Roofing liability insurance information

Home » Trend » Roofing liability insurance informationYour Roofing liability insurance images are available in this site. Roofing liability insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Roofing liability insurance files here. Get all free images.

If you’re looking for roofing liability insurance pictures information related to the roofing liability insurance keyword, you have visit the ideal blog. Our website always gives you suggestions for downloading the maximum quality video and picture content, please kindly surf and find more enlightening video content and graphics that match your interests.

Roofing Liability Insurance. Roofers have a much higher risk that painters, landscapers, and other contractors that mainly stay on the ground. What’s covered under roofer general liability insurance? Most carriers ask for loss runs and experience, whether you have employees, and copies of any safety policies in place to calculate a premium. Learn more about roofing insurance and contact roof solutions for a roofing insurance quote.

Roofing Contractors Insurance, General Liability Insurance From roofingcontractorsinsurance.net

Roofing Contractors Insurance, General Liability Insurance From roofingcontractorsinsurance.net

Even in states that do not require liability insurance, it is important to consider having roofers’ insurance to protect your company in the instance of an accident. A general liability insurance policy includes coverage for: Request a roofing insurance quote today by completing our online quote form. The catchall of roofing insurance, general liability insurance covers several of the key risks that are faced by roofers workers compensation insurance should your employees or contractors suffer injuries or damages while on the job for you, a workers compensation insurance policy will ensure your business loses or costs to rectify the problem or help with their treatments are. Generally, it is hard to find general liability coverage for less than $2,000/year for roofing work. If the homeowner walks outside to check your work and tools or equipment slide off the.

You may need additional policies to protect your business and to reassure customers that you’re a professional.

Professional liability insurance, also known as errors and omissions insurance, is connected specifically to your role as a roofer, and the work you do as a roofer. Learn more about roofing insurance and contact roof solutions for a roofing insurance quote. You may need additional policies to protect your business and to reassure customers that you’re a professional. With roofing general liability insurance, you’ll have financial protection if someone other than an employee gets hurt or you are held responsible for damaging property that doesn’t belong to you. Generally, it is hard to find general liability coverage for less than $2,000/year for roofing work. Neither the broad commercial liability insurance policy nor the automobile portion of the policy covers injury to the roofing contractor’s employees.

