Royal bank critical illness insurance information

Home » Trend » Royal bank critical illness insurance informationYour Royal bank critical illness insurance images are ready in this website. Royal bank critical illness insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Royal bank critical illness insurance files here. Find and Download all free vectors.

If you’re looking for royal bank critical illness insurance pictures information connected with to the royal bank critical illness insurance topic, you have come to the ideal blog. Our site frequently provides you with suggestions for seeking the maximum quality video and picture content, please kindly hunt and locate more enlightening video content and images that match your interests.

Royal Bank Critical Illness Insurance. The premium rate will be $0.27 per $1,000 of initial insured mortgage balance. Get 12 months cover for the price of 10 when you buy home insurance (available to new royal trust finance bank home. Balanceprotector premiere plus 1 insurance plan can help make monthly payments and protect the account balance on your rbc royal bank credit card should unexpected events such as critical illness, disability, or job loss happen to you. 9 rows critical illnes insurance premium rate chart.

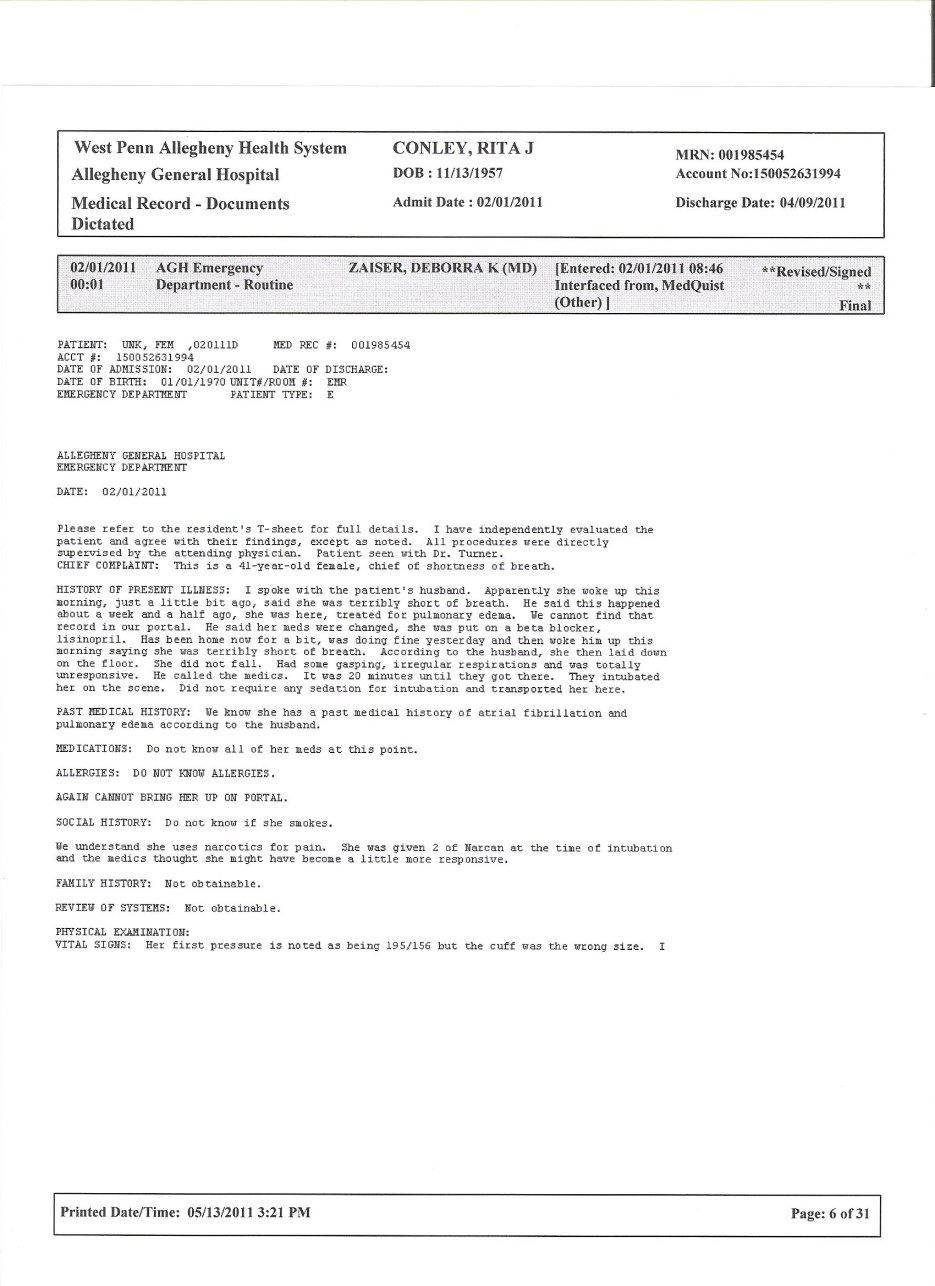

HomeProtector® Insurance Quote RBC Royal Bank From rbcroyalbank.com

HomeProtector® Insurance Quote RBC Royal Bank From rbcroyalbank.com

The third quarter which ended on july 31, 2018, went up by 11% from $313 million from the previous. It pays out if you contract a disease. It is an extra that can be added to your policy, or can be combined with your standard life insurance. Loanprotector ® insurance provides group creditor life, critical illness and disability insurance underwritten by the canada life assurance company (insurer or canada life), under group policy (policy) g28444, h28544 and h28445, issued to the royal bank of canada including associated companies (rbc royal bank) as the policyholder. What is critical illness cover? Cover can be added to a life insurance or mortgage protection policy.

Please note, partial coverage applies to loan/line of credit balances above $300,000 at time of application.

