities. If you�re looking to lower monthly costs or add new plan benefits, consider these risks of changing insurance companies. How are businesses’ attitudes to risk & resilience changing?

Source: 53.com

Source: 53.com

Therefore, an insurer needs to consider a wide range of possible risks and the outcome that may affect the current and future financial position. Often referred to as society’s risk manager, insurance companies have an important role in the web of climate change complexities. It is the board of directors which is tasked to start talks on the principles of risk appetite. Insurance companies face the dual challenge of addressing escalating climate change risks and shifting industry regulations. Winning the race means thriving in the business;

Source: blog.ecbm.com

See why climate change insurance risk is intensifying, examine the insurance industry’s response to climate change, and explore action items insurers should consider to address risks and achieve greater resilience. Naturally, reinsurers are just as interested in emerging risks as the insurance companies that purchase reinsurance are. This was unprecedented in the past 250 years. 6 risks of changing insurance companies. The role of management boards within the insurance company.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title risks of changing insurance companies by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information