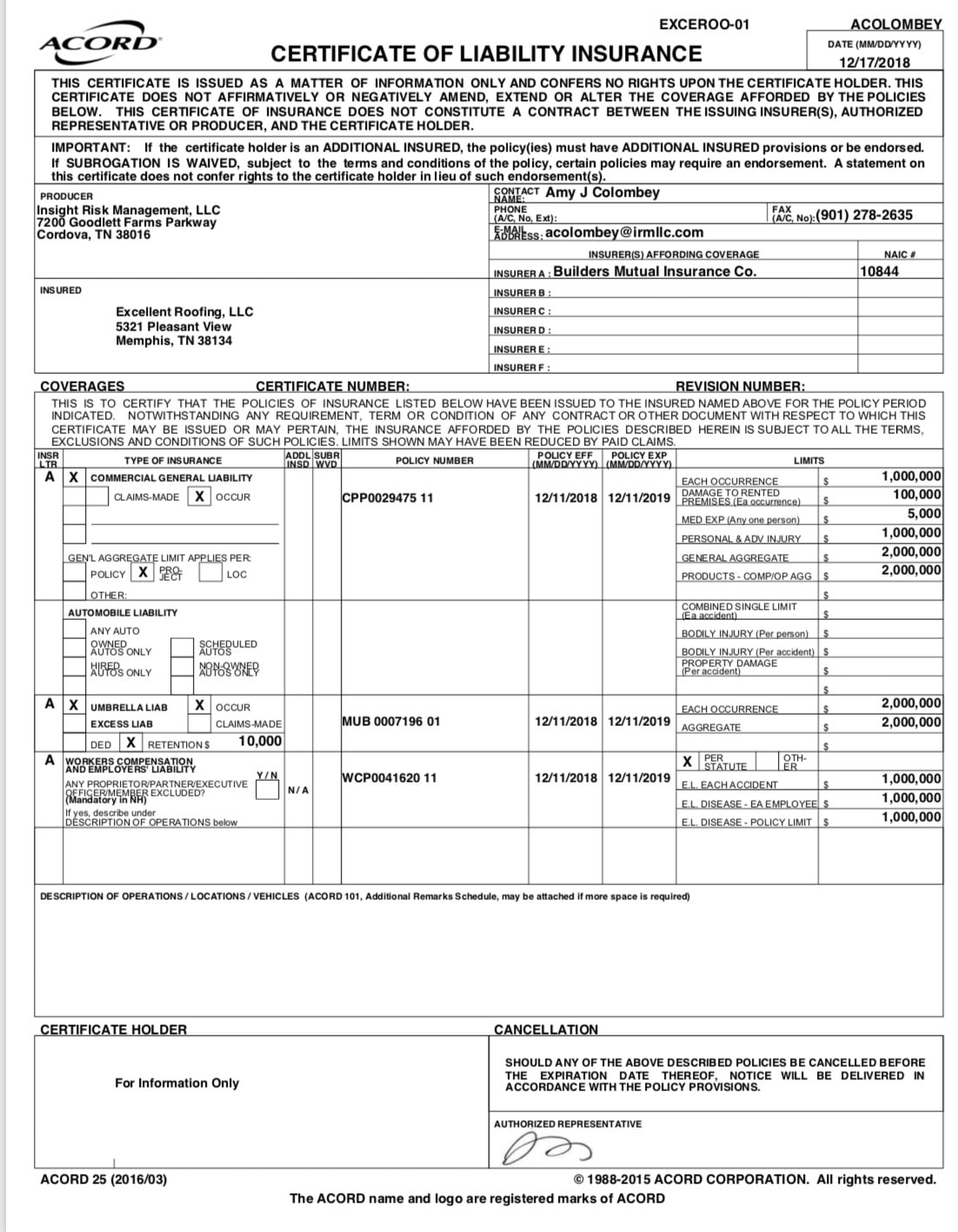

Source: excellentroofing.com

Source: excellentroofing.com

Most carriers ask for loss runs and experience, whether you have employees, and copies of any safety policies in place to calculate a premium. Professional liability insurance, also known as errors and omissions insurance, is connected specifically to your role as a roofer, and the work you do as a roofer. Generally, it is hard to find general liability coverage for less than $2,000/year for roofing work. Roofing liability insurance will provide coverage (payment) to a third party for a claim (accident) you become legally liable for relating to the roofing activities taking place on any specific project. If the homeowner walks outside to check your work and tools or equipment slide off the.

Source: dickwattsinsurance.com

Source: dickwattsinsurance.com

General liability might be required for a roofer license in your state, and it’s common for clients to ask for proof of coverage. A general liability insurance policy includes coverage for: Be sure to meet with multiple insurance agents to find the best policy and price for you. You may need additional policies to protect your business and to reassure customers that you’re a professional. A general liability insurance policy typically includes coverage for:

Source: tradesmansaver.co.uk

Source: tradesmansaver.co.uk

Services offered, such as residential or commercial roofing; Most carriers ask for loss runs and experience, whether you have employees, and copies of any safety policies in place to calculate a premium. These include public liability insurance and employers’ liability cover, plus tools insurance and contract works insurance. It protects roofers if they miss a step during installation that causes damage to a building, or if they give advice or recommendations to building owners that eventually lead to damage. Also, roofing contractor insurance requirements vary in each state and province.

Source: muthroofing.com

Source: muthroofing.com

What’s covered under roofer general liability insurance? Public liability covers injury to third parties and damage to property of third parties that you and your employees are responsible for in the course of your business, legal fees incurred during a claim are also covered by this policy. Our roofers insurance policies offer public and employers liability insurance for you, your staff, customers and the public. A general liability insurance policy for roofing businesses usually has several components that protect the roofers from liability, including: As a roofer, there are several insurance policies you should be looking at.

Source: roofingcontractorsinsurance.net

Source: roofingcontractorsinsurance.net

A general liability insurance policy for roofing businesses usually has several components that protect the roofers from liability, including: Most carriers ask for loss runs and experience, whether you have employees, and copies of any safety policies in place to calculate a premium. A general liability insurance policy includes coverage for: Our roofers insurance policies offer public and employers liability insurance for you, your staff, customers and the public. Also, roofing contractor insurance requirements vary in each state and province.

Source: primeis.com

Source: primeis.com

Request a roofing insurance quote today by completing our online quote form. Without sufficient coverage, you and your business could face serious. These include public liability insurance and employers’ liability cover, plus tools insurance and contract works insurance. If the homeowner walks outside to check your work and tools or equipment slide off the. This is where a good roofing public liability insurance comes in and will protect you from possible financial loss.

Source: contractors-insurance.ca

Source: contractors-insurance.ca

As a roofer, there are several insurance policies you should be looking at. Click on insurance for roofers to obtain price quotes online. Roofing worksites tend to get a bit messy. This insurance will pay for bodily injury and/or property damage to an outside party that becomes your responsibility. Roofing contractor insurance also known as general liability insurance for roofers is an insurance coverage that financially protects the insured in the event he or she causes bodily injury, damages, or loses to clients of third parties.