Note coverage for mortgage balances over $300,000 at time of. Loanprotector ® insurance provides group creditor life, critical illness and disability insurance underwritten by the canada life assurance company (insurer or canada life), under group policy (policy) g28444, h28544 and h28445, issued to the royal bank of canada including associated companies (rbc royal bank) as the policyholder. The premium rate for the homeprotector critical illness insurance joint coverage will be based on the age of the older person. Cover can be added to a life insurance or mortgage protection policy. Single critical illness insurance:if you are diagnosed with a covered illness (heart attack, stroke or cancer), this insurance can pay off or reduce your mortgage balance up to $300,000. The maximum product benefit for life coverage is $750,000 so the life insurance amount is capped at $750,000.

Source: electrocomsolutions.com.au

Source: electrocomsolutions.com.au

What is critical illness cover? It pays out if you contract a disease. It is an extra that can be added to your policy, or can be combined with your standard life insurance. Royal bank of canada reported a net income of $3,109 million for the third quarter on wednesday, august 22, 2018. The illness developed must be specified in your policy contract.

Source: insurdinary.ca

Source: insurdinary.ca

Should you take out royal bank of scotland life insurance critical illness cover? Critical illness (level term) let our expert ratings help you quickly find out what the quality of your critical illness cover is. The maximum benefit for critical illness coverage is $300,000 so the critical illness insurance amount is capped at $300,000. Creditor insurance (also called credit protection) is optional coverage you can buy to help cover your debt balances in case of death, disability, critical illness or job loss (rbc credit card only). Loanprotector insurance coverage is optional and is governed by the terms and conditions of the creditor�s group insurance policies #g28444 for life insurance, #h28544 for critical illness insurance and #h28445 for disability insurance, issued to royal bank of canada by the canada life assurance company.

Source: insurdinary.ca

Source: insurdinary.ca

If you are diagnosed with a covered illness (heart attack, stroke or cancer), this insurance can reduce your loan or line of credit balance up to $300,000. The premium rate for the homeprotector critical illness insurance joint coverage will be based on the age of the older person. Critical illness cover providing peace of mind insurance packages we offer home insurance royal golden trust bank home insurance gives you a choice of different levels of protection for your home and contents. Get 12 months cover for the price of 10 when you buy home insurance (available to new royal trust finance bank home. Life, accidental dismemberment and disability insurance is provided under group policy 51000 and critical illness insurance is provided under group policy 57903.

