Roof requirements for homeowners insurance information

Home » Trend » Roof requirements for homeowners insurance informationYour Roof requirements for homeowners insurance images are ready. Roof requirements for homeowners insurance are a topic that is being searched for and liked by netizens today. You can Get the Roof requirements for homeowners insurance files here. Find and Download all royalty-free photos and vectors.

If you’re looking for roof requirements for homeowners insurance pictures information linked to the roof requirements for homeowners insurance interest, you have come to the ideal site. Our website always provides you with suggestions for downloading the maximum quality video and picture content, please kindly surf and locate more informative video content and graphics that match your interests.

Roof Requirements For Homeowners Insurance. If a roof is older than ten years, an insurance company can reduce coverage based on a roof’s type and age. In fact, florida specifically now says that all ho3 policies are of type rcv; Your homeowners insurance policy covers some roof damage but not all of it. Insurers won’t renew a policy that fails inspection without a roof replacement.

No More "Free Roof" or Rebates for Insurance Deductibles From hettlerinsurance.com

No More "Free Roof" or Rebates for Insurance Deductibles From hettlerinsurance.com

Homeowners insurance providers may closely inspect your roof�s condition before offering or continuing home insurance coverages. Roof requirements for homeowners insurance. Most homeowners insurance policies won�t pay to replace or. Insurers won’t renew a policy that fails inspection without a roof replacement. Most insurers will not renew existing homeowners’ insurance policies on homes with roofs that are more than 20 years old. Roof requirements for homeowners insurance.

The 1 key type of roof replacement insurance:

Most homeowners insurance policies cover roof replacement if the damage is the result of an act of nature or sudden accidental event. Insurance companies place a lot of importance on roof condition when determining a home’s coverage eligibility and rates. For policyholders renewing with their current insurer, those requirements may also be in place or they could drop your coverage entirely. Roof requirements for homeowners insurance when binding a policy as a new policyholder, many insurers won’t write you a policy if your roof hasn’t been updated in the last 40 years. Avoid possible legal consequences by working with a roofing expert who understands the requirements for hoa roof replacement. There are certain stipulations that keep homeowners from utilizing their insurance policies for payouts that can help alleviate expenses.

Source: nextinsurance.com

Source: nextinsurance.com

Oftentimes, a standard homeowners policy will cover damages caused by roof leaks, but it will depend on what type of home insurance policy you carry and what caused the roof leak. The age of your roof and insurance coverage go hand in hand. In fact, florida specifically now says that all ho3 policies are of type rcv; If you live in an area at risk for these disasters, consider flood insurance or earthquake. If your home has a newer roof, you’ll likely see lower rates — maybe even a policy discount.

Source: insurancemaneuvers.com

Source: insurancemaneuvers.com

You can expect 15 to 25 years out of an asphalt roof. The insurance company is responsible for honoring the claim, which they do once they cut you a check. Homeowners insurance may pay to replace your roof, but only if it is damaged by a covered hazard, like fire or bad weather. At an average of around $100 to $150 per square, it�s the most affordable roof option. A newer roof may mean a lower rate.

Source: revisi.net

Source: revisi.net

When required, testing is in accordance with astm e108 or ul 790. Roof insurability depends on various factors, such as: These insurance companies may only pay actual cash value for roof replacements on older roofs when they’re damaged. Most homeowners insurance policies cover roof replacement if the damage is the result of an act of nature or sudden accidental event. The age of your roof and insurance coverage go hand in hand.

Source: stonecreekroofing.com

Source: stonecreekroofing.com

If you live in an area at risk for these disasters, consider flood insurance or earthquake. It is the latest twist in florida. In fact, florida specifically now says that all ho3 policies are of type rcv; At an average of around $100 to $150 per square, it�s the most affordable roof option. 1 that include a requirement that roofs on underlying properties be 15 years and.

