Root insurance scorecard information

Home » Trend » Root insurance scorecard informationYour Root insurance scorecard images are available. Root insurance scorecard are a topic that is being searched for and liked by netizens today. You can Get the Root insurance scorecard files here. Find and Download all free photos and vectors.

If you’re searching for root insurance scorecard pictures information related to the root insurance scorecard interest, you have visit the right blog. Our website frequently gives you hints for viewing the maximum quality video and picture content, please kindly search and find more enlightening video articles and graphics that match your interests.

Root Insurance Scorecard. Root insurance save up to 900 unidays student discount from www.myunidays.com. Scorecard designs, themes, templates and downloadable graphic elements on dribbble. With root, everything can be done through the app. As such, you can take decisive measures to drive down your overall production downtime while making strategic.

Root Insurance Raises 100 Million for 1 Billion From programbusiness.com

Root Insurance Raises 100 Million for 1 Billion From programbusiness.com

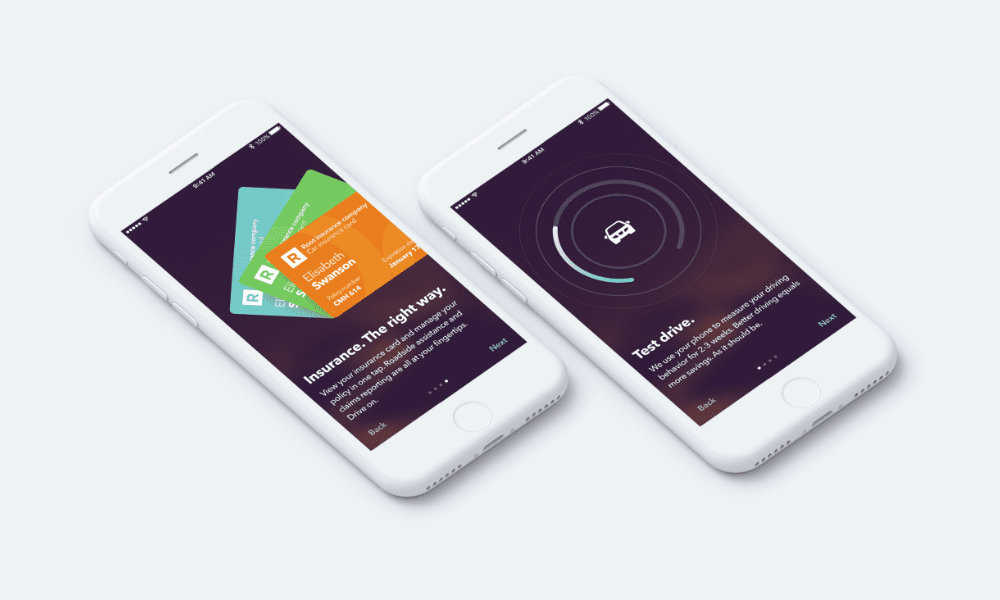

To that end, root is the first car insurance company that was founded on the relentless pursuit of fairness. As such, you can take decisive measures to drive down your overall production downtime while making strategic. Your screen will look different than mine if root is still tracking you. Some also use your credit score, although this isn�t. We use an app to rate drivers based on how they actually drive—not just their demographics. With root, everything can be done through the app.

Your driving score is the #1 factor that goes into your car insurance quote.

To access these risk scorecards, follow these steps: A score above 1.0 means a company has higher complaints than average for an insurer of its size. Obviously safe drivers who go through the driving test and pay attention to the driver scorecard will save the most. Luketic will be responsible for the strategic direction and management of. Select new > new scorecard; So you’ll be protected until you complete your test drive.

Source: nanalyze.com

Source: nanalyze.com

Some also use your credit score, although this isn�t. Use tools like the driver scorecard within the app to learn about your driving. Pa\ment integrit\ scorecard change from previous fy ($m) ke\ milsones accomplishments in reducing monetar\ loss $7,544m program or activit\ unemployment insurance dol unemployment insurance amt($) root cause of monetar\ loss root cause description mitigation strateg\ brief description of mitigation strateg\ and anticipated impact $408m Since proof of insurance is typically a requirement when purchasing a car, it’s a good idea to plan ahead. If you�re on a galaxy fold, consider unfolding your phone or viewing it in full screen to best optimize your experience.