Source: protectionguru.co.uk

Source: protectionguru.co.uk

Balanceprotector premiere plus 1 insurance plan can help make monthly payments and protect the account balance on your rbc royal bank credit card should unexpected events such as critical illness, disability, or job loss happen to you. Get 12 months cover for the price of 10 when you buy home insurance (available to new royal golden trust bank insurance. What is critical illness cover? Our experts select and analyse between 30 and 100 features or benefits for every policy on the market. 2) the information provided herein is for comparison of current product offerings only and does not replace the policy contract.

Source: theopenwindowquotesjigasui.blogspot.com

Source: theopenwindowquotesjigasui.blogspot.com

Loanprotector ® insurance provides group creditor life, critical illness and disability insurance underwritten by the canada life assurance company (insurer or canada life), under group policy (policy) g28444, h28544 and h28445, issued to the royal bank of canada including associated companies (rbc royal bank) as the policyholder. The maximum product benefit for life coverage is $750,000 so the life insurance amount is capped at $750,000. Should you take out royal bank of scotland life insurance critical illness cover? Please note, partial coverage applies to loan/line of credit balances above $300,000 at time of application. Disability insurance maintains your regular mortgage payments (up to $3,000 per month, for up to 24 months) if you are disabled and unable to work due to an illness or an injury.

Source: bestadvice.co.uk

Source: bestadvice.co.uk

Single critical illness insurance:if you are diagnosed with a covered illness (heart attack, stroke or cancer), this insurance can pay off or reduce your mortgage balance up to $300,000. Single critical illness insurance:if you are diagnosed with a covered illness (heart attack, stroke or cancer), this insurance can pay off or reduce your mortgage balance up to $300,000. It pays out if you contract a disease. Benefit is paid when you are diagnosed with a covered critical illness, as defined in the policy, and satisfy the survival period, as defined in the policy. Disability insurance maintains your regular mortgage payments (up to $3,000 per month, for up to 24 months) if you are disabled and unable to work due to an illness or an injury.

Source: rbcroyalbank.com

Source: rbcroyalbank.com

If you are diagnosed with a covered illness (heart attack, stroke or cancer), this insurance can reduce your loan or line of credit balance up to $300,000. The maximum product benefit for life coverage is $750,000 so the life insurance amount is capped at $750,000. Note coverage for mortgage balances over $300,000 at time of. Should you take out royal bank of scotland life insurance critical illness cover? It pays out if you contract a disease.

Source: time-to-change.org.uk

Source: time-to-change.org.uk

How does royal bank of scotland critical illness insurance work? Disability insurance maintains your regular mortgage payments (up to $3,000 per month, for up to 24 months) if you are disabled and unable to work due to an illness or an injury. Loanprotector ® insurance provides group creditor life, critical illness and disability insurance underwritten by the canada life assurance company (insurer or canada life), under group policy (policy) g28444, h28544 and h28445, issued to the royal bank of canada including associated companies (rbc royal bank) as the policyholder. The premium will be calculated as follows: Note coverage for mortgage balances over $300,000 at time of.

Source: styrowing.com

Source: styrowing.com

Our experts select and analyse between 30 and 100 features or benefits for every policy on the market. Critical illness cover providing peace of mind insurance packagaes we offer home insurance royal trust finance bank home insurance gives you a choice of different levels of protection for your home and contents. The premium will be calculated as follows: 9 rows critical illnes insurance premium rate chart. The maximum product benefit for life coverage is $750,000 so the life insurance amount is capped at $750,000.

Source: rbcroyalbank.com

Source: rbcroyalbank.com

Our experts select and analyse between 30 and 100 features or benefits for every policy on the market. Please note, partial coverage applies to loan/line of credit balances above $300,000 at time of application. The third quarter which ended on july 31, 2018, went up by 11% from $313 million from the previous. Critical illness (level term) let our expert ratings help you quickly find out what the quality of your critical illness cover is. If you’re over the age of 55 and are refinancing or adding on to an existing insured mortgage, you may qualify for prior critical illness coverage.

Source: insurdinary.ca

Source: insurdinary.ca

If you are diagnosed with a covered illness (heart attack, stroke or cancer), this insurance can reduce your loan or line of credit balance up to $300,000. Disability insurance maintains your regular mortgage payments (up to $3,000 per month, for up to 24 months) if you are disabled and unable to work due to an illness or an injury. ($200,000 ÷ $1,000) x $0.27 =$54 per month + pst where applicable. Creditor insurance (also called credit protection) is optional coverage you can buy to help cover your debt balances in case of death, disability, critical illness or job loss (rbc credit card only). The premium rate will be $0.27 per $1,000 of initial insured mortgage balance.

