Root insurance revenue information

Home » Trend » Root insurance revenue informationYour Root insurance revenue images are ready. Root insurance revenue are a topic that is being searched for and liked by netizens now. You can Get the Root insurance revenue files here. Download all royalty-free images.

If you’re looking for root insurance revenue pictures information linked to the root insurance revenue keyword, you have come to the ideal blog. Our site frequently provides you with suggestions for viewing the highest quality video and picture content, please kindly search and find more informative video articles and images that fit your interests.

Root Insurance Revenue. It generates revenue from the sale of auto insurance policies within the united states. The company uses smart phone technology and data science to understand actual driving behavior determines personal automobile insurance rates. Subscribe to the crunchbase daily. Q4 revenue of $84.9m beat the.

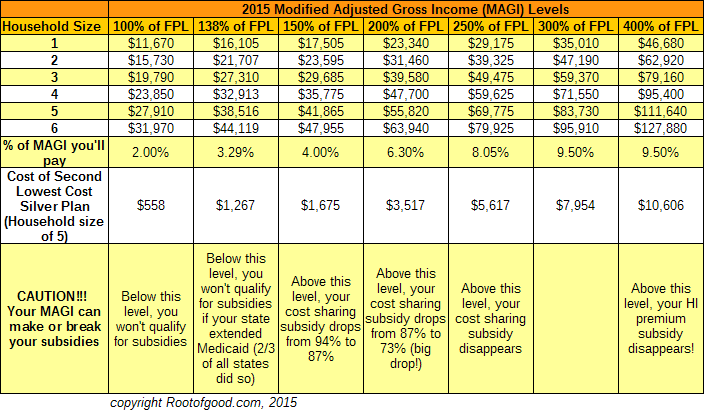

Don’t Fall Off The Affordable Care Act Subsidy Cliffs From rootofgood.com

Don’t Fall Off The Affordable Care Act Subsidy Cliffs From rootofgood.com

Over the last four quarters, root insurance�s revenue has grown by 84.3%. It generates revenue from the sale of auto insurance policies within the united states. According to crunchbase, root insurance has raised a total of $527.5 million across 5 rounds of venture capital funding. Root insurance makes the majority of its money off of net premiums. See insights on root including office locations, competitors, revenue, financials, executives, subsidiaries and more at craft. In his new roles at the parent of root insurance co., rosenthal is in charge of developing strategies to grow revenue and streamline operations, encompassing underwriting, pricing, business.

Looking at the quarterly results, revenue for root insurance fell by 36.6% compared to the same time last year.

Root started by tackling the archaic car insurance industry, using data and technology to base rates primarily on how people. Root has 901 employees at their 1 location and $290.2 m in annual revenue in fy 2019. In fact, $322.5 million or 93% of root’s total revenue came from net premiums earned in 2020. Root (root) reported a 4th quarter december 2021 loss of $0.44 per share on revenue of $93.2 million. The company raised another $724.4 million during its ipo. In the first six months of 2020, the company’s revenue was $245.4 million with a.

Source: meritechcapital.com

Source: meritechcapital.com

3 lessons from root’s ipo pricing. Investors into the insurtech include dst global, tiger global management, ribbit capital, redpoint, and many more. Root insurance funding, valuation & revenue. In his new roles at the parent of root insurance co., rosenthal is in charge of developing strategies to grow revenue and streamline operations, encompassing underwriting, pricing, business. Policies in force grew 15% over the year to 322,759, but lost 3.4% of the paying auto customers it had at the end of the first quarter of 2020.

Source: insuranceperfectt.blogspot.com

Source: insuranceperfectt.blogspot.com

Root enters the ipo arena with a record of rising revenue — and rising net losses. Root insurance funding, valuation & revenue. Root insurance makes the majority of its money off of net premiums. Subscribe to the crunchbase daily. This is however misleading as the decline was brought about by.

Source: mvinsurancecompany.com

Source: mvinsurancecompany.com

Revenue for root insurance (root) revenue in 2021 (ttm): In his new roles at the parent of root insurance co., rosenthal is in charge of developing strategies to grow revenue and streamline operations, encompassing underwriting, pricing, business. View root stock / share price, financial statements, key ratios and more at craft. The top 10 competitors average 8.4b. In fact, $322.5 million or 93% of root’s total revenue came from net premiums earned in 2020.