Source: youtube.com

Source: youtube.com

Services offered, such as residential or commercial roofing; You may need additional policies to protect your business and to reassure customers that you’re a professional. Roofing worksites tend to get a bit messy. There are at least three different kinds of roofers insurance you may need: Liability insurance for roofers can vary in options and prices.

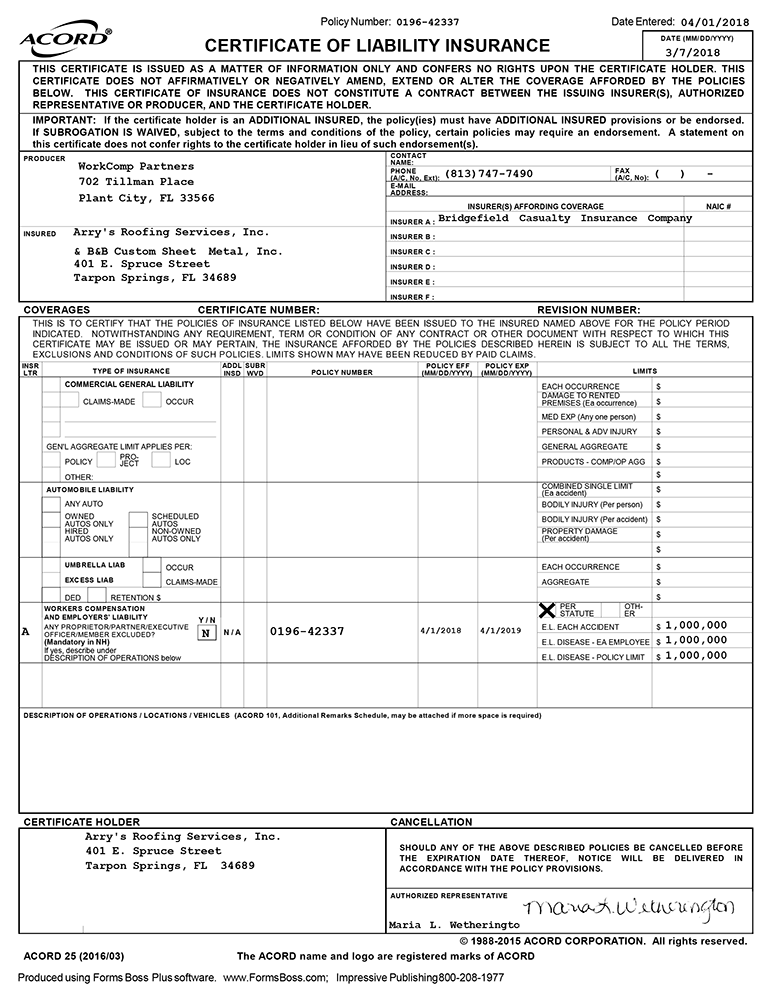

Source: arrysroofing.com

Source: arrysroofing.com

Being a roofing contractor is rewarding but also demanding. It protects roofers if they miss a step during installation that causes damage to a building, or if they give advice or recommendations to building owners that eventually lead to damage. Roofing liability insurance is professional liability insurance for roofing companies. Generally, it is hard to find general liability coverage for less than $2,000/year for roofing work. Being a roofing contractor is rewarding but also demanding.

Source: whiteoutpress.com

Source: whiteoutpress.com

If the homeowner walks outside to check your work and tools or equipment slide off the. Most carriers ask for loss runs and experience, whether you have employees, and copies of any safety policies in place to calculate a premium. Workers’ compensation, general liability and a surety bond. A general liability insurance policy for roofing businesses usually has several components that protect the roofers from liability, including: Commercial general liability insurance (cgl), also known as roofing liability insurance, covers you from common accidents that involve other people’s property or cause bodily injury.

Source: pathwayinsurance.net

Source: pathwayinsurance.net

Without sufficient coverage, you and your business could face serious. Roofer general liability insurance gives you broad protection against the risks you and your employees face every day. A general liability insurance policy includes coverage for: A general liability insurance policy for roofing businesses usually has several components that protect the roofers from liability, including: It protects roofers if they miss a step during installation that causes damage to a building, or if they give advice or recommendations to building owners that eventually lead to damage.