Source: moneysmylife.com

Source: moneysmylife.com

Root said that plans begin as low as $6 per month and that consumers have the ability to bundle their root renters and auto insurance plans for even lower rates. Your screen will look different than mine if root is still tracking you. Safe driving could lead to more savings. To address this root cause, it is critical for states to identify as quickly as possible that a ui claimant has returned to work and to ensure that claimants understand their responsibility to report when they return to work. Root insurance went from writing only $4 million in direct premium in 2017 to $106.4 million in 2018, including a 55% sequential increase in the fourth quarter of 2018.

Source: joinroot.com

Source: joinroot.com

To access these risk scorecards, follow these steps: Click on the more templates… menu and scroll down to the kris section And the entire root experience is simple and easy. Effectiveness of the balanced scorecard (success stories) mobil north america marketing and refining cigna property and casualty insurance brown & root energy services’ rockwater division chemical (chase) retail bank at canada, inc. Keep track of your score.

Root auto insurance traditional auto insurance companies rely on your driving history and demographic information to determine your rates. Select new > new scorecard; We use an app to rate drivers based on how they actually drive—not just their demographics. The root app makes it easy to customize your coverage. To access these risk scorecards, follow these steps:

Texas and kentucky were the main drivers of root�s growth in direct premiums written in the fourth quarter of 2018, accounting for 22.3% and 15.5%, respectively, of the total $18 million increase. With this digestible and easily quantifiable visual created with online business intelligence software, you can get to the root of the problem swiftly by understanding what percentage of your downtime is attributed to which specific issue or inefficiency. Reckless drivers will either pay a higher price or receive no quote at all because driving habits is the number one factor in calculating. Root insurance has hired dave luketic as the director of government affairs. Texas and kentucky were the main drivers of root�s growth in direct premiums written in the fourth quarter of 2018, accounting for 22.3% and 15.5%, respectively, of the total $18 million increase.

Root gives you highly customizable coverage that can be easily adjusted at any time directly through the root app. All plans include replacement cost. A score above 1.0 means a company has higher complaints than average for an insurer of its size. So you’ll be protected until you complete your test drive. As an insurance company with only five years in business, root doesn’t have the track record that many of its competitors have.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

(not pictured) 2) open the root app and click on view driving score. (left) 3) click on the question mark on the top right of the next page. The global community for designers and creative professionals. Reckless drivers will either pay a higher price or receive no quote at all because driving habits is the number one factor in calculating. Key risk indicators, scorecard, and template. Effectiveness of the balanced scorecard (success stories) mobil north america marketing and refining cigna property and casualty insurance brown & root energy services’ rockwater division chemical (chase) retail bank at canada, inc.

Your driving score is the #1 factor that goes into your car insurance quote. With root, everything can be done through the app. Root has a slightly high complaint index score of 1.05, according to the national association of insurance commissioners. The root app makes it easy to customize your coverage. Read our review to find out if they�re a good fit for you.

Source: itriedrootcarinsurance.weebly.com

Source: itriedrootcarinsurance.weebly.com

In this newly created role, mr. Texas and kentucky were the main drivers of root�s growth in direct premiums written in the fourth quarter of 2018, accounting for 22.3% and 15.5%, respectively, of the total $18 million increase. By not insuring bad drivers, root is able to save good drivers hundreds on their car insurance. Luketic will be responsible for the strategic direction and management of. Obviously safe drivers who go through the driving test and pay attention to the driver scorecard will save the most.