Source: pinterest.com

Source: pinterest.com

It was founded on the belief that the services people need for everyday life should serve them better. That metric jumped by 30% in the quarter from the same period in 2019 to $155 million or $605 million in 2020. For the six months ended june 30, root’s direct written premiums totaled $306.5 million, with revenue at $245.4 million and a net loss of $144.5 million. Root insurance�s revenue is the ranked 5th among it�s top 10 competitors. Root insurance is the nation’s first licensed insurance carrier powered entirely by mobile.

Source: fourweekmba.com

Source: fourweekmba.com

Subscribe to the crunchbase daily. Root insurance�s revenue is the ranked 5th among it�s top 10 competitors. Root insurance funding, valuation & revenue. Root started by tackling the archaic car insurance industry, using data and technology to base rates primarily on how people. Interested parties can register for or listen to the call.

Subscribe to the crunchbase daily. The insuretech also revealed that it bought a shell insurance company that will allow it to sell personal auto policies in 48 states. The earnings whisper number was for a loss of $0.50 per share. That metric jumped by 30% in the quarter from the same period in 2019 to $155 million or $605 million in 2020. Root (root) reported a 4th quarter december 2021 loss of $0.44 per share on revenue of $93.2 million.

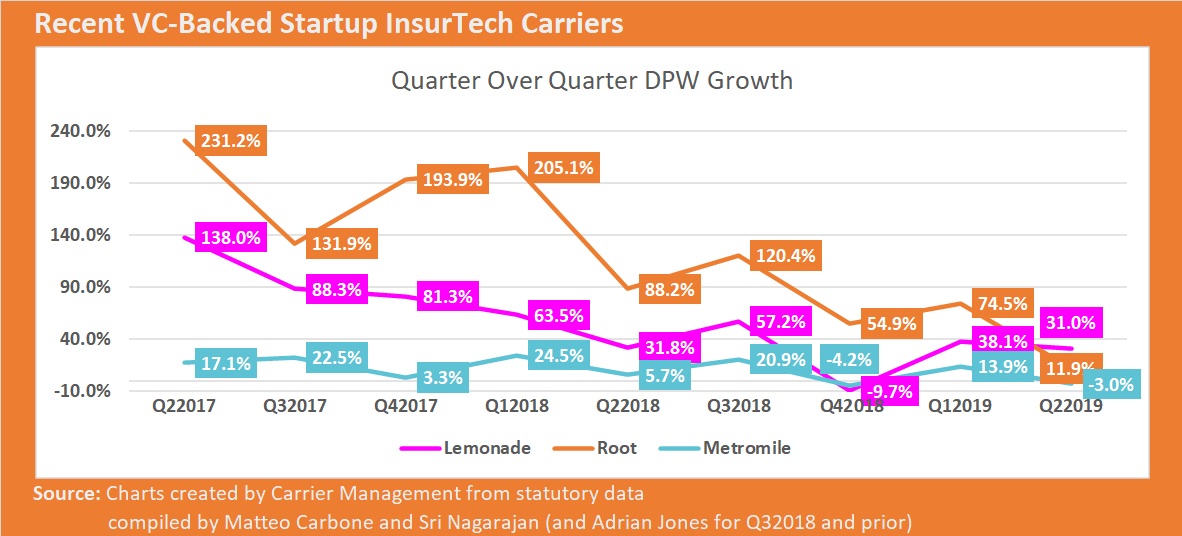

Source: carriermanagement.com

Source: carriermanagement.com

Root�s preferred metric is to go by insurance premiums paid by. The top 10 competitors average 8.4b. Over the last four quarters, root insurance�s revenue has grown by 84.3%. Q4 revenue of $84.9m beat the. It was founded on the belief that the services people need for everyday life should serve them better.

Source: meritechcapital.com

Source: meritechcapital.com

Is the parent company of root insurance. The company uses smart phone technology and data science to understand actual driving behavior determines personal automobile insurance rates. The consensus estimate was a loss of $0.49 per share on revenue of $59.1 million. Interested parties can register for or listen to the call. Root�s preferred metric is to go by insurance premiums paid by.

Source: zerodha.com

Source: zerodha.com

In fact, $322.5 million or 93% of root’s total revenue came from net premiums earned in 2020. Root market cap is $452 m, and annual revenue was $290.2 m in fy 2019. Policies in force grew 15% over the year to 322,759, but lost 3.4% of the paying auto customers it had at the end of the first quarter of 2020. Is the parent company of root insurance. Q4 revenue of $84.9m beat the.