Source: tradesmansaver.co.uk

Source: tradesmansaver.co.uk

You may need additional policies to protect your business and to reassure customers that you’re a professional. These include public liability insurance and employers’ liability cover, plus tools insurance and contract works insurance. As a roofing contractor, roofing insurance protects you and not your customers. Roofing liability insurance is professional liability insurance for roofing companies. Professional liability insurance, also known as errors and omissions insurance, is connected specifically to your role as a roofer, and the work you do as a roofer.

Source: aiaroofing.com

Source: aiaroofing.com

Roofing liability insurance will provide coverage (payment) to a third party for a claim (accident) you become legally liable for relating to the roofing activities taking place on any specific project. You might also be interested in: There are at least three different kinds of roofers insurance you may need: Van insurance to cover your commercial vehicle. This insurance will pay for bodily injury and/or property damage to an outside party that becomes your responsibility.

Source: contractorsliability.com

Source: contractorsliability.com

General liability might be required for a roofer license in your state, and it’s common for clients to ask for proof of coverage. Being a roofing contractor is rewarding but also demanding. Roofing worksites tend to get a bit messy. Roofers have a much higher risk that painters, landscapers, and other contractors that mainly stay on the ground. In fact, most states require contractors to have a valid roofing contractors liability insurance policy in place to get licensed, to bid on jobs, and to conduct any kind of construction operations on a roof.

Source: 5prc.com

Source: 5prc.com

Professional liability insurance, also known as errors and omissions insurance, is connected specifically to your role as a roofer, and the work you do as a roofer. Our roofing liability insurance is something you can not pass up. Commercial general liability insurance (cgl), also known as roofing liability insurance, covers you from common accidents that involve other people’s property or cause bodily injury. There are at least three different kinds of roofers insurance you may need: This insurance kicks in only if.

Source: summitroofing.com

Source: summitroofing.com

Be sure to meet with multiple insurance agents to find the best policy and price for you. It protects roofers if they miss a step during installation that causes damage to a building, or if they give advice or recommendations to building owners that eventually lead to damage. Roofers insurance is a specialized liability insurance that provides custom coverage for accidents that often require coverage legally. Roofing liability insurance or roofers liability insurance) is the first piece to include in your roofing insurance package. Public liability covers injury to third parties and damage to property of third parties that you and your employees are responsible for in the course of your business, legal fees incurred during a claim are also covered by this policy.

Source: smallbusinessliability.com

Source: smallbusinessliability.com

This insurance will pay for bodily injury and/or property damage to an outside party that becomes your responsibility. Roofing professional liability insurance starts at $50/month and relates to the work that you do as a roofer. Being a roofing contractor is rewarding but also demanding. With roofing general liability insurance, you’ll have financial protection if someone other than an employee gets hurt or you are held responsible for damaging property that doesn’t belong to you. There are at least three different kinds of roofers insurance you may need:

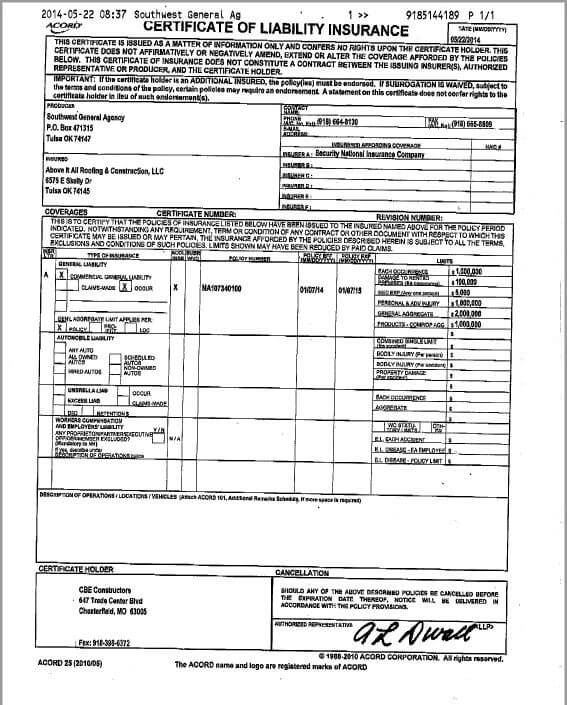

Source: roofingcontractorsinsurance.net

Source: roofingcontractorsinsurance.net

If the homeowner walks outside to check your work and tools or equipment slide off the. A general liability insurance policy includes coverage for: As a roofing contractor, roofing insurance protects you and not your customers. Roofing liability insurance is professional liability insurance for roofing companies. Roofing liability insurance will provide coverage (payment) to a third party for a claim (accident) you become legally liable for relating to the roofing activities taking place on any specific project.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title roofing liability insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information