Source: pulse.11fs.com

Source: pulse.11fs.com

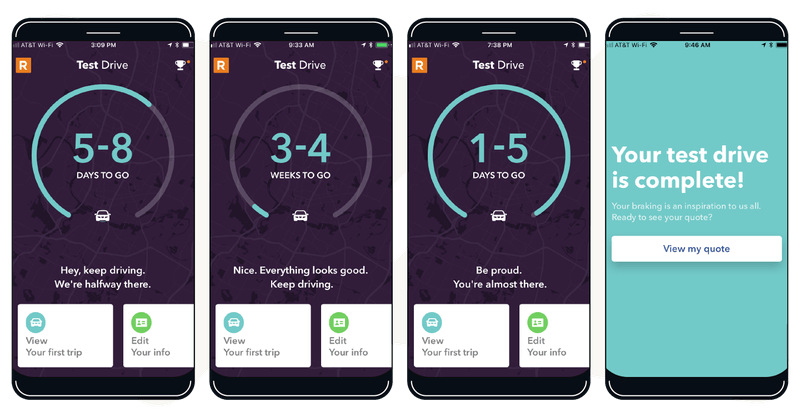

Root’s app will monitor your driving for two to three weeks, though the test period can range from one to four weeks. Promoting state strategies to improve use of the national directory of new hires data and providing The insurance industry is broken. If you�re on a galaxy fold, consider unfolding your phone or viewing it in full screen to best optimize your experience. We score them based on how proactive they are in each theme and their ability to adapt to key transformations in the theme in the coming years.

Source: programbusiness.com

Source: programbusiness.com

Your driving score is the #1 factor that goes into your car insurance quote. Zeneca ag products north america southern gardens citrus university of california, san diego duke children’s. With this digestible and easily quantifiable visual created with online business intelligence software, you can get to the root of the problem swiftly by understanding what percentage of your downtime is attributed to which specific issue or inefficiency. (not pictured) 2) open the root app and click on view driving score. (left) 3) click on the question mark on the top right of the next page. A score above 1.0 means a company has higher complaints than average for an insurer of its size.

![Root Insurance [the other Root] Just Launched Root Insurance [the other Root] Just Launched](https://coverager.com/wp-content/uploads/2018/04/Screen-Shot-2018-04-04-at-4.10.28-PM.png) Source: coverager.com

Source: coverager.com

Select new > new scorecard; Select new > new scorecard; Read our review to find out if they�re a good fit for you. View root�s policy on tracking after a test drive 1) complete the test drive and get approved. As an insurance company with only five years in business, root doesn’t have the track record that many of its competitors have.

Source: policygenius.com

Source: policygenius.com

Promoting state strategies to improve use of the national directory of new hires data and providing In this newly created role, mr. (not pictured) 2) open the root app and click on view driving score. (left) 3) click on the question mark on the top right of the next page. As such, you can take decisive measures to drive down your overall production downtime while making strategic. All plans include replacement cost.

Source: productmint.com

Source: productmint.com

The app also suggests ways to improve your driving. By not insuring bad drivers, root is able to save good drivers hundreds on their car insurance. View root�s policy on tracking after a test drive 1) complete the test drive and get approved. Click on the more templates… menu and scroll down to the kris section So you’ll be protected until you complete your test drive.

Source: idropnews.com

Source: idropnews.com

The root app makes it easy to customize your coverage. Promoting state strategies to improve use of the national directory of new hires data and providing Keep track of your score. We use an app to rate drivers based on how they actually drive—not just their demographics. Obviously safe drivers who go through the driving test and pay attention to the driver scorecard will save the most.

Source: basecampatx.com

Source: basecampatx.com

We score them based on how proactive they are in each theme and their ability to adapt to key transformations in the theme in the coming years. Use tools like the driver scorecard within the app to learn about your driving. As such, you can take decisive measures to drive down your overall production downtime while making strategic. Track how you’re doing with the app’s driver scorecard, which rates how well you brake, turn and maneuver. Effectiveness of the balanced scorecard (success stories) mobil north america marketing and refining cigna property and casualty insurance brown & root energy services’ rockwater division chemical (chase) retail bank at canada, inc.

Source: mvinsurancecompany.com

Source: mvinsurancecompany.com

Since proof of insurance is typically a requirement when purchasing a car, it’s a good idea to plan ahead. With root, everything can be done through the app. Root insurance has hired dave luketic as the director of government affairs. Obviously safe drivers who go through the driving test and pay attention to the driver scorecard will save the most. Since proof of insurance is typically a requirement when purchasing a car, it’s a good idea to plan ahead.

Source: dribbble.com

Source: dribbble.com

We use an app to rate drivers based on how they actually drive—not just their demographics. We make sure that your insurance covers your state minimum requirements, then is flexible enough to fit your own specific needs. Select new > new scorecard; To that end, root is the first car insurance company that was founded on the relentless pursuit of fairness. Your driving score is the #1 factor that goes into your car insurance quote.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title root insurance scorecard by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information