Source: rexins-holdings.com

Source: rexins-holdings.com

Root has confirmed that its next quarterly earnings report will be published on wednesday, february 23rd, 2022. View root stock / share price, financial statements, key ratios and more at craft. In the first six months of 2020, the company’s revenue was $245.4 million with a. Revenue for root insurance (root) revenue in 2021 (ttm): Waiting in the ipo wings are insurtech players hippo, metromile and next insurance.

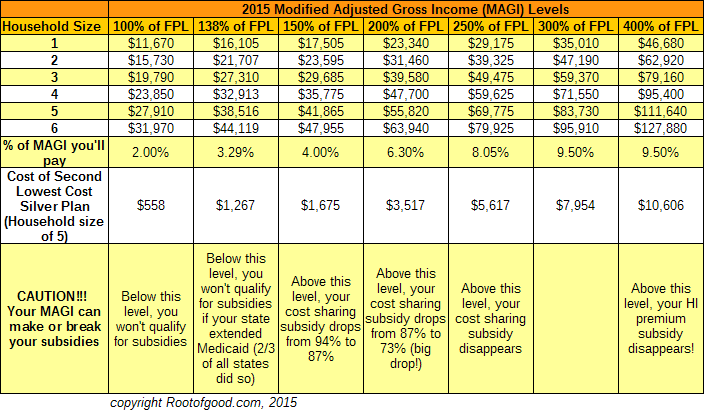

Source: rootofgood.com

Source: rootofgood.com

Root insurance�s revenue is the ranked 5th among it�s top 10 competitors. The insuretech also revealed that it bought a shell insurance company that will allow it to sell personal auto policies in 48 states. Is the parent company of root insurance. For the six months ended june 30, root’s direct written premiums totaled $306.5 million, with revenue at $245.4 million and a net loss of $144.5 million. Subscribe to the crunchbase daily.

Source: meritechcapital.com

The consensus estimate was a loss of $0.49 per share on revenue of $59.1 million. The top 10 competitors average 8.4b. The earnings whisper number was for a loss of $0.50 per share. Investors into the insurtech include dst global, tiger global management, ribbit capital, redpoint, and many more. This is however misleading as the decline was brought about by.

Source: joinroot.com

Source: joinroot.com

Root insurance company provides car insurance services. The insuretech also revealed that it bought a shell insurance company that will allow it to sell personal auto policies in 48 states. In fact, $322.5 million or 93% of root’s total revenue came from net premiums earned in 2020. Root (root) reported a 4th quarter december 2021 loss of $0.44 per share on revenue of $93.2 million. The consensus estimate was a loss of $0.49 per share on revenue of $59.1 million.

Source: insuranceperfectt.blogspot.com

Source: insuranceperfectt.blogspot.com

The earnings whisper number was for a loss of $0.50 per share. In fact, $322.5 million or 93% of root’s total revenue came from net premiums earned in 2020. Root has 901 employees at their 1 location and $290.2 m in annual revenue in fy 2019. The top 10 competitors average 8.4b. The consensus estimate was a loss of $0.49 per share on revenue of $59.1 million.

30, a 53% increase over last year. That metric jumped by 30% in the quarter from the same period in 2019 to $155 million or $605 million in 2020. Had $471 million in direct written premium as of sept. Looking at the quarterly results, revenue for root insurance fell by 36.6% compared to the same time last year. Q4 revenue of $84.9m beat the.

Source: joinroot.com

Source: joinroot.com

Subscribe to the crunchbase daily. Waiting in the ipo wings are insurtech players hippo, metromile and next insurance. Root (root) reported a 4th quarter december 2021 loss of $0.44 per share on revenue of $93.2 million. Root started by tackling the archaic car insurance industry, using data and technology to base rates primarily on how people. 30, a 53% increase over last year.

Source: newmlmmodel.blogspot.com

Root said the move will result in lower revenue compared with prior quarters. Root has 901 employees at their 1 location and $290.2 m in annual revenue in fy 2019. In the first six months of 2020, the company’s revenue was $245.4 million with a. Root market cap is $452 m, and annual revenue was $290.2 m in fy 2019. The company raised another $724.4 million during its ipo.

Source: insuranceperfectt.blogspot.com

Source: insuranceperfectt.blogspot.com

Root insurance company provides car insurance services. Interested parties can register for or listen to the call. Root�s preferred metric is to go by insurance premiums paid by. Had $471 million in direct written premium as of sept. See insights on root including office locations, competitors, revenue, financials, executives, subsidiaries and more at craft.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title root insurance revenue by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information