Source: independentamericancommunities.com

Source: independentamericancommunities.com

One homeowner that we worked with recently was thrilled to find out that his homeowner’s insurance premiums went down by more than 25% after swapping out their existing roofing for a metal roof. A newer roof may mean a lower rate. Homeowners must file property insurance, supplemental insurance, or reopened claims within two years if a roof is less than ten years old, the insurance company must fully cover a replacement. Most insurers will not renew existing homeowners’ insurance policies on homes with roofs that are more than 20 years old. And american strategic insurance corp.

Source: hettlerinsurance.com

Source: hettlerinsurance.com

The insurance companies required the owner to replace the roof before renewing the homeowner’s insurance. In fact, a hip roof can reduce your homeowners. Learn what your policy may or may not cover, and what you can do to keep your roof. You can expect 15 to 25 years out of an asphalt roof. 1 that include a requirement that roofs on underlying properties be 15 years and.

Source: bonedryroofing.net

Source: bonedryroofing.net

Generally, there are four key factors insurers look at. It is the latest twist in florida. Home insurers like it due to its protective capabilities and replacement cost. Homeowners must file property insurance, supplemental insurance, or reopened claims within two years if a roof is less than ten years old, the insurance company must fully cover a replacement. For policyholders renewing with their current insurer, those requirements may also be in place or they could drop your coverage entirely.

Source: pinterest.com

Source: pinterest.com

There are certain stipulations that keep homeowners from utilizing their insurance policies for payouts that can help alleviate expenses. At an average of around $100 to $150 per square, it�s the most affordable roof option. Most homeowners insurance policies cover roof replacement if the damage is the result of an act of nature or sudden accidental event. A newer roof may mean a lower rate. Homeowners insurance providers may closely inspect your roof�s condition before offering or continuing home insurance coverages.

Source: accesshomeinsurance.com

Source: accesshomeinsurance.com

Homeowners insurance also won’t cover damage caused floods or earthquakes, including roof damage. If a tornado rips your roof off, for instance, you can file a claim with your homeowners insurance, pay your deductible. And american strategic insurance corp. For policyholders renewing with their current insurer, those requirements may also be in place or they could drop your coverage entirely. If your home has a newer roof, you’ll likely see lower rates — maybe even a policy discount.

Source: nunezroofingllc.com

Source: nunezroofingllc.com

You are free to spend it any way you like it. Homeowners insurance may cover roof leaks. Homeowners insurance may pay to replace your roof, but only if it is damaged by a covered hazard, like fire or bad weather. The insurance company is responsible for honoring the claim, which they do once they cut you a check. Most insurers will not renew existing homeowners’ insurance policies on homes with roofs that are more than 20 years old.

Source: revisi.net

Source: revisi.net

Roof requirements for homeowners insurance. For policyholders renewing with their current insurer, those requirements may also be in place or they could drop your coverage entirely. Progressive�s asi preferred insurance corp. Most homeowners insurance policies won�t pay to replace or. It is the latest twist in florida.

Source: insurancefortexans.com

In fact, florida specifically now says that all ho3 policies are of type rcv; Home insurers like it due to its protective capabilities and replacement cost. One homeowner that we worked with recently was thrilled to find out that his homeowner’s insurance premiums went down by more than 25% after swapping out their existing roofing for a metal roof. In fact, a hip roof can reduce your homeowners. If a roof is 20 years old or more, some companies.

Source: caldwellsroofing.com

Source: caldwellsroofing.com

Roof requirements for homeowners insurance when binding a policy as a new policyholder, many insurers won’t write you a policy if your roof hasn’t been updated in the last 40 years. The insurance company is responsible for honoring the claim, which they do once they cut you a check. 1 that include a requirement that roofs on underlying properties be 15 years and. You are free to spend it any way you like it. If a roof is 20 years old or more, some companies.

Source: srqwindmitigation.com

Source: srqwindmitigation.com

And american strategic insurance corp. Roof insurability depends on various factors, such as: Insurance companies place a lot of importance on roof condition when determining a home’s coverage eligibility and rates. Homeowners must file property insurance, supplemental insurance, or reopened claims within two years if a roof is less than ten years old, the insurance company must fully cover a replacement. Homeowners insurance providers may closely inspect your roof�s condition before offering or continuing home insurance coverages.