Source: lsminsurance.ca

Source: lsminsurance.ca

Get 12 months cover for the price of 10 when you buy home insurance (available to new royal golden trust bank insurance. Single critical illness insurance:if you are diagnosed with a covered illness (heart attack, stroke or cancer), this insurance can pay off or reduce your mortgage balance up to $300,000. 9 rows critical illnes insurance premium rate chart. Monthly premium rates per $1,000 of initial. Loanprotector insurance provides group creditor life, critical illness and disability insurance underwritten by the canada life assurance company (“insurer” or “canada life”), under group policy (“policy”) g28444, h28544 and h28445, issued to the royal bank of canada including associated companies (“rbc royal bank”) as the policyholder.

Source: rbcroyalbank.com

Source: rbcroyalbank.com

Critical illness cover providing peace of mind insurance packages we offer home insurance royal golden trust bank home insurance gives you a choice of different levels of protection for your home and contents. You can also download change forms online. Cover can be added to a life insurance or mortgage protection policy. Disability insurance maintains your regular mortgage payments (up to $3,000 per month, for up to 24 months) if you are disabled and unable to work due to an illness or an injury. It is an extra that can be added to your policy, or can be combined with your standard life insurance.

Benefit is paid when you are diagnosed with a covered critical illness, as defined in the policy, and satisfy the survival period, as defined in the policy. Cover can be added to a life insurance or mortgage protection policy. Note coverage for mortgage balances over $300,000 at time of. The premium will be calculated as follows: You can also download change forms online.

Source: advisor.iaprivatewealth.ca

Source: advisor.iaprivatewealth.ca

($200,000 ÷ $1,000) x $0.27 =$54 per month + pst where applicable. You can also download change forms online. Monthly premium rates per $1,000 of initial. The premium will be calculated as follows: The maximum benefit for critical illness coverage is $300,000 so the critical illness insurance amount is capped at $300,000.

Source: insurdinary.ca

Source: insurdinary.ca

How does royal bank of scotland critical illness insurance work? Creditor insurance (also called credit protection) is optional coverage you can buy to help cover your debt balances in case of death, disability, critical illness or job loss (rbc credit card only). The illness developed must be specified in your policy contract. Royal bank of canada reported a net income of $3,109 million for the third quarter on wednesday, august 22, 2018. Balanceprotector premiere plus 1 insurance plan can help make monthly payments and protect the account balance on your rbc royal bank credit card should unexpected events such as critical illness, disability, or job loss happen to you.

Source: insuredclaims.blogspot.com

Source: insuredclaims.blogspot.com

Get 12 months cover for the price of 10 when you buy home insurance (available to new royal golden trust bank insurance. Get 12 months cover for the price of 10 when you buy home insurance (available to new royal trust finance bank home. Life, accidental dismemberment and disability insurance is provided under group policy 51000 and critical illness insurance is provided under group policy 57903. Balanceprotector premiere plus 1 insurance plan can help make monthly payments and protect the account balance on your rbc royal bank credit card should unexpected events such as critical illness, disability, or job loss happen to you. Single critical illness insurance:if you are diagnosed with a covered illness (heart attack, stroke or cancer), this insurance can pay off or reduce your mortgage balance up to $300,000.

Source: mutualinsurancemaruihi.blogspot.com

Source: mutualinsurancemaruihi.blogspot.com

Get 12 months cover for the price of 10 when you buy home insurance (available to new royal trust finance bank home. Benefit is paid when you are diagnosed with a covered critical illness, as defined in the policy, and satisfy the survival period, as defined in the policy. If you’re over the age of 55 and are refinancing or adding on to an existing insured mortgage, you may qualify for prior critical illness coverage. Disability insurance maintains your regular mortgage payments (up to $3,000 per month, for up to 24 months) if you are disabled and unable to work due to an illness or an injury. Should you take out royal bank of scotland life insurance critical illness cover?

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title royal bank critical illness insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information