Source: iko.com

Source: iko.com

Roof requirements for homeowners insurance. A newer roof may mean a lower rate. Home insurers like it due to its protective capabilities and replacement cost. These insurance companies may only pay actual cash value for roof replacements on older roofs when they’re damaged. Homeowners must file property insurance, supplemental insurance, or reopened claims within two years if a roof is less than ten years old, the insurance company must fully cover a replacement.

Source: icmroofing.com

Source: icmroofing.com

While more homeowners should have the pride of ownership that you do and care for their castles like you, roof age insurance eligibility guidelines are strictly based on the law of large numbers. Metal roofing is a major investment and can offer some seriously good benefits, but sometimes it offers benefits that homeowners aren’t expecting. Insurance companies place a lot of importance on roof condition when determining a home’s coverage eligibility and rates. Your homeowners insurance policy covers some roof damage but not all of it. After the 2005 changes to florida homeowners insurance laws, homeowners in florida can have a replacement cost policy that should pay the replacement cost value of the roof at the time of a covered loss.

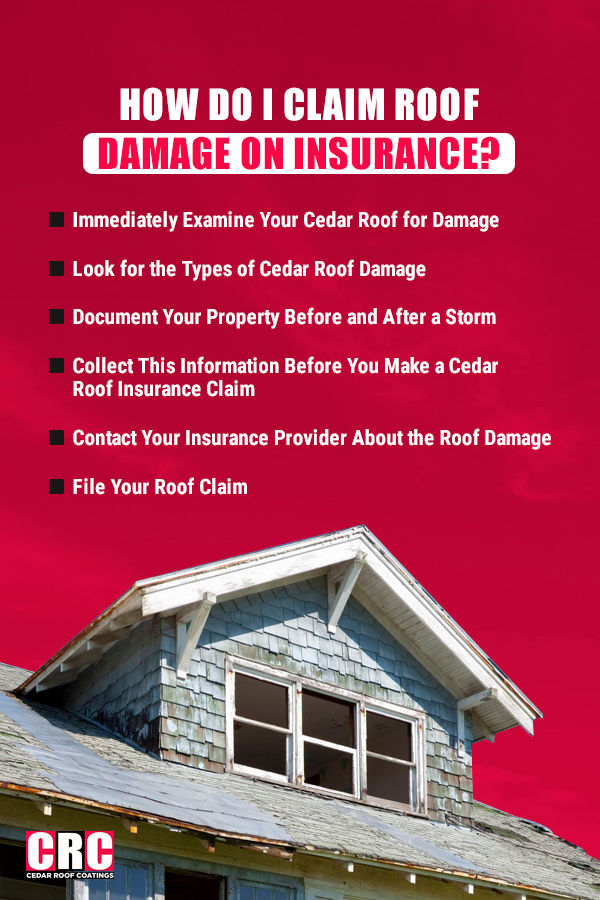

Source: cedarroofcoatings.com

Source: cedarroofcoatings.com

Other insurers have a policy to not write new policies for homes with roofs over 20 years old. Age of roof and insurance. If a roof is older than ten years, an insurance company can reduce coverage based on a roof’s type and age. Roof requirements for homeowners insurance. Learn what your policy may or may not cover, and what you can do to keep your roof.

Source: capitalroofingllc.us

Source: capitalroofingllc.us

The insurance company is responsible for honoring the claim, which they do once they cut you a check. Most homeowners insurance policies will require you to complete the repairs before fully reimbursing you. For you to continue to have homeowners insurance coverage, a home inspector from the insurance company will need to inspect the roof once it has been replaced, and certify it as properly done. Your homeowners insurance policy covers some roof damage but not all of it. Roof insurability depends on various factors, such as:

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title roof requirements for homeowners insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information